Notícias do Mercado

-

23:40

GBP/JPY Price Analysis: Head-and-shoulders chart pattern in the H4 targets a fall towards 161.50

- GBP/JPY is registering a minimal loss of 0.06% as the Asian session begins.

- A risk-off impulse, alongside Japanese authorities’ verbal intervention in the FX markets, bolstered the yen against most G8 currencies.

- The GBP/JPY 4-hour chart portrayed the formation of a head-and-shoulders pattern which targets a drop to 161.50.

On Thursday, the GBP/JPY extended its losses for the third consecutive trading day, courtesy of a risk-off impulse that kept investors leaning toward less risky assets, turning to the greenback alongside US Treasuries. Meanwhile, US equities finished with losses between 0.66% and 1.71%. At the time of writing, the GBP/JPY is trading at 164.31, below its opening price by 0.08%.

GBP/JPY Price Analysis: Technical outlook

During the week, the GBP/JPY hit a weekly high at around 167.94 before retreating due to some factors. Rumors of Japanese authorities intervening in the Forex Markets caused a Japanese yen repricing across most crosses. Therefore, the GBP/JPY tumbled on sentiment, though it’s testing the September 9 cycle low at 164.30. If the latter gives way, the pair could drop towards a confluence area with the 20, 50, and 100-day EMAs, around 163.00-34.

The GBP/JPY 4-hour chart confirms the bearish bias in the near term. A head-and-shoulders chart pattern emerged, which, measured by the distance of the head-to-the-neckline, would target a drop from current spot prices toward 161.50. therefore, the GBP/JPY first support would be the S1 pivot at 164.01. A breach of the latter will expose the confluence of the S2 daily pivot and the 100-EMA at 163.52, ahead of the confluence of the 200-EMA and the S3 pivot at 162.82, ahead of the161-50 target.

GBP/JPY Key Technical Levels

-

23:40

Gold Price Forecast: XAU/USD eyes further losses below $1,700 amid firmer yields, hawkish Fed bets

- Gold price dropped to the lowest levels since April 2020 on breaking the key support, tests 61.8% FE.

- US dollar cheers the data-driven strength of the yields, odds of Fed’s aggression.

- Risk-negative headlines from China, Europe also weigh on the XAU/USD price.

- Preliminary readings of Michigan Consumer Sentiment Index could entertain traders.

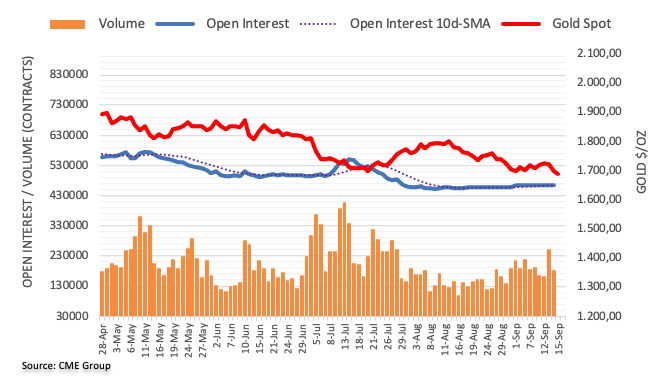

Gold price (XAU/USD) remains on the back foot at the 2.5-year low as bears attack $1660 support during Friday’s Asian session. The metal dropped the most since early July the previous day after breaking the short-term key support line. The reason could be linked to the firmer US dollar and yields that propel the hawkish Fed bets.

Increasingly hawkish Fed bets appear to be the underlying reason behind the US dollar’s strength, which in turn drowns the XAU/USD price. Also keeping the metal bears hopeful are the firmer yields backed by the mostly stronger data.

On Thursday, US Retail Sales rose 0.3% in August versus 0.0% expected and July’s revised down -0.4%. Further, NY Fed Empire State Manufacturing Index improved to -1.5 in September compared to -31.3 in August and market expectation of -13. Alternatively, Philadelphia Fed Manufacturing Index declined to -9.9 for the said month compared to 2.8 expected and 6.2 prior. Additionally, US Industrial Production slid to -0.2% in August versus a market expectation for an expansion of 0.1% and downwardly revised prior to 0.5%.

Additionally, pessimism emanating from China and Europe are an extra burden on metal prices. Bloomberg ran a piece suggesting that China is likely to witness harder days than it witnessed in 2020. On the same line was the news surrounding the Sino-American tussles and the People’s Bank of China’s (PBOC) inaction. Elsewhere, fears that the Eurozone will remain in dire conditions despite having a good stock for winter joined hawkish comments from the European Central Bank (ECB) policymakers to keep the pessimism higher.

Against this backdrop, Wall Street closed in the red and the US Treasury bond yields were firmer. Further, the market’s pricing of the Fed’s 0.75% and 1.0% rate hikes in the next week’s Federal Open Market Committee (FOMC) also rose to 80% and 20% in that per the CME’s FedWatch Tool.

Although the risk-aversion can keep the gold bears hopeful amid a firmer US dollar, today’s readings of the Michigan Consumer Sentiment Index (CSI) for September will be important to watch for fresh impulse.

Technical analysis

A sustained downside break of the two-month-old support line, now resistance around $1,695, joins the bearish MACD signals to keep XAU/USD sellers hopeful of a fresh multi-month low. However, the oversold RSI (14) challenges the immediate downside around the 61.8% Fibonacci Expansion (FE) of the bullion’s April-August moves, near $1,660.

Should the metal price drops below $1660, which is more likely, the 78.6% FE level near $1,622 and the $1,600 threshold could quickly flash on the chart. However, a downward sloping support line from May, near $1,593, could challenge the gold bears afterward.

Alternatively, recovery moves not only need to cross the support-turned-resistance line near $1,695 but should also stay successfully beyond the $1,700 threshold to convince intraday buyers.

Even so, the 21-DMA and a three-month-old descending resistance line, respectively near $1,718 and $1,765, will question the metal’s upside before welcoming the bulls.

Gold: Daily chart

Trend: Further weakness expected

-

23:32

New Zealand Business NZ PMI above forecasts (52.5) in August: Actual (54.9)

-

23:25

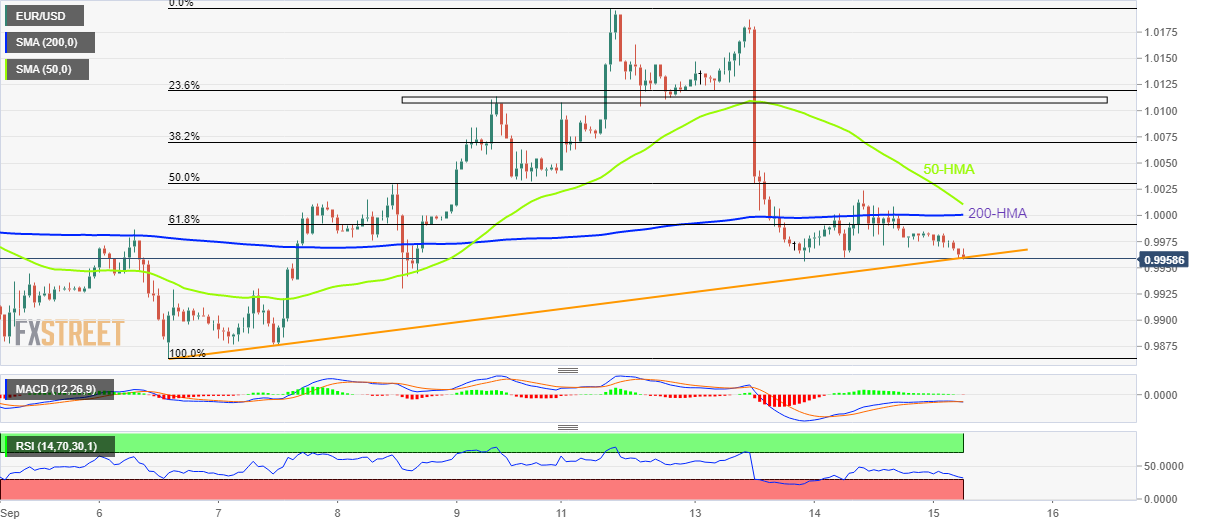

EUR/USD hovers around 1.0000, downside remains favored ahead of US Michigan CSI

- EUR/USD is oscillating around 1.0000, more weakness expected on Eurozone stagflation fears.

- An unexpected improvement in US Retail Sales is keeping the DXY at elevated levels.

- Investors are blaming the ECB for underestimating the pace of inflation.

The EUR/USD pair is displaying back-and-forth moves below the magical figure of 1.0000 in the early Tokyo session. On a broader note, the asset has turned sideways in a range of 0.9955-1.0025 after nosediving from Tuesday’s high at 1.0187. Usually, a consolidation phase after a perpendicular fall is followed by a resumption in the downside move due to a lack of optimism in the market participants.

On Thursday, the asset displayed a less-confident pullback after re-testing Tuesday’s low around 0.9955. The pullback move is expected to conclude sooner and will convert into a sheer fall on higher expectations for US Michigan Consumer Sentiment Index (CPI).

The US consumer sentiment data is seen higher at 60 against the prior release of 58.2. It is worth noting that the sentiment data is in a recovery mode after dropping to 50 in June. In the past two months, the confidence of consumers is returning led by a solid labor market, falling gasoline prices, and higher growth prospects.

Also, the US Retail Sales data on Thursday landed higher at 0.3% against the expectations of stagnancy and the prior decline in retail demand by 0.5%. This indicates that the retail demand is returning and eventually the confidence of consumers despite higher-than-expected inflationary pressures.

On the Eurozone front, investors should brace for a period of stagflation amid a deepening energy crisis and an accelerating price rise index. Investors are blaming the European Central Bank (ECB) for underestimating the pace of price pressures. A delayed response by ECB policymakers towards the inflation mess has pushed it to 9.1% and a consensus for a double-digit figure cannot be ruled out.

-

23:14

AUD/USD bears poke 0.6700 key support, China data dump, RBA’s Lowe eyed

- AUD/USD remains pressured at the lowest levels in two months, sellers attack upward sloping support line from July.

- Mostly firmer US data, fears surrounding China’s economy and mixed Aussie jobs report pleased bears.

- Firmer yields, hawkish Fed bets could keep focus on the next week’s FOMC.

- China’s Industrial Production, Retail Sales for August will precede US Michigan Consumer Index to direct intraday moves.

AUD/USD holds lower ground near the yearly bottom marked in July, poking the two-month-old support line, as risk-aversion propels the US dollar ahead of the day’s key catalysts. That said, the Aussie pair drops to 0.6696 by the press time.

Strong US data joined pessimism surrounding China and Europe, as well as mixed Australia employment and inflation expectations numbers, to weigh on the AUD/USD prices the previous day.

US Retail Sales rose 0.3% in August versus 0.0% expected and July’s revised down -0.4%. Further, NY Fed Empire State Manufacturing Index improved to -1.5 in September compared to -31.3 in August and market expectation of -13. Alternatively, Philadelphia Fed Manufacturing Index declined to -9.9 for the said month compared to 2.8 expected and 6.2 prior. Additionally, US Industrial Production slid to -0.2% in August versus market expectation for an expansion of 0.1% and downwardly revised prior of 0.5%.

At home, Australia’s Employment Change rose to 33.5K in August, versus 35K expected and -40.9K prior. Further, the Unemployment Rate also rose beyond 3.4% market consensus and the previous readings to 3.5% whereas the Participation Rate matched 66.6% forecasts during the stated period versus 66.4% prior. Also, Australia’s Consumer Inflation Expectations softened to 5.4% for September versus 6.7% expected and 5.9% prior.

It should be noted that Bloomberg ran a piece suggesting that China is likely to witness harder days than it witnessed in 2020. On the same line was the news surrounding the Sino-American tussles and the People’s Bank of China’s (PBOC) inaction. Elsewhere, fears that the Eurozone will remain in dire conditions despite having a good stock for winter joined hawkish comments from the European Central Bank (ECB) policymakers to keep the pessimism higher.

Amid these plays, Wall Street closed in the red and the US Treasury bond yields were firmer. Further, the market’s pricing of the Fed’s 0.75% and 1.0% rate hikes in the next week’s Federal Open Market Committee (FOMC) also rose and weighed on the AUD/USD prices.

Looking forward, China’s monthly data dump including the Industrial Production, Retail Sales and housing numbers for August could offer immediate directions. Following that, Reserve Bank of Australia (RBA) Governor Philip Lowe’s Testimony and preliminary readings of the Michigan Consumer Sentiment Index (CSI) will be crucial for nearby directions. Above all, bears are likely to keep reins amid anxiety ahead of the Fed meeting.

Technical analysis

With the AUD/USD pair’s U-turn from the 50-DMA, around 0.6890 by the press time, joining the lack of oversold RSI (14) and bearish MACD signals, the pair is all set to revisit the yearly low near 0.6680.

-

23:05

EUR/GBP Price Analysis: Probing the 2022 YTD highs above 0.8700

- The EUR/GBP extended its gains, despite the overall bearish bias in euro crosses.

- From a daily chart perspective, the EUR/GBP is headed upwards.

- Short term, the EUR/GBP 4-hour chart suggests the cross could drop before recording a fresh YTD high.

On Thursday, the EUR/GBP rallied for the second day in the week, registering a fresh weekly high at around 0.8720, spurred by overall British pound courtesy, amidst uncertainty around the new Prime Minister Liz Truss’s government. At the time of writing, the EUR/GBP is trading at 0.8717, unchanged as the Asian session begins.

EUR/GBP Price Analysis: Technical outlook

The EUR/GBP advanced for the second day during the week, facing a solid resistance near the YTD high at 0.8721. The Relative Strength Index (RSI) is headed north but shifted flat around 66.93, with little room before reaching overbought conditions after last week’s ECB’s decision, ahead of the following week’s BoE. It’s worth noting that a decisive break above 0.8721 could pave the way towards the 0.8800 mark, but price action might shift choppy, in the vicinity of a 50 bps rate hike by the BoE.

The EUR/GBP 4-hour scale offers a different bias than the daily chart. Even though the moving averages (EMAs) are below the spot price, the divergence between the RSI, recording lower highs, and price action at higher highs might open the door for further downside.

Therefore, the EUR/GBP first support would be the 0.8700 mark, followed by the daily pivot at 0.8691, followed by the confluence of the 50-EMA and the S1 pivot point at 0.8660/62. Once cleared, the cross will tumble towards the confluence of the S2 pivot and the 100-EMA at around 0.8605/08.

EUR/GBP Key Technical Levels

-

22:51

GBP/USD declines towards 1.1400 on lower consensus for UK Retail Sales

- GBP/USD is expected to scale down further towards 1.1400 ahead of UK Retail Sales data.

- As per the estimates, UK Retail Sales will drop by 4.2% on an annual basis.

- The DXY is maintaining itself at elevated levels on higher-than-expected US Retail Sales data.

The GBP/USD pair has surrendered the psychological support of 1.1500 and is declining towards a multi-decade low at 1.1400. The asset has extended its losses after dropping below Wednesday’s low at 1.1480 and more downside looks certain amid downbeat consensus for the UK Retail Sales data. An upbeat US Retail Sales data released on Thursday is responsible for the establishment of the cable below the psychological support of 1.1500.

On Thursday, the US Retail Sales landed at 0.3%, higher than the expectations of 0% and the prior release of -0.4%. As the retail demand has expanded by 0.3%, investors keep the US dollar index (DXY) at elevated levels.

The investing community is aware of the fact that the inflationary pressures have yet not responded well to the soaring interest rates by the Federal Reserve (Fed). And, higher interest rates always decline the value of paychecks received by the households. But growth prospects, retail demand, and labor market are extremely robust in the US economy, which is shielding the economy against the consequences of red-hot inflation.

On the pound front, investors are dumping sterling ahead of the UK Retail Sales data. The economic data is expected to decline by 4.2% against a decline of 3.4% reported earlier on an annual basis. Also, the monthly figure will display a decline of 0.5% against a rise of 0.3% reported earlier. The overall demand in the UK economy is getting poor led by higher energy bills and a worsening labor market. This indicates a significant decline in the confidence of consumers in the economy.

-

22:17

Forex Today: The greenback keeps on keeping on

Here is what you need to kow for Friday 16 Sep.

The US dollar keeps its dominance as the case for ongoing aggressive hikes by the Federal Reserve dominates the markets. DXY, which measures the greenback vs. a basket of major rivals ended the North American session flat but put in a high of 109.21 within the upper end of this week's bullish channel having climbed from a low of 109.42

Retail Sales moved up 0.3% last month and the US dollar has held near recent peaks, supported by the view that the Federal Reserve will keep tightening policy aggressively. The data of late, including this week's surprise increase in consumer prices in August, has reinforced the bullish case for the greenback as investors price in a third consecutive 75-basis-point rate hike next Wednesday.

Meanwhile, the US 10-year yield climbed 5bps to 3.45%, and key majors, such as the yen came back under pressure despite authorities that verbally intervened, jawboning the currency following sharp declines.USD/JPY fell to 143.33.

GBP/USD bulls were attempting a correction from an important support area near the midpoint of the 1.1400 area, with the price recovering from a low of 1.1462 and now testing the bear's commitments at 1.1500.

EUR/USD remained trapped between a key 4-hour channel and consolidated ahead of 1.0025 and 0.995 breakout levels. On an hourly basis, the pair moved sideways, coiling for a move either way.

As for the Australian dollar, it traded between a daily high at around 0.6770 and the bears moved in on the key 0.67 level, piercing it to a low of 0.6899. The price levelled out after yesterday's employment report was solid, adding 33.5K employments in August, in line with forecasts, while the unemployment rate rose to 3.5% from 3.4%. ANZ bank analysts expect that the Reserve Bank of Australia (RBA) will lift rates by 50 bps.“An overall solid labor market report adds to the case made by the strong NAB business survey and US CPI data earlier this week for the RBA to hike the cash rate 50bp in October,” said analysts at ANZ. This brings the market into a consolidation phase into the weekend.

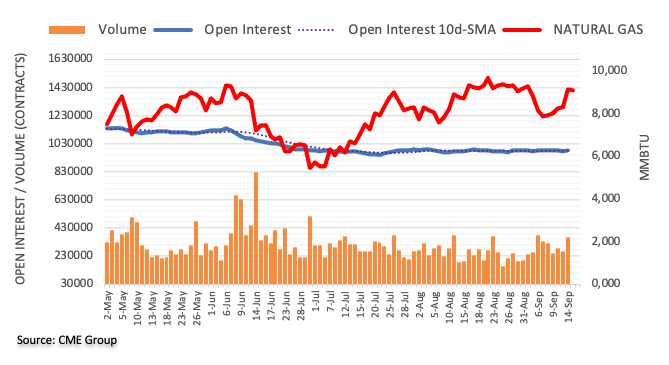

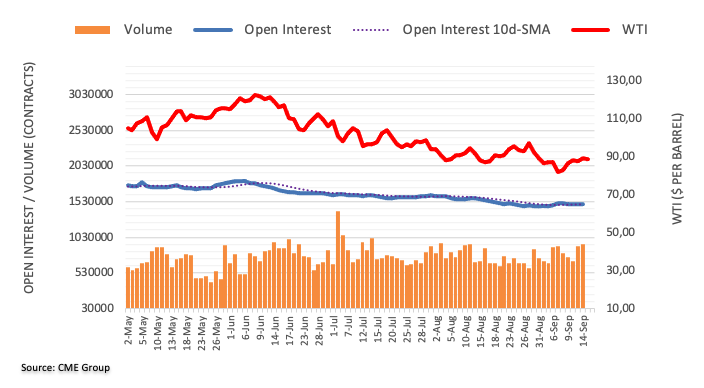

On the commodities front, WTI fell to $84.9/bbl as the US Department of Energy said their restocking of oil reserves would likely involve deliveries after the fiscal year 2023. Gold slipped 1.4% to $1,662.

-

22:01

South Korea Export Price Growth (YoY) below forecasts (22.9%) in August: Actual (13.4%)

-

22:00

South Korea Import Price Growth (YoY) registered at 22.9%, below expectations (23.1%) in August

-

21:48

NZD/USD bears move in on key support into the last hour

- NZD/USD bears are treading on firm bullish territory at demand.

- The RBNZ is now a key market focus and eyes on 0.6000.

NZD/USD was lower on the day as the greenback came back to push the commodity bloc lower, with the bird hanging over a key support level around the midpoint of the 0.5900s. Headlining into the close of the New York session, NZD/USD was down some 0.5% on the day following a resurgence of the greenback that shattered the bulls.

''Kiwi is lower this morning, having made a more convincing break below 0.60 overnight as risk appetite wavers and US bond yields edge higher again. The more substantive overnight move should quell any debate about whether the 0.60 level has been sustainably breached or not, and technically, it brings 0.5940 (the 76.4% Fibo of the 2020/21 rally) and 0.5915 (the May 2020 low after the April 2020 bounce) into focus, analysts at ANZ Bank explained.

Ahead of next week's key meeting, the markets expect 75 basis points when its policy committee meets next week and lower market hopes for a smaller increase. However, there is a one-in-five chance that the Fed will raise rates by a full percentage point, up from zero a day before the CPI report according to FEDWATCH.

''FX sentiment remains USD/globally driven, and the Kiwi struggled to garner any support from Gross Domestic Product data yesterday. Surprising as that was, given the size of the miss, what that tells you is that the market will be sensitive to next week’s Fed “75 or 100bps” rate hike decision,'' the analysts said.

-

20:56

AUD/USD drops to fresh two-month lows, below 0.6700

- The Aussie dollar briefly traded below the 0.6700 figure, at around 0.6695.

- Positive US economic data further concrete the case for a Fed 75 bps interest rate increase.

- AUD/USD Price Analysis: A daily close below 0.6700 would expose the pair to selling pressure.

The Australian dollar continues to weaken against the greenback, failing to recover after Tuesday’s hot US inflation report spurred expectations that the US Federal Reserve might tighten even 100 bps in September’s monetary policy meeting. Nevertheless, with the CME FedWatch Tool, odds for a large increase lie at 20%, less than the 80% chance of a 75 bps rate hike.

Therefore, the AUD/USD is down, after hitting a daily high at around 0.6770, but is tumbling sharply. At the time of writing, the AUD/USD trades at 0.6702, above the 0.6700 psychological level.

AUD/USD stumbles below the 0.6700 figure on Fed’s aggressive estimates

US data released earlier during the day confirms that the Federal Reserve would likely continue to tighten monetary conditions. A solid US Retail Sales report in August, with sales bouncing 0.3% MoM above estimates, cements the case for the Fed hiking 75 bps. The year-over-year figure was 9.37%, lower than July’s figures.

At the same time, the US Labor Department showed that Initial Jobless Claims for the past week, ending on September 10, decelerated by 213K, lower than economists’ estimates of 227K, showing the labor market’s resilience.

Elsewhere, the New York and Philadelphia Fed Manufacturing Indices were mixed. The Empire State, albeit improving, remained in contractionary conditions, while the Philadelphia Fed index dropped to the contractionary part after rebounding in the August report

On the Australian side, the employment report was solid, adding 33.5K employments in August, in line with forecasts, while the unemployment rate rose to 3.5% from 3.4%. ANZ bank analysts expect that the Reserve Bank of Australia (RBA) will lift rates by 50 bps.

“An overall solid labor market report adds to the case made by the strong NAB business survey and US CPI data earlier this week for the RBA to hike the cash rate 50bp in October,” said analysts at ANZ.

What to watch

The Australian economic docket will be light, reporting the Consumer Sentiment Index (CSI). The US economic docket will feature the University of Michigan Consumer Sentiment alongside consumer inflation expectations.

AUD/USD Price Analysis: Technical outlook

From a daily chart perspective, the AUD/USD is downward biased, with room to challenge the YTD low at 0.6681. The Relative Strength Index (RSI) pointing downwards, below the 50-midline, confirm the bearish bias in the major, with enough room to spare, before reaching oversold territory. Therefore, the AUD/USD first support would be 0.6681, which, once cleared, would expose the 0.6600 figure on its way towards May 2020 lows at 0.6372.

-

20:53

Gold Price Forecast: XAU/USD is pulling in the bid following big drop

- Gold bears take the lead but the bulls are making their move.

- The US dollar is taking the lead ahead of the Fed, causing a capitulation in the yellow metal.

Gold prices have settled down into the late session of the New York trade but it begs more from the bears at this juncture as the gold price rest at key support. On the day, the yellow metal dropped heavily from a high of $1698.32 to a low of $1,660.43. The bulls need to commit here, at the lowest since May 2020.

Pressures come as the greenback US bond yields keep rising ahead of next week's Federal Reserve's policy committee meeting. Analysts at TD Securities explained that the precious metal has broken the'' $1700/oz support as aggressive Fed expectations are being priced in.''

''We expect continued outflows from money managers and ETF holdings to weigh on prices, which ultimately raises the probability of a pending capitulation from the small number of family offices and proprietary trading shops who hold complacent length in gold. The persistence of inflation continues to support an aggressive effort by the Fed.''

Traders are of the view that the Federal Reserve will keep tightening policy aggressively. The data of late, including this week's surprise increase in consumer prices in August, has reinforced the bullish case for the greenback as investors price in a third consecutive 75-basis-point rate hike next Wednesday.

The analysts at TD Securities note that ''indeed, gold and silver prices have tended to display a systematic underperformance when markets expect the real level of the Fed funds rate to rise above the neutral rate, as estimated by Laubach-Williams.''

Gold technical analysis

As per the prior analysis, the price of gold has indeed headed lower:

Gold H1 chart

The bears have well and truly made their move.

And from here...

The daily M-formation is now compelling for a retracement into the prior lows that meets that 38.2% Fibonacci retracement area.

-

20:20

Colombia Industrial output (YoY) below expectations (7.1%) in July: Actual (5.2%)

-

20:20

Colombia Retail Sales (YoY) came in at 7.7%, below expectations (12.8%) in July

-

19:58

USD/CAD Price Analysis: Rallies above the 1.3200 figure, threatening to clear the YTD high

- USD/CAD approaches the YTD high at around 1.3223, amidst a risk-off mood.

- If USD/CAD buyers hold the fort above 1.3200, it could open the door for further gains, as they eye 1.3300.

The USD/CAD conquers the 1.3200 figure for the third time during the year, reaching a fresh weekly high, but shy of the YTD high reached on July 14 at 1.3227. The USD/CAD is trading at 1.3222, above its opening price by 0.39% at the time of writing.

USD/CAD Price Analysis: Technical outlook

The USD/CAD continued extending its gains throughout the week. After Tuesday’s gains of 1.36%, the major stabilized around the day’s highs, shy of the YTD peak, eyeing a break above that could pave the way towards 1.3300. Worth noting that the Relative Strength Index (RSI) remains in bullish territory, with some room before reaching overbought conditions, suggesting that a 1.3300 test is on the cards.

Near term, the USD/CAD four-hour chart shows the major testing of the 1.3200 figure for the third time in the month, poised to print a fresh YTD high above 1.3220. If buyers clear the 1.3227 YTD high, a move towards 1.3300 is likely to happen, but firstly it would need to overcome some hurdles on its way up.

The USD/CAD first resistance would be the YTD high at 1.3227. The break above will expose the R2 pivot point at 1-3237, followed by the R3 daily pivot at 1.3268, ahead of the 1.3300 figure.

On the flip side, the USD/CAD failure to hold above 1.3200 could pave the way for further downside. Therefore, the USD/CAD first support would be the daily pivot at 1.3172. Once it’s cleared, it would expose support levels, like the S1 daily pivot at 1.3134, followed by the 20-EMA at 1.3117, ahead of the S2 pivot at 1.3104.

USD/CAD Key Technical Levels

-

19:46

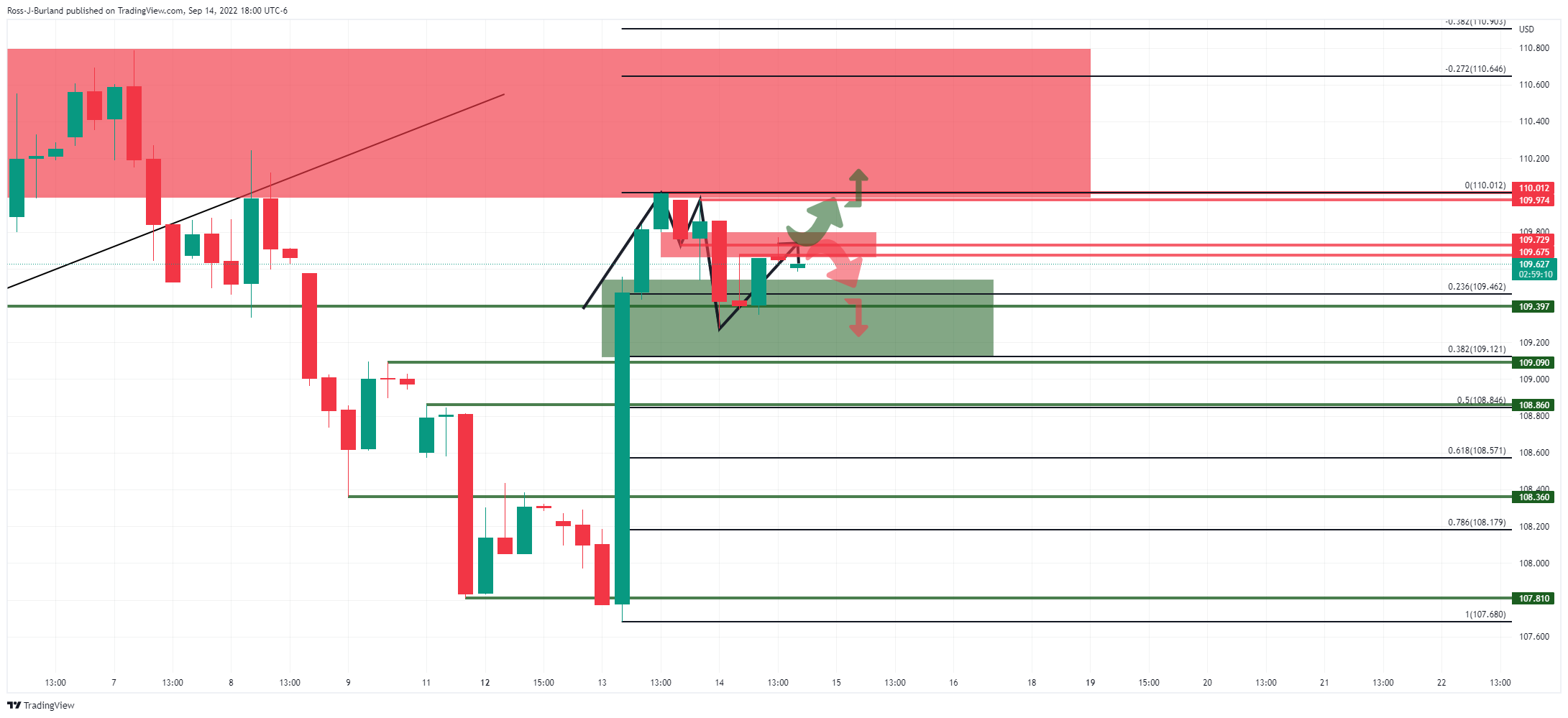

AUD/USD Price Analysis: Bearish bias persits as bears take control at key daily support

- AUD/USD bears seeking a break of 0.67 the figure.

- Meanwhile, the US dollar is stuck in a range, breakout traders are on alert.

AUD/USD shows no sign of correcting at this stage on a longer-term time frame basis, as illustrated below and threatens a break of key support in the following analysis:

AUD/USD daily chart

AUD/USD H1 chart

Meanwhile, the bears will be looking for an engulfing formation below the pin bar that has tapped the lower quarter of the 0.67 area that has pierced the 50% retracement of the latest bearish impulse on the hourly time frame. This is an area of confluence as per the wicks there and the bias is to the downside below 0.6750 tops.

Meanwhile, however, while the US dollar consolidates, it could be sideways action until a break of either 109.80 or 109.25 as per the DXY index that measures the greenback vs. a basket of currencies:

-

18:43

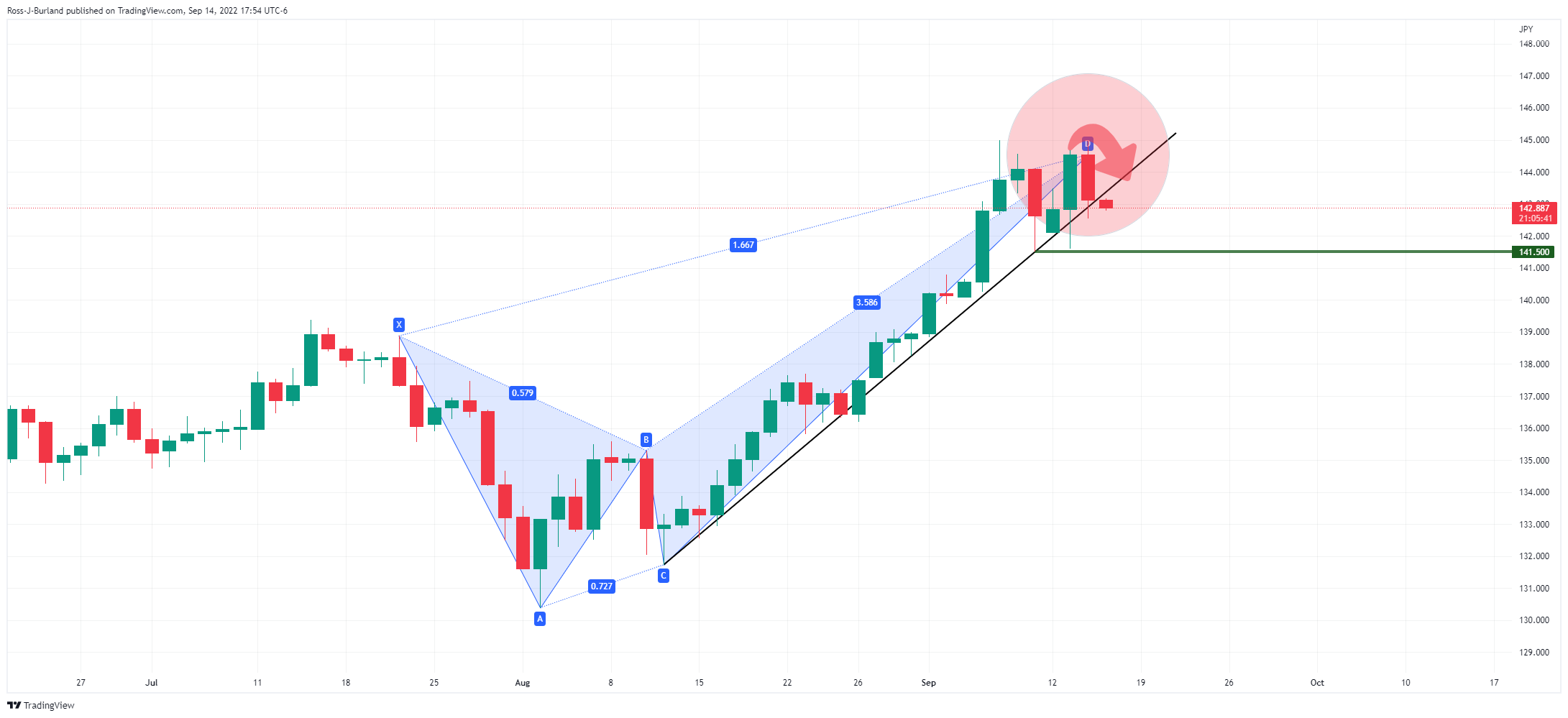

USD/JPY Price Analysis: Subdued around 143.30s after threats of a Japanese intervention

- USD/JPY remains subdued after a verbal intervention by Japanese authorities.

- Negative divergence in the daily chart could send the USD/JPY towards 142.00.

- In the near term, the USD/JPY could test the 141.00 area.

The USD/JPY recovers some ground following rumors of a possible Forex intervention by Japanese authorities to propel the Japanese yen but stays below the 144.00 mark, above its opening price by 0.21%. At the time of writing, the USD/JPY is trading at 143.43.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the USD/JPY remains upward biased, but price action is overextended, with buyers showing signs of exhaustion. Even though the USD/JPY retested the YTD high on September 14, the Relative Strength Index (RSI) showed signs of negative divergence, suggesting the major could dive soon. If the USD/JPY clears the 145.00 figure, a test of the August 1998 high at 147.67 is on the cards. Conversely, a break below 143.00 could send the USD/JPY tumbling towards the 142.00 figure.

Short term, the 4-hour chart shows the major testing of the daily pivot for the last five candles. Failure to do so portrays soft demand for the buck, exposing the pair to further losses. Once sellers clear the 50-EMA at 143.09, it would pave the way toward the 143.00 figure. Break below will expose the S1 pivot point at 142.13, ahead of the 142.00 mark, followed by the S2 saily pivot at 141.13.

USD/JPY Key Technical Levels

-

18:37

GBP/USD bulls step in at key support in the face of USD headwinds

- GBP/USD bulls are attempting to hold the key support areas on the charts

- However, the greenback remains in the hands of the bears ahead of key central bank meetings.

GBP/USD bulls are attempting a correction from an important support area near the midpoint of the 1.1400 area, with the price recovering from a low of 1.1462 and now testing the bear's commitments at 1.1500. The pound, however, is still losing some .03% on the day as the US dollar edges up following data showing US Retail Sales unexpectedly rebounded in August.

Retail Sales increased 0.3% last month and the US dollar has held near recent peaks, supported by the view that the Federal Reserve will keep tightening policy aggressively. The data of late, including this week's surprise increase in consumer prices in August, has reinforced the bullish case for the greenback as investors price in a third consecutive 75-basis-point rate hike next Wednesday.

Meanwhile, the Bank of England is also expected to hike by another 50bp on Thursday 22 September, but it remains a close call between 50bp and 75bp due to the rising recession risk. Analysts at Danske Bank argue that the BoE has had a tendency to surprise to the dovish side at recent meetings. ''Additionally, BoE was the first G10 central bank to forecast a recession by Q4 2022 at its last meeting, while using a far more dovish market pricing as policy input than what is currently priced.''

The analysts expect 50bp hikes in September, November and December followed by a final 25bp hike in February 2023. ''The endpoint is thus lifted to 3.25% (from 2.50%). We see the possibility for further hikes in 2023, if we see underlying inflation pressures to prove persistent.''

Politically, the analysts cite the newly elected Prime Minister Liz Truss; plans to add upside to inflation down the road with inflation possibly proving to be more persistent. ''This could highlight the need for further hikes in 2023, yet amid the deficit funding uncertainty we still lean towards 50bp next week.''

-

17:34

EUR/USD reclaims parity, despite some ECB officials taking a dovish stance

- EUR/USD is seesawing around parity after mixed ECB official signals.

- Upbeat US Retail Sales confirms the case of the Fed going 75 bps.

- ECB officials emphasized the need to hike rates;

- ECB official Mario Centeno expressed that the central bank should take “as small steps as possible.”

The EUR/USD is positive in the day for the second-straight day but faces solid resistance around the parity on woes of a large US Federal Reserve rate hike, spurring a jump in US Treasury bond yields. However, the shared currency remains resilient, though slightly up by 0.19%, amidst a risk-off environment.

During the day, the EUR/USD began trading at around 0.9980, sliding toward the daily low at 0.9955 in the early European session. However, fresh bids lifted the shared currency towards hitting the daily high at 1.0018 before settling at the current spot price. At the time of writing, the EUR/USD is trading at 1.0002.

US economic data released before the Wall Street open and during the beginning of Thursday’s trading session further cemented the Fed’s case for going aggressive, as shown by money market futures odds at 80% of increasing rates by 75 bps and 20% chances of going 100.

The US Commerce Department reported that Retail Sales in August jumped by 0.3% MoM, higher than expectations of a 0.1% contraction, while the annual base reading was 9.37%, less than the previous month’s data. At the same time, the Department of Labor showed that unemployment claims for the past week, ending on September 10, decreased to 213K, lower than economists’ estimates of 227K, showing the labor market’s resilience.

The EUR/USD barely reacted to data, though it brought the major under parity. Meanwhile, the US Dollar Index, a gauge of the buck’s value vs. its peers, is recovering from earlier losses, up 0.10%, at 109.751.

Of late, a tranche of manufacturing data revealed by regional Fed banks began with the New York Fed Empire State Index and the Philadelphia Fed Index. The New York Fed Index showed signs of improvement though remains in contractionary territory, while the Philadelphia Fed index dropped to the contractionary part after rebounding in the August report.

ECB officials continue expressing the need for hiking rates due to high inflationary pressures on the Eurozone side. Philip Lane, ECB Chief Economist, said, “We expect that this transition will require us to continue to raise interest rates over the next several meetings. The appropriate size of an individual increment will be larger, the wider the gap to the terminal rate and the more skewed the risks to the inflation target.”

Later, ECB Vice-President Luis de Guindos commented that price pressures continued to elevate while adding that the euro’s depreciation added to “these inflationary pressures.” In the meantime, ECB official Mario Centeno expressed that the central bank should take “as small steps as possible” in hiking rates not to destabilize the economy, a signal perceived as dovish by market players. He emphasized that monetary policy “must remain predictable.”

EUR/USD traders should note that a part of the German bond yield curve briefly inverted on Thursday, signaling investors’ worries that an aggressive ECB might lead to an economic slowdown.

What to watch

The Eurozone calendar will feature inflation readings in the bloc and Italy. On the US side, the economic docket will feature the University of Michigan Consumer Sentiment and inflation expectations.

EUR/USD Key Technical Levels

-

16:36

United States 4-Week Bill Auction rose from previous 2.5% to 2.67%

-

16:32

EUR/USD is in danger of dipping further towards 0.95 – Rabobank

The EUR/USD continues to move sideways around the parity level ahead of next week’s FOMC meeting. According to analysts from Rabobank, the risks on the EUR/USD are tilted to the downside and they warn it could drop to 0.95.

Key Quotes:

“The precariously position of growth in the region (Eurozone) in the coming months may mean that higher short-term rates do not translate into a significantly stronger EUR. In our view, the market has not yet fully priced in the risks to the growth in the region in the coming months. Given the coincident strength of the USD, we expect that EUR/USD could be drawn further below parity in the weeks ahead.”

“It is our view that the safe haven USD is likely to remain well supported until investors are willing to move back into risky assets. This may be some months off. This period will cover what is likely to be a testing winter for the Eurozone economy. Even though further, potentially aggressive, rates hikes are widely expected from the ECB, it is our view that EUR/USD is in danger of dipping further towards 0.95.”

-

16:20

US: Staying power of consumer spending is waning – Wells Fargo

Data released on Thursday showed an increase in retail sales in August above expectations in the US. According to analysts at Wells Fargo point out the 0.3% increase was a surprise, but so was a revision that reduced last month's sales by an even larger 0.4%.

Key Quotes:

“Retail sales rose 0.3% in August, but July's sales were revised down by 0.4%. Excluding autos, the actual level of retails sales is lower in August than it was in June. The staying power of consumer good spending is at last losing momentum.”

“We anticipate the economy entering a mild recession early next year and although we anticipated this retrenchment in consumer spending, this is not yet the start of the downturn. Consumer demand for services and experience-oriented spending remains intact, for now. This was evident in the 1.1% increase in spending in bars and restaurants.”

“How goods spending evolves is particularly important for the outlook. Real retail sales are running around 8% above pre-pandemic levels. While that pales in comparison to the some 30% higher nominal sales are, it still emphasizes a high level of goods spending. Elevated consumption with still not fully restocked inventory levels can continue to exert upward pressure on prices and thus keep inflation running at a steep rate. This would make the Fed's job all the more challenging.”

-

16:10

Breaking: Gold nosedives to two-year lows below $1670

- Gold price tumbles to fresh 2-year lows below the $1670 mark.

- Expectations that the Fed would aggressively continue to tighten weighed on the yellow metal.

- Upbeat US Retail Sales continue to show the strength of the US economy.

Gold price tumbles below the $1700 psychological level, to fresh two-year lows at $1665.30, on expectations that the US Federal Reserve would continue to tighten monetary conditions, sparking a jump in US Treasury yields. Hence, the greenback followed suit but pared earlier gains. At the time of writing, the XAU/USD is trading at around $1666 a troy ounce.

Gold price tumbles on higher US Treasury bond yields

US Treasury yields jumped on expectations that the Fed might hike rates between 75 or 100 bps. The US 2-year bond yield, the most sensitive to interest rate hikes, peaked at 3.84%, while the 10-year benchmark note remained at 3.437%, gaining three bps. Worth noting that the yield curve further inverted, with the spread between 2s and 10s deepening to -0-403%, as market participants expected an aggressive Fed could derail the US economy, tapping it into a recession.

US Retail Sales for August, reported by the US Department of Commerce, surprisingly rose, after dropping a month earlier, with readings increasing 0.3%, exceeding estimates of -0.1%.

In the meantime, US economic data revealed by the Labor Department showed that Initial Jobless Claims for the week ending on September 10 was 213K, decreasing from the previous week's reading and lower than estimates of 227K.

The New York and Philadelphia Fed Manufacturing Indices were reported, showing mixed results. The New York Empire State manufacturing sector improved but remained in contractionary territory, while the Philadelphia Fed index dropped to the contractionary part after rebounding in the August report.

Gold (XAU/USD) Key Technical Levels

-

16:04

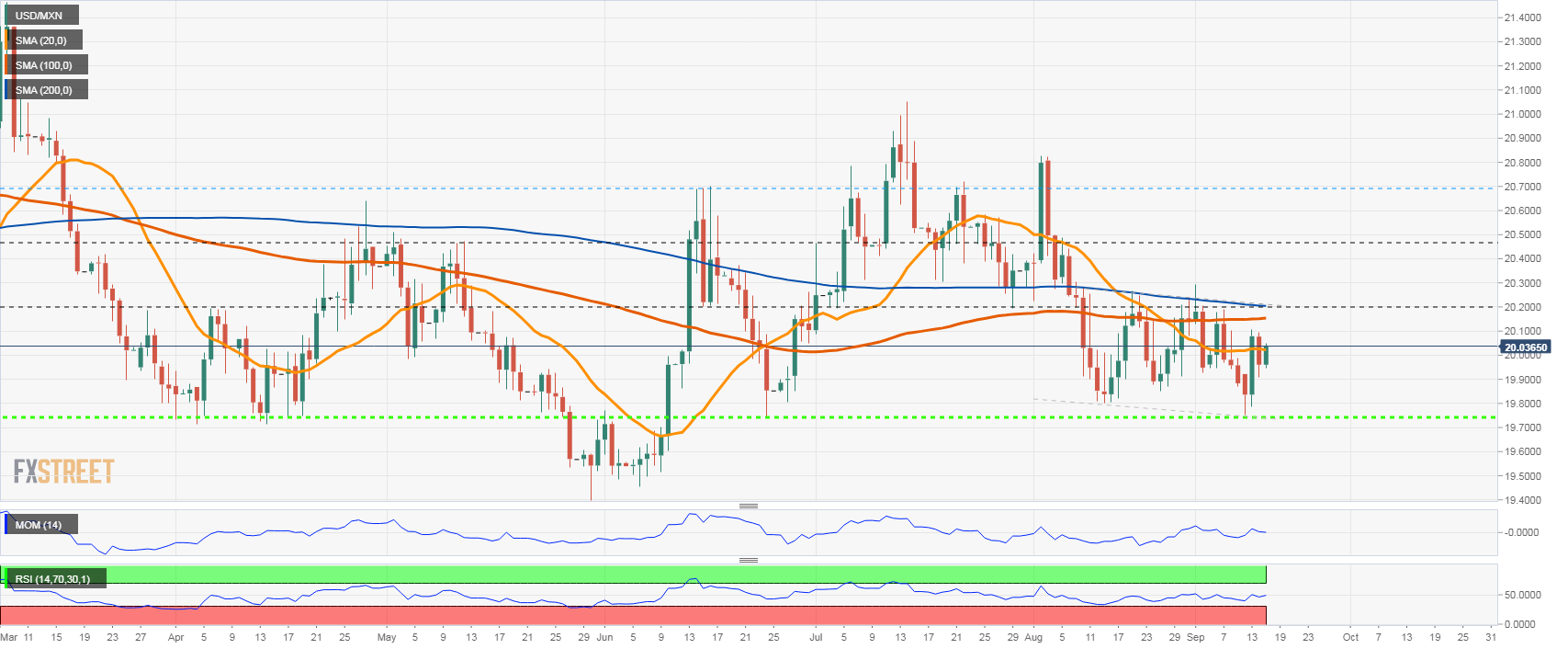

USD/MXN remains in range, looking at 20.10 as market sentiment deteriorates

- USD/MXN moving between 20.20 and 19.80 since mid-August.

- Mexican peso fails to break 19.80, and reverses.

- Stocks turn lower in Wall Street, supporting the dollar.

The USD/MXN is up on Thursday amid a stronger US dollar across the board. The pair is trading at 20.07, at the highest intraday level. Wall Street is turning from neutral to bearish, favoring the greenback.

On the upside, the immediate resistance is seen at 20.10 (Sep 8 and 13 high). A consolidation above could point to further gains and a test of the critical area between 20.17 and 20.20. A daily close above 20.20 would be a positive technical development suggesting more gains ahead, targeting the 20.45 area.

On the flip side, the first support stands at 19.95, but a more significant barrier is located at 19.90. The key area is 19.80 and a break lower would put USD/MXN on its way toward 19.70.

Eyes on the Fed

Following many US economic reports (jobless claims, retail sales, Philly Fed and industrial production) on Thursday and particularly the CPI on Tuesday, attention now sets on the FOMC meeting next week. The central bank is expected to raise interest rates by 75 basis points on Wednesday. Banxico is expected to follow on September 29.

USD/MXN daily chart

Technical levels

-

15:59

Gold Price Forecast: XAU/USD nosedives to two-year lows below $1670

- Gold price tumbles to fresh 2-year lows below the $1670 mark.

- Expectations that the Fed would aggressively continue to tighten weighed on the yellow metal.

- Upbeat US Retail Sales continue to show the strength of the US economy.

Gold price tumbles below the $1700 psychological level, to fresh two-year lows at $1665.30, on expectations that the US Federal Reserve would continue to tighten monetary conditions, sparking a jump in US Treasury yields. Hence, the greenback followed suit but pared earlier gains. At the time of writing, the XAU/USD is trading at around $1666 a troy ounce.

Gold price tumbles on higher US Treasury bond yields

US Treasury yields jumped on expectations that the Fed might hike rates between 75 or 100 bps. The US 2-year bond yield, the most sensitive to interest rate hikes, peaked at 3.84%, while the 10-year benchmark note remained at 3.437%, gaining three bps. Worth noting that the yield curve further inverted, with the spread between 2s and 10s deepening to -0-403%, as market participants expected an aggressive Fed could derail the US economy, tapping it into a recession.

US Retail Sales for August, reported by the US Department of Commerce, surprisingly rose, after dropping a month earlier, with readings increasing 0.3%, exceeding estimates of -0.1%.

In the meantime, US economic data revealed by the Labor Department showed that Initial Jobless Claims for the week ending on September 10 was 213K, decreasing from the previous week's reading and lower than estimates of 227K.

The New York and Philadelphia Fed Manufacturing Indices were reported, showing mixed results. The New York Empire State manufacturing sector improved but remained in contractionary territory, while the Philadelphia Fed index dropped to the contractionary part after rebounding in the August report.

Gold (XAU/USD) Key Technical Levels

-

15:30

United States EIA Natural Gas Storage Change above forecasts (73B) in September 9: Actual (77B)

-

15:00

Uncertain environment continues to strengthen Swiss franc – Erste

Since the recent escalation of energy price hikes in Europe, the euro has weakened slightly again against the franc. Analysts at Erste Group Research expect the EUR/CHF pair to continue its move downward.

Swiss National Bank to raise interest rates by another 25 bps

“We currently expect the situation on the energy markets in Europe to ease from the end of October. In this environment, the euro should be able to strengthen somewhat against the Swiss franc.”

“In the short-term, the upcoming parliamentary elections in Italy (September 25) also pose a further risk of a weaker euro.”

“The short-term development of the exchange rate will also depend heavily on the SNB's next interest rate decision at its meeting on September 22. Currently, we expect the SNB to raise interest rates by another 25 basis points.”

“In the event of escalating geopolitical crises, the Swiss franc could strengthen further against the euro at any time.”

-

15:00

United States Business Inventories registered at 0.6%, below expectations (0.8%) in July

-

14:53

USD/CAD retreats from two-month high, once again fails to find acceptance above 1.3200

- USD/CAD gains some positive traction and hits a two-month high on Thursday.

- A fresh leg up in oil prices undermines the loonie and offers support to the pair.

- Subdued USD demand fails to impress bulls or provide any meaningful impetus.

The USD/CAD pair climbs to a two-month high during the early North American session and looks to build on the momentum beyond the 1.3200 round-figure mark.

A fresh leg down in crude oil prices undermines the commodity-linked loonie and turns out to be a key factor pushing the USD/CAD pair higher. Concerns that a deeper global economic downturn will dent fuel demand overshadow worries about tight supply and weigh on the black liquid.

The US dollar, on the other hand, struggles to gain traction and moves little in reaction to the mixed US macro data, though remains well supported by hawkish Fed expectations. This is seen as another factor acting as a tailwind wind for the USD/CAD pair and favours bullish traders.

That said, repeated failures to build on the momentum beyond the 1.3200 mark constitutes the formation of multiple-tops on short-term charts. This makes it prudent to wait for strong follow-through buying placing fresh bullish bets around the USD/CAD pair and positioning for any further gains.

Nevertheless, the fundamental backdrop suggests that the path of least resistance is to the upside. Traders, however, might prefer to move to the sidelines ahead of next week's FOMC meeting, which will influence the USD price dynamics and provide a fresh directional impetus to the USD/CAD pair.

Technical levels to watch

-

14:46

USD/TRY reaches an all-time high past 18.27

- USD/TRY extends the march higher past 18.27 on Thursday.

- There seems to be no respite for the lira slump.

- The CBRT could reduce the policy rate further next week.

Another day, another low in the Turkish currency vs. the greenback. This time USD/TRY advanced to levels past 18.27, printing at the same time new all-time tops.

USD/TRY now looks to CBRT

USD/TRY extends the gradual march higher for yet another session on Thursday and remains well on track to close its sixth consecutive week with gains. So far this year, the lira has depreciated around 38% vs. the US dollar vs. 44% in all of 2021.

The outlook for the lira remains well in the negative territory in a context where inflation gives no signs of mitigating and the central bank (CBRT) seems to have embarked in a renewed easing cycle of its monetary conditions in response to the government’s exclusive focus on growth and the improvement of the current account.

On the latter, the CBRT meets next week and could reduce the One-Week Repo Rate for the second meeting in a row following August's 100 bps rate cut.

In Türkiye, the Budget Balance showed a TL3.59B surplus for the month of August, reversing July’s TL64B deficit.

What to look for around TRY

USD/TRY extends the upside momentum to new all-time peak around the 18.27 area on Thursday.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate option to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism.

Key events in Türkiye this week: Budget Balance (Thursday) – End Year CPI Forecast (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.20% at 18.2618 and faces the next hurdle at 18.2723 (all-time high September 15) seconded by 19.00 (round level). On the downside, a break below 17.8590 (weekly low August 17) would target 17.8203 (55-day SMA) and finally 17.7586 (monthly low August 9).

-

14:45

S&P 500 Index: Holding or not support at 3915 to shape USD trend – Scotiabank

Economists at Scotiabank analyze the correlation between the US Dollar Index, the VIX and the S&P 500 Index. They conclude that the key support at 3915 for the S&P 500 is set to determine the USD trend.

Negative correlation between the USD and the S&P 500

“Our correlation screen reflects tightening positive correlations between the DXY and the VIX (+55% on a rolling 1-month study of daily returns) on the one hand and a stronger, negative correlation between the USD and the S&P 500 (-64%) on the other.”

“Stocks are just about holding the uptrend from the Jun low on the daily chart – I spot (rising trend line) support at around 3915 for the S&P 500 currently and whether this level holds or not will go a long way to shaping USD trends into and beyond the FOMC.”

-

14:36

USD/CAD: The 1.32 area is set to continue capping the topside – Scotiabank

USD/CAD holds range. As analysts at Scotiabank note, technicals suggest USD gains have stalled around 1.32.

Loonie remains hitched to the risk on/off tone

“USD/CAD has established a well-defined trading range between support at 1.3150 and resistance at 1.3195/00 over the past couple of sessions. The CAD remains hitched to the risk on/off tone and the broader moves in the USD for now but we continue to expect USD supply to emerge at or near the recent range extremes, keeping spot broadly range bound.”

“We look for the 1.32 area to continue capping the topside.”

-

14:29

EUR/USD to find firm support on dips to the low 0.99 zone – Scotiabank

EUR/USD has carved out a well-defined range between 0.9950/1.0015 amid European Central Bank (ECB) hawks circle. Economists at Scotiabank expect the pair to find a solid floor around the 0.99 area.

EUR-bullish weekly signal from last week’s price action remains intact

“The hawkish drumbeat from ECB policymakers – Holzman, Makhlouf, Guindos in the past few hours – continues. ECB hawkishness may underpin the EUR but it may take a bit more clarity on the energy crunch to drive the EUR higher in the coming weeks.”

“Heavy losses from the 1.02 area earlier this week sustain the broader downtrend in this market and tilt overall risks to the downside in the short run. We note, however, that the EUR-bullish weekly signal from last week’s price action remains intact and this should mean firm support for the EUR on dips to the low 0.99 zone still.”

-

14:29

AUD/USD flirts with 0.6700 mark, focus shifts to Chinese macro data dump on Friday

- AUD/USD remains on the defensive despite a modest USD pullback from the daily high.

- The US bond yields retreat in reaction to the mixed US macro data and weigh on the buck.

- Aggressive Fed rate hike bets, recession fears limit the USD losses and continue to cap.

- Investors now eye the Chinese data dump on Friday for some meaningful opportunities.

The AUD/USD pair once again finds some support ahead of the 0.6700 mark and recovers a few pips from the daily low during the early North American session. The pair is currently trading around the 0.6725-0.6730 area, still down over 0.20% for the day.

The US dollar struggles to preserve its early modest gains and remains on the defensive for the second straight day on Thursday, which, in turn, offers some support to the AUD/USD pair. The mixed US economic data triggers an intraday pullback in the US Treasury bond yields and undermines the greenback.

That said, rising bets for a more aggressive policy tightening by the Fed, bolstered by Tuesday's stronger US CPI report, should act as a tailwind for the US bond yields. Apart from this, worries about a global economic downturn might continue to favour the USD bulls and cap the upside for the risk-sensitive aussie.

The fundamental backdrop suggests that the path of least resistance for the AUD/USD pair is to the downside. That said, it will still be prudent to wait for a sustained break below the 0.6700 mark before positioning for any further depreciating move. Traders now look forward to the Chinese data dump for a fresh impetus during the Asian session on Friday.

The focus, however, will remain on the key central bank event risk - the two-day FOMC monetary policy meeting on September 20-21. The outcome will play a key role in driving the USD demand in the near term and help determine the next leg of a directional move for the AUD/USD pair.

Technical levels to watch

-

14:23

A barrel of Brent Oil should cost $90 at the end of the year – Commerzbank

The price of a barrel of Brent Oil has been trading below $100 most of the time since the beginning of August. Any attempts at recovery have failed. Strategists at Commerzbank forecast Brent Oil at $90 by end-2022.

OPEC+ signals change of course

“Demand concerns about an upcoming recession in the USA and Europe and the zero-covid policy in China are weighing on prices. Oil demand, which has been quite robust so far, is likely to lose momentum.”

“OPEC+ is considering a production cut. In October, the production volume will already be slightly reduced.”

“A barrel of Brent Oil should cost $90 at the end of the year.”

-

14:20

US: Industrial Production contracts by 0.2% in August vs. +0.2% expected

- Industrial Production in the US contracted unexpectedly in August.

- US Dollar Index stays near the lower limit of its daily range.

The data published by the US Federal Reserve showed on Thursday that Industrial Production contracted by 0.2% on a monthly basis in August. This print came in worse than the market expectation for an expansion of 0.2%. In the same period, Manufacturing Production increased by 0.1% following July's growth of 0.6%.

"Capacity utilization declined 0.2 percentage points in August to 80.0%, a rate that is 0.4 percentage points above its long-run (1972–2021) average," the Fed further noted in its publication.

Market reaction

The US Dollar Index showed no immediate reaction to these figures and was last seen posting small daily losses at 109.58.

-

14:15

United States Industrial Production (MoM) below expectations (0.1%) in August: Actual (-0.2%)

-

14:15

United States Capacity Utilization below expectations (80.3%) in August: Actual (80%)

-

14:15

Gold Price Forecast: XAU/USD to extend its decline on highly-aggressive Fed tightening – TDS

Gold has broken the $1,700 support. Economists at TD Securities expect the yellow metal to extend its move downward as aggressive Fed expectations are being priced in.

Outflows from money managers and ETF holdings to weigh on gold

“We expect continued outflows from money managers and ETF holdings to weigh on prices, which ultimately raises the probability of a pending capitulation from the small number of family offices and proprietary trading shops that hold complacent lengths in gold.”

“The persistence of inflation continues to support an aggressive effort by the Fed, and we now expect the FOMC to raise the target rate by 75 bps at its meeting next week, deliver another 75 bps hike in November, and hike a further 50 bps in December.”

-

14:03

EUR/USD: No upside potential in the short-run – Commerzbank

In the case of the EUR/USD, the risks point downwards in the short-term. In the opinion of economists at Commerzbank, the euro should only start to recover when investors are increasingly betting on an end to the crisis in mid-2023.

Recession in the euro area, driven by the war of nerves over gas

“We now expect a recession for the euro area, triggered by high energy prices, in turn, a consequence of reduced gas supplies from Russia. This development is likely to weigh on the euro.”

“For 2023, we expect a partial recovery of EUR/USD when it becomes clear that Europe can meet its energy needs without Russian gas, when energy prices settle down again and when it becomes clear that the ECB resumes its rate hike cycle.”

-

14:03

US: Philadelphia Fed Manufacturing Index drops to -9.9 in September vs. 2.8 expected

- Philadelphia Fed Manufacturing Index fell into negative territory in September.

- The greenback is struggling to preserve its strength after latest US data releases.

The Federal Reserve Bank of Philadelphia's Manufacturing Business Outlook Survey's diffusion index for current general activity dropped to -9.9 in September from 6.2 in August. This print came in worse than the market expectation of 2.8.

"The new orders index fell 13 points to -17.6, and the shipments index fell 16 points to its lowest reading since May 2020 but remained positive at 8.8," the publication further read. "The prices paid index declined for the fifth consecutive month, down 14 points to 29.8, its lowest reading since December 2020 and near its long-run nonrecession average."

Market reaction

The US Dollar Index stays in negative territory below 109.50 as investors assess the latest data releases from the US.

-

14:00

Russia Central Bank Reserves $ fell from previous $561.9B to $557.4B

-

13:54

US: NY Fed Empire State Manufacturing Index improves to -1.5 in September

- NY Fed Empire State Manufacturing Index rose in September but stayed in negative territory.

- US Dollar Index edges lower, trades below 109.50.

The headline General Business Conditions Index of the Federal Reserve Bank of New York's Empire State Manufacturing survey improved to -1.5 in September from -31.3 in August. This reading came in better than the market expectation of -13.

"Labor market indicators pointed to a modest increase in employment and no change in the average workweek," the NY Fed said in its publication. "Price indexes moved notably lower, pointing to a deceleration in price increases. Looking ahead, firms were not very optimistic that business conditions would improve over the next six months."

Market reaction

The greenback is facing modest bearish pressure in the early American session and the US Dollar Index was last seen losing 0.17% on a daily basis at 109.45.

-

13:46

US: Weekly Initial Jobless Claims decline to 213K vs. 226K expected

- Initial Jobless Claims in the US fell by 5,000 in the week ending September 10.

- US Dollar Index stays in daily range slightly above 109.50.

There were 213,000 initial jobless claims in the week ending September 10, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 218,000 (revised from 222,000) and came in better than the market expectation of 226,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 224,000, a decrease of 8,000 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending September 3 was 1,403,000, an increase of 2,000 from the previous week's revised level," the DOL reported.

Market reaction

The US Dollar Index posts small daily losses on the day but manages to hold above 109.50 after this data.

-

13:45

GBP/USD keeps the red near weekly low, moves little post-US economic data

- GBP/USD comes under renewed selling pressure on Thursday amid a modest USD strength.

- Bets for more aggressive Fed rate hikes, elevated US bond yields revive the USD demand.

- The mixed US economic data fails to impress the USD bulls or provide impetus to the pair.

The GBP/USD pair extends its steady intraday descent through the early North American session and seems rather unaffected by US macro releases. The pair is currently trading around the 1.1470-1.1465 area and remains well within the striking distance of its lowest level since 1985 touched last week.

Following the previous day's modest downtick, the US dollar regains some positive traction on Thursday amid hawkish Fed expectations and turns out to be a key factor exerting pressure on the GBP/USD pair. That said, a generally positive tone around the equity markets keeps a lid on any meaningful gains for the safe-haven greenback.

Even the mixed US economic data also did little to impress the USD bulls or provide any meaningful impetus to the GBP/USD pair. The US Census Bureau reported that the headline sales unexpectedly rose by 0.3% in August. This, however, was offset by the fact that core sales (excluding autos) remain flat during the reported month.

Separately, the US Weekly Initial Jobless Claims fell to 213K during the week ended September 9 against a rise to 226K anticipated. Furthermore, the Empire State Manufacturing Index improves to -1.5 in September from -31.3 previous, while Philly Fed Manufacturing Index plunges to -9.9, missing estimates for a fall to 2.8 from 6.2 in August.

The data, meanwhile, does little to push back against bets for a more aggressive policy tightening by the Fed. This, in turn, remains supportive of elevated US Treasury bond yields and favours the USD bulls, suggesting that the path of least resistance for the GBP/USD pair is to the downside. Hence, a slide back towards the YTD low, around the 1.1400 mark, remains a distinct possibility.

Technical levels to watch

-

13:36

US: Retail Sales rise by 0.3% in August vs. 0% expected

- Retail Sales in the US rose modestly in August.

- US Dollar Index holds above 109.50 after the data.

Retail Sales in the US stayed increased by 0.3% to $683.3 billion in August, the data published by the US Census Bureau showed on Thursday. This reading followed July's decrease of 0.4% (revised from 0%) and came in better than the market expectation for a no-change.

Further details of the report revealed that Retail Sales ex Autos were down by 0.3%.

"Total sales for the June 2022 through August 2022 period were up 9.3% from the same period a year ago," the publication read. "The June 2022 to July 2022 percent change was revised from virtually unchanged to down 0.4%."

Market reaction

The US Dollar Index showed no immediate reaction to these figures and was last seen trading flat on the day at 109.68.

-

13:32

United States Continuing Jobless Claims below forecasts (1.475M) in September 2: Actual (1.403M)

-

13:32

United States Export Price Index (YoY) above forecasts (9.6%) in August: Actual (10.8%)

-

13:32

United States Import Price Index (YoY) came in at 7.8%, below expectations (7.9%) in August

-

13:31

United States Philadelphia Fed Manufacturing Survey came in at -9.9 below forecasts (2.8) in September

-

13:31

United States NY Empire State Manufacturing Index registered at -1.5 above expectations (-13) in September

-

13:31

United States Retail Sales ex Autos (MoM) below forecasts (0.1%) in August: Actual (-0.3%)

-

13:31

United States Export Price Index (MoM) registered at -1.6%, below expectations (-1.2%) in August

-

13:30

United States Retail Sales (MoM) registered at 0.3% above expectations (0%) in August

-

13:30

United States Initial Jobless Claims came in at 213K below forecasts (226K) in September 9

-

13:30

United States Initial Jobless Claims 4-week average: 224K (September 9) vs previous 233K

-

13:30

United States Import Price Index (MoM) registered at -1% above expectations (-1.2%) in August

-

13:30

United States Retail Sales Control Group registered at 0%, below expectations (0.5%) in August

-

13:28

EUR/USD: Consolidative trade to end on a break of 0.9960-1.0060 range – OCBC

EUR/USD continues to trade below parity on Thursday. Economists at OCBC Bank highlight the key technical levels to watch.

Price cap for gas imports and windfall levy to support the EUR

“Mild bullish momentum on daily chart shows tentative signs of fading but RSI was flat. Consolidative trades likely.”

“Support at 0.9960, 0.9910 levels. Resistance at 1.0060.”

“In European Commission President Ursula’s state of the union speech, she said that the EU will launch a ‘deep and comprehensive’ reform of the electricity market. A swift move to firm up on the proposals on price cap for gas imports and windfall levy could help to ease price pressures and provide further support for EUR.”

-

13:19

USD/JPY: Intervention risk on a sharp move higher to test 145, but unlikely to alter the trend – OCBC

USD/JPY treads water around mid-143s. Economists at OCBC Bank expect a test of 145 to trigger intervention from Japanese authorities but it is unlikely to stop the pair’s current rally.

Intervention impact could be most felt within the first 48 hours

“We opined that the actual intervention may be conducted if there is another sharp move higher to test 145.”

“Intervention can impact the JPY and the impact could be most felt within the first 48 hours based on past observation. But intervention alone is not likely to alter the trend unless USD, UST yields turn lower or BoJ changes/tweaks policy.”

-

13:12

US Dollar Index to retain a bid tone, next resistance seen at 110.30 – OCBC

The US Dollar Index holds in positive territory but stays below 110.00. Strategists at OCBC Bank highlight the key technical levels to watch.

USD could still stay bid on dips

“The USD could still stay bid on dips and take cues from upcoming US data – retail sales, industrial production today, Uni of Michigan sentiment on Fri, alongside the roll-out of regional Fed manufacturing surveys for September. In the interim, the debate between a 75 bps and 100 bps hike is likely to retain a bid tone on the USD overall.”

“Resistance at 110.30 before 110.78 (previous high). Support at 109.10 (21 DMA), 108.45 (38.2% Fibo retracement of Aug low to Sep high) and 107.70 levels (50 DMA, 50% Fibo).”

See – US Retail Sales Preview: Forecasts from six major banks, can the US consumer remain strong?

-

13:05

Silver Price Analysis: XAG/USD maintains a large top, further downside ahead – Credit Suisse

Silver maintains the top analysts at Credit Suisse have been highlighting since mid-May. Therefore, XAG/USD is expected to decline towards the $15.56 support.

Break above $21.39 required to negate the top

“Silver has risen back above the crucial 61.8% retracement support of the whole 2020/21 upmove at $18.65/15, however, still maintains a large top below $21.39 and we hence expect further downside from here towards the $15.56 support from a technical analysis perspective.”

“Next resistance is seen at $20.87 and above $21.39 remains needed to negate the top.”

-

12:40

ECB's Centeno: No sign of inflation expectations de-anchoring

European Central Bank (ECB) Governing Council member Mario Centeno said on Thursday that he does not see any signs of a de-anchoring of inflation expectations, per Reuters.

"The monetary policy must act at the margin in as small steps as possible," Centeno added and further noted that he expects the effects of unprecedented supply shocks to ease.

Market reaction

These comments don't seem to be having a significant impact on the shared currency's performance against its major rivals. As of writing, EUR/USD was up 0.15% on the day at 0.9991.

-

12:20

EUR/USD Price Analysis: Selling pressure alleviated above 1.0180

- EUR/USD treads water below the parity zone on Thursday.

- The pair needs to clear the multi-month resistance line near 1.0180.

EUR/USD trades in an inconclusive fashion, while a break above the parity level remains elusive on Thursday.

If the recovery picks up extra pace, then the interim hurdle comes at the 55-day SMA at 1.0163 prior to the key 7-month resistance line, today near 1.0180. A move beyond the latter is needed to reduce the selling bias and allow the pair to confront the September high at 1.0197 (September 12) before the 100-day SMA at 1.0325.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0735.

EUR/USD daily chart

-

12:12

US Dollar Index Price Analysis: Another visit to the 2022 top remains in place

- DXY fades Wednesday’s retracement and flirts with 110.00.

- Extra upside could see the 2022 high near 110.80 revisited.

DXY trades with decent gains in the vicinity of the 110.00 mark, leaving behind the previous day’s decline.

The dollar manages well to keep the trade in the upper end of the recent range and its short-term bullish view remains unchanged while above the 7-month support line around 106.30.

That said, the surpass of the 110.00 neighbourhood should put the index en route to a probable visit to the YTD top at 110.78 (September 7).

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 101.60.

DXY daily chart

-

11:56

When are US monthly retail sales figures and how could they affect EUR/USD?

US Monthly Retail Sales Overview

Thursday's US economic docket highlights the release of monthly Retail Sales figures for August, due later during the early North American session at 12:30 GMT. On a monthly basis, the headline sales are estimated to remain flat for the second straight month. Excluding autos, core retail sales probably rose a modest 0.1% during the reported month, down from 0.4% growth in July.

Analysts at Deutsche Bank sounded more optimistic and offered a brief preview of the report: “We expect a +0.6% MoM reading, up from last month's flat print. As gasoline prices continue their downward trend, whether this assuages the inflationary pressures on consumer spending will be important.”

How Could it Affect EUR/USD?

Ahead of the key release, expectations for a more aggressive policy tightening by the Fed continue to act as a tailwind for the US dollar. A surprisingly stronger data will lift bets for a full 100 bps at next week's FOMC meeting and provide an additional lift to the USD. Conversely, any disappointment is unlikely to dent the underlying bullish sentiment surrounding the buck, suggesting that the path of least resistance for the EUR/USD pair is to the downside.

Eren Sengezer, Editor at FXStreet, outlines important technical levels to trade the EUR/USD pair: “The Fibonacci 61.8% retracement of the latest uptrend forms key resistance at 1.0000. The 50 and the 100-period SMAs on the four-hour chart reinforce that level as well. In case EUR/USD manages to flip that level into support, it could target the 1.0030/40 area (Fibonacci 50% retracement, 20-period SMA) and the 1.0070/80 area (Fibonacci 38.2% retracement, 200-period SMA).”

“On the downside, sellers could take action with a drop below 0.9950 (static level) and cause EUR/USD to decline toward 0.9900 (psychological level) and 0.9865 (September 6 low),” Eren adds further.

Key Notes

• US Retail Sales Preview: Can consumers keep up with inflation? A breather could weigh on the dollar

• US Retail Sales Preview: Forecasts from six major banks, can the US consumer remain strong?

• EUR/USD Forecast: Euro defines range before next breakout

About US Retail Sales

The Retail Sales released by the US Census Bureau measures the total receipts of retail stores. Monthly per cent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish).

-

11:43

EU's Dombrovskis: We want to continue to put pressure on Russia

European Commission Executive Vice-President and Commissioner for Trade, Valdis Dombrovskis, said on Thursday that they want to continue to put pressure on Russia and reiterated that sanctions will remain in place, as reported by Reuters.

"We have spoken with the US on their tax incentives for e-cars and expressed our concerns," Dombrovskis added. "We want to go into further details in the coming weeks."

Market reaction

The shared currency struggles to find demand following these comments and the EUR/USD pair was last seen trading flat on the day at 0.9975.

-

11:38

Gazprom's Aksyutin: There is no alternative to Russian pipeline gas for Europe

Oleg Aksyutin, Deputy Chief Executive Officer of Gazprom, said on Thursday that Europe had no other alternative other than Russian gas, as reported by Reuters.

Aksyutin added that no additional LNG supplies could be expected in global markets in the short term and argued that nearly-full EU gas inventories couldn't guarantee a safe winter for Europe.

Market reaction

These comments don't seem to be having a significant impact on risk mood during the European trading hours. As of writing, the Euro Stoxx 600 Index was up 0.15% on a daily basis.

-

11:16

Gold Price Forecast: XAU/USD languishes near its lowest since July 21, below $1,700 mark

- Gold continues losing ground for the third straight day and drops to its lowest level since July 21.

- Bets for more aggressive Fed rate hikes, a positive risk tone continue to weigh on the XAU/USD.

- A modest intraday USD pullback lends support, for the time being, ahead of the US macro data.

Gold remains under heavy selling pressure for the third successive day and drops to its lowest level since July 21 on Thursday. The XAU/USD now seems to have entered a bearish consolidation phase and oscillates in a range around the $1,685-$1,690 region through the first half of the European session.

The prospects for a more aggressive policy tightening by the Fed turn out to be a key factor that continues to weigh on the non-yielding gold. Following surprisingly strong US consumer inflation data on Tuesday, the markets started pricing in the possibility of a full 100 bps rate hike at the September FOMC meeting. Fed funds futures indicate a 30% chance of such a move next week.

Furthermore, investors now expect the US central bank to deliver another supersized 75 rate increase in November, which remains supportive of elevated US Treasury bond yields. It is worth mentioning that the yield on the rate-sensitive two-year US government bond reached its highest level since November 2007 on Tuesday and the benchmark 10-year Treasury note stood tall near the YTD peak.

Apart from this, a generally positive tone around the equity markets further seems to exert downward pressure on the safe-haven precious metal. The US dollar, meanwhile, struggles to preserve its modest intraday gains, which, in turn, is seen lending some support to the dollar-denominated gold. The fundamental backdrop, however, remains skewed in favour of bearish traders.

Hence, any attempted recovery move could still be seen as a selling opportunity. Next on tap is the US economic docket, featuring the release of Retail Sales, Weekly Initial Jobless Claims, Regional Manufacturing Indices, and Industrial Production data. This, along with the US bond yields, the USD price dynamics and the broader risk sentiment might provide some impetus to gold.

Technical levels to watch

-

11:02

Philippines: BSP expected to hike rates this month – UOB

Economist at UOB Group Lee Sue Ann suggests the BSP could raise further its policy rate at the September 22 meeting.

Key Quotes

“Ongoing uncertainties particularly global recession risks into 2023 and a tentative retreat in global oil prices could also lead BSP to pause its rate hikes soon.”

“Thus, we stick to our call for a hike in the policy rate by another 25bps in Sep and thereafter keep the RRP rate at 4.00% through 4Q22 and 2023, unless both global and domestic environments move in unexpected directions.”

-

10:47

Japan LDP’s Hagiuda calls for $209B stimulus to combat inflation, weak yen

Japan’s ruling Liberal Democratic Party's (LDP) policy chief Koichi Hagiuda called for an additional stimulus package worth over JPY 30 trillion ($208.97 billion) to tackle the inflation and weak yen problem, Sankei newspaper reported.

Key quotes

"The supplementary budget of last year exceeded 30 trillion yen in size."

"Considering the price rises, global economic slowdown and weak yen and so on since then, more fine-tuned measures than last year are necessary."

Market reaction

USD/JPY is falling back towards 143.00 on these headlines, trading at 143.29, still up 0.12% on the day. The pair hit a session high of 143.80 earlier this morning.

-

USD/JPY pares intraday gains, retreats below mid-143.00s ahead of US macro data

-

-

10:30

USD/JPY pares intraday gains, retreats below mid-143.00s ahead of US macro data

- USD/JPY catches fresh bids on Thursday and recovers a part of the precious day’s losses.

- A positive risk tone undermines the safe-haven JPY amid the Fed-BoJ policy divergence.

- Elevated US bond yields revive the USD demand and remain supportive of the move up.

- Traders now look forward to important US macro releases for some meaningful impetus.

The USD/JPY pair catches fresh bids on Thursday and reverses a part of the previous day's retracement slide from the vicinity of the 24-year peak. The pair, however, trims a part of its intraday gains and retreats below mid-143.00s during the mid-European session, though is still up nearly 0.20% for the day.