Notícias do Mercado

-

23:56

NZD/USD slides below 0.6200 on downbeat NZ Retail Sales, focus on US data, RBNZ’s Orr

- NZD/USD takes offers to refresh intraday low after downbeat New Zealand data.

- New Zealand’s Q2 Retail Sales dropped -2.3% QoQ, -1.6% YoY.

- Fears surrounding China recedes, mixed US data also tests DXY bulls ahead of the key event.

- Second-tier US statistics will decorate calendar ahead of Thursday’s speech from RBNZ Governor Orr.

NZD/USD remains pressured for the second consecutive day, taking offers around 0.6190 to refresh the intraday low, amid downbeat New Zealand (NZ) Retail Sales figures. Also exerting downside pressure on the Kiwi pair is the cautious mood ahead of the key annual speaking event at the Jackson Hole.

New Zealand’s second quarter (Q2) Retail Sales growth slumped to -2.3% QoQ versus -0.5% prior. The yearly figures also dropped way below the previous readings of 0.0% to -1.6% YoY.

Being the first partial indicator for the NZ Q2 GDP, the data managed to keep bears hopeful and raise challenges for Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr when he speaks at the Jackson Hole on Thursday. It’s worth noting that the recently mixed NZ data have raised doubts about the RBNZ’s further rate hikes, which in turn keeps the NZD/USD bears hopeful.

Even so, mixed US data and the market’s anxiety ahead of the key event, namely the Jackson Hole symposium, keep the pair bears on their toes. US Durable Goods Order for July dropped to 0.0% versus 0.6% expected and an upwardly revised 2.2% previous reading. However, Nondefense Capital Goods Orders ex Aircraft rose past 0.3% market consensus to 0.4%, versus 0.9% prior. Further, Pending Home Sales improved to -1.0% MoM in July versus -4.0% expected and -8.9% prior (revised down from -8.6%). On a yearly basis, the Pending Home Sales decreased by 19.9%, versus the previous contraction of 20.0%.

Also testing the NZD/USD bears are the recent hopes that China may manage to overcome the recession woes, even with smaller losses. Various Chinese state media agencies are coming to the rescue of the local currency, the yuan, after the recent depreciation, justifying that the country’s strong exports should offset a stronger dollar and hawkish Fed rate hikes, mentioned Reuters on Wednesday.

Against this backdrop, the US 10-year Treasury yields rose the most in a week while refreshing a two-month high around 3.10% whereas the Wall Street benchmarks printed mild gains.

Looking forward, the second version of the US Q2 GDP will join the US Personal Consumption Expenditure (PCE) for the said period to decorate the calendar. However, major attention will be given to RBNZ Governor Orr’s speech at the Jackson Hole for fresh impulse.

Technical analysis

NZD/USD seesaws between a two-month-old horizontal area of 0.6135-50 and the 50-DMA level near 0.6235. However, MACD and RSI (14) are in favor of the sellers of late.

-

23:47

New Zealand Retail Sales ex Autos (QoQ): -1.6% (2Q) vs previous 0%

-

23:46

New Zealand Retail Sales (QoQ): -2.3% (2Q) vs previous -0.5%

-

23:45

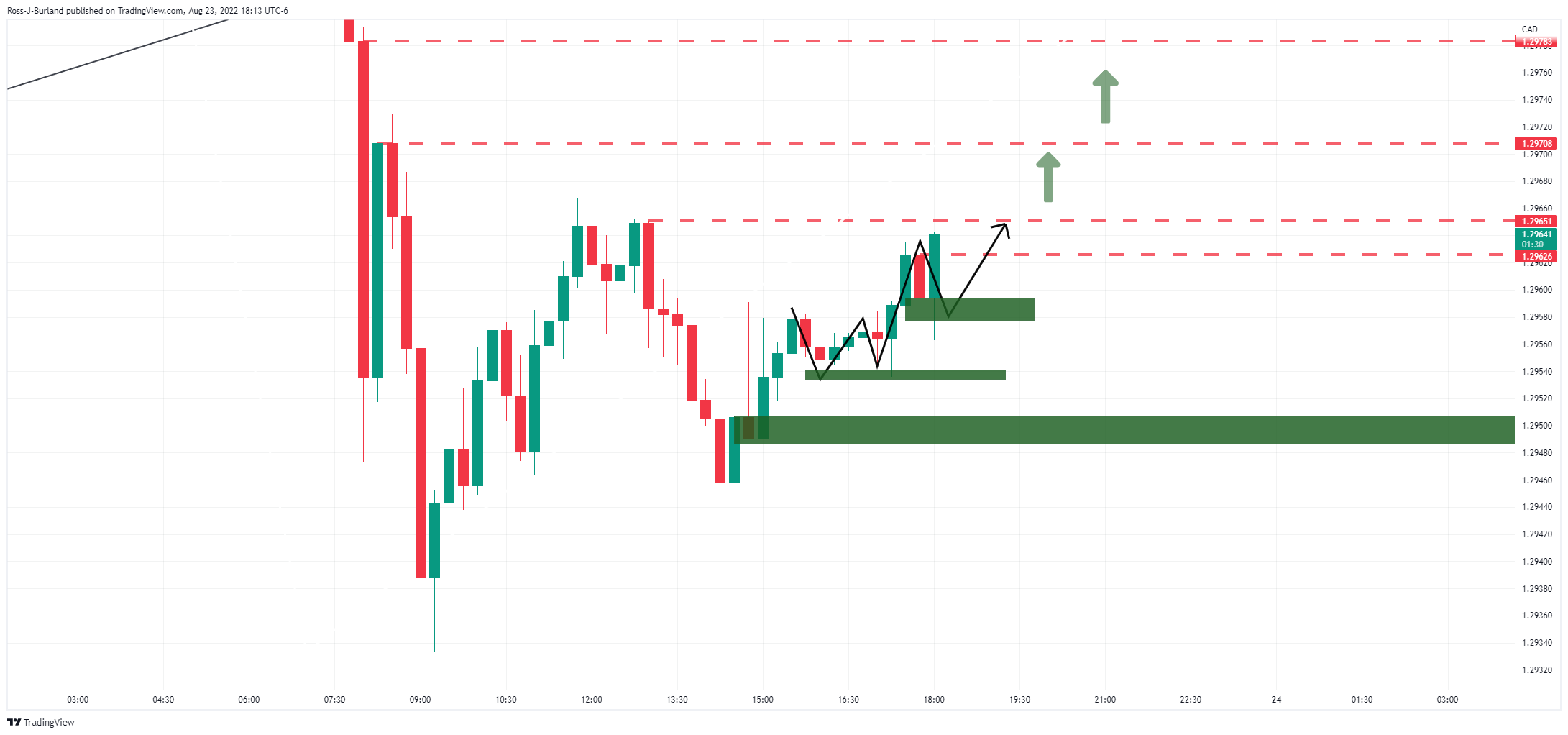

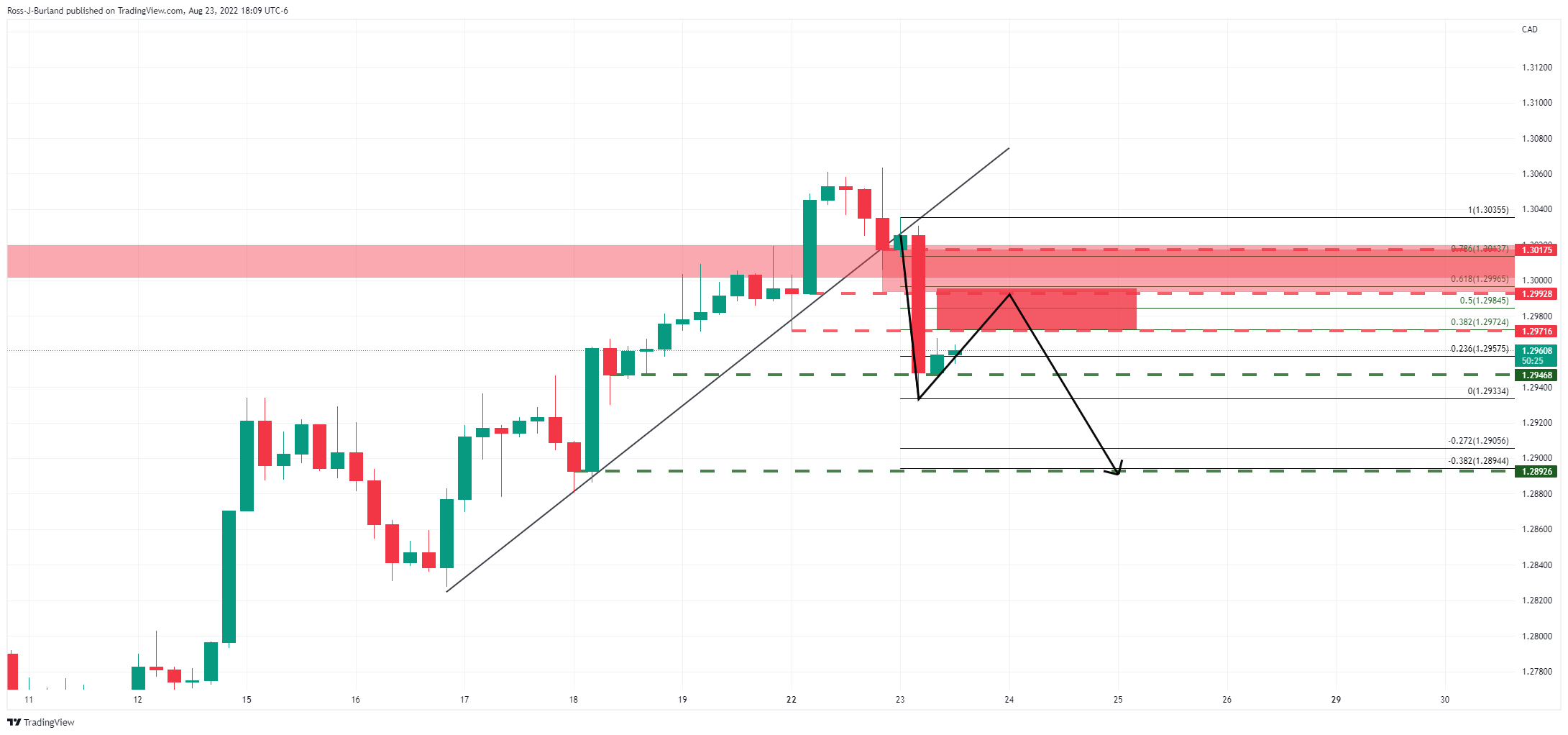

USD/CAD Price Analysis: Bears face rejection near 1.2950 inside fortnight-old rising channel

- USD/CAD sellers attack support line of the bullish chart pattern.

- Bearish MACD signals, lower high formation keep sellers hopeful.

- Buyers have a bumpy road on the way to previous monthly top.

USD/CAD stays defensive around 1.2965, poking the support line of a two-week-old ascending trend channel, during Thursday’s Asian session.

That said, the Loonie pair’s recent lower high formation joins the bearish MACD signals to tease sellers inside a bullish chart pattern.

However, a clear downside break of the stated channel’s support line, at 1.2950 by the press time, appears necessary for the USD/CAD bear’s entry.

Even so, the 200-SMA level near 1.2905 could test the downside momentum before directing the bears towards the monthly low of 1.2727. During the fall, multiple supports around 1.2800 and 1.2765 could challenge the sellers.

Alternatively, recovery moves may initially have to cross the weekly falling resistance line, at 1.3000 by the press time, before challenging the 61.8% Fibonacci retracement level of July-August downside, around 1.3035.

Following that, a horizontal area established from early July, close to 1.3085-90, will be important to watch for the pair buyers. Additionally challenging the USD/CAD upside is the top of the stated channel, near 1.3115 at the latest.

USD/CAD: Four-hour chart

Trend: Further weakness expected

-

23:36

GBP/USD Price Analysis: Bearish pennant advocates more downside ahead

- The cable is going through the process of inventory distribution for further downside.

- For more downside, a breakdown of the RSI (14) below 40.00 could be optimal.

- EUR/USD could re-visit pandemic lows after violating the round-level support of 1.1700.

The GBP/USD pair is indicating a volatility squeeze as the asset is auctioning in an extremely narrow range in the early Tokyo session. The cable is struggling to cross the immediate hurdle of 1.1800. On a broader note, the asset is oscillating in a 1.1757-1.1838 range after a pullback move from a two-year low at 1.1717.

A formation of a bearish pennant chart pattern on an hourly scale is strengthening the greenback bulls. The above-mentioned chart pattern results in a sheer downside move after a downside break of the consolidation. Usually, a consolidation phase denotes the distribution of inventory from institutional investors to retail participants as the latter prefers catching a falling knife rather than selling the weakness.

The 20-period Exponential Moving Average (EMA) at 1.1800 is overlapping with the cable prices, which signals a consolidation ahead.

Also, the Relative Strength Index (RSI) is oscillating in a 40.00-60.00 range, which indicates the unavailability of a potential trigger for a decisive move. However, a dip below 40.00 by the momentum oscillator will activate a fresh downside impulsive wave.

The investing community will witness a vertical downside move if cable drops below the two-year low at 1.1717, which will drag the asset towards the 25 March 2020 low at 1.1638, followed by the 19 March 2020 low at 1.1472.

Alternatively, the pound bulls could regain their mojo and may drive the asset higher towards the August 3 low and high at 1.2135 and 1.2200 after violating the psychological resistance of 1.2000 decisively.

GBP/USD hourly chart

-637969773489663442.png)

-

23:25

EUR/USD treads water around mid 0.9900s with eyes on Jackson Hole

- EUR/USD remains sidelined after a volatile day that ended near the opening price.

- US dollar bulls relinquished controls after mixed US data helped equities to print mild gains.

- DXY printed small gains despite strong yields amid anxiety ahead of central bankers’ speeches at the Jackson Hole.

- The second readings of German/US GDP, Germany’s IFO Sentiment figures and US Core PCE data could also entertain traders.

EUR/USD steadies around 0.9970 while fading the bounce off 0.9910, as well as cooling down the retreat from 0.9998, amid traders’ anxiety ahead of the Jackson Hole symposium speech from Fed Chair Jerome Powell. The major currency pair also struggled for clear directions after mixed US data and a lack of major comments from the ECB/Fed policymakers.

US Dollar Index (DXY) began Wednesday on a firmer footing before retreating towards 108.50 as equities pared recent losses amid a lack of too-strong US data. Also exerting downside pressure on the greenback’s gauge versus the six major currencies was the indecision among the latest Fedspeak and market chatters that Fed Chair Powell may repeat his economic fears and may refrain from too hawkish comments at the Jackson Hole Symposium.

Talking about the US data, Durable Goods Order for July dropped to 0.0% versus 0.6% expected and an upwardly revised 2.2% previous reading. However, Nondefense Capital Goods Orders ex Aircraft rose past 0.3% market consensus to 0.4%, versus 0.9% prior. Further, Pending Home Sales improved to -1.0% MoM in July versus -4.0% expected and -8.9% prior (revised down from -8.6%). On a yearly basis, the Pending Home Sales decreased by 19.9%, versus the previous contraction of 20.0%.

It should be noted that Minneapolis Fed President Neel Kashkari mentioned that the biggest fear is that we are misreading underlying inflation dynamics, per Reuters. The policymaker also added that the Fed can relax on rate hikes when compelling evidence of CPI heading toward 2% is seen.

On the other hand, an influential economist Marcel Fratzscher of the German Institute for Economic Research mentioned, per Reuters, “The economic impact on Germany of Russia's invasion of Ukraine will last years.”

Elsewhere, Sara Johnson, Executive Director of Economic Research at S&P Global Market Intelligence, said in a statement on Wednesday, that global growth is likely to remain subdued in late 2022 and 2023 while inflation is seen moderating over the next two years.

Amid these plays, the US 10-year Treasury yields rose the most in a week while refreshing a two-month high around 3.10% whereas the Wall Street benchmarks printed mild gains.

Moving on, Final readings of Germany’s second quarter (Q2) GDP and the second version of the US Q2 GDP will join the US Personal Consumption Expenditure (PCE) for the said period to decorate the calendar. Also important to watch will be the monthly prints of Germany’s IFO sentiment figures. However, major attention will be given to Jackson Hole for fresh impulse.

Technical analysis

Doji candlestick at the multi-year low joins nearly oversold RSI to suggest that the EUR/USD bears are running out of fuel.

-

23:10

Silver Price Forecast: XAG/USD waver around $19.00 on subdued trading, ahead of Jackson Hole

- Silver prices remain choppy trading as investors prepare for Powell’s speech at Jackson Hole.

- XAG/USD benefitted from thin liquidity conditions and a soft greenback which, despite gaining, traded off the week’s highs.

- Fed’s Kashkari: Inflation is very high, and the Fed will relax until further evidence shows that inflation is reaching 2%.

Silver prices remain subdued on late Wednesday after Wall Street closed, with US equities recording minimal gains on a day characterized by thin market volatility as traders brace for Fed Chair Jerome Powell’s speech on Jackson Hole. At the time of writing, XAG/USD is trading at $19.15 a troy ounce, up by 0.13%.

On Wednesday, XAG/USD opened near the day’s high at around $19.10 before diving toward the daily lows at $18.93. However, buyers lifted white metal prices, reclaiming the $19.00 figure, and hitting a daily high at $19.22, before settling at current price levels.

Before the New York Stock Exchange (NYSE) opened, US Durable Good Orders for July unexpectedly jumped, as shown by data released by the US Commerce Department. Headline Orders were unchanged on a monthly reading while excluding defense and aircraft; so-called core Durable Good Orders rose by 0.4%, higher than estimates at 0.3%.

Later, US Pending Home Sales fell for the sixth consecutive month, collapsing by 19.9% YoY, less than 22% contraction, while on a month-over-month, it fell -1%, vs. -4% forecasts.

The US Dollar Index, a gauge of the greenback’s value against a basket of six currencies, extended its gains by 0.09%, at 108.600, while the 10-year US Treasury note rate at 3.109%, gaining six bps.

On Tuesday, Minnesota Fed President Neil Kashkari said that inflation is very high, and it is the Fed’s job to bring it down. He emphasized the need to tighten monetary policy and added that the Fed could only relax on rate increases when they see compelling evidence of inflation heading toward 2%.

What to watch

The US economic docket will feature the GDP growth rate for the second quarter, Initial Jobless Claims, and the Kansas City Fed Manufacturing Index for August.

Silver (XAG/USD) Key Technical Levels

-

22:55

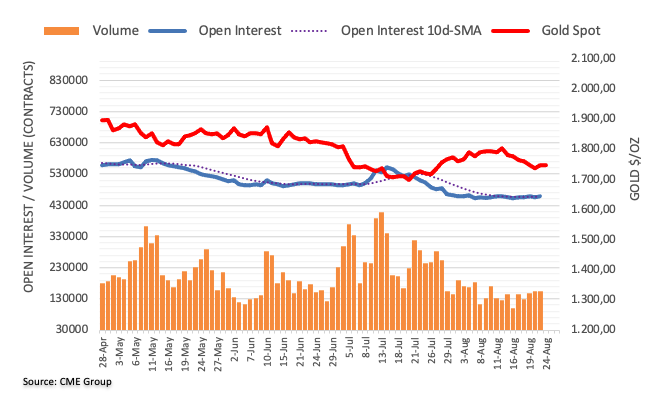

Gold Price Forecast: XAU/USD aims establishment above $1,750, DXY stabilizes ahead of Jackson Hole

- Gold price is aiming to scale up its auctioning territory above $1,750.00.

- The DXY has turned sideways as investors await Jackson Hole Economic Symposium.

- The Fed is expected to continue its pace of hiking interest rates further.

Gold price (XAU/USD) is displaying a lackluster performance as it is hovering around the critical hurdle of $1,750.00. On a broader note, the precious metal is auctioning in an inventory adjustment phase after a firmer rebound from Tuesday’s low of $1,727.85.

The US dollar index (DXY) has also turned sideways around 108.60 despite a weak performance on the US Durable Goods Orders data front. The economic data landed a 0%, lower than the forecast of 0.6% and the prior release of 2.2%. Looks like, the market participants are purely focusing on the commentary from Federal Reserve (Fed) chair Jerome Powell at Jackson Hole Economic Symposium.

After the release of the downbeat US Purchasing Managers Index (PMI) economic data on Tuesday, the think tanks were dictating that the Fed might slow down its pace of hiking interest rates. As a contraction in economic activities is a consequence of vigorous interest rate hikes, Fed may trim the extent of a rate hike.

However, commentary from Minneapolis Fed Bank President Neel Kashkari has faded the rumors. Fed policymaker believes that the inflation rate above 8% is a big reason to worry and the Fed will stick to its path of bringing price stability sooner.

Gold technical analysis

Gold prices are displaying topsy-turvy moves in a tad wider range of $1,742.90-1,753.85 after establishing above the 61.8% Fibonacci retracement (placed from July 27 low at $1,711.53 to August 10 high at $1,807.93) at $1,748.38 on an hourly scale.

The precious metal is comfortably auctioning above the 20-period Exponential Moving Average (EMA) at $1,749.00, which validates a short-term uptrend.

Meanwhile, the Relative Strength Index (RSI) is attempting to shift into the bullish range of 60.00-80.00. The momentum oscillator is hovering around 60.00.

Gold hourly chart

-

22:41

AUD/USD Price Analysis: Bulls eye 0.6950 for Thursday's business, bears need to get below 0.6880

- AUD/USD bulls getting set for a significant move.

- The bears need to break 0.6900 and then 0.6880.

AUD/USD has been bottoming on the charts with a move below 0.69 the figure from where it has formed a peak bullish formation and bulls will be looking to engage from within 0.69 again for a bust higher over the course of the forthcoming sessions. The money is above the various swing pints on the hourly time frame:

AUD/USD H1 charts

The Gartley pattern is a bullish feature on the chart whereby the target aligns with a 78.6% Fibonacci retracement o the current corrective range between recent highs and lows of 0.6965 and 0.6880. The prior structure aligns with this target as being the 0.6945/50 area on the chart. The resistance until there are 0.6912, 0.6922 and 0.6931.

The W-formations are bottoming patterns where the price has, so far, been supported by the necklines. This is bullish for the Tokyo open and the day ahead. On the other hand, a break below these necklines, 0.6906, 0.6896 and then the 0.6880 lows will be bearish.

-

22:38

EUR/JPY Price Analysis: In consolidation, unable to crack the 137.00 mark on risk-on mood

- EUR/JPY bounced off weekly lows at around 135.51 due to improved sentiment.

- From a monthly chart perspective, an August close below 135.54 would keep sellers in control.

- The EUR/JPY weekly chart depicts the formation of a head-and-shoulders chart pattern, targeting the YTD lows around 124.00.

The EUR/JPY edges higher during the day, above the 136.50 figure, for the first time in the week, snapping two days of consecutive losses as the New York session finishes. As the Asian Pacific session starts, the EUR/JPY is trading at 136.67, with marginal gains of 0.01%.

EUR/JPY Price Analysis: Technical outlook

From the monthly chart perspective, the EUR/JPY shows traders undecided, about to form a dragonfly-doji, after July staggering loss of 4.24%, created a bearish-engulfing candle pattern, which initially drove prices towards August lows around 133.39. If the EUR/JPY fails to achieve a monthly close below 135.54, July’s low will pave the way for further losses. Otherwise, expect prices to seesaw around the 136.20-138.40 area.

Meanwhile, the EUR/JPY weekly chart suggests forming a head-and-shoulders chart pattern, pending to break below the neckline around the 133.00-134.00 area for confirmation. Once achieved, the EUR/JPY profit target will be the 124.00 mark, below the YTD lows at 124.39.

EUR/JPY Key Technical Levels

-

22:04

GBP/JPY Price Analysis: Subdued around 161.70, range-bound for the last four days

- GBP/JPY snaps two days of consecutive gains, down by 0.01%.

- The GBP/JPY daily chart illustrates the pair as range-bound.

- The GBP/JPY is seesawing in the 161.00-162.30 area, unable to break beyond the range.

The GBP/JPY is seesawing within a narrow range for the third consecutive day, though on Wednesday, it failed to continue the last five days of successive series of lower highs/lows; however, indecision keeps lurking at the cross-currency pair. As of writing, the GBP/JPY is trading at 161.63, below its opening price.

On Wednesday, the cross-currency pair opened near the day’s high before sliding sharply to the lows of the day of 160.08, at a time when market sentiment turned sour. However, the GBP/JPY stayed a comeback and rallied towards the 100-hour EMA at 161.79, stalling the pair’s recovery.

GBP/JPY Price Analysis: Technical outlook

From a daily chart perspective, the GBP/JPY has remained subdued for the last four days. During the previous three days, indecision surrounds the cross, further confirmed by the Relative Strength Index (RSI) almost flat, despite residing below the 50-midline.

In the short term, the GBP/JPY hourly chart portrays the pair as neutral biased. The exponential moving averages (EMAs) in the hourly chart are within a narrow range, below the exchange rate, except for the 100-EMA at 161.79. Therefore, the GBP/JPY trend is skewed to the upside, so a break above the latter, would open the door for further gains.

Therefore, the GBP/JPY first resistance would be the 162.00 figure. Once cleared, the next resistance would be the R1 pivot at 162.44, followed by the 163.00 mark.

On the other hand, if the GBP/JPY tumbles below the 161.00 mark, it would pave the way for further downside. The first support would be the 160.50 mark, followed by the S2 daily pivot at 160.11, followed by 160.00.

GBP/JPY Key Technical Level

-

22:00

South Korea Producer Price Index Growth (MoM) in line with forecasts (0.3%) in July

-

22:00

South Korea Producer Price Index Growth (YoY) below expectations (9.3%) in July: Actual (9.2%)

-

21:25

NZD/USD bulls are beaten back in a non-favourable environment

- NZD/USD is back under pressure following a resurgence in the greenback.

- The bulls, however, are also feeling the heat in an unfavourable commodities complex environment.

NZD/USD is trading at 0.6190 and has been in a range of between 0.6162 and 0.6218 on the day, losing some 0.3% currently into a sleepy close on Wall Street.

US stocks were mixed on the day, initially rallying as incoming data beat expectations on the whole. Analysts at ANZ Bank explained that growth in US Durable Goods Orders came in weaker than expected at 0% in July (exp: 0.8%, prev: 2.2%). ''However, this was largely driven by the volatile transportation component.

Excluding this, durable goods orders beat expectations, rising 0.3% (exp: 0.2%, prev: 0.3%). This was largely down to machinery, computers & electronics and fabricated metals. The stronger data suggests that investment activity is not slowing as quickly as some of the weaker survey and PMI data may suggest.''

Nevertheless, the US dollar gave up some gains later in the session into the London fix which enabled the kiwi to take flight early doors, although the price melted thereafter printing towards the lows of the day in midday trade from where the price has consolidated in and around thereafter.

''In many ways, the USD’s comeback is logical (at least from an NZ perspective) – it’s late-cycle here, so early winners may be early faders, and global growth risks abound – that’s hardly a supportive backdrop for commodity exporters,'' the analysts argued.

-

20:42

Forex Today: Caution prevails ahead of Jackson Hole

What you need to take care of on Thursday, August 25:

The dollar seesawed between gains and losses, ending the day mixed, but little changed across the FX board. The American currency advanced at the beginning of the day but shed some ground after Wall Street’s opening, as US stocks managed to post modest gains.

The US reported July Durable Goods Orders, which stayed virtually unchanged at $273.5 billion, missing expectations of a 0.6% increase. However, the reading on Nondefense Capital Goods Orders excluding Aircraft increased by 0.4%, beating the 0.3% expected.

Meanwhile, US Treasury yields edged sharply higher. The 10-year note yielded as much as 3.1269%, while the 2-year note yield peaked at 3.393%. The dollar eased during US trading hours despite yields holding at the upper end of their range.

The EUR/USD pair settled around 0.9960, little changed for a second consecutive day. GBP/USD trades just below the 1.1800 threshold. The AUD/USD trades at around 0.6900, down for the day, while USD/CAD trades at 1.2965.

Spot gold stands at around $1,750 a troy ounce while crude oil prices extended their advance, with WTI now trading at around $95 a barrel.

The dollar posted modest gains against its safe-haven rivals. USD/CHF stands at 0.9660 while USD/JPY trades at around 137.20.

The focus now shifts to the Jackson Hole Symposium. The US Federal Reserve’s annual event will host economists and policymakers from around the globe in which they will discuss global issues. Market players will try to reassess their estimates on potential rate hikes across major economies, alongside the risk of steeper economic downturns.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Early bulls meet the butcher

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:34

USD/JPY Price Analysis: Bears are stepping on the gas and a move to 135.50 could be on the cards

- USD/JPY is meeting daily resistance, and a break of the hourly trendline support would expose 137 the figure.

- A break below there could open the way for a move below 136.80 towards 135.50.

USD/JPY bears are moving in and the following illustrates the prospects of a sizeable move to the downside to correct a significant portion of the recent rally in the US dollar.

USD/JPY daily chart

The Gartley pattern offers resistance around 137.50 which leaves the focus on the downside and back towards the pattern's neckline. This also aligns with the W-formation's 38.2% and 50% ratios. Zooming down to the hourly chart, we can see that the price is moving out of the bullish trend as follows:

USD/JPY H1 chart

The price moved out of the trend and is now coming back into to restest the old supports, counter trendline and now resistance area. Zooming in further, we can see the price is attempting to move out of a sub trend:

A break of the trendline support would expose 137 the figure. A break below there could open the way for a move below 136.80 and set off a waterfall sell-off for the days ahead, in accordance with the daily bearish scenario towards 135.50.

-

20:23

USD/CHF Price Analysis: Clears the 50/100-DMAs on its way to 0.9700

- USD/CHF holds to its gains above the 50 and 100-DMA.

- The USD/CHF daily chart illustrates the pair as neutral biased.

- In the 4-hour chart, unsuccessfully tests of the 20-EMA on the downside keep the USD/CHF tilted upwards.

USD/CHF advances during the North American session, up by 0.31%, bolstered by a strong US dollar, despite a release of mixed US economic data ahead of the so-awaited Jerome Powell speech at Jackson Hole. At the time of writing, the USD/CHF is trading at 0.9662, above its 50 and 100-day EMAs.

USD/CHF Price Analysis: Technical outlook

The daily chart illustrates price action in the last couple of days as range-bound, about to form a “bearish-harami” candle pattern, which would pose downward pressure on the major. Nevertheless, the Relative Strength Index (RSI) at 58.65 exerts upward pressure on the pair, meaning that the best way to trade the USD/CHF from a daily chart perspective is to expect a break of the previous high/low and wait for a re-test of the breakout.

The 4-hour chart paints a different picture. The USD/CHF has been advancing steadily since August 11, until Tuesday, when the USD/CHF printed a negative day. Nevertheless, it’s worth noting that the day’s low pierced the 20-EMA of the 4-hour chart, stalling the major’s dive before consolidating for a re-test. Today, the USD/CHF re-tested the previously-mentioned moving average, and for the second consecutive time, USD/CHF buyers lifted prices to current price levels.

However, with the Relative Strength Index (RSI) at 61.73, aiming downwards could keep the USD/CHF risks skewed to the downside. But if the USD/CHF breaks above the August 23 high at 0.9692, that will expose the 0.9700 figure, followed by the R2 daily pivot at 0.9730.

USD/CHF Key Technical Levels

-

19:28

Copper drops from two-month highs due to global economic slowdown, speculators’ shorts

- Copper prices are trading with losses of almost 1.50%.

- The Euro area energy crisis, China’s property and construction crisis, and a possible US recession are headwinds for copper.

- Copper Price Analysis: Could test the monthly lows around $3.4160 once it clears $3.5420.

Copper futures are dropping for the first time in the week, down by 1.53% on Wednesday, courtesy of an ongoing global economic slowdown, portrayed in part by released S&P Global PMIs in the week, painting a gloomy picture while worries about China’s economy had increased. At the time of writing, Copper futures are trading at $3.6390 after hitting a daily high of $3.6980 during the Asian session.

US equities are trading in the green, portraying a positive mood. Meanwhile, the ongoing energy crisis in Europe, China’s property and construction market crisis, and recession fears in the US, are posing downward pressure on the red metal

In the meantime, the investment house Goehring & Rozencwajg Associates, in their Q2 update, pointed out that after bottoming at 165,000 tonnes at the end of 2021, inventories rebounded to 300,000 by mid-May but pulled back to 240,000 tonnes. They commented that inventories, when adjusted for days of consumption, are almost as low as in 2005, just before copper prices more than doubled. 2005, copper exchange inventories covered consumption by only two days.”

Aside from this, China’s appetite for the red metal, from which it accounts for 55% of the world’s copper consumption, its imports are up almost 6%. However, according to Shanghai Metals Market, stocks of copper in the country are at year lows.

All that said, Dr. Copper should be headed to the upside. Nevertheless, the Commitment of Traders report shows that speculators are net short 16,000 lots for the past six weeks, so a further downside is expected before recovering some ground.

Copper Price Analysis: Technical outlook

The Copper daily chart illustrates the non-yielding metal as neutral biased. The red metal remains seesawing for nine consecutive days in the $3.5420-$3.7315 area. However, it’s worth noting that the Relative Strength Index (RSI) recorded a successive series of lower highs, contrary to price action, meaning that prices are about to edge lower.

Hence, the first support would be the confluence of the 20 and 50-DMA around $3.5925-55. Once it’s broken, the next support will be the bottom of the range above-mentioned at $3.5420, followed by the August 3 low at $3.4160.

-

18:51

United States 5-Year Note Auction rose from previous 2.86% to 3.23%

-

18:16

Gold Price Forecast: XAU/USD bulls reach a critical milestone on daily chart ahead of Jackson Hole

- Gold extended its bullish correction to the 38.2%$ ratio target and there is every chance of a deeper correction.

- As the clock ticks down to the Jackson Hole, fundamentals take precedent.

The gold price is back to flat on the day as the US dollar comes back up for air. At the time of writing, XAU/USD is trading at $1,749 after falling from a high of $1,755.94. The yellow metal has been as low as $1,742.51 on the day. The theme of the day centres around the Federal Reserve and US data, driving the direction of the US dollar and yields.

The US dollar gained against a basket of currencies on Wednesday, holding near a 20-year high as investors waited for a Friday speech by the Federal Reserve Chairman, Jerome Powell. Investors are looking for insight into how aggressive the central bank will be in its plight against inflationary headwinds. The greenback has been pushed and pulled in everchanging sentiment as to whether the Fed could will be in a position to curtail its rate hike path in the face of inflation that remains at 8.5% on an annual basis, far exceeding the Fed's 2% objective.

US data, in this regard, is what counts. The first round of data that moved the needle in financial markets came in yesterday's report that showed US private sector activity contracted for a second-straight month in August. The S&P Global flash composite purchasing managers index (PMI) for August dropped to 45 this month, the lowest since February 2021, as demand for services and manufacturing weakened in the face of inflation and tighter financial conditions. A reading below 50 indicates a contraction in activity.

However, the dollar regathered itself on the back of a jump in US yields following a bullish 2-year Treasury auction. The demand from domestic and international buyers was far below a 6-month average which led to a rally in the 2 and 10-year yields, supporting the US dollar and weighing on gold prices. The greenback recovered from a touch above 108 the figure as per the DXY index all the way to 109.11 highs over the course of Asia, Europe and early New York session.

Data on Wednesday also showed that new orders for US-made capital goods increased at a slower pace in July from the prior month, suggesting that business spending on equipment could struggle to rebound after contracting in the second quarter. However, the move in the greenback to the downside did not come until around the London fix. We saw a sharp sell-off which lifted the price of gold momentarily. However, US yields remained firm which ultimately lead to the price of the yellow metal's decline again and has enabled the greenback to recover some ground as we progress through the US session.

Due to the less inflationary data, Fed funds futures traders are pricing in a 59% chance that the Fed will hike rates by another 75 basis points at its September meeting, and a 41% probability of a 50 basis points increase.

Will the Jackson Hole be a big letdown?

For the rest of the week, Thursday's Gross Domestic Product, Initial Jobless Claims and Personal Consumption Expenditures will be key ahead of the speech by Fed chair Powell at 10.00 ET Friday. In the past, the Fed has used this symposium to announce or hint at policy shifts. However, analysts at Brown Brothers Harriman argued that they do not think the Fed will paint itself into a corner ahead of the September 20-21 FOMC meeting. ''Rather, we expect the Fed to try and manage market expectations by maintaining the hawkish message it has perfected since the July FOMC meeting.''

The analysts note that between now and the September FOMC, all the major August data and some of the early September surveys such as the preliminary S&P Global PMI readings and regional Fed surveys will be released. ''The Fed will also have a better idea of how the economy is doing in Q3''

Those gold bugs holding out for a bearish narrative for the US dollar and yields pertaining to recently less inflationary data could be left disappointed in the case that Powell doesn't push back on hawkish sentiment.

"The dollar's still well bid and I think that the market's concluding that these data are not going to change the Fed's position about what's going to happen next month," said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

"While the market might be swinging back and forth between inflation and recession, the central banks aren't. They are focused, it seems to be nearly exclusively, on inflation," Chandler said.

Gold technical analysis

As per the prior analysis, it was stated that the price of gold had left behind an M-formation on the daily chart. This is a reversion pattern that put the spotlight on the support near a 38.2% Fibonacci around $1,755:

As illustrated, the prior analysis anticipated the correction, above, and the bulls committed to the moves this week so far as per the chart below:

At this juncture, there is every chance of a deeper correction although as the clock ticks down to the Jackson Hole, fundamentals take precedent.

-

18:04

AUD/USD drops below the 0.6900 figure as the USD strengthens

- AUD/USD trimmed Tuesday’s gains as USD bulls recovered some ground ahead of Jackson Hole.

- US Durable Good Orders beat estimates, contrarily to US housing data, flashing recession.

- AUD/USD Price Analysis: Range-bound, expecting the outcome of Fed’s Jerome Powell speech.

The AUD/USD remains on the defensive on Wednesday, trimming some of its Tuesday gains, but remains above the 0.6900 figure amidst an upbeat sentiment, putting a lid on the AUD/USD fall. Factors like mixed US economic data released and investors awaiting Jerome Powell’s speech at the Kansas City Fed symposium in Jackson Hole keep traders cautious.

The AUD/USD hit a daily low of around 0.6879, but the release of mixed US economic data weighed on the greenback, so the major, climbed back above the 0.6900 figure, though falling short of its opening price. At the time of writing, the AUD/USD trades at 0.6900, down by 0.37%.

US Durable Good Orders surprisingly rose in July, according to the US Commerce Department, with orders at 0% MoM, while excluding defense and aircraft, rose by 0.4%, higher than estimates at 0.3%.

In the meantime, US Pending Home Sales fell for the sixth consecutive month, collapsed -19.9% YoY, less than -22% drop, while on a month-over-month, dipped -1%, vs. -4% forecasts.

Meanwhile, the US Dollar Index, a gauge of the greenback’s value against a basket of peers, extended its gains by 0.26%, at 108.800, a headwind for AUD/USD prices. US Treasury bond yields are echoing the US dollar direction, led by the 10-year note rate at 3.113%, gaining six and a half bps.

Elsewhere, late on Tuesday, the Minnesota Fed President Neil Kashkari crossed wires. Kashkari said that inflation is very high, and it is the Fed’s job to curb it. He emphasized the need to tighten monetary policy and added that the Fed could only relax on rate increases when they see compelling evidence of inflation heading toward 2%.

An absent Australian economic docket left traders leaning towards US dollar dynamics. Australia’s PMI was soft in tone with worldwide S&P Global PMIs released during the week. But, it would not deter the Reserve Bank of Australia from hiking rates. Money market futures expect at least a 35 bps increase of the Reserve Bank of Australia at their next monetary policy meeting on September 6th.

AUD/USD Price Analysis: Technical outlook

The AUD/USD daily chart illustrates the major bottoming around the 0.6850-0.6930 area for the last four trading days, while the Relative Strength Index (RSI) crossed below the 50-midline. Nevertheless, the pair might be set for the Jackson Hole outcome. Even though the RSI crossed above its 7-day SMA, it shifted gears to the downside, meaning that AUD/USD sellers could be gathering momentum. Therefore, a break below the bottom of the range will expose the 0.6800 figure, followed y the YTD low at 66.81. On the flip side, an AUD/USD upside break will put in play the 20-day EMA at 0.6973, followed by the 0.7000 figure.

-

17:55

USD could peak during the fourth quarter – Wells Fargo

Analysts at Wells Fargo continue to see US Dollar strength through the end of 2022 as a result of the hawkish Federal Reserve. They point out the dollar could peak during the fourth quarter of 2022, starting a period of cyclical weakness against most currencies in 2023 as the U.S. economy enters recession and the Fed unwinds rate hikes.

Key Quotes:

“We expect the U.S. dollar to strengthen moderately through the end of 2022 as the Fed raises interest rates 75 bps in September and policymakers reinforce their hawkish stance at the Jackson Hole Annual Symposium. However, we believe peak inflation and peak interest rates could be approaching, and we believe the dollar will broadly weaken against most G10 and select emerging market currencies over the course of 2023.”

“We expect the U.S. dollar to trend lower over the course of the 2023. While we also forecast other major central banks to ease monetary policy next year, we believe the Fed will likely cut policy rates quicker than peers. With interest rate differentials swinging back in favor of foreign currencies next year, the greenback should enter a period of cyclical decline against most G10 currencies as well as certain emerging currencies.”

-

17:45

EUR/USD remains under pressure after short-lived rebound

- US Dollar loses momentum on risk appetite.

- Market participants turn attention to Jackson Hole.

- EUR/USD unable to recover 1.0000, holds near 20-year lows.

The EUR/USD rose from the daily low at 0.9907 to 0.9998 in a few minutes around the London fix, on the back of a broad-based slide of the US dollar. The euro failed to hold to gains and pulled back to the 0.9950 area.

The greenback weakened even as US yields held at daily highs. The improvement in risk sentiment weighed on the dollar. The Dow Jones is up by 0.37% and the Nasdaq gains 0.80%. The DXY printed a fresh daily low at 108.36 and, as of writing, it is hovering around 108.70, up 0.22% for the day.

Data released on Wednesday showed Durable Goods Orders showed a 0% increase in July against expectations of a 0.6% rise and Pending Home Sales declined 1%, less-than-expected. The numbers did not have a significant impact on market that are turning their attention to the Jackson Hole symposium.

Fed Chair Powell will deliver his speech on Friday. “While some may be looking for an explicit policy signal, we believe the Fed will leave all options open for the September 20-2 FOMC meeting. However, we expect Chair Powell and his colleagues to maintain a very hawkish tone at the symposium. We also give an overview of current U.S. economic conditions”, explained analysts at Brown Brothers Harriman.

The EUR/USD remains under pressure, unable to sustain a recovery. Another test of 0.9900 over the next sessions should not be ruled out. A break lower could trigger more losses with the next support seen around 0.9860. A firm break above 1.0000 could alleviate the bearish pressure, particularly if the euro manages to recover 1.0030.

Technical levels

-

17:00

Russia Industrial Output above forecasts (-2.4%) in July: Actual (-0.5%)

-

16:45

Iran's ForMin Spokesperson: Tehran has started assessing US response

A spokesperson for Iran's Foreign Ministry said on Wednesday that Iran has received the United States' response to the draft agreement proposed by the European Union and said they have started assessing it, as reported by Reuters.

Market reaction

With the initial market reaction to this headline, crude oil prices came under modest bearish pressure. As of writing, the barrel of West Texas Intermediate was trading at around $93, where it was down nearly 1% on a daily basis. Meanwhile, the barrel of Brent was down 0.9% at $99.20.

-

16:34

NZD/USD rebounds toward 0.6200 as USD loses momentum

- Dollar drops into the London fix, even as US yields remain at weekly highs.

- DXY reverses turns negative, erasing a 0.60% daily gain.

- NZD/USD: key support above 0.6150 remains in place.

The NZD/USD again rebounded from near 0.6150 and climbed to 0.6200, trimming daily losses. A decline of the US dollar across the board boosted the pair.

The greenback weakened around the London fix, even as US yields printed fresh daily highs. In Wall Street, stocks turned decisively positive and commodities erased losses. The DXY dropped from above 109.00 to 108.40.

Economic data from the US showed on Wednesday a mixed Durable Goods Order report with the headline missing expectations but with positive detail. A different report revealed Existing Home Sales dropped 1% in July to the lowest in two years. On Thursday, a new estimate of Q2 GDP, the weekly Jobless Claims and the Kansas Fed Manufacturing index are due.

During the Asian session Retail Sales data is due in New Zealand. Later on Thursday, the market focus will turn to the Jackson Hole symposium. Jerome Powell will speak on Friday.

Crucial support at 0.6150

The bias in NZD/USD continues to favor the downside. The crucial support is around 0.6150, which capped the upside during the last four trading days. A break lower would clear the way to more losses targeting 0.6125 initially and then 0.6095.

On the upside, the immediate resistance may be seen at 0.6205, followed by 0.6240.

Technical levels

-

16:34

GBP/USD dwindles and falls toward 1.1800 on mixed US data, and Jackson Hole looming

- GBP/USD records marginal losses of 0.23% on Wednesday, trimming some of Tuesday’s gains.

- Market participants are “laser-focused” on Friday’s US Fed Jerome Powell speech.

- US Pending Home Sales shows the housing market deteriorating, while Durable Good Orders stood still.

The British pound erases Tuesday’s gains and drops, towards the 1.1800 figure, amidst a slightly upbeat mood, with traders being cautious ahead of the Jackson Hole Symposium, with market players’ eyes “laser-focused” on Fed chief Jerome Powell’s speech. At the time of writing, the GBP/USD is trading at 1.1803.

On Wednesday, the GBP/USD opened nearby daily highs around 1.1830 but dropped to the lows of the day at 1.1755, an hour before Wall Street opened, with US economic data hitting newswires. The lack of the UK’s economic releases will keep GBP/USD traders adrift to US dollar dynamics.

In the meantime, the US Dollar Index resumed its upward trajectory, though marginally up by 0.03%, at 108.523, while US T-bond yields rose. US economic data revealed during the last couple of weeks has been mixed, though in tone with an ongoing deceleration of the US economy.

Before Wall Street opened, US Pending Home Sales dropped to their lowest levels since the Covid-19 pandemic began. On its annual reading, collapsed -19.9%, less than -22% drop, while on a month-over-month, fell -1%, vs. -4% forecasts.

Earlier, Durable Good Orders for July remained unchanged at 0% MoM, missing estimations, but June’s reading was upward revised to 2.2%, showing consumer resilience. Orders excluding Defense and Transportation rose by 0.4%, higher than estimates of 0.3%.

Even though US data was dollar positive, the GBP/USD recovered some ground, lifting towards the 1.1817 area, current price levels, given that around 14:00 GMT, the British pound was trading sub 1.1800.

Elsewhere, late on Tuesday, the Minnesota Fed President Neil Kashkari crossed wires. Kashkari said that inflation is very high, and is the Fed’s job to curb it. He emphasized the need to tighten monetary policy and added that they (the Fed) could only relax on rate increases when they see compelling evidence of inflation heading toward 2%.

On the UK side, given that the country is reaching record energy prices and double-digit inflation levels, it would likely keep the Sterling downward pressured. Additionally, with elections coming on September 5, uncertainty about a new Prime Minister keeps market participants uneasy. Therefore, further British pound weakness is expected, despite further rate hikes by the Bank of England.

In the meantime, JP Morgan Analysts foresee the pound would hit 1.14 “if gas prices continue to do what they are doing,” as said Sam Zief, head of global FX strategy at JP Morgan.

What to watch

The UK economic docket will feature the CBI Distributive Trades on Thursday. In the US, the calendar will reveal the GDP growth rate for the second quarter, Initial Jobless Claims, and the Kansas City Fed Manufacturing Index for August.

GBP/USD Price Analysis: Technical outlook

The GBP/USD trades below the midline of a descending channel drawn from late May, while the 20-DMA crossed under the 50-DMA, signaling that sellers are gathering momentum. Worth noting that if the GBP/USD records a daily close below the July 14 cycle low at 1.1759, it could open the door for a YTD low test at 1.1716. Otherwise, it would open the door for a consolidation in the 1.17601.1878 area, ahead of the Bank of England’s next monetary policy decision.

-

15:30

United States EIA Crude Oil Stocks Change registered at -3.282M, below expectations (-0.933M) in August 19

-

15:04

US: Pending Home Sales decline by 1% in July vs. -4% expected

- Pending Home Sales in the US continued to fall in July.

- US Dollar Index clings to strong daily gains near 109.00.

Pending Home Sales in the US declined by 1% on a monthly basis in July, the data published by the National Association of Realtors showed on Wednesday. This reading followed June's decrease of 8.9% and came in better than the market expectation for a contraction of 4%.

On a yearly basis, Pending Home Sales decreased by 19.9% in July.

Market reaction

The US Dollar Index edged slightly higher with the immediate reaction to this report and was last seen rising 0.5% on a daily basis at 109.05.

-

15:02

Gold Price Forecast: XAU/USD slips as USD inches back closer to a two-decade high

- Gold meets with a fresh supply on Wednesday and erodes a part of the overnight gains.

- Resurgent USD demand, rising US bond yield exert some downward pressure on the metal.

- Recession fears could help limit losses for the XAU/USD ahead of Fed’s Powell on Friday.

Gold turns south following an early uptick to the $1,754 area and drops to a fresh daily low during the early North American session. The XAU/USD reverses a part of the previous day's goodish recovery move to the weekly high and is currently placed around the $1,745 level, down nearly 0.25% for the day.

The downtick is sponsored by the emergence of fresh buying around the US dollar, which tends to dent demand for dollar-denominated gold. The overnight hawkish remarks by Minneapolis Fed President Neel Kashkari revive bets for a further policy tightening by the US central bank. Adding to this, Wednesday's release of mostly upbeat US Durable Goods Orders data reaffirms hawkish Fed expectations and further underpins the greenback.

The current market pricing indicates an equal possibility of a 50 bps rate hike or a supersized 75 bps move at the September FOMC policy meeting. This, in turn, trigger a fresh leg up in the US Treasury bonds and further contributes to driving flow away from the non-yielding yellow metal. In fact, the yield on the benchmark 10-year US government bond climbs to a nearly two-month high and offers additional support to the buck.

Apart from this, signs of stability in the financial markets further seem to weigh on the safe-haven XAU/USD, though recession fears could help limit deeper losses, at least for now. Investors also seem reluctant and might prefer to wait for a more hawkish message from Fed Chair Jerome Powell at the Jackson Hole symposium on Friday. This, in turn, warrants some caution for aggressive bearish traders and positioning for any further decline.

Technical levels to watch

-

15:00

United States Pending Home Sales (YoY) increased to -19.9% in July from previous -20%

-

15:00

United States Pending Home Sales (MoM) above forecasts (-4%) in July: Actual (-1%)

-

14:38

EUR/USD loses the grip and approaches 0.9900, focus on Jackson Hole

- EUR/USD remains on the defensive and closer to 0.9900.

- The dollar climbs to daily highs following yields and data.

- The Jackson Hole Symposium kicks in on Thursday.

Further selling pressure forces EUR/USD to trade at shouting distance from the 0.9900 zone on Wednesday.

EUR/USD now looks to the 2022 low

EUR/USD sees its daily decline gather extra pace and approach the area of recent lows near 0.9900 and a tad below, always on the back of the relentless move higher in the US dollar.

The persistent advance in the buck, in the meantime, found extra fuel in the equally strong march north in US yields, where the belly and the long end of the curve navigate levels last seen in late June around 3.10% and 3.30%, respectively.

In the docket, US Durable Goods Orders came flat on a monthly basis in July, while orders excluding the Transport sector surprised to the upside and expanded 0.3% inter-month.

Also collaborating with the upside in US yields and the dollar appear consensus’ expectations of a hawkish message from Chair Powell at his speech at the Jackson Hole Symposium on Friday.

What to look for around EUR

EUR/USD returns to the 0.9900 region as the greenback rapidly left behind Tuesday’s hiccup.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Final Q2 GDP Growth Rate, Germany IFO Business Climate, ECB Accounts (Thursday) – Germany GfK Consumer Confidence.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is losing 0.48% at 0.9920 and a break below 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low). On the other hand, the next up barrier comes at 1.0202 (high August 17) followed by 1.0267 (55-day SMA) and finally 1.0368 (monthly high August 10).

-

14:29

USD/JPY retakes 137.00 mark amid modest USD strength, rising US bond yields

- USD/JPY steadily climbs back above the 137.00 mark during the early North American session.

- Renewed USD buying, a fresh leg up in the US bond yields remain supportive of the move up.

- Recession fears could offer support to the safe-haven JPY and keep a lid on any further gains.

The USD/JPY pair attracts some dip-buying near the 136.20-136.15 region on Wednesday and climbs to a fresh daily high during the early North American session. Spot prices, however, seem to struggle to capitalize on the move beyond the 137.00 round-figure mark.

The US dollar regains positive traction and moves back closer to a two-decade high touched the previous day. This turns out to be a key factor lending some support to the USD/JPY pair. The USD drew support from the overnight hawkish remarks by Minneapolis Fed President Neel Kashkari, which revived bets a further policy tightening by the US central bank.

The USD bulls further took cues from mostly upbeat US Durable Goods Orders. In fact, the US Census Bureau reported that headline orders remain flat MoM in July against the 0.6% rise anticipated. The disappointment, however, was offset by an upward revision of the previous month's reading and a slightly better-than-expected growth in orders excluding transportation items.

Nevertheless, the data reaffirms expectations that the Fed would raise interest rates further and the current market pricing points to equal chances of a 50 bps or a 75 bps hike in September. This marks a big divergence in comparison to a more dovish monetary policy stance adopted by the Bank of Japan, which continues to exert some pressure on the Japanese yen.

Meanwhile, hawkish Fed expectations lift the US Treasury bond yields to a nearly two-month high, widening the US-Japan rate differential and further weighing on the JPY. That said, the prevalent cautious market mood, amid growing worries about a global economic downturn, offers some support to the safe-haven JPY and could cap the upside for the USD/JPY pair.

The fundamental backdrop, however, remains tilted firmly in favour of bullish traders and supports prospects for a further near-term appreciating move. That said, market participants might refrain from placing aggressive bets and prefer to wait for a more hawkish message from Fed Chair Jerome Powell at the Jackson Hole symposium on Friday.

Technical levels to watch

-

14:19

AUD/USD to clamber back to 0.71 on a six-month view – Rabobank

AUD/USD has failed to sustain above 0.69. But economists at Rabobank expect the pair to move back higher towards 0.71 over the coming months.

Aussie to catch its breath

“Going forward Australian growth is set to slow. The central bank forecasts growth at 3.25% over 2022, underpinned by growth in consumption and a recovery in investment and service exports. Growth is then expected to slow to around 1.75% over both 2023 and 2024. This outlook compares favourably with the Eurozone, UK and the US all of which are at risk of recession next year.

“We had anticipated a pullback to AUD/USD 0.69 on the back of dollar strength. We continue to see scope for AUD/USD to clamber back to 0.71 on a six-month view.”

-

14:12

EUR/USD: Strong bearish momentum at present – Scotiabank

EUR/USD drifts lower as bearish perspectives prevail. Economists at Scotiabank expect the pair to remain under pressure.

Resistance aligns at 0.9970

“The only remarkable thing from my point of view is the prevalence of EUR bearishness across the screens and market commentary.”

“The broader bear trend remains intact and enjoys the backing of strong, bearish momentum at present.”

“Resistance is 0.9970 and 1.0000/10.”

-

14:11

USD/TRY pushes higher and prints new 2022 highs above 18.1500

- USD/TRY advances to fresh YTD highs beyond 18.1500.

- Further upside could challenge the all-time peak around 18.25.

- The sentiment around the Turkish lira continues to deteriorate.

Further weakness in the Turkish lira motivates USD/TRY to clinch new 2022 peaks past 18.1500 on Wednesday.

USD/TRY now targets the all-time high near 18.25

USD/TRY keeps the upside bias unabated for the sixth consecutive session so far on Wednesday, always on the back of the relentless rally in the US dollar and the persistent offered tone in the lira.

In fact, while expectations of extra Fed’s tightening continue to fortify the buying interest in the dollar, the Turkish currency keeps suffering the unexpected reduction of the policy rate by the Turkish central bank (CBRT) last week against the backdrop of the utter absence of measures to tackle the rampant inflation in the country.

It is worth remembering that inflation in Türkiye ran at the fastest pace since 1998 at nearly 80% YoY in July.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and now targets the all-time high around 18.25 following the unexpected interest rate cut by the CBRT on August 18.

In the meantime, the lira’s price action is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent. In addition, there seems to be no Plan B to attract foreign currency in a context where the country’s FX reserves dwindle by the day.

Key events in Türkiye this week: Capacity Utilization, Manufacturing Confidence (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.32% at 18.1557 and faces the immediate target at 18.1582 (2022 high August 24) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.4896 (55-day SMA) and finally 17.1903 (weekly low July 15).

-

13:44

USD/CAD refreshes daily high, climbs above 1.3000 post-US Durable Goods Orders

- USD/CAD regains positive traction on Wednesday and reverses a part of the overnight slide.

- Rising bets for aggressive Fed rate hikes help revive the USD demand and extend support.

- Mostly upbeat US Durable Goods Orders remain supportive of the intraday USD strength.

- An uptick in oil prices could underpin the loonie and keep a lid on any meaningful upside.

The USD/CAD pair maintains its bid tone through the early North American session and climbs to a fresh daily high in the last hour, with bulls looking to build on the momentum beyond the 1.3000 psychological mark.

The US dollar makes a solid comeback on Wednesday and inches back closer to a two-decade high touched the previous day, which, in turn, extends support to the USD/CAD pair. Tuesday's disappointing US PMI prints and weak US home sales data had fueled speculations that the Fed may be less aggressive in its rate hiking cycle. That said, hawkish remarks by Minneapolis Fed President Neel Kashkari - the biggest dove - revive expectations for a supersized rate hike in September and push the USD higher.

The intraday USD buying remains well supported by mostly upbeat US Durable Goods Orders data. The US Census Bureau reported that headline orders remain flat MoM in July, missing expectations for a 0.6% rise. The disappointment, however, was offset by an upward revision of the previous month's reading, showing a growth of 2.2%. Adding to this, orders excluding transportation items recorded a slightly better-than-expected growth of 0.3% during the reported month, reaffirming hawkish Fed expectations.

In fact, the current market pricing indicates greater chances of a 75 bps Fed rate hike move at the September policy meeting. This remains supportive of elevated US Treasury bond yields and continues to lend support to the greenback. That said, a modest uptick in crude oil prices to a three-week high seems to underpin the commodity-linked loonie and might keep a lid on any further gains for the USD/CAD pair. Nevertheless, spot prices have managed to reverse a part of the overnight corrective decline from a six-week high.

Technical levels to watch

-

13:36

US: Durable Goods Orders virtually unchanged at $273.5 billion in July

- US Durable Goods Orders stayed unchanged on a monthly basis in July.

- US Dollar Index stays in positive territory below 109.00.

New orders for manufactured durable goods orders in the US stayed virtually unchanged at $273.5 billion in July, the US Census Bureau reported on Wednesday. This reading followed June's 2.2% expansion and came in worse than the market expectation for an increase of 0.6%.

"Excluding transportation, new orders increased 0.3%," the publication further read. "Excluding defense, new orders increased 1.2%. Transportation equipment, down following three consecutive monthly increases, drove the decrease, $0.6 billion or 0.7% to $93.0 billion."

Market reaction

These figures had little to no impact on the dollar's valuation. As of writing, the US Dollar Index was up 0.3% on the day at 108.84.

-

13:30

United States Durable Goods Orders ex Transportation above forecasts (0.2%) in July: Actual (0.3%)

-

13:30

United States Durable Goods Orders below forecasts (0.6%) in July: Actual (0%)

-

13:30

United States Durable Goods Orders ex Defense came in at 1.2%, above forecasts (0%) in July

-

13:19

EUR/PLN to hit 4.85 by year-end, then fall back to 4.60 by end-2023 – TDS

EUR/PLN is hovering around 4.7770. Economists at TD Secutities expect the pair to reach 4.85 by year-end. Nonetheless, EUR/PLN is set to move back lower next year.

Positive view on the zloty over the long-term

“We expect gradual zloty weakness ahead with EUR/PLN reaching 4.85 by end of December. However, over the long-term, we continue to hold a positive view on the zloty and think that EUR/PLN will fall back to 4.60 by the end of 2023.”

“Overall, the National Bank of Poland (NBP) has been much more decisive in tightening than the ECB and we think that Poland can reap the benefits of that further down the line.”

-

13:14

BoE: More front-loaded hikes and sooner cuts is the strategy – TDS

The Bank of England (BoE) remains torn between a weak growth outlook and near-record inflation. Economists at TD Securities revise their Bank Rate profile, and now expect sharp hikes in the near-term, followed by cuts once the wage-price link has been broken.

A more hawkish BoE, for now

“We now expect the MPC to deliver sequential 50 bps hikes at its September and November meetings, before slowing to a 25 bps hike in December.”

“We expect policy to remain on hold from the start of 2023, with 25 bps cuts coming from August to December that year, and a final 25 bps cut in 2024 to take Bank Rate to its neutral 1.75% rate.”

“Our new profile sees Bank Rate reach a peak of 3.00% from December this year, still well below the market's expectation of a 4.00% terminal rate.”

-

13:08

USD/KRW: Won to appreciate when the trade deficit narrows – Standard Chartered

The South Korean won has depreciated along with widening trade deficit. The strong correlation between the trade balance and the KRW implies that the won will likely appreciate when the trade deficit narrows, economists at Standard Chartered report.

Widening trade deficit weighs on the KRW

“Counter-intuitively, we have found that the trade balance has a much higher correlation with the KRW than the C/A balance. This strong correlation may partly explain recent KRW weakness and implies that the KRW is likely to appreciate when the trade deficit narrows.”

“We do not expect the trade account to turn supportive of the KRW in the near-term. Slowing global growth and external demand will likely keep the trade account under pressure, outweighing any benefits from a pullback in commodity prices.”

“We highlight a notable improvement in Korea’s capital account. Korean retail purchases of foreign equities have slowed and foreign flows to Korean equities have recovered – this is improving net equity flows following a sharp deterioration in the past two years.”

“We believe the improving capital account may allow the KRW to start outperforming peers, even as broad USD strength and weak risk sentiment likely keep USD/KRW supported in the short-term.”

See – BoK Preview: Forecasts from seven major banks, monetary tightening set to continue

-

13:01

USD/JPY set to test the July 14 high near 139.40 – BBH

USD/JPY traded as high as 137.70 on Tuesday but has since fallen back to around 136.60. Economists at BBH expect the pair to tackle the July 14 high near 139.40.

Japan eases COVID-19 entry requirements

“The USD/JPY pair remains on track to test the July 14 high near 139.40.”

“Japan will end its requirement for boosted inbound travelers to show a negative covid test result to enter the country. This will go into effect on September 7. With the economy showing signs of slowing, it’s clear that policymakers are looking to boost tourism in the coming months. Of note, the weak yen should help promote foreign visitors.”

-

13:00

Brazil Mid-month Inflation registered at -0.73% above expectations (-0.81%) in August

-

12:57

EUR/USD remains on track to test the September 2002 low near 0.9615 – BBH

EUR/USD remains heavy after Tuesday’s bounce really could not crack 1.00 and is currently trading near 0.9930. Economists at BBH expect the pair to challenge the September 2002 low near 0.9615.

ECB officials are acknowledging the risks of recession

“We believe EUR/USD remains on track to test the September 2002 low near 0.9615.”

“European Central Bank (ECB) executive board member Fabio Panetta stressed that monetary policy ‘needs to be strictly data dependent, taking fully into consideration the condition of the euro-area economy. This implies first of all being fully aware that the probability of a recession is increasing in the euro area because of the consequences of the pandemic, the shock to commodity prices of recent months, because of the war and its consequences for trade and uncertainty’.”

-

12:25

Indonesia: BI seen raising rates to 4.50% by year-end – UOB

Economist at UOB Group Enrico Tanuwidjaja comments on the latest interest rate decision by the Bank Indonesia (BI).

Key Takeaways

“Bank Indonesia (BI) raised its benchmark rate (7-Day Reverse Repo) to 3.75% at its Aug MPC.”

“BI unexpectedly raised borrowing costs for the first time since 2018 amidst mounting inflation risks.”

“We keep our view for BI to continue hiking in months to come with three more 25bps hikes in 2H22, taking its benchmark rate to 4.5% by the end of 2022.”

-

12:20

EUR/USD Price Analysis: Another test of the sub-0.9900 area appears probable

- EUR/USD reverses Tuesday’s gains and approaches 0.9900.

- Losses below the 2022 low could extend to 0.9860.

EUR/USD sees Tuesday’s bullish attempt rapidly eroded and refocuses instead on the lower end of the recent range near the 0.9900 area.

Further decline remains on the cards for the time being. That said, the breach of the 2022 low at 0.9899 (August 23) could sponsor a deeper pullback to the December 2002 low at 0.9859.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0838.

EUR/USD daily chart

-

12:00

Mexico 1st half-month Inflation came in at 0.42%, above expectations (0.35%) in August

-

12:00

Mexico 1st half-month Core Inflation above forecasts (0.34%) in August: Actual (0.49%)

-

12:00

United States MBA Mortgage Applications climbed from previous -2.3% to -1.2% in August 19

-

12:00

When are the US durable goods orders and how could they affect EUR/USD?

US durable goods orders overview

Wednesday's US economic docket highlights the release of Durable Goods Orders data for July. The US Census Bureau will publish the monthly report at 12:30 GMT and is expected to show that headline orders rose 0.6% during the reported month, marking a notable slowdown from the 2% increase recorded in June. Orders excluding transportation items, which tend to have a broader impact, are anticipated to grow by a modest 0.2% in July as compared to a 0.4% rise reported in the previous month.

Analysts at Wells Fargo offer a brief preview of the report and explain: “Demand for goods is slowing. That is as true for business spending as it is for personal consumption. For businesses, the growing concern the economy is about to tip into recession is weighing on activity, as well as higher borrowing costs and demand largely having been pulled forward throughout the pandemic.”

How could it affect EUR/USD?

Ahead of the key data, the emergence of fresh US dollar buying drags the EUR/USD pair back closer to its lowest level since December 2002 touched the previous day. A stronger-than-expected domestic data will reinforce hawkish Fed expectations, which, in turn, should result in higher US Treasury bond yields and a stronger USD.

Conversely, a weaker report will further fuel concerns about a global economic downturn and weigh on investors' sentiment, offering some support to the greenback's safe-haven status. This, along with fears of a prolonged energy-supply crunch in the Eurozone, suggests that the path of least resistance for the EUR/USD pair is to the downside.

That said, any immediate market reaction is more likely to be short-lived as market participants might prefer to wait on the sidelines ahead of Fed Chair Jerome Powell's appearance at the Jackson Hole symposium on Friday. Nevertheless, a big divergence from the expected readings might still provide some meaningful impetus to the EUR/USD pair.

Eren Sengezer, Editor at FXStreet, meanwhile, offered a brief technical outlook for the EUR/USD pair: “On the four-hour chart, the Relative Strength Index (RSI) indicator stays well below 40 after having moved out of the oversold territory on Tuesday. Additionally, EUR/USD is yet to make a four-hour close above the descending regression channel coming from August 12. Both of these technical developments suggest that the pair's latest recovery was a technical correction rather than a reversal..”

Eren also outlined important technical levels to trade the EUR/USD pair: “In case the pair starts using 0.9950 (static level, upper limit of the descending regression channel) as support, it could face interim resistance at 0.9975 (20-period SMA) before testing parity. On the downside, 0.9900 (static level, psychological level) aligns as first support before 0.9870 (former resistance area from October 2002) and 0.9800 (psychological level).”

Key Notes

• EUR/USD Forecast: Euro stays fragile while below parity

• EUR/USD: Unlikely to bounce as long as the energy crisis lasts – SocGen

• EUR/USD: A drop to 0.98 is more likely than a sustained recovery above parity – ING

About US durable goods orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

-

11:26

US Dollar Index Price Analysis: Bets for a test of the 2022 high remain intact

- DXY regains the smile following Tuesday’s marked drop.

- Above the 109.00 mark the dollar could revisit the YTD highs.

DXY fades Tuesday’s decline and returns to the positive territory with the next target at the 109.00 neighbourhood.

The continuation of the upside momentum looks increasingly likely in the very near term. That said, beyond the 2022 high at 109.29 (July 14) the index could challenge the September 2002 peak at 109.77 prior to the round level at 110.00.

In the meantime, while above the 6-month support line near 105.10, the index is expected to keep the short-term positive stance.

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.55.

DXY daily chart

-

11:13

USD/CHF flirts with daily low, bears now await sustained weakness break below 0.9600 mark

- USD/CHF meets with a fresh supply on Wednesday and drops to the 0.9600 neighbourhood.

- Recession fears offer some support to the safe-haven CHF and exert pressure on the major.

- Softer US bond yields act as a headwind for the USD and contribute to the modest weakness.

- Hawkish Fed expectations should limit any meaningful slide for the greenback and the pair.

The USD/CHF pair attracts some selling near the 0.9660-0.9665 region on Wednesday and slides to a fresh daily low during the first half of the European session. Bears now await a sustained break below the 0.9600 round figure before positioning for an extension of the overnight pullback from the vicinity of the 0.9700 mark, or over a one-month high.

Investors remain concerned about a global economic downturn in the wake of stubbornly high inflation, tighter financial conditions and headwinds stemming from China's COVID-19 lockdowns. This is evident from a generally weaker tone around the equity markets, which offers some support to the safe-haven Swiss franc and exerts some downward pressure on the USD/CHF pair.

The downside, however, seems cushioned mid the emergence of some US dollar buying, bolstered by hawkish Fed expectations. Investors seem convinced that the Fed will stick to its policy tightening path and have been pricing in at least a 50 bps rate hike move at the September FOMC meeting. That said, a modest pullback in the US Treasury bond yields cap gains for the buck.

The mixed fundamental backdrop warrants some caution before positioning for a firm near-term direction. Traders might also prefer to wait on the sidelines ahead of Fed Chair Jerome Powell's speech at the Jackson Hole symposium on Friday. Market participants are bracing for a more hawkish message and will look for clues about a supersized 75 bps Fed rate hike in September.

In the meantime, traders on Wednesday might take cues from the US economic docket - featuring Durable Goods Orders and Pending Home Sales data later during the early North American session. This, along with the US bond yields, might influence the USD. Apart from this, the broader market risk sentiment should contribute to producing short-term trading opportunities around the USD/CHF pair.

Technical levels to watch

-

10:59

EUR/JPY Price Analysis: Further losses expected below 134.94

- EUR/JPY extends the leg lower well below 136.00.

- Initial support comes at the weekly low at 134.94.

EUR/JPY loses ground for the third session in a row, this time breaking below the support at the 136.00 level.

Extra weakness now appears in store for the cross, with the immediate support at the weekly low at 134.94 (August 16). The loss of this level should expose a deeper pullback to the 200-day SMA, today at 134.15.

While above the latter, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

10:56

S&P Global Market Intelligence: Inflation to moderate in 2023 and 2024

Sara Johnson, Executive Director of Economic Research at S&P Global Market Intelligence, said in a statement on Wednesday, global growth is likely to remain subdued in late 2022 and 2023 while inflation is seen moderating over the next two years.

Key quotes

“World real GDP growth is thus projected to slow from 5.8% in 2021 to 2.7% in 2022 and 2.3% in 2023.

“Once inflation subsides and financial conditions improve, global growth is expected to revive to 3% in 2024,”

mainland China’s economy continues to struggle. “The housing market remains in a deep recession, and declining land sales are hurting local government finances. Real GDP growth is projected to slow from 8.1% in 2021 to 3.8% in 2022 before picking up to 4.9% in 2023.”

“After slowing from 6.2% in 2021 to 3.8% in 2022, Asia-Pacific’s real GDP growth is projected to pick up to 4.2% in 2022 and 4.5% in 2023.”

“India, Indonesia, Vietnam, the Philippines, Bangladesh, and Cambodia will likely achieve growth rates of 5%-7%.”

US real GDP growth is projected to slow from 5.7% in 2021 to 1.5% in 2022 and 1.0% in 2023 before picking up to 1.7% in 2024.”

“With growth falling short of potential, the US unemployment rate will likely rise from 3.5% in July to 4.8% in mid-2024.”

“With consumer price inflation at 10.1% year-on-year in July and headed higher (with a 75% October increase in gas and electricity rate caps), the UK recession is expected to linger through the spring quarter of 2023.”

Related reads

- Why the S&P 500 surge may not last, three reasons to remain cautious – Morgan Stanley

- Goldman Sachs, Nomura cut China’s GDP outlook

-

10:44

AUD/USD remains on the defensive, around 0.6920 area amid modest USD strength

- AUD/USD attracts some dip-buying on Wednesday, though lacks bullish conviction.

- Retreating US bond yields seem to cap the USD and offer some support to the major.

- Recession fears, hawkish Fed expectations favour USD bulls and cap gains for the pair.

The AUD/USD pair reverses an intraday dip to sub-0.6900 levels and climbs back closer to the top end of its daily range during the early part of the European session. The pair, however, lacks follow-through buying and is currently trading with modest intraday losses, around the 0.6915-0.6920 region.