Notícias do Mercado

-

20:00

Dow +115.69 15,733.91 +0.74% Nasdaq -11.08 3,928.78 -0.28% S&P +6.32 1,769.29 +0.36%

-

19:20

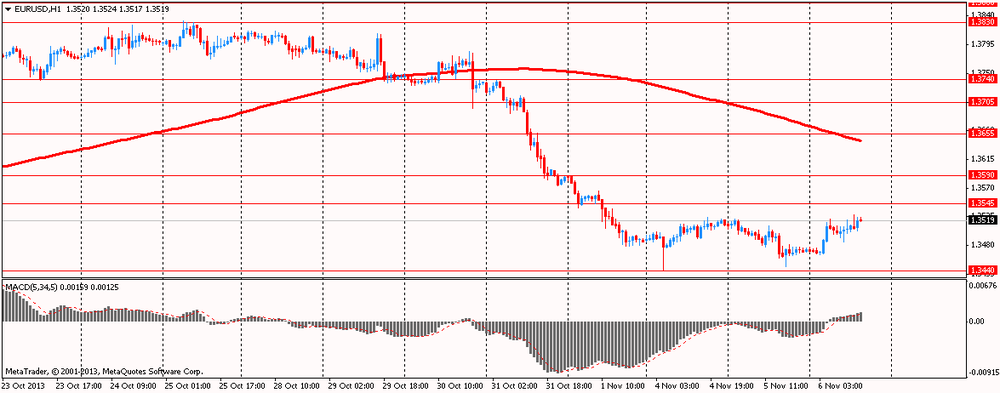

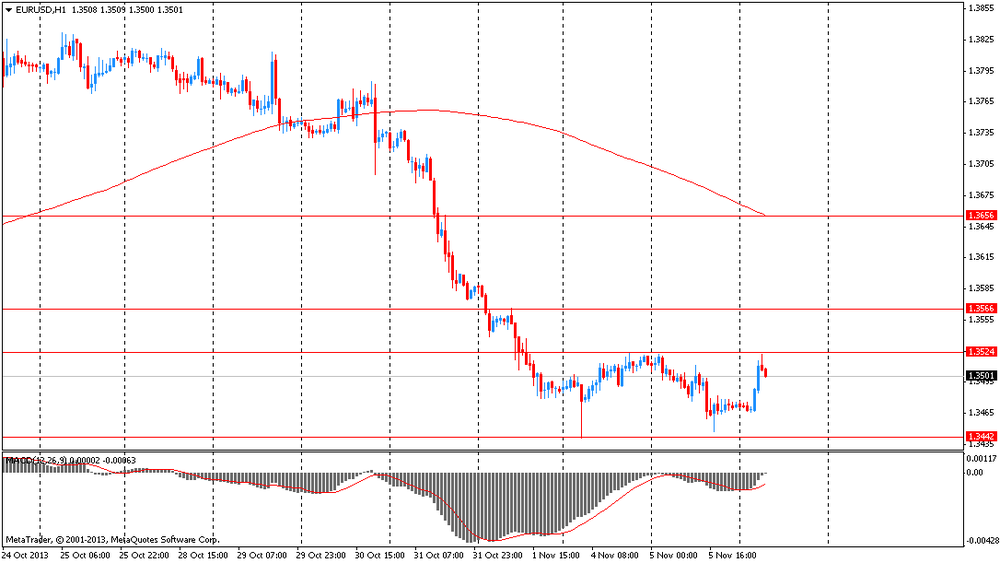

American focus : the dollar fell against the euro

The euro exchange rate rose sharply against the dollar, although it has lost some of the previously won positions in response to rumors that report , quoting official sources in the ECB that the decline in inflation does not become a reason to lower the rates of the Central Bank at tomorrow's meeting.

Now the pair continues to consolidate above the key level of 1.3500 , and all the attention of market participants have already drawn for tomorrow's ECB meeting . Meanwhile, traders are walking among rumors of a possible lowering of rates or operated other instrument of monetary stimulus .

If the ECB decides tomorrow to leave rates unchanged , likely rally EUR / USD will be much less extensive than the fall , which could determine the reduction rate by 25 basis points This is due to the fact that after the announcement of the decision itself (presumably - the abandonment rate at the same level ), attention switches to the markets of the subsequent press conference , the tone of which can be very dovish , and will assume or the inclusion of the ECB dictionary of vocabulary or allusions to measures - and potentially aggressive - in the future . "

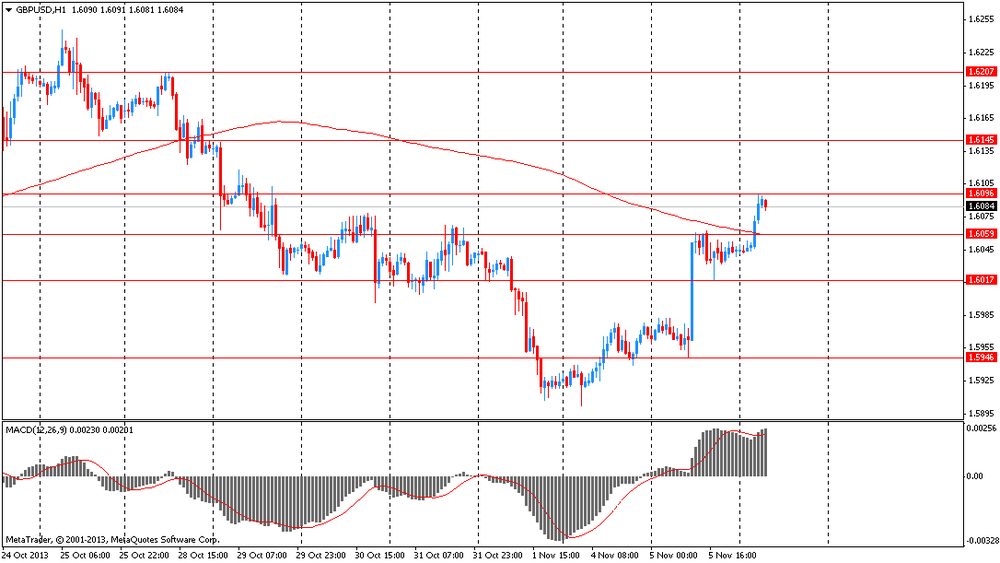

The pound traded higher against the dollar, while retreating from a session high . Note that initially helped the growth of currency data on industrial production in the UK , which showed that total production rose by 2.2 percent year on year in September , after falling 1.5 percent in August and 1.1 percent decline in July. The consensus forecast of economists was at 1.8 percent.

In addition, the data showed that manufacturing output increased by 0.8 percent annually in September. This happened after falling 0.2 percent in August and 0.4 percent drop in July. The result corresponds to the forecast of economists.

On a monthly basis , total production increased by 0.9 percent compared with a forecast of 0.7 percent growth. Manufacturing output increased by 1.2 percent in September compared with the previous month , in line with economists' forecasts .

It should be noted that the support of the pound has also had a report from the National Institute of Economic and Social Research (NIESR), which showed that economic growth in the UK for three months , including October , is 0.7 %, mainly due to service companies of the private sector . It is slightly smaller than the GDP growth of 0.8 % in the three months through September , and significantly less than the growth of 1.3% , which was mentioned in the latest study by PMI .

NIESR expects GDP growth rate in 2013 at 1.4 % , and 2.0 % in 2014 , slightly below average expectations of economists.

Add that little pressure on the currency have expectations of tomorrow's Bank of England decision . Note that the Bank of England is likely to leave monetary policy unchanged, despite signs of strengthening the economy , as fulfills the promise to keep the level of the key rate , while unemployment exceeds the benchmark .

-

18:20

European stock close

European stocks climbed to a five-year high after companies from Alstom SA to ING Groep NV posted earnings that beat analysts’ estimates, and as industrial data from Germany and the U.K. improved.

The Stoxx Europe 600 Index added 0.3 percent to 323.14 at 4:30 p.m. in London, its highest level since May 22, 2008. The equity benchmark has rallied 16 percent so far in 2013, its best performance since 2009.

A report from the Office for National Statistics showed U.K. industrial production rose 0.9 percent in September, rebounding from its biggest decline in almost a year and exceeding the median forecast for growth of 0.6 percent.

A release from Germany’s Economy Ministry showed factory orders in Europe’s largest economy increased 3.3 percent in September. That exceeded the 0.5 percent median estimate of economists..

Markit Economics’ gauge of services industries in the 17-nation euro area fell at a slower-than-projected rate in October. A separate report from the European Union’s statistics agency showed that retail sales in the currency bloc increased 0.3 percent in September from last year, less than the 0.6 percent gain that economists had predicted.

The European Central Bank will cut its benchmark interest rate to 0.25 percent at tomorrow’s meeting, according to three out of 70 estimates. Eight of 38 economists in a separate survey forecast policy makers will lower interest rates in December.

National benchmark indexes climbed in every Western-European market except the U.K. and Iceland.

FTSE 100 6,741.69 -5.15 -0.08% CAC 40 4,286.93 +33.59 +0.79% DAX 9,040.87 +31.76 +0.35%

Alstom, the French maker of trains, gained 6.5 percent to 28.84 euros, its biggest advance since June 2012. Operating profit in the period between April 1 and Sept. 30 fell to 695 million euros from 703 million euros last year. That still beat the average analyst estimate of 664 million euros. Chief Executive Officer Patrick Kron said the company will seek to sell a minority stake in Alstom Transport SA and other assets, according to a statement.

ING added 3.6 percent to 9.61 euros, rebounding from its biggest loss since August. Net income dropped 85 percent to 101 million euros in the third quarter from a year earlier, following a 950 million-euro writedown on the sale of its South Korean life insurance unit. Analysts had predicted a 27.3 million-euro loss. The Dutch financial-services company also said it has reached an agreement with the European Commission to sell more than 50 percent of ING Life Japan by the end of 2015.

Adecco climbed 3.6 percent to 68.50 Swiss francs after saying third-quarter net income surged 61 percent to 190 million euros. That exceeded the 138.2 million-euro average estimate of analysts. Sales dropped less in France this quarter, its largest market, while revenue from Spain and Portugal showed its first quarterly increase in more than two years, Adecco said in a statement.

Axel Springer AG, the publisher of the Die Welt and Bild-Zeitung newspapers in Germany, advanced 1.8 percent to 44.20 euros. Third-quarter sales rose 3.6 percent to 815.8 million euros from last year, beating the 808 million-euro average estimate.

Vestas Wind Systems A/S (VWS) surged 15 percent to 167.20 kroner, its highest price since May 2011. The world’s largest wind-turbine maker forecast an earnings-before-interest-and-taxes margin of at least 2 percent in 2013, up from 1 percent in the second quarter. Vestas also said free cash flow will exceed 500 million euros and may climb as high as 700 million euros, more than double the previous estimate.

-

17:00

European stock close: FTSE 100 6,741.69 -5.15 -0.08% CAC 40 4,286.93 +33.59 +0.79% DAX 9,040.87 +31.76 +0.35%

-

16:40

Oil: an overview of the market situation

The price of oil has grown considerably today , rising at the same time to $ 95 (WTI) and $ 106 (Brent), which was associated with an unexpectedly large drop in gasoline inventories in the United States, and the concerns about reduced supplies from Libya.

Note that the data of the Department of Energy on changes in stocks in the U.S. for the week October 27 - November 2 showed that:

- Oil stocks rose 1.577 million barrels to 385.448 million barrels ;

- Gasoline inventories decreased by 3,755 million barrels . to 210.036 million barrels . ;

- Distillate stocks fell 4.899 million barrels . to 117.817 million barrels .

- Refining capacity utilization rate of 86.8 % versus 87.3 % a week earlier .

We also add that according to preliminary data analysis organization , " American Petroleum Institute " (API), which came out yesterday, commercial crude oil inventories in the United States on the basis of the reporting week ending November 1 , increased by 871 thousand barrels per day . , While the industry experts forecast a week before the rise in oil inventories at 2.4-2.6 million barrels.

According to analysts , the overall picture is still negative for oil , given the low level of demand, especially in Europe.

Meanwhile , we note that the increase in oil prices today are also due to the active technical purchases of oil futures , which on the eve of significantly dropped in price , providing favorable conditions for opening long positions.

In addition, the rise in the cost of oil to maintain a positive macroeconomic data from the euro zone . The composite index of business activity in the region , in the final assessment in October fell to 51.9 points from 52.2 points in September , when the figure stood at the highest in more than two years level. However, the data were better than analysts' forecasts , which believed that the rate will remain at the level of the initial assessment of 51.5 points.

The cost of the December futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 94.95 a barrel on the New York Mercantile Exchange.

December futures price for North Sea Brent crude oil mixture rose $ 0.37 to $ 106.01 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold prices rose slightly today , breaking with the longest string of declines in nearly six months, as the dollar fell to strengthen expectations that the U.S. Federal Reserve will expand its monetary stimulus . Note that , according to John Williams , president of the Federal Reserve Bank of San Francisco , the economic growth in the U.S. in recent months, did not meet expectations. In this regard , he noted that the situation in the labor market are unlikely to improve without incentives.

It should be noted that the timing of a possible narrowing of the monthly bond purchases by the Fed was the main factor that influenced the price of gold. Precious metal has lost a fifth of its value so far on fears that the Fed will reduce the volume of stimulation.

Recent mixed economic data cast doubt on the real strength of the U.S. economy, leading some economists were made with the assumption that the Fed will change its policy before the end of the year.

Add that trading volumes were low in the past few sessions , and , most likely, and will remain so in the coming days , as investors are awaiting data on employment in the non-agricultural sector of the economy, which may give more clues about the state of the economy and future incentives by the Fed .

Also, market participants are waiting for the ECB 's interest rate. Improvement in macroeconomic indicators in the U.S. and the UK in sharp contrast with the data from the euro zone , where in the last week have been reported record- high unemployment and negative inflation . It is expected that the ECB will leave rates unchanged , but the dynamics of gold will also depend on the value of the dollar relative to the single European currency.

Demand for physical gold has not grown much as traders are waiting for the determined price direction . Customers in Asia are hoping to wait for a lower price.

The cost of the December gold futures on COMEX today rose to $ 1316.90 per ounce.

-

15:30

U.S.: Crude Oil Inventories, October +1.6

-

15:01

Canada: Ivey Purchasing Managers Index, October 62.8 (forecast 54.7)

-

15:00

United Kingdom: NIESR GDP Estimate, October +0.7% (forecast +0.5%)

-

15:00

U.S.: Leading Indicators , September +0.7% (forecast +0.7%)

-

14:28

Before the bell: S&P futures +0.47%, Nasdaq futures +0.43%

U.S. stock-index futures advanced, as investors awaited this week’s data on jobs and economic growth for guidance on how long the Federal Reserve will maintain stimulus.

Nikkei 14,337.31 +111.94 +0.79%

Hang Seng 23,036.94 -2.01 -0.01%

Shanghai Composite 2,139.61 -17.63 -0.82%

FTSE 6,747.72 +0.88 +0.01%

CAC 4,290.84 +37.50 +0.88%

DAX 9,046.83 +37.72 +0.42%

Crude oil $93.90 +0,57%

Gold $1317.80 +0.74%

-

13:45

Option expiries for today's 1400GMT cut

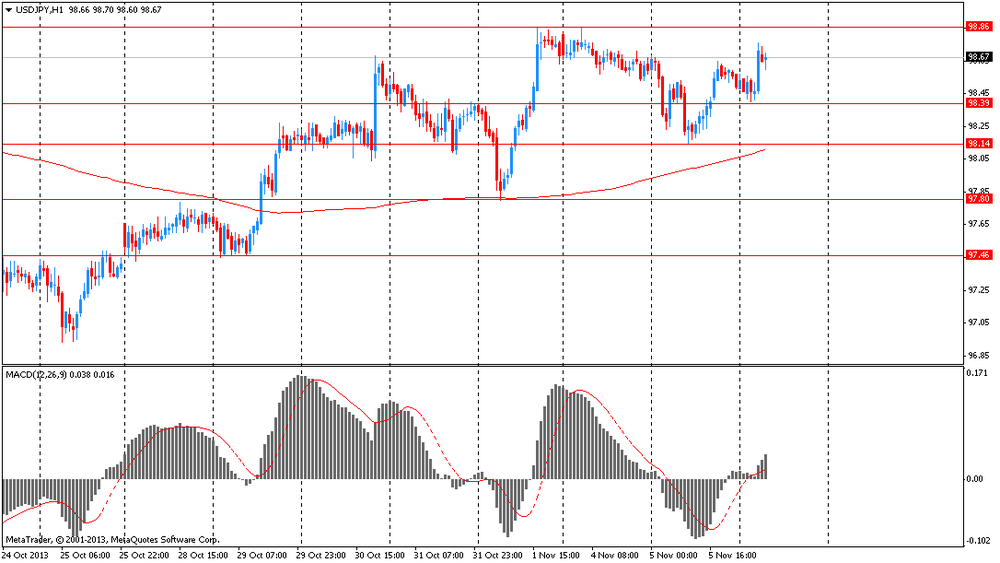

USD/JPY Y97.00, Y98.45, Y98.50, Y98.65, Y98.75, Y99.00, Y100.00

EUR/USD $1.3350, $1.3450, $1.3470, $1.3475, $1.3500, $1.3600, $1.3620, $1.3650

GBP/USD $1.6000, $1.6010, $1.6060, $1.6075

EUR/GBP stg0.8445, stg0.8470

USD/CHF Chf0.9100

AUD/USD $0.9400, $0.9500

AUD/JPY Y94.00

AUD/CHF Chf0.8550, Chf0.8600

NZD/USD $0.8225

USD/CAD C$1.0395, C$1.0430, C$1.0455, C$1.0500

-

13:30

Canada: Building Permits (MoM) , September +1.7% (forecast +7.8%)

-

13:16

European session: the pound rose

08:00 United Kingdom Halifax house price index October +0.3% +0.4% +0.7%

08:00 nited Kingdom Halifax house price index 3m Y/Y October +6.2% +7.0% +6.9%

08:48 France Services PMI (Finally) October 50.2 50.2 50.9

08:53 Germany Services PMI (Finally) October 52.3 52.3 52.9

08:58 Eurozone Services PMI (Finally) October 50.9 50.9 51.6

09:30 United Kingdom Industrial Production (MoM) September -1.1% +0.7% +0.9%

09:30 United Kingdom Industrial Production (YoY) September -1.5% +1.8% +2.2%

09:30 United Kingdom Manufacturing Production (MoM) September -1.2% +1.2% +1.2%

09:30 United Kingdom Manufacturing Production (YoY) September -0.2% +0.8% +0.8%

10:00 Eurozone Retail Sales (MoM) September +0.5% Revised From +0.7% -0.3% -0.6%

10:00 Eurozone Retail Sales (YoY) September -0.2% Revised From -0.3% +0.6% +0.3%

11:00 Germany Factory Orders s.a. (MoM) September -0.3% +0.6% +3.3%

11:00 Germany Factory Orders n.s.a. (YoY) September +3.1% +5.6% +7.9%

The euro traded in a range against the dollar amid mixed statistics on retail sales in the euro zone and industrial orders in Germany.

Retail sales in the euro zone fell in September as consumer spending remained weak against the backdrop of high unemployment and slow wage growth . Retail sales rose in July and August, and their fall in September serves as a reminder that , despite the rise in consumer confidence , consumer demand in the euro area remains sluggish and inflation pressures - is extremely low. The European Union 's statistics agency announced on Wednesday that sales in September compared with August fell by 0.6 % , although up 0.3 % compared to the same period in 2012 . The data was worse than expected.

Orders in the industrial sector in Germany in September rebounded sharply thanks to strong foreign demand for capital goods , as well as in a large volume of orders for big-ticket items . Orders in the manufacturing sector rebounded in September by 3.3 % compared with the previous month , far exceeding forecasts of economists, who expected an increase of 0.6 %. In the previous two months, the volume of orders decreased.

Strong performance of orders in September provided a jump in foreign demand : foreign orders jumped by 6.8 % compared with the previous month , offsetting a 1.0% decline in domestic demand. Compared to the same period of the previous year, the total volume of orders adjusted for the number of working days increased by 7.9%. Unadjusted orders jumped 11.0%.

The pound rose against the dollar , supported by data on industrial production in Britain.

British industrial production rose in September after two consecutive declines , according to the latest figures from the Office for National Statistics . Recovery was stronger than economists expected.

Total production increased by 2.2 percent year on year in September , after falling 1.5 percent in August and 1.1 percent decline in July. The consensus forecast of economists was at the level of growth of 1.8 percent .

Manufacturing output grew by 0.8 per cent per annum in September. This happened after falling 0.2 percent in August and 0.4 percent drop in July. The result corresponds to the forecast of economists.

On a monthly basis , total production increased by 0.9 percent compared with a forecast of 0.7 percent growth. Manufacturing output increased by 1.2 percent in September compared with the previous month , in line with economists' forecasts .

EUR / USD: during the European session, the pair is trading in the range of $ 1.3486 - $ 1.3528

GBP / USD: during the European session, the pair rose to $ 1.6117

USD / JPY: during the European session, the pair fell to Y98.46

Canada at 13:30 GMT will publish the change in volume of building permits issued in September , at 15:00 GMT - the index of the PMI Ivey ( seasonally adjusted ) from the Ivey PMI index for October. At 15:00 GMT Britain will release data on the change in GDP from NIESR for October. At 18:00 GMT the United States places the 10 - year bonds .

-

13:00

Orders

EUR/USD

Offers $1.3650, $1.3615/20, $1.3600, $1.3565/70, $1.3540/50, $1.3525

Bids $1.3420, $1.3350

GBP/USD

Offers $1.6250/60, $1.6200/10, $1.6180, $1.6160/65, $1.6140/50, $1.6120/25

Bids $1.6050/40, $1.6021

AUD/USD

Offers $0.9650, $0.9600, $0.9575/80, $0.9545/50

Bids $0.9500, $0.9450, $0.9420, $0.9400

EUR/GBP

Offers stg0.8650/55, stg0.8600/05, stg0.8575/85, stg0.8520/30, stg0.8500, stg0.8480

Bids stg0.8380, stg0.8370/65, stg0.8320, stg0.8300

EUR/JPY

Offers Y134.20, Y134.00, Y133.40/50

Bids Y132.80, Y132.55/50, Y132.00

USD/JPY

Offers Y99.50, Y99.20, Y99.00

Bids Y98.00, Y97.80

-

11:30

European stocks climbed to a five-year high

European stocks climbed to a five-year high as companies from Alstom SA to ING Groep NV reported earnings that beat analysts’ estimates. U.S. index futures and Asian shares also rose.

U.K. industrial production rose 0.6 percent in September, rebounding from its biggest decline in almost a year, economists predicted before a report at 9:30 a.m in London. Separately, the National Institute of Economic and Social Research will release its estimates for U.K. economic growth in the three months through October at 3 p.m. Gross domestic product expanded 0.8 percent in the quarter ending September, the NIESR estimated.

Alstom, the French maker of power equipment and trains, jumped 5 percent to 28.43 euros. Operating profit in the period between April 1 and Sept. 30 fell to 695 million euros from 703 million euros last year. That still beat the average analyst estimate of 664 million euros. Chief Executive Officer Patrick Kron said the company will seek to sell a minority stake in Alstom Transport SA and other assets, according to a statement.

ING added 3.9 percent to 9.63 euros, rebounding from its biggest loss since August. The Dutch financial-services company reached an agreement with the European Commission to sell more than 50 percent of ING Life Japan by the end of 2015. ING also agreed to bring forward a deadline to sell all of its insurance and investment management activities in Europe by two years to the end of 2016.

Adecco rallied 5.4 percent to 69.95 Swiss francs after saying net income surged 61 percent to 190 million euros. That exceeded the 138.2 million-euro average estimate of five analysts in a survey.

FTSE 100 6,754.24 +7.40 +0.11%

CAC 40 4,291.8 +38.46 +0.90%

DAX 9,044.78 +35.67 +0.40%

-

11:20

Eurozone retail sales fall more than forecast

Eurozone retail sales declined slightly more than expected in September driven by the weakness in both food and non-food product turnover, data showed Wednesday.

The volume of retail sales dropped 0.6 percent month-on-month, reversing August's 0.5 percent rise, Eurostat reported. Economists had forecast sales to fall 0.4 percent in September.

Sale of food, drinks and tobacco slipped 0.6 percent and non-food product sales edged down 0.1 percent.

Compared to the same period of last year, retail sales were up 0.3 percent in September, in contrast to the 0.2 percent drop seen in August.

-

11:10

Eurozone's private sector expands faster than estimated

Eurozone's private sector business activity expanded at a slightly faster pace than previously estimated in October, detailed results of a survey by Markit Economics showed Wednesday. However, the rate of expansion remained weaker than that of September.

The composite output index, an indicator that measures performance of both manufacturing and service sectors, came in at 51.9, higher than the flash reading of 51.5. In September, the index stood at 52.2, a 27-month high.

This suggested that the October slowdown was less marked than originally thought, Markit said.

A PMI reading above 50 indicates expansion of the sector while a reading below 50 suggests contraction.

The services business activity index scored 51.6 in October, up from the preliminary reading of 50.9. This was lower than 52.2 in September.

New orders received by Eurozone private sector grew at a weaker pace in October, leading to further fall in employment.

-

11:02

Germany: Factory Orders n.s.a. (YoY), September +7.9% (forecast +5.6%)

-

11:00

Germany: Factory Orders s.a. (MoM), September +3.3% (forecast +0.6%)

-

10:45

U.K. industrial output rebounds in September

British industrial production bounced back in September after two consecutive declines, the latest figures from the Office for National Statistics showed Wednesday. The rebound was stronger than expected by economists.

Total production rose 2.2 percent year-on-year in September following a 1.5 percent fall in August and a 1.1 percent decline in July. The consensus was for an increase of 1.8 percent.

Manufacturing output grew 0.8 percent annually in September. This comes after a 0.2 percent fall in August and a 0.4 percent drop in July. The outcome matched economists' forecast.

On a monthly basis, total production increased 0.9 percent compared with forecast for a 0.6 percent gain. Factory output increased 1.2 percent in September from a month earlier, a tad faster than 1.1 percent rise expected.

-

10:27

Option expiries for today's 1400GMT cut

USD/JPY Y97.00, Y98.45, Y98.50, Y98.65, Y98.75, Y99.00, Y100.00

EUR/USD $1.3350, $1.3450, $1.3500, $1.3600, $1.3620, $1.3650

GBP/USD $1.6000, $1.6010, $1.6060, $1.6075

EUR/GBP stg0.8445, stg0.8470

USD/CHF Chf0.9100

AUD/USD $0.9400, $0.9500

AUD/JPY Y94.00

AUD/CHF Chf0.8550, Chf0.8600

NZD/USD $0.8225

USD/CAD C$1.0395, C$1.0430

-

10:20

Asia Pacific stocks close

Asian stocks rose, snapping a four-day drop on the regional equities benchmark, as Japanese shares were boosted by the yen weakening against the dollar and Commonwealth Bank of Australia posted a surge in profit.

Nikkei 225 14,337.31 +111.94 +0.79%

S&P/ASX 200 5,433.8 +1.84 +0.03%

Shanghai Composite 2,140.89 -16.35 -0.76%

Canon Inc. gained 0.8 percent as the yen dropped, boosting the outlook for earnings at Japanese exporters.

Commonwealth Bank, Australia’s largest lender by market value, climbed 1.3 percent to a record after saying first-quarter cash profit jumped 14 percent on lower bad-debt charges.

HTC Corp. rose 3.9 percent after analysts said the smartphone maker’s fourth-quarter forecast was better than estimated.

-

10:00

Eurozone: Retail Sales (MoM), September -0.6% (forecast -0.3%)

-

10:00

Eurozone: Retail Sales (YoY), September +0.3% (forecast +0.6%)

-

09:30

United Kingdom: Industrial Production (MoM), September +0.9% (forecast +0.7%)

-

09:30

United Kingdom: Industrial Production (YoY), September +2.2% (forecast +1.8%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , September +1.2% (forecast +1.2%)

-

09:30

United Kingdom: Manufacturing Production (YoY), September +0.8% (forecast +0.8%)

-

09:15

FTSE 100 6,759.78 +12.94 +0.19%, CAC 40 4,285 +31.66 +0.74%, Xetra DAX 9,042.91 +33.80 +0.38%

-

09:00

Eurozone: Services PMI, October 51.6 (forecast 50.9)

-

08:53

Germany: Services PMI, October 52.9 (forecast 52.3)

-

08:48

France: Services PMI, October 50.9 (forecast 50.2)

-

08:04

United Kingdom: Halifax house price index, October +0.7% (forecast +0.4%)

-

08:04

United Kingdom: Halifax house price index 3m Y/Y, October +6.9% (forecast +7.0%)

-

07:22

European bourses are seen narrowly mixed Wednesday: the FTSE down 8, the DAX up 15 and the CAC up 2.

-

07:03

Asian session: The euro rose against the dollar

00:30 Australia Trade Balance September -0.82 -0.51 -0.28

The euro rose against the dollar and the yen as traders speculated a recent drop in the common currency was too rapid with economists saying the European Central Bank will hold interest rates unchanged tomorrow.

The yen fell against major peers as a surge in Asian equities reduced demand for the currency as a haven.

The dollar retreated from near a six-week high against the euro before data tomorrow forecast to show the world’s largest economy slowed last quarter, weighing on expectations the Federal Reserve will move to reduce stimulus. A report tomorrow is predicted to show U.S. gross domestic product grew at a 2 percent annualized rate in the third quarter, down from 2.5 percent in the previous three months, according to the median estimate in a Bloomberg News survey. San Francisco Fed President John Williams said yesterday economic growth in recent months has fallen short of his expectations, partially eroding his confidence gains in the labor market will endure without monetary stimulus.

New Zealand’s kiwi climbed to its highest since Oct. 24 as employers added more jobs than forecast. The nation’s employment rose 1.2 percent in the third quarter, compared with a 0.4 percent gain in the previous three months.

EUR / USD: during the Asian session the pair rose to $ 1.3525

GBP / USD: during the Asian session, the pair rose to $ 1.9095

USD / JPY: during the Asian session the pair rose to Y98.75

Across the Atlantic, the calendar gets underway from 1200GMT, when the MBA Mortgage Index for the November 1 week are released, followed by the October challenger layoffs data at 1230GMT. At 1500GMT, the US September Leading Indicator data will be released. The index of leading indicators is expected to rise 0.7% in September. Positive contributions are expected from a lower initial claims level and some rebound in stock prices, offset by a decline in consumer expectations and a shorter factory workweek. At 1530GMT, the EIA Crude Oil Stocks for the November 1 week are due to be released. At 1810GMT, Cleveland Federal Reserve Bank President Sandra Pianalto will deliver a speech on housing and the economy, in Columbus, Ohio. -

06:25

Commodities. Daily history for Nov 5’2013:

GOLD 1,310.10 -4.60 -0.35%

OIL (WTI) 93.40 -1.22 -1.29%

-

06:24

Stocks. Daily history for Nov 5’2013:

Nikkei 225 14,225.37 +23.80 +0.17%

S&P/ASX 200 5,431.96 +41.43 +0.77%

Shanghai Composite 2,157.24 +7.61 +0.35%

FTSE 100 6,746.84 -16.78 -0.25%

CAC 40 4,253.34 -35.25 -0.82%

DAX 9,009.11 -28.12 -0.31%

Dow -22.06 15,617.06 -0.14%

Nasdaq +3.27 3,939.86 +0.08%

S&P -5.11 1,762.82 -0.29%

-

06:24

Currencies. Daily history for Nov 5'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3473 -0,30%

GBP/USD $1,6045 +0,49%

USD/CHF Chf0,9133 +0,41%

USD/JPY Y98,49 -0,10%

EUR/JPY Y132,69 -0,41%

GBP/JPY Y158,00 +0,37%

AUD/USD $0,9507 -0,02%

NZD/USD $0,8363 +0,96%

USD/CAD C$1,0453 +0,30%

-

06:05

Schedule for today, Wednesday, Nov 6’2013:

00:30 Australia Trade Balance September -0.82 -0.51

08:00 United Kingdom Halifax house price index October +0.3% +0.4%

08:00 United Kingdom Halifax house price index 3m Y/Y October +6.2% +7.0%

08:48 France Services PMI (Finally) October 50.2 50.2

08:53 Germany Services PMI (Finally) October 52.3 52.3

08:58 Eurozone Services PMI (Finally) October 50.9 50.9

09:30 United Kingdom Industrial Production (MoM) September -1.1% +0.7%

09:30 United Kingdom Industrial Production (YoY) September -1.5% +1.8%

09:30 United Kingdom Manufacturing Production (MoM) September -1.2% +1.2%

09:30 United Kingdom Manufacturing Production (YoY) September -0.2% +0.8%

10:00 Eurozone Retail Sales (MoM) September +0.7% -0.3%

10:00 Eurozone Retail Sales (YoY) September -0.3% +0.6%

11:00 Germany Factory Orders s.a. (MoM) September -0.3% +0.6%

11:00 Germany Factory Orders n.s.a. (YoY) September +3.1% +5.6%

13:30 Canada Building Permits (MoM) September -21.2% +7.8%

15:00 United Kingdom NIESR GDP Estimate October +0.8% +0.5%

15:00 Canada Ivey Purchasing Managers Index October 51.9 54.7

15:00 U.S. Leading Indicators September +0.7% +0.7%

15:30 U.S. Crude Oil Inventories October +4.1

22:30 Australia AiG Performance of Construction Index October 47.6

-