Notícias do Mercado

-

23:51

Japan: CSPI, y/y, February +0.7% (forecast +0.8%)

-

23:31

Stocks. Daily history for March 25’2014:

(index / closing price / change items /% change)

Nikkei 14,423.19 -52.11 -0.36%

Hang Seng 21,732.32 -114.13 -0.52%

Shanghai Composite 2,067.31 +1.03 +0.05%

S&P 500 1,865.62 +8.18 +0.44%

NASDAQ 4,234.27 +7.88 +0.19%

Dow 16,367.88 +91.19 +0.56%

FTSE 6,604.89 +84.50 +1.30%

CAC 4,344.12 +67.78 +1.59%

DAX 9,338.4 +149.63 +1.63%

-

23:29

Commodities. Daily history for March 25’2014:

(raw materials / closing price /% change)Gold $1,311.4 +0.20 +0.02%

ICE Brent Crude Oil $106.99 +0.39 +0.39%

NYMEX Crude Oil $99.2 -0.39 -0.39%

-

23:19

Currencies. Daily history for March 25'2014:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3825 -0,09%

GBP/USD $1,6531 +0,22%

USD/CHF Chf0,8799 -0,09%

USD/JPY Y102,26 +0,04%

EUR/JPY Y141,39 -0,04%

GBP/JPY Y169,03 +0,25%

AUD/USD $0,9160 +0,38%

NZD/USD $0,8571 +0,30%

USD/CAD C$1,1166 -0,26% -

23:00

Schedule for today, Wednesday, March 26’2014:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Financial Stability Review March

06:00 Australia RBA's Governor Glenn Stevens Speech

07:00 United Kingdom Nationwide house price index March +0.6%

07:00 United Kingdom Nationwide house price index, y/y March +9.4%

07:00 Germany Gfk Consumer Confidence Survey April 8.5 8.5

07:00 Switzerland UBS Consumption Indicator February 1.44

12:30 U.S. Durable Goods Orders February -1.0% +1.1%

12:30 U.S. Durable Goods Orders ex Transportation February +1.1% +0.3%

12:30 U.S. Durable goods orders ex defense February -1.8% +2.0%

14:00 Switzerland SNB Quarterly Bulletin Quarter I

14:30 U.S. Crude Oil Inventories March +5.9

21:45 New Zealand Trade Balance, mln February 306 600

-

19:00

Dow +96.33 16,373.02 +0.59% Nasdaq +3.23 4,229.62 +0.08% S&P +7.12 1,864.56 +0.38%

-

18:20

American focus : the euro exchange rate rose substantially against the U.S. dollar

The euro exchange rate against the dollar rose sharply , returning almost all the ground lost during today's trading . Impact on the dynamics of the U.S. data , as well as the statements of the ECB's Draghi . Report from the Conference Board showed that consumer confidence index has improved markedly in March , while offsetting the decline in February . The index now stands at 82.3 points ( 1985 = 100 points ) , compared to 78.3 points in February . Present situation index fell to 80.4 points from 81.0 points, while the expectations index rose to 83.5 from 76.5 . Meanwhile, it became known that the assessment of current conditions consumers almost unchanged in March - the proportion of those who reported improvement of business conditions rose to 22.9 percent from 21.2 percent, while those who reported worsening , has risen to 23 2 percent from 22.0 percent . Estimation by consumers of the labor market was relatively unchanged - the proportion of those who said about improving conditions , decreased to 13.1 percent from 13.4 percent, and is reported to decline increased to 33.0 percent from 32.4 percent .

As for Draghi speech , he noted that the ECB will do everything necessary to maintain price stability . Perhaps he hinted at HTA program aimed at helping vulnerable members of the eurozone by buying their government bonds , which was proposed in the fall of 2012, but did not work. He also said that the soft policy will support the gradual elimination of the lag in economic growth. According to him, visible signs that monetary policy becomes more effective . Draghi also spoke about the euro , noting that the strengthening of the euro caused by external factors , including the Japanese monetary policy , as well as increased confidence in the eurozone. Furthermore, he added that the ECB is closely monitoring the situation with the exchange rate.

The British pound rose against the dollar , helped by data on inflation in Britain and weak U.S. data . In the UK inflation slowed in February , as expected , to a four-year low due to lower transport prices showed Tuesday, official data Office for National Statistics . Consumer prices rose 1.7 percent year -on-year after increasing 1.9 percent in January. Growth rates in line with economists' expectations . On a monthly measurement of consumer prices rose by 0.5 percent , according to the forecast , offsetting a drop of 0.6 percent in January. At the same time, core inflation , which excludes prices of energy, food , alcoholic beverages and tobacco , rose to 1.7 percent from 1.6 percent .

Meanwhile, U.S. data showed that new home sales fell in February , becoming the latest sign that the severe weather conditions and rising mortgage rates undermine the housing market recovery . Sales of newly built homes fell 3.3% to a seasonally adjusted annual rate of 440,000 compared with the previous month , the Ministry of Commerce said . Strong growth in January was revised downward to an annual rate of 455,000 . Data on sales of new buildings represent a small portion of the homes purchased in the United States and may be subject to significant revisions . But they provide more current sensor market conditions than some other figures , because they are calculated at the time of signing the contract , and not when it is closed . February sales were lower than expected by economists and 447,000 were at the lowest level since September.

-

18:00

European stock close

European stocks rose the most in three weeks as better-than-forecast U.S. consumer-confidence and housing data signaled the world’s largest economy has rebounded from the harsh winter.

The Stoxx Europe 600 Index added 1.2 percent to 328.33 at 4:30 p.m. in London after yesterday falling the most in two weeks.

In the U.S., the Conference Board’s consumer-confidence index rose to 82.3 this month, exceeding the median estimate of 78.5 in a survey of economists. Consumer spending accounts for about 70 percent of economic activity in the U.S. A separate release showed new house sales in America declined at a slower-than-expected rate last month after climbing in January to the highest level in a year.

German business confidence slipped this month, data showed. The Ifo institute’s business-climate index, based on a survey of executives, fell to 110.7 from 111.3 in February. That missed the 110.9 median economist estimate.

National benchmark indexes rose in every western-European market that opened today, except Iceland.

FTSE 100 6,604.89 +84.50 +1.30% CAC 40 4,344.12 +67.78 +1.59% DAX 9,338.4 +149.63 +1.63%

EasyJet climbed 3.4 percent to 1,687 pence. The low-cost airline forecast a pretax loss for the first half of its financial year of 55 million pounds ($91 million) to 65 million pounds, narrower than its Jan. 23 prediction for a loss of as much as 90 million pounds.

Luxottica increased 4 percent to 40.50 euros. The world’s largest maker of glasses will design, develop and sell spectacles that use Google Glass technology, according to a joint statement late yesterday. Google Glass combines a small screen, camera and audio on a device worn at eye level. Luxottica owns the Ray-Ban and Oakley brands.

Baloise climbed 2.9 percent to 112.30 Swiss francs after saying it plans to increase its payout to 4.75 francs ($5.36), more than the dividend forecast of 4.50 francs. The 151-year-old insurer also reported profit that climbed 3.7 percent to 453 million francs last year, missing the 467.8 million-franc average analyst projection.

A gauge of European mining stocks rallied 2.6 percent. Anglo American Plc increased 4 percent to 1,498 pence as workers at its largest copper mine in Chile returned to work following violent protests yesterday. The company said that normal activity will resume at Los Bronces today as it evaluates the damage to the facility.

Kingfisher Plc (KGF) gained 6 percent to 430.8 pence after saying adjusted pretax profit advanced 4.1 percent to 744 million pounds, more than the 730.2 million-pound average analyst projection. The British home-improvement chain also said it would return about 200 million pounds to shareholders during its 2015 financial year.

Leoni AG slid 3.4 percent to 49.36 euros after forecasting earnings before interest and taxes of at least 200 million euros this year. Analysts had predicted Ebit of 226 million euros.

-

17:00

European stock close: FTSE 100 6,604.89 +84.50 +1.30% CAC 40 4,344.12 +67.78 +1.59% DAX 9,338.4 +149.63 +1.63%

-

16:00

Oil: an overview of the market situation

Oil prices rose slightly , due to concerns about further decline in production in Libya and hopes for economic stimulus measures in China.

Today, the National Oil Corporation said that oil production in Libya on Tuesday will decrease by 80,000 bpd to 150,000 bpd due to stop production at the field El Feel, due to the overlapping of the pipeline leading to the port of Melita .

"The situation in Libya to the extraction worse and worse, not including offshore oil and gas production has almost stopped ," - said analyst Olivier Jakob Petromatrix .

Hopes that China , the second largest oil consumer in the world, will act to support the economy by supporting prices. Stronger Chinese growth is likely to increase demand for oil and other commodities such as copper.

On the price of oil also affect the outcome of the meeting of leaders of the "Big Seven" , where it was decided to suspend cooperation with Russia in the G8 . Russian leaders also threatened sanctions against a number of sectors in the case of a further escalation of tensions in the Ukraine.

"Currently, the growth of the oil market is still worth geopolitics, mainly related events with Ukraine. Changes in the balance of supply and demand seem to have not such a strong impact on the market . Incoming news reinforce concerns about the fact that the crisis between the West and Russia may increase " , - said Saxo Bank strategist Ole Hansen .

We also add that investors expect the weekly U.S. inventory data to gauge the strength of oil demand from the largest consumer in the world.

Recall that today the American Petroleum Institute will release its report on stocks , while a government report , scheduled for Wednesday may show that oil stocks rose 2.5 million barrels in the week ended March 21. Data are also expected to show that stocks of distillates , including heating oil and diesel, fell by 1.1 million barrels , while gasoline stocks are projected to have declined by 1.7 million barrels.

May futures for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 100.07 per barrel on the New York Mercantile Exchange (NYMEX).

May futures price for North Sea Brent crude oil mixture rose $ 0.72 to $ 107.21 a barrel on the London exchange ICE Futures Europe.

-

15:40

Gold: an overview of the market situation

Gold prices fell sharply today, but standby output of key U.S. economic data led to recover to a session high . Also the cost increased due to short covering and increase reserves backed by gold exchange-traded funds .

"Support is provided growth stocks ETF, it is one of the main reasons to stabilize prices this year. Covering short positions at the beginning of the year , gold's appeal in developing countries as a reliable investment and crisis in Ukraine also support prices," - said the director of Societe analysis of commodity markets Generale Mark Keenan . " But these factors are short-lived . Macroeconomic background is still unfavorable for gold. Since the price could not go above $ 1,400 , the market returned to sales and a decrease in quotations " - added Keenan .

As for U.S. data , they showed that sales of newly built homes fell 3.3% to a seasonally adjusted annual rate of 440,000 compared with the previous month. Strong growth in January was revised downward to an annual rate of 455,000 . February sales were lower than expected by economists and 447,000 were at the lowest level since September.

Another report showed that consumer confidence index has improved markedly in March , while offsetting the decline in February . The index now stands at 82.3 points, compared with 78.3 points in February . Present situation index , meanwhile, fell to 80.4 points from 81.0 points, while the expectations index rose to 83.5 from 76.5 .

Recall that gold is under heavy selling pressure in recent sessions , as market participants and institutional investors have reduced long positions on expectations that the Fed may raise interest rates earlier than previously thought . Fed Chairman Janet Yellen said last week that the bank may start to raise interest rates after approximately 6 months after the QE program is completed, which is expected to happen this fall.

Meanwhile, it was reported that the world's largest reserves secured gold exchange-traded fund SPDR Gold Trust on Monday rose by 0.55 percent to 821.47 tons, and in terms of ounces of reserves peaked in December .

We also add that the physical market dealers point decline in demand from jewelers and individual investors , and the ">The cost of the April gold futures on the COMEX today rose to $ 1312.30 per ounce.

-

14:00

U.S.: New Home Sales, February 440 (forecast 447)

-

14:00

U.S.: Consumer confidence , March 82.3 (forecast 78.7)

-

13:59

U.S.: Richmond Fed Manufacturing Index, March -7 (forecast -1)

-

13:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.15, Y102.50, Y102.80/85, Y103.00, Y103.25, Y103.30

EUR/USD $1.3680, $1.3720/25, $1.3755, $1.3800, $1.3900

AUD/USD $0.9075, $0.9180/85

GBP/JPY Y171.00

USD/CAD Cad1.1140, Cad1.1150/60, Cad1.1200, Cad1.1250/60, Cad1.1275, Cad1.1300

GBP/USD $1.6705

EUR/CHF Chf1.2225

GBP/CHF Chf1.5000

USD/CHF Chf0.8860

-

13:34

U.S. Stocks open: Dow 16,356.13 +0.49%, Nasdaq 4,259.35 +0.78%, S&P 1,866.89 +0.51%

-

13:21

Before the bell: S&P futures +0.44%, Nasdaq futures +0.40%

U.S. stock-index futures advanced as investors awaited data on consumer confidence and new-home sales for clues on the strength of the world’s largest economy.

Global markets:

FTSE

6,598.26

+1.19%

CAC

4,340.99

+1.51%

DAX

9,345.46

+1.71%

Nikkei

14,423.19

-0.36%

Hang Seng

21,732.32

-0.52%

Shanghai Composite

2,067.31

+0.05%

Crude oil $100.01 (+0.42%)

Gold $1308.40 (-0.20%).

-

13:15

European session: the euro fell

09:00 Germany IFO - Business Climate March 111.3 110.9 110.7

09:00 Germany IFO - Current Assessment March 114.4 114.6 115.2

09:00 Germany IFO - Expectations March 108.3 107.7 106.4

09:30 United Kingdom Retail Price Index, m/m February -0.3% +0.5% +0.6%

09:30 United Kingdom Retail prices, Y/Y February +2.8% +2.6% +2.7%

09:30 United Kingdom RPI-X, Y/Y February +2.8% +2.6% +2.7%

09:30 United Kingdom Producer Price Index - Input (MoM) February -0.9% +0.4% -0.4%

09:30 United Kingdom Producer Price Index - Input (YoY) February -3.1% -5.3% -5.7%

09:30 United Kingdom Producer Price Index - Output (MoM) February +0.3% +0.2% 0.0%

09:30 United Kingdom Producer Price Index - Output (YoY) February +1.2% +1.0% +0.5%

09:30 United Kingdom BBA Mortgage Approvals February 50.0 50.0 47.6

09:30 United Kingdom HICP, m/m February -0.6% +0.5% +0.5%

09:30 United Kingdom HICP, Y/Y February +1.9% +1.7% +1.7%

09:30 United Kingdom HICP ex EFAT, Y/Y February +1.6% +1.6% +1.7%

11:00 United Kingdom CBI industrial order books balance March 37 30 13

Euro fell against the dollar on weak data on Germany from the IFO. Level of business confidence in Germany fell more than expected in March , according to the monthly report from the institute IFO. Business climate index , which reflects business sentiment fell to 110.7 from 111.3 in February, when according to the expectations index was down to 110.9 . Meanwhile, the assessment of current conditions improved to 115.2 from 114.4 in the previous month . Economists expected the index to rise slightly to 114.6 . The expectations index fell to 106.4 in March from 108.3 a month ago. Experts' forecasts were at 107.7 .

Furthermore, the pressure on the euro was head of the Bundesbank comments . Governor of the Bank of Germany Jens Weidmann said in an interview today MNI, that negative interest rates until represent a kind of " terra incognita ", and there is no certainty that they will help to lower rates on loans. Head of the Bundesbank , who is also a member of the ECB Governing Council , admitted that negative rates can be an adequate tool to curb growth in the euro , but this issue requires more careful consideration.

"We should discuss their efficiency, their costs and side effects , - said Weidmann . He also added that this is not intended to completely exclude an application QE. In addition, Weidmann said that in case of risks to price stability, followed by tightening monetary policy.

The British pound rose moderately against the U.S. dollar after a report on inflation. In the UK inflation slowed in February , as expected , to a four-year low due to lower transport prices showed Tuesday, official data Office for National Statistics . Consumer prices rose 1.7 percent year -on-year after increasing 1.9 percent in January. Growth rates in line with economists' expectations .

On a monthly measurement of consumer prices rose by 0.5 percent , according to the forecast , offsetting a drop of 0.6 percent in January . At the same time , core inflation , which excludes prices of energy, food , alcoholic beverages and tobacco , rose to 1.7 percent in February from 1.6 percent in January.

Another report showed that the number of mortgage certificates to purchase a home in the UK unexpectedly fell in February to its highest level in almost six and a half years , to reflect the latest data from the British Bankers Association (BBA).

Agreed amount of mortgage loans decreased from a seasonally adjusted 47,550 to 49,341 in January , which was revised to 49,972 . Economists had forecast an increase on the 50,000 figure . The level of January is the highest since September 2007 , when it was 54,148 . In February 2013 the number of certificates was 31,073 .

The total number of approvals , which includes re- mortgage and other secured borrowings , was 78,424 in February, compared with 81,047 in the previous month .

Gross mortgage borrowing increased by 47 percent annually to 11.5 billion pounds in February to the highest level since August 2008 . Credit card spending rose by 7 per cent compared with the previous year to 8.2 billion pounds . Deposits of individuals increased by 3.7 percent .

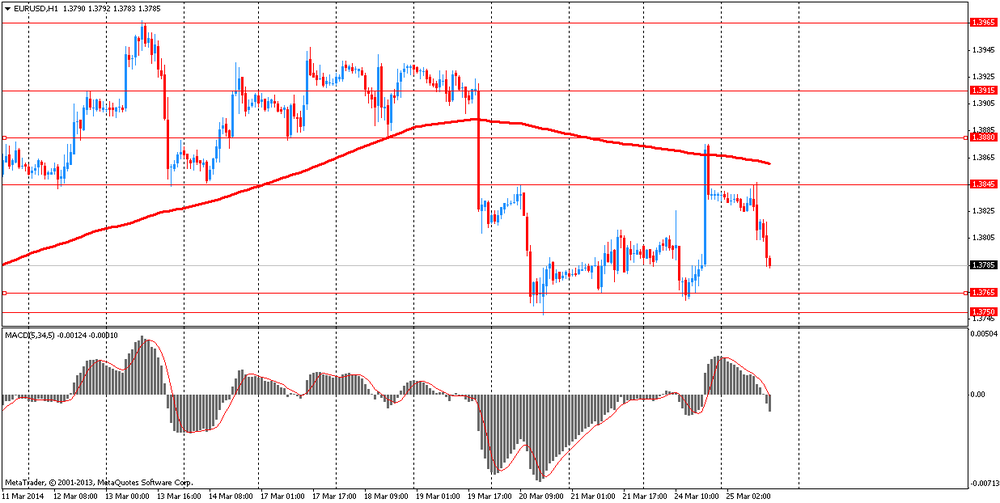

EUR / USD: during the European session, the pair fell to $ 1.3784

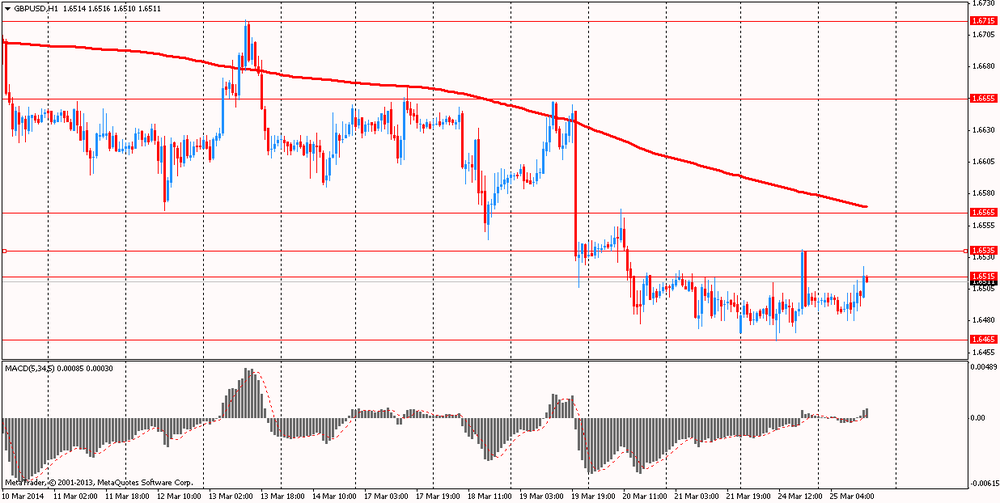

GBP / USD: during the European session, the pair rose to $ 1.6504

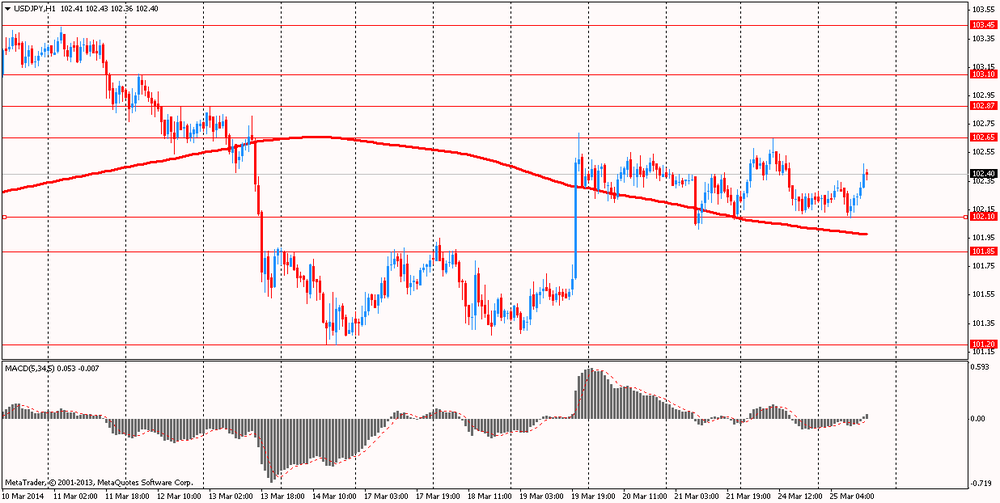

USD / JPY: during the European session, the pair rose to Y102.47

U.S. at 13:00 GMT release index of home prices in 20 major cities of S & P / Case-Shiller, national composite house price index S & P / CaseShiller January to 14:00 GMT - indicator of consumer confidence for March, sales in the primary market in February.

-

13:01

Upgrades and downgrades before the market open:

Upgrades:

Downgrades:

AT&T (T) downgraded to Neutral from Overweight at HSBC Securities; target lowered to $35 from $39

Other:

-

13:00

U.S.: Housing Price Index, y/y, January +7.4%

-

13:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, January +13.2% (forecast +13.3%)

-

13:00

U.S.: Housing Price Index, m/m, January +0.5% (forecast +0.7%)

-

12:45

Orders

EUR/USD

Offers $1.3950, $1.3930, $1.3890-910, $1.3845/50

Bids $1.3800, $1.3765/60, $1.3755-30, $1.3725/20, $1.3710/00, $1.3694

GBP/USD

Offers $1.6620, $1.6600, $1.6580/85, $1.6515/20

Bids $1.6470/65, $1.6455/50, $1.6410/00, $1.6385/80

AUD/USD

Offers $0.9245/50, $0.9200, $0.9155/60

Bids $0.9100, $0.9085/80, $0.9050, $0.9020/10, $0.9000

EUR/JPY

Offers Y142.50, Y142.00, Y141.45/50

Bids Y141.00, Y140.50/40, Y140.00

USD/JPY

Offers Y103.00, Y102.80, Y102.50

Bids Y102.00, Y101.80, Y101.50, Y101.25/20

EUR/GBP

Offers stg0.8450, stg0.8435/40, stg0.8420/25, stg0.8405/10

Bids stg0.8350, stg0.8320/15

-

11:30

European stocks rose

European stocks rose, following their biggest drop in more than two weeks, as investors awaited American data to gauge whether the world’s largest economy has rebounded from the harsh winter. U.S. index futures also climbed, while Asian shares were little changed.

A U.S. report at 10 a.m. in New York will show the Conference Board’s consumer-confidence index rose this month, according to a Bloomberg survey of economists. Consumer spending accounts for about 70 percent of economic activity in the U.S. A separate release at the same time will probably show new house sales in America declined last month after climbing in January to the highest level since July 2008, economists projected.

German business confidence slipped this month, data showed. The Ifo institute’s business-climate index, based on a survey of executives, fell to 110.7 from 111.3 in February. That missed the 110.9 median economist estimate compiled by Bloomberg.

EasyJet added 5.7 percent to 1,725 pence. The low-cost airline forecast a pretax loss for the first half of its financial year of 55 million pounds ($91 million) to 65 million pounds, narrower than its Jan. 23 prediction for a loss of as much as 90 million pounds.

Luxottica increased 4.3 percent to 40.65 euros. The world’s largest maker of glasses will design, develop and sell spectacles that use Google Glass technology, according to a joint statement late yesterday. Google Glass combines a small screen, camera and audio on a device worn at eye level. Luxottica owns the Ray-Ban and Oakley brands.

Baloise rose 2.6 percent to 111.90 Swiss francs after saying it plans to increase its payout to 4.75 francs ($5.38), more than the Bloomberg dividend forecast of 4.50 francs. The 151-year-old insurer also reported profit that climbed 3.7 percent to 453 million francs last year, missing the 467.8 million-franc average analyst projection compiled by Bloomberg.

FTSE 100 6,588.75 +68.36 +1.05%

CAC 40 4,325.16 +48.82 +1.14%

DAX 9,298.18 +109.41 +1.19%

-

11:00

United Kingdom: CBI industrial order books balance, March 13 (forecast 30)

-

09:45

Option expiries for today's 1400GMT cut

USD/JPY Y102.15, Y102.50, Y102.80/85, Y103.00, Y103.25, Y103.30

EUR/USD $1.3680, $1.3720/25, $1.3755, $1.3800, $1.3900

AUD/USD $0.9075, $0.9180/85

GBP/JPY Y171.00

USD/CAD Cad1.1140, Cad1.1150/60, Cad1.1200, Cad1.1250/60, Cad1.1275, Cad1.1300

GBP/USD $1.6705

EUR/CHF Chf1.2225

GBP/CHF Chf1.5000

USD/CHF Chf0.8860

-

09:33

United Kingdom: BBA Mortgage Approvals, February 47.6 (forecast 50.0)

-

09:32

United Kingdom: Producer Price Index - Output (YoY) , February +0.5% (forecast +1.0%)

-

09:32

United Kingdom: Retail Price Index, m/m, February +0.6% (forecast +0.5%)

-

09:32

United Kingdom: Retail prices, Y/Y, February +2.7% (forecast +2.6%)

-

09:31

United Kingdom: Producer Price Index - Input (MoM), February -0.4% (forecast +0.4%)

-

09:31

United Kingdom: Producer Price Index - Input (YoY) , February -5.7% (forecast -5.3%)

-

09:31

United Kingdom: Producer Price Index - Output (MoM), February 0.0% (forecast +0.2%)

-

09:30

United Kingdom: HICP, m/m, February +0.5% (forecast +0.5%)

-

09:30

United Kingdom: HICP, Y/Y, February +1.7% (forecast +1.7%)

-

09:30

United Kingdom: HICP ex EFAT, Y/Y, February +1.7% (forecast +1.6%)

-

09:23

Asia Pacific stocks close

Asian stocks swung between gains and losses, after the biggest rally in a month for the regional benchmark index yesterday, as data showed slowing U.S. factory activity and investors weighed prospects of recession in Russia. The gauge advanced 1.2 percent yesterday, the steepest rise since Feb. 21. Banks warned Russia’s economy is at risk of shrinking as the world’s leading industrial powers threaten further sanctions to deter it from invading other parts of Ukraine after the annexation of Crimea.

Nikkei 225 14,423.19 -52.11 -0.36%

S&P/ASX 200 5,336.63 -10.27 -0.19%

Shanghai Composite 2,067.31 +1.03 +0.05%

Tongda Group Holdings Ltd., a maker of casings for notebook computers, slumped 7.9 percent in Hong Kong after selling 600 million new shares.

Tingyi Holding Corp., a maker of instant noodles and beverages, rose 2.7 percent in Hong Kong after UBS AG upgraded the stock.

Sekisui House Ltd. dropped 1 percent after saying it found defects in a Tokyo residential complex being built by Taisei Corp.

-

09:01

Germany: IFO - Expectations , March 106.4 (forecast 107.7)

-

09:00

Germany: IFO - Business Climate, March 110.7 (forecast 110.9)

-

09:00

Germany: IFO - Current Assessment , March 115.2 (forecast 114.6)

-

08:40

FTSE 100 6,547.98 +27.59 +0.42%, CAC 40 4,297.58 +21.24 +0.50%, Xetra DAX 9,232.7 +43.93 +0.48%

-

06:39

European bourses are seen trading modestly higher Tuesday: the FTSE, DAX and CAC higher by around 0.2% to 0.3%

-

06:24

Asian session: The euro held

02:00 China Leading Index February +0.3% Revised From +1.2% +0.9%

04:45 Australia RBA Assist Gov Lowe Speaks

The euro held gains versus most of its major counterparts before a report today that may show business confidence in Germany, the region’s biggest economy, held near a 2 1/2-year high. The Ifo institute’s business climate index, which is a measure of sentiment in Germany and based on a survey of 7,000 executives, was probably at 110.9 this month, according to the median estimate of economists polled by Bloomberg News. The gauge rose to 111.3 in February, the strongest reading since July 2011.

Europe’s shared currency remained higher versus its U.S. peer before European Central Bank President Mario Draghi speaks today and after data yesterday signaled growth in manufacturing and services in the region stayed close to the fastest in almost three years. Draghi is scheduled to deliver a lecture in Paris today. He said this month the euro area’s economy was meeting the central bank’s baseline scenario of a gradual recovery, following a decision by policy makers to keep the benchmark rate at a record-low 0.25 percent.

The U.S. Commerce Department may say today new home sales fell 4.9 percent last month to a 445,000 annualized pace, according to the median forecast of analysts surveyed by Bloomberg. A separate report may show the Federal Housing Finance Agency’s home price index climbed 0.6 percent in January after a 0.8 percent advance the previous month.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3830-40

GBP / USD: during the Asian session, the pair traded in the range of $ 1.6490-05

USD / JPY: during the Asian session, the pair rose to Y102.35

The European calendar kicks off at 0745GMT, with the release of the French March business climate index, along with the service and manufacturing sentiment indices. At 0800GMT, the Spanish February PPI data will be released. The main European release comes at 0900GMT, when the German March IfO business climate index crosses the wires. the business climate is seen edging lower to 110.9, while the expectations index is seen slipping to 107.7 from 108.3. Across the Atlantic, the calendar gets underway at 1145GMT, when the ICSC-Goldman Store Sales data for the March 22 week are published. The Redbook Average for the same period are set for release at 1255GMT. At 1300GMT, the January FHFA Home Price Index and the January S&P/Case-Shiller Index will cross the wires. February New Home Sales data will be released at 1400GMT, along with the Conference Board's March Consumer confidence data. Central bankers are set to appear late in the day. At 2100GMT, Atlanta Federal Reserve Bank President Dennis Lockhart will hold a fireside chat on the economic outlook, in Atlanta. At 2300GMT, Philly Fed President Charles Plosser will give a speech on the economic outlook and monetary policy, in New York. -

02:09

China: Leading Index , February +0.9%

-