Notícias do Mercado

-

23:50

Japan Foreign Bond Investment: ¥-941.8B (December 16) vs previous ¥-605.7B

-

23:50

Japan Foreign Investment in Japan Stocks down to ¥-667.1B in December 16 from previous ¥1154.2B

-

23:25

GBP/USD Price Analysis: 200-DMA probes bears ahead of UK/US GDP

- GBP/USD bears poke 200-DMA after breaking short-term key support line.

- Bearish MACD signals, steady RSI conditions keep sellers hopeful.

- Buyers remain off the table beyond 1.2350, monthly high adds to the upside filters.

GBP/USD bears struggle to keep the reins around 1.2080 during early Thursday, following a clear downside break of the three-month-old ascending support line, now resistance.

Even so, the bearish MACD signals join mostly steady RSI (14) to keep the sellers hopeful of breaking the 1.2080 immediate support, comprising the 200-DMA.

It’s worth noting that the 1.2000 psychological magnet acts as an immediate downside support for the Cable pair.

However, a horizontal area comprising multiple levels marked since mid-November, around 1.1950, could challenge the GBP/USD bears afterward.

In a case where the quote remains bearish past 1.1950, the odds of witnessing a south run towards October’s peak near 1.1640 can’t be ruled out.

Alternatively, recovery moves need to stay beyond the adjacent support-turned-resistance line, close to 1.2100 by the press time, to convince intraday buyers.

Following that, a gradual rise towards the 13-day-old horizontal region surrounding 1.2355-60 could gain the GBP/USD buyer’s attention. Also acting as an upside filter is the monthly high near 1.2445.

Overall, GBP/USD recently broke short-term key support and the oscillators are favorable to the pair sellers. However, sustained trading below the 200-DMA becomes necessary for the bears to keep the reins as Cable traders await the final readings of the US/UK Gross Domestic Product (GDP) for the third quarter (Q3).

GBP/USD: Daily chart

Trend: Further downside expected

-

23:05

German finance ministry sees subdued economic activity over winter

Germany's finance ministry expects activity in Europe's biggest economy to remain subdued during the fourth quarter of this year and first quarter of next and sees declining inflation rates during 2023, it said in its monthly report per Reuters.

Key quotes

Overall, economic developments are expected to remain subdued in the winter half (year).

However, relatively stable labour market developments and the government's relief measures ... are providing supportive impetus.

Current estimates pointed to declining inflation rates, albeit at a raised level, next year.

Tax revenues rose 2% in November from the same month last year to 55.95 billion Euros.

In the first 11 months of the year, the tax take increased by 8.7%.

EUR/USD stays intact

EUR/USD remains unchanged around 1.0600, paying little heed to the news, as traders await the US GDP data for fresh impulse amid the year-end holiday mood.

Also read: Forex Today: Little action across the FX board

-

22:57

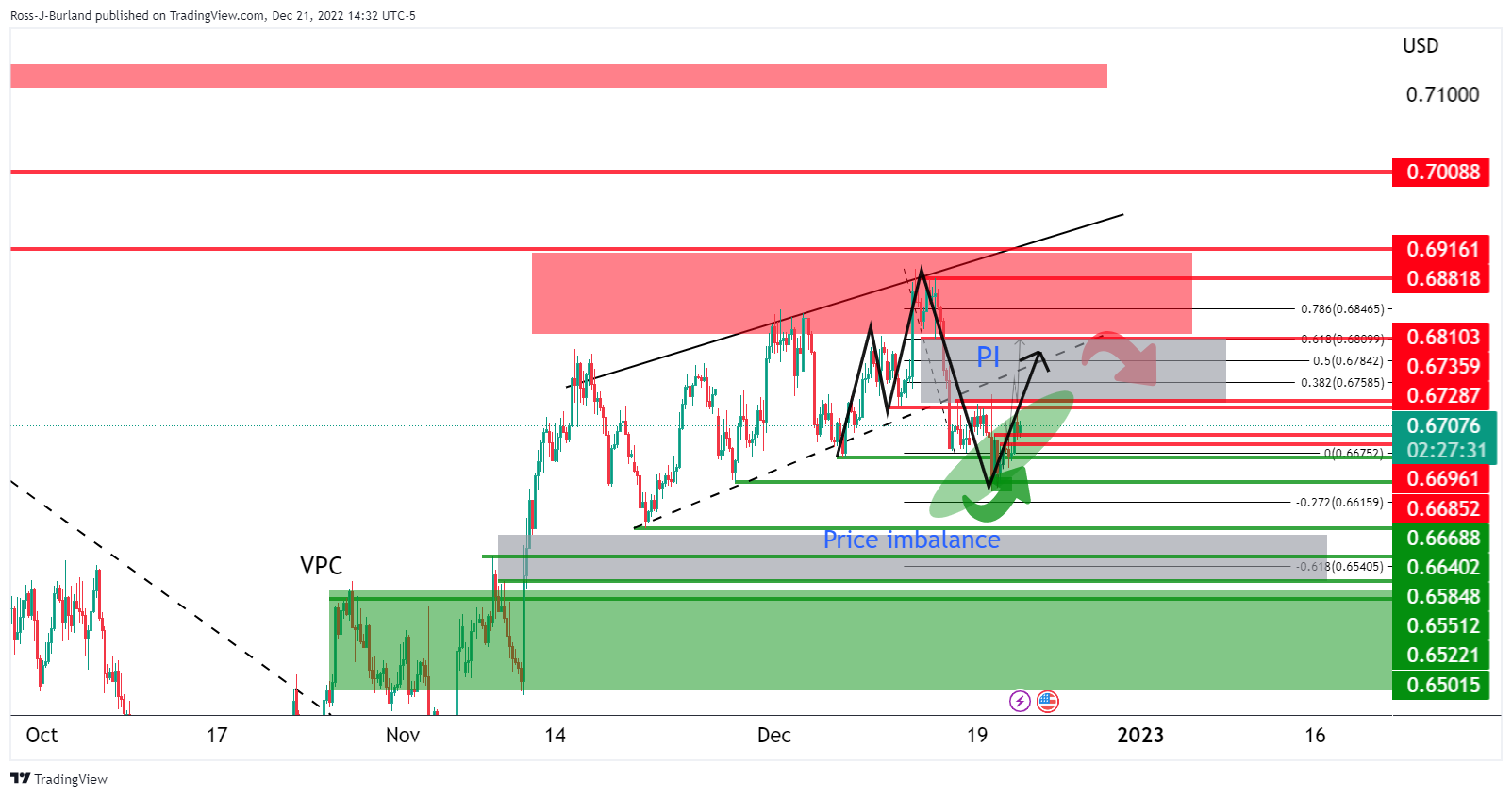

AUD/USD steadies near 0.6700 with eyes on US GDP

- AUD/USD treads water after printing the biggest daily gains in over a week.

- Firmer US data, challenges to sentiment probe Aussie buyers ahead of US Q3 GDP.

- Downbeat Aussie numbers failed to tame prices amid risk-positive headlines surrounding China.

- Consolidation of BOJ-led moves added strength to the Aussie pair’s recovery.

AUD/USD seesaws around the 0.6700 round figure, following a nice rebound from the weekly low, as well as posting the biggest daily gains in eight days. Even so, the Aussie buyers take a breather during early Thursday as traders await the key United States Gross Domestic Product (GDP) for the third quarter (Q3).

The Aussie pair’s latest gains could be linked to the upbeat headlines from China as Foreign Ministers of Canberra and Beijing meet after a long time, suggesting a settlement over the thorny issues. As the meeting went on, China President Xi Jinping crossed wires while saying, “Healthy, stable development of China-Australia ties conducive to promoting, peace, stability and prosperity in Asia-Pacific.” The policymaker also added that (they) will work with Australia to promote China-Australia comprehensive strategic partnership. Additionally, headlines suggesting more stimulus from China also underpin the AUD/USD rebound due to the Aussie-China trade links.

Alternatively, downbeat prints of Australia’s Australia’s Westpac Leading Index, to -0.1% in December compared to -0.05% prior readings, should have probed the AUD/USD bulls. On the same line is the eight-month high US Conference Board’s (CB) Consumer Confidence, which marked the latest print of 108.3 for December, compared to the market forecasts of 101.0 and the revised prior readings of 101.40.

It’s worth noting that Ukrainian President Volodymyr Zelensky’s US visit and Russian President Vladimir Putin’s readiness to increase the country’s military potential seemed to have probed the AUD/USD bulls of late.

Above all, the consolidation of the Bank of Japan (BOJ) led shock seemed to have helped the AUD/USD bulls against all the odds.

Amid these plays, Wall Street closed positive and the US Treasury yields retreated. Even so, the US Dollar Index (DXY) snapped a two-day downtrend.

Looking forward, a light calendar in Asia may restrict AUD/USD moves ahead of the European and North American trading sessions.

Today’s scheduled United States Gross Domestic Product (GDP) for the third quarter (Q3) and Core Personal Consumption Expenditure (PCE) details for Q3 will be crucial for immediate directions. Forecasts suggest that the US GDP is expected to confirm 2.9% Annualized growth in Q3 while the Core PCE will also meet the initial forecasts of 4.6% QoQ during the stated period. As a result, the softer US numbers may allow the AUD/USD buyers to keep the reins.

Technical analysis

Repeated bounces off the 100-DMA, currently around 0.6660, keep AUD/USD buyers hopeful.

-

22:41

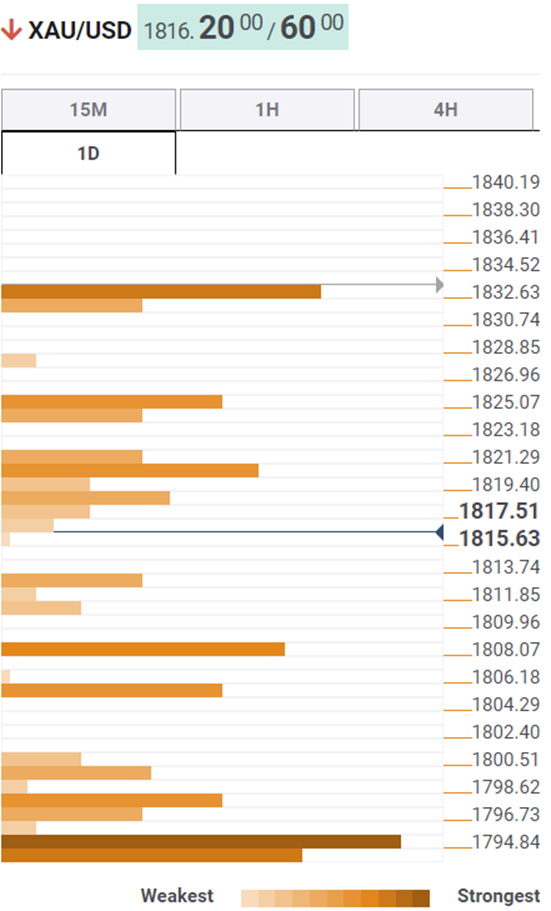

Gold Price Forecast: XAU/USD prints bull flag ahead of United States Gross Domestic Product

- Gold price stays on the way to snap two-week uptrend, portrays bullish chart formation.

- United States data underpin US Dollar recovery but firmer sentiment keeps Gold buyers hopeful.

- US Gross Domestic Product is expected to confirm initial forecasts for third quarter (Q3), suggesting further upside for XAU/USD.

- Headlines surrounding Russia, China should be eyed for clear directions.

Gold price (XAU/USD) remains sidelined after retreating from a one-week high as traders await the key United States Gross Domestic Product (GDP) for the third quarter (Q3). Also challenging the yellow metal prices could be the mixed sentiment and year-end inaction. It’s worth noting, however, that a bullish chart formation on the hourly play keeps the XAU/USD bulls hopeful ahead of the US data.

Gold retreats as United States data underpinned US Dollar rebound

After initially refreshing the one-week high on the softer US Dollar, the Gold price reversed gains late Wednesday as the greenback cheered firmer data from the United States, as well as challenges to the sentiment.

That said, the US Conference Board’s Consumer Confidence jumped to the highest levels in eight months with the latest print of 108.3 for December, compared to the market forecasts of 101.0 and the revised prior readings of 101.40. It’s worth noting, however, that softer prints of the US Existing Home Sales for November, 4.09M MoM compared to 4.2M expected and 4.43M prior, challenged the greenback bulls afterward.

Following that, the US Dollar Index (DXY) printed the first daily gain in three even as it retreated to 104.22 by the end of Wednesday.

Given the US Dollar’s inverse relations with Gold, a firmer DXY weighed on the yellow metal price.

Risk catalysts also challenge XAU/USD bulls

In addition to the firmer data, challenges to the sentiment, mainly emanating from Russia and China, also seem to probe the Gold price.

Ukrainian President Volodymyr Zelensky is in the United States for a diplomatic visit. During the same, Us President Joe Biden said that the United States shares the same vision of a "free, independent, prosperous and secure Ukraine."

On the other hand, Russian President Vladimir Putin announced he would increase the country’s military potential.

Elsewhere, doubts about China’s Covid conditions also challenge the XAU/USD bulls. However, the dragon nation’s readiness for more stimulus probes the Gold bears.

Gold buyers keep eyes on US data, risk catalysts

Given the recent challenges to the Gold price, mainly due to the firmer US data and risk-negative headlines, today’s scheduled United States Gross Domestic Product (GDP) for the third quarter (Q3) and Core Personal Consumption Expenditure (PCE) details for the Q3 will be crucial for immediate directions. That said, the US GDP is expected to confirm 2.9% Annualized growth in Q3 while the Core PCE will also meet the initial forecasts of 4.6% QoQ during the stated period. As a result, the softer US numbers may allow the Gold buyers to return.

On the other hand, the Russia-Ukraine tussles are well-known and have been getting less attention of late, which in turn suggests no major negatives for Gold despite the latest downbeat headlines surrounding the geopolitical issues. Further, China’s readiness for more stimulus and opening of the economy could supersede the Covid woes and can favor the XAU/USD bulls.

Above all, the year-end holiday mood could challenge the Gold traders unless witnessing any major surprises.

Gold price technical analysis

Despite the latest retreat, Gold price prints a bull flag formation on the hourly chart.

However, bearish signals from the Moving Average Convergence and Divergence (MACD) indicator join the mostly steady Relative Strength Index (RSI), located at 14, to suggest XAU/USD’s further grinding towards the south.

As a result, the stated flag’s support line, near $1,810 by the press time, gains major attention, a break of which will not only defy the bullish chart pattern but could also drag the Gold price towards the 100-HMA level, close to $1,797 by the press time.

It’s worth noting, however, that an upward-sloping support line from Friday, near $1,795 at the latest, puts a floor under the Gold price.

On the flip side, a break of the $1,818 level will confirm the bull flag chart formation and can please the Gold buyers. Even so, an eight-day-old descending resistance line, around $1,820, could act as a validation point for the XAU/USD bull run.

Following that, XAU/USD run-up towards the theoretical target surrounding $1,855 can’t be ruled out.

In a case where the Gold price remains firmer past $1,855, June’s high near $1,880 will be in focus.

Overall, the Gold price remains on the buyer’s radar despite the latest retreat.

Gold price: Hourly chart

Trend: Limited downside expected

-

21:30

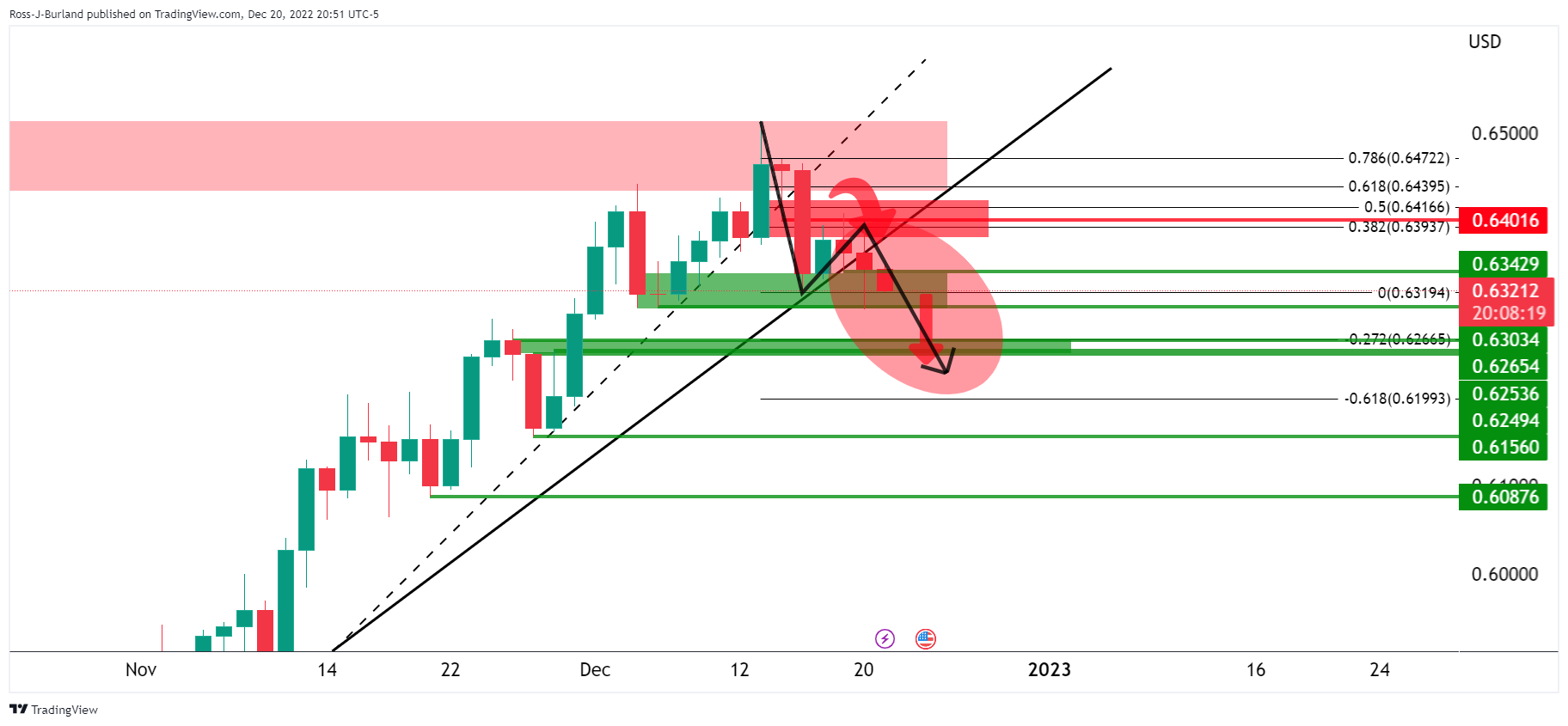

NZD/USD Price Analysis: Bears in charge and eye 0.6250

- DXY downside is playing into the hands of the bearish NZD/USD thesis.

- NZD/USD bears stay in control below the counter trendline.

As explained in the prior analysis, NZD/USD Price Analysis: Bears eye a break of 0.6300, the bears now need to stay below 0.6300 and the critical counter trendline.

NZD/USD daily chart

We have a possible downside continuation for the rest of the year on the cards with 0.6250 eyed. This ties in with the bearish bias in the US Dollar:

DXY has been pressured below the 104 mark on Wednesday but is holding losses after the Bank of Japan unexpectedly raised the upper limit of its tolerance band on 10-year government bonds to 0.5% from 0.25%.

However, an upcoming recession could keep the Federal Reserve from holding interest rates at higher levels in the FOMC’s projections last week to tame inflation, supporting the greenback and playing into the hands of the bearish NZD/USD thesis

-

21:00

South Korea Producer Price Index Growth (MoM) below forecasts (0.5%) in November: Actual (-0.2%)

-

21:00

South Korea Producer Price Index Growth (YoY) came in at 6.3%, below expectations (6.6%) in November

-

20:21

EUR/USD Price Analysis: Bears eye move into key support area

- EUR/USD bears stay in control below key resistance despite bullish attempts.

- Bears eye a test of the trendline support for days ahead.

As per the prior analysis, EUR/USD Price Analysis: Bulls and bears in a tug of war at critical area on H4 and daily charts, where it was illustrated that we saw the bears try to commit below the counter-trendline resistance and around the neckline of the formation, the bears stay in control:

EUR/USD prior analysis

EUR/USD update

If the price remains in a bearish structure and the bears commit, then a test of the trendline could be the next objective and a 50% expansion of the recent consolidation range exposes the lower quarter of the 1.05s.

On the other hand, considering the price remains in a bullish trend on the front side of the dominant trend line, then there are prospects for an outright continuation to the upside to target 1.0800:

-

20:17

Forex Today: Little action across the FX board

What you need to take care of on Thursday, December 22:

The FX board entered a low volatility consolidative phase, typical of the last two weeks of December. The US Dollar seesawed between gains and losses, ending the day mixed against its major rivals. The Greenback got a temporal boost from CB Consumer Confidence, as the index improved more than anticipated in December. However, the news underpinned US indexes, with Wall Street up for a second straight day.

On a down note that did not reach trading boards, Russian President Vladimir Putin announced he would increase the country’s military potential. The news anticipate a long-lasting conflict in Ukraine and long-term implications for Moscow's relationship with the Western world.

The EUR/USD pair continued to hover around the 1.0600 mark, ending a third consecutive day little changed just above the level.

GBP/USD fell sub-1.2100 after trading as high as 1.2240, with the pound undermined by poor UK data as government borrowing hit a record high in November.

AUD/USD found support in stocks’ momentum but struggled to extend gains beyond the 0.6700 threshold. USD/CAD trades pretty much flat at around 1.3610. Inflation in Canada rose by 6.8% YoY in November, down from 6.9% in October, slightly higher than the market expectation of 6.7%. On a monthly basis, the CPI rose by 0.1%.

Finally, USD/JPY stabilized just above the 132.00 level.

Gold flirted with December high but ended the day at around $1,813 a troy ounce. Crude oil prices, on the other hand, rallied, with WTI settling at $78.45 a barrel.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:35

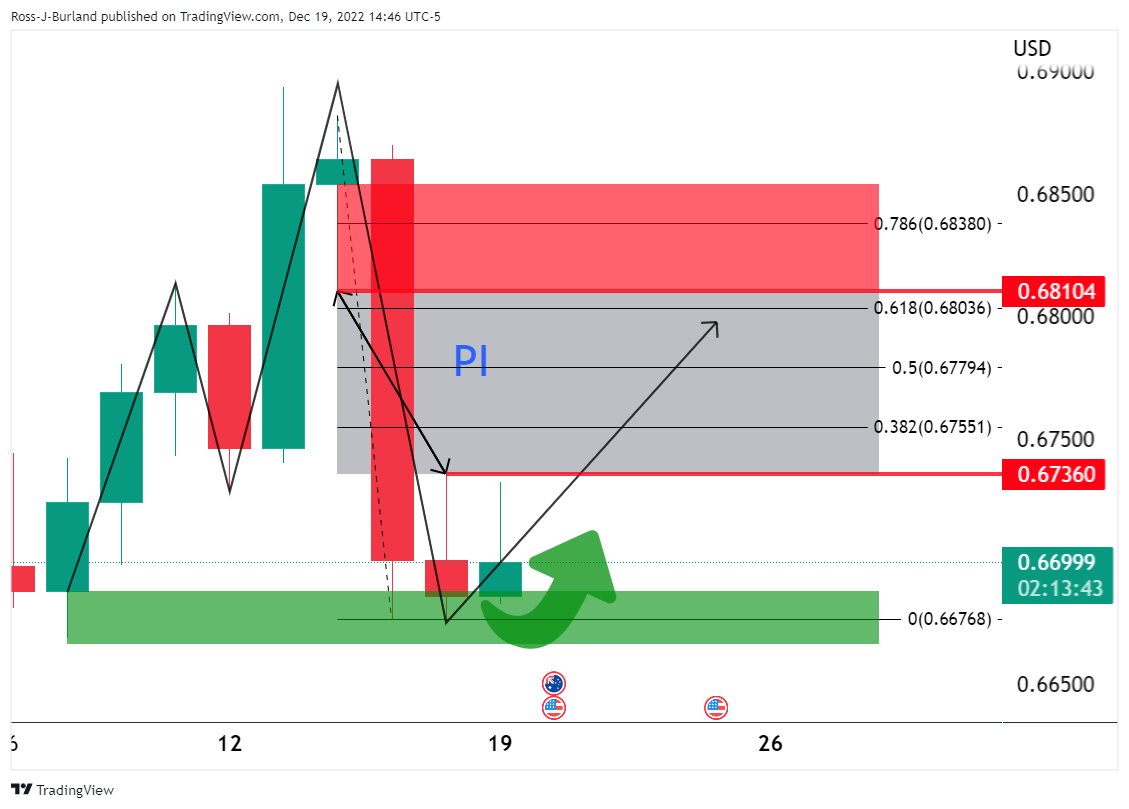

AUD/USD Price Analysis: Bulls stay the course, eyes on 0.6800

- AUD/USD bulls have taken back control rom a peak bottom formation.

- Focus is on a move into the 0.68s for the days ahead.

As per the prior day's analysis, while the overall thesis is for a move to 0.6500, there has been a meanwhile prospect for 0.6800.

In the latest price action, we have seen a sweep of liquidity to 0.6630 which has seen 0.6700 taken out

AUD/USD prior analysis

On the daily time frame it was shown that there is a price imbalance (PI) between 0.6736 and 0.6810 with the 61.8% ratio eyed as a confluence:

On the lower time frames, it was stated that the bulls will want to see a break of the trendline and prior lower high to confirm a bullish bias:

It was shown that there was a break in the trendline on the hourly chart but the market was coiling sideways.

There were equal lows at 0.6695 that were being pressured with liquidity in market orders expected below and under 0.6675 lows.

It was stated that a ''sweep' of the liquidity could result in a surge of demand from the bulls and ultimately provide enough fuel to take out the 0.6720 and then the 0.6736 resistance and create a change of character (CoCh) in the structure to bullish.

However, for the immediate future, 0.6700 is key support:

AUD/USD update

-

19:01

Argentina Unemployment Rate (QoQ) increased to 7.1% in 4Q from previous 6.9%

-

18:31

United States 20-Year Bond Auction down to 3.935% from previous 4.072%

-

18:31

GBP/USD bears take on fresh breakout lows near 1.2050

- GBP/USD has made fresh breakout lows to 1.2050s.

- Bears eye a continuation following a healthy correction.

GBP/USD is making a fresh breakout low in North American trade on Wednesday. GBP/USD is down by some 8% to 1.2070 having travelled from a high of 1.2191 to a low of 1.2055 The pound dropped as British public borrowing hit a November record, underscoring the challenges for the UK economy. Meanwhile, the greenback is picking up a safe haven bid as investors worry that an upcoming recession could keep the Federal Reserve from holding interest rates at higher levels in the FOMC’s projections last week to tame inflation.

In the Fed's December meeting, the central bank raised interest rate by a more moderate 50 basis points but indicated that the terminal rate could reach 5.1% next year, higher than markets anticipated. Meanwhile, analysts at Rabobank said that for the GBP outlook to significantly advance it is likely that investment and productivity growth will have to show signs of improvement,'' analysts at Rabobank argued.

''This may require more visible leadership from PM Sunak, though divisions in his own party will likely prove difficult to manage. Additionally, while a workable solution over the Northern Ireland protocol could bring fresh clarity over the UK’s relationship with Europe, this remains a deeply challenging issue. On balance, we expect UK fundamentals to remain sour in the months ahead.''

As for the technical outlook, GBP/USD remains on the backside of the late September rally's trendline where the pair gained some 20% in the quarter so far, albeit shedding gains to around 3% to the current spot price and consolidation lows of 1.20975.

GBP/USD technical analysis

Still, the Pound Sterling is on track for its best quarter in more than 13 years. However, However, GBP/USD remains about 10% lower for the year and the following analysis is going to be through the eyes of the bears.

The bearish wicks have been a compelling feature which put the emphasis on a test of 1.2080 and below:

-

16:48

Canada: Inflation is easing, but progress in November was slower than expected - CIBC

Data released on Wednesday in Canada showed the annual inflation rate dropped from 6.9% to 6.8%. Analysts at CIBC, point out that inflation is easing but is a slower progress than what probably the Bank of Canada was hoping for.

Key Quotes:

"The 6.8% headlinethanual rate was only a tick lower than the prior month and slightly above the consensus expectation (6.7%). Of greater concern to policymakers, however, is that the easing in core measures of inflation (including CPI-trim, median and ex food/energy) appears to have stalled at levels still above those that would be consistent with a 2% inflation target. We would like to see signs of a deceleration in core measures when the December data are released to be more confident in our view that the Bank will pause its rate hiking cycle at the January meeting (which is a week after the next CPI release).

"The good news is that inflation is easing, and that will become more noticeable when the big monthly increases seen this spring start to drop out of the annual calculation next year. However, the bad news is that it is slower progress than we and maybe even the Bank of Canada was hoping for. We still expect no change in interest rates at the January meeting, although it would be nice to see a deceleration in some core measures of inflation in next month's release to be more confident in that call."

-

16:27

EUR/USD keeps moving sideways around 1.0600 as stocks jump

- US Dollar mix on Wednesday between higher US yields and risk appetite.

- Wall Street posts important gains: Dow Jones up by 1.70%.

- EUR/USD on a quiet range, moving near 1.0600.

The EUR/USD continues to move without a clear direction. It printed a fresh daily low at 1.0595 and then rebounded back above 1.0600.

The US Dollar is posting mixed results across the board. The rebound in US bond yields is being offset by risk appetite. The Dow Jones is up by 1.70% while the S&P 500 gains by 1.60%.

US data: one positive, one negative

Existing Home Sales dropped in November for the 10th straight month to an annual rate of 4.09 million, below the 4.20 million of market consensus. A different report showed the Conference Board Consumer Confidence Index rose in December to 108.3 beating market estimates.

Risk sentiment prevailed after the numbers and even US bond yields. The US 10-year bond yield stands at 3.68% after rebounding from 3.62% while the 2-year bond yield climbed from under 4.20% to 4.23%. In Europe, bond yields also rebounded, helping EUR/USD remain sideways. The Euro is also receiving support from the rally in EUR/GBP that trades at monthly highs above 0.8770.

EUR/USD sideways

Since the beginning of the week, EUR/USD is moving around 1.0610, in a range, with the upper limit at 1.0660 and the bottom at 1.0575. A consolidation below 1.0570 could open the doors to an extension of the correction after reaching levels above 1.0700 last week.

On the contrary, a firm break above 1.0660 should expose the 1.0700 mark that protects the December high at 1.0737.

Technical levels

-

16:00

Russia Producer Price Index (YoY) declined to -1.9% in November from previous 0.8%

-

15:59

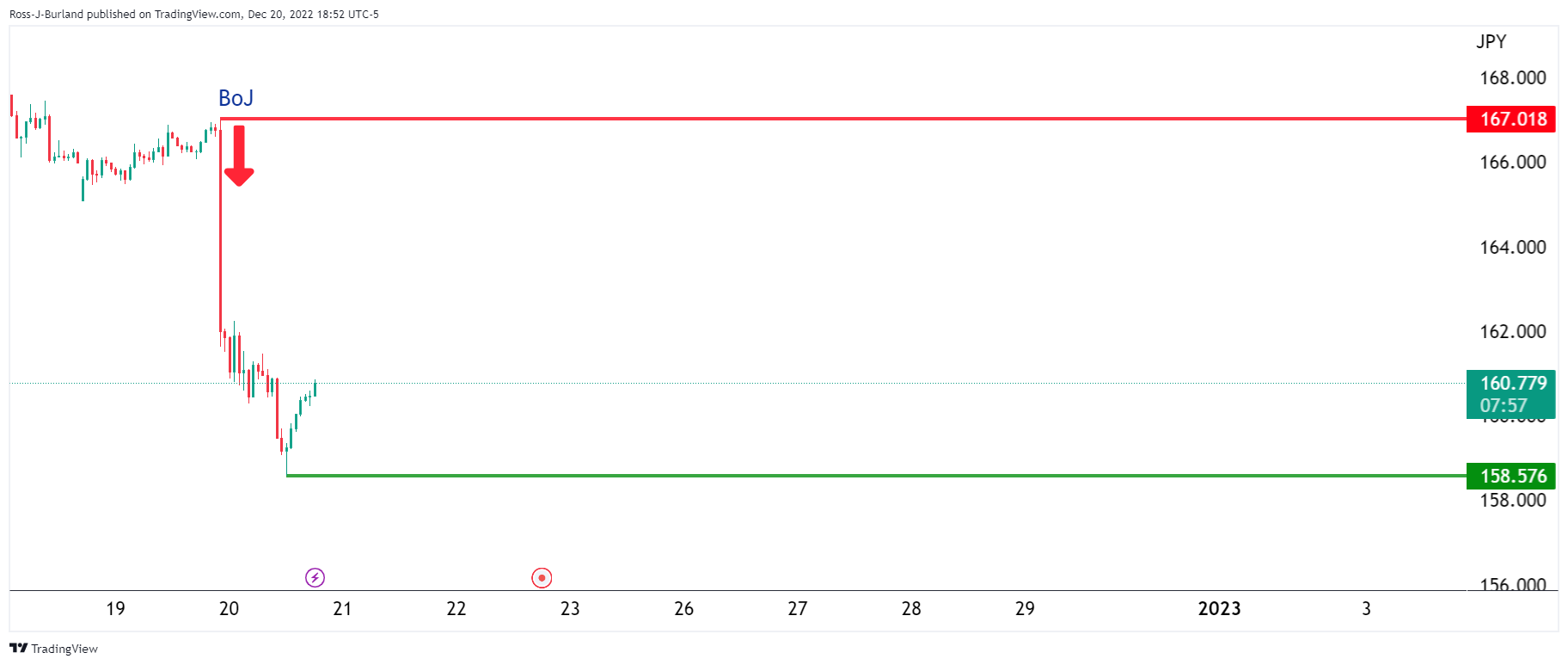

USD/JPY: Further weakness expected by end-2023 – HSBC

USD/JPY plunged on surprise Yield Curve Control modification. Economists at HSBC expect some level of USD/JPY weakness by end-2023 but downside risks may be emerging.

Policy tweak should buy the BoJ some time

“It is possible that market participants may anticipate more dramatic policy changes by the BoJ in 2023, for example, exiting negative interest rate policy (NIRP) or even abandoning YCC, but we think the policy tweak should buy the BoJ some time.”

“The next development to watch now is life insurance companies’ FX hedging. If these companies raise their FX hedge ratio, that could also cause USD/JPY to fall sharply, like in 1Q-3Q 2016.”

“We expect some level of USD/JPY weakening by end-2023 but downside risks are clearly emerging.”

-

15:42

Core PCE Preview: Forecasts from five major banks, prices to have gone up moderately

The Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (Core PCE), will be published on Friday, December 23 at 13:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of five major banks.

The market expectation is for the monthly core PCE inflation to rise by 0.4% in November following October’s 0.2% increase. On a yearly basis, consensus sees 4.6% vs. 5.0% in October. If so, it would be the second straight deceleration to the lowest since October 2021.

TDS

“Core PCE prices likely rose at a 0.2% MoM pace for a second consecutive month in Nov (also matching the core CPI data). The YoY rate likely fell to 4.6% from 5.0% in Oct, suggesting prices continue to moderate but remain sticky at elevated levels. Separately, personal spending is expected to rise a firm 0.3% MoM after the solid 0.7% MoM pace registered, on avg, over Aug-Oct.”

Deutsche Bank

“We think it should come in at 0.2% MoM, taking the YoY rate down three-tenths to 4.7%. Normally core PCE is above core CPI but over the next 12 months our economists think that anomalies in healthcare components between the two means that the former will edge above the latter at 3.2% for 2023 Q4/Q4 against 3.1%.”

NBF

“Still in November, Core PCE deflator may have moved down from 5.0% to 4.7%.”

CIBC

“The Fed’s preferred measure of prices, core PCE prices, could have risen more modestly on a monthly basis than its CPI counterpart, given the lower weighting of shelter in the index, leaving the annual pace at 4.6%. We are roughly in line with the consensus, which should limit any market reaction.”

Wells Fargo

“We expect a 0.2% monthly rise in the headline index and a 0.3% increase in the core index.”

-

15:40

US Dollar will come under further pressure in 2023 – UBS

USD/JPY touched its lowest level in over four months at 130.60. Economists at UBS expect the pair to extend its decline towards 125 as the greenback will remain under pressure.

Tightening outside the US adds to downward pressure on the US Dollar

“We had been expecting the Yen to appreciate modestly against the US currency through next year, with USD/JPY going from 133 at present to around 125 by the end of 2023. The question for markets now will be whether the Bank of Japan will allow yields to rise further when the new governor takes over from Kuroda in April. This could put additional upward pressure on the Yen.”

“We believe that the US Dollar will weaken in 2023, given that the US Federal Reserve is closer to an end of its tightening cycle that other major central banks.”

-

15:30

United States EIA Crude Oil Stocks Change: -5.894M (December 16) vs previous 10.231M

-

15:20

EUR/JPY points to a deeper drop towards 130 – SocGen

EUR/JPY licks its wounds after slump to 138.81. Nevertheless, economists at Société Générale expect the pair to suffer further losses toward 130.

New highs for 10y Bund yields and swaps are possible in Q1

“For European and US fixed income markets, less Japanese buying could mean trouble ahead and greater pressure on domestic investors to absorb the overhang of new debt.”

“New highs for 10y Bund yields and swaps are possible Q1 if we bring together bearish forces including bond supply, higher ECB rates and the start of QT.”

“Fundamentals aside, the chart for EUR/JPY is showing an interesting parallel with early 2015 and points to a deeper drop towards 130.”

-

15:16

EUR/GBP hits fresh one-month highs at 0.8780

- Pound among worst performers on Wednesday.

- UK: Borrowing was higher than expected in November.

- EUR/GBP bullish, looking at 0.8800 and more.

The EUR/GBP cross gained momentum during the European session and climbed to 0.8780, hitting the highest level since November 15. It then pulled back, finding support at 0.8745 and after the beginning of the American session, it is approaching daily highs.

The Euro jumped last week after the European Central Bank and the Bank of England meetings, rising above 0.8700. After pausing and holding above 0.8700, EUR/GBP appears to be resuming the upside. If the rally continues, the next level to watch is the November high at 0.8825/30.

The key support for the current move higher is seen at 0.8670, the 50-day Simple Moving Average. A break lower could send EUR/GBP back to the previous range between 0.8550 and 0.8660.

Pound hit by data

Data released on Wednesday showed the UK government borrowed 22 billion pounds in November, above the 8 billion of market expectations. It was a record for the month. The energy price support scheme and inflation effects are having an impact on UK public finances.

Analysts at Rabobank see UK fundamentals to remain sour in the coming months. They see the pound vulnerable and forecast EUR/GBP rising to 0.90 on a six to nine months perspective.

Technical levels

-

15:11

US: Existing Home Sales decline by 7.7% in November vs. 0% expected

- Existing Home Sales in the US fell sharply in November.

- US Dollar Index clings to small daily gains slightly above 104.00.

Existing Home Sales in the US declined by 7.7% in November to a seasonally adjusted annual rate of 4.09 million, the National Association of Realtors (NAR) reported on Wednesday. This reading came in much worse than the market expectation for a no-change.

"The median existing-home sales price rose to $370,700, an increase of 3.5% from one year ago," the NAR further noted in its publication.

Market reaction

This report doesn't seem to be having a significant impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was up 0.15% on the day at 104.12.

-

15:05

US: CB Consumer Confidence improves to 108.3 in December

- CB Consumer Confidence Index in the US rose in December.

- US Dollar Index retreats toward 104.00 in the American session.

Consumer sentiment in the US continued to improve in the US with the Conference Board's Consumer Confidence Index rising to 108.3 from 101.4 in November. This reading came in better than Reuters' estimate of 101.0.

Further details of the publication revealed that the Present Situation Index rose to 147.2 from 138.3 and the Consumer Expectations Index edged higher to 82.4 from 76.7.

Finally, the one-year consumer inflation rate expectations dropped to 6.7% from 7.1%.

Market reaction

The US Dollar Index edged lower with the initial reaction and it was last seen rising 0.15% on the day at 104.13.

-

15:01

China optimism fading would pressure AUD lower – MUFG

The Australian Dollar was the worst performing G10 currency yesterday. The Aussie is still vulnerable to downside correction, in the view of economists at MUFG Bank.

Greater caution of the RBA could spell trouble for AUD

“China optimism as lockdowns end seems to us to have been one source for AUD outperformance. But that could quickly turn. Data from China showed business conditions at small and medium-sized firms in China was in contractionary territory for the third consecutive month in December highlighting that the surge in infections may be continuing to curtail economic growth despite the announcements of restrictions being eased.”

“We continue to expect scope for a worsening of risk conditions in Q1 which could well add to downside risks for AUD that were highlighted in the RBA minutes that there is a building reluctance to tighten much further.”

-

15:00

United States Existing Home Sales (MoM) below forecasts (4.2M) in November: Actual (4.09M)

-

15:00

United States Existing Home Sales Change (MoM) registered at -7.7%, below expectations (0%) in November

-

14:58

BI Preview: Forecasts from four major banks, slowing the pace of rate hikes in December

Bank Indonesia (BI) will hold its monthly governor board meeting on Thursday, December 22. Here you can find the expectations as forecast by the economists and researchers of four major banks regarding the upcoming central bank's rate decision.

BI is expected to hike rates by 25 basis points (bps) to 5.50%. At the last meeting on November 17, the bank hiked rates by 50 bps to 5.25%.

Standard Chartered

“We expect BI to hike the 7-day reverse repo rate by 25 bps to 5.5%, following three consecutive 50 bps hikes. With inflation on track to return to BI’s inflation target, we think interest rates will be calibrated to respond to Fed hikes, which have pressured the IDR; BI said it expects December inflation to ease further to 5.2% from 5.4% in November. While pressure on the IDR may ease with diminishing USD strength, a Fed pivot, and the unwinding of foreign investors’ underweight positioning, BI may need to keep the policy rate flat for the rest of 2023 to strengthen monetary policy transmission. We expect another 25 bps hike in January, taking the policy rate to 5.75% by end-2023.”

ING

“BI will likely hike by 25 bps. BI will need to sustain rate hikes but softer-than-expected headline inflation could mean that the central bank also slows the pace of its tightening. BI may also need to hike rates to support the rupiah which has faced some pressure after the recent strong support provided by sterling export growth appears to be fading fast.”

TDS

“BI may opt for a step down in its hiking pace to 25 bps as inflation has peaked and is moderating. BI Governor Warijyo's comment that inflation expectations are ‘coming down rapidly and nearing BI's goal’ also suggests to us that BI is likely to end its front-loading policy stance.”

SocGen

“We expect BI to announce a rate hike of 25 bps to take the year-end policy rate to 5.50%. With inflation clearly having peaked and showing signs of moderation, vs our earlier expectation of further strengthening, we see the central bank approaching the end of its current rate-hike cycle. We expect BI to make one final hike of 25 bps at its meeting in January before bringing the cycle to an end.”

-

14:33

EUR/GBP to creep towards 0.90 amid weak UK fundamental backdrop – Rabobank

GBP is ending the year down around 11.6% vs, the USD and down 4.2% vs. the EUR. Economists at Rabobank expect UK fundamentals to remain sour in the months ahead.

Weak investment growth and low productivity levels

“For the GBP outlook to significantly advance it is likely that investment and productivity growth will have to show signs of improvement. This may require more visible leadership from PM Sunak, though divisions in his own party will likely prove difficult to manage.”

“Additionally, while a workable solution over the Northern Ireland protocol could bring fresh clarity over the UK’s relationship with Europe, this remains a deeply challenging issue.”

“We continue to view the Pound as vulnerable and expect EUR/GBP to creep towards 0.90 on a six to nine-month view.”

-

14:25

USD/JPY could see further notable declines into the high 120’s – MUFG

USD/JPY plunged by over 4% on Tuesday, the largest drop since October 1998. Economists at MUFG Bank believe that the pair could extend its slide to the high 120’s.

JPY is now the top performing G10 currency since 21st October

“Governor Kuroda was expressing reservations about the sustainability of the pick-up in inflation, predicting it would fall back next year.”

“The Yen has gained 15% versus the dollar since the close on 20th October and will if sustained act as a powerful disinflationary force next year. It will certainly help protect Japan more from global energy price inflation.”

“The Yen is likely to remain under upward pressure and positioning liquidation risks as year-end approaches could see further notable declines in USD/JPY into the high 120’s.”

-

14:07

Gold Price Forecast: XAU/USD consolidates below multi-month top, bullish potential intact

- Gold price reverses an intraday dip to the $1,811 area, though lacks follow-through.

- The USD fails to preserve its modest intraday gains and offers support to the metal.

- Hawkish central banks and the risk-on-impulse act as a headwind for the XAU/USD.

Gold price struggles to capitalize on the previous day's rally of around 2% and hits a hurdle near the $1,822-$1,824 region, or its highest level since late June touched earlier this month. The intraday dip, however, turns out to be short-lived and stalls near the $1,811 area. The XAU/USD turns neutral during the early North American session and remains at the mercy of the US Dollar price dynamics.

Modest US Dollar downtick offers support to Gold price

In fact, the US Dollar Index (DXY), which measures the Greenback's performance against a basket of currencies, surrenders its modest gains amid a fresh leg down in the US Treasury bond yields. This, in turn, is seen as a key factor lending some support to the US Dollar denominated Gold price. The upside potential for the XAU/USD, meanwhile, seems limited amid the risk-on impulse and the prospects for further policy tightening by major central banks, including the Federal Reserve (Fed).

Hawkish central banks might continue to cap Gold price

It is worth recalling that the US central bank struck a more hawkish tone and indicated that it will continue to hike interest rates to combat stubbornly high inflation. Furthermore, the European Central Bank (ECB), the Bank of England (BoE), the Reserve Bank of Australia (RBA), and the Reserve Bank of New Zealand (RBNZ) have signalled that more hikes were likely. This, in turn, might hold back traders from placing aggressive bullish bets around the non-yielding Gold price and cap gains.

Recession fears could act as a tailwind for Gold price

That said, growing recession fears, amid a surge in COVID-19 cases in China and geopolitical risks, could benefit the safe-haven Gold price. In the latest development surrounding the Russia-Ukraine saga, Ukrainian President Volodymyr Zelensky travels to the United States to meet President Joe Biden. Russia, meanwhile, says that there is no chance of peace talks and that the continued arms supplies by Western allies to Ukraine would lead to a deepening of the ongoing conflict.

Focus shifts to important macro data from the United States

Traders might also prefer to wait for a fresh catalyst from this week's important macro data from the United States. The final US Q3 GDP print is scheduled for release on Thursday. The focus will then shift to the US Core PCE Price Index (the Federal Reserve's preferred inflation gauge), which should provide some meaningful impetus to Gold price ahead of the year-end holiday season.

Gold price technical outlook

From a technical perspective, acceptance above the very important 200-day Simple Moving Average (SMA) favours bullish traders. The constructive set-up is reinforced by the fact that oscillators on the daily chart are holding comfortably in the positive territory and are still far from being in the overbought zone. That said, it will still be prudent to wait for some follow-through buying beyond the multi-month top, around the $1,822-$1,824 region, before positioning for any further gains.

On the flip side, the $1,812-$1,810 horizontal resistance breakpoint now seems to protect the immediate downside. Any further pullback could attract fresh buyers near the $1,800 mark, which, in turn, should help limit the downside near the 200-day SMA. The latter is currently pegged near the $1,786 area and should act as a strong base for the Gold price, which if broken decisively might negate the near-term positive outlook.

Key levels to watch

-

13:34

Canada: Annual CPI declines to 6.8% in November vs. 6.7% expected

- Annual Core CPI in Canada stayed unchanged at 5.8% in November.

- USD/CAD holds above 1.3600 after Canadian inflation figures.

Inflation in Canada, as measured by the Consumer Price Index (CPI), declined to 6.8% in November from 6.9% in October. This reading came in slightly higher than the market expectation of 6.7%. On a monthly basis, the CPI rose by 0.1%.

Additionally, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, stayed unchanged at 5.8% on a yearly basis.

Market reaction

The USD/CAD pair showed no immediate reaction to these data and was last seen trading modestly higher on the day at 1.3617.

-

13:30

Canada Consumer Price Index - Core (MoM): 0.3% (November) vs 0.2%

-

13:30

United States Current Account: $-217.1B (3Q) vs $-251.1B

-

13:30

United States Current Account up to $-217.1B in 3Q from previous $-251.1B

-

13:30

United States Current Account increased to $0.3B in 3Q from previous $-251.1B

-

13:30

Canada BoC Consumer Price Index Core (YoY) below expectations (6.4%) in November: Actual (5.8%)

-

13:30

Canada Consumer Price Index (MoM) above forecasts (0%) in November: Actual (0.1%)

-

13:30

Canada BoC Consumer Price Index Core (MoM) meets forecasts (0%) in November

-

13:30

Canada Consumer Price Index (YoY) above expectations (6.7%) in November: Actual (6.8%)

-

13:24

EUR/USD: Short-term peak suggests consolidation in the next few weeks – Scotiabank

EUR/USD holds in a narrow range around 1.06. Economists at Scotiabank think risks are tilted to the downside for the Euro in the next few weeks.

More range trading looks likely in the near term

“We continue to think the EUR has reached a short-term peak and may consolidate somewhat in the next few weeks. The likelihood of more ECB tightening steps in early 2023 suggests the EUR will remain supported on dips, however.”

“More range trading looks likely in the near term. Spot is more or less mid-way between support at 1.0575/80 and resistance at 1.0655/60.”

“Trend signals are weak on the short-term studies and the bull trend evident on the daily oscillator signal is clearly over-extended.”

-

12:45

USD/CAD: Movementto be quite limited amid mixed technicals – Scotiabank

The Canadian Dollar can’t hold sub-1.36 gains against the USD. Economists at Scotiabank look for more range-trading in the short-term at least.

Shorter-term price signals are mixed for USD/CAD

“A weak (technically bearish) close for the USD yesterday should – on the face of it – lend more weight to pressuring support around 1.36 but intraday price action suggests a firm floor and, possibly, a bullish reversal developing around the overnight failure to extend much below the figure area once again.”

“Support is 1.3590/00.”

“Resistance is 1.3665/75.”

-

12:39

When is the Canadian consumer inflation (CPI report) and how could it affect USD/CAD?

Canada CPI Overview

Statistics Canada will release the consumer inflation figures for November later during the early North American session on Wednesday, at 13:30 GMT. The headline CPI is expected to remain flat during the reported month as compared to the 0.7% increase in October. Furthermore, the yearly rate is expected to ease to 6.7% in November from the 6.9% previous. More importantly, the Bank of Canada's Core CPI, which excludes volatile food and energy prices, is estimated to come in flat for November, though rise to 6.4% on a yearly basis from 5.8% in October.

Analysts at Wells Fargo offer a brief preview of the key macro data and write: “The CPI rose at 6.9% YoY in October, and taking a closer look at the details, price gains for gasoline and mortgage interest costs were offset by softer food inflation. Commodity prices have come down from their peak, which may provide some relief on the headline inflation front. In November, we expect CPI inflation trended lower to 6.4% YoY.”

How Could it Affect USD/CAD?

Ahead of the release, the USD/CAD pair gains some positive traction and holds steady above the 1.3600 mark amid the emergence of some US Dollar buying. That said, a mildly bullish tone around crude oil prices underpins the commodity-linked Loonie and acts as a headwind for the major. A stronger Canadian CPI print will be enough to provide a fresh lift to the domestic currency and attract fresh sellers around the pair. Conversely, a softer-than-expected report should allow the pair to capitalize on its intraday uptick and aim back to conquer the 1.3700 round-figure mark.

Key Notes

• Canadian CPI Preview: Forecast from five major banks, inflation to cool

• USD/CAD Outlook: Ascending trend-line could protect the downside ahead of Canadian CPI

• USD/CAD holds steady above 1.3600 ahead of Canadian CPI, US Consumer Confidence Index

About Canadian CPI

The Consumer Price Index (CPI) released by Statistics Canada is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of CAD is dragged down by inflation. The Bank of Canada aims at an inflation range (1%-3%). Generally speaking, a high reading is seen as anticipatory of a rate hike and is positive (or bullish) for the CAD.

-

12:32

Brazil Current Account above expectations ($-2.1B) in October: Actual ($-0.6B)

-

12:24

GBP/USD: Losses to extend toward the low/mid-1.19s below 1.2090 support – Scotiabank

The GBP/USD pair slides to the 1.21 support zone. A break under recent range base support at 1.2090 would open up room for further losses, economists at Scotiabank report.

Resistance aligns at 1.2180

“Short-term trend momentum has picked up bearishly for the GBP and corrective pressure, following the sustained rise from the Sep extreme low, is building.”

“Near-term downside risk extends to the low/mid 1.19s below support at 1.2090.”

“Resistance is 1.2180.”

See: GBP/USD could return to the 1.15-1.18 range in the new year – ING

-

12:17

USD/JPY: August low at 130.40 is a foregone conclusion, then May low near 126.35 – BBH

The Yen is trading flat near 131.80 after trading as low as 130.60 yesterday. Break below the August low near 130.40 would set up a test of the May low near 126.35, economists at BBH report.

BoJ to hike in 2023

“Now, all bets are off as markets rightfully price in a BoJ hike in 2023.”

“The August low for USD/JPY near 130.40 is a foregone conclusion. After that is the May low near 126.35. After that is the March 31 low near 121.30 but let's get to 125 first and then we can talk.”

-

12:13

GBP/USD hangs near two-and-half-week low, bears flirt with 200-day SMA support

- GBP/USD comes under renewed selling pressure and slides back closer to over a two-week low.

- The Fed’s hawkish outlook, rising US bond yields revive the USD demand and weigh on the pair.

- The risk-on impulse caps gains for the safe-haven buck and limits any further slide for the major.

The GBP/USD pair meets with a fresh supply on Wednesday and slides back below the 1.2100 round-figure mark during the mid-European session. The pair is currently placed just a few pips above a two-and-half-week low touched on Tuesday, with bears still awaiting a sustained break below the very important 200-day SMA.

The US Dollar regains positive traction and recovers a part of the previous day's heavy losses, which, in turn, is seen as a key factor exerting downward pressure on the GBP/USD pair. As investors digest the Bank of Japan's surprise policy shift, the Fed's hawkish outlook last week assists the greenback to attract fresh buying. It is worth recalling that the US central bank indicated that it will continue to raise interest rates to crush inflation and projected an additional 75 bps lift-off by the end of 2023.

The British Pound, on the other hand, continues to be undermined by a dovish outcome from the Bank of England (BoE) meeting, where two MPC members voted to keep rates unchanged. This, along with growing recession fears, further contributes to the offered tone surrounding the GBP/USD pair. That said, the risk-on impulse - as depicted by a goodish move up in the US equity markets - might hold back traders from placing aggressive bullish bets around the safe-haven buck. This, in turn, could help limit losses for the major.

Hence, it will be prudent to wait for some follow-through selling and acceptance below a technically significant 200-day SMA before placing aggressive bearish bets around the GBP/USD pair. Nevertheless, the fundamental backdrop suggests that the path of least resistance for spot prices is to the downside and supports prospects for a further near-term depreciating move. Traders now look forward to the release of the Conference Board's US Consumer Confidence Index for a fresh impetus during the early North American session.

Technical levels to watch

-

12:01

Mexico Private Spending (YoY) came in at 6.4%, above expectations (6.1%) in 3Q

-

12:00

Mexico Private Spending (QoQ) below expectations (1.3%) in 3Q: Actual (0.4%)

-

12:00

United States MBA Mortgage Applications fell from previous 3.2% to 0.9% in December 16

-

11:42

GBP/JPY looks as though it is heading back towards 120 – SocGen

UK public sector finances are taking their third big hit in 25 years. Kit Juckes, Chief Global FX Strategist at Société Générale, expect the GBP/JPY pair to slide toward the 120 level.

Pounding on the debt

“Sentiment regarding Sterling is still as dire as ever, and if positions echo that, the Pound will find some support at some stage, but there’s no shortage of bad news out there to keep the pressure on.”

“Today’s bad news for the currency comes from the public sector borrowing data. The latest ONS press release makes dismal reading: PSNB excluding the public sector banks was GBP22 bn in November, almost GBP14 bn than the same month last year, and the biggest November deficit on record. Debt interest payments were also the biggest on record for November.”.

“GBP/JPY, which was briefly above 170 this Autumn, looks as though it’s heading back towards 120, a level which has had magnetic appeal since the financial crisis.”

-

11:17

US Dollar to see a early 2023 recovery – ING

US Dollar sell-off pauses. Economists at ING remain bullish on the Dollar in early 2023.

What to watch in markets during the festive period

“The US calendar includes personal income, PCE and durable goods orders for November (on 23 December) as well as Dallas and Richmond Fed manufacturing indices on 27-28 December. For the time being, there are no scheduled Fed speakers until the Fed minutes release on 4 January. We doubt data will be able to shake markets in the low-volatility environment of the festive period.”

“In China, an increasing number of unofficial reports suggest that the actual death toll may be considerably larger than the reported one: should this be backed by more evidence, markets may increasingly doubt the sustainability of China’s zero-Covid exit path, with negative implications for the yuan, Asian EMFX, and high-beta currencies.”

“On the energy side, Russia’s potential retaliation to the EU cap on gas prices, a possible re-escalation in the conflict in Ukraine and weather-related news may all have repercussions on the FX market. European currencies continue to look quite vulnerable from this point of view.”

“We think DXY could close the year around the current levels. It’s worth remembering that the Dollar rose in each of the past four years in January. Our view for early 2023 is still one of USD recovery.”

-

11:16

UK: CBI Retail Sales Balance in December improves to +11 from -19 in November

The Confederation of British Industry (CBI) reported on Wednesday that the Retail Sales Balance in December improved to +11 from -19 in November.

The CBI's Expected Retail Sales for January stood at -17.

Market reaction

This report doesn't seem to be having a significant impact on risk sentiment. As of writing, the UK's FTSE 100 Index was rising 0.7% on the day and US stock index futures were up between 0.65% and 0.75%.

Meanwhile, GBP/USD stays on the back foot and was last seen trading at 1.2120, where it was losing 0.5% on a daily basis.

-

10:50

NZD/USD to appreciate a little amid ongoing volatility – ANZ

The NZD has firmed in the past couple of months. Economists at ANZ Bank analyze the Kiwi’s outlook for the next months.

When global risks are high the NZD tends to be weaker

“Looking ahead, we expect to see ongoing volatility in the NZD as opposing forces impact its value.”

“If interest rates lift more in New Zealand than elsewhere that will put upward pressure on our currency.”

“Global risk continues to be a dominant factor influencing the value of our currency. In times of uncertainty, investors tend to favour the USD which is considered a safe haven. Therefore, when global risks are high the NZD tends to be weaker.”

“At present we expect the NZD to generally appreciate a little through our forecast horizon although it is still at the low end of the ranges seen in the past decade.”

-

10:25

USD/CAD holds steady above 1.3600 ahead of Canadian CPI, US Consumer Confidence Index

- USD/CAD attracts some dip-buying on Wednesday amid a modest USD strength.

- The Fed’s hawkish outlook and rising US bond yields help revive the USD demand.

- Bullish oil prices underpin the Loonie and keep a lid on further gains for the pair.

- Traders eye Canadian CPI and the US consumer confidence index for a fresh impetus.

The USD/CAD pair shows some resilience below the 1.3600 mark for the second straight day and attracts some dip-buying on Wednesday. The pair sticks to its modest intraday gains through the first half of the European session and is currently placed near the top end of the daily trading range, around the 1.3615-1.3620 region.

The US Dollar catches fresh bids amid a further rise in the US Treasury bond yields and turns out to be a key factor acting as a tailwind for the USD/CAD pair. The spillover effect of the Bank of Japan's policy tweak on Tuesday, widening the range for fluctuations in the 10-year government bond yield, continues to push the US bond yields higher. Apart from this, a more hawkish commentary by the Fed last week lifts the yield on the benchmark 10-year US government bond to a fresh monthly high and lends support to the greenback.

That said, a goodish recovery in the global risk sentiment - as depicted by a strong move up in the US equity futures - keeps a lid on any further gains for the safe-haven buck. Apart from this, an intraday pickup in crude oil prices underpins the commodity-linked Loonie and contributes to capping the upside for the USD/CAD pair, at least for the time being. Oil prices remain well supported by Tuesday's bullish report by the American Petroleum Institute, which showed a larger-than-expected draw in the US crude oil inventories.

Furthermore, the latest optimism over the easing of COVID-19 curbs in China further seems to benefit crude oil prices. That said, worries about rising cases in the world's top oil importer - China - could act as a headwind for the black liquid. The mixed fundamental backdrop warrants caution before placing aggressive bullish bets around the USD/CAD pair ahead of the crucial Canadian consumer inflation figures, due later during the early North American session.

Traders will further take cues from the US economic docket, featuring the release of the Conference Board's Consumer Confidence Index. This, along with the US bond yields and the broader risk sentiment, should drive the USD demand and provide some impetus to the USD/CAD pair. Apart from this, oil price dynamics could contribute to producing short-term trading opportunities.

Technical levels to watch

-

10:17

Reinforced NBH hawkishness might help EUR/HUF visit the sub-400 area in 2023 – ING

The National Bank of Hungary decided to maintain the monetary setup as it is when it gathered for the last time in 2022. The recent meeting strengthened the positive direction of the Forint, in the view of economists at ING.

"Whatever it takes" stance remains with a hawkish twist

“The National Bank of Hungary repeated its ‘whatever it takes’ stance at its last rate setting meeting in 2022. Moreover, it added a bit more hawkish flavour to its forward guidance, possibly due to the upgraded 2023 inflation outlook.”

“NBH managed to maintain or even strengthen the hawkish market sentiment, which should at least keep the current momentum of the Forint. In addition, the NBH extended the programme of providing hard currency to energy importers for the next months, which is another positive news for the Forint, delaying some of the selling pressure on the domestic currency.”

“Beyond the NBH meeting, conditions are also positive for the forint at the global level. Gas prices are heading lower and implied rates in Hungary, on the other hand, are again near record high levels providing a shield for potential selling pressures.”

“We remain bullish on the Forint and expect further appreciation towards 400 EUR/HUF by year-end and below this level next year.”

-

09:50

Riksbank: New board members might adjust rate path – Commerzbank

The exciting question for 2023 will be to what extent the monetary policy approach amongst Riksbank board members will change in 2023. Economists at Commerzbank analyze how change could affect the Swedish Krona.

How does Riksbank’s board change?

“New members will be Aino Bunge, who took up her position on 1st December, and Erik Thedeen, who will take over from Ingves on 1st January. Both of them come from the Swedish Financial Supervisory Authority, and the meeting in February will be their first rate decision. If there is a stalemate amongst the 6 board members Thedeen’s vote is decisive.”

“The current implied rate path might not be sufficient to get a grip on inflation. This is where the new board members come in: if they tend more towards a dovish approach the Riksbank is likely to stick to its approach, which would be neutral for the Krona. If they turn out to be hawks, the Riksbank might adjust its rate path to the upside if the latest inflation data surprises on the upside once more.”

“However, we are only likely to find out about this in February unless Thedeen and Bunge make comments in one or the other direction beforehand.”

-

09:44

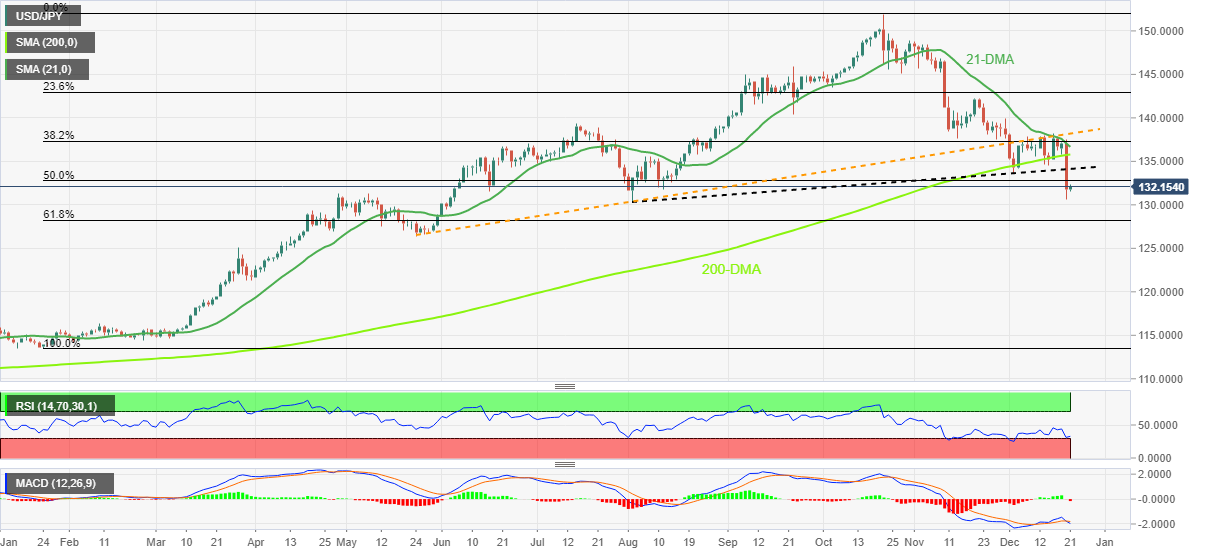

USD/JPY consolidates losses above 131.50 ahead of US data

- USD/JPY is recovering from a brief dip to near the 131.50 region.

- Markets stabilize after BoJ’s surprise tweak to yield policy.

- USD/JPY remains vulnerable amid a potential bear flag on the 4H chart.

USD/JPY is licking its wound just above the 131.50 support, as bears bide time before resuming the downtrend. The positive shift in risk sentiment and stabilizing US Dollar, as well as, the Treasury yields, are doing little to put a floor under the USD/JPY pair.

The currency pair remains vulnerable amid mixed comments from Japanese authorities on the Bank of Japan’s (BoJ) surprise policy move. The BoJ stunned markets on Tuesday, with an unexpected revision to its yield control policy, which fuelled a massive 3.8% surge in the Japanese Yen against US Dollar.

However, USD/JPY is poised to break its latest consolidative mode below 132.00 to the downside, as the pair has carved out a bear flag formation on the four-hour chart.

A four-hourly candlestick closing below the rising trendline support at 131.89 will confirm the bearish continuation pattern.

A fresh downswing will be initiated, calling for a retest of the 131.00 round figure. Further south, the four-month low of 130.57 will be the next target on sellers’ radars.

The 14-day Relative Strength Index (RSI) sits flat within the oversold territory, warranting caution for bears.

USD/JPY: Four- hour chart

Should the oversold conditions trigger a renewed upswing, then buyers will need to find a strong foothold above the intraday high of 132.37. Recapturing the 132.50 psychological level is critical to unleashing the additional recovery in the USD/JPY pair.

USD/JPY: Additional technical levels

-

09:37

NZD/USD struggles below 0.6300 mark, nearly three-week low amid modest USD uptick

- NNZD/USD slides to a nearly three-week low and is pressured by a modest USD strength.

- The Fed’s hawkish outlook and rising US bond yields help revive demand for the greenback.

- Acceptance below the $0.6300 mark supports prospects for additional losses for the major.

The NZD/USD pair comes under heavy selling pressure on Wednesday and drops to a nearly three-week low during the first half of the European session. The pair is currently placed just below the 0.6300 mark, down around 0.75% for the day, and is pressured by a modest US Dollar strength.

The Bank of Japan's policy tweak, which triggered a sell-off in bond markets on Tuesday, along with the Fed's hawkish commentary last week, continues to push the US Treasury bond yields higher. In fact, the yield on the benchmark 10-year US government bond hits a fresh monthly low and helps revive demand for the greenback, which, in turn, is seen weighing on the NZD/USD pair.

The New Zealand Dollar, meanwhile, fails to gain any respite from the upbeat domestic data, showing that the trade deficit narrowed to $1,863 million in November from $2298 million previous. That said, a recovery in the global risk sentiment might hold back traders from placing aggressive bullish bets around the safe-haven buck and lend support to the perceived riskier Kiwi.

Nevertheless, a convincing break and acceptance below the 0.6300 mark for the NZD/USD pair could be seen as a fresh trigger for bearish traders. This, in turn, supports prospects for an extension of the recent pullback from over a six-month top, just above the 0.6500 psychological mark, touched earlier this December. Hence, any attempted recovery is likely to get sold into.

Traders now look forward to the US economic docket, featuring the release of the Conference Board's Consumer Confidence Index. This, along with the US bond yields and the broader risk sentiment, will influence the USD and provide some impetus to the NZD/USD pair. The focus will then shift to the final US Q3 GDP print and the US Core PCE Price Index on Thursday and Friday, respectively.

Technical levels to watch

-

09:22

EUR/USD may find some stabilisation around 1.0600 into year-end – ING

EUR/USD registered small daily gains on Tuesday but struggled to gather bullish momentum. Economists at ING expect the pair to hover around 1.06 in the last days of the year.

Keeping an eye on energy market volatility

“We think EUR/USD may find some stabilisation around 1.0600 into year-end as volatility starts to drop. A drop to sub-1.0500 levels is, however, possible should market sentiment deteriorate, especially on the energy side.”

“There are no major data releases to highlight in the next two weeks for the Euro, at least until the German CPI figures for December are released (3 January). No European Central Bank speakers are scheduled.”

-

09:02

EUR/USD struggles for a firm direction, stuck in a narrow band just above 1.0600 mark

- EUR/USD extends its sideways consolidative price action and remains confined in a range.

- The Fed’s hawkish outlook, rising US bond yields underpin the USD and act as a headwind.

- The risk-on impulse caps gains for the safe-haven buck and lends some support to the pair.

The EUR/USD pair continues with its struggle to gain any meaningful traction and remains confined in a narrow trading band held since the beginning of this week. The pair, however, manages to hold its neck above the 1.0600 mark through the first half of the European session on Wednesday.

The US Dollar regains some positive traction and reverses a part of the overnight sharp fall, which, in turn, is seen acting as a headwind for the EUR/USD pair. The Bank of Japan's policy tweak triggered a sell-off in bond markets on Tuesday and pushed the US Treasury bond yields higher. Apart from this, the Federal Reserve's hawkish commentary last week lifts the yield on the benchmark 10-year US government bond to a fresh monthly top and benefits the greenback.

That said, a goodish recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - seems to cap gains for the safe-haven buck. Furthermore, hawkish signals from the European Central Bank (ECB), indicating that it will need to raise rates significantly further to crush inflation, underpins the shared currency. The combination of factors offers some support to the EUR/USD pair and helps limit the downside, at least for now.

On the data front, the Gfk German Consumer Confidence Index improves to -37.8 for the current month from -40.1 in November, though does little to provide any impetus. Market participants now look forward to the US economic docket, featuring the release of the Conference Board's Consumer Confidence Index. This, along with the US bond yields and the market risk sentiment, will influence the USD and produce short-term opportunities around the EUR/USD pair.

Technical levels to watch

-

09:00

Greece Current Account (YoY) fell from previous €-0.811B to €-2.704B in October

-

08:58

GBP/USD could return to the 1.15-1.18 range in the new year – ING

GBP/USD is having a difficult time pulling away from the 1.2150 area. Economists at ING expect the pair to drop back to the 1.15-1.18 range in the new year.

Outlook for 2023 still looks challenging

“While dealing with multiple strikes, the UK will not see a lot of data releases in the coming two weeks, with tomorrow’s first GDP data unlikely to move the market. There are no scheduled Bank of England speakers until the first week of January.”

“We continue to see mostly downside risks for the Pound in the new year, as a recessionary environment and sensitivity to market instability may cause a return to the 1.15-1.18 range in Cable.”

“For this festive season, GBP/USD may hold around 1.2100-1.2250.”

-

08:51

IFO: German employment outlook for Q1 2023 is positive

Germany’s IFO economic institute said in a statement on Wednesday, the outlook for Germany’s labor market is expected to be upbeat for the first quarter of 2023.

Key takeaways

“The latest employment barometer showed "the employment outlook for the first quarter of 2023 is positive, driven primarily by service providers.”

“Personnel service providers are also optimistic about the coming months."

Market reaction

The Euro remains pays little heed to the upbeat report, with EUR/USD keeping its range at around 1.0620, 0.10% higher on the day, as of writing.

-

08:35

US data could trigger a sudden move in the greenback – Commerzbank

There is quite a bit of data yet for publication over the course of the week. As liquidity is likely to be thin, the fluctuation in USD could be quite pronounced, Antje Praefcke, FX Analyst at Commerzbank, reports.

Do not ignore the screens completely

“Those of you who will be on their screens until just before Christmas should not switch off completely and keep an eye on US data publications, so as not to miss a possible sudden move in the US Dollar.”

“Thin markets, US data and the market’s attempt to get a better idea of future monetary policy do not necessarily but could potentially constitute an explosive mix. We don’t want any nasty surprises just before Christmas after all.”

-

08:24

Silver Price Analysis: XAG/USD corrects from multi-month top, downside seems limited

- Silver retreats from a fresh eight-month high touched earlier this Wednesday.

- The technical setup supports prospects for the emergence of some dip-buying.

- A break below the $23.00 confluence is needed to negate the positive outlook.

Silver extends its steady intraday descent through the early European session and retreats further from an eight-month top, around the $24.30 area touched earlier this Wednesday. The white metal slides below the $24.00 mark in the last hour, eroding a part of the previous day's strong gains.

The bias, however, remains tilted in favour of bullish traders and supports prospects for the emergence of some dip-buying around the XAG/USD. The positive outlook is reinforced by bullish oscillators on 4-hour/daily charts, which are still far from being in the overbought territory. Hence, any subsequent fall is more likely to find decent support near the $23.60-$23.50 strong horizontal resistance breakpoint.

That said, some follow-through selling will expose confluence support near the $23.00-$22.90 region, comprising the 100-period SMA on the 4-hour chart and an ascending trend-line extending from November low. A convincing break below the latter will negate the near-term positive outlook and shift the bias in favour of bearish traders. The XAG/USD might then slide towards testing the $22.00 round figure.

On the flip side, the monthly month peak, around the $24.30 region, now seems to act as an immediate barrier. A sustained strength beyond should pave the way for additional near-term gains and allow the XAG/USD to reclaim the $25.00 psychological mark, with some intermediate hurdle near the $24.60-$24.70 zone.

Silver 4-hour chart

Key levels to watch

-

08:17

EUR/CZK: Koruna will hit its limit soon – ING

Today, we will see the last Czech National Bank meeting of the year. Yesterday, Koruna reached its strongest level against the Euro in 11 years. However, economists at ING do not expect CZK to gain further ground.

CNB unlikely to provide any surprises

“In line with the market, we expect rates and the FX regime to remain unchanged. The board members have been very open in their talks over the past few days, so we are unlikely to see any surprises.”

“For now, we believe the Koruna is mainly supported by global conditions, falling gas prices and a weaker US Dollar. In both cases, we believe this is temporary and moreover, the positioning seems mostly long within the region in the case of the Koruna. Thus, we think Koruna will hit its limit soon.”

-

08:01

Sweden Consumer Confidence (MoM) below expectations (56.6) in December: Actual (54.1)

-

07:58

Market not buying the Fed’s guidance suggests weaker USD – NBF

The Federal Reserve refrained from softening its forward guidance. However, markets are not convinced that the central bank will fulfill its commitments. Therefore, the US Dollar is set to move downward, Stéfane Marion, Chief Economist and Strategist at the National Bank of Canada, reports.

Fed has yet to convince the markets that it will walk the talk of its latest guidance

“In its last dot plot of 2022, the FOMC was even more hawkish than just three months ago with the committee now seeing more rate hikes in 2023 with no rate cuts before 2024. But the Fed has yet to convince the markets, or us, that it will walk the talk of its latest guidance.”

“Following Chairman Powell's press conference, the two-year Treasury yield fell below the federal funds rate for the first time in this tightening cycle. Such an inversion at this stage of the economic cycle has historically been negative for the greenback – until a recession occurs (which is not our base case at this time).”

-

07:48

CNB will keep rates on hold and should be able to convince the market anyway – Commerzbank

The Czech National Bank (CNB) is expected to maintain its policy rate unchanged in its meeting today. Economists at Commerzbank expect the central bank to convince the market of its strategy.

CNB will only consider a further rate hike if inflation turns out to be more stubborn

“CNB will likely rely on global as well as national inflation easing next year and will therefore most probably keep its key rate unchanged at 7% today.”

“Since the CNB had expected 18.8% for November anyway it might use the lower 16.2% as an argument to justify its rate decision today. As a result, the CNB is likely to be able to convince the market of its strategy.”

“The CNB board will probably only consider a further rate hike in case inflation turns out to be more stubborn after all, currently it is avoiding that for fear of the possible effects on the economy.”

“During the course of 2023, it will then emerge whether the CNB was right and whether its strategy of keeping the key rate at 7% will work out as real interest rates will rise simply as a result of falling inflation rates. If that is not the case the CNB will likely have to increase FX interventions against the expected CZK weakness or it might even have to hike the key rate once again.”

-

07:45

AUD/USD pares intraday gains, faces rejection near 0.6700 mark amid renewed USD buying

- AUD/USD gains some positive traction on Wednesday, albeit lacks follow-through.

- The risk-on impulse benefits the Aussie; a modest USD strength caps the upside.

- The fundamental backdrop supports prospects for a further depreciating move.

The AUD/USD pair struggles to capitalize on its modest intraday gains on Wednesday and faced rejection near the 0.6700 round-figure mark. The pair, however, sticks to a mildly positive bias through the early European session and is currently trading around the 0.6675-0.6680 region, just above the 100-day SMA support.

A goodish recovery in the global risk sentiment - as depicted by the upbeat tone around the equity markets - is seen as a key factor lending some support to the perceived riskier Aussie. That said, the emergence of some US Dollar buying keeps a lid on any meaningful upside for the AUD/USD pair and warrants some caution for bullish traders.

The USD draws some support from a modest uptick in the US Treasury bond yields, bolstered by the Fed's hawkish outlook. In fact, the US central bank indicated that it will continue to raise rates to crush inflation. Furthermore, the Bank of Japan's policy tweak, which triggered a sell-off in bond markets on Tuesday, act as a tailwind for the US bond yields.

Apart from this, worries about rising COVID-19 cases in China contribute to capping gains for the AUD/USD pair. This, along with dovish Reserve Bank of Australia (RBA) minutes released on Tuesday, showing that policymakers considered leaving rates unchanged at the December meeting, suggests that the path of least resistance for spot prices is to the downside.

Market participants now look forward to the US economic docket, featuring the release of the Conference Board's Consumer Confidence Index later during the early North American session. Traders will further take cues from the US bond yields and the broader risk sentiment, which will influence the USD price dynamics and provide some impetus to the AUD/USD pair.

Technical levels to watch

-

07:34

Canadian CPI Preview: Forecast from five major banks, inflation to cool

Statistics Canada will release November Consumer Price Index (CPI) data on Wednesday, December 21 at 13:30 and as we get closer to the release time, here are the forecasts by the economists and researchers of five major banks regarding the upcoming Canadian inflation data.

Headline is expected to have eased in November from 6.9% year-on-year in October. If so, this would be the lowest since February and would continue the deceleration from the 8.1% peak in June.

TDS

“We look for CPI to edge 0.1pp lower to 6.8% as softer energy prices hold the headline index to a 0.1% MoM gain. Food prices should bounce back from last month, while rents and mortgage interest costs will provide another large contribution for shelter. Core inflation will also remain in focus with CPI-trim/median expected to soften by 0.1pp on average.”

RBC Economics

“CPI growth likely edged down to 6.7% YoY. Though that’s still very high, it nevertheless marks another drop below the measure’s 8.1% peak in June.”

NBF

“Lower gasoline prices, combined with expected weakness in the goods sector, should have weighed on the headline figure, offsetting sustained price pressure in the service segment and translating into a 0.1% monthly decline for the headline index. If we are right, the 12-month rate should drop four ticks to 6.5%. While we expect only modest gains for core measures on MoM basis, a positive base effect should prevent any decline in the 12-month rate, with CPI-median moving up one tick to 4.9% and CPI-trim remaining unchanged at 5.3%.”

CIBC

“After increasing in the prior month, gasoline prices dropped throughout November and will be the primary factor holding CPI to a muted 0.2% monthly increase. That would see the annual rate tick down, albeit only slightly, to 6.8%. Some positive signs of an easing in goods prices within the US CPI data could also show up in the Canadian data. However, food price inflation appears to have remained stubborn, and rising rates will continue to impact the mortgage interest payment part of the inflation basket.”

Wells Fargo

“The CPI rose at 6.9% YoY in October, and taking a closer look at the details, price gains for gasoline and mortgage interest costs were offset by softer food inflation. Commodity prices have come down from their peak, which may provide some relief on the headline inflation front. In November, we expect CPI inflation trended lower to 6.4% YoY.”

-

07:16

Forex Today: US Dollar selloff pauses ahead of mid-tier data releases

Here is what you need to know on Wednesday, December 21:

The US Dollar weakened against its major rivals on Tuesday but seems to be holding its ground early Wednesday. US stock index futures trade in positive territory in the early European morning and the 10-year US Treasury bond yield stays quiet near 3.7%. Existing Home Sales for November will be featured in the US economic docket later in the day and the Conference Board will release the December Consumer Confidence Index. November Consumer Price Index (CPI) figures from Canada will also be looked upon for fresh impetus.

The US Census Bureau announced on Tuesday that Housing Starts and Building Permits in the US declined by 0.5% and 11.2% on a monthly basis, respectively, in November. With these figures reminding investors of the negative impact of the Federal Reserve's policy on the housing market, the US Dollar lost interest in the second half of the day.

The sharp decline witnessed in USD/JPY on the Bank of Japan's (BOJ) unexpected policy tweak continued during the American trading hours on Tuesday. After having lost nearly 500 pips and having touched its lowest level in over four months at 130.60, USD/JPY seems to have steadied at around 132.00 early Wednesday. Takatoshi Ito, a contender to succeed BOJ Governor Haruhiko Kuroda, noted that the latest policy action could be the first step toward an exit from the ultra-loose monetary easing. Japanese economy minister Shigeyuki Goto, however, argued that the tweak to the yield curve control strategy was not meant to be an exit from monetary easing, helping the pair limit its losses for now.