Notícias do Mercado

-

23:53

WTI Price Analysis: Bounces off key support confluence around $84.50

- WTI rebounds from a fortnight low to snap four-week downtrend.

- 100-SMA, two-week-old support line restricts immediate downside amid sluggish oscillators.

- Buyers need validation from a convergence of previous support, weekly resistance trend lines.

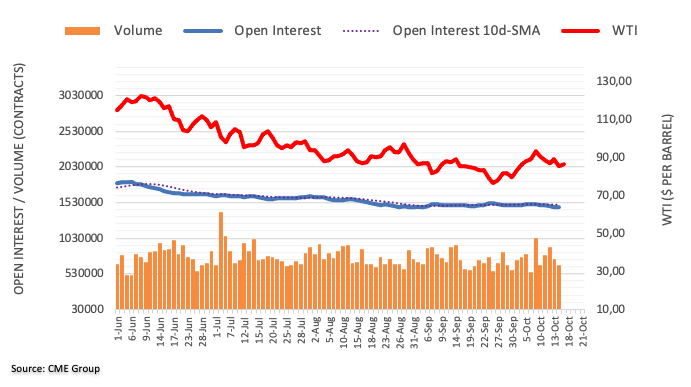

WTI crude oil prices keep recovering from the $84.50 support, around $84.90 during Tuesday’s Asian session. In doing so, the black gold snaps a four-week downtrend while bouncing off the convergence of a 100-SMA and a two-week-old descending trend line.

It should, however, be noted that the sluggish RSI and MACD challenge the WTI buyers as they poke the 200-SMA hurdle, around $85.00 by the press time.

Even if the black gold crosses the $95.00 SMA resistance, a confluence of the one-week-old descending trend line and the support-turned-resistance line from September 26, around $87.00, will be a major challenge for the bulls.

Should the quote manage to stay firmer past $87.00, the monthly peak of $92.63 should gain the market’s attention.

Alternatively, a downside break of the $84.50 support could quickly drag the WTI crude oil prices toward the September 30 swing high near $82.50.

Following that, the early September low near $80.90 and the $80.00 threshold may entertain the oil bears before directing them to the previous monthly low of $76.08.

WTI: Four-hour chart

Trend: Limited recovery expected

-

23:48

NZD/USD advances steadily around 0.5640s post-hot NZ CPI

- NZD/USD jumped 30 pips on the release of New Zealand’s inflation, surpassing expectations.

- NZ hot inflation justifies further RBNZ’s rate hikes.

- US NY Empire State Manufacturing Index for October fell more than estimated, at -9.1 vs. -1.5.

The NZD/USD advances as the Asian session begins, following the release of New Zealand’s inflation, jumping more than estimates, propelling the major towards a fresh weekly high at 0.5659, extending its gains amid an upbeat mood. At the time of writing, the NZD/USD is trading at 0.5640, above its opening price by 0.17%.

NZD/USD marches firmly, following New Zealand’s high inflation report

Statistics of New Zealand reported that inflation rose by 2.2% QoQ, above estimates of 1.5%, exceeding the previous quarter’s reading. Of note, the annually-based reading came at 7.2%, above 6.5% YoY estimates, cementing the RBNZ’s case for further tightening.

Analysts at ANZ bank expected CPI to ease to 6.6% and foresaw that the RBNZ Overnight Cash Rate (OCR) would continue on its way to peak at around 4.75% in May 2023.

Aside from this, Asian equity futures are set to open higher, bolstered by US equities, which recorded solid gains, as traders’ mood turned positively following UK’s finance minister Jeremy Hunt, who acted quickly, scrapping his predecessor Kwarteng GBP 45 billion tax cut mini-budget sparked Gilts turmoil. On Monday, Gilts rose, while the GBP/USD rallied more than 200 pips, also a tailwind for NZD/USD.

In the meantime, the US Dollar Index dropped more than 1%, down to 112.065, as the British pound recovery lifted most G8 currencies, a headwind for the buck.

Elsewhere, Fed policymakers, in the last week, kept their hawkish posture, reiterating their commitment to tackling stubbornly high inflation, following a hot US inflation report, particularly core CPI, reaching a 40-year peak above 6.6% YoY.

Data-wise, the US economic calendar featured the US New York Fed Empire State Manufacturing Index for October, which contracted 9.1, vs. a 1.5 drop estimated.

NZD/USD Price Forecast

Therefore, the NZD/USD remains downward biased unless it clears the October 6 cycle high at 0.5813, which could open the door for further upside, exposing key resistance levels at 0.5900, followed by the 100-day EMA at 0.5958, ahead of the 0.6000 figure. On the flip side, a break under 0.5600 will open the door for a YTD low test at 0.5512.

NZD/USD Key Technical Levels

-

23:36

GBP/USD bulls take a breather at fortnight top, retreats to 1.1350 with eyes on UK politics

- GBP/USD remains sidelined after refreshing a two-week high.

- UK Chancellor’s dramatic U-turn on “mini-budget” renews market sentiment, propels the Pound.

- Risk-on mood, downbeat US data trigger US dollar pullback amid light calendar.

GBP/USD pares recently gains around a two-week high, easing back to 1.1350 during early Tuesday in Asia after an upbeat start to the week as bulls seek confirmation of the latest optimism surrounding the UK economy.

That said, the Cable pair renewed the multi-day top the previous day after British Finance Minister’s, also called Chancellor, reversal of earlier policy announcement boosted the market’s hope that London will overcome the impending market collapse. “Under the new policy, most of Truss's 45 billion pounds of unfunded tax cuts will go and the two-year energy subsidy scheme for households and businesses - expected to cost well over 100 billion pounds - will now be curtailed in April,” stated Reuters.

Other than the political plays, the Bank of England’s (BOE) readiness for debt buybacks, starting November 07, also adds strength to the GBP/USD.

On the other hand, the US dollar had to bear the burden of the market’s risk-on mood, as well as downbeat US data.

That said, Wall Street closed positive and the yields were mildly bid amid the broad market optimism despite a light calendar on Monday. Talking about the data, NY Empire State Manufacturing Index for October dropped -9.5 versus -4.0 expected and -1.5 prior.

Looking ahead, GBP/USD buyers will need more positives to defend the latest recovery otherwise hawkish Fed bets and recession fears could easily recall the bears.

Technical analysis

Failure to provide a daily close beyond the five-week-old resistance line, around 1.1370 by the press time, favors GBP/USD pullback towards the 21-DMA support, close to 1.1145 at the latest.

-

23:25

AUD/USD sees an establishment above 0.6300 on cheerful market mood, RBA minutes eyed

- AUD/USD is aiming to shift the auction above 0.6300 amid an absence of a risk aversion theme.

- S&P500 witnessed a V-shape recovery after nose-diving on Friday, while yields are upbeat.

- The release of the RBA minutes will remain in focus.

The AUD/USD pair has concluded its time corrective move after dropping to near 0.6280 in the early Tokyo session. The asset is aiming to sustain above the immediate hurdle of 0.6300 amid an improvement in the risk appetite of the market participants. A significant drop in safe-haven’s appeal resulted in a steep fall in the US dollar index (DXY). The mighty DXY tumbled to near 112.00 as investors parked their funds into the risk-perceived assets.

S&P500 witnessed a V-shape recovery after nose-diving on Friday. While yields are upbeat as the odds of a hawkish monetary policy by the Federal Reserve (Fed) are rock solid. The 10-year US Treasury yields are confidently sustaining above the critical figure of 4%.

On Tuesday, investors' focus will remain on the release of the Reserve Bank of Australia (RBA) minutes. The market participants will get a detailed explanation of a decline in the pace of hiking interest rates by RBA Governor Philip Lowe. It is worth noting that RBA announced a 25 basis point (bps) hike in the Official Cash Rate (OCR), unlike the spell of a 50 bps rate hike.

Adding to that, the economic fundamentals and monetary policy guidance will be of utmost importance.

Later this week, Australian employment data will be the key event, which will release on Thursday. As per the consensus, the Employment Change will drop to 25k vs. the prior release of 33.5k. While the Unemployment Rate will remain steady at 3.5%. As the economy is maintaining full employment levels, the increment in payroll data may continue at a diminishing rate.

-

23:11

AUD/NZD renews five-week low around 1.1100 on strong New Zealand Inflation, RBA Minutes eyed

AUD/NZD remains pressured at five-week low after the firmer NZ data.

New Zealand Q3 CPI rose 2.2% versus 1.6% expected and 1.7% prior.

Risk-on mood defend buyers even as firmer NZ inflation teases bears.

RBA Minutes will be important due to the surprise 0.25% rate hike.

AUD/NZD takes offers to renew a five-week low around 1.1135 after New Zealand Statistics released the quarterly Consumer Price Index (CPI) data early Tuesday morning in Asia. In doing so, the cross-currency pair fails to justify the market’s risk-on mood ahead of the key Reserve Bank of Australia (RBA) Meeting Minutes.

New Zealand’s third quarter (Q3) CPI rose to 2.2% compared to the 1.6% market forecast and 1.7% prior. The details also mentioned that the YoY CPI increased to 7.2% versus the 6.6% expected and 7.3% prior.

The jump in the inflation data ignored the easing in the oil prices during the Q3, which in turn allows the Reserve Bank of New Zealand (RBNZ) hawks to keep the reins and propel the New Zealand dollar (NZD).

It should be noted, however, that the week-start risk-on mood challenges the pair’s downside, together with the cautious mood ahead of the RBA Minutes.

To state the catalysts, optimism that Jeremy Hunt will safeguard the UK economy and China will be able to overcome the recession woes seemed to have favored the market’s relief the previous day. On the same line could be the softer NY Empire State Manufacturing Index for October, down to -9.5 versus -4.0 expected and -1.5 prior.

That said, the AUD/NZD should wait for the RBA Minutes for fresh clues to the policymakers’ latest decision to surprise the markets by only a 0.25% rate hike. Should the update appear dovish, the quote has more to lose.

Technical analysis

AUD/NZD bears attack the 100-DMA key support, near 1.1420 by the press time, a break of which will direct prices towards 1.1115.

-

23:01

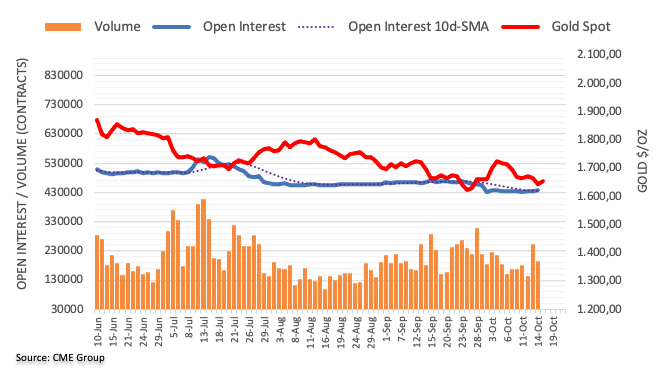

Gold Price Forecast: XAU/USD builds cushion around $1,650, hawkish Fed fears remain elevated

- Gold price has picked bids around the $1,650.00 support as DXY sees more pressure.

- Strong yields brought sheer weakness in the gold prices after a pullback.

- Upbeat US NFP is delighting the Fed to hike interest rates unhesitatingly.

Gold price (XAU/USD) is witnessing some buying interest around $1,650.00 despite soaring bets for bigger rate hikes by the Federal Reserve (Fed). On Monday, the precious metal eased the majority of the gains despite mayhem in the US dollar index (DXY). The DXY dropped to near the round-level cushion of 112.00 as the risk-on impulse gained significant traction. S&P500 advanced vertically and recovered Friday’s losses.

Soaring yields backed by advancing certainty of policy tightening by the Fed resulted in a steep fall in gold prices. The 10-year US Treasury yields sustain above 4%. A divergence in price action from the DXY and yields kept the gold prices in the bush of bears and risk-perceived currencies in the bullish trajectory.

Higher-than-projected Consumer Price Index (CPI), released last week, and September’s better-than-expected Nonfarm Payrolls (NFP) data are compelling the Fed to sound hawkish and continue the current pace of hiking interest rates.

Meanwhile, commentary from Societe Generale carries a bearish view on gold for a tad longer period. “In the past, we have observed that gold seems to correlate well with three factors – US real rates, the dollar, and ETF flows (regression r-squared of almost 95%). However, the price of gold has remained quite elevated compared to the theoretical value yielded by our models.”

“If real rates remain elevated for the foreseeable future, one of the assets that could come under pressure is gold.”

Gold technical analysis

On an hourly scale, the gold prices have picked significant selling pressure in several attempts of surpassing the highest auction area placed in a range of $1,661.70-1,684.50. The precious metal has dropped below the 20-period Exponential Moving Average (EMA) at $1,654.43.

The Relative Strength Index (RSI) (14) is hovering around 40.00, and a drop below the same will trigger the downside momentum.

Gold hourly chart

-

22:50

EUR/USD Price Analysis: Surpasses the 20-DMA hurdle, eyeing the 50-DMA around 0.9930

- EUR/USD climbs above 0.9830 due to an upbeat sentiment and the break of the 20-day EMA.

- The daily chart shows that the EUR/USD bias remains downwards.

- Short term, the EUR/USD hourly chart depicts the pair as upwards; it could challenge 0.9900 once RSI exits from overbought territory.

The EUR/USD advances sharply above the 0.9800f figure for the first time since October 6, courtesy of broad US dollar weakness amidst a risk-on impulse, as shown by global equities rising. The EUR/USD is trading at 0.9839, above its opening by 1.24%, distancing from the 20-day EMA.

EUR/USD Price Forecast

The EUR/USD keeps trading downwards, even though price action broke above the 20-day EMA, opening the door to test the top trendline of a descending channel drawn from February 2022 highs and also at around the 50-day EMA at 0.9925/32, which, once broken will expose the October 4 daily high at 0.9999, around parity. The break above will expose the 100-day EMA at 1.0141.

In the near term, the EUR/USD opened the week upwards, as shown by Monday’s session, closing around 0.9837. Of note, the major is trading between the daily pivot and the R1 resistance level, with the latter sitting around 0.9886, and with the Relative Strength Index (RSI) at overbought conditions, might refrain traders from opening new longs until the RSI neutralizes.

Once RSI exits from overbought, the EUR/USD first resistance would be the R1 daily pivot. Brak above will expose the 0.9900 figure, followed by the confluence of the October 5 high and the R2 daily pivot at 0.9926/40, followed by 0.9950.

EUR/USD Key Technical Levels

-

22:47

Breaking: NZ CPI 7.2% YoY, higher than expected, NZD rockets to 0.5659

Statistics New Zealand has released the third quarter Consumer Price Index inflation data as follows:

New Zealand CPI (Q/Q) Q3 2.2% (est 1.5%; prev 1.7%) - CPI (Y/Y) Q3 7.2% (est 6.5%; prev 7.3%)

NZD/USD has bolted to the upside for fresh highs on the day:

There was a lot of room for the headline CPI number to surprise on the upside or the downside which was reflected in the range of expectations for this morning’s data, from a low of 6.3% YoY to a high of 7.0% YoY (with the median estimate being 6.5%).

The data can support the prospects of rate hikes from the Reserve Bank of New Zealand and this support the bird for the foreseeable future.

The weekly template remains bullish for the day ahead but there are longs all the way from Asia and thus pullbacks onto them to be wary of. However, the data should keep them protected for the day ahead.

About NZ Consumer Price Index

With the Reserve Bank of New Zealand's (RBNZ) inflation target being around the midpoint of 2%, Statistics New Zealand’s quarterly Consumer Price Index (CPI) publication is of high significance. The trend in consumer prices tends to influence RBNZ’s interest rates decision, which in turn, heavily impacts the NZD valuation. Acceleration in inflation could lead to faster tightening of the rates by the RBNZ and vice-versa. Actual figures beating forecasts render NZD bullish.

-

22:45

New Zealand Consumer Price Index (YoY) above forecasts (6.6%) in 3Q: Actual (7.2%)

-

22:45

New Zealand Consumer Price Index (QoQ) came in at 2.2%, above expectations (1.6%) in 3Q

-

22:36

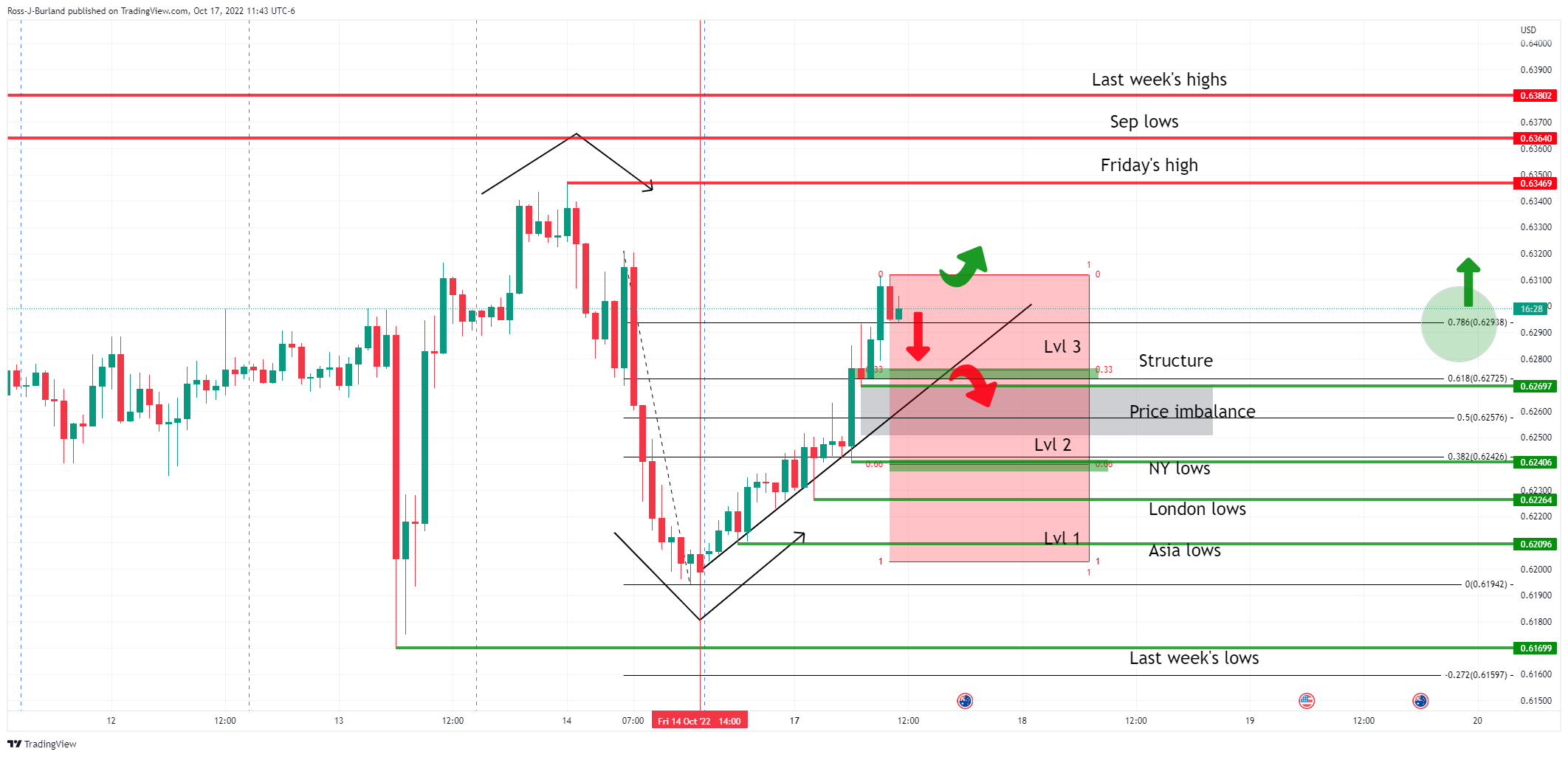

AUD/JPY Price Analysis: Bears eye a break of structure of 93.55 and 93.28, bulls eye 94.00

- AUD/JPY H1 structure is key at 93.28 as it guards the price imbalance to 93 the figure.

- A deeper move below there towards level 1 longs below 92.50.

The AUD/JPY outlook will likely be determined by today's New Zealand Consumer Price Index, at least for the immediate future. There’s a lot of room for the headline CPI number to surprise on the upside or the downside, and the antipodeans could be shaken up one way or the other.

Analysts at ANZ Bank explained that they estimate that annual CPI inflation eased to 6.6% in Q3, down from 7.3% in Q2:

The following illustrates the market structure as per the hourly time frame for AUD/JPY.

AUD/JPY H1 chart

The price is lofty above a price imbalance and three levels of rise since yesterday's open. There are a lot of longs that have been holding onto their positions which could come under pressure if the data disappoints, setting off a chain reaction of offers. The structure is key at 93.28 as it guards the price imbalance to 93 the figure and a deeper move below there towards level 1 longs below 92.50.

On the other hand, bulls eye 94.00 the figure and price imbalances higher up.

-

22:09

When is New Zealand CPI and how might it affect NZD/USD?

We have Statistics New Zealand that will be releasing the third quarter Consumer Price Index inflation data this morning in Asia. There’s a lot of room for the headline CPI number to surprise on the upside or the downside and the NZD will be at the mercy of the data today.

Analysts at ANZ Bank explained that they estimate that annual CPI inflation eased to 6.6% in Q3, down from 7.3% in Q2:

''Any fall in inflation will be of some relief for Kiwi households, but the trouble for the Reserve Bank of New Zealand is we anticipate that most of the decline in headline CPI inflation will come from a roughly 8% fall in petrol prices over the September quarter (as opposed to a broad-based reduction in domestic inflation pressures).''

''That means there’s unlikely to be much evidence that underlying inflation pressures have turned the corner yet.''

''Unless there’s a steep change in the outlook, we see the RBNZ on track to lift the OCR to a peak of 4.75% in May 2023.''

''Uncertainty remains elevated, and that’s reflected in the range of expectations for this morning’s data, from a low of 6.3% YoY to a high of 7.0% YoY (with the median estimate being 6.5%).''

How might it affect NZD/USD?

The trend in consumer prices tends to influence RBNZ’s interest rates decision, which in turn, heavily impacts the NZD valuation. Acceleration in inflation could lead to a faster tightening of the rates by the RBNZ and vice-versa. Actual figures beating forecasts render NZD bullish.

However, spreads could be wide around the event making it virtually impossible to trade. However, the price has been capped near 0.5650 on Monday and following three levels of rise.

There has been little in the way of dips along the journey so there is the case for a move into level 2 or even into Asian long positions if we don't just see a continuation trade for Tuesday. The data, however, will be a very important milestone as markets gauge how much more work the RBNZ still has ahead of them.

In terms of price action, we can cast our eyes over the prior data releases and movement on the charts as follows:

On the 15-minute time frames, we can see the price moved 44 pips down in April when the data arrived lower at 6.9 vs 7.1 expected and then 20 pips in July, when the data arrived higher at 7.3 vs 7.1 expected.

Given the lofty heights, the bird has flown on Monday, anything short of the expectations could seriously impact the currency with level 1, 0.5575 eyed on a break of level 3, 0.5622 as per the chart above.

About NZ Consumer Price Index

With the Reserve Bank of New Zealand's (RBNZ) inflation target being around the midpoint of 2%, Statistics New Zealand’s quarterly Consumer Price Index (CPI) publication is of high significance. The trend in consumer prices tends to influence RBNZ’s interest rates decision, which in turn, heavily impacts the NZD valuation. Acceleration in inflation could lead to faster tightening of the rates by the RBNZ and vice-versa. Actual figures beating forecasts render NZD bullish.

-

21:25

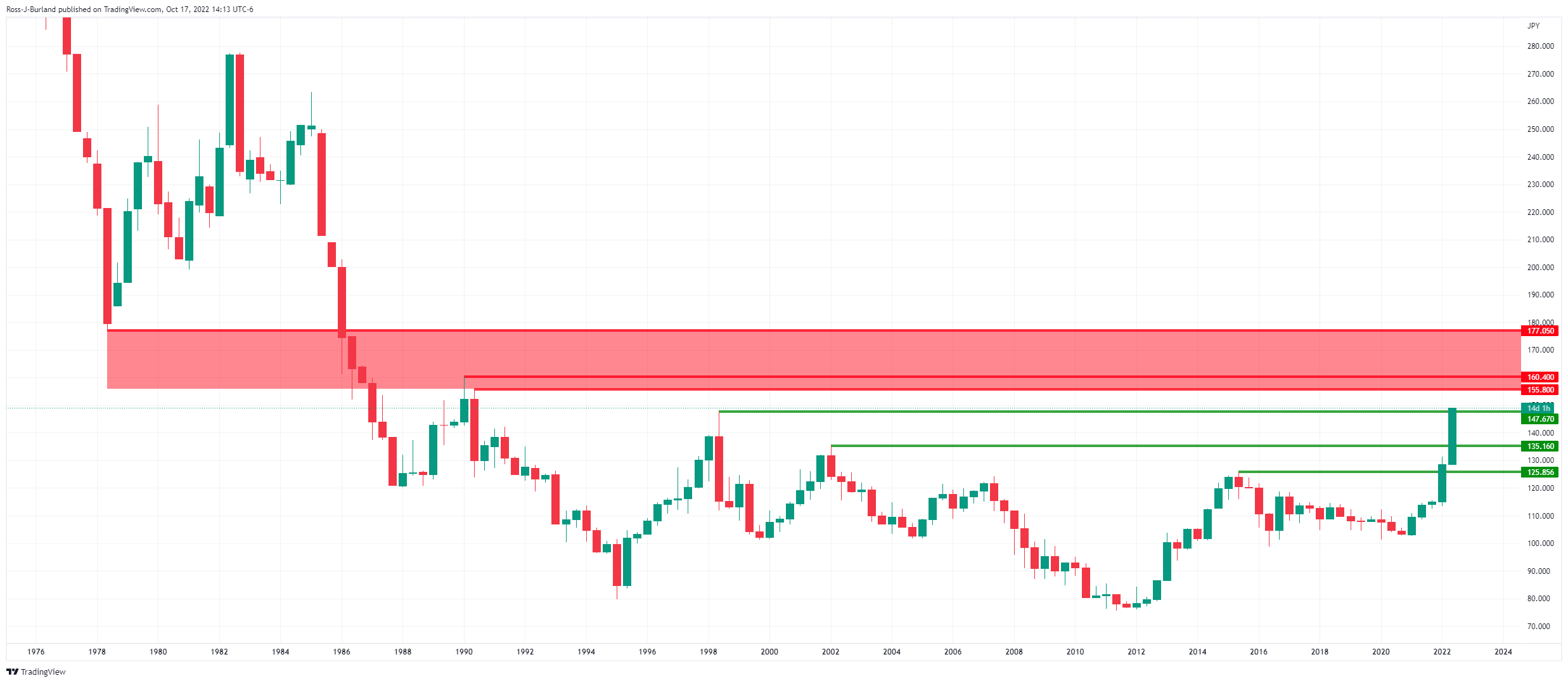

Breaking: USD/JPY pops 149.00, highest since June 1990s

- The Japanese yen hits a new 32-year low.

- Will the BoJ intervene again this week?

USD/JPY has pierced the 149.00 level as per the following 5-month chart:

The bull eye the prospects of running up to the psychological level of 150 where speculating lies for further intervention from the Japanese authorities. At the start of the week, Japan’s top currency diplomat Masato Kanda said authorities would firmly respond to any excessive currency fluctuations.

Each country would respond appropriately to an agreement on foreign exchange market moves by the Group of Seven (G7) and G20 meetings last week, he said.''

Japan's Finance Miniter Shun'ichi Suzuki has also stepped in and said that they will take decisive action against excess forex moves based on speculation. Suzuki says they are constantly watching fx movements with a sense of urgency.

The yen has declined nearly 30% against the dollar this year already as the divergence between the US Federal Reserve's hawkish stance and the Bank of Japan's ultra-lose policy. Last month, Japanese authorities conducted their largest-ever currency intervention to support the rapidly falling yen, having spent 2.84 trillion yen for its efforts which yielded a fleeting effect.

Meanwhile, the US dollar was softer against a basket of major currencies and sterling jumped on Monday after Britain's new finance minister ditched most of the government's "mini-budget", while better-than-expected earnings from Bank of America helped to boost risk appetite.

-

21:04

Copper prices decline to $3.39 on demand uncertainty

- Copper prices drop for the second consecutive day.

- Fears about a decline on Chinese demand offset the impact of supply woes.

- Copper production in Chile declined 10% in August.

Copper prices have depreciated for the second consecutive day on Monday on the COMEX market in New York, reaching $3.39 so far.

The red metal attempted to bounce up during the European morning session, favoured by the soft tone of the US dollar. Upside attempts, however, have been capped at $3.45, before giving away gains shortly afterwards and turning negative on daily charts during the US trade.

Fears about a drop in Chinese demand hit copper prices

Demand uncertainty on the back of a global economic slowdown and the increasing COVID-19 cases in China has offset the impact of supply woes. Chinese President Xi Jinping reiterated the Government’s commitment to the zero-Covid policy at the Party Committee last weekend.

Jinping’s comments triggered fears that another set of lockdowns might curb the demand for the industrial metal, which has weighed on prices.

Copper output in Chile, the world’s leading producer declined more than 10% in August.

These concerns have offset the positive impact on prices triggered by the tighter supplies and the increase on demand from China observed last week.

-

20:55

Forex Today: Dollar weaker at the beginning of the week

What you need to take care of on Tuesday, October 18:

The American dollar edged lower at the beginning of the week as news coming from the UK weighed on global government bonds and the greenback’s demand. GBP/USD surged to 1.1439, to later finish the day at around 1.1350

The new Chancellor of the Exchequer, Jeremy Hunt, announced the government would drop most of the tax-related measures announced on September 23, meant to stabilize the financial system. Prime Minister Liz Truss anticipated tax cuts and price caps on energy before becoming elected, but the British Pound collapsed after revealing her plan. The mini-budget meant to provide peace generated chaos amid funding black holes and ended up with Kwasi Kwarteng, the former Chancellor of the Exchequer, being sacked after just a couple of weeks in office. Market players reduced their bets on future rate hikes, now expecting it to total 175 bps by the end of the year.

The AUD/USD pair trades around 0.6280 after failing to retain gains above 0.6300, while USD/CAD is down to 1.3720, despite discouraging Canadian data. The Bank of Canada survey on business sentiment showed that it saw its worst drop since 2022.

USD/JPY extended its rally, now hovering around 149.00 despite Japanese Finance Minister Suzuki announcing they would respond to speculative moves while warning they are observing FX “motions.”

Gold flirted with $1,670 a troy ounce but finished the day at around $1,647, easing ahead of Wall Street’s close. Crude oil prices were under mild pressure, with WTI now trading at around $84.85 a barrel.

US government bond yields recovered ahead of the close, ending the day pretty much unchanged, despite substantial gains among US indexes.

Ripple EVM sidechain goes live for developers, XRP looking at $0.60

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:28

GBP/JPY Price Analysis: Soars to six-year highs but retraces toward the 169.00 figure

- GBP/JPY climbs sharply by more than 250 pips on Monday due to fundamental reasons.

- Negative divergence in the GBP/JPY one-hour chart opens the door for a mean reversion move.

The GBP/JPY rallies to fresh six-year highs at 170.10 due to investors’ relief on the UK’s newest Finance Minister, Jeremy Hunt, ditching Kwarteng’s mini-budget as he tries to ease the markets. Therefore, the British pound soared against most G8 currencies, particularly the yen, gaining 290 pips. At the time of writing, the GBP/JPY is trading at 169.18.

GBP/JPY Price Forecast

On Monday, the GBP/JPY surged, extending its gains towards the 170.00 figure, but profit-taking around the area weighed on the pair, retracing toward the 169.00 figure. Worth noting that the GBP/JPY is trading above the previous 2022 high, reached on June 9 at 168.04, so a daily close above it could open the door for consolidation around 169.00-170.00.

Short term, the GBP/JPY one-hour scale price action registered a series of higher highs/lows, emphasizing the upward bias. Of note, the Relative Strength Index (RSI) printed successive series of lower peaks, forming a negative divergence, opening the door for a mean-reversion move.

Therefore, the GBP/JPY first support would be the R2 daily pivot at 168.34. The break below will expose the R1 pivot at 167.28, followed by the 50-EMA at 167.17.

GBP/JPY Key Technical Levels

-

20:16

Wall Street stocks reverse Friday's blood bath

- Wall Street stocks rallied out of the gate and stayed strong throughout the day.

- UK politics, a softer US dollar and global yields helped to boost risk appetite amid strong financial's earnings.

It's been a much better day for Wall Street on Monday with the bulls charging out of the starting blocks from the get-go with pre-market prices pointing up into the open and the cash market running on risk-on sentiment. In the UK, politics were in a better place which calmed nerves in global financial markets and corporate earnings expectations were leaning bullish.

By midday, the Dow Jones Industrial Average advanced 1.8% to 30,311.95 from 29,997.62 ad up over 2%. The S&P 500 was up 2.77% to 3,681 and the Nasdaq Composite was 3.58% higher at 11,073.19. Consumer discretionary and real estate led the gainers, with all sectors in the green. in turn, risk currencies, such as the NZD, were firmer ahead of the Reserve Bank of New Zealand later today. The US dollar slid into support on the daily chart, as illustrated below, while the 10-year yield fell below 4% and tapped into its daily support structure too.

US dollar, DXY, daily chart

In terms of performers, financials were on the up with shares of Bank of America rallying some 5.3% intraday. The lender, which benefits fro higher interest rates, reported better-than-expected third-quarter results. Net interest income grew 24% to $13.77 billion, driven by higher interest rates, lower premium amortization and loan growth.

Additionally, the Bank of New York Mellon's Chief Executive Robin Vince said in a statement after posting stronger-than-anticipated performance,

"our performance benefitted from higher interest rates and continued strength in client volumes and balances across our securities services and market and wealth services segments." The giant raised its net interest revenue outlook for the full year.

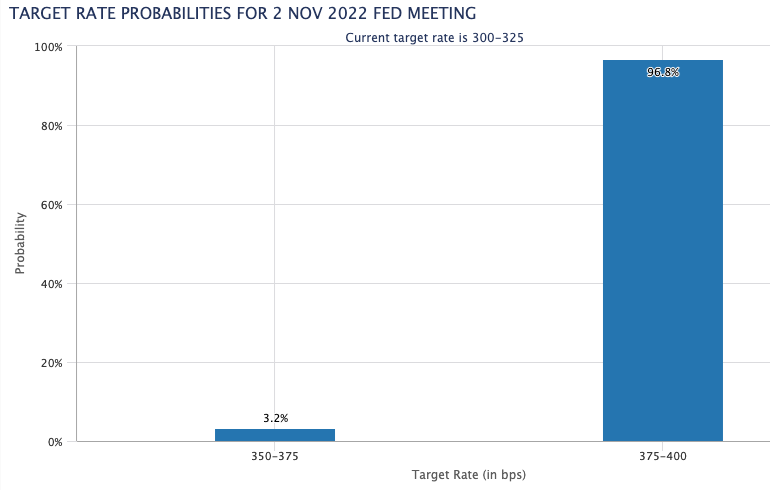

As for interest rates, markets are pricing in the probability of the fourth consecutive 75-basis-points hike to more than 99% on Monday from almost 77% a week ago, according to the CME Group's FedWatchTool.

US data of late has been a mixed bag but Federal Reserve speakers have continued to paint a hawkish outlook for the final meetings of the year. Analysts at Brown Brothers Harriman noted that ''Bostic and Kashkari speak tomorrow while Kashkari, Evans, and Bullard speak Wednesday. Harker, Jefferson, Cook, and Bowman speak Thursday. Williams speaks Friday. At midnight Friday, the media embargo goes into effect and there will be no Fed speakers until Chair Powell’s press conference on November 2.''

The Fed's Beige Book will be a highlight this week on the calendar. The analysts at BBH said that ''the last report was based on survey responses on or before August 29. Since then, we have gotten two sets of job and inflation data that show that the labour market remains firm and price pressures are still rising and broadening.''

''However,'' they said, ''recent PMI readings suggest that the supply chains continue to heal. When all is said and done, we believe the report will support a 75 bp hike at the November 1-2 FOMC meeting. Of note, a 50 bp hike at the December 13-14 FOMC meeting is fully priced in, with over 65% odds of a larger 75 bp move then. The swaps market is still pricing in a peak Fed Funds rate near 5.0% but this could move even higher.'' In turn, US stock as a whole will be at the mercy of anything more hawkish than that assessment of current pricing.

UK politics in focus

Meanwhile, however, they have enjoyed some better sentiment out of the UK's political scene. The new British finance minister Jeremy Hunt announced a plan to reverse almost all of his predecessor's unfunded tax cuts announced earlier this month in a mini-budget. This sent gilts higher, rates lower and the pound recovered into the 1.14 area, printing as high as 1.1439 at one moment. The political backdrop helped to boost market confidence which was reflected in today's rally on Wall Street.

-

20:12

ECB’s Nagel: ECB must withdraw support quickly, but ‘not stop too early’

Bundesbank President Joachim Nagel is crossing the wires again following his remarks that were least heard on Saturday that said the European Central Bank (ECB) needs several more rate hikes to tame inflation.

Today, he said that the central bank must withdraw support quickly, but ''not stop too early'', with regard to what is expected to be a deep recession in Germany.

"Further interest rate hikes will be needed to bring the inflation rate back to 2% in the medium term – not just at the monetary policy meeting at the end of October," Nagel said in a speech in Washington on the weekend.

"The ECB Governing Council must not let up too soon."

Markets currently price in a 75 basis point move on Oct. 27, the same as September's increase, and few if any policymakers have pushed back publicly on these expectations.

"As monetary policy continues to normalise, we will also need to look into scaling back Eurosystem asset holdings, which amount to almost 5 trillion euros," Nagel added.

"GDP (in Germany) could decline significantly in the final quarter of 2022 and the first quarter of 2023," Nagel said. "This would imply a recession, that is a significant, broad-based and longer-lasting decrease in economic output."

EUR/USD update

EUR/USD remains on tenterhooks as the euro bloc struggles with gas shortages. On the day it is higher but remains in the bear's lair while tucke din below daily trendline resistance:

-

20:10

USD/JPY rally stalls below 148.90 with BoJ intervention eyed

- The US dollar rally stalls right below 149.00.

- Fears of a BoJ intervention and risk appetite have undermined USD strength.

- USD/JPY: Important top at 149.31/150.00 – Credit Suisse.

The dollar has remained hovering on the upper range of 148.00 on Monday, consolidating gains at a 32-year high, following an 8-day rally from the 144.00 area.

Risk appetite and intervention fears put a lid on the USD rally

Investors’ mood improved on Monday, with the market welcoming news that the UK finance minister is planning to reverse most of the aspects of his predecessor’s mini-Budget.

Furthermore, US retail sales showed a certain resilience in consumers’ behaviour and Bank of America has reported better than expected quarterly reports, which has undermined demand for the safe-haven US dollar.

On the other hand, the pair has appreciated well above the level that triggered intervention by the Bank of Japan last month. Japanese authorities have reiterated their warnings of a firm response to avoid rapid yen declines which has set investors on the guard.

USD/JPY: Significant top at 149.31/150/00 – Credit Suisse

According to FX analysts at Credit Suisse, the pair has reached a potential top: “Our ‘ideal’ roadmap would be for a test of trend channel, gap and psychological resistance at 149.31/150.00, but our base case remains to look for a potentially significant top here. “A break and sustained close above 153.00 would suggest it is too early to look for a top, exposing then resistance next at the 160.33 high of 1990.”

Technical levels to watch

-

19:36

WTI retraces from daily highs around $87, eyeing the 20-DMA

- WTI bounces off the 20-day EMA and holds to minimal losses of 0.11%.

- The PBoC decided to continue stimulating China’s economy, a tailwind for the WTI price.

- OPEC’s cut has been outweighed by recent US dollar strength due to future Fed hikes.

US crude oil benchmark, also known as Western Texas Intermediate (WTI), paring its earlier losses and prints gains of almost 0.40% on Monday as China’s continuing losing monetary policy, would likely make up for any diminished demand amidst high inflation and an economic deceleration, sparked global recession fears. Nevertheless, at the time of writing, WTI is trading at $85.33 per barrel, below its opening price by 0.32%.

WTI drops despite China’s efforts to stimulate its economy as the greenback extends its losses

The People’s Bank of China (PBoC), China’s central bank, announced that it would continue to stimulate the economy, rolling over medium-term policy loins on Monday while maintaining its key interest rate unchanged for the second straight month. That put a lid on the oil’s rally propelled by a weaker US dollar.

Worth noting that during the Chinese Communist Party Congress, Chinese President Xi Jinping emphasized that his government would extend a zero-Covid policy, which would likely impact oil demand.

In the last week, Fed officials reiterated that the US central bank would continue tightening its monetary policy. Most street analysts expect the Federal funds rate (FFR) to peak at around 4.765-5%. Therefore, further US dollar strength is foreseen, a headwind for black gold.

Elsewhere, OPEC’s decision to cut production by more than an estimated 2 million barrels has increased flows to the oil market. According to Reuters, “Hedge funds and other money managers purchased the equivalent of 47 million barrels of petroleum-related futures and options in the week to Oct. 11.”

WTI Key Technical Levels

-

19:29

EUR/JPY accelerates its uptrend and reaches 146.50 area

- The euro rallies to fresh seven-year highs at 146.50.

- The yen, unable to capitalize on USD weakness, continues on free fall.

- The market is on the watch for BoJ intervention.

The euro opened the week on a strong note, accelerating its rally beyond 145.60, to hit 146.50 so far, its highest level since January 2015.

The Japanese yen continues on free-fall

The yen has been the only major currency unable to benefit from the US dollar weakness amid the improvement in risk appetite and has extended its decline, with the USD/JPY reaching fresh 32-year lows.

Investors remain on the watch for the possibility of an intervention by the Bank of Japan to strengthen the JPY. The yen has actually exceeded the level that triggered an intervention by the BoJ last month, and the Japanese Government has reiterated its commitment to a “firm response” to avoid rapid yen declines.

The yen is under pressure on the back of the monetary policy divergence between the BoJ and the rest of the major world central banks, and especially the Federal Reserve.The Fed is widely expected to increase rates by 0.75% for the fourth consecutive time in November while the Japanese bank maintains an ultra-expansive policy that is crushing demand on the Japanese currency.

Technical levels to watch

-

19:01

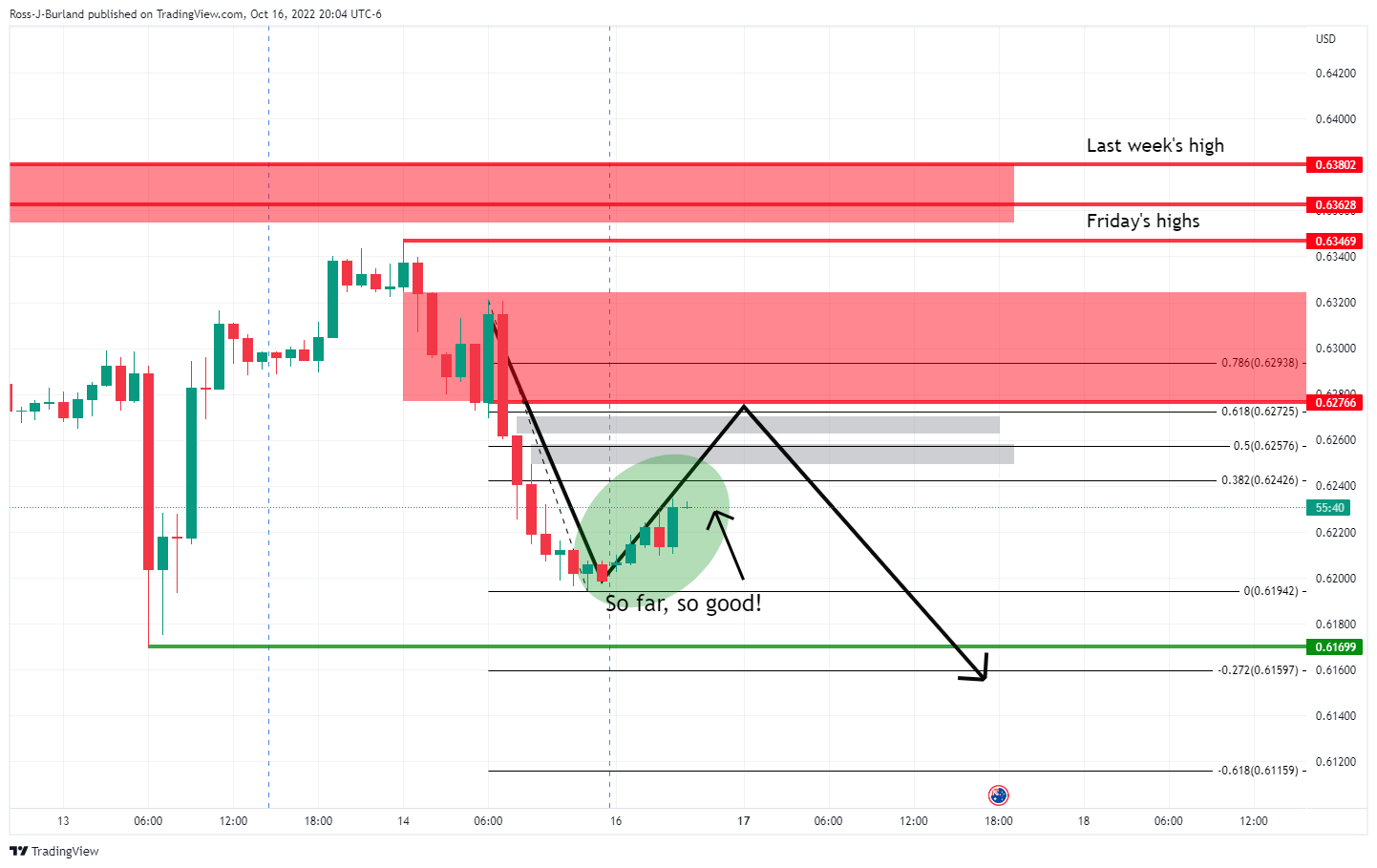

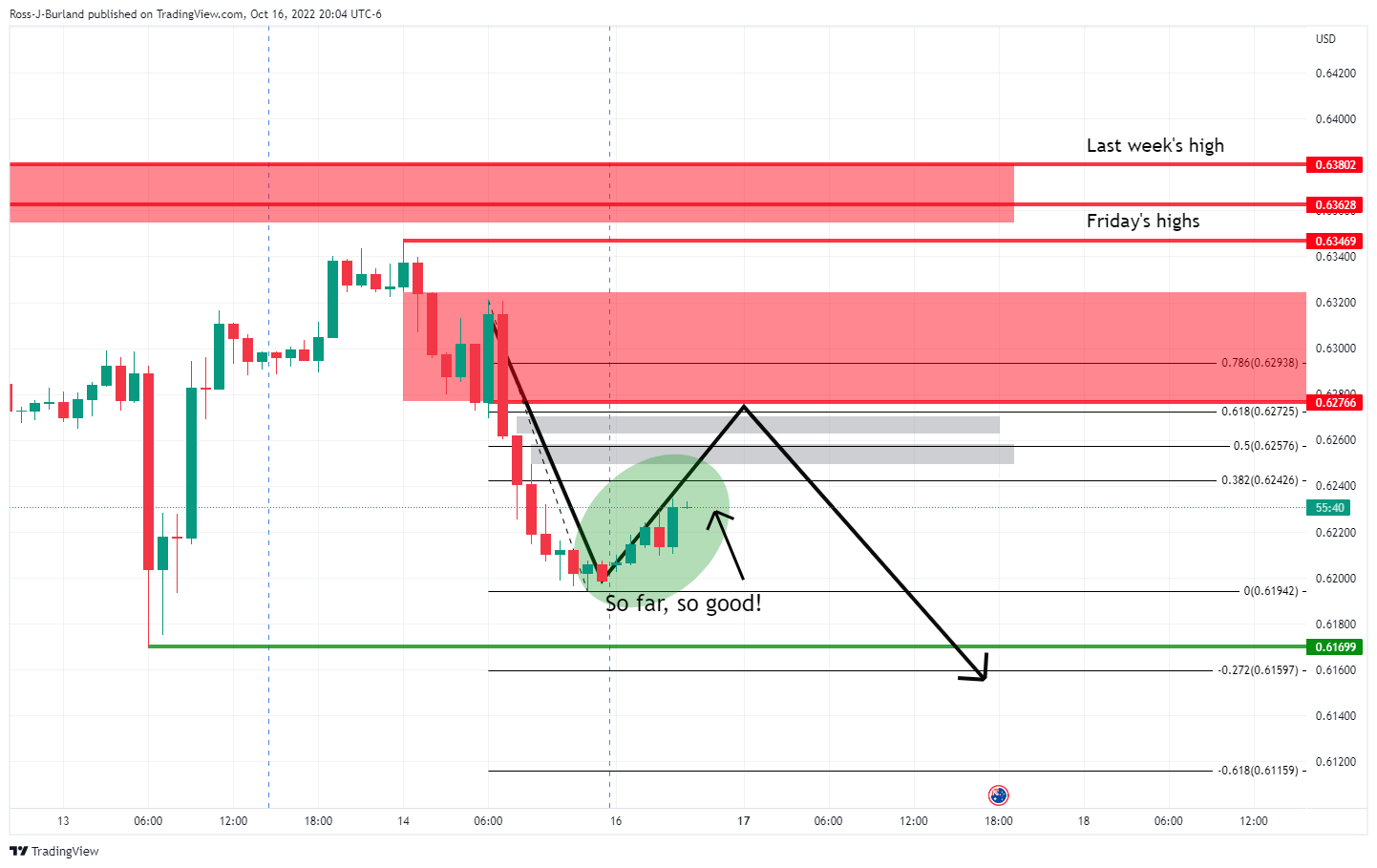

AUD/USD Price Analysis: Bulls eye a run to test Septmber lows

- AUD/USD bulls eye a test of key trendline resistance.

- The bulls need to get above last month's lows.

As per the start of the week's pre-open analysis, AUD/USD Price Analysis: Pre-open points to bullish correction, eyes on the 61.8% golden, and the follow-up later in Tokyo, AUD/USD Price Analysis: Bulls making good headway start of week, the price has gone on to the target and has even reached into test the 0.63 area as follows:

AUD/USD prior analysis, H1 chart

As per the hourly chart, it was explained that AUD/USD was ''well below last month's lows and will remain in the bear's hands so long as Friday's highs of near 0.6250 are not violated.''

A correction into the greyed areas which are price imbalances on the hourly chart was anticipated for the opening sessions on Monday which put the prior bull candle's lows in focus near a 61.8% Fibonacci retracement near 0.6275. It was stated that ''while below this area of resistance, the focus will be on a break of the fresh bear cycle lows near 0.6170 and for a downside continuation.''

Later that session ...

AUD/USD update

The price has rallied in three sessions, Asia, London and New York, in three levels of rise, respecting the front side of the trendline and breaking a 78.6% Fibonacci retracement level. Following such a move, a correction back into profitable trades in level 2, or even as far down into Asian longs in level 1 should the bulls capitulate in level 2, would be expected. There is also a price imbalance below level 3 that could be mitigated. If the bears commit, then Level 1 longs will be vulnerable considering the break of the bullish structure around 0.6270 on the backside of the trendline. On the other hand, if the bulls stay the course on the front side of the trendline, then Friday's highs near 0.6347 will be eyed that guard September's lows and last week's highs thereafter.

AUD/USD H4 chart

Meanwhile, the price is on the front side of the 4-hour trendline resistance which opens the risk of a break below 0.6170 for the foreseeable future. However, if the bulls manage to get on the backside of the trend, then there will be a bullish case developing above last month's lows.

-

18:56

Silver Price Analysis: XAG/USD’s recovery stalls below $19.00

- Silver futures recovery losses steam below $19.00.

- Precious metals have pared losses on the back of a softer USD.

- XAG/USD remains close to a key support area at $17.60/18.10.

Silver futures’ recovery from Friday’s lows at $18.00 seems to have lost steam on Monday’s US trading session. XAG/USD has failed to find acceptance above $18.90, although downside attempts remain, so far, limited above $18.65.

Precious metals pare losses on the back of a softer USD

In the absence of first-tier macroeconomic releases, the news about the UK Government’s plan to reverse most of the tax cuts announced in September has been welcomed by investors. Stock markets are posting significant advances and the safe-haven US dollar has extended its pullback from recent highs.

The precious metal gained territory on Monday to put an end to a six-day sell-off, although the bullish trend has hesitated in the vicinity of $19.00. The pair would need to breach that revel to gather momentum and aim towards the $19.70/80 resistance area.

A confirmation above the $20.00 psychological level would negate the near-term negative trend and open the path toward August and October’s peaks in the area of $21.00

On the other hand, the pair remains still dangerously close to a key support area between $18.10 and $17.60, which contains July, August, and September’s lows. A downside reversal below here might take the pair to explore June 2020 lows at the $17.00 area and Apr 14, 2020, high at S15.85.

XAG/USD daily chart

Technical levels to watch

-

18:33

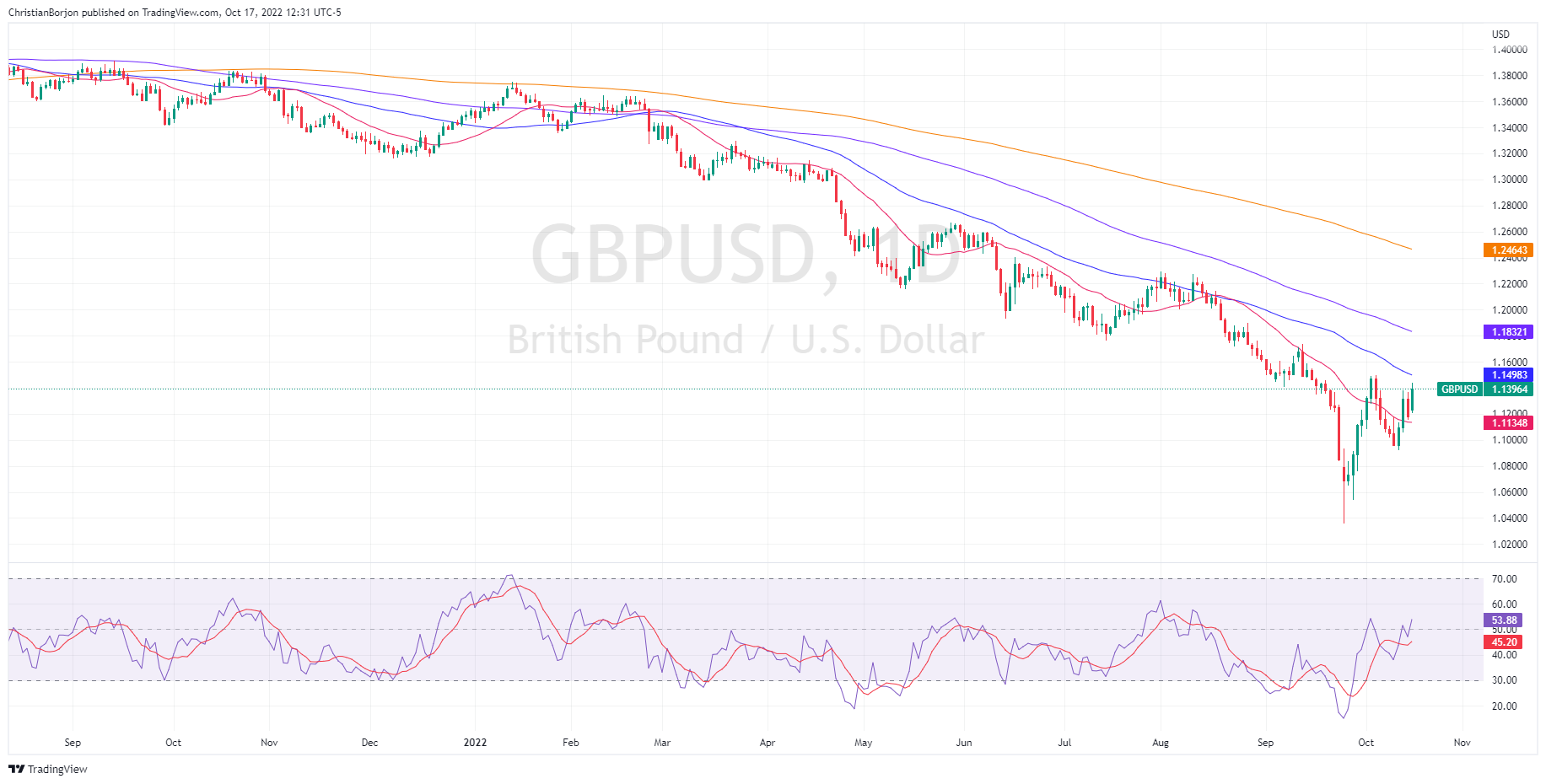

GBP/USD rallies to a two-week high above 1.1400 as traders approve Hunt's plan

- GBP/USD climbed sharply by more than 200 pips, gaining 2%.

- UK 30-year bond yields dropped 50 bps to 4.38% as the bond sell-off trims.

- UK’s Finance Minister Hunt calmed the markets, buying some time for UK’s PM Liz Truss, as pressures to oust her increase.

The GBP/USD pierces the 1.1400 mark, as the UK’s new Finance Minister, Jeremy Hunt, said in the House f Commons that the government changed its course while reiterating that Britain is a country that “pays its debts.” So far, UK Government’s U-Turn keeps investors’ mood upbeat, with global equities trading in the green. At the time of writing, the GBP/USD is trading at 1.1384, above its opening price but shy of the two-week high.

GBP/USD jumped as UK’s newest Finance Minister scrapped PM Liz Truss’s initial budget proposal

An absent US calendar left investors adrift to UK’s economic turmoil news. The UK Chancellor of the Exchequer, Jeremy Hunt, slashed the tax cuts from the newest government budget to calm the markets. So far, the 30-year Gilts has fallen 45 bps, from 4.85% to 4.35%, as tweaks made by the newest Finance Minister bought PM Liz Truss government time.

The British pound rallied sharply against the dollar on Monday, almost 2% up, gaining more than 200-pips, bouncing from daily lows around 1.1208 to its daily high at 1.1439.

Jeremy Hunt’s program increased the corporate tax rate while reversing tax changes on dividend income, alcohol duty, and a VAT-free shopping scheme aimed to raise GBP 5 billion. Additionally, Hunt commented that he would form an “economic advisory council” to provide independent advice to the government.

Aside from this, the US latest inflation figures reported last Thursday’, further cemented the case for another big-size rate hike by the Federal Reserve. Several officials expressed that inflation remains stubbornly high, the market labor is tight and emphasized the need for ratest to be restrictive.

On Saturday, the St Louis Fed President James Bullard said that US higher interest rates bolstered the greenback, which is weighing on other worldwide currencies, an addressed theme by some countries at the G20 meeting. Nevertheless, Bullard added that once the Fed gets rates to a level that could pressure inflation down, the greenback might fall.

What to watch

Tuesday’s light UK economic calendar will leave traders leaning toward UK’s political turbulence and US dynamics. On the US front, Industrial Production m Capacity Utilization, and NAHB Housing Market Index would update the status of the US economy.

GBP/USD Price Forecast

The GBP/USD recovered some ground, distancing from the 20-day EMA, as the Relative Strength Index (RSI) broke above the 50-midline, a bullish signal. On its way north, the 50-day EMA lies at 1.1498, which, once cleared, will expose the 1.1500 figure, followed by a test of the 100-day EMA at 1.1832.

-

18:02

NZD/USD returns to the 0.5640 area, pares Friday’s losses

- The NZD appreciates to 0.5650 after bouncing up from two-year lows at 0.5550.

- The kiwi pares previous losses buoyed by brighter market sentiment.

- The focus is now on the release of New Zealand's CPI data, due later today.

The New Zealand dollar has opened the week on a firm footing to reach levels right below 0.5650 on Monday, after bouncing up from two-year lows of 0.5550.

Risk appetite buoys the kiwi

The kiwi has been favoured by the brighter market sentiment on Monday, as the investors welcomed the comments of the new UK Finance Minister, confirming the U-turn on most of the aspects of the mini-Budget plan that roiled financial markets.

Investors' optimism has been reflected in the positive stock markets on Monday. The US Dow Jones Index advances 1.76%, while the S&P trades 2.5% up and the Nasdaq. Technological Index rallies 3,2% at the time of writing.

The improved sentiment has weighed on US Treasury yields, sending the US dollar lower across the board. The US Dollar Index, which measures the value of the greenback against a basket of the most traded currencies is showing a 1.1% pullback, which erases the previous two weeks' gains.

In New Zealand, the focus today will be on the release of the Q3 Consumer Prices Index figures. Inflation pressures are expected to have eased somewhat. This should not have a relevant impact on the pair, unless the final reading suggests a diversion in monetary policy expectations.

Technical levels to watch

-

17:34

USD/JPY Price Analysis: Contained around 148.70, as Japanese FX intervention looms

- Despite an upbeat sentiment, USD/JPY is almost flat as rumors of Japanese intervention in the FX market loom.

- The USD/JPY daily chart shows the pair as overbought as the RSI above 70 gives a respite to USD/JPY bulls.

- Near-term, an ascending triangle in the hourly targets the USD/JPY will rise to 149.36-50.

The USD/JPY extends its gains, for the ninth consecutive trading day, bolstered by renewed Bank of Japan (BoJ) dovish commentary during the last week, despite the Minister of Finance Suzuki and Japan’s PM Kishida’s efforts to propel the Japanese yen. At the time of writing, the USD/JPY is trading at 148.75, above its opening price by 0.01%.

USD/JPY Price Forecast

The USD/JPY printed a fresh 32-year high of 148.89, as the pair closes to the 150.00 figure, but fears of another FX intervention by Japanese authorities refrain traders from opening fresh longs on the USD/JPY. It should be noted that the daily chart depicts oscillators at overbought conditions, namely the Relative Strength Index (RSI), which at 76.74, is almost flat, giving a respite for USD/JPY shorts.

The USD/JPY one-hour chart delineates the pair in consolidation, hoovering around the 20-EMA, which, sitting below the exchange rates, suggests the pair is upwards. However, price action’s printing lower highs and higher lows signal that it could be forming an ascending triangle, which would pave the way for further gains.

A break above 148.89 will expose the 149.00 figure. Once cleared, the following resistance would be the R1 daily pivot and also the ascending-triangle measure objective at 149.36, immediately followed by 149.50 and the 150.00 figure.

USD/JPY Key Technical Levels

-

17:27

USD/CHF’s reversal from 1.0065 highs extends below parity

- The dollar extends losses on Monday and returns below parity.

- The brighter market sentiment is weighing on the safe-haven USD.

- USD/CHF: Below 0.9876 downside pressure will increase – Credit Suisse.

The US dollar is giving away on Monday most of the ground gained last week. The pair has depreciated more than 1% from Friday's highs at 1.0065, to reach session lows below 1.0000 at the time of writing.

The greenback loses ground as risk appetite returns

News reports confirming that the UK Finance Minister, Jeremy Hunt, will reverse most of the mini-Budget tax cuts plan announced in September have boosted investors’ optimism on Monday.

Most of the world’s major stock indexes posted significant advances on Monday. In the US, the Dow Jones advances 1.81%, with the S&P Index 2,74% up and the Nasdaq rallying 3,5%, which has weighed on US Treasury bond yields, pulling the safe-haven USD lower across the board.

In the long run, however, the current risk rally is likely to be short-lived. The market is widely expecting the US Federal Reserve to hike rates by r 75 basis points again in November, while global economic prospects remain fragile on the back of geopolitical tensions, higher energy prices, and increasing COVID cases in China. This scenario is highly likely to strengthen the US dollar in the longer term.

USD/CHF: Breach of 0.9876 will increase downward pressure – Credit Suisse

On the downside, FX analysts at Credit Suisse point out to a key support area at 0.9876: “USD/CHF’s surge was capped at the major resistance at the trendline from 2016 at 1.0075. This strong reversal lower paired with daily RSI holding a bearish divergence continues to strengthen the case for a near-term weakness (…) “Immediate support is seen at the recent low and the 13-day exponential average at 0.9929/13, though only a close below 0.9876 would raise more serious thoughts of the near-term risk shifting lower again.”

Technical levels to watch

-

17:24

EUR/GBP forecast at 0.89 in three months – Danske Bank

The EUR/GBP continued to pull back on Monday and fell to the lowest level in four weeks near 0.8580. According to analysts from Danske Bank, the cross will head north in a three-month period and forecast at 0.89.

Key Quotes:

“We expect BoE to continue to hike policy rates until February next year, with risks skewed to more tightening given the inflationary nature of the fiscal support measures.”

“In the near-term, we expect high volatility in the cross amid crucial BoE meetings and budget presentation. We forecast EUR/GBP at 0.89 in 3M as we expect to see fragile risk appetite, where liquidity concerns weigh on GBP. Further out, we remain cautiously optimistic that the cross will head lower as a global growth slowdown and the relative appeal of UK assets to investors are a positive for GBP relative to EUR.”

“The key risk to see EUR/GBP moving above 0.90 is a sharp sell-off in risk where capital inflows fade and liquidity becomes scares. Other risks are the outlook for the UK economy deteriorating sharply compared to the Euro Area and renewed escalations in EU-UK tensions.”

-

17:07

UK’s Jeremy Hunt: There remain many difficult decisions to be announced

British Finance Minister Jeremy Hunt is speaking to the House of Commons following the Leader of the House Penny Mordaunt. Earlier on Monday, Hunt announced the UK government will reverse almost all tax measures announced on the mini-budget. Speaking to MPs, UK Finance Minister said that there are still difficult decisions to be announced in the medium-term fiscal plan on October 31.

Hunt announced that an economic advisory council is being formed. “I want independent expert advice.” He mentioned that they need to do more in order to give certainty to markets.

Market reaction

The pound is among the top performers on Monday, with GBP/USD up by more than 200 pips. It peaked at 1.1438 (highest level since October 5) and remains near the high, above 1.1400. EUR/GBP dropped to the lowest level in five weeks.

-

16:44

EUR/USD rallies beyond 0.9800 amid a brighter market sentiment

- The euro hits session highs above 0.9800 after bouncing at 0.9720 lows.

- The common currency pares losses amid a broad-based USD weakness.

- EUR/USD seen retesting 0.9540 – ING.

The common currency has shrugged off the weakness observed last week to rally on Monday, amid an improved sentiment. The euro appreciates nearly 1% so far today bouncing up at 0.9720 area to hit session highs at 0.9820.

A higher appetite for risk is weighing on the USD

In the absence of any relevant macroeconomic data, dollar weakness seems the main reason behind the surprising euro recovery. The safe haven greenback is losing ground across the board with investors' sentiment boosted after the newly appointed British Finance Minister announced the U-turn on the mini-Budget Tax cuts.

The US Dollar Index has depreciated about 0.8% in its largest reversal of the last two weeks, retreating from last week's highs at 113.70 to test the support area at 112.00 at the time of writing.

From a wider perspective, however, the pair remains quite far from October’s peak at parity levels. Eurozone’s economy has relevant challenges ahead, with inflation at historic levels on the back of higher energy prices and with no solution in sight during the Ukrainian war, which are likely to hinder a sustained euro recovery.

EUR/USD seen retesting 0.9540 – ING

Currency analysts at ING are skeptical about the current EUR/USD rally, and see the pair resuming its downtrend: “The euro should remain heavily impacted by sterling’s swings in the near term, and here the correlation appears to be stronger on the downside i.e. the spillover from another sell-off in gilts would likely have an asymmetrically larger impact on the euro than the positive implications of a recovery in UK sentiment (…) “We still think that EUR/USD will test the 0.9540 September lows in the near-term, and extend a drop below that level by year-end.”

Technical levels to watch

-

16:39

Gold Price Forecast: XAU/USD extends recovery toward $1,670

- A weaker dollar and risk appetite offers support to gold on Monday.

- US yields off lows, limiting upside in XAU/USD.

- XAU/USD facing resistance at $1,670, building support around $1,660.

Gold is rising on Monday, recovering from the two-week low it hit on Friday at $1,639. After the beginning of the American session it peaked at $1,668 and then pulled back to the $1,660 area.

The recovery in gold is being driver by lower yields and a weaker US dollar. The US Dollar Index (DXY) is falling by 0.90% and it tested the weekly low at 112.15. The US 10-year yield stands at 3.95% while the 2-year at 4.44%.

In Wall Street, stocks are recovering sharply after Friday’s slump. The Dow Jones rises by 1.75% and the Nasdaq gains 3.21%. Crude oil is flat for the day while silver is up 2.25%.

Resistance ahead around $1,670

The upside in gold lost momentum before $1,670; a level that is a key resistance. A break higher would expose the next barrier which is the $1,680 area. A daily close above would be a positive technical development for gold bulls.

On the flip side, the immediate support is the $1,660 zone. Below the next level is the critical $1,640 that capped the downside last week. If XAU/USD drops below it could accelerate the move lower.

Technical levels

-

16:35

USD/CAD plummets under 1.3740 as sentiment improves

- USD/CAD dives below 1.3750 due to an upbeat mood and a soft US dollar.

- UK’s mini-budget U-turn sparked a rally in global equities.

- Canada’s inflation expectations rose further, justifying further BoC’s rate hikes.

The USD/CAD tumbled from around the 1.3800 figure due to a risk-on impulse, as shown by global equities recording gains, spurred by a U-turn in the UK mini-budget, which so far had stabilized the markets. At the time of writing, the USD/CAD is trading at 1.3729, below its opening price by 1%.

The Canadian dollar got bolstered by rising inflation expectations as the BoC’s Business survey showed

The absence of US economic data to be released on Monday keeps traders leaning on last week’s inflation figures, which, even though was higher-than-expected, sparked a rally in US equities. Nevertheless, investors backpedaled on Friday, with most indices closing in the red.

The St. Louis Fed President James Bullard said that faster interest rate hikes contributed to further US dollar strength against other currencies on Saturday. Bullar added that once the Federal funds rate (FFR) gets to a level “where the committee thinks we’re putting meaningful downward pressure on inflation,” so rates don’t need to continue increasing.

In the meantime, the Bank of Canaday Business sentiment survey showed that firms expect slower growth amidst the Bank of Canada’s (BoC) tightening cycle, which cools demand, with most responders foreseeing a recession likely in the next 12 months.

The BoC’s survey highlighted that businesses’ inflation expectations jumped to 7.11% from 6.82% in Q2, while for 2-years, the CPI is expected at 5.22%. That justifies further action by the Bank of Canada (BoC), as Governor Tiff Macklem said that the Bank needs “more work to do” on interest rates, signaling further hikes.

Therefore, the USD/CAD plunged as investors seeking return shifted to risk-perceived assets. Additionally, the greenback is pressured, as shown by the US Dollar Index, down almost 1% at 112.23, while crude oil prices are rising, with WTI’s paring some of last Friday’s losses, clings around $85.50 per barrel.

What to watch

The Canadian economic docket will feature House Starts Annualized, while the US calendar will reveal Industrial Production (IP), alongside Capacity Utilization and the NAHB Housing Market Index.

USD/CAD Key Technical Levels

-

15:56

SEK and NOK to hit new lows – Danske Bank

Weaker growth prospects have weighed on the Swedish krona and the Norwegian krone. Economists at Danske Bank expect EUR/SEK to move higher over the coming months to 11.20 while EUR/NOK is set to rise over the next three months.

More weakness in store for scandies

“We stick to our negative view on the SEK, which is underpinned by the gloomy global growth outlook, associated negative outlook for global and Swedish equities alike and relative monetary policy. In addition, more frontloading of rate hikes will exacerbate the downturn in the Swedish housing market, a headwind for the krona.”

“We look for weaker SEK in the 6-12M perspective, forecasting 11.20 in 12M.”

“We still think EUR/NOK is heading higher over the coming 3-6M driven by a slowdown in growth, a European recession, volatile asset markets and further spread tightening in the short-end of rates curves.”

“We forecast EUR/NOK at 10.70 in 3M.”

-

15:48

BoC: Short-term inflation expectations have edged down but remain elevated

- Bank of Canada releases the Q3 Business Outlook Survey.

- Business confidence has softened but is still positive.

- Short-term inflation expectations edged down but remain elevated.

The Bank of Canada (BoC) released on Monday the Business Outlook Survey for the third quarter of 2022. The report says that “business confidence has softened”, “many firms expect slower sales growth as interest rates rise and demand growth shifts closer to pre-pandemic levels” and regarding inflation, it states there are early signs “that pressures on prices and wages have started to ease, but firms’ inflation expectations remain high.”

Key takeaways:

- “Businesses expect their price increases to moderate due to downward pressure on prices for commodities and other input goods. They also expect their wage increases to soften from high levels. Firms’ short-term inflation expectations remain above the Bank of Canada’s inflation target.”

- “Firms’ expectations for long-term inflation are much closer to target and have been stable for the past few quarters. Most businesses that expect inflation to be substantially above 2% anticipate that it will return to target within three years.”

- “Firms’ sales outlooks have softened. Businesses with sales linked to housing activity and household consumption expect weaker sales growth due to rising interest rates. Other firms anticipate their sales growth will be healthy but slower than earlier in the economic recovery from the COVID 19 pandemic. Amid emerging signs of moderating growth in demand, firms’ plans to invest more and hire eased slightly from previously high levels.”

- “Most BLP respondents think the probability of a recession in Canada in the next 12 months is at least 50%. While many firms anticipate a recession, those not linked to housing activity and other household consumption do not expect it to have a large impact on demand for their products or services. When asked what would trigger a recession, business leaders indicated that large increases in interest rates and high prices reducing consumption would be the most likely factors.”

Market reaction

The USD/CAD remained near daily lows after the release hovering around 1.3740, weakened by a broad-based slide of the US dollar.

-

15:29

GBP/USD: Not enough good news to turn bullish – Rabobank

GBP/USD has been fluctuating around the 1.13 area today. Economists at Rabobank have been bearish on the pound for many months and believe that there is still too much uncertainty in both the UK economic and political outlooks to turn constructive on the outlook for GBP.

UK fundamentals are still sour

“Hawkish remarks from BoE Governor Bailey over the weekend confirm that the BoE is preparing to raise rates aggressively going forward. This will lend some support to the pound, though higher rates combined with the reversal of Truss’ tax pledges, underpins the recessionary outlook for the UK.”

“Aside from awakening a few bargain-hunters, the calamitous events of the past few weeks will not have done anything to tackle the lack of investment growth that has been evident in the UK in recent years, nor will it have impacted the wide current account deficit.”

“Our three-month forecast of 1.06 appears a little further away than it did a few days ago. Even so, we have not yet seen enough good news to revise this higher.”

-

15:00

Gold Price Forecast: XAU/USD needs to break above $1,750 to extend the short squeeze – TDS

Gold speculators continued to cover some shorts. But in the view of strategists at TD Securities, the yellow metal needs to break past $1,750 to extend the short squeeze.

Gold has yet to price in an extended period of restrictive rates

“As quantitative tightening continues to sap liquidity from global markets, it will increasingly constrain other central banks before it binds the Fed while pressuring global assets amid tightening monetary policies and a slowing growth outlook. This should support the dollar's rally, while weighing on gold prices, despite rising recession risks, as inflation's rising persistence suggests the Fed is unlikely to stop hiking preemptively.”

“In the near-term, however, the recovery in risk assets bolstered by signs of stabilizing Gilts is raising pressure on precious metal shorts, but gold prices need to break above $1,750 to extend the short squeeze.”

-

14:59

GBP/USD Price Analysis: Bulls looking to seize control amid heavy USD selling

- GBP/USD catches fresh bids on Monday and is supported by a combination of factors.

- Reversal of the UK government’s controversial fiscal package boosts the British pound.

- Retreating US bond yields, the risk-on mood weighs on the USD and remains supportive.

The GBP/USD pair regains positive traction on the first day of a new week and builds on its steady intraday ascent through the early North American session. The momentum lifts spot prices to a fresh daily high, around the 1.1365-1.1370 region, and is sponsored by a combination of factors.

The British pound draws support from the latest optimism over the reversal of the new UK government's controversial fiscal package. The US dollar, on the other hand, is pressured by a combination of factors and provides an additional boost to the GBP/USD pair. Retreating US Treasury bond yields, along with the risk-on impulse, turn out to be key factors undermining the safe-haven greenback.

From a technical perspective, the GBP/USD pair now seems to have found acceptance above the 200-period SMA on the 4-hour chart. This, in turn, supports prospects for an extension of last week's bounce from the 50% Fibonacci retracement level of the recent recovery from an all-time low. The positive outlook is reinforced by bullish oscillators, which are still far from being in the overbought zone.

Some follow-through buying above Friday's swing high, around the 1.1380 region, will reaffirm the bullish bias and lift spot prices beyond the 1.1400 round-figure mark. The upward trajectory could further get extended and allow the GBP/USD pair to aim back to challenge the monthly swing high, just ahead of the 1.1500 psychological mark.

On the flip side, the 1.1300 round figure now seems to protect the immediate downside. Any subsequent decline is likely to attract fresh buyers near the 23.6% Fibo. level, around the 1.1215-1.1210 region. This is closely followed by the 1.1200 mark, which if broken decisively will suggest that the momentum has run out of steam and shift the bias in favour of bearish traders.

The GBP/USD pair might then turn vulnerable to weaken further below mid-1.1100s, Friday's swing low, and drop to the 1.1100 round-figure mark. The next relevant support is pegged near 38.2% Fibo. level, around the 1.1055-1.1050 region. The latter should act as a strong base for spot prices and a key pivotal point for short-term traders.

GBP/USD 4-hour chart

-638016117062928971.png)

Key levels to watch

-

14:57

USD/TRY clings to the consolidative mood below 18.60

- USD/TRY remains within the multi-week range bound theme.

- The 18.6000 region still caps the pair’s upside bias.

- The CBRT is expected to cut the policy rate later in the week.

The Turkish lira depreciates modestly vs. the greenback, with USD/TRY navigating the usual consolidative range just below the 18.6000 mark on Monday.

USD/TRY focused on the CBRT

No changes to the side-lined pattern around the pair, which remains well capped by the 18.60 region for the time being.

The next key event in the Turkish calendar will be the interest rate decision by the Turkish central bank (CBRT) on October 20. Consensus, in the meantime, seems to have already priced in another rate cut (100 bps likely), particularly following latest comments from President Erdogan, who suggested that the One-Week Repo Rate should be around single digits by year end (from current 12.00%).

Earlier on Monday, the Turkish Treasury announced a TL38.63B deficit in the Budget Balance in September.

What to look for around TRY

USD/TRY keeps navigating the area of all-time highs near 18.60 amidst the combination of omnipresent lira weakness and bouts of strength in the dollar.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth and shift the current account deficit into surplus following a lower-interest-rate recipe.

Key events in Türkiye this week: Budget Balance (Monday) – CBRT Interest Rate Decision (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.28% at 18.5760 and faces the next hurdle at 18.5980 (all-time high October 11) followed by 19.00 (round level). On the downside, a break below 18.2200 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

14:45

USD/JPY to hover around 150.00 into year-end amid prolonged FX intervention campaign – ING

There is an elevated risk that Japanese authorities will intervene in the FX market to support the yen today. Economists at ING expect the USD/JPY pair to hover around the 150 level for the time being.

More intervention increasingly likely

“We are not making the argument that there is a clear line in the sand at 150.00 for Japanese authorities (the whole idea of a ‘line in the sand’ in the current FX market appears unrealistic), but it’s likely that allowing a move above 150.00 may well trigger an acceleration of the JPY sell-off which is exactly what Japan is trying to avoid.”

“Our view is that a prolonged FX intervention campaign in Japan will keep USD/JPY around 150.00 into year-end.”

-

14:33

Singapore: MAS tightens its monetary conditions – UOB

Head of Research at UOB Group Suan Teck Kin, CFA, and Senior FX Strategist Peter Chia review the latest decision by the MAS.

Key Takeaways

“The Monetary Authority of Singapore (MAS) in its scheduled monetary policy statement (MPS) release on Thu (14 Oct) announced the re-centring of the mid-point of the S$NEER policy band up to its prevailing level, but without any change to the slope and width of the band. As inflationary pressures have intensified since the economic recovery from the COVID-19 pandemic, this is the fifth time in a row that the MAS has strengthened the S$NEER policy since kicking off the cycle at the scheduled release in Oct 2021.”

“The MAS narrowed the inflation forecasts in its latest statement, with projections for 2022 headline inflation at around 6% and core inflation at around 4%, from the forecast ranges of 5.0-6.0% and 3.0-4.0%, respectively. These projections are consistent with our call of 6% (for headline or CPI-All Items) and 4.2% (core), as inflationary pressures remain elevated with Sep CPI readings hitting the highest since 2008.”

“The MAS expects that in 2023, after taking into account all factors including the GST increase, core inflation is expected at 3.5–4.5% on average over the year, and CPI-All Items inflation at 5.5–6.5%. Even after excluding the one-off effects of the GST increase early next year, core inflation would still remain above trend at 2.5–3.5% and headline inflation at 4.5–5.5%.”

“Singapore’s preliminary 3Q22 GDP announced at the same time came in at 4.4% y/y from a revised 4.5% growth in 2Q22, within our call of 4.2% but well ahead of Bloomberg poll of 3.5%. On a seasonally adjusted basis, 3Q22 GDP rebounded strongly by 1.5% q/q, from -0.2% in 2Q22. Manufacturing sector slowed as we had anticipated to 1.5% y/y from 5.7% in 2Q22 while services sector outperformed with a 6.1% y/y gain compared to 4.8% in 2Q22 and despite a strong performance of 6.8% in the same quarter last year. With the 3Q22 outcome largely within our expectations, we keep our GDP growth outlook for Singapore at 3.5% for 2022, before easing to 0.7% for 2023 to reflect the broad slowing in external outlook next year.”

“MAS Outlook – Singapore’s monetary policy is further into a restrictive setting after five rounds of tightening since Oct 2021. With the MAS pulling only one lever this time, there is still room for further tightening into 2023, especially if core inflation does not show signs of moderation. While we believe off-cycles are likely done for the remainder of 2022, it may still be a possibility especially in early 2023.”

-

14:25

AUD/USD refreshes daily peak, 0.6300 mark back in sight amid notable USD supply

- AUD/USD regains some positive traction on Monday amid broad-based USD weakness.

- Retreating US bond yields, along with the risk-on impulse, weighs on the safe-haven buck.

- Disappointing US macro data adds to the USD selling bias and provides an additional lift.

The AUD/USD pair builds on its steady intraday ascent and hits a fresh daily high, around the 0.6285 region during the early North American session.

The US dollar comes under renewed selling pressure on Monday, which, in turn, assists the AUD/USD pair to attract some buying near the 0.6200 mark and recover a major part of Friday's losses. Retreating US Treasury bond yields turns out to be a key factor weighing on the greenback. Apart from this, the risk-on impulse - as depicted by a strong rally in the equity markets - further undermines the safe-haven buck and benefits the risk-sensitive aussie.

The intraday USD selling picks up pace in reaction to the disappointing release of the Empire State Manufacturing Index, which plunged to -9.1 for October from -1.5 in the previous month. That said, a combination of factors might hold back traders from placing aggressive bullish bets around the AUD/USD pair. Investors remain concerned about the potential economic headwinds stemming from rapidly rising borrowing costs and geopolitical tensions.

Furthermore, China's zero-COVID policy has been fueling worries about a deeper global economic downturn and should keep a lid on any optimistic move in the markets. Apart from this, the prospects for a more aggressive policy tightening by the Fed should limit the USD losses and cap the upside for the AUD/USD pair. In fact, the markets have priced in a nearly 100% chance of another supersized 75 bps Fed rate hike move at the November policy meeting.

This, along with the Reserve Bank of Australia's (RBA) decision to slow the pace of policy tightening earlier this month, suggests that the path of least resistance for the AUD/USD pair is to the downside. Hence, the ongoing recovery move might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Market participants now look forward to the RBA monetary policy meeting minutes and top-tier Chinese macro data, due for release during the Asian session on Tuesday. This will drive the China-proxy Australian dollar and provide some meaningful impetus to the AUD/USD pair. In the meantime, the USD price dynamics will continue to play a key role in influencing spot prices and allow traders to grab short-term opportunities.

Technical levels to watch

-

14:19

EUR/JPY: On course to retest the 145.65 high – Credit Suisse

EUR/JPY continues to move steadily higher. Economists at Credit Suisse expect the pair to test the 145.65 peak of September.

Important support seen at 143.87

“We stay bullish and look for strength back to the actual September high at 145.65. Whilst this should again be respected, our bias is to look for a break above here in due course with resistance then seen next at 146.45/48 and eventually back at the 149.78 high of 2014.”

“Support is seen at 144.24 initially, then 143.87, below which can see a setback to 143.05, ahead of the 13-day exponential average at 142.85, which we look to try and hold.”

-

14:11

EUR/USD Price Analysis: Rebound needs to surpass 0.9800

- EUR/USD regains composure and leaves behind the 0.9700 area.

- Immediately to the upside comes recent peaks around 0.9800.

EUR/USD manages to leave behind Friday’s retracement and advances well north of the 0.9700 hurdle on Monday.

The continuation of the recovery needs to clear last week’s top just above 0.9800 the figure to open the door to further gains in the short-term horizon.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0568.

EUR/USD daily chart

-

13:52

USD/JPY remains confined in a range near 32-year peak, just below 149.00 mark

- USD/JPY oscillates in a narrow trading band below a fresh 32-year high touched this Monday.

- Retreating US bond yields prompts some USD selling and acts as a headwind for the major.

- The Fed-BoJ policy divergence, the risk-on impulse undermines the JPY and offers support.

The USD/JPY pair consolidates its recent strong gains to the highest level since 1990 and oscillates in a range below the 149.00 mark through the early North American session.

The US dollar struggles to capitalize on Friday's strong move up and meets with a fresh supply on the first day of a new week, which, in turn, is seen acting as a headwind for the USD/JPY pair. The USD downtick could be attributed to a modest pullback in the US Treasury bond yields. This results in the narrowing of the US-Japan rate differential, which extends some support to the Japanese yen and further contributes to capping the major.

The downside, however, remains cushioned amid the risk-on impulse, which is seen undermining the safe-haven JPY. The market sentiment gets a strong boost in reaction to the new UK government's U-turn on planned tax cuts. Apart from this, the prospects for a more aggressive policy tightening by the Fed should help limit the downside for the US bond yields and the USD. This, in turn, should continue to lend some support to the USD/JPY pair.

In fact, the markets have priced in a nearly 100% chance for another supersized 75 bps Fed rate hike move for the fourth consecutive meeting in November. The bets were reaffirmed by the stronger US CPI report released last week and the recent hawkish comments by several Fed officials. In contrast, the Bank of Japan remains committed to continuing with its monetary easing, marking a big divergence in comparison to a more hawkish Fed.

This, in turn, adds credence to the near-term positive outlook for the USD/JPY pair and suggests that the path of least resistance for spot prices is to the upside. That said, speculations that Japanese authorities might intervene in the markets to stem any further weakness in the domestic currency warrant caution for bullish traders.

Technical levels to watch

-

13:35

GBP/USD to tick down but unlikely to dive below the 1.05-1.07 support zone – Standard Chartered