Notícias do Mercado

-

20:00

Dow +147.54 15,902.90 +0.94% Nasdaq +31.78 4,032.76 +0.79% S&P +13.56 1,788.88 +0.76%

-

19:21

American focus : the euro lost some previously earned positions against the dollar

Euro fell against the dollar retreated from a session high , which was associated with the release of U.S. data . One of the reports showed that in December, the index of activity in the manufacturing sector of the Federal Reserve Bank of New York rose to 0.98 , compared to -2.21 in November. According to the average forecast of economists , the value of production index would grow to a level of 4.9 .

In addition, it was reported that in December preliminary index of business activity in the U.S. manufacturing sector Markit PMI showed a slowdown in expansion. The index fell from 54.7 to 54.4 , confounding forecast 54.9 , but kept in the area of expansion over the 50.0 mark key . The slowdown impacted by lower index of new orders component , with new export orders remained unchanged . Employment and procurement prices rose moderately .

No less important were also data on industrial production . They showed that industrial production in the U.S. in November for the first time exceeded the pre-recession peak , which is another sign of renewed growth in the economy.

The volume of industrial production, which includes manufacturing, utilities , mining sector grew by 1.1 % compared with October . This is the highest growth for the year . Capacity utilization rose by 0.8% to 79.0 . Economists had expected industrial production growth of 0.6% and capacity utilization to 78.5% . Industrial Production in October revised to 0.1% . Growth in the manufacturing industry, which is the largest in terms of production , made in November to 0.6%. The largest growth was the automotive industry , followed by textile , oil and coal , wood products ,

The Canadian dollar was trading lower against the U.S. dollar , but has regained some of the previously lost positions . Note that a moderate impact on the couple had data that showed that investments in securities of non-residents of Canada in October totaled $ 4.4 billion and mainly occurred in corporate debt instruments . At the same time , Canadian investment in foreign securities decreased due to the sale of shares in the United States.

Investments of non-residents in Canadian bonds decreased by $ 38 million , mainly a reflection of flow of funds between the bond market and the money market .

Investments of non-residents in Canadian stocks rose to $ 4.5 billion , after rising 10.7 billion in September. Increased investment in stocks continues for six of the last seven months . In September, the shares were acquired mainly in the secondary market . In October the price of Canadian shares rose by 4.5% , reaching a peak in May 2011 with

Foreign investment in bonds in October amounted to $ 6.1 billion , mainly due to new securities denominated in U.S. dollars.

Acquisition of foreign corporate bonds in August was $ 4.7 billion , which includes bonds as private and public companies.

Foreign ownership of government bonds declined. Long-term interest rates in Canada declined in October for the second month in a row.

Investments of non-residents in Canadian money market instruments in October fell by $ 6.2 billion after six months of consecutive growth in the amount of 12.4 billion

-

18:21

European stock close

European stocks climbed the most in two months after a gauge of manufacturing in the euro area rose more than forecast and as investors awaited a Federal Reserve meeting starting tomorrow to gauge the timing of stimulus cuts.

The Stoxx Europe 600 Index advanced 1.3 percent to 313.64 at 4:37 p.m. in London. The regional benchmark gauge fell for two straight weeks, the first back-to-back weekly losses since Oct. 4, as better-than-estimated U.S. economic data led some investors to speculate the Fed will decide to slow bond purchases as early as this week.

National benchmark indexes gained in all of the western European markets except Greece and Luxembourg.

FTSE 100 6,522.2 +82.24 +1.28% CAC 40 4,119.88 +60.17 +1.48% DAX 9,163.56 +157.10 +1.74%

Euro-area factory output grew at a faster pace in December than economists had forecast, led by Germany. An index based on a survey of purchasing managers in the manufacturing industry increased to 52.7 from 51.6 in November, London-based Markit Economics said in a statement. That beat the estimate of 51.9. European

Central Bank President Mario Draghi said at the European Parliament in Brussels today that euro-area fourth-quarter growth will be modest.

U.S. industrial production climbed in November by the most in a year, a report from the Federal Reserve showed today in Washington. Output at factories, mines and utilities rose 1.1 percent after a revised 0.1 percent gain in October that was previously reported as a decline. The median forecast called for a 0.6 percent increase. A separate report showed a gauge of manufacturing in the New York region rose less than economists projected.

Aggreko jumped 8.5 percent to 1,645 pence. The provider of mobile-power generators forecast debt will drop by 200 million pounds ($326 million) compared with the year-ago period. The company expects full-year results to beat estimates, according to a statement. It also announced contracts to provide temporary power to the FIFA World Cup in Brazil and the Commonwealth Games in Glasgow next year.

Deutsche Telekom climbed 3.8 percent to 11.79 euros. Sprint is studying antitrust concerns and may make a bid for T-Mobile in the first half of next year, the Wall Street Journal reported, citing people familiar with the matter. Deutsche Telekom merged its T-Mobile USA unit with MetroPCS Communications Inc.

Moncler rose to 14.97 euros, or 47 percent higher than its initial public offering price, after investors sought about 27 times the amount of stock available. Moncler’s private-equity owners have raised about 784 million euros ($1.08 billion) after selling shares at the top of a targeted range and exercising an over-allotment option.

Hennes & Mauritz AB (HMB) advanced 1.7 percent to 283.10 kronor. Europe’s second-biggest clothing retailer said revenue at stores and operations open at least a year rose 10 percent last month compared with a year earlier. That topped the 4 percent gain estimated in a survey of analysts by SME Direkt. It was the biggest advance in same-store sales in 20 months. The Stockholm-based company’s total sales rose 21 percent in November, compared with a projected 14 percent gain.

ArcelorMittal (MT) SA declined 2.7 percent to 11.72 euros. Nomura Holdings Inc. cut its recommendation on the steelmaker to reduce from buy, saying steel prices will probably fall.

-

17:00

European stock close: FTSE 100 6,522.2 +82.24 +1.28% CAC 40 4,119.88 +60.17 +1.48% DAX 9,163.56 +157.10 +1.74%

-

16:41

Oil: an overview of the market situation

Oil prices rose today , while rising above $ 110 per barrel (Brent) and $ 97 per barrel (WTI), against a background of renewed concerns over supplies from Libya . As it became known , Libya failed to reach agreement with tribal leaders to put an end to the blockade of several oil-exporting ports. Libya has cut vital for her oil exports to 110 thousand barrels per day from 1 million in July due to the closure of ports and oil strikes , civil servants and local tribes in the fields . Western countries fear that Libya will slide into chaos due to the inability of the government to control armed groups that helped overthrow Muammar Gaddafi in 2011 and did not lay down their arms .

But analysts warn Commerzban that the impact of negative news from Libya should not be overestimated , given that the country is currently producing only 200,000 barrels of oil per day.

Growth in oil demand also contributed to macroeconomic data from the U.S., which showed that industrial production in November rose 1.1 % compared with October, with growth forecast at 0.6%.

We also add that many investors are waiting for the Fed meeting . December 17-18 U.S. central bank ( Fed ) will hold a meeting at which may decide to reduce the volume of buying bonds to $ 85 billion per month. Such a step may cause an increase in the dollar, which adversely affect the prices of raw materials.

Not unimportant today were data from China , which showed that the expansion in China's manufacturing sector slowed down a bit in the month of December , as production growth is weak, and employment continued to decline even further.

According to the report, the purchasing managers' index for the manufacturing sector from Markit Economics fell in December to three-month low , namely, to reach 50.5 points compared to 50.8 points in November . However, despite this decline, the figure remains above the level of 50 points , indicating that the expansion of the sector .

The price of January futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 97.59 a barrel on the New York Mercantile Exchange.

January futures price for North Sea Brent crude oil mixture increased by $ 1.78 to $ 110.55 a barrel on the London exchange ICE Futures Europe.

-

16:20

Gold: an overview of the market situation

Gold futures rose sharply, allowing to recover all early losses , and update the session high. Such dynamics are related to the fact that many traders are waiting for the Fed meeting, which will take place this week, and can provide hints about the quantitative easing program , which plays an important role for gold.

Recall that this is the last meeting under the chairmanship of Ben Bernanke as Fed chairman , which increases the chances that any vital decisions would be taken , and the mission of reducing the program of "quantitative easing " the Fed will get a new chapter - Janet Yellen , which will come into office in February . Probably tone Bernanke comments will be soft , no surprises are expected . This would allow investors to finish the year on a positive note .

Meanwhile, experts say that with the approach of Christmas trading volumes in all markets begin to decrease considerably and the thin trading usually means that prices can move very rapidly and substantially .

The course of today's trading also affected the U.S. data , which showed that in December the index of activity in the manufacturing sector of the Federal Reserve Bank of New York rose to 0.98 , compared to -2.21 in November. Note that, according to the average forecast of economists , the value of production index would grow to a level of 4.9 . Recall that the index values above zero indicate expanding activity , and below zero - at its decline.

In addition, there was one more important report , which showed that in December preliminary index of business activity in the U.S. manufacturing sector Markit PMI showed a slowdown in expansion. The index fell from 54.7 to 54.4 , confounding forecast 54.9 , but kept in the area of expansion over the 50.0 mark key . The slowdown impacted by lower index of new orders component , with new export orders remained unchanged . Employment and procurement prices rose moderately .

Cost February gold futures on the COMEX today rose to $ 1242.10 per ounce.

-

14:36

us. stock open: Dow 15,850.62 +95.26 +0.60%, Nasdaq 4,019.90 +18.92 +0.47%, S&P 1784.60 +9.10 +0.51%

-

14:30

before the open: S&P (+0.54%) NASDAQ (+0.49%)

U.S. stock-index futures gained, as investors gauged the outlook for stimulus before a two-day Federal Reserve meeting that starts tomorrow.

Global markets:

Nikkei 15,152.91 -250.20 -1.62%

Hang Seng 23,114.66 -131.30 -0.56%

Shanghai Composite 2,160.86 -35.21 -1.60%

FTSE 6,503.7 +63.74 +0.99%

CAC 4,113.29 +53.58 +1.32%

DAX 9,161.59 +155.13 +1.72%

Crude oil $97.17 (+0.61%).

Gold $1235.50 (+0.07%).

-

14:15

U.S.: Capacity Utilization, November 79.0% (forecast 78.5%)

-

14:15

U.S.: Industrial Production (MoM), November +1.1% (forecast +0.6%)

-

14:00

U.S.: Total Net TIC Flows, October 194.9

-

14:00

U.S.: Net Long-term TIC Flows , October 35.4 (forecast 31.4)

-

13:58

U.S.: Manufacturing PMI, December 54.4 (forecast 54.9)

-

13:45

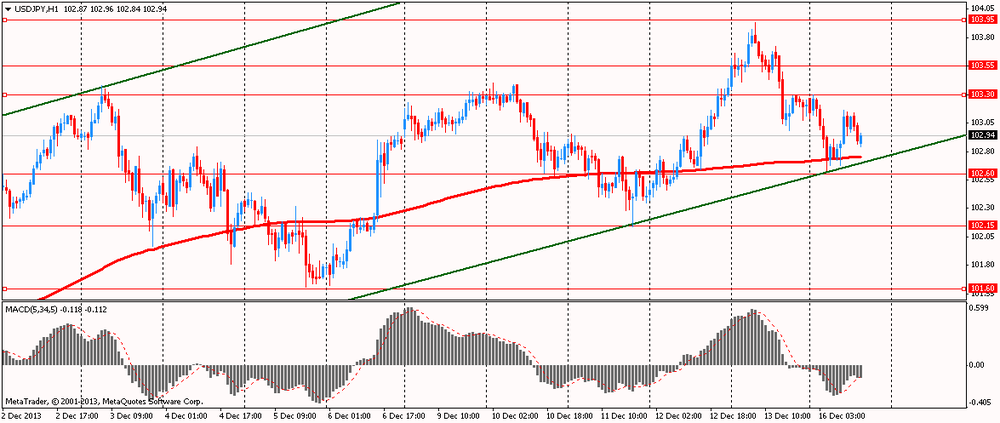

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.50, Y102.60, Y103.00, Y103.20, Y103.50, Y104.00

EUR/USD $1.3650, $1.3700, $1.3705, $1.3720, $1.3725, $1.3745, $1.3750, $1.3800, $1.3825

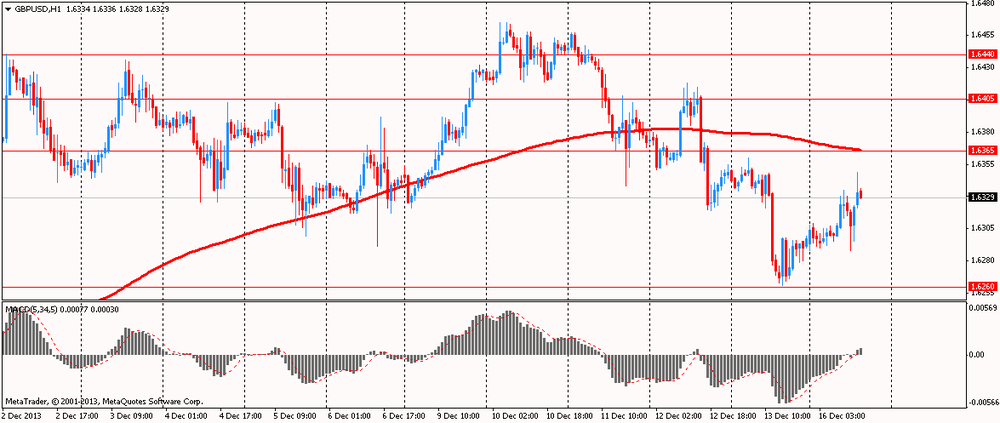

GBP/USD $1.6325, $1.6400

USD/CHF Chf0.8925

AUD/USD $0.8900, $0.8950, $0.8965, $0.9100, $0.9120-25

EUR/SEK Sek8.9795, Sek9.0500

AUD/JPYY92.55

USD/CAD Cad1.0700

EUR/CHF Chf1.2190

NZD/USD $0.8240

-

13:31

U.S.: Nonfarm Productivity, q/q, Quarter III +3.0% (forecast +2.9%)

-

13:31

Canada: Foreign Securities Purchases, October 4.41 (forecast 9.24)

-

13:30

U.S.: NY Fed Empire State manufacturing index , December 0.98 (forecast 4.9)

-

13:15

European session: the euro rose

07:58 France Manufacturing PMI (Preliminary) December 48.4 49.1 47.1

07:58 France Services PMI (Preliminary) December 48.0 48.9 47.4

08:28 Germany Manufacturing PMI (Preliminary) December 52.7 53.1 54.2

08:28 Germany Services PMI (Preliminary) December 55.7 55.2 54

08:58 Eurozone Manufacturing PMI (Preliminary) December 51.6 51.9 52.7

08:58 Eurozone Services PMI (Preliminary) December 51.2 51.5 51.0

10:00 Eurozone Trade Balance s.a. October 14.3 15.2 14.5

The euro rose against the dollar after strong data on business activity in the euro zone and Germany. Eurozone private sector activity grew at a faster pace in December , and to a greater extent than expected by economists , showed a survey conducted by Markit Economics. On a seasonally adjusted composite index of production, which measures the performance of the manufacturing sector and the services sector rose to 52.1 December from 51.7 in November. Economists had expected a modest increase to 51.9 .

Led recovery of the total activity of the private sector is worth purchasing managers index for the manufacturing sector , which rose to 52.7 in December from 51.6 in November , reaching its highest level in thirty one month. Economists had forecast an increase to 51.9 . Meanwhile, the activity indicator for the services sector fell to a four-month low of 51 in December from 51.2 in November , marking the third consecutive slowdown . Expectations were at 51.5 .

Activity index for the manufacturing of Germany rose in December to its highest level in thirty months , indicating a much more rapid increase in activity. The seasonally adjusted purchasing managers' index (PMI) for the manufacturing rose to 54.2 in December from 52.7 in November. Value in December was the highest in thirty months. Economists had expected the index to rise to 53.1 .

Production in the manufacturing sector rose the steepest pace since May 2011 , and growth accelerated for the third month in a row. This reflects the continued growth of new business, which was the fastest since April 2011 . Input price inflation faced by German producers, accelerated in December , while the selling prices for the products increased only slightly due to strong competition for new orders.

Meanwhile, the activity indicator for the services sector fell to 54 in December from 55.7 in November. Economists' expectations were at a decline to 55.2 . The composite index , reflecting activity in the manufacturing sector and in the services sector fell to two-month low of 55.2 in December from 55.4 in November.

Pound rose against the dollar , recovering from the lows . Economic Calendar for Britain today presented only data on the housing market . According to real estate Rightmove, the average asking price for homes for sale on the website Rightmove, was 1.9 % lower in December compared to November , but remained 5.4% higher than at the end of 2012 . In November , house prices fell by 2.4% m / m and rose 4.0 % y / y

Monthly decline , typical for this time of year , was the smallest since the beginning of December to the global credit crisis and suggests that the demand for real estate remains high, which is expected to support prices afloat in 2014 - according to Rightmove.

" The smallest drop in December 2006 shows that the housing market is on track to grow further momentum in 2013 ," - said Miles Shipsayd , director of Rightmove. Due to the constant lack of proposals , house price inflation has gathered momentum in 2013, exerting upward pressure on prices . Only increase in the number of homes for sale until spring will be sufficient to limit the rate of appreciation of property prices to the extent observed in 2013 - said Shipsayd .

EUR / USD: during the European session, the pair rose to $ 1.3789

GBP / USD: during the European session, the pair fell to $ 1.6288 , and then rose to $ 1.6349

USD / JPY: during the European session, the pair rose to Y103.16 and stepped

At 13:30 GMT , Canada will report on the volume of transactions with foreign securities in October. At 13:30 GMT the U.S. manufacturing index will be released in December Empire Manufacturing and changes in the level of labor productivity in the non-manufacturing sector for the 3rd quarter . At 14:00 GMT to make a speech , ECB President Mario Draghi . In the U.S. at 14:00 GMT will net purchases of long-term U.S. securities by foreign investors in October , the index of business activity in the manufacturing sector in December , total net purchases of U.S. securities by foreign investors in October , in the 14:15 GMT - the load factor of production capacity, the change in volume of industrial production in November. At 17:00 GMT a speech SNB board member Fritz Zurbrugg . At 23:00 GMT Australia is to publish an index of leading economic indicators from the Conference Board in October.

-

13:00

Orders

EUR/USD

Offers $1.3870/80, $1.3850, $1.3830/35, $1.3815/20, $1.3790-805

Bids $1.3740, $1.3705/00

GBP/USD

Offers $1.6420/30, $1.6395/400, $1.6380, $1.6355/60, $1.6335/40

Bids $1.6280, $1.6250, $1.6240, $1.6220

AUD/USD

Offers $0.9045/50, $0.8980/90

Bids $0.8920, $0.8900, $0.8850

EUR/JPY

Offers Y143.50, Y143.00, Y142.45/50, Y142.20

Bids Y141.50, Y141.25/20, Y141.00, Y140.50

USD/JPY

Offers Y104.00, Y103.80, Y103.45/50, Y103.20

Bids Y102.50, Y102.20, Y102.00, Y101.80

EUR/GBP

Offers stg0.8575/85, stg0.8550, stg0.8520/30, stg0.8500, stg0.8475/80

Bids stg0.8380, stg0.8355/45, stg0.8330/20

-

11:32

European stocks climbed

European stocks climbed after a gauge of manufacturing in the euro area rose more than forecast and as investors awaited a Federal Reserve meeting starting tomorrow to gauge the timing of stimulus cuts. U.S. stock-index futures rose and Asian shares fell.

Euro-area factory output grew at a faster pace than economists had forecast in December, led by Germany. An index based on a survey of purchasing managers in the manufacturing industry increased to 52.7 from 51.6 in November, London-based Markit Economics said in a statement today. That’s above the estimate of 51.9 in a Bloomberg News survey of 35 economists. European Central Bank President Mario Draghi is scheduled to speak to the European Parliament in Brussels.

The Fed may begin reducing its $85 billion of monthly bond purchases at its Dec. 17-18 meeting, according to 34 percent of economists in a Dec. 6 Bloomberg survey, up from 17 percent in a Nov. 8 poll

Aggreko jumped 5.9 percent to 1,605 pence. The provider of mobile-power generators forecast debt will drop by 200 million pounds ($326 million) compared with the year-ago period. The Glasgow-based company expects full-year results to be ahead of expectations, according to a statement.

H&M advanced 2.3 percent to 285 kronor. Europe’s second-biggest clothing retailer said revenue at stores and operations open at least a year rose 10 percent last month compared with a year earlier, the Stockholm-based company said. That topped the 4 percent gain anticipated in a survey of analysts by SME Direkt. It is the biggest advance in same-store sales in 20 months. The company’s total sales rose 21 percent in November, compared with a projected 14 percent gain.

Moncler rose to 14.40 euros, or 41 percent higher than its initial public offering price after investors sought about 27 times the amount of stock available. The shares were offered at 10.20 euros apiece. Moncler’s private-equity owners have raised about 784 million euros ($1.08 billion) after selling shares at the top of a targeted range and exercising an over-allotment option.

ArcelorMittal SA declined 2.8 percent to 11.72 euros. Nomura Holdings Inc. cut its recommendation on the steelmaker to reduce from buy, saying steel prices will probably fall.

FTSE 100 6,470.88 +30.92 +0.48%

CAC 40 4,093.14 +33.43 +0.82%

DAX 9,128.64 +122.18 +1.36%

-

10:31

Option expiries for today's 1400GMT cut

USD/JPY Y102.50, Y102.70, Y103.00, Y103.25, Y103.50, Y104.00, Y105.00

EUR/JPY Y142.00

EUR/USD $1.3600, $1.3700, $1.3750, $1.3760, $1.3800, $1.3810

GBP/USD $1.6360

GBP/USD Y168.50

USD/CHF Chf0.9000

AUD/USD $0.8820, $0.8950, $0.9000, $0.9010, $0.9020, $0.9100, $0.9160

NZD/USD $0.8200, $0.8275

NZD/JPY Y84.50

USD/CAD C$1.0590, C$1.0595, C$1.0600, C$1.0615, C$1.0640, C$1.0750

-

10:01

Eurozone: Trade Balance s.a., October 14.5 (forecast 15.2)

-

09:22

FTSE 100 6,444.4 +4.44 +0.07%, CAC 40 4,065.96 +6.25 +0.15%, Xetra DAX 9,029.95 +23.49 +0.26%

-

08:59

Eurozone: Manufacturing PMI, December 52.7 (forecast 51.9)

-

08:59

Eurozone: Services PMI, December 51.0 (forecast 51.5)

-

08:47

Asia Pacific stocks close

Asian stocks fell for a fourth day, poised for a three-month low, after a gauge of Chinese manufacturing fell and as investors awaited a Federal Reserve meeting starting tomorrow to gauge the timing of stimulus cuts.

Nikkei 225 15,152.91 -250.20 -1.62%

Hang Seng 23,132 -113.96 -0.49%

S&P/ASX 200 5,089.63 -8.79 -0.17%

Shanghai Composite 2,160.86 -35.21 -1.60%

Toyota Motor Corp., Asia’s largest carmaker, slid 1.9 percent, leading losses among consumer-discretionary firms as the yen advanced against the dollar.

Senex Energy Ltd. sank 8.4 percent after its A$752 million ($674 million) initial takeover proposal for AWE Ltd. was rejected by the oil and gas explorer.

AWE shares surged 7.2 percent. Tokyo Electric Power Co. gained 1 percent on a report the government plans to double interest-free loans to the utility.

-

08:29

Germany: Manufacturing PMI, December 54.2 (forecast 53.1)

-

08:29

Germany: Services PMI, December 54 (forecast 55.2)

-

07:59

France: Services PMI, December 47.4 (forecast 48.9)

-

07:58

France: Manufacturing PMI, December 47.1 (forecast 49.1)

-

07:26

European bourses are initially seen trading lower Monday: the FTSE down 37, the DAX down 23 and the CAC down 20.

-

06:57

Asian session: The yen strengthened from a five-year low

00:01 United Kingdom Rightmove House Price Index (MoM) December -2.4% -1.9%

00:01 United Kingdom Rightmove House Price Index (YoY) December +4.0% +4.5% +5.4%

01:45 China HSBC Manufacturing PMI (Preliminary) December 50.8 51.0 50.5

The yen strengthened from a five-year low as investors assess U.S. economic data to see when the Federal Reserve will start to taper monetary stimulus. While 34 percent of economists surveyed by Bloomberg forecast the Fed will probably decide to reduce $85 billion in monthly bond purchases at its Dec. 17-18 meeting, futures traders bet it will keep interest rates near zero at least until the end of next year.

Reports from the Fed today are projected to show that U.S. manufacturing is improving. Industrial production probably rose 0.6 percent last month from October when it fell 0.1 percent, according to the median estimate of economists surveyed by Bloomberg News. A gauge of manufacturing in the New York region is likely to have advanced to a three-month high, a separate poll of economists shows.

The euro reached a one-month high against the pound ahead of European data on manufacturing and services. London-based Markit Economics will probably say today that its composite index for the services and manufacturing industries in the currency bloc rose to 52 in December from 51.7 in November, economists forecast.

The central bank’s quarterly Tankan business confidence report today showed sentiment among Japan’s largest manufacturers rose to the highest level since 2007.

EUR / USD: during the Asian session, the pair rose to $ 1.3760

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6290-10

USD / JPY: on Asian session the pair fell to Y102.60

A busy schedule is expected to provide direction this week in thinned out Christmas markets as dealers look ahead to data releases from UK CPI on Tuesday, FOMC rate decision/minutes on Wednesday, UK Retail Sales on Thursday, followed by UK GDP on Friday.

-

06:01

Schedule for today, Monday, Dec 16’2013:

00:01 United Kingdom Rightmove House Price Index (MoM) December -2.4%

00:01 United Kingdom Rightmove House Price Index (YoY) December +4.0% +4.5%

01:45 China HSBC Manufacturing PMI (Preliminary) December 50.8 51.0

07:58 France Manufacturing PMI (Preliminary) December 48.4 49.1

07:58 France Services PMI (Preliminary) December 48.0 48.9

08:28 Germany Manufacturing PMI (Preliminary) December 52.7 53.1

08:28 Germany Services PMI (Preliminary) December 55.7 55.2

08:58 Eurozone Manufacturing PMI (Preliminary) December 51.6 51.9

08:58 Eurozone Services PMI (Preliminary) December 51.2 51.5

10:00 Eurozone Trade Balance s.a. October 14.3 15.2

11:00 Germany Bundesbank Monthly Report December

13:30 Canada Foreign Securities Purchases October 8.36 9.24

13:30 U.S. NY Fed Empire State manufacturing index December -2.21 4.9

13:30 U.S. Nonfarm Productivity, q/q (Revised) Quarter III +1.9% +2.9%

13:58 U.S. Manufacturing PMI (Preliminary) December 54.7 54.9

14:00 Eurozone ECB President Mario Draghi Speaks

14:00 U.S. Net Long-term TIC Flows October 25.5 31.4

14:00 U.S. Total Net TIC Flows October -106.8

14:15 U.S. Industrial Production (MoM) November -0.1% +0.6%

14:15 U.S. Capacity Utilization November 78.1% 78.5%

16:15 Eurozone ECB President Mario Draghi Speaks

17:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks

23:00 Australia Conference Board Australia Leading Index October +0.3%

-