Notícias do Mercado

-

23:44

Commodities. Daily history for March 26’2014:

(raw materials / closing price /% change)

Gold $1,303.4 -8.00 -0.61%

ICE Brent Crude Oil $107.03 +0.05 +0.05%

NYMEX Crude Oil $100.2 +0.80 +0.80%

-

23:24

Stocks. Daily history for March 26’2014:

(index / closing price / change items /% change)

Nikkei 14,477.16 +53.97 +0.37%

Hang Seng 21,887.75 +155.43 +0.72%

Shanghai Composite 2,063.67 -3.64 -0.18%

S&P 500 1,852.56 -13.06 -0.70%

NASDAQ 4,173.58 -60.69 -1.43%

Dow 16,268.99 -98.89 -0.60%

FTSE 6,605.3 +0.41 +0.01%

CAC 4,385.15 +41.03 +0.94%

DAX 9,448.58 +110.18 +1.18%

-

23:19

Currencies. Daily history for March 26'2014:

(pare/closed(GMT +2)/change, %)

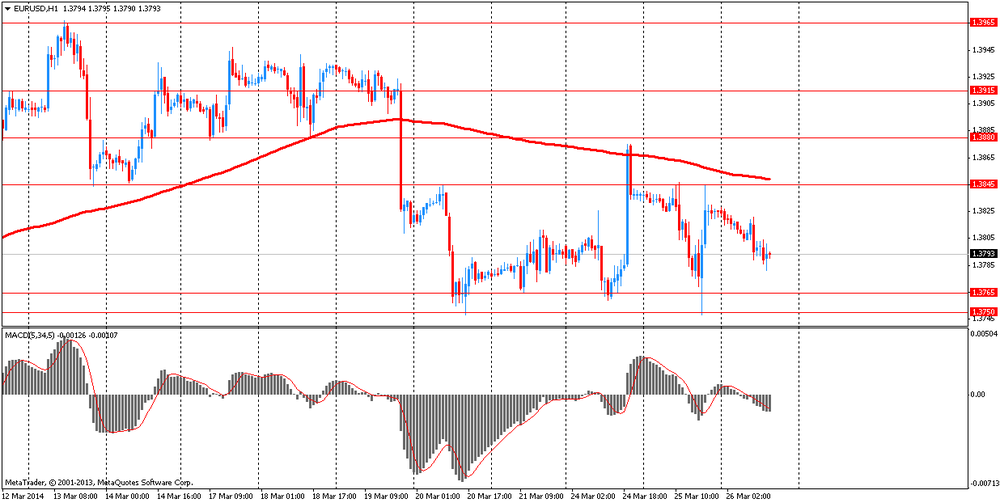

EUR/USD $1,3784 -0,30%

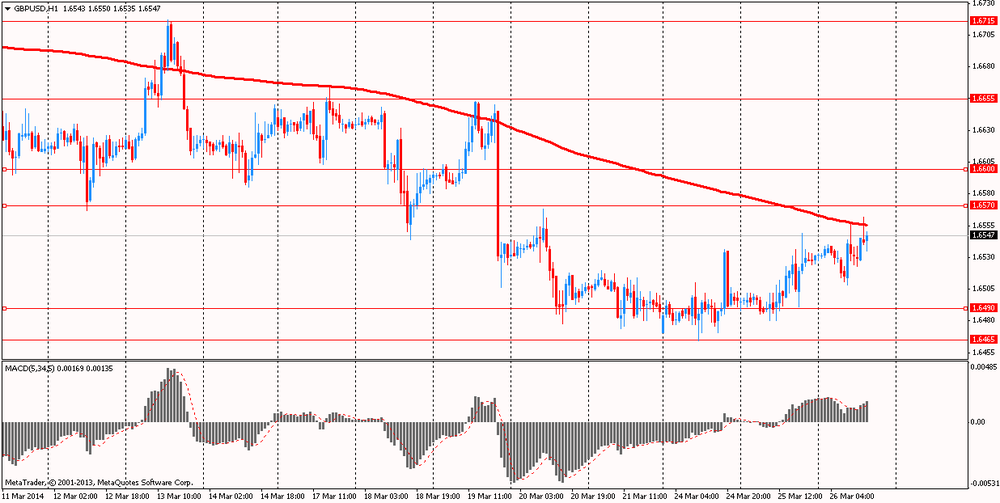

GBP/USD $1 ,6575 +0,27%

USD/CHF Chf0,8847 +0,54%

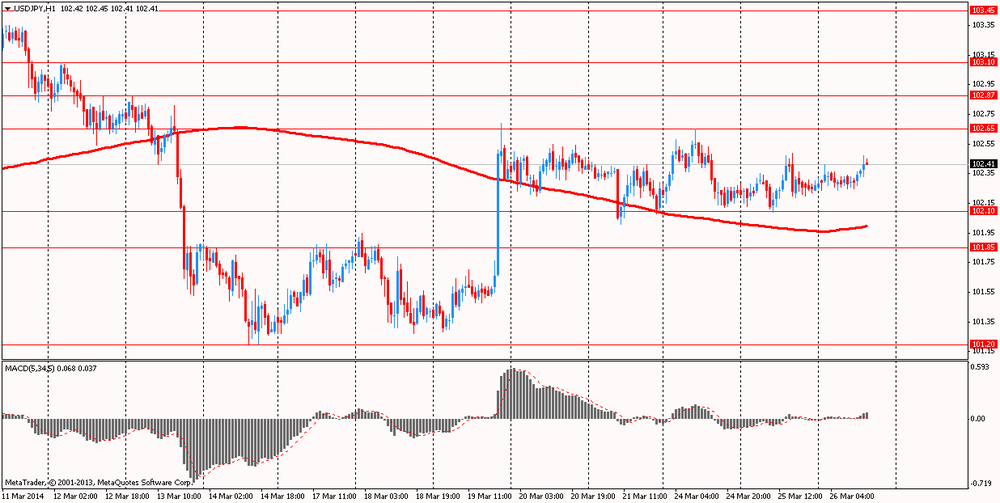

USD/JPY Y102,06 -0,20%

EUR/JPY Y140,69 -0,50%

GBP/JPY Y169,16 +0,08%

AUD/USD $0,9219 +0,64%

NZD/USD $0,8598 +0,31%

USD/CAD C$1,1100 -0,59% -

23:00

Schedule for today, Thursday, March 27’2014:

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Nationwide house price index March +0.6%

07:00 United Kingdom Nationwide house price index, y/y March +9.4%

09:00 Eurozone M3 money supply, adjusted y/y February +1.2% +1.3%

09:30 United Kingdom Retail Sales (MoM) February -1.5% +0.5%

09:30 United Kingdom Retail Sales (YoY) February +4.3% +2.4%

12:30 U.S. FOMC Member Pianalto Speaks

12:30 U.S. Initial Jobless Claims March 320 326

12:30 U.S. PCE price index, q/q Quarter IV +2.6%

12:30 U.S. PCE price index ex food, energy, q/q Quarter IV +1.3%

12:30 U.S. GDP, q/q (Finally) Quarter III +2.4% +2.7%

14:00 U.S. Pending Home Sales (MoM) February +0.1% +0.2%

17:00 Switzerland Gov Board Member Fritz Zurbrugg Speaks

23:30 Japan Unemployment Rate February 3.7% 3.7%

23:30 Japan Household spending Y/Y February +1.1% +0.3%

23:30 Japan Tokyo Consumer Price Index, y/y March +1.1% +1.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y March +0.9% +0.9%

23:30 Japan National Consumer Price Index, y/y February +1.4% +1.5%

23:30 Japan National CPI Ex-Fresh Food, y/y February +1.3% +1.3%

23:50 Japan Retail sales, y/y February +4.4% +3.6%

-

19:00

Dow -26.59 16,341.29 -0.16% Nasdaq -26.2 4,208.07 -0.62% S&P -2.57 1,863.05 -0.14%

-

18:20

American focus : the pound was up against the U.S. dollar

The Euro is trading lower against the dollar, which has been associated with the release of U.S. data , as well as statements from representatives of the Central Bank. Ministry of Commerce announced today that orders for planes take off in February , masking slow demand for other industrial and durable goods. According to the report , orders for durable goods - products such as refrigerators and cars , period of use for more than three years - rose a seasonally adjusted 2.2% in February compared with the previous month , said Wednesday . This is the strongest value in November. Result January was revised downward to fall by 1.3%. Economists forecast that overall orders for durable goods rise by 1.1%. New orders for civilian and defense aircraft and parts led growth. Excluding the volatile transportation segment , orders for durable goods rose by only 0.2 %. New orders for primary metals and electronic products led the growth. But the demand for electrical machinery and equipment declined last month.

Little support for the euro had words of a member of the Governing Council of the ECB Luis Linde, who said that the eurozone faces a small but real risk of deflation , which could force the European Central Bank to take action. Linde, which is the main central bank of Spain, said that the ECB is ready and should be taken to avoid a deflationary trend. His comments were made after Tuesday's other Fed officials have sent a strong signal that they want to consider drastic measures to protect against dangerous low inflation. Earlier Wednesday, the head of the central bank of Slovakia Jozef Makuch said that the ECB is ready to fight to prevent a decline in prices, which , according to him, threatening to undermine the recovery in the eurozone.

Pound was up against the U.S. dollar , thus responding to the U.S. data and statements by the Bank of England Huila . Note that a member of the Bank of England Monetary Committee in an interview with Martin Weale Reading Post said that there is evidence of improvement in the economy. Britain feels better than Europe amid rising wages. Member of the Monetary Committee , which decides on rates , said uneven recovery : in some parts of it better than others. According to Wil there can be no guarantees with respect to any increase in interest rates in the future , but any increase will be gradual . He said: " I think everything is going very well . It is evident that the economy is growing faster than a year ago. Inflation slightly below the target level after a long period exceeding it , it's certainly good news that we are doing our job . Wage growth is encouraging, we need revenue . " Will gave to understand how the economic picture is not the same in different parts of the country : " From the point of view of the Committee - a national policy that we are pursuing , should consider all and not only the rich part. Painting is never completely uniform . "

-

18:01

European stock close

European stocks rose for a second day, with the Stoxx Europe 600 Index posting its biggest two-day gain in three weeks, as auto companies climbed.

The Stoxx 600 added 0.7 percent. The benchmark index has rallied 2 percent in the past two days, after falling 4 percent through March 24 as tension grew between the West and Russia over Ukraine. The measure is still heading for a 2.1 percent drop this month, its biggest monthly decline since June.

U.S. President Barack Obama speaks today on what the standoff with Russia over Ukraine means for European security, as the former Soviet republic holds bailout talks with the International Monetary Fund. The U.S. and the European Union imposed sanctions on Russian officials and threatened more if President Vladimir Putin fails to ease the crisis.

In the U.S., Commerce Department data showed durable-goods orders rose 2.2 percent in February, beating economists’ forecasts for a 0.8 percent gain.

A gauge of German consumer confidence will remain at a seven-year high in April, Nuremberg-based GfK AG said today. The research company estimated that its index will hold at 8.5 next month, unchanged from March.

National benchmark indexes rose in 16 of the 18 western-European markets.

FTSE 100 6,605.3 +0.41 +0.01% CAC 40 4,385.15 +41.03 +0.94% DAX 9,448.58 +110.18 +1.18%

Peugeot added 3.1 percent to 13.06 euros. The carmaker got more than 120,000 orders in a year for its 2008 crossover model, while orders for its 308 vehicle stand at 65,000, La Tribune newspaper reported, citing an unidentified person at the company.

Volkswagen AG, Europe’s largest automaker, rose 1.4 percent to 183.55 euros. Bayerische Motoren Werke AG advanced 1.3 percent to 90.58 euros. A gauge of European auto stocks posted the best performance of the 19 industry groups on the Stoxx 600.

Standard Life jumped 6.7 percent to 399 pence after Scotland’s biggest insurer said its Standard Life Investments unit is buying Ignis Asset Management from Phoenix for 390 million pounds ($645 million). Phoenix rose 4.7 percent to 743.5 pence.

Airbus Group NV advanced 1.3 percent to 52.69 euros after Les Echos reported it is extending its partnership with Aviation Industry Corporation of China. The aircraft manufacturer and Avic plan to produce 1,000 EC175 helicopters over the next 20 years, according to the report, which didn’t cite anyone.

Mediaset SpA climbed 3.9 percent to 4.03 euros after the broadcaster controlled by former Italian Prime Minister Silvio Berlusconi posted a return to profit for 2013. Net income last year totaled 8.9 million euros ($12.3 million) after a net loss in 2012. Sales fell 8.2 percent to 3.41 billion euros, compared with the 3.44 billion-euro average of analyst estimates.

William Hill Plc increased 2.8 percent to 348.9 pence. HSBC Holdings Plc upgraded the bookmaker to overweight, the equivalent of a buy rating, from underweight, saying that the prospect of further regulatory change has now been priced in to the shares, while its online operations are growing.

-

17:00

European stock close: FTSE 100 6,605.3 +0.41 +0.01% CAC 40 4,385.15 +41.03 +0.94% DAX 9,448.58 +110.18 +1.18%

-

15:40

Oil: an overview of the market situation

Oil has risen moderately today as supply disruptions from Nigeria and Libya supported prices and data on oil reserves in the U.S. have improved investor sentiment .

Note that the oil company Royal Dutch Shell declared force majeure on oil supplies from Nigeria as one of the oil leak , and production in Libya has fallen by another 80,000 barrels per day to 150,000 after stopping work on one of the largest deposits . Rebels in Libya, control multiple ports with oil export terminals , announced their readiness to start talks with the government if the government refuses to take threats to attack on these ports.

"Demand for oil remains high. Moreover, given the signs that consumption of motor gasoline , perhaps increased recently, as well as reduced production in Libya and the problems in Nigeria , we can assume that all of this is supporting the growth of quotations "- said Global Hunter Securities strategist Richard Hastings .

With respect to data from the Ministry of Energy , they showed :

- Crude oil inventories in the U.S. 6.619 million barrels to 382.471 million barrels

- Load refinery in the U.S. 86.0% against 85.6 % a week earlier

- Distillate stocks in the U.S. 1,555,000 barrels to 112.401 million barrels

- Stocks of gasoline in the U.S. -5,101,000 barrels to 217.198 million barrels

- Oil terminal in Cushing last week -1.325 million barrels to 28.477 million barrels

Recall also that the report presented yesterday its Petroleum Institute API. He testified:

- Capacity utilization in the week 86.8% against 86.9%

- Distillate stocks last week 0.267 million barrels

- Gasoline inventories last week -2.8 million barrels

- Oil reserves for the week 6.3 million barrels

Experts note that the "stabilization" of tensions between Western powers and Russia - world's second largest oil exporter , to keep prices in the range . Meanwhile, U.S. President Barack Obama warned Russia that the United States and its European allies are still evaluating the possible sanctions in the energy sector .

On the dynamics of trade also affected the U.S. data , which showed that orders for durable goods in February increased by 2.2% compared to December adjusted for seasonal variations. This is the strongest growth since November. The January figure was revised down to -1.3 % from -1.0% . Economists had forecast a rise in orders in February by 1.1%.

May futures for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 99.69 per barrel on the New York Mercantile Exchange (NYMEX).

May futures price for North Sea Brent crude oil mixture rose $ 0.10 to $ 107.04 a barrel on the London exchange ICE Futures Europe.

-

15:20

Gold: an overview of the market situation

Gold prices declined , reaching a five-week low at the same time , which was associated with the release of U.S. data . It is learned that orders for durable goods - products such as refrigerators and cars , period of use for more than three years - rose a seasonally adjusted 2.2% in February compared to a month earlier. This is the strongest value in November. Result January was revised downward to fall by 1.3%.

Economists forecast that overall orders for durable goods rise by 1.1%. New orders for civilian and defense aircraft and parts led growth.

Excluding the volatile transportation segment , orders for durable goods rose by only 0.2 %. New orders for primary metals and electronic products led the growth. But the demand for electrical machinery and equipment declined last month.

We also add that investors also evaluate options for development of the situation in the relations between Russia and the West. Big Seven disbanded Group of Eight , isolating Russia , as long as it will not change its policy towards Ukraine. Big Seven also promised to take further sanctions in response to the Crimea to Russia . Note that some investors consider gold safe haven and prefer to own this precious metal in times of geopolitical or economic instability .

Demand in the physical market dropped , and ">Analysts said the drop in gold to $ 1,300 may attract buying interest . Without physical demand quotes precious metal may continue to fall and return to the downtrend channel , because the prospects of the Fed raising interest rates and collapse of the third round of quantitative easing are strong negative factors for gold.

In addition, it was reported that the world's largest asset holder of gold investment institutions ETFs SPDR Gold Trust fell yesterday by 2.7 tons - up to 818.77 tons , the lowest level since March 21 this year.

The cost of the April gold futures on the COMEX today dropped to $ 1303.60 per ounce.

-

14:30

U.S.: Crude Oil Inventories, March +6.6

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.50, Y102.00, Y102.15, Y102.30, Y102.40, Y102.50, Y102.65, Y103.10

EUR/USD $1.3800, $1.3830/40, $1.3850, $1.3900/05, $1.3935

AUD/USD $0.8950, $0.8970/75, $0.9000, $0.9100

USD/CAD Cad1.1080, Cad1.190, Cad1.1265, Cad1.1350

GBP/USD $1.6510, $1.6530

EUR/CHF Chf1.2300

EUR/GBP stg0.8285, stg0.8305

-

13:37

U.S. Stocks open: Dow 16,453.07 +0.52%, Nasdaq 4,257.60 +0.55%, S&P 1,874.60 +0.48%

-

13:27

Before the bell: S&P futures +0.38%, Nasdaq futures +0.53%

U.S. stock-index futures rose, investors weighed a report showing durable-goods orders rose more than forecast while investment in business equipment fell.

Global markets:

Nikkei 14,477.16 +53.97 +0.37%

Hang Seng 21,887.75 +155.43 +0.72%

Shanghai Composite 2,063.67 -3.64 -0.18%

FTSE 6,639.17 +34.28 +0.52%

CAC 4,393.21 +49.09 +1.13%

DAX 9,473.18 +134.78 +1.44%

Crude oil $99.67 (+0.48%)

Gold $1313.80 (-0.18%).

-

13:15

European session: the euro fell

07:00 Germany Gfk Consumer Confidence Survey April 8.5 8.5 8.5

07:00 Switzerland UBS Consumption Indicator February 1.44 1.57

12:30 U.S. Durable Goods Orders February -1.0% +1.1% +2.2%

12:30 U.S. Durable Goods Orders ex Transportation February +1.1% +0.3% +0.2%

12:30 U.S. Durable goods orders ex defense February -1.8% +2.0% +1.8%

Euro fell against the dollar despite strong data on consumer confidence in Germany. German consumer confidence index , as expected , remained 7 - year high in April , but the events in the Crimea may affect consumer sentiment in the coming weeks , showed on Wednesday the results of a survey research group GfK. Expected consumer confidence index remained unchanged at 8.5, in line with expectations . Result is consistent with the March value , which was the highest since January 2007. The survey , based on the opinions of consumers in 2000 , was held on the eve of the crisis escalates to the referendum and the subsequent annexation of Russian autonomous region of Crimea in Ukraine . If Crimean crisis will spread to other parts of Ukraine , will be very likely negative effect on German consumer sentiment , said the GfK. " It can not be excluded that this event will unsettle consumers in the coming weeks ," the statement said.

Economic expectations of consumers in March were on the road to recovery. The indicator rose by 1.3 points to 33.2 points. According to GfK, a favorable global growth prospects with improved export prospects , as well as lower interest rates will stimulate the propensity to invest .

Meanwhile , a measure of expected income fell by three points to 45.6 points in March . Nevertheless , expectations remain at very high levels , while stable job market strengthens hopes for a greater increase in collective income. After a slight decline in the previous month, the third component of consumer confidence , willingness to purchase , registered a clear gain of 6.6 points , reaching 55.5 points in March . The indicator shows that the upward trend that started in early 2013 , was continued. Stable labor market, good dynamics of income and moderate inflation will continue to maintain a willingness to buy . GfK has confirmed that private consumption will again be a reliable pillar of the economy this year.

U.S. Department of Commerce published a report on orders for durable goods contributed to the growth of the U.S. dollar against the yen. Orders for durable goods - products such as refrigerators and cars , period of use for more than three years - rose a seasonally adjusted 2.2% in February compared to a month earlier , said the Ministry of Commerce on Wednesday . This is the strongest value in November. Result January was revised downward to fall by 1.3%. Economists forecast that overall orders for durable goods rise by 1.1%.

New orders for civilian and defense aircraft and parts led growth. Fluctuations in these categories can cause significant changes in the overall index . The Boeing Company reported an increase almost twice the number of orders for its aircraft in February compared to a month earlier.

Excluding the volatile transportation segment , orders for durable goods rose by only 0.2 %. New orders for primary metals and electronic products led the growth. But the demand for electrical machinery and equipment declined last month.

The Australian dollar rose for a fourth day after the head of the Reserve Bank of Australia Governor Glenn Stevens in his speech said that the period of record-low interest rates will continue for some time . However, he warned that the region's economic prospects remain uncertain due to the attenuation of the boom in the mining industry .

EUR / USD: during the European session, the pair fell to $ 1.3781

GBP / USD: during the European session, the pair rose to $ 1.6562

USD / JPY: during the European session, the pair rose to Y102.47

At 21:45 GMT New Zealand will release the trade balance (for 12 months , from the beginning of the year ) , trade balance for February.

-

13:09

Upgrades and downgrades before the market open:

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) initiated with a Neutral at UBS, target $230

-

12:31

U.S.: Durable Goods Orders ex Transportation , February +0.2% (forecast +0.3%)

-

12:31

U.S.: Durable goods orders ex defense, February +1.8% (forecast +2.0%)

-

12:30

U.S.: Durable Goods Orders , February +2.2% (forecast +1.1%)

-

11:30

European stocks advanced for a second day

European stocks advanced for a second day as investors awaited data that may show an increase in U.S. durable-goods orders. U.S. stock-index futures and Asian shares rose.

The Stoxx Europe 600 Index gained 0.7 percent to 330.7 at 9:59 a.m. in London. The benchmark index is heading for a 2.2 percent drop this month, its biggest monthly decline since June, amid tension between the West and Russia over Ukraine, and data indicating a slowdown in Chinese economic growth. Standard & Poor’s 500 Index futures increased 0.2 percent today and the MSCI Asia Pacific Index rose 1 percent.

A report at 8:30 a.m. New York time will show U.S. durable-goods orders rose 0.8 percent in February after declining 1 percent the previous month, according to the average economist estimate in a Bloomberg News survey.

A gauge of German consumer confidence will remain at a seven-year high in April, Nuremberg-based GfK AG said today. The research company estimated that its consumer sentiment index will hold at 8.5 next month, unchanged from March.

President Mario Draghi late yesterday reiterated in a speech in Paris that the European Central Bank will act if necessary to safeguard the region’s economy.

He also said the central bank’s accommodative monetary policy should become more effective within the euro-area economy as disruptions in the financial system dissipate, while warning that risks remain.

Airbus climbed 1.4 percent to 52.76 euros. The aircraft manufacturer and Avic plan to produce 1,000 EC175 helicopters over the next 20 years, according to the report, which didn’t cite anyone.

Mediaset added 1.1 percent to 3.92 euros. The broadcaster said late yesterday that net income last year totaled 8.9 million euros ($12.3 million) after a net loss in 2012. Sales fell 8.2 percent to 3.41 billion euros, compared with the 3.44 billion-euro average of analyst estimates compiled by Bloomberg.

Lloyds slipped 3.9 percent to 76 pence. The U.K. government raised 4.2 billion pounds ($6.9 billion) from selling shares at 75.5 pence apiece, U.K. Financial Investments Ltd., which manages the government’s investment in the lender, said in a statement. The shares were sold at a 4.6 percent discount to yesterday’s closing price. The sale reduces the government’s stake in Lloyds to less than 25 percent from 33 percent.

FTSE 100 6,637.42 +32.53 +0.49%

CAC 40 4,390.03 +45.91 +1.06%

DAX 9,461.58 +123.18 +1.32%

-

10:01

Option expiries for today's 1400GMT cut

USD/JPY Y101.00, Y101.50, Y102.00, Y102.15, Y102.30, Y102.40, Y102.50, Y102.65, Y103.10

EUR/USD $1.3800, $1.3830/40, $1.3850, $1.3900/05, $1.3935

AUD/USD $0.8950, $0.8970/75, $0.9000, $0.9100

USD/CAD Cad1.1080, Cad1.190, Cad1.1265, Cad1.1350

GBP/USD $1.6510, $1.6530

EUR/CHF Chf1.2300

EUR/GBP stg0.8285, stg0.8305

-

09:27

Asia Pacific stocks close

Asian stocks rose after U.S. consumer confidence climbed to a six-year high, buoying investor optimism about the outlook for the world’s biggest economy.

Nikkei 225 14,477.16 +53.97 +0.37%

Hang Seng 21,887.75 +155.43 +0.72%

S&P/ASX 200 5,376.75 +40.13 +0.75%

Shanghai Composite 2,063.67 -3.64 -0.18%

Samsung Electronics Co., a consumer electronics maker that gets a fifth of its revenue in America, rose 3 percent in Seoul.

China Mengniu Dairy Co., the country’s largest dairy producer, soared 8.6 percent in Hong Kong after posting a 25 percent profit gain last year.

Kirin Holdings Co. advanced 2.6 percent on a report the Japanese beverage maker will raise its annual dividend to at least 40 yen and consider a share buyback.

-

08:47

FTSE 100 6,614.88 +9.99 +0.15%, CAC 40 4,359.09 +14.97 +0.34%, Xetra DAX 9,391.48 +53.08 +0.57%

-

07:01

Switzerland: UBS Consumption Indicator, February 1.57

-

07:00

Germany: Gfk Consumer Confidence Survey, April 8.5 (forecast 8.5)

-

06:40

European bourses are seen trading modestly higher Weds: the FTSE and DAX will open 0.2% higher and the CAC up 0.1%.

-

06:23

Asian session: The euro remained lower

00:30 Australia RBA Financial Stability Review March

06:00 Australia RBA's Governor Glenn Stevens Speech

The euro remained lower against most of its 16 major peers as weaker European business data fueled speculation the region’s economic recovery will falter. Ifo Institute’s German business climate index, based on a survey of 7,000 executives, fell to 110.7 in March after increasing to 111.3 the previous month, the highest level since July 2011. Economists predicted a decline to 110.9, according to a Bloomberg News survey. Germany is Europe’s biggest economy.

The shared currency was near the lowest in three weeks versus the greenback before U.S. reports that analysts predict will show higher durable goods orders and stronger economic growth. In the U.S., durable goods orders probably increased 0.8 percent in February from the previous month, when they dropped 1 percent, according to the median estimate of economists surveyed by Bloomberg News before the Commerce Department releases data today.

Federal Reserve Bank of Atlanta President Dennis Lockhart said yesterday he expects rate increases in the second half of next year. The Atlanta Fed’s Lockhart said yesterday “the second half of 2015 is a reasonable time frame in which we might get to lift off” the benchmark interest rate from a record low. Lockhart, answering questions in a forum in Atlanta, said the U.S. central bank will probably begin to raise the main interest rate more than six months after halting its purchases of bonds.

The Aussie rose for a fourth day after RBA Governor Stevens said there are encouraging early signs of a handover from mining-led demand growth to domestic consumption. He repeated today that borrowing costs, currently at a record-low 2.5 percent, were likely to remain steady for a period.

EUR / USD: during the Asian session the pair fell to $ 1.3810

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6425-40

USD / JPY: on Asian session the pair traded in the range of Y102.25-40

-