Notícias do Mercado

-

20:00

Dow +67.87 15,368.51 +0.44% Nasdaq +5.17 3,721.14 +0.14% S&P +4.1 1,687.52 +0.24%

-

19:20

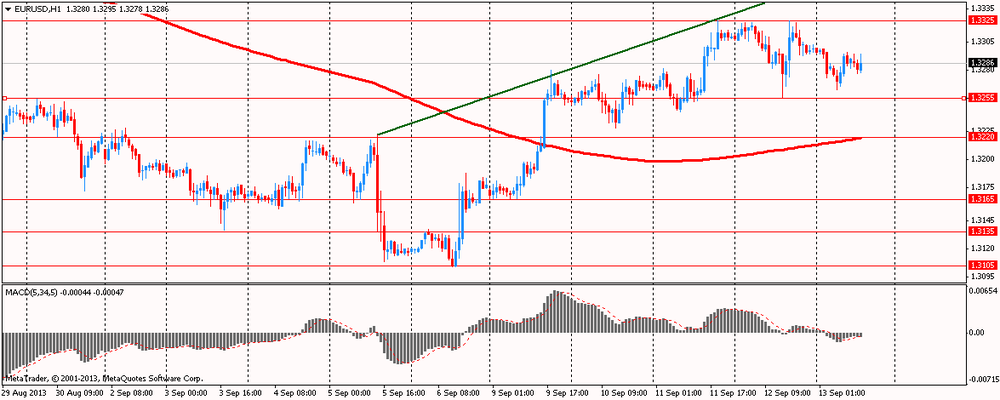

American focus: the British pound rose against the dollar significantly

Dollar Mixed trend against the euro , moving from growth to decline. Note that the weak retail sales data , coupled with denials of prospects for the appointment of Larry Summers as the new head of the Federal Reserve, sent EUR / USD pair beyond $ 1.3320 , after which the euro has lost momentum , making it possible to show a sharp rise in the dollar , which also plays out.

The White House was forced to issue an official denial excited the market rumors that President Obama intends to nominate Larry Summers to head the Federal Reserve .

President Obama has not yet made a decision on the issue of successor Ben Bernanke as head of the Fed , said White House spokesman Amy Brundage , who wrote on his Twitter account that the " morning reports in the Japanese press are not true ." As for the data, they showed that retail sales rose by a seasonally adjusted 0.2 % in August compared with the previous month , showing a smaller increase than the 0.5 % growth forecast of economists and the smallest increase since April. Most of the increase was due to a surge in car sales, which tend to be unstable and to recover from the recession, while households have made a long-awaited purchase of new cars .

Excluding autos, retail sales rose by only 0.1 %, which is a sign of weakness for the broader discretionary spending .

At the same time, the report contains some positive points : sales in July were stronger than previously thought , and showed an increase of 0.4 % compared to the initial 0.2 %.

We add that the current dynamics of trading is also associated with the upcoming Fed meeting , which is scheduled for next week.

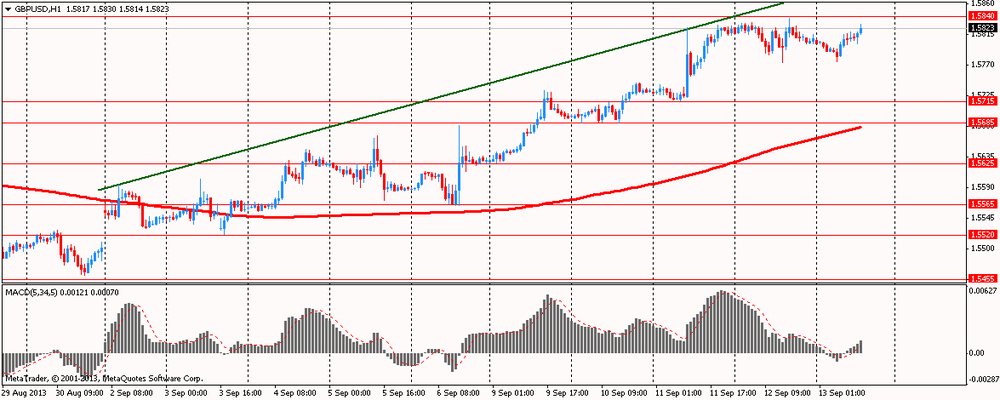

Value of the pound has increased significantly against the dollar, which continues to help the previously reported rate of unemployment . Note that the unemployment rate / p at 7.7 % was lower than expected and made a positive contribution to the overall economic picture of the country. Earlier today it was announced that in the month of July, the volume of production in the construction sector rose a seasonally adjusted 2.2 per cent ( on a monthly basis ) , while recovering from the 1.1 - percent decline, which was recorded in June. Add that led recovery volumes stood 3.2 percentage increase in new construction, as well as an increase of 0.6 percent as repair and maintenance. In addition, the data showed that the annualized construction output rose in July by 2 percent, which was slightly slower than the 2.2 - percent growth , marked by a month earlier . The volume of new work increased by 5.8 percent per year, while the repair work fell by 3.6 per cent .

Despite the downward revisions in the June data , the total score for the 2 nd quarter was revised to increase , but it was not enough to make an impact on GDP. Meanwhile, America has published a statistics block , which was generally negative. The index of consumer sentiment University of Michigan was 76.8 vs. 82.0 .

-

15:00

U.S.: Business inventories , July +0.4% (forecast +0.4%)

-

14:55

U.S.: Reuters/Michigan Consumer Sentiment Index, September 76.8 (forecast 82.6)

-

14:46

Option expiries for today's 1400GMT cut

EUR/USD $1.3250, $1.3300, $1.3310, $1.3350

USD/JPY Y98.65, Y99.00, Y99.50, Y99.75, Y99.80, Y100.00

EUR/JPY Y132.50, Y132.75

GBP/USD $1.5800

EUR/GBP stg0.8400

GBP/JPY Y157.50

EUR/CHF Chf1.2355

AUD/USD $0.9200, $0.9205, $0.9210, $0.9220, $0.9230, $0.9300, $0.9330, $0.9350

USD/CAD C$1.0335, C$1.0400

-

13:31

U.S.: PPI excluding food and energy, Y/Y, August +1.1% (forecast +1.3%)

-

13:31

Canada: Capacity Utilization Rate, Quarter II 80.6% (forecast 81.3%)

-

13:30

U.S.: Retail sales, August +0.2% (forecast +0.5%)

-

13:30

U.S.: Retail sales excluding auto, August +0.1% (forecast +0.3%)

-

13:30

U.S.: PPI, m/m, August +0.3% (forecast +0.2%)

-

13:30

U.S.: PPI excluding food and energy, m/m, August 0.0% (forecast +0.2%)

-

13:30

U.S.: PPI, y/y, August +1.4% (forecast +1.3%)

-

13:14

European session: the euro rose

07:15 Switzerland Producer & Import Prices, m/m August 0.0% +0.2% +0.2%

07:15 Switzerland Producer & Import Prices, y/y August +0.5% +0.5% +0.2%

09:00 Eurozone ECOFIN Meetings September

09:00 Eurozone Eurogroup Meetings September

Euro rose moderately against the dollar after yesterday analysts from Goldman Sachs Group raised its forecast for the next half a year for the pair eur / usd to $ 1.40 from $ 1.37 previously . According to statements by GS, outlook raised expectations to improve the prospects for economic growth in the euro area , which will lead to an influx of capital into the euro area and help to recover from the financial crisis. Expert Division Goldman Sachs Group, led by the London-based chief currency strategist Thomas Stolper , sees growth in the euro over the next three months to $ 1.38 , against a previous forecast of $ 1.34 .

Of secondary statistics in the region can be noted on the weak data reduction of employment in the euro area. EU statistics agency said Friday that the number of people employed in the 2nd quarter decreased by 0.1 % compared to the first quarter and amounted to 145 million people, which is 1 % less than in the 2 - fourth quarter 2012 . Employment growth has generally lagged behind the growth of production for a few months, so the decline in the second quarter is not surprising. But with the decline in industrial production, which occurred at the beginning of the third quarter, this fact underscores the fragility of the recovery in the euro area.

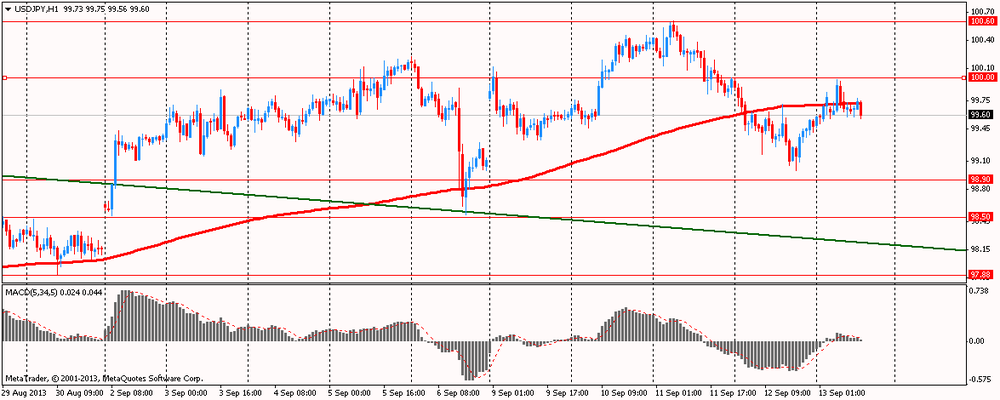

The yen weakened after his September report to the Cabinet of Japan said that the country is " on the path to economic recovery at a moderate pace ." Recall that at the moment , Japanese Prime Minister Shinzo Abe and the Bank of Japan's attempt to revive the economy and get out of the long-established 15 -year deflation by the unprecedented monetary stimulus programs .

Governor of the Bank of Japan Haruhiko Kuroda on Friday reiterated its support for a sales tax increase , reversing its potentially negative consequences for the economy.

" It is highly probable that the economic growth in Japan will continue to exceed its capacity even after the increase in the sales tax " to 8 % from 5 % in April, Kuroda said at a meeting of the Council on Economic and Fiscal Policy , an advisory body to the Prime Minister Shinzo Abe .

Kuroda stressed that "it is possible to deal with deflation ," and at the same time to rebuild public finances through tax increases.

EUR / USD: during the European session, the pair rose to $ 1.3290

GBP / USD: during the European session, the pair rose to $ 1.5830

USD / JPY: during the European session, the pair rose to Y99.98

At 12:30 GMT will be released in Canada capacity utilization in Q2 . U.S. at 12:30 GMT will publish the change in retail sales , the change in retail sales excluding auto sales , changes in the volume of retail trade sales , excluding cars and fuel, the producer price index , producer price index excluding prices for food and energy prices in August , at 13:55 GMT - the index of consumer sentiment from the University of Michigan in September, the 14:00 GMT - change in stocks in commercial warehouses in July. At 19:00 GMT the United States will be made by the Treasury report on currency.

-

13:00

Orders

EUR/USD

Offers $1.3350, $1.3325/30, $1.3315

Bids $1.3255/50, $1.3240/30, $1.3210/00, $1.3150/40

GBP/USD

Offers $1.5920/30, $1.5900, $1.5870/80, $1.5840/50

Bids $1.5755/50, $1.5720, $1.5700

AUD/USD

Offers $0.9400, $0.9380/85, $0.9280

Bids $0.9220, $0.9205/00, $0.9155/50

EUR/GBP

Offers stg0.8550/55, stg0.8520, stg0.8460/65, stg0.8440/50, stg0.8425/30

Bids stg0.8380, stg0.8350, stg0.8300

EUR/JPY

Offers Y134.60, Y134.30/40, Y133.80, Y133.50, Y133.00/10, Y132.70

Bids Y132.20, Y132.00, Y131.80/70, Y131.50, Y131.30/20

USD/JPY

Offers Y101.50/55, Y101.00, Y100.80, Y100.60/65, Y100.20/30, Y100.00

Bids Y99.50/40, Y99.00, Y98.60/50

-

11:15

Eurozone employment falls at slower pace

The pace of decline in the number of employed persons in euro area eased in the second quarter, according to the latest data released by Eurostat on Friday.

Employment fell 0.1 percent quarter-on-quarter to 145 million in the second quarter, slower than a 0.4 percent drop recorded in the first quarter.

On an annual basis, employment fell 1 percent, at the same pace as in the previous quarter.

The number of employed in EU28, including Croatia which joined the bloc in July, remained unchanged from the first quarter. Employment declined 0.4 percent from second quarter of 2012.

Among the member states, Estonia, Lithuania, Portugal, Luxembourg, the Czech Republic and Ireland recorded the highest growth rates compared with the previous quarter. Meanwhile, Cyprus, Spain, the Netherlands, Slovenia and Slovakia registered the largest decreases.

-

10:25

Option expiries for today's 1400GMT cut

EUR/USD $1.3150, $1.3200, $1.3250, $1.3300, $1.3310, $1.3350

USD/JPY Y98.65, Y99.00, Y99.50, Y99.75, Y99.80, Y100.00, Y100.20, Y100.25, Y101.00

EUR/JPY Y130.70, YY132.50, Y132.75

GBP/USD $1.5800

EUR/GBP stg0.8400, stg0.8480/85

GBP/JPY Y157.50

EUR/CHF Chf1.2355

AUD/USD $0.9100, $0.9180, $0.9200, $0.9205, $0.9210, $0.9220, $0.9230, $0.9300, $0.9330, $0.9350

USD/CAD C$1.0240, C$1.0250, C$1.0335, C$1.0400, C$1.0440

-

08:15

Switzerland: Producer & Import Prices, y/y, August +0.2% (forecast +0.5%)

-

08:15

Switzerland: Producer & Import Prices, m/m, August +0.2% (forecast +0.2%)

-

07:01

Asian session: The dollar rose versus the yen

04:30 Japan Industrial Production (MoM) (Finally) July +3.2% +3.2% +3.4%

04:30 Japan Industrial Production (YoY) (Finally) July +1.6% +1.6% +1.8%

The dollar rose versus the yen, poised for a second weekly gain, ahead of a report that may show U.S. retail sales accelerated. Consumer purchases in the U.S. climbed 0.5 percent in August after a 0.2 percent increase in July, according to the median forecast of economists surveyed by Bloomberg News before today’s Commerce Department figures.

The yen weakened after Japan’s Cabinet Office said in its September report that the nation is “on the way to recovery at a moderate pace.” Prime Minister Shinzo Abe and the Bank of Japan are trying to revitalize the economy and end 15 years of entrenched deflation through an unprecedented stimulus program.

The euro was near a two-week high after Goldman Sachs Group Inc. upgraded its forecast to $1.40 in six months from $1.37. GS raised its forecast for the euro versus the dollar on the expectation improved growth prospects will boost capital inflows for the region as it recovers from a fiscal crisis. Europe’s common currency will climb to $1.38 in three months compared with a previous forecast for $1.34, analysts led by London-based chief currency strategist Thomas Stolper wrote in a client note on Sept. 12.

EUR / USD: during the Asian session the pair fell to $ 1.3270

GBP / USD: during the Asian session, the pair fell below $ 1.5780

USD / JPY: during the Asian session the pair rose to Y99.85

The calendar quietens down somewhat Friday, although we still have releases on both sides of the Atlantic. French data gets the session underway, with the release of the August Bank of France retail survey. The limited UK data will see the release of the July construction output numbers at 0830GMT. Further eurozone data is set for release at 0900GMT, with the release of the second quarter employment numbers. Also at 0900GMT, the ECOFIN is set to meet in Vilnius, Lithuania. Across the Atlantic, the US calendar gets underway at 1230GMT, when the August retail sales index is released, along with the August producer price index. At 1355GMT, the University of Michigan Sep Consumer Sentiment index is set to be published. At 1400GMT, the July Business Inventories data will cross the wires.

-

06:19

Currencies. Daily history for Sep 12'2013:

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,3255 -0,41%

GBP/USD $1,5806 -0,10%

USD/CHF Chf0,9303 -0,03%

USD/JPY Y99,49 -0,49%

EUR/JPY Y132,31 -0,57%

GBP/JPY Y157,25 -0,59%

AUD/USD $0,9262 -0,65%

NZD/USD $0,8135 +0,14%

USD/CAD C$1,0326 +0,11%

-

06:00

Schedule for today, Friday, Sep 13’2013:

04:30 Japan Industrial Production (MoM) (Finally) July +3.2% +3.2%

04:30 Japan Industrial Production (YoY) (Finally) July +1.6% +1.6%

07:15 Switzerland Producer & Import Prices, m/m August 0.0% +0.2%

07:15 Switzerland Producer & Import Prices, y/y August +0.5% +0.5%

09:00 Eurozone Trade Balance s.a. July 14.9 15.3

09:00 Eurozone ECOFIN Meetings September

09:00 Eurozone Eurogroup Meetings September

12:30 Canada Capacity Utilization Rate Quarter II 81.1% 81.3%

12:30 U.S. Retail sales August +0.2% +0.5%

12:30 U.S. Retail sales excluding auto August +0.5% +0.3%

12:30 U.S. PPI, m/m August 0.0% +0.2%

12:30 U.S. PPI, y/y August +2.1% +1.3%

12:30 U.S. PPI excluding food and energy, m/m August +0.1% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y August +1.2% +1.3%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) September 82.1 82.6

14:00 U.S. Business inventories July 0.0% +0.4%

-

05:32

Japan: Industrial Production (YoY), July +1.8% (forecast +1.6%)

-

05:31

Japan: Industrial Production (MoM) , July +3.4% (forecast +3.2%)

-