Notícias do Mercado

-

23:54

New Zealand Current Account - GDP Ratio came in at -5.224%, above expectations (-7.4%) in 2Q

-

23:54

New Zealand Current Account - GDP Ratio above forecasts (-7.4%) in 2Q: Actual (-5.22%)

-

23:48

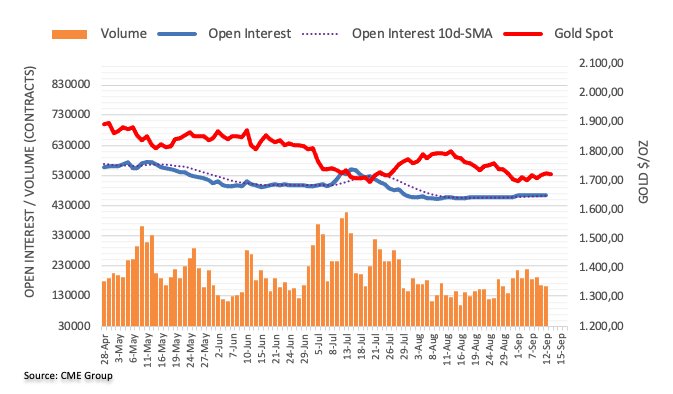

Gold Price Forecast: XAU/USD licks US inflation-linked wounds near $1,700

- Gold price remains pressured around one-week low after declining the most in two months.

- US inflation data renewed recession fears, propelled odds of Fed’s aggression.

- Geopolitical fears emanating from China, Russia also weigh on XAU/USD price.

- US PPI eyed for intraday moves, other consumer-centric data may entertain ahead of Fed.

Gold price (XAU/USD) remains pressured at around $1,700 as bears take a breather after the biggest daily slump in two weeks, thanks to US inflation. It should, however, be noted that a lack of major data/events seemed to restrict the immediate bullion moves during Wednesday’s Asian session.

US inflation data renewed fears of the Federal Reserve’s aggressive rate hike, as well as propelled the recession woes, on Tuesday. Also acting as the downside catalysts for the XAU/USD are the geopolitical concerns surrounding China and Russia.

US Consumer Price Index (CPI) for August rose past 8.1% market forecasts to 8.3% YoY, versus 8.8% prior regains. The monthly figures, however, increased to 0.1%, more than -0.1% expected and 0.0% previous readings. The core CPI, means CPI ex Food & Energy, also crossed 6.1% consensus and 5.9% prior to print 6.3% for the said month.

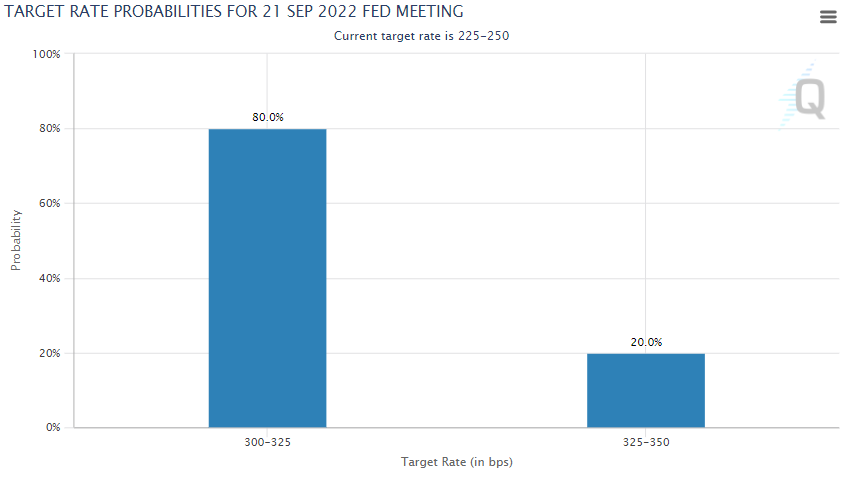

Following the US inflation data release, the bets on the Fed’s next move turned increasingly hawkish, with the 75 basis points (bps) of a hike appearing almost certainly next week. It’s worth noting that there is around 25% chance that the US Federal Reserve (Fed) will announce a full 1.0% increase in the benchmark Fed rate on September 21 meeting.

It should be noted that the yield inversion also widened after US inflation data and propelled the recession woes, which in turn drowned the XAU/USD prices due to the pair’s risk-barometer status. That said, the US 10-year Treasury yields rallied to 3.412% and those for 2-year bonds increased to 3.76% following the data, around 3.41% and 3.745% respectively at the latest. Furthermore, the US stocks had their biggest daily slump in almost two years after the US CPI release and that also pleased the metal bears.

Elsewhere, US President Joe Biden’s chip plans to increase hardships for China join the rush toward stronger ties with China to fuel the Sino-American woes. Further, expectations that Russia will hit hard after retreating from some parts of Ukraine also weighed on the market sentiment and the gold price.

Looking forward, a light calendar ahead of the US Producer Price Index (PPI) may keep XAU/USD on the dicey floor but the bears are likely to keep control before Thursday’s August month US Retail Sales and Friday’s preliminary reading of the Michigan Consumer Sentiment Index for September.

Technical analysis

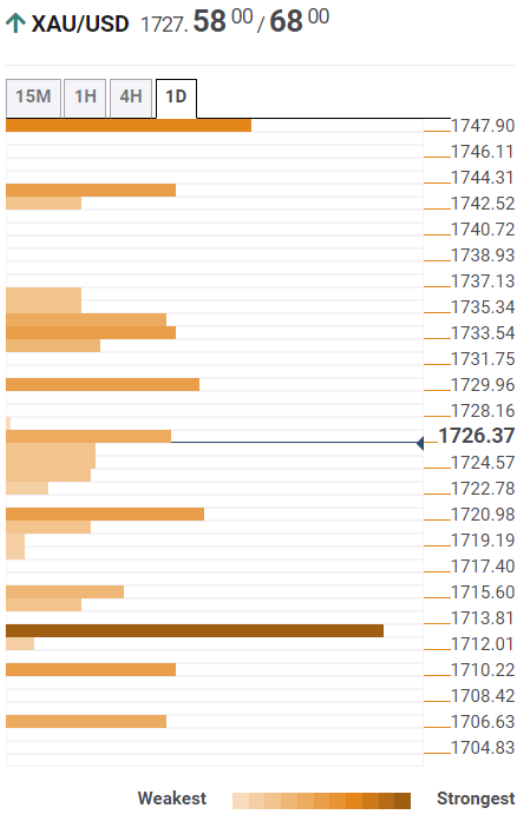

A clear U-turn from the 21-DMA and a one-month-old descending resistance line, around $1,727-28 by the press time, joins downbeat MACD to direct gold bears towards an upward sloping support line from July 21, around $1,690.

Should the quote manage to break the stated support line, the odds of which are brighter, it can quickly refresh the yearly low under the current $1,680 level. In doing so, the 61.8% Fibonacci Expansion (FE) of the metal’s late April to early August moves, near $1,657, will be in focus.

Alternatively, an upside break of the $1,727-28 resistance confluence needs validation from the late August swing high around $1,765 to convince XAU/USD bulls.

Following that, a run-up towards the $1,800 threshold and the previous monthly peak near $1,807 can’t be ruled out.

Gold: Daily chart

Trend: Further weakness eyed

-

23:45

New Zealand Current Account - GDP Ratio came in at -7.7%, below expectations (-7.4%) in 2Q

-

23:45

New Zealand Current Account (QoQ) came in at $-5.224B below forecasts ($-4.7B) in 2Q

-

23:34

EUR/USD Price Analysis: More weakness ahead on Tweezer Tops formation, 0.9860 a key support

- A Tweezer Tops formation has created an intermittent hurdle for the asset.

- Declining 20-and 50-EMAs add to the downside filters.

- The Eurozone bulls weakened after surrendering the 1.0000 parity.

The EUR/USD pair is attempting a rebound after hitting a low of 0.9855 on Tuesday. It seems that a less-confident buying interest is a dead-cat bounce after a bloodbath in the risk-perceived currency. The asset witnessed a vertical downside momentum after failing to recapture the critical hurdle of 1.0200. The major extended its losses after surrendering the magical figure of 1.0000.

A formation of the Tweezer Tops candlestick pattern in which selling wicks are formed at similar levels indicates a continuation of the downside move. After concluding the inventory distribution at similar levels, a mark-down phase triggers an intense sell-off by the market participants.

The 50-period Exponential Moving Average (EMA) at 1.0132 has acted as a major hurdle for the shared currency bulls. Also, the 20-EMA at 1.0027 is declining, which adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is still holding above 40.00. However, a downside break will accelerate the downside momentum.

A break below Wednesday’s low at 0.9955 will drag the asset towards the round-level support of 0.9900, followed by a 19-year low at 0.9864.

On the contrary, the eurozone bulls could defy the downside momentum and make a comeback on overstepping the magical figure of 1.0000. An occurrence of the same will send the major towards 31 August high at 1.0080, followed by Monday’s high around 1.0200.

EUR/USD daily chart

-

23:21

AUD/USD bears eye 0.6700 amid inflation woes, Aussie Employment, RBA’s Lowe eyed

- AUD/USD holds lower ground at weekly bottom after falling the most since March 2020.

- Strong US inflation data renewed fears of Fed’s aggression, yields revived recession woes.

- China’s return, readiness for more stimulus failed to infuse any optimism.

- Second-tier data may entertain traders but bears are likely to keep reins.

AUD/USD bears are in full steam as the US inflation release renewed fears of the Fed’s aggression. Also acting as the risk-negative catalyst, as well as weighing on the Aussie pair prices, are the tensions surrounding the US-China ties. With this, the quote holds lower ground near 0.6730 after declining the most in 2.5 years the previous day.

US Consumer Price Index (CPI) for August rose past 8.1% market forecasts to 8.3% YoY, versus 8.8% prior regains. The monthly figures, however, increased to 0.1%, more than -0.1% expected and 0.0% previous readings. The core CPI, means CPI ex Food & Energy, also crossed 6.1% consensus and 5.9% prior to print 6.3% for the said month.

Following the US inflation data release, the bets on the Fed’s next move turned increasingly hawkish, with the 75 basis points (bps) of a hike appearing almost certain next week. It’s worth noting that there is around 25% chance that the US Federal Reserve (Fed) will announce a full 1.0% increase in the benchmark Fed rate on September 21 meeting.

It should be noted that the yield inversion also widened after US inflation data and propelled the recession woes, which in turn drowned the AUD/USD prices due to the pair’s risk-barometer status. That said, the US 10-year Treasury yields rallied to 3.412% and those for 2-year bonds increased to 3.76% following the data, around 3.41% and 3.745% respectively at the latest.

Other than the inflation and recession woes, the geopolitical fears emanating from China and Russia also weighed on the AUD/USD prices. Headlines from the Financial Times (FT) suggest mixed views over US President Joe Biden’s chip plan that challenges China to seem to weigh on the AUD/USD buyers. On the same line, Chinese President Xi Jinping’s aim to reassert Beijing’s influence during the first foreign trip after covid-led lockdowns underpins the cautious mood as it could escalate the US-China tension.

Alternatively, Bloomberg reported that China’s Premier Li Keqiang vowed more policy support to drive up consumption in the economy. The news also signaled that China will adhere to multiple measures to stabilize growth, employment and prices. However, the same failed to impress AUD/USD prices.

Amid the risk-off mood, Wall Street benchmarks and the prices of gold slumped, which in turn exerted additional downside pressure on the gold.

Moving on, a light calendar ahead of the US Producer Price Index (PPI) may keep AUD/USD on the dicey floor but the bears are likely to keep control before Thursday’s Australia jobs report and Friday’s speech from the Reserve Bank of Australia (RBA) Governor Philip Lowe.

Technical analysis

A clear reversal from the 50-DMA, around 0.6890 by the press time, directs AUD/USD bears towards the yearly low of 0.6680.

-

23:06

USD/CAD Price Analysis: Surges on higher US inflation report, traders eye 1.3200

- The Canadian dollar is under heavy pressure following Tuesday’s loss of 1.36%.

- The US August inflation report augmented demand for safe-haven assets and underpinned the US dollar.

- USD/CAD Price Analysis: To re-test the YTD high in the short-term; otherwise, a fall toward 1.3000 is on the cards.

On Tuesday, the USD/CAD edges higher following the release of US inflation figures, which exceeded estimations, further cementing the Federal Reserve’s case for a 75 bps rate hike. At the time of writing, the USD/CAD is trading at 1.3167, above its opening price, after hitting a weekly during Tuesday’s session at 1.3175.

USD/CAD Price Analysis: Technical outlook

During the Tuesday session, the USD/CAD bounced off the 50-day EMA at 1.2958, where it hit Tuesday’s daily low, and never looked back, reclaiming on its way north, the 20-day EMA at 1.3059, and the 1.3100 figure. Therefore, the USD/CAD resumed its upward trend, further confirmed by the Relative Strength Index (RSI) crossing above its 7-day SMA, signaling buyers are in charge.

Short term, on the four-hour scale, the USD/CAD could challenge the YTD high at 1.3208. Once it’s cleared, the next supply zone would be the R1 daily pivot at 1..3242, followed by the psychological 1.3300 mark., and then the R2 pivot point at 1.3321.

On the other hand, if the USD/CAD tumbles below the daily pivot at 1.3100, that could pave the way for further losses. The USD/CAD first support would be the S1 pivot at 1.3020, followed by the 1.3000 figure, and then the 200-EMA at 1.2962.

USD/CAD Key Technical Levels

-

22:54

GBP/USD oscillates below 1.1500 ahead of UK Inflation

- GBP/USD is auctioning below 1.1500 on higher-than-expected US inflation data.

- A release of headline US CPI at 8.3% has escalated the expectations of a Fed’s bumper rate hike.

- Higher UK CPI will accelerate troubles for the BOE policymakers.

The GBP/USD pair is displaying back-and-forth moves below the psychological support of 1.1500 from the late New York session. The pair witnessed an intense sell-off after the release of the US Consumer Price Index (CPI) data. Risk-perceived currencies nosedived after higher-than-expected US inflation data. The headline CPI landed at 8.3%, higher than the expectations of 8.1% but remained lower than the prior release of 8.5%.

On an increment in US inflation data, investors infused an adrenaline rush into the US dollar index (DXY). The mighty DXY rallied vigorously towards the psychological resistance of 110.00 from a low of 107.69. The market participants channelized liquidity into the DXY as the market mood soured on soaring odds for a bumper rate hike by the Federal Reserve (Fed) in its September monetary policy meeting.

Investors were expecting that the Fed will trim the pace of hiking interest rates but now higher-than-expected inflation data is hinting at a third consecutive 75 basis points (bps) rate hike announcement. Also, the core CPI that excludes oil and food prices increased significantly to 6.3% against the expectations of 6.1% and the prior release of 5.9%, which is mainly responsible for DXY’s juggernaut rally.

On the UK front, investors are awaiting the release of the UK inflation data. The economic data is seen higher at 10.2% vs. 10.1% reported earlier on an annual basis. Also, the core CPI is seen higher at 6.3% vs. 6.2% for June. A higher-than-expected release of the inflation rate will accelerate troubles for the Bank of England (BOE) as inflationary pressures along with soaring jobless claims will restrict the BOE to announce interest rate hikes unhesitatingly. The economy reported an increase in the number of jobless benefits by 6.3k.

-

22:22

Forex Today: Biggest US dollar rally since 2020

Here is what you need to know for the day ahead, Wednesday, September 14:

The US dollar soared on Tuesday on the back of data released by the Labor Department that reported on US Consumer Prices that unexpectedly rose in August. The dollar index DXY, which measures the greenback against a basket of currencies was up 1.5% at 109.85 in its biggest one-day percentage gain since March 2020. However, the US dollar remains below last week's two-decade peak of 110.79.

The yield on the US 10-year Treasury note rallied to 3.412%, while the yield on the 2-year note is now at 3.76% after stronger-than-expected US inflation data boosted investor bets that the Federal Reserve will need to stay aggressive in raising interest rates. The market is pricing in a third straight 75 basis points hike that would lift the Fed's current 2.25% to 2.5% policy rate range to 3% to 3.25%. However, rate contracts now also reflect about one-in-four odds of a surprise full-percentage-point increase at the Sept. 20-21 meeting.

The single currency fell to a low of 0.9966 after hitting a nearly one-month high of 1.0198 in the previous session to the greenback on the back of hawkish talk from the European Central Bank.

GBP/USD rose to a two-week high after the British jobless rate dropped to its lowest level since 1974, while wages excluding bonuses rose by 5.2%, the highest rate since the three months to August 2021, but the US data whipsawed the price to a low of 1.1490 from 1.1715 the high.

The AUD/USD dropped more than 2%. USD/JPY rallied to a high of 144.68 putting it back on track for a fresh bull cycle high if the bulls stay the course for the day ahead.

In cryptocurrencies, bitcoin, BTCUSD, was losing a whopping 12% $20,058.00 in an exaggerated reaction to the bearish price action in the general markets, which saw the S&P 500 dive about 4%.

-

21:57

United States API Weekly Crude Oil Stock up to 6.035M in September 9 from previous 3.645M

-

21:39

NZD/USD bears have taken out 0.6000 on strong US dollar, US CPI beat

- NZD/USD bears take the bird down into a hard landing on the 0.60 level.

- The bird is testing below the level with a low of 0.5986 so far, the lowest since 2020.

NZD/USD has been sold off heavily on Tuesday to the lowest levels since 2020, down some 2.4% at the time of writing and falling from a high of 0.6161 to a low of 0.5986 as we head towards the early Asian open on Wednesday. The data from the US has been the culprit, sending the US dollar surging higher along with US yields. The Federal Reserve will release its policy decision at the close of its two-day meeting next week, on Sept. 20-21.

''The shock rebound in US Consumer Price Index (which the consensus assumed had peaked) reverberated violently through financial markets overnight, and has put NZD/USD back below the key 0.60 level this morning,'' analysts at ANZ Bank said.

The data sent both the US dollar and bond yields sharply higher as the expectations for an oversized rate hike from the Federal Reserve. Inflation in the United States ran at an 8.3% annualized pace in August, ahead of expectations for an 8.0% rise. The markets generally expect 75 basis points when its policy committee meets next week and lower market hopes for a smaller increase.

However, there is a one-in-five chance that the Fed will raise rates by a full percentage point, up from zero a day before the CPI report according to FEDWATCH. Nomura analysts said on Tuesday that the Fed is likely to raise its short-term interest rate target by a full percentage point at its policy meeting next week, because of the emergence of upside inflation risks.

''The data make next week’s Fed decision more uncertain (it was looking much more assured yesterday,'' the analysts at ANZ bank said. They look to today's key event in the New Zealand current account data. ''We expect a deficit of 7.5% of Gross Domestic Product, and that’s big!''

-

21:16

United States 30-Year Bond Auction rose from previous 3.106% to 3.511%

-

20:59

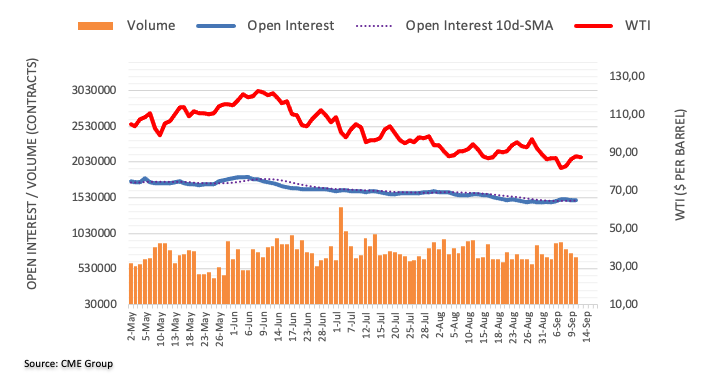

Gold Price Forecast: XAU/USD bears take on bulls below key daily resistance

- Gold is pressured as the US dollar continues to make highs.

- The US CPI leaves the door open for aggressive tightening by the Fed.

The price of gold was pressured on Tuesday and has fallen by over 1.3% on the day. At the time of writing, the yellow metal is testing the $1,700 level and has reached a low of $1,697.11 so far on the day. Consumer prices handily beat expectations according to the Labor Department report, underlying inflation picked up amid rising costs for rents and healthcare.

This sent both the US dollar and bond yields sharply higher as the expectations for an oversized rate hike from the Federal Reserve. Inflation in the United States ran at an 8.3% annualized pace in August, ahead of expectations for an 8.0% rise. Traders expect 75 basis points when its policy committee meets next week and lower market hopes for a smaller increase. However, there is a one-in-five chance that the Fed will raise rates by a full percentage point, up from zero a day before the CPI report according to FEDWATCH.

The dollar and bond yields both rose following the release of the data, on expectations higher interest rates are on the way, bearish for gold since it offers no yield. The DXY index, a measure of the US dollar vs. a basket of currencies rallied to a high of 109.853 while the yield on the US 10-year note rose to 3.460%, over 1.8% higher on the day.

''While prices are weak, precious metals' price action is still not consistent with their historical performance when hiking cycles enter into a restrictive rates regime,'' analysts at TD Securities explained. ''We expect continued outflows from money managers and ETF holdings to weigh on prices, which will ultimately raise the pressure on a small number of family offices and proprietary trading shops to capitulate on their complacent length in gold.''

Gold technical analysis

The bulls have been stripped of their moment and the focus is back on the downside while below the neckline of the daily M-formation, as follows:

Zooming out, we can see that the downside target has been a key level for a considerable amount of time:

-

20:44

AUD/USD plunges more than 150 pips amid US inflation exceeding estimates

- Traders were caught off guard by higher-than-foreseen August US inflation.

- A risk-off impulse weighed on US equities, alongside high-beta currencies, like the Australian dollar.

- AUD/USD Price Analysis: Traders are eyeing a re-test of September’s low at 0.6698.

The AUD/USD tanks more than 2% courtesy of renewed fears about inflation in the US, exceeding estimates, although decelerating compared with the previous month’s reading. Nevertheless, a risk-off impulse sent US equities tumbling between 3.52% and 5.00%, meaning that market players were expecting a lower reading.

As the New York session is about to end, the AUD/USD is trading at 0.6736, well below its opening price, after hitting a daily high at 0.6916.

The US Department of Labour reported that August inflation in the US came at 0.1% MoM, above -0.1% contraction foreseen by analysts, while annually based, ticked higher to 8.3%, against a consensus of 8.1%. Excluding volatile items like food and energy, the so-called Core Consumer Price Index (CPI) for the same period rose by 0.6% MoM, above 0.3% estimates, while the year-over-year reading increased by 6.3%, topping 5.9% forecasts.

Aside from this, the US Dollar Index, a gauge of the buck’s value against a basket of peers, rallied on expectations of a 100 bps rate hike in September, up 1.39%, at 109.816, underpinned by higher US Treasury yields, led by the benchmark note rate at 3.422%, rising six bps.

On the Australian dollar side, the Aussie economic docket featured the Business Consumer Confidence, data increasing 1 point to +20 in August, according to the National Australia Bank (NAB). The survey showed that prices eased in August to 4.4% from a record high of 5.3% in July, though it would likely not deter the Reserve Bank of Australia from hiking, even at a slower pace.

AUD/USD Price Analysis: Technical outlook

From a daily chart perspective, the AUD/USD is downward biased after failing to reclaim the 20 and 50-day EMAs at 0.6849 and 0.6891, respectively. AUD/USD traders should be aware that the Relative Strength Index (RSI), crossed below its 7-day SMA, flashing that sellers are gathering momentum. Therefore, in the near term, could be expected a re-test of the month’s low at 0.6698.

-

20:23

EUR/USD falls deeper into the abyss with eyes on 0.9950

- EUR/USD bears keep hold of the baton and eye the 0.9950s.

- The US dollar is firmer on the hawkish sentiment surrounding the Fed.

EUR/USD printed a fresh low in midday New York near 0.9973 and fell from a high of 1.0187 on the day following the US inflation data. At the time of writing, the price is trading near 1.4% down on the day with eyes on the 0.9950s.

Consumer prices handily beat expectations according to the Labor Department report, underlying inflation picked up amid rising costs for rents and healthcare. ''The core index significantly exceeded expectations as well, on the back of unrelenting shelter price inflation, rising at a robust 0.6% MoM. The YoY change in headline CPI fell to a four-month low of 8.3%, but prices in the core index accelerated to a five-month high of 6.3% YoY,'' analysts at TD Securities explained.

''In our view, the August CPI report supports a continued aggressive effort by the Fed to restrict its inflation-adjusted policy stance.''

''We now expect the FOMC to raise the target rate by 75bp at its meeting next week, deliver another 75bp hike in November, and hike a further 50bp in December. We also now expect a higher terminal rate range of 4.25-4.50% by year-end.''

Meanwhile, however, Nomura analysts said on Tuesday that the Fed is likely to raise its short-term interest rate target by a full percentage point at its policy meeting next week, because of the emergence of upside inflation risks. The Federal Reserve will release its policy decision at the close of its two-day meeting next week, on Sept. 20-21.

Nomura predicted that the US central bank would raise its fed funds target rate by 50 basis points at both the November and December meetings. The fed funds target is currently 2.25%-2.50%, following the Fed's 75-basis-point hike in July.

EUR/USD technical analysis

As per the prior analysis, EUR/USD Price Analysis: Bears eye a run to 0.9950 on a break of trendline support, it stated that the weekly chart showed that the price was correcting into the neckline of the M-formation with scope for a deeper correction towards a 61.8% ratio:

Update:

The price has been rejected at the 61.8% ratio and there are now eyes on a move lower towards the 0.9950s as per the hourly chart:

-

19:10

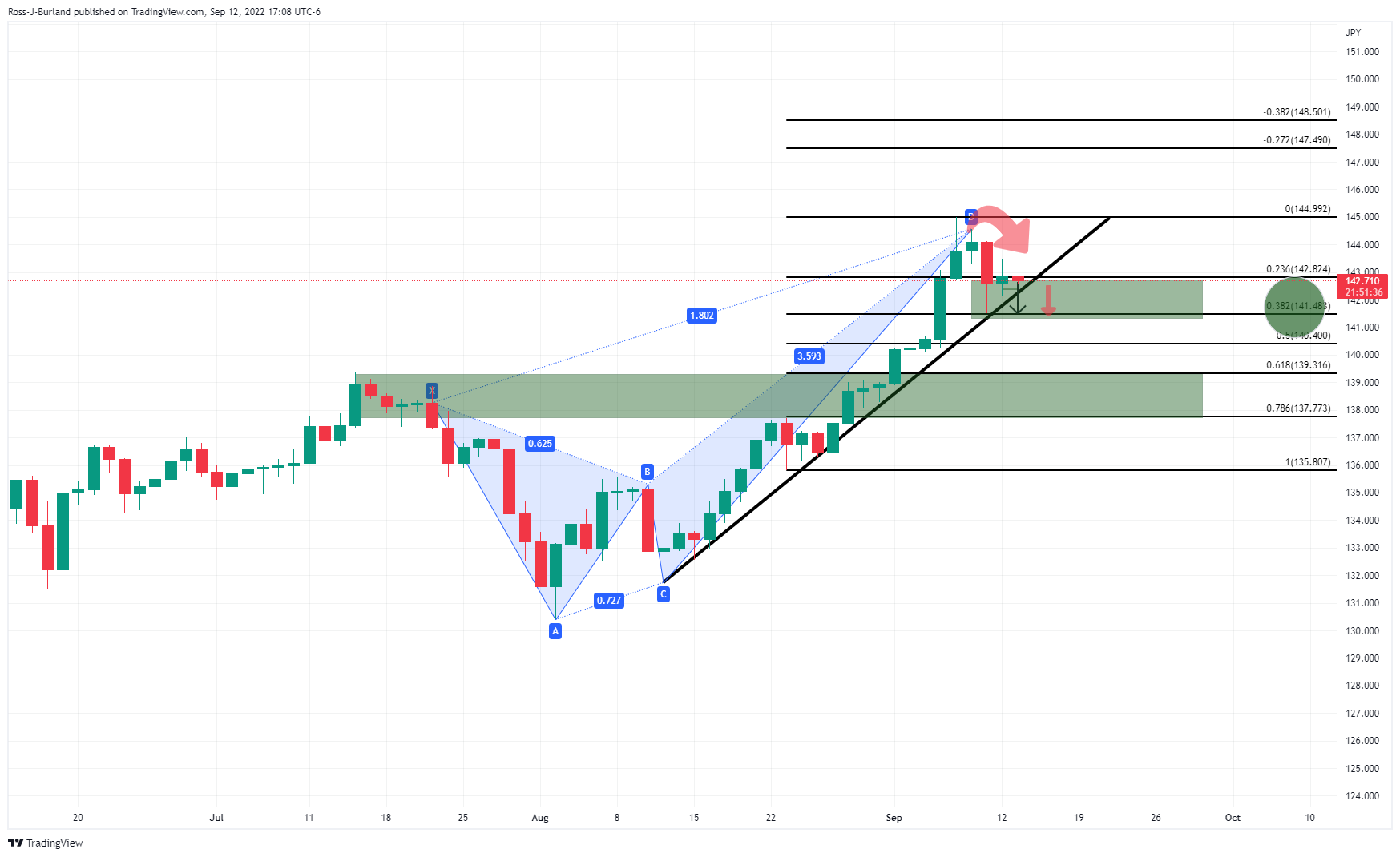

USD/JPY Price Analysis: Marches firmly towards 144.40 after elevated US CPI

- USD/JPY is in overbought conditions, but the BoJ’s dovish stance would keep the yen weak.

- A clear break of 145.00 would send the major rallying toward August 1998 at 147.67.

The USD/JPY rallied after the US Department of Labor reported that inflation was decelerating but exceeding estimations, catching off USD/JPY traders expecting a lower reading. At the time of writing, the USD/JPY is trading at 144.43, up by 1.09%.

USD/JPY Price Analysis: Technical outlook

After the US inflation report struck newswires, the USD/JPY rallied towards the daily highs at 144.68. Worth noting that, albeit being upward biased, the Relative Strength Index (RSI), alongside price action, shows signs that the USD/JPY is overbought. Nevertheless, the Bank of Japan’s dovish stance would likely pressure the Japanese yen, opening the door for the August 1998 test at 147.67.

Short term, the USD/JPY one-hour scale depicts the major testing of September’s 8 daily high at 144.44. A clear break would expose September 7 daily high at 144.56, followed by the YTD high at 144.99. On the other hand, the USD/JPY first support would be the 144.00 figure. Once cleared, the next support would be the R1 daily pivot at 143.50, followed by the 100 and 20-EMAs at around 143,18 – 143.05 area, respectively. A breach of the latter would expose the Daily pivot at 142.81.

USD/JPY Key Technical Levels

-

19:00

United States Monthly Budget Statement came in at $-220B below forecasts ($-213.5B) in August

-

17:51

NZD/USD nosedives to fresh weekly lows, eyeing the YTD low at 0.5996

- NZD/USD collapsed after US CPI rose higher than estimated, further cementing a large Fed interest rate increase.

- August inflation in the US flashed signs of being stickier than expected.

- Traders await NZ Current Account alongside US PPI on Wednesday.

The NZD/USD sinks more than 100 pips or 2% during Tuesday’s North American session, spurred by a hot US inflation reading, which favors the US Federal Reserve’s case of a 75 bps rate hike in the September 20-21 meeting. That, alongside higher US Treasury bond yields and a stronger greenback, triggered a risk-off impulse.

The kiwi began trading around 0.6140 and edged toward the daily high at 0.6161. However, as US economic data was released, the NZD/USD slumped to the daily low at 0.6009 before trimming some of its late losses. At the time of writing, the NZD/USD is trading at 0.6007, down 2.12%.

NZD/USD dropped after elevated US CPI

The US Bureau of Labor (BLS) reported that August inflation rose by 0.1% MoM, highest than estimates of a contraction of 0.1% by market participants, while annually based, it hit the 8.3% threshold, also exceeding expectations. The so-called core Consumer Price Index (CPI), which excludes food and energy, ticked up 0.6% MoM, above July’s 0.3%, due to higher rent and medical indexed, as reported by the BLS. The year-over-year core CPI rose by 6.3%, more than 5.9% in July.

Elsewhere, market participants have fully priced in a 75 bps rate hike next Wednesday at FOMC’s meeting, while odds of a 100 bps increased to 20% via the CME FedWatch Tool.

Source: CME FedWatch ToolIn the meantime, the US Dollar Index, a measure of the buck’s performance against a basket of peers, is rallying more than 1%, up at 109.606, underpinned by higher US Treasury yields, like the 10-year benchmark note rate at 3.447%, gaining close to 9 bps.

On the New Zealand side, the ANZ House Price Index fell 1.3% MoM in August, while adjusted sales printed a solid 4.9%. Later in the day, the New Zealand economic docket will reveal the Current Account data for the second quarter.

The US economic docket will feature the Producer Price Index (PPI) for August on Wednesday, with the headline foreseen at -0.1% MoM, while the core PPI is expected at 0.3%.

NZD/USD Key Technical Levels

-

16:38

US: Slower inflation, but still disappointing – Wells Fargo

Data released on Tuesday showed inflation in the US rose above expectations in August, boosting the US dollar across the board. According to analysts at Wells Fargo, a 50 basius points rate hike at next week's FOMC meeting now seems like a distant pipe dream, with a 75 bps rate hike now all but assured.

Key Quotes:

“The Consumer Price Index increased 0.1% in August, but the modest gain for the headline index masked what was a disappointing report. Gasoline prices fell 10.6% in the month, helping to keep overall inflation in check, but beyond energy goods there were not many encouraging takeaways. Excluding food and energy prices, core inflation increased 0.6%, well above the Bloomberg consensus of 0.3%. Core goods inflation remained strong and broad-based despite indications that supply chains are functioning more smoothly and inventory stockpiles are building. Core services inflation also remained hot, increasing 0.6% in August.”

“There remains considerable ground to cover before getting inflation back to a pace that resembles the Fed's target. Over the past three months, the core CPI has advanced at a 6.5% annualized pace, more than triple the 2% target. Moreover, a sustained return to 2% inflation remains even more distant at present. The tight labor market has kept compensation, the largest cost for most businesses, advancing well above 2% (even after accounting for productivity growth), while consumer and business inflation expectations remain high relative to the range of recent decades.”

“We think the road to returning inflation to target is still a long one, and we continue to look for the FOMC to press ahead with another 75 bps point hike at its meeting next week.”

-

16:23

USD/CHF soars to 0.9630 as dollar jumps on US inflation numbers

- US dollar jumps across the board after August US CPI numbers.

- Swiss franc prints fresh highs versus the euro and pound.

- USD/CHF rebounds at the 200-day SMA, having best day in weeks.

The USD/CHF rose sharply from the lowest level in four weeks to the highest since Friday following the release of US inflation data. The pair climbed from 0.9477 to 0.9632. It is hovering around 0.9600/10, having the best day in weeks.

US inflation explains it all

The US dollar dropped during the previous days amid expectations of a decline in the August CPI, but the numbers showed a different story. The CPI rose 0.1% in August and reinforced expectations of an aggressive Federal Reserve boosting the dollar and triggering a Treasury sell-off.

The US 10-year yield jumped to 3.47%, reaching the highest level since June and the 2-year yield rose to 3.74%, a fresh cycle high. The DXY rebounded from weekly lows under 108.00 to 109.55; it is up by more than 1%.

Despite the sharp slide versus the dollar, the Swiss franc rose against the euro and the pound amid risk aversion. The EUR/CHF trades at 0.9610, the lowest since late August, while GBP/CHF is at historic lows at 1.1070.

More US inflation numbers are due on Wednesday. Next week is the FOMC meeting. A 75 basis points rate hike is already priced in. “In our view, the August CPI report supports a continued aggressive effort by the Fed to restrict its inflation-adjusted policy stance”, explained analysts at TD Securities. They forecast a 75 bps rate hike next week and also in November.

Technical levels

-

16:10

Silver Price Forecast: XAG/USD plunges from four-week highs after hot US CPI

- Silver prices tumbled on higher-than-estimated August inflation figures, cementing the case for a third-straight Fed 75 bps rate hike.

- US CPI headline unexpectedly rose by 8.3 YoY, higher than 8.1% estimates.

- The CME FedWatch Tool has fully priced in a 75 bps rate hike.

Silver price drops from weekly highs near the $20.00 figure due to high US inflation data reported by the Department of Labor, exceeding analysts’ estimates, with most expecting a dip that could deter the US Fed from hiking interest rates.

XAG/USD opened around the $19.70s area and climbed towards its daily high at $19,94, ahead of the release of US inflation. However, once the headline crossed newswires, the pair tumbled toward the daily low at $19,34 before settling around the current spot price. XAG/USD is trading at $19.52, below its opening price.

XAG/USD tumbled on an unexpected rise in US inflation

Before Wall Street opened, the US Labor Department released that August inflation in the US i, hit the 8.3% YoY mark, lower than the 8.5% in the previous month. Even though it’s a positive number, economists were expecting a lower reading, spurred by lower energy prices, with WTI oil prices peaking at around $129.43 around March of 2022.

Inflation, excluding volatile items like food and energy, continued its uptrend, from 5.9% YoY in July to 6.3%, mainly caused by higher rent costs, further cementing the case for a large rate hike by the US Federal Reserve.

Elsewhere, the US Dollar Index, a gauge of the greenback’s value vs. six peers, is recovering a lot of ground, after tumbling towards a daily low at 107.660, edges up almost 1% at 109.375, a headwind for the precious metals complex.

The US 10-year T-bond yield edged up seven bps, at 3.431%, while US 10-year Treasury Inflation-Protected Securities yield cleared the 1% threshold for the first time since January 2019.

The US Federal Reserve entered its blackout period until the September 21 monetary policy decision. Market participants have fully priced in a 75 bps rate hike, according to the CME FedWatch Tools, which would see the Federal Funds Rate (FFR) reach the 3.25% threshold.

What to watch

The US economic docket will feature prices paid by producers on Wednesday, followed by the New York Fed PMI, the Philadelphia Fed PMI, Initial Jobless Claims, and Retail Sales on Thursday. On Friday, the University of Michigan (UoM) will release the US Consumer Confidence ahead of next’s weeks FOMC monetary policy decision.

Silver Key Technical Levels

-

15:50

GBP/USD could plummet to 1.0520 if 1.1409/1.1350 breaks – Credit Suisse

GBP/USD fell to the key low of 2020 and long-term trend support stretching back to 1985 at 1.1500/1409. Economists at Credit Suisse look for eventual downside below 1.1350.

Break under 1.1350 to signal a substantial breakdown

“GBP remains weak on a Trade Weighted basis and we thus continue to look for a break below 1.1409 and then a move to potential trend support at 1.1350, below which would signal a substantial breakdown and open the door to 1.1285 next, ahead of 1.1020/00, which is now our core objective. However, we would not rule out a move all the way to the 1985 lows at 1.0520 if 1.1409/1.1350 breaks.”

“First resistance is seen at 1.1745/63, then at the 55-day moving average and the recent high at 1.1900/1.1923, which ideally caps to prevent a lengthier consolidation.”

-

15:44

USD/JPY to eventually push towards 153.00 – Credit Suisse

USD/JPY continues to advance higher. Economists at Credit Suisse expect the pair to reach their r long-held target at 147.62/153.01.

Any abrupt setback is ideally held at 139.43/39

“We stay with our long-held bullish view and look for further upside to our long-term core objective at 147.62/153.01 – the 38.2% retracement of the entire fall from 1982 and price high of 1998. Our bias remains to see a move towards the upper end of this zone, where we would then stay alert to a potentially important top.”

“Any abrupt setback is ideally held at 139.43/39 to keep the risk directly higher.”

-

15:30

USD/CNY: Medium-term momentum remains strong – Credit Suisse

USD/CNY’s surge has paused. But the core uptrend remains in place, economists at Credit Suisse report.

Near-term support remains at 6.8870/8717

“The market looks to be having a temporary pause, in line with the current correction in USD. Nonetheless, medium-term momentum remains strong and with the broader USD strength expected to resume, our bias is to eventually challenge 6.9957/7.0000, a sustained break above which would open the door to reach 7.1844 in the medium-term.”

“Near-term support remains at the recent ‘continuation gap’ at 6.8870/8717, which ideally holds any additional near-term weakness.”

-

15:17

Gold Price Forecast: XAU/USD could sink as low as $1,451/40 on a close below $1,691/76 – Credit Suisse

Gold is breaking lower following the higher-than-expected US inflation data. A dip under $1,691/76 would turn the risks lower over at least the next 1-3 months, strategists at Credit Suisse report.

A major top continues to threaten

“We continue to stress that a closing break below $1,691/76 would be sufficient to complete a large ‘double top’, which would turn the risks lower over at least the next 1-3 months. We note that the next support should this top be triggered is seen at $1,618/16, then $1,560 and eventually $1,451/40.”

“Only a convincing break above the 55-day average at $1,746 would confirm further ranging in the 2-year range, with next resistance then seen at the even more important 200-day average, currently at $1,833.”

See – Gold Price Forecast: XAU/USD bears are not ready to hibernate yet – SocGen

-

15:12

ECB to raise its deposit rate to 2% most likely by the end of this year – ABN Amro

Economists at ABN Amro have revised their European Central Bank (ECB) policy rate forecasts. The central bank is now expected to raise its deposit rate to 2% most likely by the end of 2022.

Upgrading the view of the ECB rate peak

“We now expect the ECB to raise its deposit rate to 2% most likely by the end of this year. In our revised base case, we see another 75 bps hike in October, followed by a 50 bps step in December. The policy rate then settles at 2% through 2023.”

“The most likely alternative to this base, is three steps of 50 bps, which would mean the terminal rate is reached in February of next year. We had previously signalled a peak rate of 1.5%.”

-

15:03

United States IBD/TIPP Economic Optimism (MoM) increased to 44.7 in September from previous 38.1

-

14:58

USD/CAD climbs to fresh daily highs near 1.3100

- USD/CAD gathered bullish momentum and rose toward 1.3100 on Tuesday.

- Dollar outperforms its rivals after the US CPI data.

- Crude oil prices trade little changed on the day.

USD/CAD dropped to its lowest level in over two weeks near 1.2950 on Tuesday but reversed its direction in the early American session. Fueled by the renewed dollar strength, USD/CAD rose sharply toward 1.3100 before starting to consolidate its daily gains. As of writing, the pair was up 0.6% on the day at 1.3070.

The data published by the US Bureau of Labor Statistics revealed on Tuesday that annual inflation in the US, as measured by the Consumer Price Index (CPI), edged lower to 8.3% in August from 8.5% in July. More importantly, the Core CPI, which excludes volatile food and energy prices, jumped to 6.3% from 5.9%, surpassing the market expectation of 6.1%. Following this report, the US Dollar Index erased its weekly losses in a matter of minutes and climbed above 109.00.

Meanwhile, crude oil prices stay relatively calm and allow the dollar's valuation to drive the pair's action. The barrel of West Texas Intermediate (WTI) was last seen trading virtually unchanged on the day at $88.15.

Following the hot US inflation report, Wall Street's three main indexes are down between 1.7% and 3%, allowing the dollar to preserve its strength in the second half of the day.

There won't be any high-impact data releases in the remainder of the day and the risk perception could drive the pair's action.

Technical levels to watch for

-

14:54

AUD/USD bounces off daily low, remains vulnerable amid stronger US CPI-inspired USD rally

- AUD/USD witnessed a dramatic turnaround from a two-week high touched earlier this Tuesday.

- The post-US CPI USD rally turns out to be a key factor exerting downward pressure on the pair.

- The risk-off impulse further contributes to driving flows away from the perceived riskier aussie.

The AUD/USD pair retreats over 135 pips from a two-week high touched earlier this Tuesday and dives to 0.6780-0.6775 area amid a strong pickup in the US dollar demand during the early North American session. Spot prices, however, manage to recover a few pips and move back above the 0.6800 mark.

The USD witnessed a dramatic intraday turnaround from the monthly low and strengthened across the board in reaction to stronger US consumer inflation figures. In fact, the headline CPI unexpectedly rose by 0.1% in August and the yearly rate eased to 8.3%, beating estimates for a decline to 8.1%.

Adding to this, the Core CPI, which excludes volatile food and energy prices, rose by 0.6% in August (0.3% anticipated) and climbed to 6.3% on yearly basis from 5.9% in July. The data revives bets for a more aggressive policy tightening by the Fed and provides a strong boost to the greenback.

The markets have now started pricing in the possibility of a jumbo 100 bps rate hike at the September FOMC meeting and another supersized 75 bps hike in November. This is reinforced by a sharp spike in the US Treasury bond yields, which, in turn, is seen as another factor underpinning the buck.

The prospects for faster rate hikes by the US central bank, along with recession fears, trigger a fresh wave of the risk-aversion trade. This is evident from a steep decline in the equity markets, which further contributes to driving flows away from the perceived riskier Australian dollar.

With the latest leg down, the AUD/USD pair reverses a major part of its gains recorded over the past two trading sessions. Furthermore, acceptance below the 0.6800 mark will set the stage for further depreciating move towards the 0.6740-0.6730 intermediate support en route to the 0.6700 round figure.

Technical levels to watch

-

14:37

US Dollar Index Price Analysis: Rising bets for a retest of 110.00

- DXY abruptly changes direction and advances past 109.00.

- The next up barrier emerges at the YTD high near 110.80.

DXY now challenges 3-day highs in the mid-109.00s following an unexpected change of heart among investors in the wake of higher-than-expected US CPI.

The short-term bullish view in the dollar remains in place as long as it trades above the 7-month support line near 106.30. That said, and in light of the current price action, another move to the 20-year highs around 110.80 (September 6) should not be ruled out in the near term.

Looking at the long-term scenario, the constructive view in DXY remains unchanged while above the 200-day SMA at 101.46.

DXY daily chart

-

14:32

EUR/USD Price Analysis: The parity zone is expected to hold the downside

- EUR/USD reverses gear and plummets to the parity region.

- The loss of that level could expose the YTD low at 0.9863.

EUR/USD sharply reverses the recent advance and rapidly drops to revisit the vicinity of the psychological parity level on Tuesday.

The continuation of the retracement threatens to breach that important area of contention and pave the way for a potential challenge of the 2022 low at 0.9863 (September 6).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0748.

EUR/USD daily chart

-

14:29

GBP/USD drops to mid-1.1500s amid relentless dollar rally

- GBP/USD lost nearly 200 pips after the US inflation data.

- Core CPI in the US rose at a stronger pace than expected in August.

- US Dollar Index jumped above 109.00, reflecting broad dollar strength.

GBP/USD came under heavy bearish pressure and erased nearly 200 pips in less than 30 minutes after the US inflation data. The pair was last seen losing 1.05% on a daily basis at 1.1557.

The US Bureau of Labor Statistics reported that the Core Consumer Price Index climbed to 6.3% in August from 5.9% in July. This print surpassed the market expectation of 6.1%. Although the headline CPI edged lower to 8.3% from 8.5% in the same period, it still arrived above analysts' forecast of 8.1%.

The benchmark 10-year US Treasury bond yield is up nearly 3% on the day and the US Dollar Index is rising 1% at 109.35. According to the CME Group's FedWatch Tool markets are currently fully pricing in a 75 basis points rate hike in September.

The hot inflation report also weighed on risk mood. Nasdaq Futures, which was up 1% earlier in the day, is now losing more than 3%.

Earlier in the day, mixed labour market data from the UK helped the British pound find demand but the reaction to the US data clearly shows that the dollar's market valuation is the primary driver of the pair's action.

Technical levels to watch for

-

14:18

USD/JPY surges past mid-144.00s amid post-US CPI rally in USD and US bond yields

- USD/JPY rallies over 200 pips from the daily low and moves back closer to the 24-year peak.

- The stronger US CPI report lifts bets for more aggressive Fed rate hikes and boosts the USD.

- The risk-on impulse fails to benefit the safe-haven JPY or stall the strong intraday move up.

The USD/JPY pair witnessed a dramatic intraday turnaround and rallied over 200 pips during the early North American session following the release of US consumer inflation figures. The pair is currently placed near the daily high, just above mid-144.00s, and has now moved well within the striking distance of a 24-year high touched last week.

The US dollar stages a solid rebound from the fresh monthly low touched earlier this Tuesday after the stronger-than-expected US CPI report lifted bets for a more aggressive policy tightening by the Fed. This, in turn, is seen as a key factor that assisted the USD/JPY pair to attract fresh buying near the 142.60-142.55 area on Tuesday.

The markets have now started pricing in the possibility of a jumbo 100 bps rate hike at the upcoming FOMC meeting on September 20-21 and another supersized 75 bps hike in November. This is reinforced by a sharp spike in the US Treasury bond yields. In fact, the yield on rate-sensitive two-year US government bonds surges to the highest level since 2007.

Moreover, the benchmark 10-year US Treasury note jumps back closer to the YTD peak touched in June, widening the US-Japan rate differential. This, along with a big divergence in the Fed-Bank of Japan policy divergences, offsets the risk-on impulse and fails to lend any support to the Japanese yen or stall the USD/JPY pair's strong intraday rally.

It will now be interesting to see if bulls can maintain their dominant position amid speculations that authorities may soon step in to arrest a freefall in the JPY. This makes it prudent to wait for a sustained strength beyond the 145.00 psychological mark before traders start positioning for the resumption of the recent well-established upward trajectory.

Technical levels to watch

-

13:55

United States Redbook Index (YoY) up to 11.4% in September 9 from previous 10.9%

-

13:48

Gold Price Forecast: XAU/USD plummets amid stronger US CPI-led USD rally

- Gold meets with aggressive supply following the release of a stronger US CPI report.

- Bets for more aggressive Fed rate hikes boost the USD and weigh on the commodity.

- A sharp fall in the equity markets could offer support to the safe-haven XAU/USD.

Gold came under intense selling pressure during the early North American session and dives to a fresh daily low, around the $1,708 area in the last hour.

The US dollar catches aggressive bids in reaction to stronger US consumer inflation figures and stages a solid recovery from the monthly low touched earlier this Tuesday. This, in turn, is seen as a key factor weighing heavily on the dollar-denominated commodity.

The US Bureau of Labor Statistics reported that the headline CPI decelerated to 8.3% YoY in August from 8.5% in the previous month. This, however, was slightly above consensus estimates for a fall to 8.1%. Adding to this, the gauge unexpectedly rose by 0.1% in August.

Additional details of the report revealed that the Core CPI, which excludes volatile food and energy prices, rose by 0.6% in August (0.3% anticipated) and climbed to 6.3% on yearly basis from 5.9% in July. The data lifted bets for a more aggressive policy tightening by the Fed.

In fact, the markets have now started pricing in the possibility of a jumbo 100 bps at the upcoming FOMC meeting on September 20-21. This is evident from a sharp spike in the US Treasury bond yields, which further contributes to driving flows away from the non-yielding gold.

That said, a dramatic turnaround in the global risk sentiment, as depicted by a steep decline in the equity markets, could offer some support to the safe-haven precious metal. Nevertheless, the fundamental backdrop suggests that the path of least resistance for gold is to the downside.

Technical levels to watch

-

13:31

United States Consumer Price Index Core s.a: 296.95 (August) vs 295.28

-

13:31

United States Consumer Price Index ex Food & Energy (MoM) came in at 0.6%, above forecasts (0.3%) in August

-

13:30

United States Consumer Price Index (YoY) above expectations (8.1%) in August: Actual (8.3%)

-

13:30

United States Consumer Price Index ex Food & Energy (YoY) registered at 6.3% above expectations (6.1%) in August

-

13:30

United States Consumer Price Index (MoM) above forecasts (-0.1%) in August: Actual (0.1%)

-

13:30

United States Consumer Price Index n.s.a (MoM) above expectations (295.53) in August: Actual (296.171)

-

13:30

Breaking: US annual CPI inflation declines to 8.3% in August vs. 8.1% expected

The US Bureau of Labor Statistics reported this Tuesday that inflation, as measured by the Consumer Price Index (CPI), decelerated to 8.3% on a yearly basis in August from 8.5% in the previous month. The reading was slightly above consensus estimates pointing to a decline to 8.1%.

The Core CPI, which excludes volatile food and energy prices, rose by 0.6% in August (0.3% anticipated) and climbed to 6.3% on yearly basis, up from 5.9% in July and 6.1% expected.

Follow our live coverage of the market reaction to US inflation data.

Market reaction

The US dollar catches aggressive bids in reaction to the stronger-than-expected CPI report and for now, seems to have stalled its recent sharp pullback from a two-decade high touched last week.

-

13:24

USD/JPY: A move to 150 can not be ruled out – Rabobank

The pullback in the broad-based value of the USD in recent sessions has offered a reprieve to various stressed currency pairs, among them USD/JPY. Nonetheless, economists at Rabobank still believe that the pair could reach the 150 level.

Scope for USD/JPY to head higher in the coming months

“The dip back towards 142.00 this week will be welcomed by Japanese officials. That said, it is our view that USD strength will sustain for some months yet. It is also possible that the BoJ will maintain loose policy settings into next year. This suggests scope for USD/JPY to head higher in the coming months.”

“A move to 150 can not be ruled out.”

-

13:21

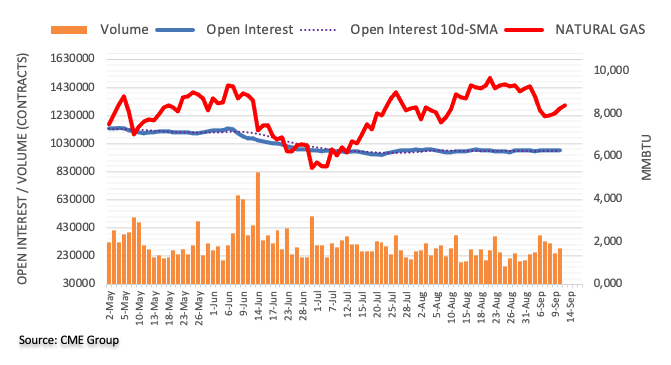

Brent Oil to remain elevated around $125 until September 2023 – UBS

Economists at UBS favor the energy sector. They still expect a rebound after the recent fall in prices, which has taken Brent from $105 a barrel in late August to $94 at present.

Oil prices to remain supported even if rebound is slower

“We have reduced our December Brent oil forecast by $15 to $110 per barrel due to prospects of slower recovery in Chinese oil demand. The revised forecast is still higher than the current Brent spot price of $94 per barrel.”

“We maintain our projection for Brent to climb to $125 per barrel by March 2023 and to remain elevated around there till September 2023.”

-

13:17

With a new UK leader, sterling remains vulnerable but stocks attractive – UBS

A reduction in political uncertainty with the appointment of a new UK prime minister, Liz Truss, did not immediately help the pound last week. Cable fell to its weakest intraday level against the US dollar since 1985, taking its decline close to 15% year-to-date. But UK equities have held up well, up 0.5% so far in 2022 versus -17.5% for global stocks, and economists at UBS expect this outperformance to continue.

Earnings growth should be boosted by the weaker pound

“We don’t expect the new government’s policies to do much to support the pound over the coming months. In fact, a widening budget deficit could prove an additional headwind for sterling since the new prime minister is proposing tax cuts and higher spending, starting with a package to curb rising energy bills.”

“FTSE 100 companies generate around 75% of their revenues outside the UK, which means the market is less sensitive to domestic growth concerns. It also means that earnings growth should be boosted by the weaker pound.”

“From a valuation perspective, the FTSE 100 trades on a 12-month forward P/E of 9.4x, an attractive 35% discount to the MSCI All Country World index.”

-

13:11

Gold Price Forecast: XAU/USD with limited recovery potential – Commerzbank

Gold price began the week by further recovering from its latest dip below the $1,700 mark. However, strategists at Commerzbank see limited recovery potential for the yellow metal.

Risk of more pronounced rate hikes will not disappear

“Besides the weaker US dollar, it is likely being helped by the general expectation that US inflation has cooled for the second month running, suggesting that the peak of inflation is finally behind us. This could dissuade the US Fed from implementing any more aggressive rate hikes – this at least is presumably what the market is hoping for.”

“That said, the potential for the gold price to recover is probably limited given that inflation will remain high, meaning that the risk of a de-anchoring of inflation expectations persists which in turn could cause high inflation to solidify. This also means that the risk of more pronounced rate hikes will not disappear for the foreseeable future.”

See – Gold Price Forecast: XAU/USD bears are not ready to hibernate yet – SocGen

-

13:07

EUR/USD: Failure to breach 1.02 after US CPI to disappoint bulls – TDS

EUR/USD has rejected trend resistance at 1.02 thus far. Economists at TD Securities expect bulls to be disappointed if the pair continues to trade below the 1.02 mark after US Core Price Index (CPI) report.

EUR/USD remains strongly correlated to global growth dynamics

“We expect 1.02 to be formidable resistance around US CPI, but a failure to breach and/or hold gains above that level post-data could be a disappointment for EUR bull chasers.”

“The next topside level comes in around 1.0350, but this may require a wholesale adjustment to expectations about the EU and global growth. Asset prices remain linked to the latter, which has only worsened and should spark concern about a premature rally in EUR/USD.”

See – US CPI Preview: Forecasts from 12 major banks, inflation begins to ease

-

12:53

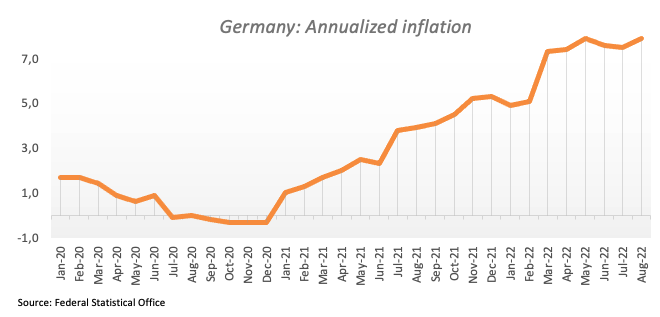

Germany's Habeck: We face threat of recession next year

German Economy Minister Robert Habeck said on Tuesday that their goal is to introduce a new energy market design and price reduction measures for 2022 retroactively, as reported by Reuters.

"We face a threat of recession next year," Habeck added.

Market reaction

These comments don't seem to be having a significant impact on risk mood. As of writing, Germany's DAX 30 Index was up 0.75% on the day at 13,502. Meanwhile, EUR/USD preserves its bullish momentum and continues to push higher toward 1.0200.

-

12:18

EUR/JPY Price Analysis: A technical decline is not ruled out

- EUR/JPY gives away part of Monday’s advance to new cycle tops.

- Overbought conditions could trigger a corrective move.

EUR/JPY trades in an unconclusive fashion around the mid-144.00s on Tuesday.

Extra gains in the cross appear well favoured for the time being. The next target, however, is not expected to emerge until the 2014 high at 149.78 (December 8). Of note, however, is that the cross remains within the overbought territory and suggests the likelihood of a technical correction in the short-term horizon.

In the meantime, the constructive outlook in the cross remains unchanged while above the 200-day SMA, today at 135.01.

EUR/JPY daily chart

-

11:59

When is the US consumer inflation (CPI report) and how could it affect EUR/USD?

US CPI Overview

Tuesday's US economic docket highlights the release of the critical US consumer inflation figures for August, scheduled later during the early North American session at 12:30 GMT. On a monthly basis, the headline CPI is anticipated to decline by 0.2% during the reported month. The yearly rate is also expected to decelerate to 8.1% in August from the 8.5% previous. Meanwhile, core inflation, which excludes food and energy prices, is projected to remain steady at 0.3% in August and tick higher to 6.1% on yearly basis, up from 5.9% in July.

Analysts at Deutsche Bank offered a brief preview of the report and explained: “We expect a slight decline in the headline CPI number (-0.09% MoM) but an acceleration of +0.30% in core, which would continue the pattern from July's reading (unchanged and +0.3%, respectively) which came in lower than expected. We believe the YoY headline CPI should fall five-tenths to 8.0%, while core should tick up a tenth to 6.0%.”

How Could it Affect EUR/USD?

A survey released by the Federal Reserve Bank of New York on Monday showed that consumer expectations for US inflation over the coming years declined sharply to the lowest level since October last year. This, in turn, keeps the US dollar depressed near the monthly low. A weaker US CPI print will point to a sustained decline in US inflation and fuel speculations for less aggressive policy tightening by the Fed. This could drag the US Treasury bond yields and the USD lower. This, in turn, should allow the EUR/USD pair to extend its recent recovery move from a two-decade low and build on the momentum further beyond the 1.0200 round-figure mark.

Conversely, stronger inflation figures will revive bets for faster interest rate hikes by the US central bank. This will be enough to provide a fresh lift to the greenback and attract aggressive selling around the EUR/USD pair. The immediate market reaction to the report, however, is more likely to be limited as investors now start repositioning for the FOMC monetary policy meeting on September 20-21. Nevertheless, a big divergence from the expected readings should infuse some volatility in the FX markets and allow traders to grab meaningful opportunities around the pair.

Eren Sengezer offers a brief technical outlook for the pair and outlines important technical levels: “EUR/USD is trading within a touching distance of 1.0160 (Fibonacci 61.8% retracement of the latest downtrend). In case the pair clears that hurdle and flips into support, it could test 1.0200 (psychological level, Monday high) and target 1.0245 (static level) afterwards.”

“On the downside, 1.0100 (200-period SMA, Fibonacci 50% retracement) aligns as key support. A daily close below that level could be seen as a significant bearish development and bring in additional sellers, dragging the pair back toward 1.0050 (Fibonacci 38.2% retracement) and 1.0000 (psychological level, 50-period SMA, 100-period SMA),” Eren adds further.

Key Notes

• US CPI Preview: Dollar set to climb on low core expectations, three scenarios

• US CPI Preview: Forecasts from 12 major banks, inflation begins to ease

• EUR/USD Forecast: Euro bulls ignore dismal sentiment data

About the US CPI

The Consumer Price Index released by the US Bureau of Labor Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of the USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

-

11:32

Silver Price Analysis: XAG/USD bulls now await a move beyond descending trend line hurdle

- Silver attracts some dip-buying on Tuesday and inches back closer to a multi-week high.

- The set-up favours bullish traders and supports prospects for additional near-term gains.

- Only a sustained break below the $18.45-40 area will negate the near-term positive bias.

Silver reverses its early lost ground and moves back to the $19.80 area during the first half of the European session on Tuesday. The white metal is currently placed just below a nearly four-week high touched the previous day and seems poised to prolong its recent recovery from the $17.55 area, or over a two-year low.

The positive outlook is reinforced by the fact that technical indicators on the daily chart have just started moving in the bullish territory and are still far from being in the overbought zone. That said, the overnight rejection by a descending trend line extending from the April swing high warrants some caution for aggressive bullish traders.

Hence, it will be prudent to wait for a convincing daily close above the trend line, currently at around the $19.75 mark before positioning for any further appreciating move. The XAG/USD might then climb to test the 100-day SMA, near the $20.45 region, before accelerating the move towards reclaiming the $21.00 round-figure mark.

Some follow-through buying has the potential to lift the XAG/USD towards the next relevant hurdle, around the $21.50 area. The upward trajectory could further get extended towards the $22.00 mark. This is closely followed by the very important 200-day SMA, around the $22.15 region, which should act as a strong barrier for the commodity.

On the flip side, any further slide below the daily low, around the $19.55-$19.50 area, now seem to find decent support near the $19.25 region, or the 50-day SMA. Any subsequent slide could be seen as a buying opportunity and remain limited near the $18.45-$18.40 support zone. A convincing break below the latter is needed to negate the positive bias.

Silver daily chart

-637986612868731536.png)

Key levels to watch

-

11:00

United States NFIB Business Optimism Index rose from previous 89.9 to 91.8 in August

-

10:54

USD/CAD struggles below 1.3000, hangs near two-week low ahead of US CPI

- USD/CAD turns lower for the fourth straight day and is pressured by a combination of factors.

- Bullish oil prices underpin the loonie and act as a headwind amid sustained USD selling bias.

- The market focus remains glued to the release of the crucial US consumer inflation figures.

The USD/CAD pair struggles to capitalize on its modest uptick on Tuesday and attracts fresh selling in the vicinity of the 1.3000 psychological mark. The pair turns lower for the fourth successive day and drops the 1.2970-1.2965 area during the first half of the European session, back closer to over a two-week low touched the previous day.

Crude oil prices reverse the early lost ground and hold steady near a one-week high amid concerns about tight global supply, fueled by Russia's threat to cut oil flows to any country that backs a price cap. This continues to underpin the commodity-linked loonie and acts as a headwind for the USD/CAD pair. The US dollar, on the other hand, remains depressed near the monthly low and turns out to be another factor exerting downward pressure on the major.

Given that the markets already seem to have priced in a 75 bps Fed rate hike at the September meeting, the prevalent risk-on mood is seen weighing on the safe-haven buck. Furthermore, signs of a sustained decline in the US inflation lead to a modest downtick in the US Treasury bond yields and contributes to the offered tone surrounding the greenback. That said, traders might refrain from placing aggressive bets ahead of the US consumer inflation figures.

The crucial US CPI report, due later during the early North American session, will play a key role in influencing the Fed's policy outlook and dictate the near-term trajectory for the USD. Traders will further take cues from OPEC’s monthly outlook report, which will impact oil price dynamics and produce short-term opportunities around the USD/CAD pair.

Technical levels to watch

-

10:46

BoE could hike by 50 bps later in the week – UOB

Further tightening could well see the BoE raising the policy rate by 50 bps at its meeting later in the week, suggests Economist at UOB Group Lee Sue Ann.

Key Quotes

“With the worsening in the cost-of-living crisis, we see room for only a further 50bps increase in the Bank Rate to 2.25%, before a pause thereafter.”

“That said, we bear in mind that the BoE has warned that ‘policy is not on a pre-set path’, as it projects a UK recession will begin in the fourth quarter and last all the way through next year”.

“It also boosted its forecast for the peak of inflation to 13.3% in Oct amid a surge in gas prices, and warned that price gains will remain elevated.”

-

10:44

Gold Price Forecast: XAU/USD eyes key resistance at $1,735 ahead of US inflation – Confluence Detector

- Gold price is replicating Monday’s price action, resuming recovery towards $1,735.

- The US dollar keeps falling with the Treasury yields amid a global risk rally.

- XAU/USD’s fate hinges on critical US inflation as Fed is set to hike rates by 75 bps next week.

Gold price is building on the previous recovery momentum, reversing the dip seen earlier in the Asian session. Markets are duplicating Monday’s moves, as the US dollar correction kicks in again amid a renewed weakness in the Treasury yields, allowing bulls to regain the upside traction. The extended risk rally globally is on the heels of expectations of more Chinese stimulus, inflation peaking in the US and some optimism surrounding Ukraine’s progress against Russia. All eyes now remain on the US inflation data for August, which will provide a fresh cue on the Fed’s rate hike path, with the world’s most powerful central bank seen hiking rates by 75 bps next week. An upside surprise in the core CPI could be on the cards, given the lower consensus.

Also read: Gold Price Forecast: XAU/USD could attack $1,700 on a US core CPI upside surprise

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is looking to break above the convergence of the previous week’s high and Fibonacci 23.6% one-day at $1,729.

Next on tap for bulls is a dense cluster of healthy resistance levels stacked up around $1,735, where the Fibonacci 23.6% one-month, pivot point one-week R1 and the previous day’s high meet.

Buying pressure will accelerate above the latter, initiating a fresh upswing towards the SMA 50 one-day at $1,742.

On the flip side, the immediate support is seen at around $1,721, the confluence of the Fibonacci 23.6% one-week, Fibonacci 61.8% one-day and the previous low four-hour.

The Fibonacci 38.2% one-week at $1,716 will come to the rescue of bulls if the downside extends. The last line of defense for XAU buyers is envisioned at $1,712. At that level, the previous day’s low, SMA10 one-day and pivot point one-day S1 merge.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

-

10:29

EU is unlikely to cap price of Russian gas – The Guardian

Citing a leaked document, the Guardian is reporting this Tuesday that the European Union (EU) is unlikely to impose a price cap on Russian gas while levying windfall taxes on energy company “surplus” profits.

This comes ahead of the European Commission president, Ursula von der Leyen, plan on dealing with surging electricity prices when she makes her annual state of the union speech on Wednesday.

Market reaction

EUR/USD was last seen trading at 1.0155, up 0.38% on the day.

-

10:15

AUD/USD Price Analysis: Bulls look to build on momentum beyond 0.6900 ahead of US CPI

- AUD/USD reverses modest intraday downtick and hits a nearly two-week high on Tuesday.

- The prevalent selling bias surrounding the USD remains supportive of the intraday uptick.

- A breakout through the 0.6865-0.6860 confluence supports prospects for additional gains.

The AUD/USD pair attracts some dip-buying near the 0.6860 area on Tuesday and turns positive for the third straight day. The pair is currently placed near a two-week high, with bulls awaiting a sustained move beyond the 0.6900 round-figure mark.

The US dollar selling remains unabated through the first half of the European session and turns out to be a key factor acting as a tailwind for the AUD/USD pair. The uptick, however, lacks follow-through buying as investors keenly await the crucial US consumer inflation figures, due later today.

From a technical perspective, the emergence of fresh buying near the 0.6865-0.6860 confluence hurdle breakpoint supports prospects for further gains. The said area comprises the top end of a one-month-old descending channel and the 38.2% Fibonacci retracement level of the August-September decline.

This should now act as a pivotal point for intraday traders. Any subsequent pullback could be seen as a buying opportunity near the overnight swing low, around the 0.6825 area. This, in turn, should limit any further losses for the AUD/USD pair near the 0.6800 round figure, or the 23.6% Fibo. level.

A convincing break below the latter will suggest that the corrective bounce has run out of steam and shift the bias back in favour of bearish traders. The AUD/USD pair could then drop to the 0.6730 intermediate support en route to the 0.6700 mark and the YTD low, around the 0.6680 region.

On the flip side, sustained strength beyond the 0.6900 mark is likely to confront stiff resistance near the 100-day SMA, currently around the 0.6960 area. Some follow-through buying should pave the way for a further appreciating move and allow the AUD/USD pair to reclaim the 0.7000 psychological mark.

AUD/USD 4-hour chart

Key levels to watch

-

10:12

Euro area: Unprecedented rate hike by the ECB – UOB

Economist at UOB Group Lee Sue Ann reviews the latest ECB interest rate decision.

Key Takeaways

“The European Central Bank (ECB) decided to raise its three key interest rates by 75bps, and ECB President Christine Lagarde hinted it could do the same again as part of ‘several’ future moves to fight against rampant inflation. The ECB significantly revised higher their inflation projections, now expecting inflation to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024. It also revised down markedly GDP growth to 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024, thus avoiding an economic recession.”

“The Eurozone economy is, however, expected to stagnate later in the year and in the first quarter of 2023. Russia’s war on Ukraine, an uneven recovery from the COVID-19 pandemic and a drought across much of the continent have combined to create a significant amount of uncertainty and downside risks. We are in the midst of revising our growth and inflation forecasts for the region and will be publishing them at the upcoming 4Q22 Quarterly Outlook.”

“Meanwhile, the implied hawkish tone by the ECB, despite the absence of a formal forward guidance, has led us to pencil in further rate hikes ahead. There are two more meetings left for the year. For now, we see the ECB hiking by another cumulative 50bps for this year to bring the refinancing rate to 1.75% and the deposit rate to 1.25% by year-end. Although we believe the ECB wants to play catch up, it needs to exercise a lot more caution as we see the Eurozone economy inevitably falling into a recession during winter, even without additional rate hikes. For this reason, we acknowledge the high uncertainty surrounding our ECB call, and the “terminal rate” of this current hiking cycle.”

-

10:10

Spain 9-Month Letras Auction up to 1.308% from previous 0.597%

-

10:05

German ZEW Economic Sentiment Index dives to -61.9 in September vs. -60.0 expected

- German ZEW Economic Sentiment arrived at -61.9 in September vs. -60.0 expected.

- The ZEW Current Situation for Germany came in at -60.5 in September vs. -52.2 expected.

- EUR/USD hovers above 1.0150 despite downbeat German and Eurozone data.

The German ZEW headline numbers for September showed that the Economic Sentiment Index worsened to -61.9 while missing estimates of -60.0 vs. -55.3 previous.

The headline ZEW was last weaker than -60.0 at the height global financial crisis (GFC).

Meanwhile, the Current Situation sub-index arrived at -60.5 in September vs. -52.2 expectations and August’s -47.6.

The Eurozone ZEW Economic Sentiment Index stood at -60.7 in the current month as compared to the -54.9 previous reading and -52.0 expected.

Key takeaways

Indicator of economic sentiment decreased again in September.

Together with the more negative assessment of the current situation, the outlook for the next six months has deteriorated further.

Prospect of energy shortages in winter has made expectations even more negative for large parts of the German industry.

In addition, growth in China is assessed less favourably.

Latest statistical figures already show a decline in incoming orders, production, and exports.

FX market reaction

The euro ignores discouraging ZEW Surveys from Germany and Eurozone. EUR/USD was last seen trading at 1.0156, up 0.36% on the day.

-

10:03

European Monetary Union ZEW Survey – Economic Sentiment came in at -60.7, below expectations (-52) in September

-

10:02

Germany ZEW Survey – Economic Sentiment came in at -61.9, below expectations (-60) in September

-

10:02

Germany ZEW Survey – Current Situation came in at -60.5, below expectations (-52.2) in September

-

09:55

Spain 3-Month Letras Auction rose from previous 0.138% to 0.707%

-

09:50

Germany’s Scholz: We are also looking at introducing cap on gas prices

Germany’s Chancellor Olaf Scholz said on Tuesday that, “we are also looking at introducing a cap on gas prices” after the power-price cap.

Additional quotes

The power-price cap is to be implemented with great speed.

We have ensured that our gas storage is fuller than the same time last year, and that it will continued to be filled before the winter.

Hydrogen is the gas of the future; we will create a huge boom.

Related reads

- EUR/USD looks firm around 1.0150 ahead of EMU data, US CPI

- German Economy Ministry: Economic outlook for H2 dramatically worsened

-

09:44

German Economy Ministry: Economic outlook for H2 dramatically worsened

The latest report published by the German Economy Ministry on Tuesday underscored concerns over the country’s economic outlook in the second half of this year.

Key takeaways

Early indicators and polls point to a rising number of insolvencies in H2 but no "insolvency wave" in sight.

German economic outlook for H2 dramatically worsened, output in H2 could stagnate or contract.

German labor market is defying global uncertainties for time being, indicators have stabilized and demand for labor remains high.

Market reaction

The shared currency is undeterred by Germany’s dire economic outlook, as EUR/USD flirts with highs near 1.0150, up 0.31% on the day.

-

09:43

EUR/GBP set to enjoy more upside – SocGen

The Office for National Statistics (ONS) released the figures for the UK labour market. The report is set to continue placing downward pressure on the British pound, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

Bank of England remains in a bad place

“Very low unemployment, higher wage growth, still low labour force participation and a sharp drop-off in vacancies make for inflation persistence, but slower growth ahead. That in turn, makes sure the BoE’s MPC remains in a bad place and sterling remains on the back foot.”

“We expect more EUR/GBP upside.”

-

09:34

GBP/USD sticks to gains above 1.1700 mark, sits near two-week high ahead of US CPI

- GBP/USD gains traction for the third straight day and climbs to a nearly two-week high.

- The prevalent USD selling bias and the upbeat UK employment data remain supportive.

- The uptick lacks bullish conviction as traders now await the release of the US CPI report.

The GBP/USD pair builds on its recent recovery move from the lowest level since 1985 and gains traction for the third successive day on Tuesday. The momentum lifts the pair to a nearly two-week high, around the 1.1730-1.1735 region during the first half of the European session and is sponsored by sustained selling around the US dollar.