Notícias do Mercado

-

23:54

GBP/USD aims to regain 1.2200 on softer US Dollar ahead of US CB Consumer Confidence

- GBP/USD picks up bids to extend the previous day’s rebound from three-week low.

- US Treasury bond yields allow USD to regain upside momentum.

- Pessimism surrounding the UK workers’ strike, cautious mood ahead of the key US data probes Cable buyers.

GBP/USD extends the previous day’s rebound from a three-week low, up 0.11% intraday near 1.2190 during the mid-Asian session on Wednesday. In doing so, the Cable pair cheers the broad-based US Dollar weakness, due to the receding fears of the recession. However, the cautious mood ahead of the key US data and challenges to the UK’s health sector seems to probe the pair buyers of late.

“Around 100,000 nurses went on strike on Tuesday for the second time in a week as their union issued an ultimatum to the government to respond to pay demands within 48 hours or face another round of industrial action in January,” said Reuters.

Elsewhere, the US Dollar Index (DXY) dropped the most in a week the previous day, down 0.67% intraday to 103.95, as the greenback traders feared less Japanese bond-buying from the US due to the BOJ action. It’s worth noting that Japan is the biggest holder of the US Treasury bonds and the latest move allows Tokyo to put more funds into the nation than letting it flow outside. That said, the 10-year counterpart rose more than the two-year ones and hence reduced the yield curve inversion that suggests the odds of the recession.

It should be noted that the downbeat US housing data also allowed the GBP/USD pair to remain firmer, before the latest softer run-up.

Talking about the data, US Housing Starts declined by 0.5% MoM in November following October's 2.1% contraction while Building Permits fell by 11.2% versus a 3.3% drop recorded in the previous month. Further, the German Producer Price Index (PPI) for November dropped to -3.9% YoY versus -2.6% market forecasts and -4.2% prior.

While portraying the mood, the US 10-year Treasury yields grind near a three-week high of 3.69% while the two-year bond coupons stay firmer around 4.26% by the press time. Further, Wall Street closed in green and allow stocks in the Asia-Pacific bloc to print mild gains of late.

Looking forward, the United States Conference Board (CB) Consumer Confidence figures for December, expected at 101.00 versus 100.00 prior, will join the political updates from the UK to direct short-term GBP/USD moves. Though, major attention will be given to Thursday’s UK Gross Domestic Product (GDP) figures and Friday’s US Core PCE Inflation data for clear directions.

Technical analysis

21-day EMA joins a one-month-old ascending support line to restrict short-term GBP/USD downside near 1.2160. However, bearish MACD signals and steady RSI challenges the pair buyers.

-

23:37

Gold Price Forecast: XAU/USD grinds higher, United States Consumer Confidence, Treasury bond yields eyed

- Gold price seesaws around weekly top after rising the most in three weeks.

- United States Treasury bond yields underpinned US Dollar’s biggest daily fall in a week and propelled XAU/USD.

- Gold buyers also cheered receding fears of recession, hopes for more stimulus from China.

- US data, risk catalysts will be crucial as Gold traders approach the key resistance near $1,820.

Gold price (XAU/USD) remains sidelined around $1,820 as the metal buyers take a breather during early Wednesday, following the biggest daily jump in three weeks. That said, the US Dollar’s weakness and receding fears of the economic slowdown, as per the Treasury bond yields curve inversion, seemed to have favored the XAU/USD bulls previously. However, the cautious mood ahead of the key United States data and technical analysis challenges the bullion buyers of late.

Gold buyers cheer softer US Dollar

Gold price rallied heavily the previous day as the US Dollar Index (DXY), a gauge of the US Dollar’s move versus the major six currencies, dropped the most in a week, down 0.67% intraday to 103.95 while marking a two-day downtrend. In doing so, the DXY traders feared less Japanese bond-buying from the United States due to the latest Bank of Japan (BOJ) action. It’s worth noting that Japan is the biggest holder of the US Treasury bonds and the latest move allows Tokyo to put more funds into the nation than letting them flow outside.

Bank of Japan (BOJ) rocked markets the previous day and fuelled the Gold price with a surprise move that suggests lesser funds flowing outside Japanese bond markets due to a policy tweak. The Japanese central bank kept the monetary policy unchanged but widened the band of Yield Curve Control (YCC) to -/+ 0.5% from -/+0.25% prior.

United States Treasury bond yields favored XAU/USD bulls, via recession signals

It’s worth noting that the Bank of Japan’s moves triggered the United States bond market signals that suggested receding bets on the economic slowdown, which in turn allowed the Gold buyers to keep the reins. That said, the 10-year counterpart rose more than the two-year ones and hence reduced the yield curve inversion that suggests the market’s fears of recession. It should be noted that the US 10-year Treasury yields grind near a three-week high of 3.69% while the two-year bond coupons stay firmer around 4.26% by the press time.

China-linked headlines also welcome Gold buyers

Being one of the largest customers of Gold, headlines suggesting more stimulus from China, mainly due to the downbeat economic forecasts from the World Bank and policymakers’ readiness to defend the economy, propelled XAU/USD prices the previous day. It’s worth noting, however, that recently softer China economics and mixed concerns surrounding Covid challenge Gold buyers.

US data, yields in focus

Having witnessed a solid run-up, Gold buyers seem to take a breather after the United States Conference Board (CB) Consumer Confidence figures for December, expected 101.00 versus 100.00 prior. Also likely to have probed the XAU/USD bulls could be the latest inaction in the bond markets, after a volatile day, as well as technical space that probes the Gold’s further upside. Should the scheduled US data manage to print higher numbers, the US Dollar may witness a recovery and hence the Gold price could retreat.

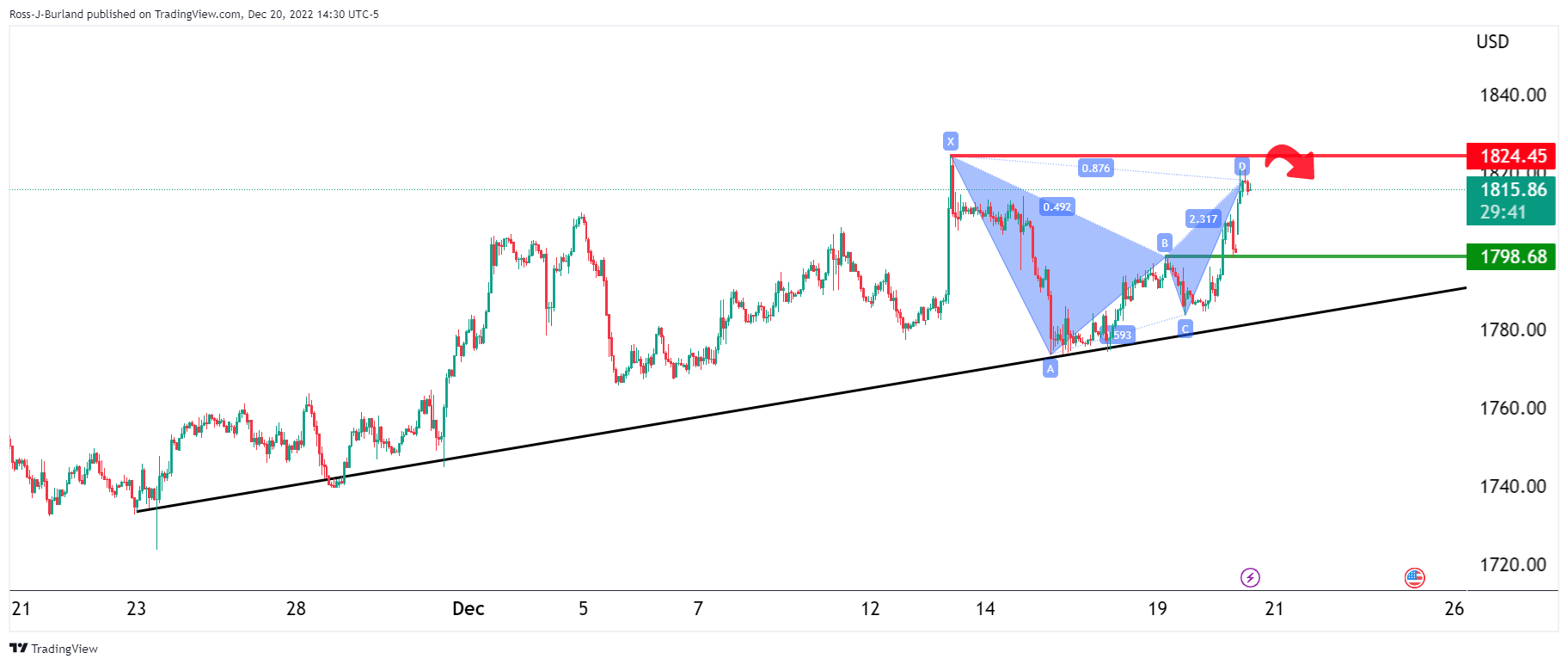

Gold price technical analysis

With the heaviest daily rise since December’s start, Gold price approaches the upper line of a five-week-long rising wedge bearish chart pattern, around $1,823 by the press time.

It’s worth noting, however, that the Relative Strength Index (RSI), located at 14, suggests the commodity’s limited upside by being near the overbought region. On the same line, sluggish signals from the Moving Average Convergence and Divergence (MACD) indicator challenge Gold’s further advances.

Hence, the XAU/USD’s upside appears capped near $1,825, at least for now.

However, Gold’s clear break of the said resistance would defy the bearish chart pattern and can quickly propel the precious metal toward June’s high near $1,880.

On the contrary, a convergence of the 21-DMA and the stated wedge’s lower line offers a tough nut to crack for the Gold bears, around $1,780. That said, the $1,800 round figure could restrict the short-term downside of the Gold price.

Gold price: Daily chart

Trend: Limited upside expected

-

23:31

Australia Westpac Leading Index (MoM) dipped from previous -0.05% to -0.1% in November

-

22:59

USD/CAD Price Analysis: Retreats to 1.3600 inside rising wedge

- USD/CAD remains pressured towards 1.3520 support confluence inside six-week-old rising wedge.

- 50-day EMA joins wedge’s lower line to highlight 1.3520 support.

- Looming bear cross on MACD, bearish chart formation favor sellers.

USD/CAD holds lower ground near 1.3610 as it braces for the three-day downtrend during Wednesday’s Asian session. In doing so, the Loonie pair drops inside a 1.5-month-old rising wedge bearish chart pattern.

That said, the impending bear cross on the MACD adds strength to the downside bias, in addition to the rising wedge formation.

As a result, the quote’s downside break of the 1.3600 threshold appears imminent.

However, a convergence of the 50-day Exponential Moving Average (EMA) and the lower line of the stated wedge, highlights the 1.3520 as the key support.

In a case where the USD/CAD prices drop below 1.3520, the odds of witnessing gradual declines towards the 50% and 61.8% Fibonacci retracement of the pair’s August-October upside, 1.3350 and 1.3200 in that order, can’t be ruled out.

Should the quote remains bearish past 1.3200, the theoretical target of the rising wedge confirmation, around 1.3050, gains the major attention.

On the flip side, recovery moves remain elusive unless the USD/CAD pair crosses the 1.3700 round figure.

Even so, the upper line of the stated wedge, near 1.3775 by the press time, could challenge the pair buyers.

Following that, multiple resistances near 1.3810 and 1.3850 could test the USD/CAD bulls before directing them to the yearly high marked in October around 1.3980.

USD/CAD: Daily chart

Trend: Further downside expected

-

22:48

New Zealand ANZ – Roy Morgan Consumer Confidence dipped from previous 80.7 to 73.8 in December

-

22:47

United States API Weekly Crude Oil Stock declined to -3.069M in December 16 from previous 7.819M

-

22:43

EUR/USD stays defensive above 1.0600 ahead of US CB Consumer Confidence

- EUR/USD remains sidelined after two-day uptrend, fades bullish bias of late.

- Narrowing of the yield curve inversion, softer US Dollar joined hawkish ECB talks to favor the bulls.

- Mixed sentiment surrounding the bloc, softer German PPI probed buyers.

- Risk catalysts will also be important for fresh impulse.

EUR/USD struggles to extend the previous two-day uptrend during the early hours of Wednesday’s Asian session as it makes rounds to 1.0620-30. In doing so, the major currency pair portrays the market’s indecision despite the latest fall in the US Dollar and receding fears of the recession, as portrayed by easing yield curve inversion.

Bank of Japan (BOJ) rocked markets in Asia and Europe before Wall Street managed to close in green. The reason could be linked to the surprise move by the Japanese central bank that suggests lesser funds flowing to the ex-Japan bond markets due to a policy tweak. The Japanese central bank kept the monetary policy unchanged but widened the band of Yield Curve Control (YCC) to -/+ 0.5% from -/+0.25% prior.

The resulting moves could be witnessed more in the US Dollar and Treasury yields as the US Dollar Index (DXY) dropped the most in a week the previous day, down 0.67% intraday to 103.95, as the greenback traders feared less Japanese bond-buying from the US due to the BOJ action. It’s worth noting that Japan is the biggest holder of the US Treasury bonds and the latest move allows Tokyo to put more funds into the nation than letting it flow outside.

That said, the 10-year counterpart rose more than the two-year ones and hence reduced the yield curve inversion that suggests the odds of the recession.

It’s worth noting that the hawkish comments from the European Central Bank (ECB) officials joined mixed EU data to restrict EUR/USD moves. That said, ECB Governing Council member and French central bank governor Francois Villeroy de Galhau said, “The European economy is likely to avoid a hard landing.” On the same line, ECB policymaker Peter Kazimir said on Tuesday that the “monetary policy should tighten at a stable pace.”

Elsewhere, US Housing Starts declined by 0.5% MoM in November following October's 2.1% contraction while Building Permits fell by 11.2% versus a 3.3% drop recorded in the previous month. Further, the German Producer Price Index (PPI) for November dropped to -3.9% YoY versus -2.6% market forecasts and -4.2% prior.

Moving on, US CB Consumer Confidence for December, expected 101.00 versus 100.00 prior, could entertain the EUR/USD pair traders. However, major attention will be given to the risk catalysts for fresh impulse.

Technical analysis

Despite bouncing off the 10-DMA, around 1.0600 at the latest, the EUR/USD bulls need validation from the 1.0660 hurdle to keep the reins.

-

22:19

NZD/USD seesaws near 0.6350 even as New Zealand trade deficit increases

- NZD/USD defends the bounce off three-week low, stays sidelined of late.

- New Zealand trade deficit increased in November, Exports and Imports also rose.

- Market sentiment dwindles after Bank of Japan-inspired moves, contracting yield curve inversion eases recession woes.

- Second-tier US data eyed for near-term directions as US Dollar stays depressed.

NZD/USD dropped to the lowest levels in three weeks before recently bouncing off 0.6300, making rounds to 0.6350 during early Wednesday. The Kiwi pair’s latest rebound could be linked to the downbeat US Dollar but pays little heed to New Zealand (NZ) trade numbers for November.

New Zealand Trade Balance for November dropped to $-14.63B YoY and $-1,863M MoM versus the expected prints of $12.71B and $-1,091M respective market forecasts. That said, the previous readings were revised down to $-13.86B and $-2,298M. Details suggest that the Imports rose to $8.54B from $8.26B whereas Exports also increase to 6.68B versus $5.96B prior.

Additionally important were the monthly figures of New Zealand’s ANZ-Roy Morgan Consumer Confidence Index that slumped to the lowest levels since 2004, to 73.8 for December versus 80.7 prior.

Previously, the Kiwi pair failed to cheer the broad US Dollar weakness as market sentiment worsened in the Asia-Pacific due to the Bank of Japan’s (BOJ) slight change in the monetary policy parameters. The Japanese central bank kept the monetary policy unchanged but widened the band of Yield Curve Control (YCC) to -/+ 0.5% from -/+0.25% prior.

That said, the US Dollar Index (DXY) dropped the most in a week the previous day, down 0.67% intraday to 103.95, as the greenback traders feared less Japanese bond-buying from the US due to the BOJ action. It’s worth noting that Japan is the biggest holder of the US Treasury bonds and the latest move allows Tokyo to put more funds into the nation than letting it flow outside.

Other than the BOJ-led moves, fears of China’s slower growth, backed by the World Bank’s downbeat economic forecasts, also weighed on the NZD/USD prices.

It’s worth noting that Wall Street closed on the positive side as the US Treasury bond yields rallied. Among them, the 10-year counterpart rose more than the two-year ones and hence reduced the yield curve inversion that suggests the odds of the recession.

Talking about the data, US Housing Starts declined by 0.5% MoM in November following October's 2.1% contraction while Building Permits fell by 11.2% versus a 3.3% drop recorded in the previous month.

Looking forward, US CB Consumer Confidence for December and Existing Home Sales for November will be important to watch. However, major attention will be given to the risk catalysts for fresh impulse.

Technical analysis

NZD/USD bounces off 21-DMA, around 0.6335 by the press time, to defend buyers. Even so, recovery remains elusive below the 0.6400 hurdle.

-

22:03

USD/JPY consolidates near 131.60 after huge move set-off by BoJ

- USD/JPY bears steamrolled their way in. bursting out of a coil and now eye further downside.

- Bank of Japan tweaks policy in a surprise move, sending the Yen on a tear.

USD/JPY is down some 3.8% ahead of the close and roll-over on Tuesday having dropped strongly due to the Bank of Japan's surprise policy tweak. The pair dropped from a high of 137.47 to a low of 130.56.

The Bank of Japan kept broad policy settings unchanged, pinning short-term JGB yields at -0.1% and the 10-year yield around zero. However, the volatility in the markets was set off when the BoJ announced it would let long-term yields move 50 basis points on either side of its 0% target, wider than the 25 basis point band previously. Consequently, the yen soared and broke out of a coil that was highlighted din the pre-BoJ analysis as illustrated in the following technical analysis.

USD/JPY technical analysis

As per the prior analysis, USD/JPY Price Analysis: Could be coiling ahead of a significant breakout, where it was stated that USD/JPY was in a state of consolidation, coiling below the breakout of the daily trendline support of the prior bullish cycle, the breakout occurred as follows:

USD/JPY update

The bears moved in on the first target near 130.50. At this juncture, a continuation towards 129.50 and then 126.50 is on the cards albeit with some volatility along the way is to be expected.

-

21:45

New Zealand Exports: $6.68B (November) vs $6.14B

-

21:45

New Zealand Imports climbed from previous $8.27B to $8.54B in November

-

21:45

New Zealand Trade Balance NZD (MoM) came in at $-1863M below forecasts ($-1091M) in November

-

21:45

New Zealand Trade Balance NZD (YoY) came in at $-14.63B, below expectations ($-12.717B) in November

-

21:24

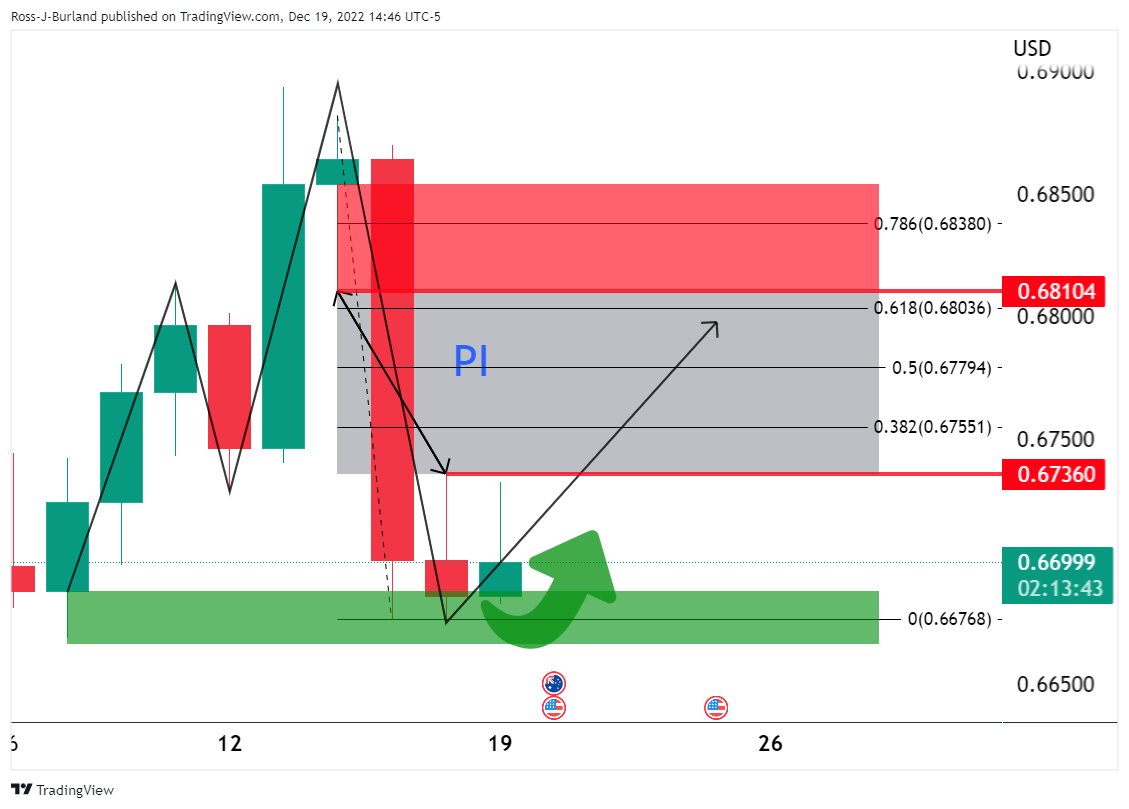

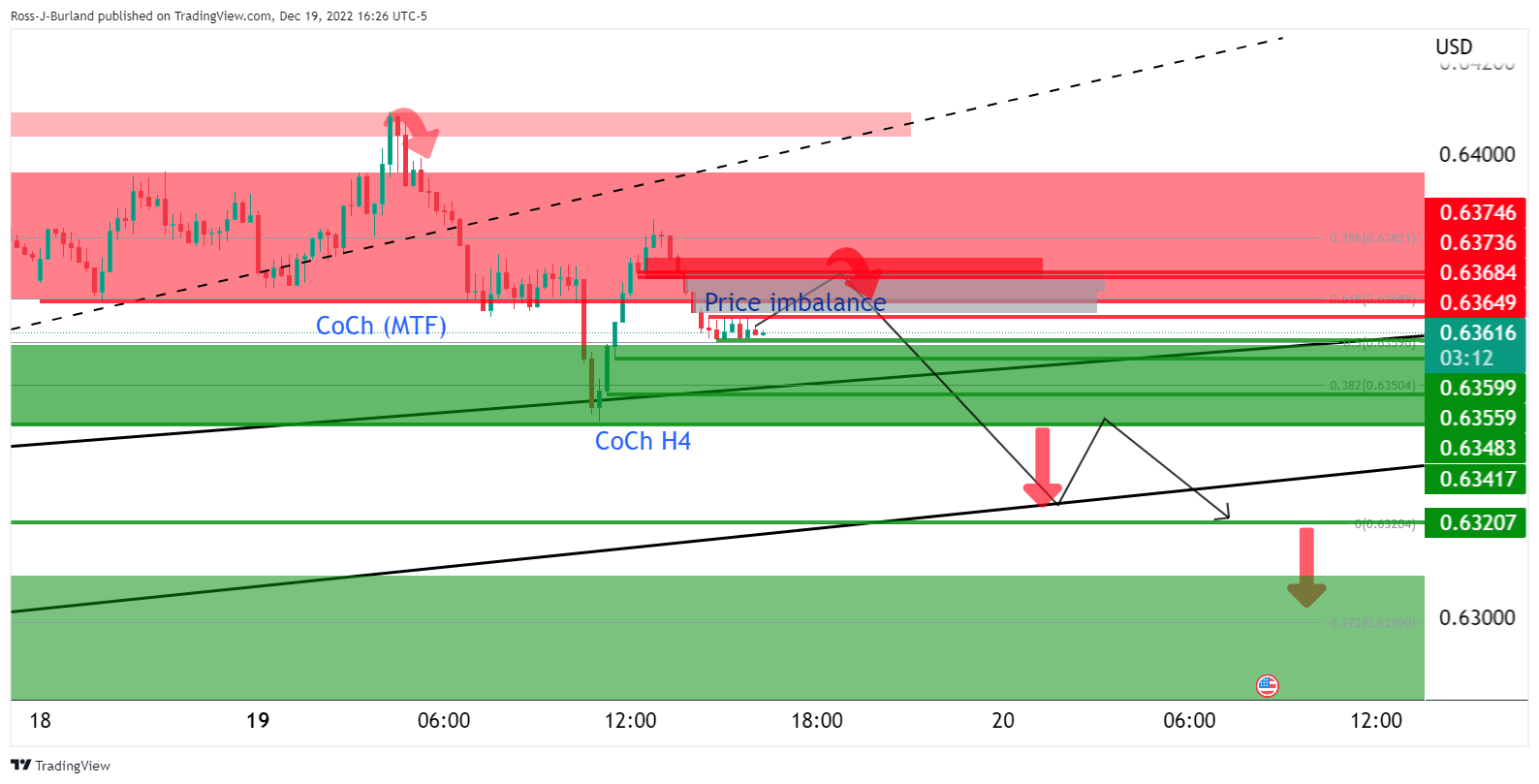

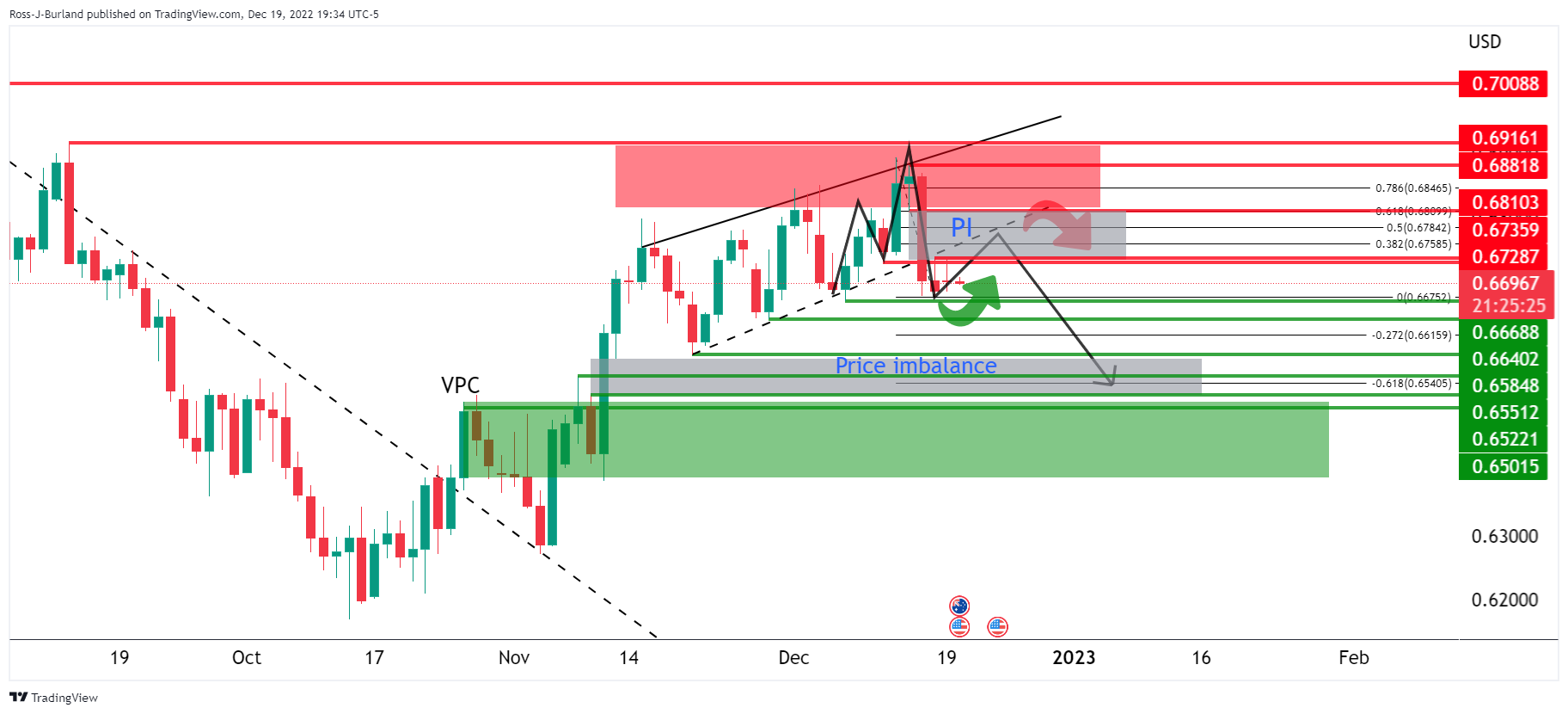

AUD/USD Price Analysis: Bulls moving in at a discount to target 0.68s

- AUD/USD bulls are moving in from a peak bottom formation.

- Focus is on a move into the 0.68s for the days ahead.

- Eyes on DXY headed towards 102.00 while on front side of bearish cycle's trendline.

As per the prior day's analysis, AUD/USD Price Analysis: Bulls are moving in with eyes on a 61.8% Fibonacci retracement towards 0.6800, while the overall thesis is for a move to 0.6500, there is a meanwhile prospect for 0.6800 still.

In the latest price action, we have seen a sweep of liquidity to 0.6630 which could now result in a move to the upside with 0.6700 as a focus and then 0.6736 to make way for 0.6800 as the following analysis of the current schematic illustrates.

AUD/USD prior analysis

On the daily time frame it was shown that there is a price imbalance (PI) between 0.6736 and 0.6810 with the 61.8% ratio eyed as a confluence:

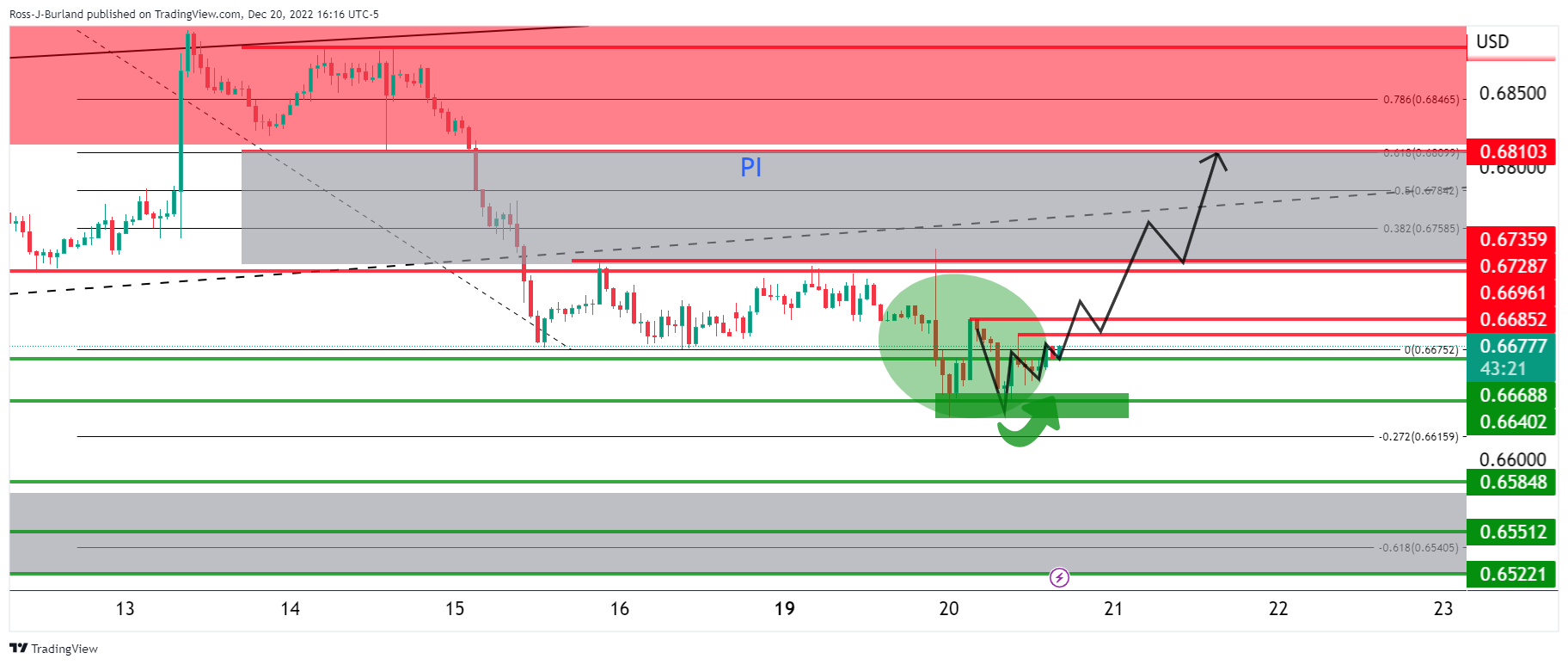

On the lower time frames, it was stated that the bulls will want to see a break of the trendline and prior lower high to confirm a bullish bias:

It was shown that there was a break in the trendline on the hourly chart but the market was coiling sideways.

there were equal lows at 0.6695 that were being pressured with liquidity in market orders expected below and under 0.6675 lows.

It was stated that a ''sweep' of the liquidity could result in a surge of demand from the bulls and ultimately provide enough fuel to take out the 0.6720 and then the 0.6736 resistance and create a change of character (CoCh) in the structure to bullish.

However, for the immediate future, 0.6685 and 0.6700 are going to be important levels:

AUD/USD update

The W-formation is being formed and should the neckline hold around 0.6670, then there will be prospects of a move to test 0.6685 resistance. A break here will result in a change of character in the market and put the bulls back into control as per the daily chart:

This would tie up with the outlook for the US dollar as per the DXY daily chart:

In prior analysis:

It was stated that the M-formation is a reversion pattern that had shown up on the daily chart above.

While on the front side of the trendline, a move into the neckline would be considered the next phase of the bearish cycle prior to a downside continuation to test 102.00 and below. We are now in the throws of such a move as illustrated above.

-

20:14

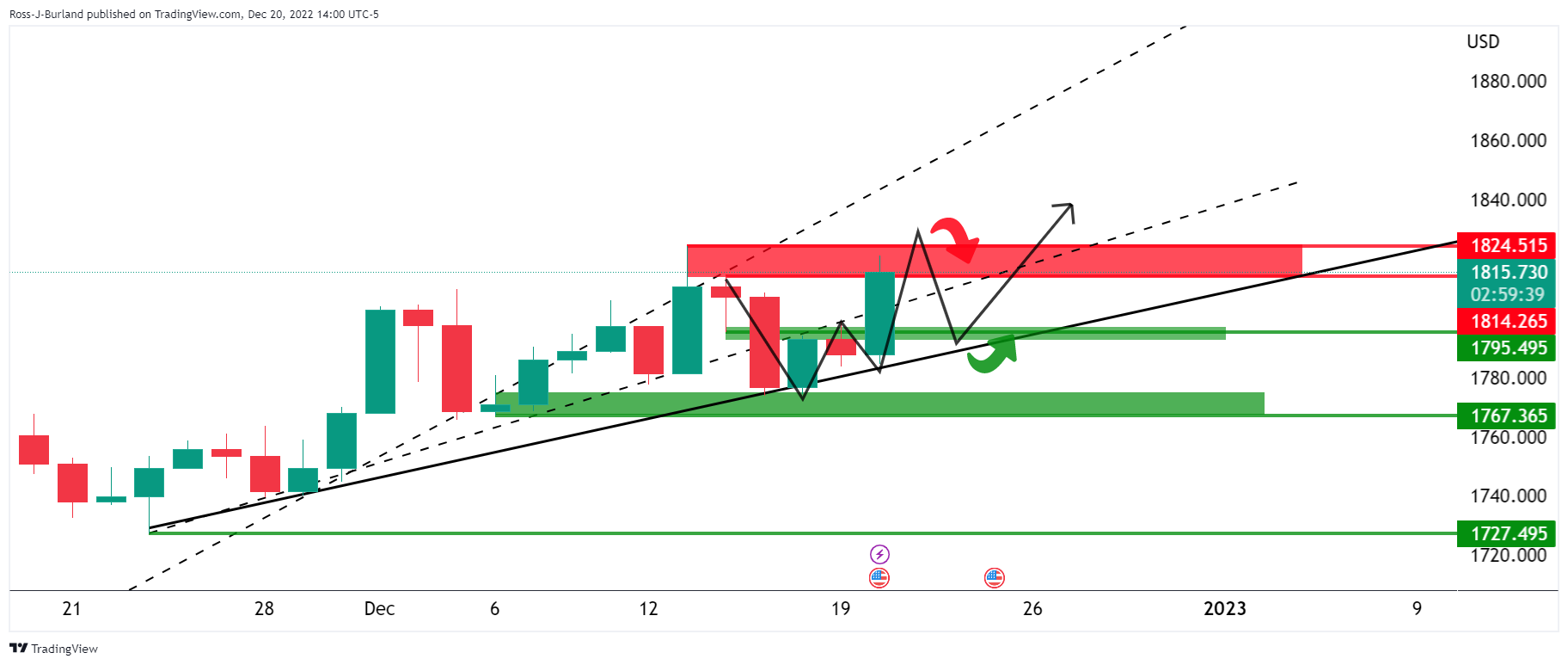

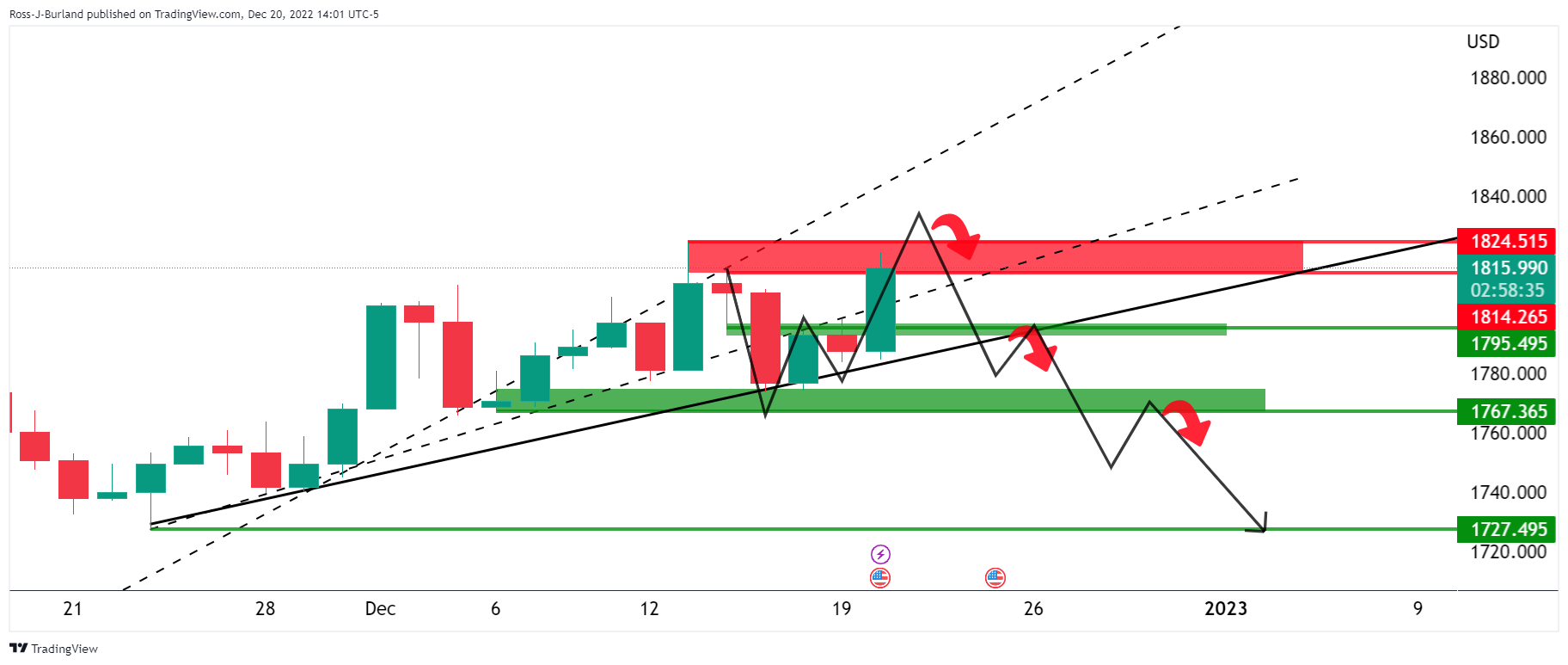

Gold Price Forecast: XAU/USD reversing its technical path (or is it?) despite Bank of Japan surprise move

- Gold price is making tracks to the upside despite the Bank of Japan's surprise relaxation on the yield of its 10-year bonds (JGBs).

- US Dollar sinks as the Yen rallies to the moon.

- US Treasury yields and a hawkish Federal Reserve could be the spanner in the works for the Gold price bulls.

The Gold price is higher on Tuesday due to volatility in the market that has sent the USD Dollar lower on the back of a surge in the Japanese Yen following a surprise move by the Bank of Japan (BoJ) in Asian markets.

Gold price rallies on Bank of Japan's surprise move

A decision by Japan's central bank to raise a cap on the yield of its 10-year Japanese government bonds (JGBs) sent markets into a state of shock and lured investors away from US debt. The BoJ is allowing 10-year bonds to trade at interest rates up to 0.5%, up from 0.25% and such a rise in the cap encourages domestic buying of its bonds. However, the Gold price has rallied despite the subsequent lower global borrowing costs and sell-off in bonds across the world, likely as a direct effect of a cheaper US Dollar.

US Dollar is slammed as Yen soars

Nevertheless, the US Dollar has sunk as per the DXY index as the Bank of Japan (BoJ) switches gears which sent the Yen around 5% higher vs the USD. USD/JPY fell from a pre-BoJ high of 137.40 to a low of 130.56. Consequently, the US Dollar as measured against a basket of currencies, including the yen which makes up 13.6% of the basket fell to a low of 103.77. DXY was trading at a high of 104.90 before the announcement by the BoJ.

US Treasury yields and yield curve in view

Nevertheless, higher global yields are potentially capping the rally in the Gold price since Gold offers no interest. The benchmark 10-year Treasury note yields rose to 3.710 and two-year note yields rose to 4.312% although they have started to come off their highs and Gold price is finding demand in late North American trade. Nevertheless, the US Treasury yield curve between two-year and 10-year Treasury notes remains at deeply negative levels, indicating concerns about an impending recession which is commonly positive for the US Dollar.

Federal Reserve sentiment remains key

Going forward, what is going to be critical for the Gold price is the sentiment surrounding the Federal Reserve (Fed). After rising as high as 5.5% after last week’s Federal Open Market Committee (FOMC) meeting, the terminal rate as seen by the swaps market fell back to just below 5.0% despite the hawkish rate hike.

''We cannot understand why the markets continue to fight the Fed,'' analysts at Brown Brothers Harriman said. ''With the exception of some communications missteps here and there, Fed chair Jerome Powell and company have been resolute about the need to take rates higher for longer. Although the media embargo has been lifted, there are no Fed speakers scheduled this week.''

Gold price technical analysis

Prior Gold price analysis:

It was stated that the downside bias in Gold price was in play so long as the bulls are kept at bay below the counter trendlines and $1,800. The price has instead rallied on Tuesday and the bales could be turning. However, holiday markets are setting in and it is uncommon for intended momentum trade setups to play out in what are usually choppy conditions for the Gold price.

Gold price update

The Gold price has switched bullish as per the move into the $1,800s and bulls are now facing a resistance area.

However, Gold price markets do one of three things: 1) Break out, pull back and continue 2) break out pull back and reverse, or 3), break out, pull back and go into a trading range.

Gold price scenario 1:

Gold price scenario 2:

Gold price scenario 3:

Gold price lower time frames

The Gold price 1-hour picture is bearish while below the resistance near $1,825 but not until the Gold price moves to the backside of the micro trend line:

On the 15-minute chart for the Gold price, we can draw the extensions to the downside based on the presumed sideways consolidation box that could form over the coming sessions/days due to the pull of the harmonic bearish pattern on the Gold price daily chart.

-

19:49

Forex Today: US Dollar on the back foot, despite a better mood

What you need to take care of on Wednesday, December 21:

The US Dollar plunged early on Tuesday, recovering ground unevenly throughout the rest of the day to end the day mixed. The Bank of Japan (BoJ) triggered the Greenback sell-off as the Japanese central bank announced its monetary policy decision. The BoJ left its benchmark rate unchanged at -0.1% and maintained the 10-year Japanese Government Bond (JGB) yield at 0.00%, as expected. Policymakers, however, introduced a minor twist: they will allow the 10-year JGB yield to fluctuate between -0.5% and 0.5%, compared to -0.25% and 0.25% previously, and noted that they would review the yield curve control operation.

Following the decision, BoJ’s Governor Haruhiko Kuroda reaffirmed the central bank's dovish stance, repeating they are ready to ease further if needed and noting it is no time to debate exiting quantitative tightening. The USD/JPY pair plummeted to 130.55, its lowest since early August, and now trades at around 131.50 while heading into the Asian opening.

Asian shares plunged, while European indexes also closed in the red, but managed to trim most of their intraday losses. Wall Street shrugged off the downbeat mood and maintained the green by the end of the day.

Meanwhile, US Treasury yields advanced, although that on the 10-year note did it at a faster pace than the one on the 2-year one. The yield curve remains inverted, but the distance is shrinking.

EUR/USD was unable to advance beyond 1.0650 and finished another day little changed just above the 1.0600 level. GBP/USD seesawed between gains and losses but finished the day flat at 1.2150.

AUD/USD reached a fresh December low of 0.6628 and finished the day in the red, undermined by the poor performance of Asian and European stock markets. US better tone was not enough to put the pair back into the green.

The USD/CAD pair finished the day in the red at around 1.3610, with the CAD underpinned by higher oil prices. WTI settled at $76.25 a barrel.

Canada will publish November inflation figures on Wednesday.

Gold soared on the broad US Dollar weakness, and currently trades at $1,816 a troy ounce.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

18:29

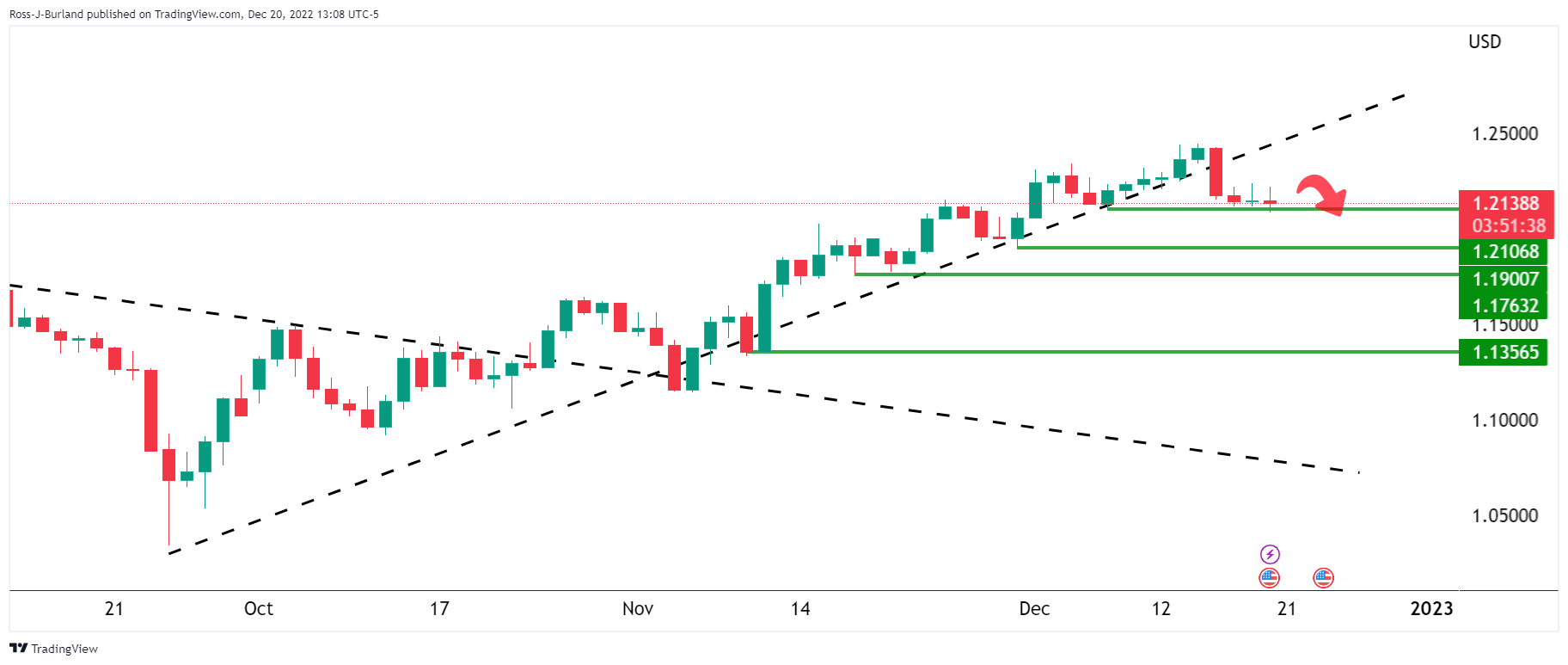

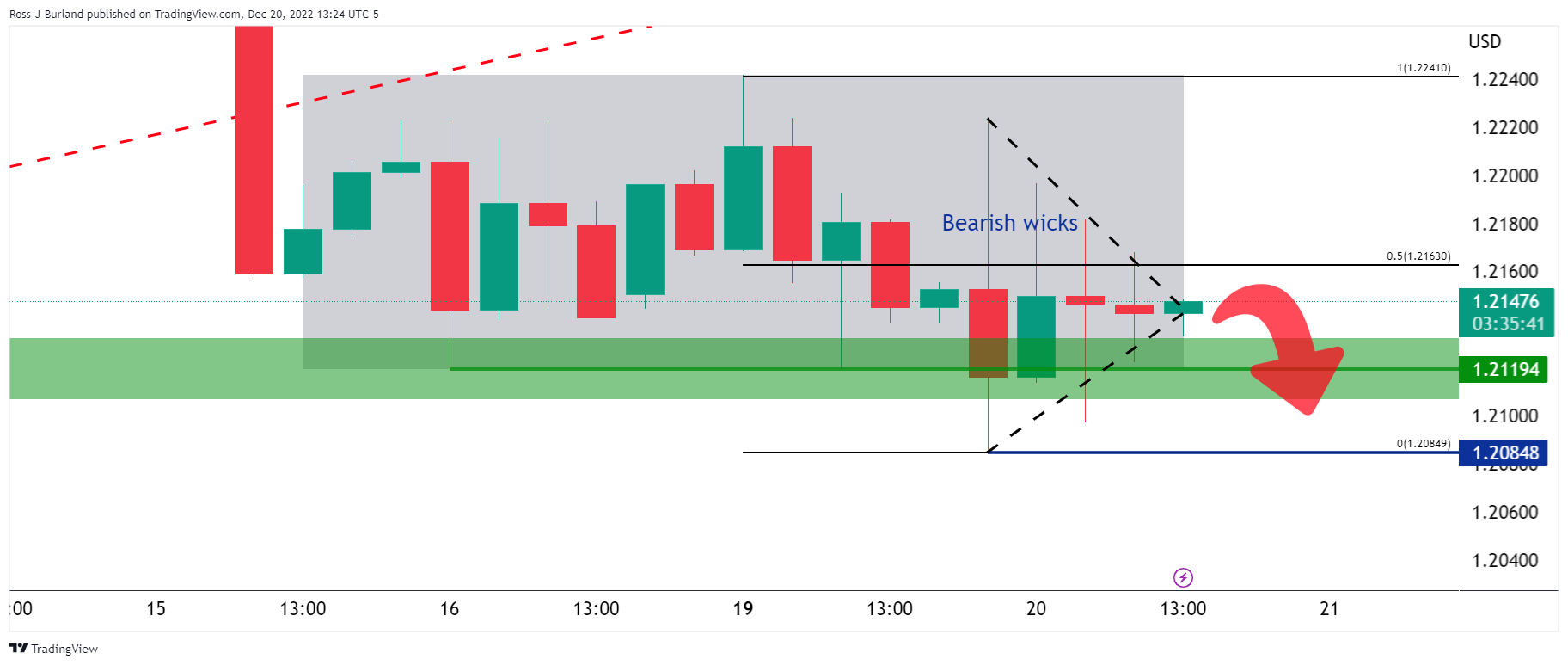

GBP/USD Price Analysis: On track for strongest quarterly gain against USD since 2009

- GBP/USD is coming to a peak in a coil which puts to an imminent breakout.

- The emphasis is currently on a test of 1.2080 for the coming sessions.

- If the bears fail to break this level of support, then a meaningful correction to the upside will be on the cards.

GBP/USD remains on the backside of the late September rally's trendline where the pair gained some 20% in the quarter so far, albeit shedding gains to around 3% to the current spot price and consolidation lows of 1.20975. Still, the Pound Sterling is on track for its best quarter in more than 13 years. However, However, GBP/USD remains about 10% lower for the year and the following analysis is going to be through the eyes of the bears.

GBP/USD was last -0.6% having fluctuated in and out of the positive territory on Tuesday, driven by volatility due to the Bank of Japan's (BoJ) surprise tweak to its bond yield control. The BoJ is now allowing long-term interest rates to rise more in a move aimed at easing some of the costs of prolonged monetary stimulus.

This means that the Japanese could be looking to bring assets home, sinking all ships vs. the yen on the forex board. However, the price is now settled back within the volatility between 1.2223 and 1.2084 but it is coiled into a potential breakout peak below 1.2150.

GBP/USD Daily chart

As the images above show, the price is on the backside of the trend and us testing the 1.2100 support. An upside correction into the prior bearish impulse would be expected which eyes 1.2250 resistance that is marked by the volume profile and confluence with the 38.2% Fibonacci retracement as well as the prior structure.

GBP/USD H4 charts

However, moving down to the lower time frames, the bears are flexing and we may have seen the last-ditch effort from the bulls already:

Meanwhile, the coil is coming to a peak and a break out is expected one way or the other. If the price imbalances above are not swept, then the outlook could play out as the above.

Staying with the bearish bias, the bearish wicks are a compelling feature which puts the emphasis on a test of 1.2080 for the coming sessions. If the bears fail to break this level of support, then a meaningful correction to the upside, as oper the daily chart, has a higher probability of playing out.

-

18:24

Colombia Trade Balance up to $1475M in October from previous $-1401M

-

17:00

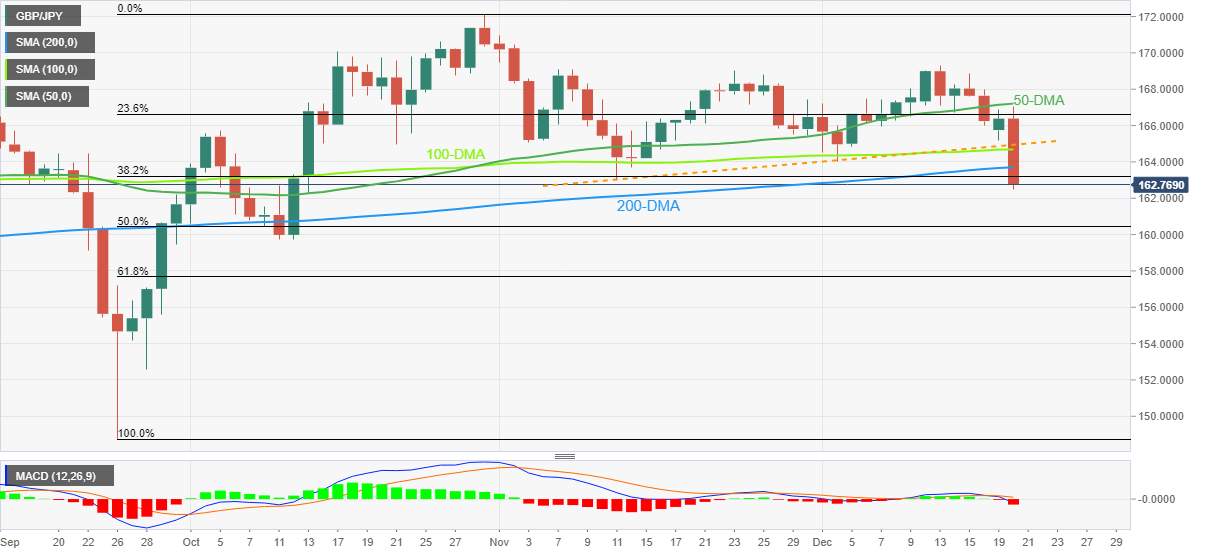

GBP/JPY drops below 160.00 to the lowest since September; down more than 700 pips

- GBP/JPY loses more than 4%, on worst day in months.

- Next medium-term support at 158.00.

- Japanse Yen soars across the board after the Bank of Japan’s decision.

The GBP/JPY cross is losing more than 700 pips on Tuesday amid a rally of the Japanese Yen following the Bank of Japan’s monetary policy announcement.

The decision of the Bank of Japan to raise the upper range of its yield curve control of the 10-year bond from 0.25% to 0.50% boosted the Japanese Yen, that is having one of the most significant gains in years. The announcement took markets by surprise, leading to a selloff in government bonds.“Governor Kuroda stressed that the move did not represent tightening and that it was made to improve market functioning. While the policy rate was kept at -0.10%, speculation will grow for an eventual rate hike next year. We thought it was an H2 prospect but today’s move suggests it could happen as early as H1. Furthermore, given Governor Kuroda’s propensity for surprises, this hike could come under his watch rather than his successor’s”, explained analysts at Brown Brothers Harriman.

The Yen is rising by more than 4% against its main rivals on Tuesday. The GBP/JPY cross is down by more than 700 pips, on its way to the lowest daily close since September 29.

Recently the cross bottomed at 159.06 and it is hovering around 159.40. Before BoJ’s decision, it was trading at 166.70. On the downside, the next strong support area is seen around 158.00.

Technical levels

-

16:16

USD/JPY tumbles by more than 4.5%, tests 131.00

- Yens keeps rising across the board after Bank of Japan’s surprise.

- USD/JPY drops by more than 4% on Tuesday.

- US dollar mixed across the board, on risk appetite.

The USD/JPY dropped even further during the American session and bottomed at 131.00, the lowest intraday level since August 2. It remains near the low, falling more than 550 pips or 4.15%.

The pair is headed toward the lowest daily close since June with the Yen having one of the biggest daily gains across the board boosted by the decision of the Bank of Japan to raise the upper banks of its yield curve control of the 10-year bond from 0.25% to 0.50%.

BoJ breaks market correlation?

It was a small change from the BoJ but market participants are seen a lot more. The impact of the announcement shows that a more significant policy shift could take place much sooner than expected.

Until a few hours ago, higher US yields meant a weaker Japanese Yen and bearish pressure for gold. The Japanese Yen is having the best day in years across the board and Gold prices are at weekly highs.Main indexes in Wall Street are now positive for the day, not affected by higher US yields. Back in the old days, prior to the wide divergence between the Federal Reserve and the BoJ monetary policy, higher yields were normal at times of optimism in the equity market, reflecting money going out of safer assets, looking for higher returns.

Technical levels

-

16:06

US: Atlanta Fed GDPNow for Q4 declines to 2.7%

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.7% in the fourth quarter, down slightly from 2.8% in the previous estimate.

"After this morning’s housing starts report from the US Census Bureau, the nowcast of fourth-quarter real residential investment growth decreased from -21.2% to -21.5%," the Atlanta Fed explained in its publication.

Market reaction

This report doesn't seem to be having a significant impact on the US Dollar's performance against its major rivals. As of writing, the US Dollar Index was down 0.7% on the day at 103.95.

-

15:57

A small step for the BoJ, a big step for the Yen – SocGen

The Yen has gained more than 3% against the Dollar today after the Bank of Japan (BoJ) surprised by shifting its Yield Curve Control (YCC) framework. Kit Juckes, Chief Global FX Strategist at Société Générale, believes that the JPY may have further to run.

Yen reached lows not seen since 1973, and has room to bounce

“The BoJ widened the band in which 10yr JGB yields can fluctuate to +/-50 bps and announced daily operations to buy 10-year JGBs at a yield of 0.5%. Monthly purchases will increase from Y7.3 trn to about Y9 trn. The BoJ emphasises that this move is intended tackle the (damaged) functioning of the bond market but attempts to downplay it’s policy significance will fall on deaf ears.”

“This is a change of direction for the BoJ, which has stood firm against any shift in recent months. Symbolically, this is an important step. Also, the Yen remains undervalued on almost any measure. In real effective terms, it had fallen to its lowest level since 1973.”

“We’ve previously argued that big USD/JPY swings are largely a function of Japan’s net international investment position, and changes in FX hedging ratios. This move increases pressure to hedge foreign asset portfolios and so, to buy the Yen, in thin holiday markets.”

-

15:52

Gold Price Forecast: XAU/USD hits fresh weekly highs above $1,820

- US Dollar weakens during the American session as market sentiment improves.

- Gold rises further despite higher US yields.

- XAU/USD with bullish bias, looking at monthly highs around $1,825.

Gold prices broke above $1,810 and jumped to $1,821 reaching the highest level in a week. XAU/USD remains around $1,1815 looking at the monthly high amid an improvement in market sentiment and despite higher US yields.

Equity prices in Wall Street accelerated to the upside during the last hours after opening in negative ground. The Dow Jones is up by 0.50% and the Nasdaq gains by 0.42%. US yields are off highs but still up for the day. The US 10-year bond yield rose to 3.70%, the highest level since November. Also European yields are up, boosted by the Bank of Japan (BoJ) surprise.The BoJ widened the band of its yield curve control and triggered a selloff in bond around the globe. Gold prices held relatively steady and then started to rise on European hours. After the beginning of the American session, XAU/USD rose even further.

Short-term outlook

Gold prices are now looking at the monthly high around $1,825. A break higher would expose the next resistance area $1,830. The outlook is bullish for gold, however a slide back below $1,810 should keep XAU/USD in the wide range with support at the 20-day Simple Moving Average at $1,780.

A daily close around current levels would be the strongest since late June. On the downside, a daily close under $1,765 could suggest a near term peak.

Technical levels

-

15:46

Precious metals could face considerable setback potential – Commerzbank

Latest surge in precious metals prices was presumably supported by speculative buying. Thus, the sector faces considerable setback potential, strategists at Commerzbank report.

Potential for further gains could be limited

“The surge in precious metals prices to multi-month highs that has been observed since early November is likely to have been driven by speculative buying.”

“The potential for further gains will be limited if speculative financial investors rethink their recently optimistic attitude towards precious metals given the prospect of more pronounced interest rate hikes next year.

“If previous long positions were to be liquidated or new short positions built up, prices could even face considerable setback potential.”

-

15:29

BoJ shift likely to fuel further JPY strength – MUFG

The Bank of Japan shifts its yield curve control (YCC) stance with obvious consequences. USD/JPY could be into the 120’s sooner than analysts at MUFG Bank expected.

BoJ’s surprise will impact all FX market players

“The BoJ has surprised the markets by announcing an adjustment to its YCC policy. Nobody will be surprised to see the 10yr JGB yield jump close to the top of the new trading range around zero percent of +/-50 bps.”

“To us this decision will impact all FX market players – corporate hedging behaviour; investor hedging behaviour; speculative behaviour; and capital flows.”

“The shift from the BoJ merely reinforces a strong and compelling view that the divergence at the heart of the surge in JPY selling in 2022 is going to reverse in 2023, resulting in a reversal of JPY selling that took the Yen to record levels of under-valuation.”

“USD/JPY could be into the 120’s sooner than we expected.”

-

15:19

Colombia Trade Balance: $-1475M (October) vs previous $-1401M

-

15:15

NZD/USD finds support at 0.6300 and rebounds toward 0.6350

- US Dollar post mix results across the board on Tuesday.

- NZD and AUD are among worst performers hit by BoJ.

- NZD/USD faces next resistance at 0.6365, key support at 0.6300.

The NZD/USD dropped to test the 0.6300 area after the beginning of the American session. Buyers again appear and pushed the pair back to the 0.6340 area.

Risk sentiment improves, helping Kiwi

Equity prices in the US turned positive amid an improvement in market sentiment. The Dow Jones is up by 0.19% and the Nasdaq by 0.03%. Commodity prices are trading near daily highs.

Treasury bond yields are up following the Bank of Japan (BoJ) policy announcement. Early on Tuesday, the BoJ shocked markets by easing its bond-yield controls. This was seen as a potential shift. The US 10-year reached 3.70% while the 2-year rose to 4.30%. Higher yields are giving some support to the US Dollar. The DXY is falling by 0.75%, mostly due to the USD/JPY’s slide of more than 3%. The Kiwi and the Aussie are the worst performers among G10 currencies.

US economic data released on Tuesday came in below expectations. Building Permits tumbled 11.2% to 1.342 million (annual rate) below the 1.470 million of market consensus. Housing starts dropped less than expected to 1.427 million.

Technical outlook

The NZD/USD is rebounding after being able to hold above 0.6300. A break lower would open the doors to more losses. The next relevant support is seen at 0.6250. On the upside, the pair faces a critical resistance at 0.6365 (horizontal level and the 20-Simple Moving Average in 4-hour chart). A break higher could lead to a test of 0.6400.

Technical levels

-

15:13

Eurozone Consumer Confidence Index improves to -22.2 in December vs. -22 expected

- Consumer Confidence Index in the Eurozone rose modestly in December.

- EUR/USD continues to trade in positive territory near 1.0650.

Consumer sentiment in the Euro area improved modestly in December with the Consumer Confidence Index rising to -22.2 from -23.9 in the flash estimate. This reading came in slightly weaker than the market expectation of -22.

In the EU, the Consumer Confidence Index rose by 1.4 points to -24.4.

"Consumer confidence remains well below its long-term average but is now slightly above the trough reached at the onset of the COVID-19 pandemic," the European Commission noted in its publication.

Market reaction

EUR/USD pair edged higher after this report and was last seen rising 0.4% on the day at 1.0648.

-

15:01

European Monetary Union Consumer Confidence came in at -22.2 below forecasts (-22) in December

-

15:01

S&P 500 Index could slump to the 3000 level – Morgan Stanley

Economists at Morgan Stranley expect price declines for equities. The S&P 500 Index could fall to the 3000 level.

Have markets fully priced an earnings decline?

“We are feeling more confident about our 2023 forecast for S&P 500 earnings per share of $195. This remains well below both the bottoms up consensus of $231 and the top down forecasts of $215.”

“The consensus view on the buy side is now that we won't make new lows on the S&P 500 next year, but will instead defend the October levels or the 200 week moving average, approximately 3500 to 3600 on the S&P 500.”

“We remain decidedly in the 3000 to 3300 camp with a bias toward the low end given our view on earnings.”

“With the year end Santa Claus rally now fading, there is reason to believe the decline from last week is the beginning of the move lower into the first quarter for stocks that we've been expecting, and when a more sustainable low is likely to be made.”

-

14:59

New Zealand GDT Price Index: -3.8% vs previous 0.6%

-

14:24

USD/JPY may break below 130.00 – ING

The Bank of Japan announced a surprise change in its yield curve control policy. The immediate impact on the yen has been sizeable, with USD/JPY dropping more than 3%. The pair could slump under the 130 level, economists at ING report.

BoJ delivers last shock of the year

“The BoJ announced a surprising change in its YCC policy. The target band for the 10-year JGB has been widened to +/- 0.50% from the previous 0.25%, essentially allowing higher interest rates in the current inflationary environment despite still officially targeting 0.00% as the outright target. The move was accompanied by an increase in the amount of JGB purchases, from JPY7.3 tn per month to 9 tn.”

“For now, we think risks remain skewed to the downside for USD/JPY into the festive break, and we cannot exclude a break below 130.00 – also given the generally soft Dollar environment.”

“For now, the negative reaction in global equities is capping pro-cyclical currencies, and offering some USD support on balance, but broader dollar weakness is surely a possibility in the near term. DXY could press 103.50 by the end of this week.”

-

14:02

EUR/USD Price Analysis: Flirts with a nearly two-week-old ascending trend-line, around 1.0600

- EUR/USD extends its two-way price move for the second successive day on Tuesday.

- The setup supports prospects for the emergence of some dip-buying at lower levels.

- A break below a two-month-old ascending channel is needed to negate the positive bias.

The EUR/USD pair seesaws between tepid gains/minor losses through the early North American session and is currently placed in neutral territory, around the 1.0600 mark.

From a technical perspective, the EUR/USD pair, so far, has managed to defend support marked by an upward-sloping trend-line extending from December 7. A convincing break below might prompt aggressive technical selling and accelerate the fall towards the 100-period SMA on the 4-hour chart, currently around the 1.0520 area.

Meanwhile, oscillators on hourly charts have just started drifting in the negative territory and favour bearish traders amid looming recession risks. Technical indicators on the daily chart, however, are holding comfortably in the bullish zone and support prospects for the emergence of some dip-buying around the EUR/USD pair.

That said, some follow-through selling will make the EUR/USD pair vulnerable to weaken below the 1.0500 psychological mark and test the next relevant support near the 1.0460-1.0455 area. The latter coincides with the lower boundary of a nearly two-month-old ascending channel and should act as a pivotal point for short-term traders.

On the flip side, the 1.0650-1.0660 region now seems to have emerged as an immediate hurdle. This is closely followed by the 1.0680 horizontal barrier ahead of the 1.0700 round figure. Any subsequent move-up could meet with some supply near the trend-channel resistance, currently around the 1.0725 area, just ahead of the post-ECB swing high.

A sustained strength beyond will be seen as a fresh trigger for bullish traders and set the stage for an extension of the recent strong recovery move from over a two-decade low touched in September. The EUR/USD pair might then aim to reclaim the 1.0800 round-figure mark for the first time since April 2022.

EUR/USD 4-hour chart

-638071416064365696.png)

Key levels to watch

-

13:55

United States Redbook Index (YoY): 7.6% (December 16) vs 5.9%

-

13:37

Canada: Retail Sales rise by 1.4% in October vs -0.3% expected

- Retail Sales in Canada rose unexpectedly in October.

- USD/CAD trades in negative territory, holds above 1.3600.

Retail Sales in Canada rose by 1.4% on a monthly basis in October following September's 0.6% decline, the data published by Statistics Canada revealed on Tuesday. This reading came in much better than the market expectation for a decrease of 0.3%.

Retail Sales ex Autos increased by 1.7% in the same period, compared to analysts' estimate of 0.8%.

Market reaction

USD/CAD edged slightly lower with the initial reaction to this data and was last seen losing 0.15% on the day at 1.3622.

-

13:33

US: Housing Starts decline 0.5%, Building Permits plunge 11.2% in November

- Housing Starts and Building Permits in the US continued to decline in November.

- US Dollar Index stays in negative territory below 104.50.

The monthly data published by the US Census Bureau revealed on Tuesday that Housing Starts declined by 0.5% on a monthly basis in November following October's 2.1% contraction.

In the same period, Building Permits fell by 11.2%, compared to a 3.3% drop recorded in October.

Market reaction

These figures don't seem to be having a significant impact on the US Dollar's valuation against its major rivals. As of writing, the US Dollar Index was down 0.35% on the day at 104.30.

-

13:30

Canada Retail Sales (MoM) above forecasts (-0.3%) in October: Actual (1.4%)

-

13:30

Canada Retail Sales ex Autos (MoM) above forecasts (0.8%) in October: Actual (1.7%)

-

13:30

United States Building Permits Change: -11.2% (November) vs previous -2.4%

-

13:30

United States Building Permits (MoM) below forecasts (1.47M) in November: Actual (1.342M)

-

13:30

United States Housing Starts (MoM) above forecasts (1.415M) in November: Actual (1.427M)

-

13:30

United States Housing Starts Change climbed from previous -4.2% to -0.5% in November

-

13:28

Silver Price Analysis: XAG/USD seems poised to retest multi-month high, north of $24.00

- Silver catches fresh bids on Tuesday and rallies to the $24.00 neighbourhood.

- The technical setup favours bulls and supports prospects for additional gains.

- A break below the $22.80 confluence is needed to negate the positive outlook.

Silver gains strong positive traction on Tuesday and rallies to a fresh daily high, back closer to the $24.00 mark in the last hour. The white metal, however, trims a part of its intraday gains and retreats to the mid-$23.00s heading into the North American session.

Given the recent bounce from a confluence comprising an ascending trend-line extending from November low and the 100-period SMA on the 4-hour chart, the bias seems tilted in favour of bulls. The positive outlook is reinforced by the fact that oscillators on the daily chart are holding comfortably in the bullish territory and have again started gaining traction on the 4-hour chart.

That said, RSI (14) on the 1-hour chart flashes slightly overbought conditions and holds back traders from positioning for any further gains. Nevertheless, the XAG/USD still seems poised to surpass the $24.00 mark and retest the multi-month top, around the $24.10-$24.15 area touched earlier this month. Some follow-through buying should pave the way for additional near-term gains.

On the flip side, the $23.30 horizontal support now seems to protect the immediate downside ahead of the $23.00 mark and the aforementioned confluence, currently around the $22.80 region. A convincing break below will negate the constructive set-up and prompt aggressive technical selling. The XAG/USD might then slide to the next relevant support near the $22.00 round figure.

Silver 4-hour chart

Key levels to watch

-

13:25

EUR/USD: Gains through 1.0655/60 will add to upside momentum – Scotiabank

EUR/USD consolidates around 1.0600. The pair could extend its gains on a break past 1.0655/60 in the short run, economists at Scotiabankr report.

EUR’s recent rally is due a pause or correction lower

“We still rather think the EUR’s recent rally is due a pause or correction lower but intraday price action looks modestly constructive and may develop a little more upside pressure in the short run.”

“EUR/USD losses have been well-supported on sub-1.06 dips; intraday gains that extend through 1.0655/60 (minor bull trigger) will add to upside momentum for a retest of the low 1.07s.”

“Intraday support is 1.0575/80.”

-

13:06

GBP/USD: Sub-1.20 dips likely to remain well supported – Scotiabank

GBP/USD stays at around 1.2150. Economists at Scotiabank expect the pair to hold above the 1.20 level.

More sideways range trade in the near term

“Cable is holding in about the middle of the past week’s range between support at 1.2090/00 and resistance at 1.2240/50.”

“Trend signals are mixed and weak across the shorter-term studies, suggesting more sideways range trade in the near term.”

“Broader trends suggest some modest downside risk as spot corrects the sharp rise from the Sep low but sub-1.20 dips are likely to remain well supported.”

-

12:54

USD/CAD drops to three-day low, around 1.3600 mark ahead of Canadian/US data

- USD/CAD turns lower for the second straight day amid broad-based USD weakness.

- A combination of factors could offer some support to the pair and help limit losses.

- Growing recession fears act as a headwind for oil prices and undermine the Loonie.

- Hawkish Fed, rising US bond yields should revive the USD demand and lend support.

The USD/CAD pair continues with its struggle to find acceptance or build on the momentum beyond the 1.3700 mark and turns lower for the second successive day on Tuesday. The downward trajectory drags spot prices to a three-day low, around the 1.3600 round figure heading into the North American session and is sponsored by the heavily offered tone surrounding the US Dollar.

The Bank of Japan-inspired strong rally in the Japanese Yen is seen weighing on the greenback. Apart from this, a slight recovery in the risk sentiment - as depicted by a modest bounce around the US equity futures - exerts additional pressure on the safe-haven greenback and attracts fresh selling around the USD/CAD pair. That said, a combination of factors should help limit the downside for the buck and lend some support to the major, at least for the time being.

Investors remain concerned that a surge in new COVID-19 cases in China could delay a broader reopening of the economy and dent fuel demand. This, in turn, acts as a headwind for crude oil prices, which, in turn, is seen undermining the commodity-linked Loonie. Furthermore, growing recession fears might keep a lid on any optimism in the markets. This, along with the Fed's hawkish outlook, could revive the USD demand and attract some dip-buying around the USD/CAD pair.

Traders now look to Tuesday's economic docket, featuring the release of monthly Retail Sales figures from Canada and the US housing market data. The data might do little to provide any meaningful impetus, leaving the USD/CAD pair at the mercy of the USD demand. Apart from this, traders will take cues from oil price dynamics to grab short-term opportunities around the major.

Technical levels to watch

-

12:45

USD/CAD: Upbeat Canadian Retail Sales to lift the Loonie, but gains could be short-lived – Scotiabank

USD/CAD is little changed ahead of what should be positive Retail Sales data. However, gains following the figures could be short-lived, according to economists at Scotiabank.

Clear push under 1.3620 should see USD/CAD dip to the 1.3540 zone

“The advance estimate for Canadian Retail Sales suggests a solid 1.5% increase in the Nov month. Not that the CAD will likely react to positive economic news. Positive data should give the CAD a lift but gains may be minor and/or short-lived.”

“Technically, after repeated failures around 1.37, the USD edging below 1.3620 (the low point of the past week’s range and a double/triple top trigger) today should have produced more downside pressure on USD/CAD. That may still develop but the market seems reluctant to bring negative pressure to bear on the USD.”

“A clear push under 1.3620 should see USD/CAD dip to the 1.3540 zone in the next few days.”

-

12:19

Gold Price Forecast: XAU/USD bulls again turn to bullion after CPI numbers emerge – SocGen

Gold edged higher following Consumer Price Index (CPI) data and is now trading above the $1,800 level, economists at Société Générale report.

Gold rises after November CPI prints

“US inflation data for November were released at the very end of the week, with core CPI printing at 6.0% YoY compared to analysts’ forecast of 6.1%. This was particularly supportive for Gold since it was thought that it would further convince the Fed to slow the pace of tightening during its 13-14 December FOMC meeting.”

“Although lower inflation would typically be bearish for Gold, the bullion has been supported recently by the prospect of the Fed slowing interest rate increases. Because Gold is a non-interest generating asset, a lower peak interest rate is bullish for the bullion.”

“The US Dollar depreciated following the data release, which improved the affordability of the precious metal to foreign investors, further supporting Gold prices.

-

12:13

USD/JPY pauses BoJ-inspired slump to multi-month low, finds some support near 132.00

- USD/JPY comes under intense selling pressure in reaction to the BoJ’s hawkish twist on Tuesday.

- Recession fears continue to weigh on investors’ sentiment and further benefit the safe-haven JPY.

- The Fed’s hawkish outlook, rising US bond yields fails to impress USD bulls or lend any support.

The USD/JPY pair adds to its heavy intraday losses and plummets to over a four-month low, around the 132.00 mark during the mid-European session. The pair, however, manages to recover a few pips in the last hour and is currently trading around the 132.70-132.75 region.

The sharp fall for the USD/JPY pair comes after the Bank of Japan (BoJ) stunned markets by reviewing its yield curve control policy. In a surprise move, the Japanese central bank decided to widen the range for fluctuations in the 10-year government bond yield. This is seen as a precursor to the end of the BoJ's ultra-accommodative monetary policy and prompts aggressive buying around the Japanese Yen.

Moreover, the cautious mood - amid growing recession fears - benefits the safe-haven JPY and exerts additional downward pressure on the USD/JPY pair. Investors remain concerned that a surge in COVID-19 cases in China could delay a broader reopening of the economy. Adding to this, geopolitical risks fuel worries about a deeper global economic downturn and take its toll on the risk sentiment.

The US Dollar, on the other hand, struggles to attract buyers despite a more hawkish commentary by the Fed last week. It is worth recalling that the US central bank indicated that it will continue to raise interest rates to crush inflation and projected an additional 75 bps lift-off by the end of 2023. This triggers a fresh leg up in the US Treasury bond yields, though fails to impress the USD bulls.

The intraday slump, meanwhile, confirms a fresh breakdown below a technically significant 200-day SMA and supports prospects for an extension of the depreciating move. That said, the oversold RSI (14) on hourly charts hold back traders from placing fresh bearish bets. This, in turn, assists the USD/JPY pair to find some support near the 132.00 mark, though any meaningful bounce seems elusive.

Market participants now look forward to the release of the US housing market data - Building Permits and Housing Starts. The data might do little to influence the USD or provide any impetus to the USD/JPY pair. Nevertheless, the aforementioned factors suggest that the path of least resistance for spot prices is to the downside and attempted recovery is more likely to get sold into.

Technical levels to watch

-

12:11

Bank of Spain trims 2023 growth projection to 1.3% from 1.4%

In its quarterly macroeconomic projections, the Bank of Spain revised the 2023 growth forecast to 1.3% from 1.4% previously. The bank sees Gross Domestic Product (GDP) growth of 2.7% in 2024 and 2.1% in 2025.

In the fourth quarter of the year, the bank expects the economy to expand only by 0.1%. "Weak consumption is one of the main factors behind the modest GDP growth forecast for the fourth quarter," the bank explained in its publication.

Finally, the bank forecasts the annual HICP inflation to decline to 4.9% in 2023 and 3.9% in 2024 from 8.4% in 2022.

Market reaction

The EUR/USD pair showed no immediate reaction to this publication and was last seen rising 0.25% on the day at 1.0633.

-

12:00

Mexico Retail Sales (YoY) came in at 3.8%, below expectations (4%) in October

-

12:00

Mexico Retail Sales (MoM) registered at 0.7% above expectations (-0.7%) in October

-

11:59

USD/JPY seen at 125 by end-2023 as the uptrend has come to an end – ABN Amro

Bank of Japan (BoJ) surprised the market by raising the upper band on its yield curve control (YCC) policy. The move triggered the Yen to rally by more than 3% versus the USD and the Euro. Economists at ABN Amro expect a further comeback of the JPY.

BoJ tweaks YCC

“The BoJ surprised friend and foe by shifting its YCC framework much earlier than expected. While leaving its policy balance rate and 10-yr yield target unchanged for now (at -0.1% and 0.0%, respectively), the BoJ announced to widen the trading band on 10-year bond yields and raise the upper limit of the band to around 0.50%, from 0.25%.”

“The uptrend of the US Dollar versus the Yen has now also come to an end, with the breaking of the 200-Day Moving Average in USD/JPY.”

“We expect more upside in the Yen versus the USD, mainly because of the rate cuts by the Fed we foresee to start end of 2023.”

“Our end-of-year forecasts for USD/JPY currently stand at 132 for 2023 and 125 for 2024.”

-

11:24

EUR/GBP may move to the upper half of the 0.87-0.88 band – ING

EUR/GBP is back at Monday’s close. Economists at ING expect the pair to move to the upper half of the 0.87-0.88 band.

No domestic drivers

“There is nothing to highlight in the UK calendar today, and the Pound should continue to be driven by Dollar dynamics.”

“EUR/GBP initially had a positive reaction to the BoJ announcement, likely due to GBP’s higher sensitivity to the adverse response in global equities, but is now back at yesterday’s close.”

“Still, GBP downside risks should be larger than for the Euro if risk sentiment remains pressured today, and EUR/GBP may move to the upper half of the 0.87-0.88 band.”

-

11:17

Portugal Current Account Balance up to €-2.871B in October from previous €-3.597B

-

11:06

USD/JPY: Defending 130.40 is essential to avert a revisit of 2015 levels near 125.85/124.00 – SocGen

USD/JPY has slumped to its weakest level in four months below 133.00. Holding above 130.40 is critical to avoid a deeper fall, economists at Société Générale report.

Signals of a meaningful rebound are not yet visible

“Daily MACD is in deep negative territory, however, signals of a meaningful rebound are not yet visible.”

“A revisit of August trough near 130.40 is not ruled out. Defending this would be essential to avert a revisit of 2015 levels near 125.85/124.00.”

“The MA at 135.60 is near term hurdle.”

-

10:55

EUR/USD could test 1.0700 before Christmas – ING

EUR/USD is holding marginally above 1.0600. The pair could test 1.07 in the coming days, economists at ING report.

Sidelined, for now

“It’s likely that the downward pressure on the Dollar from the BoJ's hawkish shift has been fully offset by the deterioration in risk sentiment, which negatively impacts the pro-cyclical Euro.”

“There are lingering downside risks to the Dollar and we could see EUR/USD test 1.0700 before Christmas. Anyway, volatility should become significantly thinner from Wednesday/Thursday, with today’s BoJ announcement having been the last major event in markets.”

-

10:36

BoJ’s surprise makes more difficult to assess what monetary policy will be like under new chief – Commerzbank

The Yen made a massive jump as the Bank of Japan (BoJ) is moving after all. Economists at Commerzbank believe that now it will more difficult to assess what monetary policy will be like under the new BoJ chief.

A first admission to the upward pressure on yields

“BoJ extended the target for the 10-year yield from -0.25 to +0.25% to -0.50 to +0.50%. However, it immediately limits this step again.”

“I am still a bit split on how to assess today's action. It makes sense to allow a wider target range of yields, which are pushing higher, when yields are rising globally. But to simultaneously increase buying volume to better defend the new target again dilutes this decision.”

“Perhaps this is a first admission to the upward pressure on yields and at the same time paves the way for Haruhiko Kuroda's successor, who will take office in the spring. At least we now know that the BoJ can also move. This will probably make it all the more difficult to assess what monetary policy will be like under the new BoJ chief.”

-

10:30

Gold Price Forecast: XAU/USD eyes $1,810-12 hurdle amid weaker US Dollar, recession fears

- Gold price catches fresh bids on Tuesday and draws support from a combination of factors.

- Recession fears act as a tailwind for the safe-haven metal amid broad-based USD weakness.

- The upside seems limited amid the prospects for further tightening by major central banks.

Gold price regains positive traction on Tuesday and steadily climbs back above the $1,800 mark during the first half of the European session. The XAU/USD is currently placed above a technically significant 200-day Simple Moving Average (SMA) and is supported by a combination of factors.

Recession fears underpin safe-haven Gold price

Despite the easing of strict COVID-19 restrictions in China, investors remain worried that a surge in new infections in the country could delay a broader reopening of the economy. Adding to this, the protracted Russia-Ukraine war has been fueling concerns about a deeper global economic downturn and weighing on investors' sentiment. This is evident from the prevalent cautious market mood, which, in turn, is driving some flows towards the safe-haven Gold price.

Weaker US Dollar further benefits Gold price

Apart from this, a weaker US Dollar provides an additional boost to the US Dollar-denominated Gold price. The sharp intraday fall in the buck could be solely attributed to the Bank of Japan (BoJ)-inspired strong buying around the Japanese Yen. Apart from this, the USD downfall lacks any obvious fundamental catalyst and is more likely to remain limited, at least for the time being, amid a more hawkish commentary by the Federal Reserve (Fed) last week.

Hawkish central banks could cap Gold price

In fact, the US central bank signalled that it will continue to raise rates to crush inflation. Adding to this, policymakers projected at least an additional 75 bps increases in borrowing costs by the end of 2023. This, in turn, triggers a fresh leg up in the US Treasury bond yields and favours the USD bulls. This, along with the prospects for further tightening by other major central banks, could also contribute to capping gains for the non-yielding Gold price.

The European Central Bank (ECB) last week stressed that significant tightening remained ahead and pledged that rates will be increased again, potentially as many as three times, by the same amount to tame runaway inflation. The Bank of England (BoE) lifted the benchmark rate to its highest level since 2008 and indicated that more hikes were likely. Furthermore, the Swiss National Bank (SNB) Chairman Thomas Jordan said that further tightening was necessary to crush inflation.

Bulls need to wait for move beyond $1,810-$1,812 supply zone

The aforementioned fundamental backdrop makes it prudent to wait for a sustained strength back above the $1,810-$1,812 supply zone before placing fresh bullish bets around Gold price. Nevertheless, the XAU/USD, for now, seems to have found acceptance above the $1,800 mark and remains at the mercy of the USD price dynamics.

Gold price technical outlook

From a technical perspective, some follow-through buying beyond the aforementioned barrier should lift Gold price to a multi-month top, around the $1,824-$1,825 region touched earlier this month. The momentum could get extended further towards the $1,854-$1,855 hurdle en route to the next relevant resistance near the $1,886-$1,887 zone.

On the flip side, dips below the $1,800 mark could attract some buyers near the very important 200-day Simple Moving Average (SMA), currently around the $1,788 area. This is followed by support near the $1,774-$1,773 region, which if broken decisively will negate any positive bias and prompt some technical selling. Gold price might then accelerate the fall toward the $1,766 intermediate support before eventually dropping to the $1,760 level.

Key levels to watch

-

10:01

FX option expiries for Dec 20 NY cut

FX option expiries for Dec 20 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0700 806m

- USD/JPY: USD amounts

- 135.50 312m

- 136.32 572m

- AUD/USD: AUD amounts

- 0.6535 374m

- 0.6725 387m

- NZD/USD: NZD amounts

- 0.6180 615m

-

10:00

Belgium Consumer Confidence Index climbed from previous -22 to -15 in December

-

09:57

USD Index: Price objective should be somewhere closer to 95-96 levels in the medium term – OCBC

On the US Dollar Index (DXY) weekly chart, bearish momentum remains intact. Thus, economists at OCBC Bank expect DXY to plunge toward 95.96 over the next months.

Near term upside risk

“Near term, daily momentum is showing signs of mild bullish bias while RSI rose. Price action also resembles a falling wedge pattern – typically associated with a bullish reversal. We do not rule out the risk of rebound in the near term.”

“Resistance at 105.30 (21 DMA), 105.90 (200 DMA) and 107.”

“Price action on weekly chart exhibited a head & shoulders (H&S) pattern with neckline around 104.10. Further downside puts next support at 102.15 (50% fibo retracement of 2021 low to 2022 high).”

“Assuming what we are seeing is an eventual playout of a head & shoulders beyond the near term, then the textbook price objective of the breakdown should be somewhere closer to 95-96 levels (medium term).”

-

09:25

ECB's Kazimir: Monetary policy should tighten at a stable pace

European Central Bank (ECB) policymaker Peter Kazimir said on Tuesday that the “monetary policy should tighten at a stable pace.”

On Monday, Kazimir noted that “strong action will be necessary in the first half of 2023.”

Also read: The European economy is likely to avoid a hard landing

Market reaction

The Euro cheers the hawkish commentary from the ECB policymakers, extending gains at around 1.0630, at the time of writing. The pair is up 0.26% on the day.

-

09:22

The JPY has a lot more room to run – TDS

In a surprise move, the Bank of Japan widened its 10y JGB Yield Curve Control (YCC) Band to +/- 0.5% from +/- 0.25% previously. Markets reacted sharply, with JPY strengthening. Economists at TD Securities believe that USD/JPY downside will persist.

More JPY upside

“BoJ widens its YCC band to +/- 0.5% in a surprise move. While a shift in the YCC band was the most plausible option in our view, the widening was bigger and earlier than anticipated, with no prior signalling. We maintain the view that a more extensive policy shift in terms of policy balance rate and 10y JGB target will take place once there is a new BoJ Governor in place. We do not rule out further band widening, however.”

“Despite the sharp knee-jerk move higher in the JPY, we think it will extend further in the coming days given how soon this shift has occurred.”

“We also see a return to FX value as a key driver for the currency space amid peak USD. On that basis, the JPY has a lot more room to run.”

“Major support levels for USD/JPY comes in the 130/132 area before reassessing the extension. Meanwhile, we see more extension to 90/95 in CAD/JPY and 135 in EUR/JPY though the latter will be less linear given the ECB's hawkishness.”

-

09:20

GBP/USD struggles to capitalize on its modest bounce from over two-week low

- GBP/USD reverses an intraday dip to sub-1.2100 levels, or over a two-week low.

- The BoJ-inspired rally in the JPY weighs on the USD, which, in turn, lends support.

- Hawkish Fed, rising US bond yields and recession fears should limit the USD losses.

The GBP/USD pair attracts fresh buying near the very important 200-day SMA and rebounds nearly 100 pips from a two-and-half-week low touched earlier this Tuesday. The momentum is supported by the heavy US Dollar selling and lifts spot prices closer to the 1.2200 mark during the first half of the European session, though lacks bullish conviction.

An unexpected hawkish twist by the Bank of Japan triggers a massive rally in the Japanese Yen, which, in turn, weighs on the greenback. Apart from this, an intraday recovery in the risk sentiment is seen as another factor undermining the safe-haven buck and acting as a tailwind for the GBP/USD pair. That said, any meaningful upside still seems elusive, warranting some caution for aggressive bullish traders and positioning for a further intraday appreciating move.

Worries that a surge in new COVID-19 infections in China could delay a broader reopening in the country overshadows the recent easing of strict lockdown measures. This, along with the protracted Russia-Ukraine war, has been fueling fears about a deeper global economic downturn, which should keep a lid on any optimistic move in the markets. Moreover, a more hawkish commentary by the Federal Reserve supports prospects for the emergence of some dip-buying around the USD.

It is worth recalling that the US central bank indicated that it will continue to raise rates to crush inflation. Furthermore, policymakers projected at least an additional 75 bps increases in borrowing costs by the end of 2023. This, in turn, leads to a fresh leg up in the US Treasury bond yields and favours the USD bulls. Apart from this, a dovish outcome from the Bank of England meeting last week might contribute to capping the upside for the GBP/USD pair.

In fact, two out of nine BoE MPC members voted to keep interest rates unchanged, suggesting that the central bank is closer to ending the current policy tightening cycle. Hence, any further recovery might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly. Bearish traders, however, might wait for a sustained break below a technically significant 200-day SMA support before placing fresh bets and positioning for deeper losses.

Technical levels to watch

-

09:18

ECB’s Villeroy: The European economy is likely to avoid a hard landing

European Central Bank (ECB) Governing Council member and French central bank governor Francois Villeroy de Galhau made some comments on the economic outlook on Tuesday.

Key quotes

“The European economy is likely to avoid a hard landing.”

“France probably will escape a recession.”

Market reaction

Amidst broad US Dollar sell-off and encouraging ECB-speak, EUR/USD is holding its recovery gains at around 1.0625, at the time of writing. The spot is up 0.20% on the day.

-

09:02

Japan’s Suzuki: No comment on market reaction to BoJ decision

Japanese Finance Minister Shunichi Suzuki declined to comment on the market reaction, in response to the Bank of Japan’s (BoJ) policy decision.

Additional comments

“Monetary policy is up to BoJ to decide.“

“BoJ decision aimed at improving corporate finance while maintaining accommodative monetary conditions.”

Market reaction

USD/JPY remains heavily sold-off into the hawkish BoJ policy shift, which sent markets into a tailspin. The pair is down 3.40% on the day at 132.25, at the press time.

-

09:01

European Monetary Union Current Account s.a above forecasts (€-11.6B) in October: Actual (€-0.4B)

-

09:01

European Monetary Union Current Account n.s.a came in at €-4.4B, above forecasts (€-13.8B) in October

-

08:57

It might get more difficult for the Dollar over the coming weeks – Commerzbank

The US Dollar was unable to benefit from the Fed meeting. Economists at Commerzbank expect the greenback to struggle in the next few weeks.

Some US economic data is now deteriorating

“The first comments from FOMC members following last week’s Fed meeting were more on the hawkish side. After all the dots were moved upwards and signal that Fed Funds will peak above 5%. That means further restrictive comments over the coming days should not come as a surprise, nor should they prompt anyone to buy the Dollar.”

“Some US economic data is now deteriorating too, such as the PMI. That is more likely to fuel scepticism that the Fed might be overdoing its restrictive approach and will therefore have to lower the key rate that much more again next year – which would be detrimental to the Dollar.”

“Shortly before Christmas liquidity on the market is getting increasingly thin, but regardless of this fact I fear that every time weak US data is published USD will be under close scrutiny in future. That means things might get more difficult for the greenback over the coming weeks.”

-

08:43

EUR/USD struggles for a firm intraday direction, consolidates around 1.0600 mark

- EUR/USD oscillates in a familiar trading range around the 1.0600 mark on Tuesday.

- The BoJ-inspired rally in the JPY weighs on the USD and lends support to the major.

- Hawkish Fed, rising US bond yields and the risk-off mood limits losses for the buck.

The EUR/USD pair struggles to gain any meaningful traction and seesaws between tepid gains/minor losses through the early European session on Tuesday. Spot prices, however, show resilience below the 1.0600 mark and remain at the mercy of the US Dollar price dynamics.

The Bank of Japan-inspired rally in the Japanese Yen is seen weighing on the USD, which, in turn, is seen lending some support to the EUR/USD pair. That said, a combination of factors continues to act as a tailwind for the greenback and keeps a lid on any meaningful upside for the major, at least for the time being.

Investors seem worried that a surge in COVID-19 cases in China could delay a broader reopening. This, in turn, overshadows the optimism over the easing of lockdown measures and takes its toll on the global risk sentiment. This is evident from a weaker tone around the equity markets and should benefit the safe-haven buck.

Apart from this, a more hawkish outlook by the Federal Reserve last week supports prospects for the emergence of some USD dip-buying. In fact, the US central bank indicated that it will continue to raise rates to tame inflation and projected at least an additional 75 bps increase in borrowing costs by the end of 2023.

This, in turn, pushes the US Treasury bond yields higher and reaffirms the near-term positive outlook for the greenback. That said, hawkish signals from the European Central Bank (ECB), signalling that it will need to raise interest rates significantly further to crush inflation, warrant caution for bearish traders.

In the absence of any major market-moving economic releases from the Eurozone, the mixed fundamental backdrop warrants some caution before placing aggressive directional bets. The US economic docket, meanwhile, features housing market data - Building Permits and Housing Starts - later during the early North American session.

This, along with the US bond yields and the broader risk sentiment, will drive the USD demand and provide some impetus to the EUR/USD pair. The focus, however, will remain on the final US Q3 GDP print on Thursday, followed by the release of the Core PCE Price Index - the Fed's preferred inflation gauge - on Friday.

Technical levels to watch

-

08:31

Hong Kong SAR Consumer Price Index below forecasts (3%) in November: Actual (1.8%)

-

08:12

GBP/USD: Clean break below 21DMA could open room for further downside – OCBC

GBP/USD stays relatively quiet at around 1.2150. A break below here could open room for further losses, economists at OCBC Bank report

Risks still skewed to the downside in the near term

“Daily momentum is mild bearish while RSI is flat.”

“Bearish divergence on MACD and rising wedge pattern (bearish reversal) continue to caution for pullback play lower in the near term.”

“Risks still skewed to the downside in the near term.”