Notícias do Mercado

-

23:52

Japan: Adjusted Merchandise Trade Balance, bln, November -925.0 (forecast -990.0)

-

23:31

Australia: Leading Index, November -0.1%

-

23:00

Schedule for today, Wednesday, Dec 17’2014:

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Average Earnings, 3m/y October +1.0% +1.3%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y October +1.3% +1.6%

09:30 United Kingdom ILO Unemployment Rate October 6.0% 5.9%

09:30 United Kingdom Claimant count November -20.4 -19.8

09:30 United Kingdom Claimant Count Rate October 2.8%

09:30 United Kingdom Bank of England Minutes

10:00 Eurozone Harmonized CPI November 0.0% -0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) November +0.3% +0.3%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y November +0.7% +0.7%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) December -7.6

13:30 Canada Wholesale Sales, m/m October +1.8% +0.9%

13:30 U.S. Current account, bln Quarter III -99 -98

13:30 U.S. CPI, m/m November 0.0% -0.1%

13:30 U.S. CPI, Y/Y November +1.7%

13:30 U.S. CPI excluding food and energy, m/m November +0.2% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y November +1.8%

14:00 Switzerland SNB Quarterly Bulletin

15:30 U.S. Crude Oil Inventories December +1.5

19:00 U.S. FOMC Economic Projections

19:00 U.S. FOMC Statement

19:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

19:30 U.S. Federal Reserve Press Conference

21:45 New Zealand GDP q/q Quarter III +0.7% +0.7%

21:45 New Zealand GDP q/q Quarter III +3.9% +3.3%

-

20:00

Dow +39.17 17,220.01 +0.23% Nasdaq -17.23 4,587.93 -0.37% S&P +1.02 1,990.65 +0.05%

-

17:23

December’s Reserve Bank of Australia monetary policy meeting: further depreciation of the Australian dollar is needed “to achieve balanced growth in the economy”

The Reserve Bank of Australia (RBA) released its minutes from December's monetary policy meeting on Tuesday. The RBA said that gross domestic product growth will be below trend over 2014/15, but will pick up towards the end of 2016.

The RBA noted that "very low interest rates had supported activity in the housing market". The central bank said that "subdued labour market conditions were likely to weigh on consumption growth and consumer confidence more generally".

The RBA members pointed out that "further exchange rate depreciation was likely to be needed to achieve balanced growth in the economy". They noted that monetary policy easing is possible during 2015.

Australia's central bank reiterated that "the most prudent course was likely to be a period of stability in interest rates".

-

17:09

European stocks close: stocks closed higher on the positive data from the Eurozone

Stock indices closed higher on the positive data from the Eurozone. Germany's ZEW economic sentiment index increased to 34.9 in December from 11.5 in November, exceeding expectations for a rise to 19.8. That was the highest reading since May 2014.

Eurozone's ZEW economic sentiment index fell to 10.0 in December from 11.0 in October, missing expectations for a gain to 20.1.

Eurozone's trade surplus widened to €19.4 billion in October from €17.9 billion in September, exceeding expectations for a rise to €18.2 billion. September's figure was revised up from a surplus of €17.7 billion.

Eurozone's preliminary manufacturing PMI increased to 50.8 in December from 50.1 in November, exceeding expectations for a rise to 50.5.

Eurozone's preliminary services PMI rose to 50.9 in December from 51.1 in November. Analysts had expected the index to climb to 51.6

Germany's preliminary manufacturing PMI increased to 51.2 in December from 49.5 in November, beating forecasts of an increase to 50.4.

Germany's preliminary services PMI fell to 51.4 in December from 52.1 in November, missing expectations for a gain to 52.6.

France's preliminary manufacturing PMI dropped to 47.9 in December from 48.4 in November, missing forecasts of a rise to 48.7.

France's preliminary services PMI climbed to 49.8 in December from 47.9 in November, exceeding expectations for a gain to 48.6.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,331.83 +149.11 +2.41%

DAX 9,563.89 +229.88 +2.46%

CAC 40 4,093.2 +87.82 +2.19%

-

17:00

European stocks closed in minus: FTSE 100 6,331.83 +149.11 +2.41% CAC 40 4,093.2 +87.82 +2.19% DAX 9,563.89 +229.88 +2.46%

-

16:43

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies despite the weak U.S. economic data

The U.S. dollar traded higher against the most major currencies despite the weak U.S. economic data. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in December from 55.8 in November, missing expectations for a rise to 56.1. That was the lowest level since January 2014.

Housing starts in the U.S. declined 1.6% to 1.028 million annualized rate in November from a 1.045 million pace in October, beating expectations for a decrease to 1.025 million. October's figure was revised up from 1.009 million units.

Building permits in the U.S. decreased 5.2% to 1.035 million annualized rate in November from a 1.080 million pace in October, missing expectations for a fall to 1.050 million units.

The euro fell against the U.S. dollar. Germany's ZEW economic sentiment index increased to 34.9 in December from 11.5 in November, exceeding expectations for a rise to 19.8. That was the highest reading since May 2014.

Eurozone's ZEW economic sentiment index fell to 10.0 in December from 11.0 in October, missing expectations for a gain to 20.1.

Eurozone's trade surplus widened to €19.4 billion in October from €17.9 billion in September, exceeding expectations for a rise to €18.2 billion. September's figure was revised up from a surplus of €17.7 billion.

Eurozone's preliminary manufacturing PMI increased to 50.8 in December from 50.1 in November, exceeding expectations for a rise to 50.5.

Eurozone's preliminary services PMI rose to 50.9 in December from 51.1 in November. Analysts had expected the index to climb to 51.6

Germany's preliminary manufacturing PMI increased to 51.2 in December from 49.5 in November, beating forecasts of an increase to 50.4.

Germany's preliminary services PMI fell to 51.4 in December from 52.1 in November, missing expectations for a gain to 52.6.

France's preliminary manufacturing PMI dropped to 47.9 in December from 48.4 in November, missing forecasts of a rise to 48.7.

France's preliminary services PMI climbed to 49.8 in December from 47.9 in November, exceeding expectations for a gain to 48.6.

The British pound declined against the U.S. dollar. The U.K. consumer price index declined to an annual rate of 1.0% in November from 1.3% in October. Analysts had expected the consumer price inflation to decrease to 1.2%.

Consumer price inflation excluding food, energy, alcohol, and tobacco decreased to 1.2% in November from 1.5% in October. Analysts had expected the consumer inflation to remain at 1.5%.

The Bank of England's inflation target is about 2%.

The Canadian dollar traded higher against the U.S. dollar after the mixed Canadian economic data. Canadian manufacturing shipments fell 0.6% in October, missing expectations for a 0.4% drop, after a 2.2% rise in September. That was only the second fall in 2014. September's figure was revised up from a 2.1 increase.

Foreign securities purchases in Canada rose by C$9.53 billion in October, exceeding expectations for a gain of C$5.21 billion, after a C$4.64 increase in September. September's figure was revised up from a C$4.37 billion rise.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded mixed against the greenback in the absence of any major economic reports. China's economic data weighed on the kiwi. China's HSBC preliminary manufacturing purchasing managers' index dropped to 49.5 in December from 50.0 in November, missing expectations for a decline to 49.8.

The Australian dollar mixed against the U.S. dollar. In the overnight trading session, the Aussie traded slightly higher against the greenback after the minutes from December's Reserve Bank of Australia (RBA) monetary policy meeting. The RBA said that Australia's economy has grown at a moderate pace. The central bank added that gross domestic product growth is still expected to be below trend over 2014/15, but will pick up towards the end of 2016.

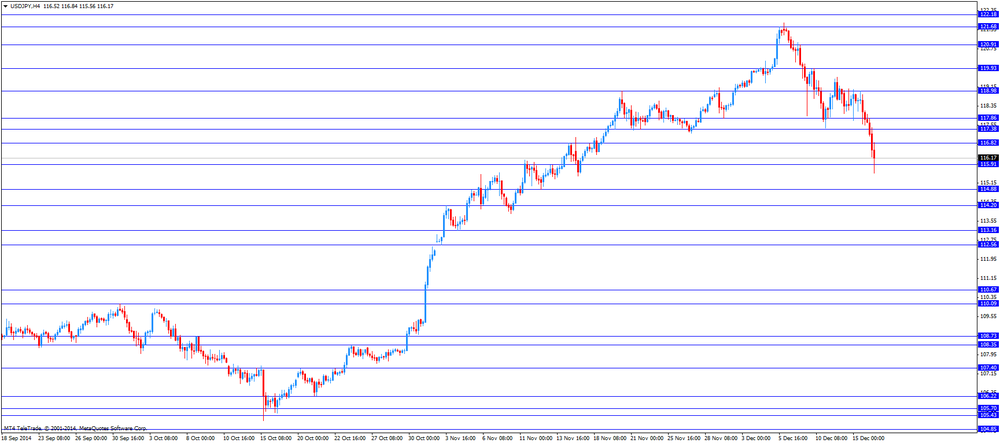

The Japanese yen fell against the U.S. dollar. In the overnight trading session, the yen rose against the greenback due to risk aversion.

Japan's preliminary manufacturing purchasing managers' index (PMI) increased to 52.1 in December from 52.o in November, missing expectations for a rise to 52.3.

-

16:40

Oil: a review of the market situation

The price of oil rose moderately after earlier today for the first time since 2009, close to $ 59 per barrel (mark Brent), which was associated with a decrease in activity in the manufacturing sector in China and the weakening of currencies of developing countries.

Previously presented data showed that business activity in the manufacturing industry in China in December fell to 7-month low. Preliminary index of purchasing managers (PMI) of China's processing industry, calculated by HSBC and Markit Economics, dropped to 49.5 points from 50 points in November. Analysts on average expected 49.8 points. Value below 50 indicates a contraction of manufacturing activity compared with the previous month, while the figure above 50 indicates growth. The data suggest the decline in the Chinese economy, despite the loose monetary policy of the Central Bank of the country.

Analysts say that the oil market is also affected by the deterioration of the economies of developing countries and the depreciation of their currencies. The Bank of Russia on Monday raised its key repo rate once a week by 6.5 percentage points to 17 per cent per annum, trying to stop a collapse of the ruble.

Meanwhile, experts Goldman Sachs today announced that future oil projects worth $ 930 billion is under threat because of falling prices for it to about $ 60 per barrel. Refusal of the development of these projects will decrease in production in the world in the next 10 years to 7.5 million barrels per day (b / d), which is about 8% of the current global demand for oil. According to experts, an overabundance of oil, which has caused a drop in prices, could soon disappear as major oil producers will postpone the launch expensive projects, which, in turn, affect the production of gasoline, fuel oil and chemicals.

Market participants also gradually transferred his attention to the meeting of the Federal Reserve System, which should begin later today and give clues on the timing of rate increases in the future.

Cost of January futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 56.82 dollars per barrel on the New York Mercantile Exchange.

January futures price for North Sea petroleum mix of Brent increased by $ 0.10 to $ 60.47 a barrel on the London Stock Exchange ICE Futures Europe.

-

16:20

Gold: a review of the market situation

Gold prices fell sharply, losing the position of all previously earned and again fell below $ 1,200. Experts point out that gold could come under pressure in the conditions of market expectations the Fed's monetary policy. Talk about the fact that the central bank may abandon his former statement, which said that rates will remain near zero "for an extended period of time," on Wednesday, supported the US dollar and damaged precious metals in recent days. Gold, which does not bring interest income, can hardly compete with the assets generating interest income when interest rates rise.

"The market will be unstable if the central bank will not abandon the phrase" considerable time ", - said an analyst at Australia and New Zealand Banking Group Victor Tyanpiriya.

According to the analyst Edward Meir INTL FCStone, the Fed will leave in a statement the phrase "considerable time" to give yourself time to evaluate the impact of the slow growth of the world economy on the US economy. "If our estimates are correct, the dollar will weaken, and commodity markets rise, so we prefer to hold long positions on the eve of the statement" - wrote Meir in the report.

The course of trading also influenced today's data for Germany and the eurozone. Recall confidence in the German economy rose to its highest level since May 2014. The indicator of economic sentiment rose sharply by 23.4 points to 34.9 in December. It was the second consecutive growth and index reached its highest level since May 2014.

"This increase is due to favorable economic conditions, such as a weak euro and low price of oil," said ZEW President Prof. Clemens Fuest. Assessment of the current situation rose by 6.7 points to 10 points in December. It was expected that the evaluation will rise to 5. sentiment indicator in the euro area rose by 20.8 points to 31.8 points in December. At the same time, the indicator of the current situation declined by 3.1 points to minus 62.8 points.

Meanwhile, a report on the euro area showed that private sector growth accelerated more than expected, up to 2-month high in December. The composite output index increased to 51.7 in December, the highest value in two months, from 51.1 in November. Economists forecast that the PMI reached 51.5. In the service sector purchasing managers index rose to 51.9 from 51.1 a month ago. Evaluation, according to forecasts, should increase to 51.6. The result also noted 2-month high. Moreover, the manufacturing PMI rose to a 5-month high of 50.8 from 50.1 in November. Reading, is expected to grow to 50.5.

As for the situation in the physical markets, gold imports from India increased by 38 per cent in October, reaching 151.58 tons in November, according to data provided by the Ministry of Commerce.

The cost of the December gold futures on the COMEX today fell $ 10.5 to 1196.70 dollars per ounce.

-

15:54

U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in December

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in December from 55.8 in November, missing expectations for a rise to 56.1. That was the lowest level since January 2014.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a softer manufacturing output and new orders. The output subindex decreased to 54.7 in December from 55.6 in November. That was the lowest level since January 2014.

The employment subindex dropped to 52.8 in December from 55.1 in November. That was the lowest level since July 2014.

The Markit Chief Economist Chris Williamson said that the pace of expansion is slowing.

-

15:07

Canadian manufacturing shipments fell 0.6% in October

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments fell 0.6% in October, missing expectations for a 0.4% drop, after a 2.2% rise in September. That was only the second fall in 2014.

September's figure was revised up from a 2.1 increase.

The decrease was driven by weaker aerospace and metal sales. Aerospace sales dropped 15.6% in October, while primary metals sales declined 5.5%.

Motor vehicle sales gained 1.8%.

-

14:45

U.S.: Manufacturing PMI, December 53.7 (forecast 56.1)

-

14:39

U.S. housing market data was negative in November

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. declined 1.6% to 1.028 million annualized rate in November from a 1.045 million pace in October, beating expectations for a decrease to 1.025 million. October's figure was revised up from 1.009 million units.

Building permits in the U.S. decreased 5.2% to 1.035 million annualized rate in November from a 1.080 million pace in October, missing expectations for a fall to 1.050 million units.

Starts of single-family homes fell 5.4% in November. Building permits for single-family homes decreased 1.2% in November.

Starts of multifamily buildings rose 6.7% in November. Permits for multi-family housing dropped 11%.

-

14:34

U.S. Stocks open: Dow 17,119.19 -61.65 -0.36%, Nasdaq 4,573.19 -31.97 -0.69%, S&P 1,982.55 -7.08 -0.36%

-

14:29

Before the bell: S&P futures -0.43%, Nasdaq futures -0.67%

U.S. stock-index futures tumbled as oil prices continued their plunge, sending equities worldwide lower.

Global markets:

Nikkei 16,755.32 -344.08 -2.01%

Hang Seng 22,670.5 -357.35 -1.55%

Shanghai Composite 3,021.26 +67.84 +2.30%

FTSE 6,199.22 +16.50 +0.27%

CAC 3,968.88 -36.50 -0.91%

DAX 9,303.81 -30.20 -0.32%

Crude oil $53.73 (-3.90%)

Gold $1210.40 (+0.24%)

-

14:07

DOW components before the bell

(company / ticker / price / change, % / volume)

Nike

NKE

95.70

+0.28%

1.0K

Travelers Companies Inc

TRV

103.85

+0.74%

0.3K

3M Co

MMM

158.50

+1.05%

0.3K

Boeing Co

BA

124.20

+1.74%

36.6K

Intel Corp

INTC

35.90

-0.06%

14.9K

UnitedHealth Group Inc

UNH

98.21

-0.06%

1.5K

Home Depot Inc

HD

99.78

-0.27%

1.0K

McDonald's Corp

MCD

88.18

-0.32%

3.0K

International Business Machines Co...

IBM

152.53

-0.35%

0.1K

Johnson & Johnson

JNJ

103.59

-0.36%

1.3K

Cisco Systems Inc

CSCO

26.58

-0.37%

18.5K

Procter & Gamble Co

PG

88.85

-0.39%

1.6K

Verizon Communications Inc

VZ

45.22

-0.44%

11.5K

AT&T Inc

T

32.10

-0.47%

19.5K

Walt Disney Co

DIS

90.47

-0.47%

0.4K

Chevron Corp

CVX

100.36

-0.50%

12.8K

Pfizer Inc

PFE

30.70

-0.52%

1.8K

Merck & Co Inc

MRK

56.65

-0.53%

0.1K

American Express Co

AXP

89.52

-0.58%

0.1K

General Electric Co

GE

24.42

-0.69%

27.3K

Caterpillar Inc

CAT

89.12

-0.70%

0.6K

Goldman Sachs

GS

184.17

-0.74%

1.0K

Exxon Mobil Corp

XOM

86.24

-0.76%

19.4K

JPMorgan Chase and Co

JPM

58.70

-0.78%

5.4K

The Coca-Cola Co

KO

40.11

-1.13%

12.8K

Microsoft Corp

MSFT

46.05

-1.33%

90.3K

-

13:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Caterpillar (CAT) downgraded to Underperform from Neutral at Macquarie

General Motors (GM) downgraded to Sector Perform from Outperform at RBC Capital Markets

Microsoft (MSFT) downgraded to Underperform from Neutral at BofA/Merrill

Other:

Twitter (TWTR) target lowered to $45 from $55, maintain Buy at Evercore ISI

-

13:47

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E706mn), $1.2400(E1.0bn), $1.2410-20(E900mn), $1.2500(E1.3bn), $1.2550(E789mn)

USD/JPY: Y117.00($2.7bn), Y117.40($400mn), Y118.00($1.9bn), Y119.00($1.3bn), Y120.00($3.68bn)

EUR/JPY: Y144.80(E325mn)

GBP/USD: $1.5800(stg747mn)

EUR/GBP: stg0.7820(E829mn), stg0.7945(E453mn), stg0.7975(E501mn)

AUD/JPY: Y98.00(A$600mn)

USD/CAD: C$1.1500($340mn)

-

13:31

U.S.: Building Permits, mln, November 1035 (forecast 1050)

-

13:30

Canada: Foreign Securities Purchases, October 9.53 (forecast 5.21)

-

13:30

Canada: Manufacturing Shipments (MoM), October -0.6% (forecast -0.4%)

-

13:30

U.S.: Housing Starts, mln, November 1028 (forecast 1025)

-

13:07

Foreign exchange market. European session: the euro rose against the U.S. dollar due to the positive data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:15 Australia RBA Assist Gov Debelle Speaks

00:30 Australia RBA Meeting's Minutes

01:35 Japan Manufacturing PMI (Preliminary) December 52.0 52.3 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) December 50.0 49.8 49.5

07:00 United Kingdom Bank Stress Test Results

07:00 United Kingdom BOE Financial Stability Report

07:00 United Kingdom Publication of the Systemic Risk Survey

07:58 France Manufacturing PMI (Preliminary) December 48.4 48.7 47.9

07:58 France Services PMI (Preliminary) December 47.9 48.6 49.8

08:28 Germany Manufacturing PMI (Preliminary) December 49.5 50.4 51.2

08:28 Germany Services PMI (Preliminary) December 52.1 52.6 51.4

08:58 Eurozone Manufacturing PMI (Preliminary) December 50.1 50.5 50.8

08:58 Eurozone Services PMI (Preliminary) December 51.1 51.6 51.9

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:30 United Kingdom Retail Price Index, m/m November 0.0% +0.1% -0.2%

09:30 United Kingdom Retail prices, Y/Y November +2.3% +2.3% +2.0%

09:30 United Kingdom RPI-X, Y/Y November +2.4% +2.0%

09:30 United Kingdom Producer Price Index - Input (MoM) November -1.5% -1.1% -1.0%

09:30 United Kingdom Producer Price Index - Input (YoY) November -8.4% -8.3% -8.8%

09:30 United Kingdom Producer Price Index - Output (MoM) November -0.3% -0.3% +0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) November -0.5% -0.2% -0.1%

09:30 United Kingdom HICP, m/m November +0.1% +0.1% -0.3%

09:30 United Kingdom HICP, Y/Y November +1.3% +1.2% +1.0%

09:30 United Kingdom HICP ex EFAT, Y/Y November +1.5% +1.5% +1.2%

10:00 Eurozone ZEW Economic Sentiment December 11.0 20.1 10.0

10:00 Eurozone Trade Balance s.a. October 17.9 18.2 19.4

10:00 Germany ZEW Survey - Economic Sentiment December 11.5 19.8 34.9

10:45 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. economic data. Housing starts in the U.S. are expected to rise to 1.025 million units in November from 1.009 million units in October.

The number of building permits is expected to increase to 1.050 million units in November from1.080 million in October.

The U.S. preliminary manufacturing purchasing managers' index is expected to climbs to 56.1 in December from 54.8 in November.

The euro rose against the U.S. dollar due to the positive data from the Eurozone. Germany's ZEW economic sentiment index increased to 34.9 in December from 11.5 in November, exceeding expectations for a rise to 19.8. That was the highest reading since May 2014.

Eurozone's ZEW economic sentiment index fell to 10.0 in December from 11.0 in October, missing expectations for a gain to 20.1.

Eurozone's trade surplus widened to €19.4 billion in October from €17.9 billion in September, exceeding expectations for a rise to €18.2 billion. September's figure was revised up from a surplus of €17.7 billion.

Eurozone's preliminary manufacturing PMI increased to 50.8 in December from 50.1 in November, exceeding expectations for a rise to 50.5.

Eurozone's preliminary services PMI rose to 50.9 in December from 51.1 in November. Analysts had expected the index to climb to 51.6

Germany's preliminary manufacturing PMI increased to 51.2 in December from 49.5 in November, beating forecasts of an increase to 50.4.

Germany's preliminary services PMI fell to 51.4 in December from 52.1 in November, missing expectations for a gain to 52.6.

France's preliminary manufacturing PMI dropped to 47.9 in December from 48.4 in November, missing forecasts of a rise to 48.7.

France's preliminary services PMI climbed to 49.8 in December from 47.9 in November, exceeding expectations for a gain to 48.6.

The British pound increased against the U.S. dollar after the mixed economic data from the U.K. The U.K. consumer price index declined to an annual rate of 1.0% in November from 1.3% in October. Analysts had expected the consumer price inflation to decrease to 1.2%.

Consumer price inflation excluding food, energy, alcohol, and tobacco decreased to 1.2% in November from 1.5% in October. Analysts had expected the consumer inflation to remain at 1.5%.

The Bank of England's inflation target is about 2%.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian economic data. Canada's manufacturing shipments are expected to decrease 0.4% in October, after a 2.1% rise in September.

Foreign securities purchases in Canada are expected to rise by C$5.21 billion in October, after a C$4.37 increase in September.

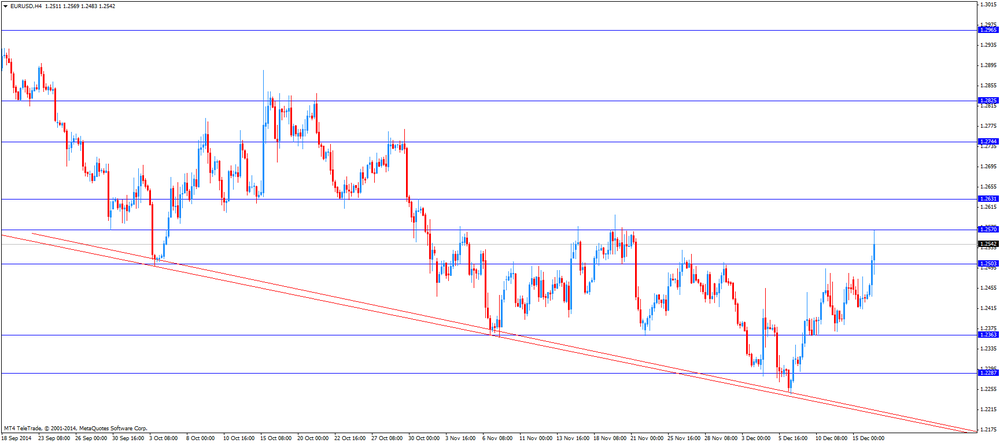

EUR/USD: the currency pair rose to $1.2569

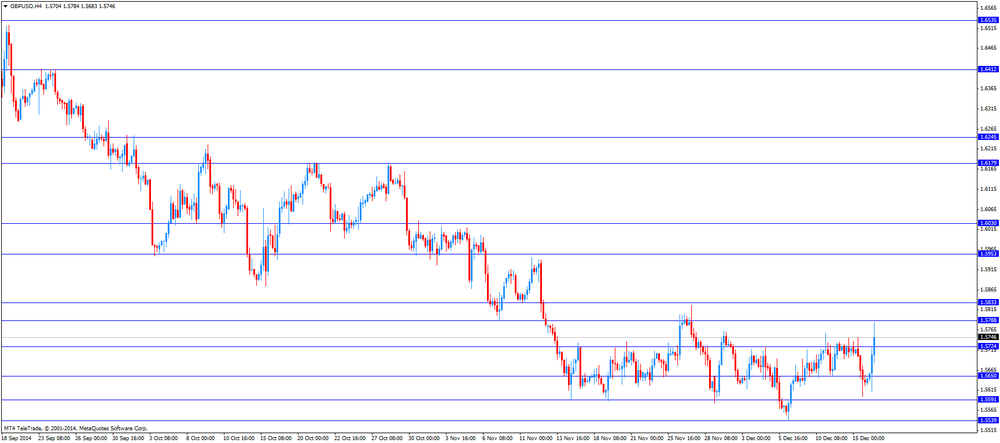

GBP/USD: the currency pair increased to $1.5784

USD/JPY: the currency pair fell to Y115.56

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) October +2.1% -0.4%

13:30 Canada Foreign Securities Purchases October 4.37 5.21

13:30 U.S. Housing Starts, mln November 1009 1025

13:30 U.S. Building Permits, mln November 1080 1050

14:45 U.S. Manufacturing PMI (Preliminary) December 54.8 56.1

21:45 New Zealand Current Account Quarter III -1.07 -5.32

23:50 Japan Adjusted Merchandise Trade Balance, bln November -977.5 -990.0

-

13:00

Orders

EUR/USD

Offers $1.2600, $1.2580/85, $1.2550

Bids $1.2485/75, $1.2445/40, $1.2415/10, $1.2385-80

GBP/USD

Offers $1.5800, $1.5780/85, $1.5760/65

Bids $1.5600, $1.5520

AUD/USD

Offers $0.8400, $0.8375/80, $0.8350, $0.8300

Bids $0.8200, $0.8180, $0.8150

EUR/JPY

Offers Y147.00, Y146.50, Y146.20/25

Bids Y145.45/40, Y145.00, Y144.50, Y144.20/00

USD/JPY

Offers Y118.20, Y118.00. Y117.50, Y117.00/20

Bids Y116.00, Y115.50

EUR/GBP

Offers stg0.8100, stg0.8066, stg0.8020

Bids stg0.7800

-

12:38

Germany's ZEW economic sentiment index climbed to 34.9 in December

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 34.9 in December from 11.5 in November, exceeding expectations for a rise to 19.8. That was the highest reading since May 2014.

The ZEW President Clemens Fuest said that "confidence in the German economy seems to be slowly returning". The improvement of sentiment was driven by a weak euro and falling oil prices, Fuest noted.

The ZEW president pointed out that "the current optimism is fuelled by factors that might change even over the short term".

Eurozone's ZEW economic sentiment index fell to 10.0 in December from 11.0 in October, missing expectations for a gain to 20.1.

-

12:25

United Kingdom: Bank of England Governor Mark Carney: Rout in emerging markets pose risk to core markets

In his speech today Bank of England Governor Mark Carney said that the fall in oil prices was positive for Britain's economy but it's impact on inflation has to be monitored by the bank. He further stated that the selloff in the emerging markets could have a negative impact in on growth in core markets. The weakening global economic outlook poses a threat to U.K.'s financial stability.

-

12:05

European stock markets mid-session: European indices are trading mixed

In today's session the FTSE 100 index added +0.69% quoted at 6,225.63 points whereas France's CAC 40 lost -0.22% trading at 3,996.50. Germany's DAX 30 is up +0.25% at 9,357.46 points as the ZEW economic sentiment index rose for a second consecutive month beating forecasts with a reading of 34.9. Analysts predicted an increase from 11.5 in November to 19.8. Eurozone's ZEW sentiment declined from 11 in November to 10 in December falling short of expectations for 20.1. Eurozone's Trade Balance improved from 17.7 to 19.4. Mixed PMI's in Germany, France and the Eurozone and falling oil prices added to a negative sentiment earlier in the session. United Kingdom's inflation rose at the slowest pace since 2002 in November.

-

11:25

Oil: Brent Crude below $60

Brent crude and West Texas Intermediate are trading at new lows. Brent Crude lost -2.88%, currently trading at USD59.30 a barrel. Crude slipped below the 60 dollar mark, its lowest since May 2009. West Texas Intermediate declined -2.56% currently quoted at USD54.48, a new five-year low. OPEC's decision taken on November 27th in Vienna to not cut output rates to fight for market shares weighs on prices. Crude almost lost 45% this year amid concerns about global economic growth and cooling demand. Yesterday United Arab Emirates energy minister said that the OPEC will not trim production while other producers continue to expand. Data on China's slowing Factory Output put further pressure on prices.

-

11:00

Gold prices recover after yesterday’s slide

Gold prices recover after yesterday's drop, the biggest one-day loss in 2014 sliding to USD1,190.30. The precious metal is currently quoted at USD1,198.00 or +0,36% a troy ounce. Market participants are awaiting the result of the FED's two-day meeting starting today to assess the timing of a benchmark interest rate hike. Experts specializing in the projections of US policy, note that the Fed could remove the phrase "extended period" and replace it with the phrase about the slow rate increase, depending on the incoming data. However, to not reach the target level of inflation in the United States could force the monetary authorities to remain faithful to the formulation of the long-term.

GOLD currently trading at USD1,198.00

-

10:40

United Kingdom: inflation rises at slowest pace since 2002

Today BoE said the weakened global economic outlook and low growth are a threat to U.K.'s financial stability. There is a danger that investors question the sustainability in debt as the economies in the Eurozone and Asia deteriorate and a low inflation could result in lower growth and increase the burden of existing debts. Risks in U.K.'s housing market have not increased since June but high household indebtedness poses a risk.

The results of a stress test showed that the Royal Bank of Scotland and Lloyds Banking Group barely passed, the Co-Operative Bank Plc failed. All other banks passed the test. BoE Governor Mark Carney said the results show that the banks have the strength to serve the real economy - even in times of severe stress.

A set of key U.K. data was published at 09:30 GMT. The Retail Price Index declined by -0.2% in November from prior 0.0% and predicted +0.1%. On a yearly basis it declined to +2.0%. The RPI-X that excludes the volatile energy cost and food items, declined by 0.4% to + 2.0%. The Producer Price Index - Input, that reflects the inflationary pressures from manufacturers on the economy declined by -1.0%. on a monthly basis - less than the predicted -1.1%, year on year -8-8%. Analysts forecasted a decline by -8.3%. The Producer Price Index - Output Index rose +0.2%, beating forecasts predicting a decline by -0.3%. The HICP slowed to 1.0% last month from 1.3% in November year on year. It was the lowest rate of inflation since September 2002 and was below forecasts of 1.2%. On a monthly basis the index declined to -0.3%, 0.4% below forecasts and below the reading of +0.1% in the previous month. The HICP ex EFAT (that excludes the volatile energy cost and food items) slowed to +1.2%, not meeting forecast of +1.5%.

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.2300(E706mn), $1.2400(E1.0bn), $1.2410-20(E900mn), $1.2500(E1.3bn), $1.2550(E789mn)

USD/JPY: Y117.00($2.7bn), Y117.40($400mn), Y118.00($1.9bn), Y119.00($1.3bn), Y120.00($3.68bn)

EUR/JPY: Y144.80(E325mn)

GBP/USD: $1.5800(stg747mn)

EUR/GBP: stg0.7820(E829mn), stg0.7945(E453mn), stg0.7975(E501mn)

AUD/JPY: Y98.00(A$600mn)

USD/CAD: C$1.1500($340mn)

-

10:00

Germany: ZEW Survey - Economic Sentiment, December 34.9 (forecast 19.8)

-

10:00

Eurozone: ZEW Economic Sentiment, December 10.0 (forecast 20.1)

-

10:00

Eurozone: Trade Balance s.a., October 19.4 (forecast 18.2)

-

09:32

United Kingdom: Producer Price Index - Output (MoM), November +0.2% (forecast -0.3%)

-

09:32

United Kingdom: Producer Price Index - Output (YoY) , November -0.1% (forecast -0.2%)

-

09:32

United Kingdom: Retail Price Index, m/m, November -0.2% (forecast +0.1%)

-

09:32

United Kingdom: Retail prices, Y/Y, November +2.0% (forecast +2.3%)

-

09:31

United Kingdom: HICP ex EFAT, Y/Y, November +1.2% (forecast +1.5%)

-

09:31

United Kingdom: Producer Price Index - Input (MoM), November -1.0% (forecast -1.1%)

-

09:31

United Kingdom: Producer Price Index - Input (YoY) , November -8.8% (forecast -8.3%)

-

09:30

United Kingdom: HICP, m/m, November -0.3% (forecast +0.1%)

-

09:30

United Kingdom: HICP, Y/Y, November +1.0% (forecast +1.2%)

-

09:20

Press Review: Ruble Fails to Sustain Gains After Surprise Russia Rate Increase

REUTERS

Gold edges up after worst day in a year, Fed eyed

SINGAPORE, Dec 16 (Reuters) - Gold edged higher on Tuesday, aided by a softer dollar, after falling more than 2 percent in the prior session in its deepest slide in over a year following a sustained slump in oil prices.

Apart from oil, investors are eyeing the Federal Reserve's two-day policy meeting which kicks off on Tuesday for clues on the timing of an increase in U.S. interest rates.

The U.S. economy has strengthened and jobs have been created at a faster-than-expected clip since the Fed's last meeting in October, when it reiterated that benchmark rates were unlikely to rise for a "considerable time".

Source: http://www.reuters.com/article/2014/12/16/markets-precious-idUSL3N0U016U20141216

BLOOMBERG

Ruble Fails to Sustain Gains After Surprise Russia Rate Increase

The ruble failed to sustain its biggest advance in 16 years in a sign slumping oil is outweighing Russia's attempt to defuse a currency crisis with the largest interest-rate increase since 1998.

The ruble erased a gain of as much as 10.8 percent, trading 0.3 percent lower at 64.6320 a dollar by 11:42 a.m. in Moscow, following a surprise Bank of Russia decision to take its key interest rate to 17 percent from 10.5 percent. Ten-year government bond yields jumped more than two percentage points to cross 15 percent for the first time.

BLOOMBERG

Why 1998 Was Different, and Same, to Emerging-Market Crisis Now

Oil prices were tanking. Emerging-market currencies were in a freefall. Venezuela was mired in a financial crisis and Russia had sunk into a debt default and devaluation.

The year was 1998.

Emerging markets today look a lot like they did back then. Yet there have been key changes that could help most of them escape full-blown crises. Here's a look at the similarities and differences between now and then.

-

09:08

European Stocks. First hour: European indices continue to decline on mixed data

European indices continued to weaken on mixed PMI data from France and Germany. Frances Manufacturing PMI for December declined to 47.9 not meeting expectations. Analyst's forecasted 48.7. The Services PMI was better-than expected, reading 49.8, beating estimates by 1.2. Germany's Manufacturing PMI beat estimates by 0.8 with a reading of 51.2 whereas the Services PMI declined to 51.4 from previous 52.1. Forecasters predicted an increase to 52.6. The Manufacturing PMI for the Eurozone beat estimates by 0.3 with a reading of 50.8. The Services PMI added 0.7 to 50.8. Analysts predicted the index to rise by only 0.4. Weaker PMI data from China also weighed on the markets fuelling fears of an economic cool down.

Markets await the speech of BoE Governor Carney taking place at 09:00 GMT, U.K.'s PPI and HICP data and Eurozone's and Germany's ZEW Economic Sentiment at 10:00 GMT.

The FTSE 100 index is currently trading -0.41% quoted at 6,157.17 points, Germany's DAX 30 lost -0.79% trading at 9,260.09. France's CAC 40 declined by --0.67%, currently trading at 3,978.71 points.

-

09:00

Eurozone: Manufacturing PMI, December 50.8 (forecast 50.5)

-

09:00

Eurozone: Services PMI, December 51.9 (forecast 51.6)

-

08:30

Germany: Manufacturing PMI, December 51.2 (forecast 50.4)

-

08:30

Germany: Services PMI, December 51.4 (forecast 52.6)

-

08:00

France: Manufacturing PMI, December 47.9 (forecast 48.7)

-

08:00

France: Services PMI, December 49.8 (forecast 48.6)

-

08:00

Global Stocks: Indices weighed down by oil prices and growth concerns

U.S. markets were trading lower on Monday on mixed U.S. data and falling oil prices. The DOW JONES lost -0.58% closing at 17,180.84 points, the S&P 500 declined -0.63%, with a final quote of 1,989.63 points. The U.S. industrial production increased 1.3% in November, exceeding expectations for a 0.8% rise, after a 0.1% gain in October. That was the highest rise since May 2010. October's figure was revised up from a 0.1% decrease. The NAHB housing market index fell to 57.0 in December from 58.0 in November, missing expectations for a rise to 59.0. The NY Fed Empire State manufacturing index dropped to -3.6 in November from 10.2 in October. That was the first negative reading since January 2013. Analysts had expected the index to rise to 12.1. Analysts had expected the index to rise to 12.1. Markets now look ahead to the final policy meeting of the FED in 2014 taking place today and tomorrow.

Chinese stocks added gains while trading in Hong Kong was negative. Hong Kong's Hang Seng is trading -1.25% at 22,740.63. China's Shanghai Composite closed at 3,021.26 points, a gain of +2.30% surpassing the 3,000 points mark. With the Chinese PMI falling below 50 market participants expect further stimulus measures from the PBoC.

Japan's Nikkei lost -2.01% closing at 16,755.32 as declining oil prices and concerns over global economic growth boosted the Japanese yen as a safe haven and put pressure on exporter stocks. The Nikkei closed at its lowest since the surprise stimulus of the BoJ on October 31st.

-

07:30

Foreign exchange market. Asian session: U.S. dollar trading broadly weeker

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:15 Australia RBA Assist Gov Debelle Speaks

00:30 Australia RBA Meeting's Minutes

01:35 Japan Manufacturing PMI (Preliminary) December 52.0 52.3 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) December 50.0 49.8 49.5

07:00 United Kingdom Bank Stress Test Results

07:00 United Kingdom BOE Financial Stability Report

07:00 United Kingdom Publication of the Systemic Risk Survey

The greenback traded weaker against its major peers but could see some support as the two day policy meeting of the FED starts today and U.S. policy makers could open the door for an interest rate hike in the middle of next year. Markets await U.S. Housing starts, building permits and the Manufacturing PMI published from 13:30 to 14:45 GMT.

The Australian dollar hit a four year low after the Chinese HSBC Manufacturing PMI showed that activity in the factory sector declined but the aussie recovered later in the session. The currency was under further pressure after the minutes of the RBA's December meetings stated that the aussie has to weaken in order to achieve balanced growth and that the Australian dollar is overvalued given the significant declines in commodity prices in the last months. The RBA is going to keep the rates stable for a period.

New Zealand's dollar traded positive to stable against the greenback currently quoted at USD0.7755. Markets are looking forward to the release of the Current Account data late in the day and GDP data on Wednesday.

The Japanese yen continued to rise to a five-week high against in the U.S. dollar as investors are seeking for a safe haven after stocks and oil declined. Japan's preliminary Manufacturing PMI for December was below expectations at 49.5 compared to 50 in November and analysts' forecasts of 49.8.

EUR/USD: the euro added against the greenback

USD/JPY: the U.S. dollar traded weaker against the yen

GPB/USD: The British pound traded stronger against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:58 France Manufacturing PMI (Preliminary) December 48.4 48.7

07:58 France Services PMI (Preliminary) December 47.9 48.6

08:28 Germany Manufacturing PMI (Preliminary) December 49.5 50.4

08:28 Germany Services PMI (Preliminary) December 52.1 52.6

08:58 Eurozone Manufacturing PMI (Preliminary) December 50.1 50.5

08:58 Eurozone Services PMI (Preliminary) December 51.1 51.6

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:30 United Kingdom Retail Price Index, m/m November 0.0% +0.1%

09:30 United Kingdom Retail prices, Y/Y November +2.3% +2.3%

09:30 United Kingdom RPI-X, Y/Y November +2.4%

09:30 United Kingdom Producer Price Index - Input (MoM) November -1.5% -1.1%

09:30 United Kingdom Producer Price Index - Input (YoY) November -8.4% -8.3%

09:30 United Kingdom Producer Price Index - Output (MoM) November -0.3% -0.3%

09:30 United Kingdom Producer Price Index - Output (YoY) November -0.5% -0.2%

09:30 United Kingdom HICP, m/m November +0.1% +0.1%

09:30 United Kingdom HICP, Y/Y November +1.3% +1.2%

09:30 United Kingdom HICP ex EFAT, Y/Y November +1.5% +1.5%

10:00 Eurozone ZEW Economic Sentiment December 11.0 20.1

10:00 Eurozone Trade Balance s.a. October 17.7 18.2

10:00 Germany ZEW Survey - Economic Sentiment December 11.5 19.8

10:45 United Kingdom BOE Gov Mark Carney Speaks

13:30 Canada Manufacturing Shipments (MoM) October +2.1% -0.4%

13:30 Canada Foreign Securities Purchases October 4.37 5.21

13:30 U.S. Housing Starts, mln November 1009 1025

13:30 U.S. Building Permits, mln November 1080 1050

14:45 U.S. Manufacturing PMI (Preliminary) December 54.8 56.1

21:30 U.S. API Crude Oil Inventories December +4.4

21:45 New Zealand Current Account Quarter III -1.07 -5.32

23:30 Australia Leading Index November 0.0%

23:50 Japan Adjusted Merchandise Trade Balance, bln November -977.5 -990.0

-

06:29

Options levels on tuesday, December 16, 2014:

EUR / USD

Resistance levels (open interest**, contracts)

$1.2559 (3336)

$1.2518 (1734)

$1.2489 (346)

Price at time of writing this review: $ 1.2457

Support levels (open interest**, contracts):

$1.2394 (769)

$1.2359 (1587)

$1.2335 (2084)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 51012 contracts, with the maximum number of contracts with strike price $1,2500 (6971);

- Overall open interest on the PUT options with the expiration date January, 9 is 55740 contracts, with the maximum number of contracts with strike price $1,2000 (7913);

- The ratio of PUT/CALL was 1.09 versus 1.14 from the previous trading day according to data from December, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1685)

$1.5804 (1748)

$1.5708 (2756)

Price at time of writing this review: $1.5659

Support levels (open interest**, contracts):

$1.5590 (1016)

$1.5494 (994)

$1.5396 (835)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 22236 contracts, with the maximum number of contracts with strike price $1,5850 (3971);

- Overall open interest on the PUT options with the expiration date January, 9 is 17536 contracts, with the maximum number of contracts with strike price $1,5200 (1618);

- The ratio of PUT/CALL was 0.79 versus 0.97 from the previous trading day according to data from December, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:30

Nikkei 225 16,798.43 -300.97 -1.76%, Hang Seng 22,886.78 -141.07 -0.61%, Shanghai Composite 2,953.81 +0.39 +0.01%

-

01:45

China: HSBC Manufacturing PMI, December 49.5 (forecast 49.8)

-

01:36

Japan: Manufacturing PMI, December 52.1 (forecast 52.3)

-