Notícias do Mercado

-

19:20

American focus : the U.S. dollar has fallen markedly against the euro

The dollar fell sharply against the euro , losing the all previously earned a position as too optimistic data on treatment for unemployment benefits , as it turned out , had been distorted because of invalid parameters submitted by the various states.

It is learned that the primary applications for unemployment benefits in the U.S. unexpectedly fell in the week ended Sept. 7. Moreover, the number of applications fell to the lowest level in more than seven years. The Labor Department said that initial applications for unemployment benefits fell to 292,000 , which is 31,000 less than the previous week's 323,000 , which has not been revised . The decrease came as a surprise to economists , who had expected that the primary applications will grow to 332,000 .

With the unexpected decrease the number of initial claims for unemployment benefits fell to the lowest level since reaching 291,000 in the week ending April 1, 2006 .

However , the Labor Department noted that the marked decrease in unemployment claims may be due to the fact that the two states were not informed of all applications for software updates .

Secondary applications for unemployment benefits in the U.S. for the week 25-31 August fell by 73,000 to 2.871 million

Analysts believe that the major currencies will be close to the current level until the Fed meeting next Tuesday and Wednesday. Before that , the market will closely monitor data on retail sales and inflation on Friday .

Note also that without distorted data in the U.S., news that could explain the strong growth of the pair does not go . From the point of view of reports from the euro zone , they were more in favor of the euro's decline , as industrial production in the euro zone fell in July by 1.5 %, although the expected decline of only 0.1 %.

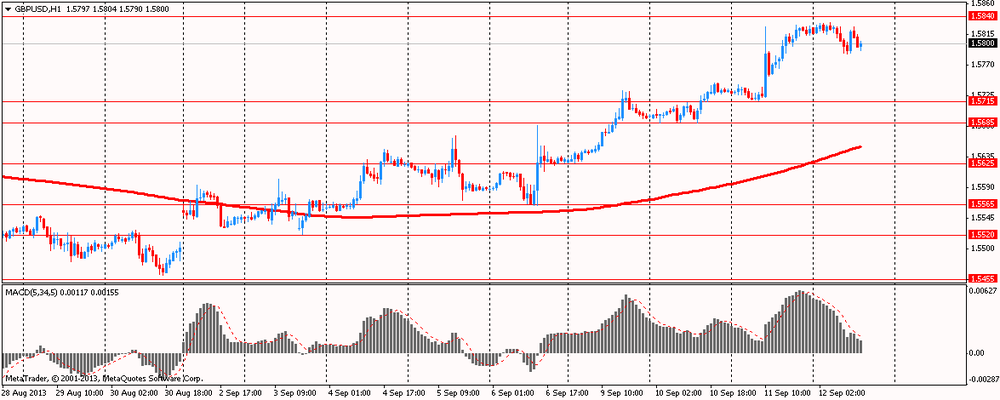

Pound back to the highs of the day against the dollar, after falling output data on the number of applications for unemployment benefits in the United States . Note that this dynamic has also been linked with the comments of the Bank of England. Carney statements were more aggressive than usual. The head of the Bank of England said that "the monetary authorities set the medium-term inflation target of 2.5 % instead of 2% due to the fact that 35 % of the unemployed are long-term unemployed ." "In order to increase transparency new MPC members must report whether they are guided by the current " politics of transparency. " Moreover, Carney said in Parliament that "the effectiveness of the policy of the Central Bank has increased, which can be called mitigation ." Fisher and Miles also noted that "the achievement of 2.5 % level of inflation will force the Bank to reconsider the policy," and "the reaction of markets to improve the GDP may be temporary ."

-

19:00

U.S.: Federal budget , August -147.9 (forecast -155.3)

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3275, $1.3290

USD/JPY Y99.00, Y99.50(large), Y99.70(large), Y99.95, Y100.00

GBP/USD $1.5785, $1.5800

EUR/GBP stg0.8400, stg0.8410

GBP/CHF Chf1.4700

USD/CHF Chf0.9325

AUD/USD $0.9200, $0.9205, $0.9330

AUD/JPY Y92.00

AUD/CAD C$0.9575

-

14:15

U.S. import prices unexpectedly unchanged in August

With higher fuel prices offset by declining non-fuel prices, the Labor Department released a report on Thursday showing that U.S. import prices unexpectedly came in flat in August.

The report said import prices were unchanged in August after ticking up 0.1 percent in July. Economists had been expecting import prices to rise by about 0.5 percent.

Meanwhile, the Labor Department said export prices fell by 0.5 percent in August following a 0.1 percent drop in the previous month. Export prices had been expected to edge up by 0.1 percent.

-

14:00

U.S. weekly jobless claims show unexpected decrease

First-time claims for U.S. unemployment benefits unexpectedly decreased in the week ended September 7th, according to a report released by the Labor Department on Thursday, with claims falling to their lowest level in over seven years.

The Labor Department said initial jobless claims dropped to 292,000, a decrease of 31,000 from the previous week's unrevised figure of 323,000. The decrease came as a surprise to economists, who had expected jobless claims to climb to 330,000.

With the unexpected decrease, jobless claims fell to their lowest level since hitting 291,000 in the week ended April 1, 2006.

However, the Labor Department noted that the notable decrease in jobless claims came as two states failed to report all of their claims amid computer upgrades.

-

13:31

U.S.: Initial Jobless Claims, September 292 (forecast 332)

-

13:31

U.S.: Import Price Index, August 0.0% (forecast +0.6%)

-

13:30

Canada: New Housing Price Index , July +0.2% (forecast +0.2%)

-

13:18

European session: the euro fell

06:45 France CPI, m/m August -0.3% +0.5% +0.5%

06:45 France CPI, y/y August 0.0% +1.0%

08:00 Eurozone ECB Monthly Report September

09:00 Eurozone Industrial production, (MoM) July +0.7% -0.1% -1.5%

09:00 Eurozone Industrial Production (YoY) July +0.3% -0.1% -2.5%

The euro fell against the dollar on weak data on industrial production in the euro area. Industrial production fell 1.5 percent in July compared with the previous month , graded the 0.6 percent rise in June , according to Eurostat . According to forecasts , industrial production was reduced by 0.1 percent . Intermediate goods fell by 0.7 percent, while the production of energy fell by 1.6 percent. Production of capital goods and durable consumer goods fell by 2.6 percent and 2.2 percent , respectively. The consumer non-durable goods fell 0.9 percent. On an annual basis, industrial production decline deepened to 2.1 percent from 0.4 percent in June. Figure exceeded the consensus forecast of a 0.1 percent drop .

Based on these data , the euro zone economy is unlikely to show strong performance in the III quarter. The downturn in the industry due to a significant drop in production at the German , Italian and French companies. Production in these countries is about two- thirds of the total. Industrial production in Germany fell by 2.3 percent. An even stronger decline was registered in the smaller countries such as Ireland, where production fell by 8.7 percent, and Malta, where the index fell by 6.7 percent.

The pound rose to the comments of the head of the Bank of England and crossed the mark of $ 1.5800 , but later backed down and continued to decline. Carney statements were more aggressive than usual. The head of the Bank of England said that "the monetary authorities set the medium-term inflation target of 2.5 % instead of 2% due to the fact that 35 % of the unemployed are long-term unemployed ." "In order to increase transparency new MPC members must report whether they are guided by the current " politics of transparency. " Moreover, Carney said in Parliament that "the effectiveness of the policy of the Central Bank has increased, which can be called mitigation ." Fisher and Miles also noted that "the achievement of 2.5 % level of inflation will force the Bank to reconsider the policy ," and "the reaction of markets to improve the GDP may be temporary ."

Investors expect the output of the U.S. employment report . According to the median forecast of economists , the number of new applications for unemployment benefits last week , is likely to grow to 330 thousand , while the last reporting rate recorded growth of 323 thousand

EUR / USD: during the European session, the pair fell to $ 1.3282

GBP / USD: during the European session, the pair dropped to $ 1.5785

USD / JPY: during the European session, the pair fell to Y99.18

At 12:30 Canada is to publish an index of housing prices in the primary market in July. At 12:30 GMT the United States will number of initial claims for unemployment insurance , the number of continuing claims for unemployment benefits , the import price index for August. At 17:00 the U.S. spends 30-year bonds. At 18:00 GMT the United States will present the monthly performance report for August. At 22:30 GMT New Zealand will release the index of business activity in the manufacturing sector of Business NZ in August.

-

13:00

Orders

EUR/USD

Offers $1.3350, $1.3325/30

Bids $1.3280/75, $1.3240/30, $1.3210/00, $1.3150/40

GBP/USD

Offers $1.5920/30, $1.5900, $1.5870/80, $1.5840/50

Bids $1.5785, $1.5685/80

AUD/USD

Offers $0.9400, $0.9380/85, $0.9290

Bids $0.9230/20, $0.9205/00, $0.9155/50

EUR/GBP

Offers stg0.8550/55, stg0.8520, stg0.8460/65, stg0.8440/50, stg0.8425/30

Bids stg0.8380, stg0.8350, stg0.8300

EUR/JPY

Offers Y134.60, Y134.30/40, Y133.80, Y133.50

Bids Y131.80, Y131.50, Y131.30/20, Y130.80, Y130.00/9.80

USD/JPY

Offers Y100.80, Y100.60/65, Y100.00, Y99.60/70

Bids Y99.20, Y99.00, Y98.60/50, Y98.25/20, Y98.00

-

11:15

Australia unemployment rate climbs to 5.8%

Australia's unemployment rate came in at a seasonally adjusted 5.8 percent in August, the Australian Bureau of Statistics said on Thursday - in line with forecasts and up from 5.7 percent in July.

But the Australian economy lost 10,800 jobs in August - missing by a mile forecasts that had suggested an increase of 10,000 jobs. That follows the loss of 10,200 jobs in the previous month.

Full-time employment decreased 2,600 to 8,128,800 and part-time employment decreased 8,200 to 3,508,300.

Unemployment increased 9,400 (1.3 percent) to 714,100. The number of persons looking for full-time work decreased 2,300 to 516,300 and the number of persons looking for part-time work increased 11,700 to 197,800.

The participation rate was 65.0 percent versus forecasts for 65.2 percent and down from 65.1 percent a month earlier.

Aggregate monthly hours worked increased 1.1 million hours to 1,650.0 million hours.

-

10:45

Eurozone July industrial output drops more than forecast

Eurozone industrial production declined at a faster-than-expected pace in July driven by widespread weakness across sub-sectors, official data showed Thursday.

Industrial output fell 1.5 percent in July from a month ago, reversing a 0.6 percent rise in June, Eurostat reported. It was forecast to fall by 0.3 percent.

Production of intermediate goods slipped 0.7 percent and energy output declined 1.6 percent. Output of capital goods and durable consumer goods declined by 2.6 percent and 2.2 percent, respectively. Non-durable consumer goods output was down 0.9 percent.

On a yearly basis, the decline in industrial output deepened to 2.1 percent from 0.4 percent in June. The rate exceeded consensus for 0.2 percent fall.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3100, $1.3215, $1.3250, $1.3350

USD/JPY Y99.50, Y99.60, Y100.10, Y100.50, Y101.00, Y101.30

EUR/JPY Y132.00

EUR/GBP stg0.8400, stg0.8405, stg0.8420

USD/CHF Chf0.9275

EUR/CHF Chf1.2310

AUD/USD $0.9200, $0.9285, $0.9300

EUR/AUD A$1.4375

NZD/USD $0.7950

USD/CAD C$1.0400, C$1.0650

-

10:00

Eurozone: Industrial production, (MoM), July -1.5% (forecast -0.1%)

-

10:00

Eurozone: Industrial Production (YoY), July -2.5% (forecast -0.1%)

-

07:45

France: CPI, m/m, August +0.5% (forecast +0.5%)

-

07:45

France: CPI, y/y, August +1.0%

-

07:00

Asian session: The greenback traded near the lowest this month

01:30 Australia Unemployment rate August 5.7% 5.8% 5.8%

01:30 Australia Changing the number of employed August -10.2 10.2 -10.8

The greenback traded near the lowest this month against the euro before a report forecast to show U.S. jobless claims rose. U.S. jobless claims probably rose to 330,000 in the week ended Sept. 7, from 323,000 in the previous seven-day period, according to the median estimate of economists surveyed by Bloomberg News before today’s data. Demand for the dollar as a haven receded as the U.S. delayed a congressional vote on military action in Syria.

Fed Bank of New York President William C. Dudley speaks today in Paris. He said in July that economic growth will probably quicken next year, possibly warranting a reduction in stimulus.

The yen gained after Japan’s machinery orders stagnated. In Japan, machinery orders were unchanged in July from June when they fell 2.7 percent, the Cabinet Office announced today in Tokyo. Economists surveyed by Bloomberg predicted a 2.4 percent increase.

Australia’s dollar fell against all 16 major counterparts after the number of people employed in the country fell 10,800 last month, following a downwardly revised loss of 11,400 jobs in July, the statistics bureau said today in Sydney. Economists predicted a 10,000 increase in August.

New Zealand’s dollar strengthened against all its major peers after the RBNZ forecast bank bill rates will be higher than previously estimated in the first half of 2014, indicating the central bank may raise benchmark borrowing costs within that period.

EUR / USD: during the Asian session the pair traded in the range of $ 1.3305-25

GBP / USD: during the Asian session, the pair traded in the range of $ 1.5815-30

USD / JPY: during the Asian session the pair fell to Y99.40

There is a full calendar on both sides of the Atlantic Thursday, with a speech from ECB President Draghi one of the highlights. The data calendar gets underway at 0600GMT, with the release of the German August wholesale price data. There is a slew of euro area inflation data expected from 0645GMT, when French August HICP umbers will be published. Spanish August data will be released at 0700GMT. Also due at 0700GMT, Bundesbank Vice President Sabine Lautenschlaeger will deliver a speech on OTC derivatives reforms, in Paris. At 0730GMT, ECB Governing Council member Erkki Liikanen holds a press conference on monetary policy and global economy, in Helsinki. Italian July industrial production data will be released at 0800GMT, along with the ECB's monthly report - likely to be a repeat of the opening statement at the last monthly press conference. At 0900GMT, the July EMU industrial output numbers will cross the wires, along with the Italian August final HICP. The OECD economic survey of Ireland will also be released at 0900GMT. There is a Euro Conference in Riga, Latvia. EU Commission VP Olli Rehn will speak at 0900GMT, while ECB President Mario Draghi will speak from 1140GMT. Bank of Latvia Gov. Ilmars Rimsevics speaks at 1220GMT

At 0845GMT, BOE Governor Mark Carney, and MPC members Fisher, Miles and McCaffery all appear before the Treasury Select Committee. With employment stronger than forecast at the recent reading, there is likely to be tight questioning over the BOE's forward guidance.

-

06:20

Currencies. Daily history for Sep 11'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3310 +0,34%

GBP/USD $1,5822 +0,57%

USD/CHF Chf0,9306 -0,45%

USD/JPY Y99,98 -0,40%

EUR/JPY Y133,06 -0,08%

GBP/JPY Y158,17 +0,17%

AUD/USD $0,9322 +0,14%

NZD/USD $0,8124 +0,74%

USD/CAD C$1,0315 -0,33%

-

06:00

Schedule for today, Thursday, Sep 12’2013:

01:30 Australia Unemployment rate August 5.7% 5.8% 5.8%

01:30 Australia Changing the number of employed August -10.2 10.2 -10.8

06:45 France CPI, m/m August -0.3% +0.5%

06:45 France CPI, y/y August 0.0%

08:00 Eurozone ECB Monthly Report September

09:00 Eurozone Industrial production, (MoM) July +0.7% -0.1%

09:00 Eurozone Industrial Production (YoY) July +0.3% -0.1%

09:00 United Kingdom MPC Member Fisher Speaks

09:00 United Kingdom MPC Member McCafferty Speaks

09:00 United Kingdom MPC Member Miles Speaks

09:00 United Kingdom Inflation Report Hearings Quarter II

09:00 United Kingdom BOE Gov Mark Carney Speaks

11:40 Eurozone ECB President Mario Draghi Speaks

12:30 Canada New Housing Price Index July +0.2% +0.2%

12:30 U.S. Initial Jobless Claims September 323 332

12:30 U.S. Import Price Index August +0.2% +0.6%

18:00 U.S. Federal budget August -97.6 -155.3

22:30 New Zealand Business NZ PMI August 59.5

-