Notícias do Mercado

-

20:00

Dow +2.59 15,329.19 +0.02% Nasdaq -0.45 3,724.56 -0.01% S&P -2.75 1,686.38 -0.16%

-

19:20

American focus : the U.S. dollar has fallen markedly against the euro

The dollar fell sharply against the euro , losing the all previously earned a position as too optimistic data on treatment for unemployment benefits , as it turned out , had been distorted because of invalid parameters submitted by the various states.

It is learned that the primary applications for unemployment benefits in the U.S. unexpectedly fell in the week ended Sept. 7. Moreover, the number of applications fell to the lowest level in more than seven years. The Labor Department said that initial applications for unemployment benefits fell to 292,000 , which is 31,000 less than the previous week's 323,000 , which has not been revised . The decrease came as a surprise to economists , who had expected that the primary applications will grow to 332,000 .

With the unexpected decrease the number of initial claims for unemployment benefits fell to the lowest level since reaching 291,000 in the week ending April 1, 2006 .

However , the Labor Department noted that the marked decrease in unemployment claims may be due to the fact that the two states were not informed of all applications for software updates .

Secondary applications for unemployment benefits in the U.S. for the week 25-31 August fell by 73,000 to 2.871 million

Analysts believe that the major currencies will be close to the current level until the Fed meeting next Tuesday and Wednesday. Before that , the market will closely monitor data on retail sales and inflation on Friday .

Note also that without distorted data in the U.S., news that could explain the strong growth of the pair does not go . From the point of view of reports from the euro zone , they were more in favor of the euro's decline , as industrial production in the euro zone fell in July by 1.5 %, although the expected decline of only 0.1 %.

Pound back to the highs of the day against the dollar, after falling output data on the number of applications for unemployment benefits in the United States . Note that this dynamic has also been linked with the comments of the Bank of England. Carney statements were more aggressive than usual. The head of the Bank of England said that "the monetary authorities set the medium-term inflation target of 2.5 % instead of 2% due to the fact that 35 % of the unemployed are long-term unemployed ." "In order to increase transparency new MPC members must report whether they are guided by the current " politics of transparency. " Moreover, Carney said in Parliament that "the effectiveness of the policy of the Central Bank has increased, which can be called mitigation ." Fisher and Miles also noted that "the achievement of 2.5 % level of inflation will force the Bank to reconsider the policy," and "the reaction of markets to improve the GDP may be temporary ."

-

19:00

U.S.: Federal budget , August -147.9 (forecast -155.3)

-

18:20

European stock close

European stocks slipped from the highest level in more than five years as the region’s industrial output contracted more than forecast.

The Stoxx Europe 600 Index slipped 0.1 percent to 310.66 at 4:32 p.m. in London, having swung between gains and losses at least 25 times. The gauge climbed to the highest level since June 2008 yesterday as U.S. President Barack Obama postponed a decision on military action against Syria. The measure has soared 11 percent in 2013 as central banks around the world maintained their stimulus programs.

Euro-area industrial output contracted more than economists forecast in July as manufacturers struggled to shake off the legacy of a record-long recession. Factory production in the region fell 1.5 percent from June, when it gained 0.6 percent, the European Union’s statistics office said today. That’s more than the 0.3 percent contraction forecast by economists, according to the median of estimates.

Still, international investors are gaining confidence in the European economy and many see the region among the best to invest, according to the latest Global Poll. Forty percent of the responding investors, analysts and traders said the euro-area economy is improving, more than four times the number in May. The European Union offers one of the best investment opportunities for 34 percent of those polled, up from 18 percent in May and the most since that question was first asked in October 2009.

National benchmark indexes declined in 12 of the 18 western European markets today.

FTSE 100 6,588.98 +0.55 +0.01% CAC 40 4,106.63 -12.48 -0.30% DAX 8,494 -1.73 -0.02%

Sanofi slid 2.8 percent to 72.23 euros in Paris. The company withdrew the application for U.S. approval of an experimental drug called lixisenatide in a delay to the company’s effort to bolster sales of diabetes medicines in the world’s biggest pharmaceutical market.

Zealand Pharma A/S, the Danish company that licensed the drug to Sanofi, plunged 15 percent to 66 kroner, the biggest drop in seven months.

Richemont declined 2.6 percent to 91 Swiss francs. The world’s largest jewelry maker said revenue in the Asia-Pacific region, its biggest market, rose 4 percent at constant exchange rates in the five months through August as lower sales in China offset growth in Hong Kong and Macau. That compared with growth of 12 percent for the same period last year. Total revenue rose 9 percent excluding currency shifts, missing the 10 percent median estimate of analysts.

EDF SA, Europe’s biggest power generator, slipped 2.6 percent to 21.66 euros. Norges Bank, the second-largest shareholder, sold 13 million shares at 21.50 euros each, according to three people familiar with the deal.

Vivendi rose 3.1 percent to 17.21 euros. Music, pay-TV, European cinema and Internet in Brazil will make up a new media group based in France after the split with phone unit SFR, according to a statement yesterday.

Home Retail gained 5.8 percent to 173.4 pence, its highest price since June 2011. Same-store sales at its Homebase home-improvement business jumped 11 percent in the 13 weeks ended Aug. 31, more than the 3 percent median of analyst estimates. Sales at its Argos unit rose 2.7 percent, also exceeding

Bouygues SA (EN), the French building, telecommunications and television company, surged 7.2 percent to 26.95 euros, the highest since November 2011. Credit Suisse Group AG upgraded the shares to neutral, similar to a hold recommendation, from underperform.

-

17:00

European stock close: FTSE 100 6,588.98 +0.55 +0.01% CAC 40 4,106.63 -12.48 -0.30% DAX 8,494 -1.73 -0.02%

-

16:40

Oil: an overview of the market situation

World oil prices rose modestly today , rising above $ 112 a barrel as investors expect to see that diplomatic efforts to eliminate chemical weapons Syria will avoid attack by the United States, which could further disrupt supplies from the Middle East. Note that the political unrest has affected the volume of production of Libyan oil - it is down to 10 % of the normal values and export declined by about 80,000 barrels per day at the beginning of this month , which led to a substantial increase in oil prices. Despite the fact that Syria is not a major oil producer , is increasing concern that a global conflict could spill over into the leading exporting countries or disrupt naval supplies .

However , the International Energy Agency ( IEA) stated that increases growth forecast for global oil demand in 2014 by 70,000 barrels per day. IEA also increased the estimate of world oil demand in Q3 by about 260,000 barrels a day. It was also noted that the amount of free oil production capacity in OPEC in August fell to 2.94 million barrels a day compared with 3.08 million barrels per day in July, and U.S. production in July increased by 1.1 million barrels a day compared with July 2012

We also add that the course of trade continue to affect yesterday's inventory data , which showed that gasoline inventories rose last week, suggesting that the increase in demand, which was supported by the summer driving season is likely to halt

The cost of the October futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 108.43 a barrel on the New York Mercantile Exchange.

October futures price for North Sea Brent crude oil mixture rose $ 0.83 to $ 112.47 a barrel on the London exchange ICE Futures Europe.

-

16:21

Gold: an overview of the market situation

Gold prices have declined substantially , losing nearly 3 percent , ahead of the Fed meeting next week at which the central bank could shed light on the future of its program of quantitative easing. According to experts , the Fed on the results of its two-day meeting to announce a reduction of its asset-purchase program , the volume of which now stands at $ 85 billion per month, which , in turn , lead to a new Volga sales of precious metals .

Note that the price of gold fell today to the lowest level since Aug. 15 , namely, to $ 1,327.40 an ounce. Against this background, the precious metal may show the biggest weekly decline since June.

Traders said selling pressure increased dramatically , after the metal broke through the 100- day moving average at $ 1,355 an ounce, as well as other key support levels . In addition, they state that the physical demand from Asia is low compared to previous weeks , as retail investors prefer to stay on the sidelines ahead of the Fed meeting next week. Recall that the ultrasoft monetary policy increased the appeal of gold as an investment in recent years , keeping interest rates at extremely low levels, while stirring up fears about inflation have helped to raise the price to a record high in 2011. Gold prices have fallen about 19 percent since then , as the Fed has indicated that it may start reducing monetary stimulus by the end of the year.

According to analysts Thomson Reuters GFMS, gold prices could fall below $ 1,300 an ounce by the end of 2014 , as the decline of quantitative easing may increase the likelihood of higher interest rates. Furthermore, they added that , despite the fact that the Fed's decision to reduce the asset purchase program is already reflected in the price of gold, we can not say that is not going to happen any hesitation , as importantly , when this will be announced .

The cost of the October gold futures on COMEX today dropped to $ 1330.50 per ounce.

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3275, $1.3290

USD/JPY Y99.00, Y99.50(large), Y99.70(large), Y99.95, Y100.00

GBP/USD $1.5785, $1.5800

EUR/GBP stg0.8400, stg0.8410

GBP/CHF Chf1.4700

USD/CHF Chf0.9325

AUD/USD $0.9200, $0.9205, $0.9330

AUD/JPY Y92.00

AUD/CAD C$0.9575

-

14:34

U.S. Stocks open: Dow 15,336.89 +10.29 +0.07%, Nasdaq 3,724.59 -0.42 -0.01%, S&P 1,688.35 -0.78 -0.05%

-

14:28

Before the bell: S&P futures -0.02%, Nasdaq futures +0.14%

U.S. stock-index futures were little changed as investors weighed an unexpected drop in jobless claims to gauge the Federal Reserve’s next move on stimulus.

Global Stocks:

Nikkei 14,387.27 -37.80 -0.26%

Hang Seng 22,953.72 +16.58 +0.07%

Shanghai Composite 2,255.6 +14.34 +0.64%

FTSE 6,598.43 +10.00 +0.15%

CAC 4,113.26 -5.85 -0.14%

DAX 8,501.99 +6.26 +0.07%

Crude oil $108.36 +0.74%

Gold $1331.40 -2.38%

-

14:15

U.S. import prices unexpectedly unchanged in August

With higher fuel prices offset by declining non-fuel prices, the Labor Department released a report on Thursday showing that U.S. import prices unexpectedly came in flat in August.

The report said import prices were unchanged in August after ticking up 0.1 percent in July. Economists had been expecting import prices to rise by about 0.5 percent.

Meanwhile, the Labor Department said export prices fell by 0.5 percent in August following a 0.1 percent drop in the previous month. Export prices had been expected to edge up by 0.1 percent.

-

14:00

U.S. weekly jobless claims show unexpected decrease

First-time claims for U.S. unemployment benefits unexpectedly decreased in the week ended September 7th, according to a report released by the Labor Department on Thursday, with claims falling to their lowest level in over seven years.

The Labor Department said initial jobless claims dropped to 292,000, a decrease of 31,000 from the previous week's unrevised figure of 323,000. The decrease came as a surprise to economists, who had expected jobless claims to climb to 330,000.

With the unexpected decrease, jobless claims fell to their lowest level since hitting 291,000 in the week ended April 1, 2006.

However, the Labor Department noted that the notable decrease in jobless claims came as two states failed to report all of their claims amid computer upgrades.

-

13:47

Upgrades and downgrades before the market open:

Upgrades:

Downgrades:

Travelers (TRV) downgraded to Market Perform from Outperform at Wells Fargo

Other:

Credit Agricole raises tgt on Facebook (FB) to $60 from $42

-

13:31

U.S.: Initial Jobless Claims, September 292 (forecast 332)

-

13:31

U.S.: Import Price Index, August 0.0% (forecast +0.6%)

-

13:30

Canada: New Housing Price Index , July +0.2% (forecast +0.2%)

-

13:18

European session: the euro fell

06:45 France CPI, m/m August -0.3% +0.5% +0.5%

06:45 France CPI, y/y August 0.0% +1.0%

08:00 Eurozone ECB Monthly Report September

09:00 Eurozone Industrial production, (MoM) July +0.7% -0.1% -1.5%

09:00 Eurozone Industrial Production (YoY) July +0.3% -0.1% -2.5%

The euro fell against the dollar on weak data on industrial production in the euro area. Industrial production fell 1.5 percent in July compared with the previous month , graded the 0.6 percent rise in June , according to Eurostat . According to forecasts , industrial production was reduced by 0.1 percent . Intermediate goods fell by 0.7 percent, while the production of energy fell by 1.6 percent. Production of capital goods and durable consumer goods fell by 2.6 percent and 2.2 percent , respectively. The consumer non-durable goods fell 0.9 percent. On an annual basis, industrial production decline deepened to 2.1 percent from 0.4 percent in June. Figure exceeded the consensus forecast of a 0.1 percent drop .

Based on these data , the euro zone economy is unlikely to show strong performance in the III quarter. The downturn in the industry due to a significant drop in production at the German , Italian and French companies. Production in these countries is about two- thirds of the total. Industrial production in Germany fell by 2.3 percent. An even stronger decline was registered in the smaller countries such as Ireland, where production fell by 8.7 percent, and Malta, where the index fell by 6.7 percent.

The pound rose to the comments of the head of the Bank of England and crossed the mark of $ 1.5800 , but later backed down and continued to decline. Carney statements were more aggressive than usual. The head of the Bank of England said that "the monetary authorities set the medium-term inflation target of 2.5 % instead of 2% due to the fact that 35 % of the unemployed are long-term unemployed ." "In order to increase transparency new MPC members must report whether they are guided by the current " politics of transparency. " Moreover, Carney said in Parliament that "the effectiveness of the policy of the Central Bank has increased, which can be called mitigation ." Fisher and Miles also noted that "the achievement of 2.5 % level of inflation will force the Bank to reconsider the policy ," and "the reaction of markets to improve the GDP may be temporary ."

Investors expect the output of the U.S. employment report . According to the median forecast of economists , the number of new applications for unemployment benefits last week , is likely to grow to 330 thousand , while the last reporting rate recorded growth of 323 thousand

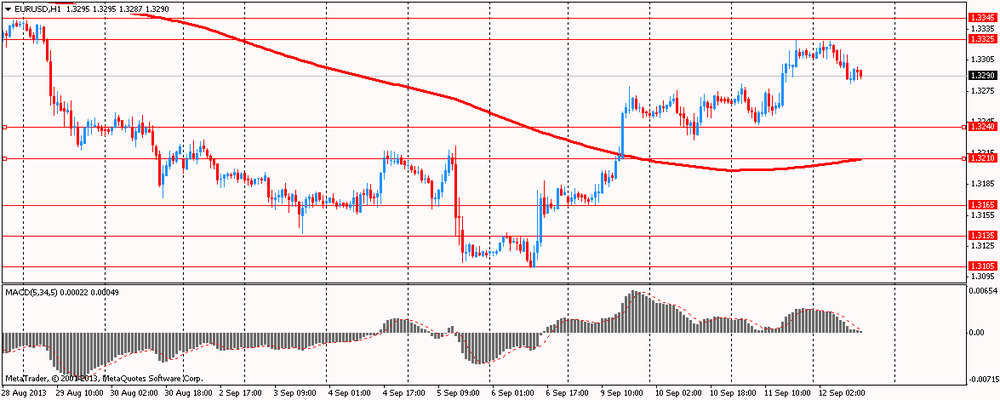

EUR / USD: during the European session, the pair fell to $ 1.3282

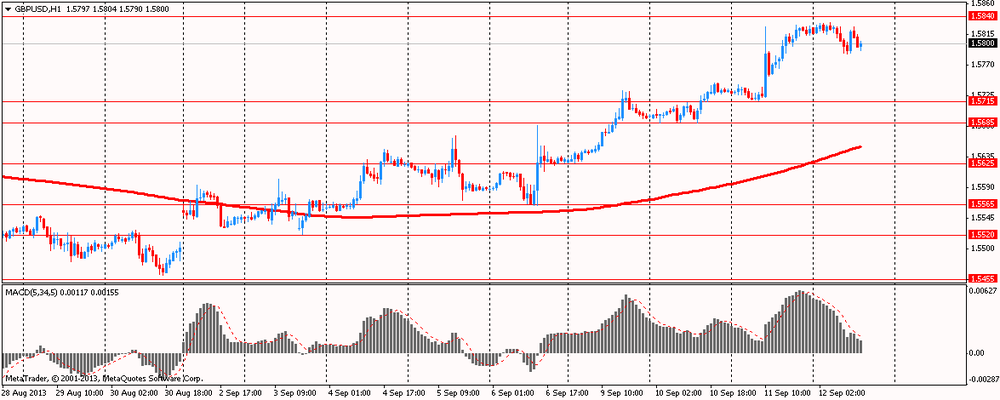

GBP / USD: during the European session, the pair dropped to $ 1.5785

USD / JPY: during the European session, the pair fell to Y99.18

At 12:30 Canada is to publish an index of housing prices in the primary market in July. At 12:30 GMT the United States will number of initial claims for unemployment insurance , the number of continuing claims for unemployment benefits , the import price index for August. At 17:00 the U.S. spends 30-year bonds. At 18:00 GMT the United States will present the monthly performance report for August. At 22:30 GMT New Zealand will release the index of business activity in the manufacturing sector of Business NZ in August.

-

13:00

Orders

EUR/USD

Offers $1.3350, $1.3325/30

Bids $1.3280/75, $1.3240/30, $1.3210/00, $1.3150/40

GBP/USD

Offers $1.5920/30, $1.5900, $1.5870/80, $1.5840/50

Bids $1.5785, $1.5685/80

AUD/USD

Offers $0.9400, $0.9380/85, $0.9290

Bids $0.9230/20, $0.9205/00, $0.9155/50

EUR/GBP

Offers stg0.8550/55, stg0.8520, stg0.8460/65, stg0.8440/50, stg0.8425/30

Bids stg0.8380, stg0.8350, stg0.8300

EUR/JPY

Offers Y134.60, Y134.30/40, Y133.80, Y133.50

Bids Y131.80, Y131.50, Y131.30/20, Y130.80, Y130.00/9.80

USD/JPY

Offers Y100.80, Y100.60/65, Y100.00, Y99.60/70

Bids Y99.20, Y99.00, Y98.60/50, Y98.25/20, Y98.00

-

11:30

European stocks slipped from a five-year high

European stocks slipped from a five-year high as the region’s industrial output contracted more than forecast. U.S. index futures and Asian shares fell.

Euro-area industrial output contracted more than economists forecast in July as manufacturers struggled to shake off the legacy of a record-long recession. Factory production in the 17-nation euro area fell 1.5 percent from June, when it gained 0.6 percent, the European Union’s statistics office in Luxembourg said today. That’s more than the 0.3 percent contraction forecast by economists, according to the median of 33 estimates in a survey.

RWE lost 2.5 percent to 24.42 euros as Handelsblatt reported that Chief Executive Officer Peter Terium may suggest an annual dividend below last year’s 2 euros a share at a supervisory board meeting next week. The German newspaper cited unidentified people close to the board.

EDF SA, Europe’s biggest power generator, slipped 2.9 percent to 21.59 euros. Norges Bank, the second-largest shareholder, sold 13 million shares at 21.50 euros each, according to three people familiar with the deal.

Richemont declined 3.5 percent to 90.20 Swiss francs. The world’s largest jewelry maker said revenue in the Asia-Pacific region, its biggest market, rose 4 percent at constant exchange rates in the five months through August as lower sales in China offset growth in Hong Kong and Macau. That compared with growth of 12 percent for the same period last year.

FTSE 100 6,566.59 -21.84 -0.33%

CAC 40 4,101.81 -17.30 -0.42%

DAX 8,477.92 -17.81 -0.21%

-

11:15

Australia unemployment rate climbs to 5.8%

Australia's unemployment rate came in at a seasonally adjusted 5.8 percent in August, the Australian Bureau of Statistics said on Thursday - in line with forecasts and up from 5.7 percent in July.

But the Australian economy lost 10,800 jobs in August - missing by a mile forecasts that had suggested an increase of 10,000 jobs. That follows the loss of 10,200 jobs in the previous month.

Full-time employment decreased 2,600 to 8,128,800 and part-time employment decreased 8,200 to 3,508,300.

Unemployment increased 9,400 (1.3 percent) to 714,100. The number of persons looking for full-time work decreased 2,300 to 516,300 and the number of persons looking for part-time work increased 11,700 to 197,800.

The participation rate was 65.0 percent versus forecasts for 65.2 percent and down from 65.1 percent a month earlier.

Aggregate monthly hours worked increased 1.1 million hours to 1,650.0 million hours.

-

10:45

Eurozone July industrial output drops more than forecast

Eurozone industrial production declined at a faster-than-expected pace in July driven by widespread weakness across sub-sectors, official data showed Thursday.

Industrial output fell 1.5 percent in July from a month ago, reversing a 0.6 percent rise in June, Eurostat reported. It was forecast to fall by 0.3 percent.

Production of intermediate goods slipped 0.7 percent and energy output declined 1.6 percent. Output of capital goods and durable consumer goods declined by 2.6 percent and 2.2 percent, respectively. Non-durable consumer goods output was down 0.9 percent.

On a yearly basis, the decline in industrial output deepened to 2.1 percent from 0.4 percent in June. The rate exceeded consensus for 0.2 percent fall.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3100, $1.3215, $1.3250, $1.3350

USD/JPY Y99.50, Y99.60, Y100.10, Y100.50, Y101.00, Y101.30

EUR/JPY Y132.00

EUR/GBP stg0.8400, stg0.8405, stg0.8420

USD/CHF Chf0.9275

EUR/CHF Chf1.2310

AUD/USD $0.9200, $0.9285, $0.9300

EUR/AUD A$1.4375

NZD/USD $0.7950

USD/CAD C$1.0400, C$1.0650

-

10:00

Eurozone: Industrial production, (MoM), July -1.5% (forecast -0.1%)

-

10:00

Eurozone: Industrial Production (YoY), July -2.5% (forecast -0.1%)

-

09:41

Asia Pacific stocks close

Asia’s benchmark stock index swung between gains and losses after Japanese machinery orders accelerated less than expected and as investors await the outcome of the Federal Reserve’s meeting next week.

Nikkei 225 14,387.27 -37.80 -0.26%

Hang Seng 22,932.77 -4.37 -0.02%

S&P/ASX 200 5,242.54 +8.15 +0.16%

Shanghai Composite 2,255.6 +14.34 +0.64%

Toyota Motor Corp. dropped 1.1 percent, pacing losses among Japanese exporters as the yen rose for a second day.

Sino Biopharmaceutical Ltd. tumbled 16 percent, prompting a trading suspension, after a report by state-run Chinese Central Television alleged bribery at a unit of the medicine maker.

Qantas Airways Ltd., Australia’s largest carrier, climbed 2.9 percent after the Australian Financial Review reported it may share its Sydney terminal with unit Jetstar Airways.

-

08:40

FTSE 100 6,594.56 +6.13 +0.09%? CAC 40 4,119.67 +0.56 +0.01%, Xetra DAX 8,500.15 +4.42 +0.05%

-

07:45

France: CPI, m/m, August +0.5% (forecast +0.5%)

-

07:45

France: CPI, y/y, August +1.0%

-

07:20

European bourses are initially seen trading higher Thursday: the FTSE up 2, the DAX up 23 and the CAC up 6.

-

07:00

Asian session: The greenback traded near the lowest this month

01:30 Australia Unemployment rate August 5.7% 5.8% 5.8%

01:30 Australia Changing the number of employed August -10.2 10.2 -10.8

The greenback traded near the lowest this month against the euro before a report forecast to show U.S. jobless claims rose. U.S. jobless claims probably rose to 330,000 in the week ended Sept. 7, from 323,000 in the previous seven-day period, according to the median estimate of economists surveyed by Bloomberg News before today’s data. Demand for the dollar as a haven receded as the U.S. delayed a congressional vote on military action in Syria.

Fed Bank of New York President William C. Dudley speaks today in Paris. He said in July that economic growth will probably quicken next year, possibly warranting a reduction in stimulus.

The yen gained after Japan’s machinery orders stagnated. In Japan, machinery orders were unchanged in July from June when they fell 2.7 percent, the Cabinet Office announced today in Tokyo. Economists surveyed by Bloomberg predicted a 2.4 percent increase.

Australia’s dollar fell against all 16 major counterparts after the number of people employed in the country fell 10,800 last month, following a downwardly revised loss of 11,400 jobs in July, the statistics bureau said today in Sydney. Economists predicted a 10,000 increase in August.

New Zealand’s dollar strengthened against all its major peers after the RBNZ forecast bank bill rates will be higher than previously estimated in the first half of 2014, indicating the central bank may raise benchmark borrowing costs within that period.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3305-25

GBP / USD: during the Asian session, the pair traded in the range of $ 1.5815-30

USD / JPY: during the Asian session the pair fell to Y99.40

There is a full calendar on both sides of the Atlantic Thursday, with a speech from ECB President Draghi one of the highlights. The data calendar gets underway at 0600GMT, with the release of the German August wholesale price data. There is a slew of euro area inflation data expected from 0645GMT, when French August HICP umbers will be published. Spanish August data will be released at 0700GMT. Also due at 0700GMT, Bundesbank Vice President Sabine Lautenschlaeger will deliver a speech on OTC derivatives reforms, in Paris. At 0730GMT, ECB Governing Council member Erkki Liikanen holds a press conference on monetary policy and global economy, in Helsinki. Italian July industrial production data will be released at 0800GMT, along with the ECB's monthly report - likely to be a repeat of the opening statement at the last monthly press conference. At 0900GMT, the July EMU industrial output numbers will cross the wires, along with the Italian August final HICP. The OECD economic survey of Ireland will also be released at 0900GMT. There is a Euro Conference in Riga, Latvia. EU Commission VP Olli Rehn will speak at 0900GMT, while ECB President Mario Draghi will speak from 1140GMT. Bank of Latvia Gov. Ilmars Rimsevics speaks at 1220GMT

At 0845GMT, BOE Governor Mark Carney, and MPC members Fisher, Miles and McCaffery all appear before the Treasury Select Committee. With employment stronger than forecast at the recent reading, there is likely to be tight questioning over the BOE's forward guidance.

-

06:20

Commodities. Daily history for Sep 11’2013:

GOLD 1,363.50 -0.20 -0.01%

OIL (WTI) 107.70 0.31 0.29%

-

06:20

Stocks. Daily history for Sep 11’2013:

Nikkei 225 14,425.07 1,71 0,01%

Hang Seng 22,937.14 -39,51 -0,17%

S & P / ASX 200 5,234.39 33,22 0,64%

Shanghai Composite 2,241.27 3,28 0,15%

FTSE 100 6,571.77 -12.22 -0.19%

CAC 40 4,119.11 +2.47 +0.06%

DAX 8,495.73 +49.19 +0.58%

Dow +134.54 15,325.60 +0.89%

Nasdaq -4.01 3,725.01 -0.11%

S&P +5.08 1,689.07 +0.30%

-

06:20

Currencies. Daily history for Sep 11'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3310 +0,34%

GBP/USD $1,5822 +0,57%

USD/CHF Chf0,9306 -0,45%

USD/JPY Y99,98 -0,40%

EUR/JPY Y133,06 -0,08%

GBP/JPY Y158,17 +0,17%

AUD/USD $0,9322 +0,14%

NZD/USD $0,8124 +0,74%

USD/CAD C$1,0315 -0,33%

-

06:00

Schedule for today, Thursday, Sep 12’2013:

01:30 Australia Unemployment rate August 5.7% 5.8% 5.8%

01:30 Australia Changing the number of employed August -10.2 10.2 -10.8

06:45 France CPI, m/m August -0.3% +0.5%

06:45 France CPI, y/y August 0.0%

08:00 Eurozone ECB Monthly Report September

09:00 Eurozone Industrial production, (MoM) July +0.7% -0.1%

09:00 Eurozone Industrial Production (YoY) July +0.3% -0.1%

09:00 United Kingdom MPC Member Fisher Speaks

09:00 United Kingdom MPC Member McCafferty Speaks

09:00 United Kingdom MPC Member Miles Speaks

09:00 United Kingdom Inflation Report Hearings Quarter II

09:00 United Kingdom BOE Gov Mark Carney Speaks

11:40 Eurozone ECB President Mario Draghi Speaks

12:30 Canada New Housing Price Index July +0.2% +0.2%

12:30 U.S. Initial Jobless Claims September 323 332

12:30 U.S. Import Price Index August +0.2% +0.6%

18:00 U.S. Federal budget August -97.6 -155.3

22:30 New Zealand Business NZ PMI August 59.5

-