Notícias do Mercado

-

23:49

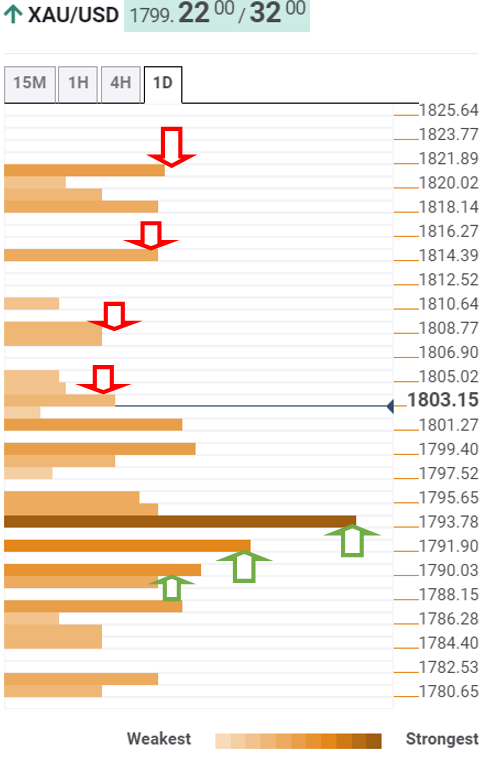

Gold Price Forecast: XAU/USD pierces $1,800 as US T-bond yields rise

- Gold aims higher, as nervousness grows on investors, of what the Federal Reserve might do next.

- The ECB adds to the growing list of central banks, saying that inflation might not be as “transitory” as expected, but expects it to fade in 2022.

- XAU/USD: The yellow-metal gained traction, as the US dollar index plunged 0.71%, well below 93.40.

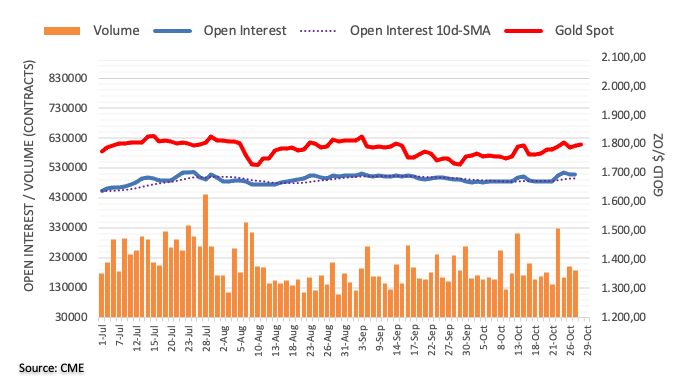

Gold (XAU/USD) climbs during the Asian session, is up 0.09%, trading at $1,800.00 a troy ounce at the time of writing. The non-yielding metal recovered some of its brightness as it seesawed on Thursday.

Risk-on market sentiment kept investors in and out of gold, thus spurring violent swings in the yellow metal. Further, slower than expected US economic growth and central bank tightening dents the prospects on the greenback, ultimately favoring gold.

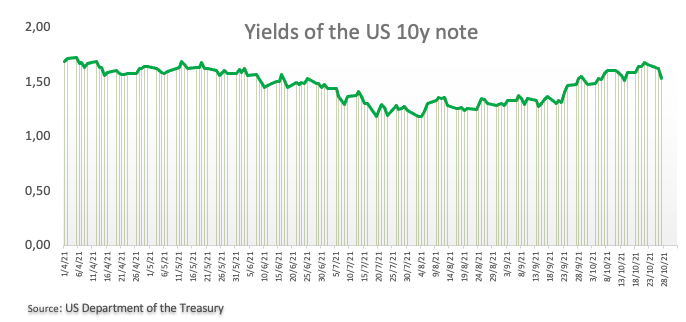

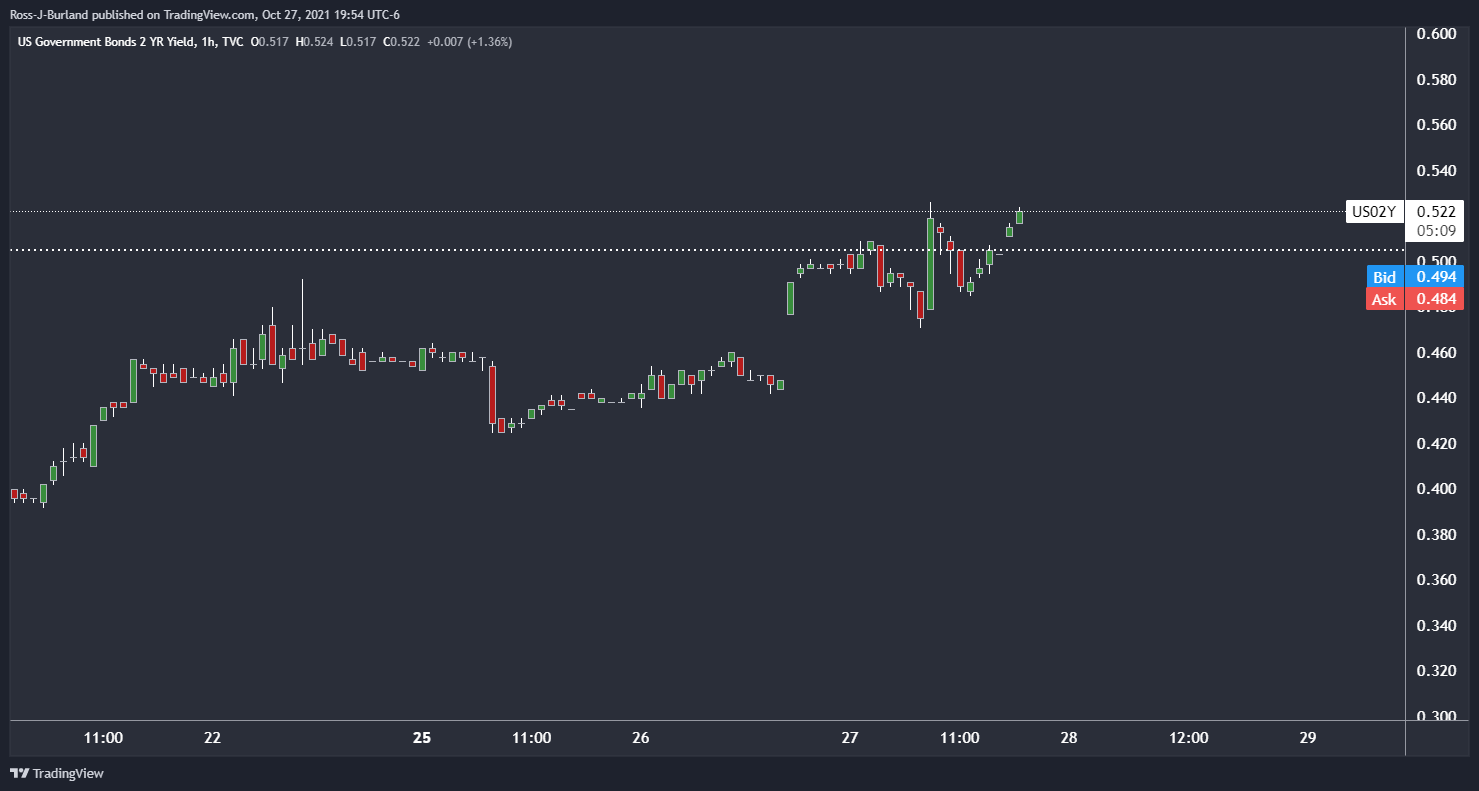

In the meantime, the US T-bond yields rose in the session, with the 10-year note improving to 1.578%, up to four basis points. Meanwhile, the US Dollar Index fell 0.71%, sitting at 93.35.

On Thursday, the European Central Bank (ECB) President Christine Lagarde said that higher inflation might be around for longer than expected. However, the bank estimates prices will start moderating in 2022.

That said, expectations around gold lie heavily on the Federal Reserve November meeting. A $15 Billion bond taper is priced in. However, If the Federal Reserve aims for a quicker than expected bond-tapering, that might send gold tumbling below the $1,720 threshold and potentially towards a renewed test of 2021 lows.

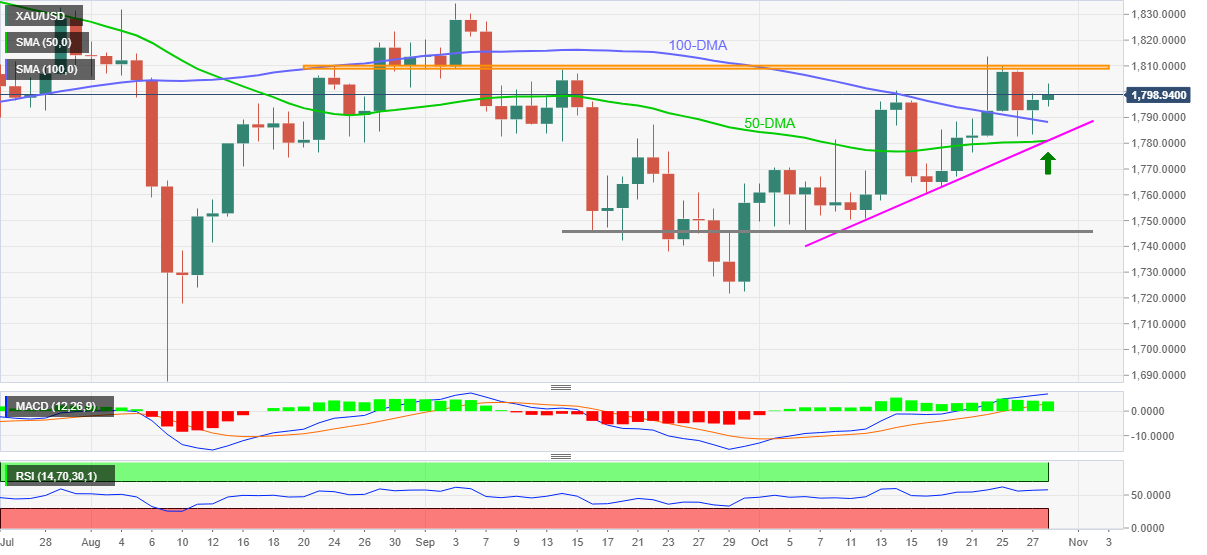

XAU/USD Price Forecast: Technical outlook

Daily chart

Gold (XAU/USD) spot price is above the confluence of the 100 and 200-day moving average (DMA) and on Tuesday broke a downward slope trendline previously resistance-turned-support, which could be viewed as a bullish signal. The Relative Strength Index (RSI) is at 58, aims slightly low, but as it remains above the 50-midline, it is bullish for the yellow metal.

To resume the upward trend, gold buyers will need a daily close above $1,800. In that outcome, the September 3 high at $1,834 would be the first resistance level. A clear break above the latter would expose the June 4 low at $1,855, followed by the $1,900 threshold.

-

23:41

AUD/USD consolidates gains above 0.7500 ahead of Aussie Retail Sales

- AUD/USD prints mild losses after refreshing three-month high.

- Market sentiment worsens amid an absence of US stimulus deal.

- Softer US GDP, ECB announcements dragged down USD despite firmer Treasury yields.

- Australia Q3 PPI, Retail Sales for September can direct immediate moves ahead of US Core PCE Inflation data.

AUD/USD struggles to extend the four-day uptrend around the highest levels since July, down 0.11% intraday around 0.7535 during Friday’s initial Asian session. In doing so, the quote portrays a cautious mood in the market ahead of the key Aussie and the US data.

In addition to the cautious mood ahead of Australia’s third-quarter (Q3) Producer Price Index (PPI) and September’s Retail Sales, an absence of a deal on the US President Joe Biden’s $1.75 trillion stimulus package also weigh on the market sentiment and the AUD/USD prices. On Thursday, US Democrats discussed details of President Biden’s infrastructure plan but some on the floor reject voting on the package unless getting final blueprints, delaying the vote to the next week.

Elsewhere, fresh chatters over inflation and firmer monetary policies also sour the sentiment. Although the US Q3 GDP’s weakness hints at the Fed’s slower rush towards monetary policy tightening, inflation expectations remain near a multi-year high in the US and Eurozone, which in turn joins the covid-led supply crunch to push policymakers towards tightening. Hence, the fears of the Fed calling an end to the easy money loom and challenge AUD/USD prices.

During the previous day, the US Dollar Index (DXY) dropped the most since October 13 after the US Q3 GDP US Q3 GDP slipped below 2.7% forecast to 2.0%, much lower than 6.7% prior. Also, the European Central Bank’s (ECB) hint to start tapering the monthly bond purchases and the PEPP (that’s the pandemic emergency purchase program) will end next March propelled the Euro and weighed down the USD. The regional central bank left monetary policy unchanged, as expected, with refinancing rate at 0.0% and deposit rates at -0.5%.

Amid these plays, the S&P 500 Futures print mild losses after the Wall Street benchmark closed positive, exerting additional downside pressure on the AUD/USD prices.

Given the anticipated QoQ weakness in the PPI, from 0.7% to 0.3%, contrasting the strong YoY expectations of 3.2% versus 2.2% prior, the Reserve Bank of Australia (RBA) may not gain much information about the factory gate inflation. Hence, the data may offer little direction to the AUD/USD prices. However, an anticipated jump in the Aussie Retail Sales, from -1.7% to +0.2% for September may hint at a further tightening of the monetary policy and rate hikes after the early week’s firmer inflation numbers, which in turn could help the quote poke July’s high of 0.7599 on positive release.

Following the Aussie data, Fed's preferred inflation gauge, namely Core Personal Consumption Expenditures (PCE) - Price Index for September will be in focus.

Read: Personal Consumption Expenditure Price Index September Preview: Transitory inflation becomes permanent

Technical analysis

AUD/USD grinds higher around July top amid sluggish Momentum line. However, the Aussie pair confirmed the bullish pennant and hence kept the buyers hopeful of revisiting the June high surrounding 0.7775 on the previous day’s sustained break of 0.7535. However, tops marked during late June around 0.7620 may offer an intermediate halt during the rally.

In a case where the bears sneak in, a downside break of the pennant’s support line, at 0.7485 by the press time, a convergence of the 100-SMA and monthly support line near 0.7420 will be eyed for further weakness.

-

23:41

USD/JPY refreshes daily lows below 113.55 ahead of UK/Japan data

- USD/JPY consolidates below 113.55 in the initial Asian session.

- The US dollar trades at four-week lows despite higher US T-bonds yields.

- BOJ interest rate decision and forecast, and mixed economic data supported the yen.

USD/JPY remains subdued on the last trading day of the week, following the previous session’s downside movement. The pair stayed in a narrow trading range. At the time of writing, USD/JPY is trading at 113.58, up 0.01% so far.

The US dollar index traded near, lowest in four weeks after GDP growth came below the forecast of 2% and PCE prices increased faster than anticipated.

On the other hand, the Japanese yen gained some traction after the Bank of Japan (BoJ) policy update. The BoJ maintained the status quo while keeping the cash rate low at -0.10%. The central bank also trimmed this year’s consumer inflation forecast to 0% from 0.6%.

It is worth noting that, S&P 500 Futures are trading at 4,577.50, down 0.23% so far.

As for now, traders are waiting for Japan Unemployment Rate, Consumer Confidence, US Personal Income and Spending to gauge the market sentiment.

-

23:22

AUD/JPY Price Analysis: Upside move capped at 86.00, doji clouds the uptrend

- AUD/JPY has been trapped within the 85.00-86.00 range in the last three days.

- AUD/JPY: Long-wicks on both sides of a doji depicts indecision between buyers/sellers.

- AUD/JPY: RSI at overbought levels could spur a correction towards 84.61 before resuming the uptrend.

The AUD/JPY hovers around familiar levels, unable to break in either direction, is trading at 85.57 during the day at the time of writing.

On Thursday, the market sentiment was upbeat, as portrayed by US stocks finishing in the green. Further, as the Asian session begins, investor mood turns sour, depicted by Asian equity futures dropping, except for the Japanese Topix and the Australian S&P/ASX 200.

AUD/JPY Price Forecast: Technical outlook

Daily chart

The daily chart portrays the cross-currency has an upward bias, depicted by the daily moving averages (DMA’s) remaining below the spot price with an upslope confirming the solid uptrend.

The pair has been unable to break to the upside, despite three previous attempts amid having a risk-on market sentiment, which usually benefits the risk-sensitive Australian dollar.

Furthermore, Wednesday’s price action formed a doji, with long wicks on both sides, confirming indecision between buyers/sellers.

Furthermore, the Relative Strength Index (RSI) is at 72 in overbought levels, indicating the AUD/JPY pair may retreat, allowing the RSI indicator to exit from the abovementioned conditions before resuming the uptrend.

Therefore, in case of a lower correction, the first meaningful support level would be the October 22 low at 84.61

-

23:15

EUR/USD Price Analysis: 50-DMA, monthly trend line check heaviest daily jump since May

- EUR/USD seesaws around monthly high following the biggest daily rise in five months.

- Bullish MACD, firmer RSI line keep buyers hopeful.

- Pullback moves may eye October 19 peak, key Fibonacci retracements can also test the bulls.

EUR/USD edges higher around one-month high, taking rounds to 1.1680 during Friday’s initial Asian session. The major currency pair jumped the most since early May the previous day and refreshed the monthly peak.

However, an upward sloping trend line from October 04 questioned the quote’s further upside before the 50-DMA hurdle that’s standing nearby.

Given the bullish MACD signals and the firmer RSI line, now overbought, the EUR/USD upside is likely to prevail. Though, a clear break of the stated resistance line and DMA, respectively around 1.1690 and 1.1700, becomes necessary to rule out chances of a pullback.

Following that, 50% and 61.8% Fibonacci retracement levels of September-October fall, near 1.1720 and 1.1760 in that order will question the EUR/USD bulls.

Meanwhile, pullback moves may test the previous high of the current month, around 1.1670, a break of which will recall the 1.1630 support to the chart.

It should be noted, however, that the 21-DMA at 1.1600 and an ascending support line from October 12 close to 1.1585 become tough challenges for EUR/USD sellers to tackle before retaking the controls.

EUR/USD: Daily chart

Trend: Pullback expected

-

22:52

GBP/USD: Softer USD cover Brexit wounds near 1.3800, focus on US Core PCE Inflation

- GBP/USD grinds higher following the biggest daily jump in over a week.

- France details UK ships, Britain summons French ambassador with readiness to retaliate.

- Softer US GDP, ECB announcements dragged down USD despite firmer Treasury yields.

- Risk catalysts can entertain ahead of Fed’s preferred inflation gauge’s release.

GBP/USD reacts to Brexit jitters with a cold heart, despite easing a bit from weekly top to 1.3800 by the press time of the initial Asian session on Friday. That being said, the cable pair seems to cheer the US dollar weakness amid risk-on mood.

“A British trawler has been seized by France and another has been fined, amid an escalating row over post-Brexit fishing rights,” said the BBC late Thursday to mark the fresh Brexit drama as the policymakers jostle over Article 16. Following that, an update showed that the UK summoned the French ambassador over the issue while Sky News reported Britain’s readiness to clash with the European Union (EU) over fallout from the key Northern Ireland (NI) protocol.

Read: Brexit saga continues and risk for GBP amount as traders brace for major clash

Other than the Brexit drama, the recent jump in the UK’s coronavirus cases and the covid-led fatalities also challenge the GBP/USD buyers. Britain registered the highest covid numbers and death toll since March before the figures eased on Thursday to 39,842 and 165 respectively. Even so, the UK removes the last seven countries from its travel red list.

UK Chancellor Rishi Sunak’s multi-billion Pound worth of budget 2021 and hints to taper the bond issuance, which indirectly signal the Bank of England’s (BOE) hawkish move, seems to play a distant role in the GBP/USD upside.

More importantly, the heaviest daily fall in 12 days by the US Dollar Index (DXY) could be linked to the cable pair’s run-up. The greenback gauge dropped the most since October 13 the previous day after US Q3 GDP slipped below 2.7% forecast to 2.0%, much lower than 6.7% prior. The softer GDP growth pushes the Fed to slow down on its monetary policy normalization rush.

It should be observed that the European Central Bank’s (ECB) hint to start tapering the monthly bond purchases and the PEPP (that’s the pandemic emergency purchase program) will end next March propelled the Euro and weighed down the USD. The regional central bank left monetary policy unchanged, as expected, with refinancing rate at 0.0% and deposit rates at -0.5%.

Amid these plays, Wall Street managed to recover Wednesday’s losses on Thursday while the US 10-year Treasury yields rose 4.9 basis points (bps) to 1.578% by the end of Thursday’s North American session.

Looking forward, Brexit, tapering and inflation headlines remain hot to determine near-term GBP/USD moves and hence today’s US Core PCE Inflation data for October, Fed’s favorite price pressure indicator will be important to watch. The Core Personal Consumption Expenditures (PCE) - Price Index for September is likely to ease to 0.2% from 0.3% prior on the MoM basis.

Read: Personal Consumption Expenditure Price Index September Preview: Transitory inflation becomes permanent

Technical analysis

GBP/USD rebounds from 50-DMA, around 1.3710 by the press time, to portray the previous day’s upside moves, which in turn joins bullish MACD signals and firmer RSI to direct the quote towards 200-DMA hurdle surrounding 1.3855.

-

22:32

NZD/USD hovers near 0.7200 amid broad US dollar weakness

- On Thursday, the NZD/USD trimmed Wednesday’s losses, approaching 0.7200.

- Overall, US dollar weakness dents the prospects of the greenback, despite higher US bond yields.

- US GDP for the Q3 was lower than expected shows that the US economy could be slowing.

The NZD/USD advances as the New York session end, is up 0.43%, trading at 0.7198 at the time of writing. Market sentiment is upbeat, portrayed by US equity indices finishing in the green, posting gains between 0.68% and 1.15%. Factors like US corporate earnings have kept investors looking for riskier assets, hurting safe-haven currencies like the US dollar, the Japanese yen, and the Swiss franc.

Furthermore, the US Dollar Index, which tracks the greenback’s performance against a basket of its peers, plummeted 0.71 %, to sit at 93.35, despite higher US Bond yields. In the meantime, the US 10-year benchmark note rose by five basis points, currently at 1.578%.

US GDP for the Q3, lower than expected, as growth seems to be peaking, but inflation not

An absent New Zealand economic docket left the pair’s behavior at the dynamics of the US dollar.

Meanwhile, the US economic docket unveiled mixed data, being the highlights the less than expected growth in the US economy, with the Gross Domestic Product for the third quarter growing 2%, just short of the 2.7% estimated, missing widely against 6.1% growth in the previous period reading. Contrary, the US Initial Jobless Claims rose to 281K, lower than the 290K estimated by analysts, showing the US labor market has been improving throughout the last month.

The NZD/USD traders now will turn their attention to the next week, when the Federal Reserve will unveil its monetary policy decision. Investors already priced in a mid-November bond tapering start, but recent US economic data could push it backward, resulting in US dollar weakness and New Zealand Dollar strength.

NZD/USD Price Forecast: Technical outlook

1-Hour chart

The 1-hour chart depicts the NZD/USD pair is tilted to the upside, with the 50, 100, and 200-simple moving averages (SMA’s) remaining beneath the spot price. Also, a rising upslope trendline that travels from the October 27 low towards the October 28 low would cap any downward move that could threaten to break below the SMA’s.

Furthermore, the Relative Strength Index at 61 aims higher with enough room to support another NZD/USD leg up before turning overbought.

Therefore, a break above the 0.7200 figure is on the cards, but strong resistance would lie on 0.7220, unsuccessfully tested three times before.

-

22:26

RBNZ’s Orr: We are now entering a different environment for rates, inflation

“Monetary policy has largely run its easing course globally,” said Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr during early Friday morning in Asia.

The RBNZ boss adds, “We are now entering a different environment for rates, inflation.”

More to come….

FX implications

NZD/USD remains on the front-foot, backed by the broad US dollar weakness, despite the recent pullback to 0.7200.

-

22:01

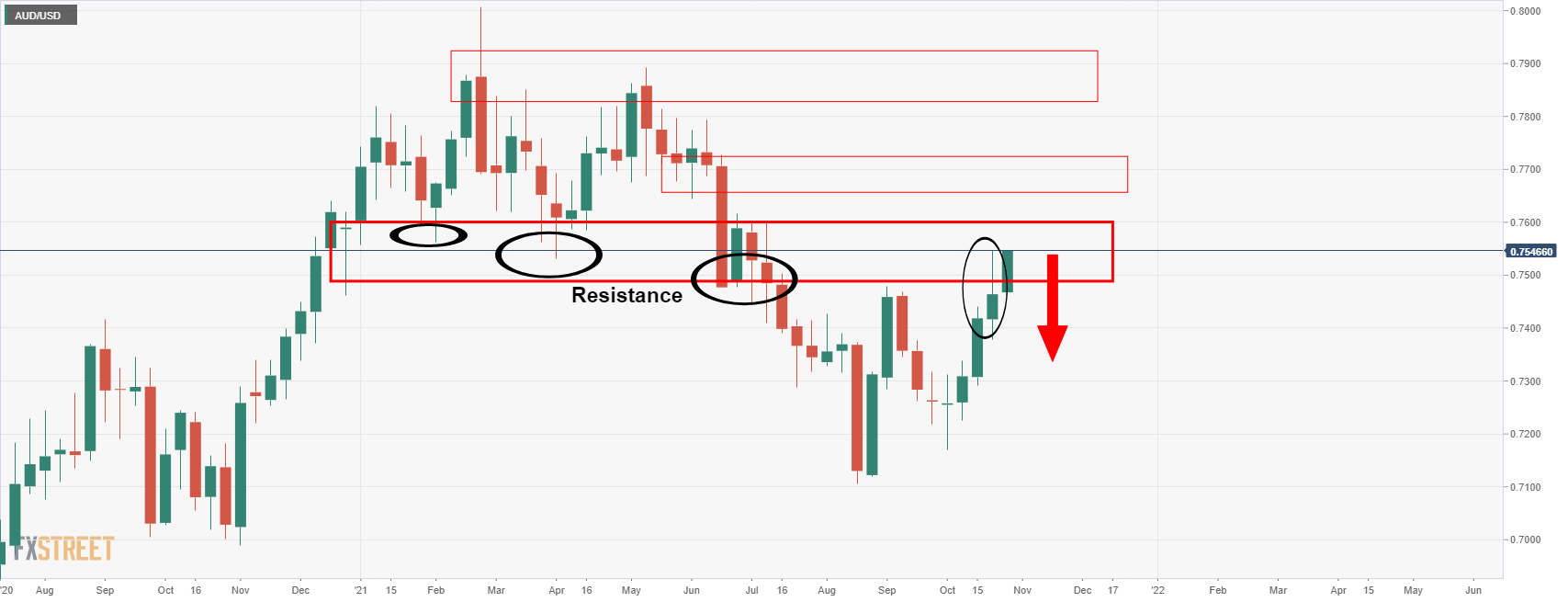

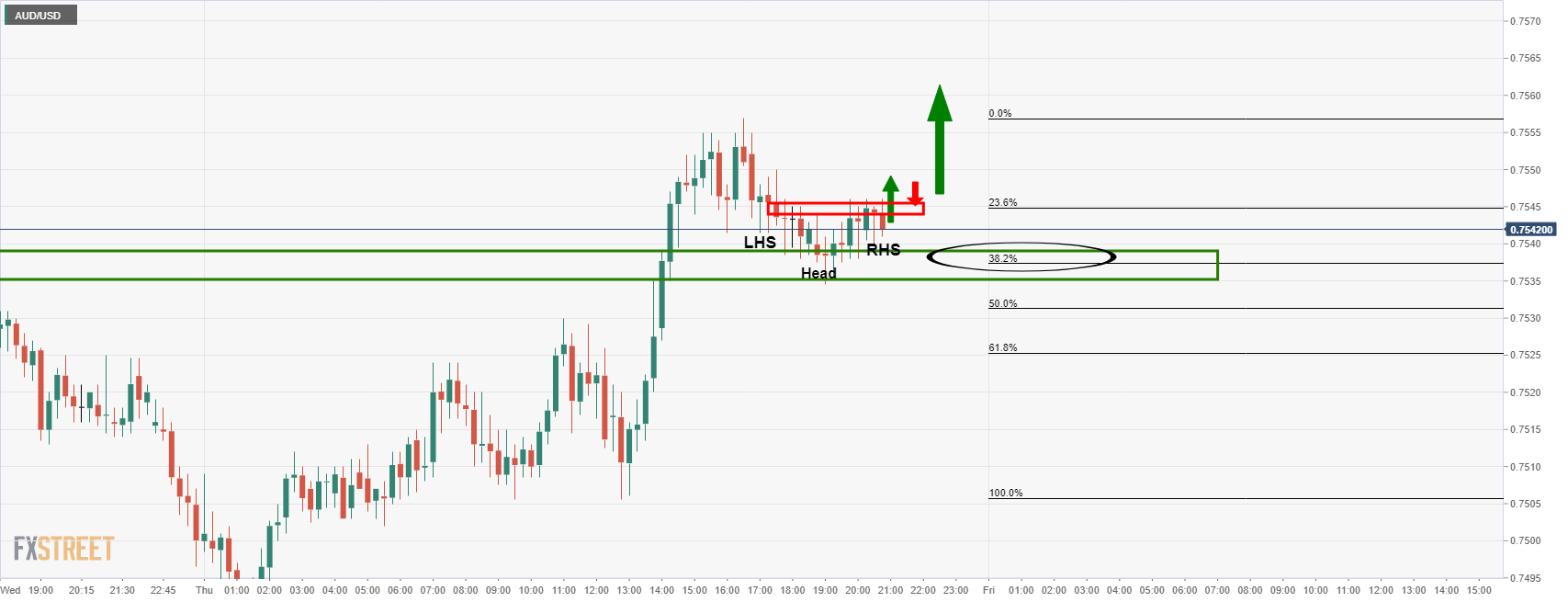

AUD/USD Price Analysis: Bulls eye a fresh cycle high for the session ahead

- AUD/USD bulls eye a scalping opportunity for a fresh cycle high in today's Asian session.

- Weekly and daily resistance could be a tough nut to crack on the way to 0.76 the figure.

AUD/USD has been an impressive run of late to the upside and there are prospects of higher highs within this currency bullish cycle. However, we have both weekly and daily resistances surrounding 0.76 the figure, but a scalping opportunity is taking shape on the 1hour and 150min time frames for the session ahead.

AUD/USD daily chart

The price has moved higher in a fresh daily impulse which could equate to further upside to challenge the 0.7650s in the coming days. However, chasing the price at this stage is risky for there is yet to be a significant pull back into 10 and 21 moving averages:

As illustrated, there is a meanwhile resistance at this juncture when looking all the way back to the end of 2020. Also, more often than not, we get a convergence of the price with the EMAs shortly after such a breakout from where bulls might want to engage on signs of stabilisation and bullish tendencies in the price action.

AUD/USD weekly chart

The weekly chart illustrates the resistance more clearly. The price has filled in last week's wick and faces 0.7600 psychological resistance.

However, from an hourly perspective, there are prospects of a scalp to the upside and to test the current daily support as follows:

AUD/USD 1HR chart

AUD/USD bulls are moving in on the correction of the hourly bullish impulse. Should there be a break of the 0.7545 level, bulls will be looking for an optimal entry point, potentially on a restest of 15-min structure as follows:

As illustrated, there are prospects of a bullish reverse head and shoulders in the making. A break of the neckline and restest could be where bulls will be interested to enter for a run into the 0.7560s for the Asian session. Retail Sales is going to be a potential mover today.

-

22:00

South Korea BOK Manufacturing BSI below expectations (91) in November: Actual (87)

-

21:31

Breaking: Apple (AAPL) Q4 misses on supply chain issues, CEO says holiday quarter impact to be worse

Update: Apple CEO Tim Cook told Reuters Apple had "larger than expected supply constraints" , "We're doing everything we can do to get more (chips) and also everything we can do operationally to make sure we're moving just as fast as possible," Cook said. "We're projecting very solid demand growth year over year. But we are also predicting that we're going to be short of demand by larger than $6 billion," Cook added.

Apple (AAPL) reported earnings after the close on Thursday. Earnings Per Share (EPS) came in at $1.24 versus the estimate of $1.24. Revenue came in at $83.36 billion versus the estimate of $84.85 billion.

Apple stock forecast

Apple stock is trading at $146.7 in the aftermarket for a loss of 3.85%.

-

21:05

Breaking: Amazon (AMZN) Q3 earnings misses estimates on EPS and revenue

Amazon (AMZN) reported earnings after the close on Thursday. Earnings Per Share (EPS) missed estimates, coming in at $6.12 versus $8.92. Revenue also missed estimates, coming in at $110.8 billion versus the $111.6 billion estimate.

Amazon stock forecast

Amazon (AMZN) stock is trading at $3300.70 in the after hours a loss of 4.2%.

-

20:46

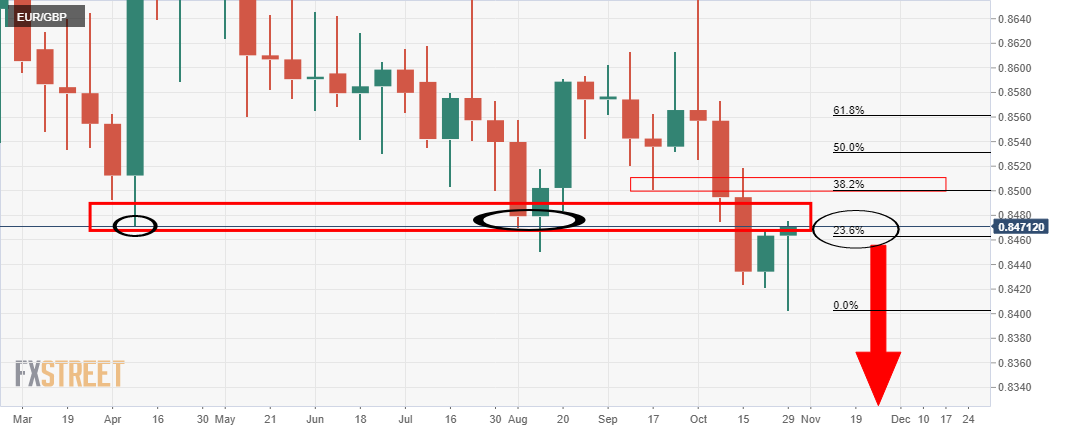

EUR/GBP Price Analysis: Trapped market, but opportunities are ripening

- EUR/GBP is trapped from a 4-hour perspective.

- Bulls are on the lookout for a break of current weekly resistance for a deeper correction.

- Scalpers are monitoring the faster price action and near-term support for a possible 50% mean reversion opportunity.

The price of the cross has been correcting the weekly bearish impulse and traders are awaiting the next moves in the pair for an optimal entry. The following illustrates the weekly, 4-hour and 1-hour markets structure and potential trading opportunities on the horizon.

EUR/GBP weekly chart

The price of EUR/GBP has seen a strong correction as per the weekly chart and the neckline of the M-formation is compelling given the confluence with the 38.2% Fibonacci retracement level near to 0.85 the figure. However, the price still needs to surpass the current resistance as illustrated below:

The price is meeting the 23.6% Fibo that has a confluence with the prior summer and April lows near 0.8472.

Meanwhile, from a 4-hour perspective the market is trapped between support and resistance as follows:

EUR/GBP 4HR chart

Until the price can break either above 0.8490 or below 0.8420, there is little bias one way or the other and scalping on the lower timeframes are where the opportunities stay for now.

EUR/GBP 1HR chart

The 50% mean reversion target aligns well with the structure looking left from the current price. bears will likely look to engage once the current support is broken, looking for bearish structure and favourable momentum.

-

20:38

Forex Today: Dollar’s selling spiral may continue on Friday

What you need to know on Friday, October 29:

The dollar tumbled after two first-tier events, ending the day sharply lower across the FX board. The preliminary estimate of Q3 Gross Domestic Product was up a modest 2%, missing expectations. Wall Street recovered from Wednesday’s slump, as poor growth hints at less aggressive financial tightening.

The European Central Bank left its monetary policy unchanged as anticipated. The statement was pretty much a copy of the previous meeting, with policymakers pledging to maintain financial support for as long as needed and repeating that inflation will soon recede from the current 13-year high.

Among other things, President Christine Lagarde said that the PEPP will likely end on March 2020, as originally planned, but added that no rate hikes are to be expected throughout 2022. “What comes next, we will discuss in December,” she said. About inflation, she blamed it on higher energy prices and supply chain issues, but those able to read between lines noted that she and her colleges are more concerned than what they showed.

Brexit jitters returned. France detained a UK boat and another has been fined, amid an escalating row over fishing rights. The British government summoned France's ambassador to clarify the situation.

The EUR/USD pair flirted with the 1.1700 level, now hovering in the 1.1680 price zone. GBP/USD met sellers around 1.3800, with Brexit headlines capping the advance.

Commodity-currencies gained traction, with AUD/USD reaching its highest since early July. CAD gains were tepid, as oil prices remain subdued.

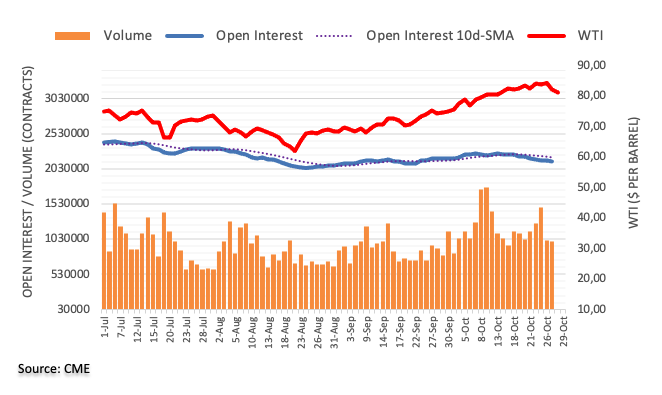

Gold struggled to overcome the 1,800 level despite the broad dollar’s weakness, settling at $1,798 a troy ounce. WTI ended the day at $82.80 a barrel.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos slow down while bulls defend the uptrend

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:38

GBP/JPY struggles at 156.50 amid risk-on market sentiment, after BoJ meeting

- The British pound recovered from Wednesday’s losses, but the upside move was capped due to a lack of follow-through.

- The market sentiment is upbeat, boosting risk-sensitive currencies except for the GBP.

- GBP/JPY: Tilted to the upside from a technical perspective, but price action reflects exhaustion in the recent upside move.

The GBP/JPY edges up during the New York session, trading at 156.55, up 0.07% at the time of writing. Positive market sentiment surrounds the financial markets, with US stock indices rising between 0.37% and almost 1%. Furthermore, bond yields are rising during the day as more central banks become aware that the “transitory” thesis appears to wane.

On the subject mentioned above, the European Central Bank (ECB) President Christine Lagarde said that higher inflation might be around for longer than expected. However, the bank estimates prices will start moderating in 2022.

On Thursday, earlier in the Asian session, the Bank of Japan (BoJ) held its monetary policy decision. The BoJ kept interest rates at -0.10% as expected while maintaining the Yield Curve Control (YCC) in an 8-1 vote, with member Kataoka dissenting on the subject.

There was no follow-through to the BoJ announcement as most Japanese yen pairs remained at familiar levels.

On Friday, the Japanese economic docket will feature the Tokyo Consumer Price Index figures. Furthermore, employment figures with the Jobs / Applicants Ratio and Unemployment Rate will offer some insights to GBP/JPY traders about the Japanese economy.

GBP/JPY Price Forecast: Technical Outlook

Weekly chart

The weekly chart depicts the GBP/JPY pair is in a solid upward trend portrayed by rising slope weekly simple moving averages (WSMA’s) located beneath the spot price, alongside a test of the February 2, 2018, resistance level at 156.61. Since July, the cross-currency has appreciated 6.50%, and the 100-WSMA is just crossing over the 200-WSMA, adding another bullish sign to the previously mentioned hints.

Furthermore, an upward slope trendline that travels from March 2020 lows under September 2020 lows was unsuccessfully tested by the GBP/JPY pair, which bounced off at 150.00, rallying over 700 pips until finally settling at current levels.

Hence, the pair could be headed towards the upside. However, the lack of recent price action above the 156.00 threshold leaves June 24, 2016, swing highs around 159.20 as the next resistance level.

-

20:02

EUR/USD consolidates near 1.1700 as the US dollar tumbles

- The euro rallies towards 1.1700 against a weaker US dollar.

- The greenback tumbles as US GDP data disappoints.

- EUR/USD rally to 1.1680 expected to be short-lived – TDS.

The euro has surged about 0.75% against the US dollar so far today to post its strongest daily performance over the last months. The pair accelerated its recovery from week lows at 1.1580 area, to consolidate a few pips shy of 1.1700, favored by broad-based USD weakness.

The dollar dives on downbeat US GDP data

The US dollar has tumbled on Thursday, hammered by the disappointing Gross Domestic Product figures released by the US Commerce Department. According to advanced estimations, US economic growth decelerated to a 2% pace in the third quarter, from 6%, even below the 2.7% pace expected. Supply chain restrictions and a sharp decline in consumer spending have been singled out as the main reasons behind the economic slowdown.

The third quarter’s data represents the weakest performance since the second quarter of 2020, with economic activity hampered by the first COVID-19 restrictions, and have crushed hopes of a strong post-pandemic recovery.

Furthermore, the impact of the dovish European Central Bank’s monetary policy statement on the euro has been muted. The ECB has stuck to the plan, with President, Christine Lagarde pushing rate hike hopes back to, at least, late 2022, as, according to the Bank, inflationary pressures will decline in the course of next year.

EUR/USD rally is expected to be short-lived – TDS

FX Analysts at TD Securities, contemplate the current euro recovery as a corrective reaction with a limited scope: “We think that there is some risk of EUR/USD testing 1.1680 resistance, but extrapolating beyond that seems like a big ask a week ahead of the Fed's meeting where tapering will be announced (…) As much as we think there is scope to test 1.1680 resistance, this should be short-lived.”

Technical levels to watch

-

19:53

Gold Price Forecast: Bulls break the 200-day EMA, eye $1,830s

- Gold is trying to move through the 200-day EMA as the US dollar drops.

- ECB sound the inflation concerns which sends EUR higher across the board.

- US rates and DXY are in focus while US GDP disappoints and easy growth is in the rear-view mirror.

The price of gold has been rising across the daily trendline support and taking on the 200-day EMA. The upside in gold is lacking conviction as it struggles to take off despite the intensifying concerns about global inflation.

At the time of writing, XAU/USD is trading around $1,801.50. Gold has travelled between a low of $1,792.42 and $1,810.50 on a volatile day in the forex space which has taken the greenback lower, supporting gold.

The volatility came in a busy day of central bank-driven activity this week that started in Australia (Inflation came in hot), Japan (bucking the inflation trend) and then Europe and precedes a meeting of the US Federal Reserve next week.

"The market is very much triggered and sensitive to inflation worries and this notion that central banks are behind the curve," said Mazen Issa, senior currency strategist at TD Securities. A contributing factor to the volatility, Issa said, is the approaching end of the month when more investment managers rebalance their portfolios across currencies.

The key focus was with the European Central Bank. The outcome of the meeting on Thursday sent the euro rising sharply against the US dollar. Markets are trying to sort through moves in the interest rate markets and comments by the European Central Bank President Christine Lagarde.

Prior to her presser, the euro moved little as the ECB, as expected, kept policy unchanged, reaffirming its plan to keep buying bonds and hold down interest rates for years to come. However, Lagarde's comments were taken as less dovish for the concerns that inflation was not as transitory as first thought.

The ECB still sees the period of higher inflation as transitory but has become much more balanced with its inflation analysis, paving the way for further asset purchase reductions in December. Lagarde preempted parts of the ECB’s December debate by announcing that she expected the Pandemic Emergency Purchase Programme (PEPP) to end as planned in March next year.

US dollar sent packing

DXY has dropped to 93.278 on the day from a high of 93.969 which has seen a spike in the daily ATR and a test of the daily trendline support.

US yields are helping to support the greenback off the lows of the day. However, if the 10-year fails to reclaim territory back within the ascending trend, as marked by the daily counter-trendline, then the downside is more probable. A Head & Shoulders could be in the making here:

US GDP decelerates

Meanwhile, US Gross Domestic Product growth decelerated to 2.0% in Q3 from 6.7% in Q2. A large part of the slowing in US GDP growth in the third quarter can be attributed to supply chain disruptions limiting the availability of products for purchase.

The economy is expected to grow more quickly in the fourth quarter. ''Still, it looks increasingly likely that much of the 'easy' growth to be had from the re-opening of the economy is in the rear-view mirror, and further gains will be harder to come by,'' analysts at RBC Economics said. ''We look for GDP to increase at a stronger 4.5% annualized pace in Q4.''

Precious metals gear up for a breakout

Analysts at TD Securities have explained that the price action in precious metals has been building towards a breakout.

''While the yellow metal is dramatically underperforming against the sharp slump in real rates, it is holding firm against market pricing for more than 2 Fed hikes by year-end 2022.''

''The aggressive central bank pricing has reverberated across global bond curves as Treasuries price in the first hike in July 2022 and a 90% chance of a hike in June, despite the fact that tapering is on course to only ending by June.''

''The hunt for inflation protection should continue to prop up interest in the yellow metal as real rates sink. Reasons to own the yellow metal are growing more compelling as Fed pricing is likely to unwind in the coming months as a US fiscal drag starts to weigh on growth data.''

Gold technical analysis

The bulls are breaking the 200-day EMA and riding the dynamic support that was reinforced by the 21-day EMA. The upside is more probable with a run towards $1,830 in prospect.

-

19:34

Brexit saga continues and risk for GBP amount as traders brace for major clash

A series of troublesome Brexit headlines have emerged in what has already been a volatile day in the forex space owing to the sensitivity to inflation worries and this notion that central banks are behind the curve.

With that aside, however, specifically for the pound, ''Britain has begun preparations for a major clash with the EU by activating a key government committee to look at the fallout from suspending cooperation over Northern Ireland,'' Sky News has learnt and reported today.

''Ministers are holding discussions inside the key cabinet committee, which oversaw Brexit fallout preparations, about the repercussions of triggering Article 16, which allows the UK to stop following some parts of the Northern Ireland Protocol.''

''The discussions on the practical implications of triggering the emergency mechanism in the Northern Ireland Protocol are being held in the "XO" cabinet committee, a pivotal institution inside government last year during Brexit talks when facing the threat of no-deal," the article said.

In other news and related to the fallout, Britain said it had summoned France's ambassador in an escalating row over post-Brexit fishing rights.

"We regret the confrontational language that has been consistently used by the French government on this issue," said a statement from British Prime Minister Boris Johnson's office.

It added: "As a next step, the Foreign Secretary has instructed Minister Morton to summon the French ambassador."

The BBC wrote that ''Britain earlier denounced France's seizure of a British boat in French waters and warned Paris against further retaliation.''

The article continued, ''A British trawler has been seized by France and another has been fined, amid an escalating row over post-Brexit fishing rights.

French maritime minister Annick Girardin said the ships were cautioned during checks off Le Havre overnight.

She said the first did not comply right away and the second was not allowed to fish in French waters so was detained.

No 10 said it was watching events closely and wanted France and EU talks but was ready to respond appropriately.

Earlier, the environment secretary said he was "urgently" investigating the situation in relation to the detained vessel - which has been named as the Cornelis Gert Jan.''

Market implications

It is well telegraphed that there are sticky and messy parts up in the air in the Brexit saga, most of which is likely already priced in, however, background stories and feelings of trouble escalation in the fall-out will leave the pound vulnerable. meanwhile, the markets are more aligned to what is happening between the central banks.

Sterling firmed a touch on Thursday against the euro and the dollar as investors assessed whether the Bank of England would proceed with an interest rate hike at the upcoming meetings or hold fire, given concerns around economic growth. Markets are pricing a chunky 34 cumulative bps in rate hikes rise from the BoE by year-end. GBP/USD is higher by some 0.4% on the day wheel EUR/GBP is also 0.4% higher following the ECB's emphasis on inflation pressures.

-

19:10

USD/CHF accelerates its downtrend and approaches 0.9100

- US dollar breaks below 0.9160 and nears 0.9100.

- Weak US economic growth figures hurt the USD.

- USD/CHF: Breach of 0.9160 support has increased downward momentum.

The US dollar has accelerated its reversal from week highs at 0.9225 on Tuesday, breaking below 0.9150 to reach fresh seven-week lows at 0.9120 so far.

Weak US data pulls the dollar further down

The greenback broke below intra-day support at 0.9160/70, hammered by the release of weaker than expected US Gross Domestic Product data. According to advanced estimations, the US economy decelerated to a 2% pace in the third quarter, from 6% in the second, even below the already slower 2.7% pace expected. Supply chain restrictions and a sharp decline in consumer spending have curbed economic growth.

These figures represent the weakest performance since the second quarter of 2020, when the first COVID-19 restrictions hit the US economy, and have crushed hopes of a strong post-pandemic recovery.

The upbeat quarterly earnings by Caterpillar and Merck released today, which helped US stock markets to pick up after a post-GDP dive, have failed to lift the US dollar, which remains sold across the board. The US Dollar Index has dropped 0.6% on the day to reach levels below 93.50 for the first time in the last four weeks.

USD/CHF: Break of 0.9150 support increases negative momentum

The pair has broken below at 0.9150 (October 22 and 24 lows) earlier today, which has increased bearish pressure. With technical indicators turning down, the next potential support levels are 0.9100 (August 18 and 30 lows) and then August 4 low at 0.9020 ahead of June lows at 0.8925.

On the upside, the pair should regain the mentioned 0.9050 and 0.9225 (October 26 high) to ease negative pressure and set its aim towards October 18 high at 0.9275.

Technical levels to watch

-

19:05

Silver Price Forecast: XAG/USD stalls around $24.20 as US T-bond yields rise

- Silver pares some weekly losses, clings to $24.00.

- An upbeat market sentiment dented investors' appetite for safe-haven assets.

- XAG/USD: The 1-hour chart depicts the white-metal is range-bound with no clear direction.

Silver (XAG/USD) trims its weekly losses, trading at $24.04 is barely up 0.04% during the New York session at the time of writing. Since Friday of last week, the yellow metal had struggled when it reached a new monthly high at $24.80. However, this week has failed to gain traction against the US Dollar, despite falling US T-bond yields.

Also, positive market sentiment has weighed on precious metals, not just silver. Investors seem to be moving flows towards riskier assets, as portrayed by US stock indices rising between 0.51% and 0.92% in the session. Moreover, US T-bond yields came back to the front seat on Thursday, with the 10-year benchmark note rising four basis points, sitting at 1.573%, weighing on the non-yielding metal.

That said, silver dynamics are lying in the dynamics of the US Dollar. In the next week, the Federal Reserve will host its November meeting. Market participants expect a bond taper announcement and the pace of it. Also, investors will keep a close eye on when it will begin the QE's reduction.

If it moves back to mid-December, it could signal that the Federal Reserve doubts so that a delay will give them more certainty in the future outlook. In that outcome, silver prices would rise in tandem with gold and other precious metals. On the flip side, the market has already priced in a bond taper to begin in mid-November.

XAG/USD Price Forecast: Technical outlook

Silver (XAG/USD) 1-hour chart depicts, the white metal is range-bound, trapped inside the hourly simple moving averages (HSMA's). However, it is slightly tilted to the upside, as a broken downslope trendline triggered a bullish signal. It also confluences with the 200-hour simple moving average (HSMA), which could propel XAG/USD toward higher prices.

The Relative Strength Index (RSI) is at 49, a tick lower than the 50-midline, aims slightly up, but it does not have enough momentum to spur an upside move in silver.

Therefore, silver traders could wait until a fresh catalyst could give additional clues about the non-yielding metal's direction.

-

18:17

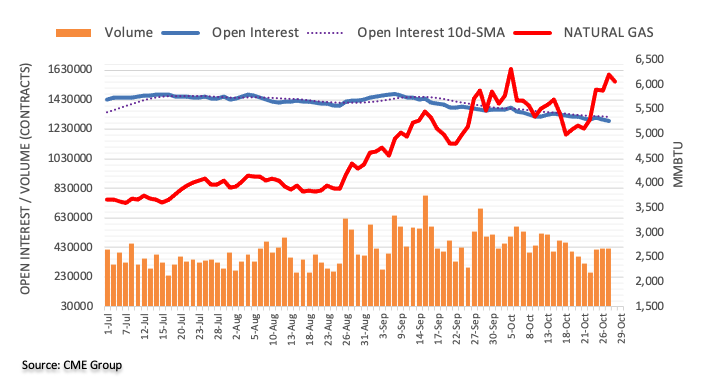

WTI prices pick up from two-week lows and return above $82.00

- WTI oil reversal from $84.95 extends below $82.00

- Higher US stocks, Iran cools off oil rally.

- WTI testing important support at $80.80.

Front-month WTI prices have picked up from day lows below $81.00, returning above $82.00 after having hit two-week lows below $81.00 earlier on Thursday.

Oil rally falters on US Stocks and nuclear talks with Iran

Crude prices have retreated about 3% over the last two days, weighed by an unexpected increase in stocks reported by the US Energy Information Administration on Wednesday. According to the EIA, commercial oil inventories increased by 4.3 million barrels last week, beating expectations of a 1.91 million barrel increase and easing fears about an energy crunch this winter.

Furthermore, rumors suggesting that Iran is ready to resume nuclear talks with the US and other global powers, which had been suspended before the Iranian elections, have contributed to cooling off oil’s rally. A tweet by one of Iran’s top negotiators, Al Bagheri Khani, stating that the Iranian authorities would agree to “start negotiations before the end of November” has boosted expectations of Iranian crude returning to the markets, which might have prompted some investors to close long positions.

Finally, Russian President Vladimir Putin assured that he is ready to start increasing gas supplies to Europe once Russian storages are full or, in any case, by November 8. This has triggered declines in gas prices, weighing further on oil futures.

WTI crude, testing an important support level at $80.60/70

WTI prices have picked up from session lows at $80.15 to return to the mid-range of $81.00 at the moment of writing. Oil futures, however, remain dangerously close to an important support level at $80.60/70, where the uptrend resistance line from late-August lows meets October 20 and 21 lows.

With technical indicators starting to point lower on daily and hourly charts, a confirmation below here might increase bearish pressure, sending prices towards $80.00 psychological level and October 13 low at 78.90.

On the upside, immediate resistance lies at intra-day highs, $82.15 and above here, October 27 high at 84.00 ahead of the $84.95 multi-year high.

WTI daily chart

Technical levels to watch

-

18:07

United States 7-Year Note Auction increased to 1.461% from previous 1.332%

-

17:51

AUD/USD struggles at 0.7550 amid risk-on market sentiment

- AUD/USD advances in the session, despite rising US T- bond yields.

- The US dollar weakens, weighed on by a slower rise in Q3 GDP.

- US Initial Jobless Claims rose to 281K, less than the 290K expected, improving for the third consecutive week.

The AUD/USD edges higher during the New York session, up 0.50%, trading at 0.7554 at the time of writing. Since Tuesday, the pair remained trapped around the 0.7490-0.7535 area, failing to gain traction either way. However, worse than expected US GDP figures for the third quarter spurred a sell-off of the greenback

In the Asian session, the AUD/USD traded near the daily lows, around 0.7480, due mainly to a mild risk-off environment. Investors ignored a tad that Australian inflationary figures rose sharply to the upside on Wednesday, increasing market participants’ bets of a possible rate hike by the Reserve Bank of Australia.

However, a slower than expected US economic growth boosted the AUD/USD pair, coupled with an upbeat market sentiment portrayed by US stocks edging higher, propelled the AUD/USD reaching a daily high at 0.7555.

In the meantime, the US Dollar Index, which measures the greenback’s performance, collapses 0.6%, down to 93.30, despite rising US T-bond yields with the 10-year benchmark note up to three basis points, sitting at 1.561%.

US Gross Domestic Product for Q3 expanded by 2%, worse than the 2.7% foreseen, the US dollar weakens

On the macroeconomic front, the US Gross Domestic Product for Q3 increased by 2%, lower than the 2.7% estimated by analysts. Moreover, the Federal Reserve’s favorite measure of inflation, the Personal Consumption Expenditure, remained high, expanding by 4.5% in the Q3, after a 6.1% bounce in the prior three months.

Nevertheless, there was a positive in the day. The US Initial Jobless Claims rose to 281K, lower than the 290K expected by analysts, dropping for the third consecutive week. Despite recent disappointments on the US Nonfarm Payrolls report, the labor market shows some signs of coming back to life.

Meanwhile, US Home Pending Home sales declined by 2.3% for September on a monthly basis, following the August reading that witnessed an increase of 8.31%, as reported by the US National Association of Realtors

AUD/USD Price Forecast: Technical outlook

The daily chart depicts the AUD/USD has printed an upside break above 0.7550 but is facing strong resistance, at the 200-day moving average (DMA), which lies at 0.7560. The Relative Strength Index (RSI), a momentum indicator is at 71 inside overbought levels, coupled with the 200-DMA, could potentially exert downward pressure on the pair, so it is worth notice for AUD/USD traders.

Nevertheless, a daily close above the latter could open the way for 0.7600, that confluences with a six-month downslope falling trendline, that would oppose strong resistance.

Therefore, an upside break is on the cards, but caution is warranted as signals of potential price exhaustion lie ahead.

-

17:28

USD/JPY's decline extends to two-week lows at 113.25

- The dollar retreats further from the 114.75top, approaching 113.00.

- Weak GDP figures hit the USD.

- USD/JPY is expected to decline towards 112.00 – Rabobank.

The dollar maintains its weak tone against the Japanese yen on Thursday, extending its reversal from multi-year highs at 114.75 reached last week. The pair has to fresh two-week lows below the mid-range of 113.00 following weaker than expected US macroeconomic figures.

US dollar dives after weak GDP data

The greenback has dropped across the board following a softer than expected US Gros Domestic Product report. According to advanced figures released by the Commerce Department, US economic growth slowed down to a 2% annual rate in the third quarter, from 6% in the previous one, well below an already slower 2.7% reading expected by the market.

These figures have dampened expectations of a strong post-pandemic recovery showing evidence that the disruptions in the supply chain and shortages of raw materials are holding companies from meeting the growing demand.

The dovish monetary policy statement by the Bank of Japan has failed to offer any significant support to the USD either. The central bank has reaffirmed the commitment with its ultra-expansive monetary policy, as widely expected, keeping interest rates near zero, and while downgrading their economic growth and consumer inflation forecasts for 2021.

USD/JPY expected slide towards 112.00 in the next three months – Rabobank

From a wider perspective, FX Analysts at Rabobank expect the USD to extend its reversal towards 112.00: observe the pair in a consolidation phase, ahead of further appreciation: “This may be a warning to the market that in view of the inflationary implications the BoJ is not entirely happy with the JPY’s position at the worst-performing G10 currency in the year to date. This signal may be sufficient to limit upside potential for USD/JPY near-term, particularly since the weakness of US Q3 GDP data has also undermined the greenback today. We retain a 3 month USD/JPY forecast of 112.”

Technical levels to watch

-

17:08

US: Growth will rebound, albeit not to the pace seen earlier – Wells Fargo

Data released on Thursday showed the US economy grew at a 2% rate (annualized) during the third quarter, below the 2.7% of market consensus. Analysts at Wells Fargo expected the economy to rebound during the fourth quarter, but not to the pace seen earlier in 2021.

Key Quotes:

“Real GDP grew only 2.0% at an annualized rate in the third quarter, which marked a significant downshift from the rate of growth that the economy posted in the first half of the year. Supply chain constraints, which are causing many prices to rise sharply and making many goods simply unavailable, were evident in the underlying details. The only saving grace was that inventories did not decline as much in the third quarter as they did in Q2. Without that positive contribution from inventories, the U.S. economy would have essentially stalled in the third quarter.”

“We expect that growth will rebound, albeit not to the pace seen earlier this year, as supply chains become unglued. The need to re-stock empty shelves and continued resilience in consumer spending should underpin spending growth. But unblocking supply chains will take time. We look for the rate of consumer price inflation, which rose to a 31-year high in the third quarter, to slow next year. But we also do not think that it will recede all the way back to 2%, as some policymakers at the Federal Reserve expect.”

“We expect that the FOMC will look through the supply chain-induced increase in prices and not tighten monetary policy next year. However, we readily acknowledge the risk that higher-than-expected inflation could force the FOMC's hand next year.”

-

16:57

ECB says inflation surge is transitory, but markets doubt it – Danske Bank

On Thursday, the European Central Bank, as expected left its monetary policy stand unchanged. Analysts at Danske Bank point out the meeting ended with no new decisions or a signal about the decisions that are to be taken at the December meeting.

Key Quotes:

“We are of the view that ECB do not expect to hike rates in the foreseeable future given ECB transitory inflation narrative. Whether this new found data dependence will last remains unknown. In any case, if inflation proves longer-lasting, the comments today makes us less confident that ECB would not change policy rates eventually.”

“While inflation is expected to stay high in the near-term (lasting a bit longer than previously expected), ECB still expects inflation pressures to ease again over the course of next year.”

“With Spanish and German CPI inflation surging to the highest level since the 1990s in October and price expectations still adjusting upwards across sectors, markets are increasingly discounting ECB’s temporary inflation narrative.”

“Despite Lagarde’s very dovish signals and overall appearance, EUR/USD followed the rates market higher. In our view, this is likely a temporary correlation and likely to soon be replaced by more downside risk as the European economy underwhelms amid inflation surprises. We do not generally see much of a link between spot EUR/USD and rising expectations towards euro area interest rates.”

-

16:51

USD/JPY: Forecast remains for a slide to 112 in 3M – Rabobank

At this week meeting, the Bank of Japan reiterated its ultra-easing monetary policy stance and reduced both growth and inflation forecasts. Although USD/JPY has backed away from its recent highs in the 114.70 area, interest rate differentials have left the currency pair elevated, explained analysts at Rabobank.

Key Quotes:

“The Bank has described that it will be paying attention price risks. These include the possibility of pass-through of cost increases to selling prices and secondly to “future developments in foreign exchange rates and international commodity prices, as well as the extent to which such developments will spread to import prices and domestic prices”. While there was no suggesting as to what action the BoJ may take if these risks lead to inflation deviated from its central scenario, the BoJ did underline the risk the exchange rate/commodity price risk suggesting that this is being very closely watched.”

“This may be a warning to the market that in view of the inflationary implications the BoJ is not entirely happy with the JPY’s position at the worst performing G10 currency in the year to date. This signal may be sufficient to limit upside potential for USD/JPY near-term, particularly since the weakness of US Q3 GDP data has also undermined the greenback today. We retain a 3 month USD/JPY forecast of 112.”

-

16:45

USD/CAD approaches 1.2300 lows as the loonie builds up

- US dollar's recovery fails at 1.2380.

- Weak US GDP data has hurt the greenback.

- USD/CAD is expected to continue sliding towards 1.2208 – Credit Suisse.

The US dollar’s recovery attempt from Wednesday’s low at 1.2300 has been frustrated at 1.2380 and the pair turned lower against, retreating to 1.2330 against a somewhat firmer Canadian dollar.

The dollar dives after downbeat US GDP data

The greenback has accelerated its decline, following the release of disappointing Gross Domestic Product figures in the US. According to an estimate from the Commerce Department, the US economy slowed down to a 2% annual growth in the third quarter, from 6% in the second, hampered by supply chain disruptions and a slight increase of COVID-19 cases

These advanced figures have fallen short of the 2.7% growth forecasted by market analysts and actually represent the weakest performance since the second quarter of 2020 when the economic activity was hit by restrictions under the first COVID-19 wave.

On the other hand, the Canadian dollar has been showing muscle over the last sessions, buoyed by the hawkish monetary statement by the Bank of Canada. The BoC confirmed on Wednesday the end of their bond-buying program and hinted at an interest rate hike in the first half of next year, which pushed Canadian bond yields higher, ultimately increasing demand for the CAD.

USD/CAD to continue depreciating towards 1.2208 – Credit Suisse

From a wider perspective, FX Analysts at Credit Suisse contemplate further depreciation ahead: “We look for a break below the recent range low at 1.2287 for a move to 1.2252 next, with further retracement support just below here at 1.2208. This level is likely to prove a tough barrier in our view, however, we note that the next supports are seen at 1.2156/45.”

Technical levels to watch

-

16:33

United States 4-Week Bill Auction increased to 0.055% from previous 0.05%

-

16:26

EUR/USD extends gains and approaches 1.1700 as USD tumbles

- US dollar drops sharply versus its G10 rivals; DXY down by 0.58%.

- Euro among top performers holds to gains after ECB.

- EUR/USD heads for highest daily close in a month.

The EUR/USD broke a multi-day range to the upside and jumped toward 1.1700. Recently it printed a fresh monthly high at 1.1686 and remains near the top, with the bullish tone intact, supported by a decline of the US dollar across the board.

The decline of the greenback and technical factors are boosting EUR/USD further to the upside. The pair is trading at the highest level since late September, extending the recovery from 1.1523 (October 12 low).

After US data and ECB, focus starts to turn to FOMC

Economic data from the US showed mixed signs, with jobless claims (initial and continuing) falling more than expected to their lowest level since March 2020 and Q3 GDP data presenting a larger than forecast slowdown to 2% (consensus: 2.7%).

The European Central Bank, as expected kept its monetary policy unchanged. The next meeting will be more relevant, considering it will make decisions regarding QE programs.

“Despite Lagarde’s very dovish signals and overall appearance, EUR/USD followed the rates market higher. In our view, this is likely a temporary correlation and likely to soon be replaced by more downside risk as the European economy underwhelms amid inflation surprises”, warn analysts at Danske Bank.

The Federal Reserve will meet next week. At Danske, analysts see the Fed probably leaning more in to their hawkish views. “On net, we continue to forecast 1.10 in 12M EUR/USD.”

Technical levels

-

16:21

GBP/USD jumps on worse than expected US economic growth report, pierces 1.3800

- GBP/USD approaches 1.3800 on broad US dollar selling across the board.

- US economy slows its growing pace, but inflation keeps rising.

- Fed’s favorite inflation measure rose by 4.5%, lower than the 6.1% of the previous quarter.

The GBP/USD rises sharply during the New York session, above the 1.3800 figure, trading at 1.3803 at the time of writing. US mixed macroeconomic data trigger a dollar sell-off across the board. The US economy is growing slower than expected, contrary to rising inflation, showing no signs of peaking. The stagflation narrative clouds the market again.

During the Asian and European session, the GBP/USD seesawed near the bottoms of the day, around 1.3720, towards 1.3770, until stabilizing around current levels after the US GDP announcement.

US Q3 Gross Domestic Product grew 2% lower than the 2.7% estimated

An absent UK economic docket was no excuse for sterling to climb, helped by the risk-on market sentiment in the financial markets. Also, it got a boost due to the US Gross Domestic Product for the Q3, rising at a 2% pace, lower than the 2.7% estimated by analysts, leaving economists guessing if the bond-tapering announcement would spur a sharper US economic deceleration.

Further, the PCE, Fed’s favorite measure of inflation, remained elevated, increasing by 4.5% in the Q3, after a 6.1% bounce in the prior three months.

However, not everything is negative out of the US. The US Initial Jobless Claims rose to 281K, lower than the 290K expected by analysts, dropping for the third consecutive week. The labor market shows some signs of coming back to life, despite recent disappointments on the US Nonfarm Payrolls report.Meanwhile, US Home Pending Home sales declined by 2.3% for September on a monthly basis, following the August reading that witnessed an increase of 8.31%, as reported by the US National Association of Realtors

That said, investors’ focus shifts to the next week when the Federal Reserve and the Bank of England will reveal their monetary policy statements. The market expects a bond-tapering announcement by the Fed. Concerning the Bank of England, investors have priced in an 80% chance of a hike rate by the November meeting.

GBP/USD Price Forecast: Technical outlook

Daily chart

The GBP/USD has been trading within the 1.3700-1.3830 tight range in the last nine days, indicating no clear direction on the pair. The daily moving averages (DMA’s) act as support and resistance levels, as they remain trapped around the abovementioned area.

At press time, the spot price is above the 100-DMA lying at 1.3784, acting as support. Furthermore, a rising upslope trendline travels below the September 29 low towards the October 12 low, adding another support level for the GBP/USD. If it is broken, it would be a strong bearish signal for GBP/USD traders.

On the flip side, the pair would find strong resistance at 1.3800 and 1.3830. It is worth noting that the abovementioned level has been unsuccessfully tested four times, so GBP/USD traders should be aware of that. A break above 1.3830 would expose the 1.3900 as the next target for GBP/USD buyers.

-

16:01

United States Kansas Fed Manufacturing Activity came in at 25, above expectations (16) in October

-

15:47

Gold Price Forecast: XAU/USD revers sharply from $1810 and tumbles toward $1790

- Metals are unable to benefit from a sharp decline of the US dollar across the board.

- XAU/USD faces resistance at $1810 and fails to hold above $1800.

Gold dropped almost $20 during the last hour and turned negative for the day. XAU/USD jumped to $1810, reaching the highest level since last Friday and then it changed its direction falling toward $1790. It bottomed at $1792, and it is hovering around $1795, still looking for a direction.

The short-term trend still points to the upside in gold, but gains were capped again at $1810 and it is also showing difficulties holding above $1800, pointing to a lack of strength is moving higher. A key support is seen around $1785, an uptrend line that if broken could trigger more losses. On the upside, the key level is $1810.

The reversal in gold took place even amid a slide of the greenback across the board. The DXY trades at 93.39, down 0.50%, at the lowest level in a month. At the same time, the 10-year US yield is modestly higher.

Economic data from the US came in mixed. The preliminary reading of Q3 GDP showed an expansion at a 2% annualized rate, below the 2.7% expected. On the positive, jobless claims dropped more than expected to the lowest level since March 2020. The numbers are relevant ahead of next’s week FOMC meeting.

Technical levels

-

15:30

United States EIA Natural Gas Storage Change came in at 87B, above expectations (86B) in October 22

-

15:28

EUR/USD: Race higher towards 1.1680 to be short-lived – TDS

As expected, the European Central Bank (ECB) left its key policy measures on hold. President Lagarde noted that the impact of COVID-19 was fading and that the Governing Council spent most of its meeting discussing inflation. In the view of economists at TD Securities, EUR/USD is to test resistance near 1.1680 off the back of this.

Short-lived EUR pop

“As widely expected, the ECB had nothing on offer today and Lagarde reinforced that financing conditions will need to remain accommodative. And while they admit that inflationary forces will persist longer than expected, they remain confident – perhaps borderline arrogant – that price pressures will fade.”

“We think that there is some risk of EUR/USD testing 1.1680 resistance, but extrapolating beyond that seems like a big ask a week ahead of the Fed's meeting where tapering will be announced.”

“As much as we think there is scope to test 1.1680 resistance, this should be short-lived.”

“From a technical point of view, EURUSD momentum indicators suggest that price action is nearing fatigue above 1.16.”

-

15:08

US: Pending Home Sales decline by 2.3% in September vs. 0% expected

- Pending Home Sales in the US declined in September.

- US Dollar Index stays deep in the negative territory below 93.50.

Pending Home Sales in the US decreased by 2.3% on a monthly basis in September following August's sharp increase of 8.31, the data published by the US National Association of Realtors showed on Thursday. Investors were not expecting any changes.

Further details of the publication showed that, on a yearly basis, the change in Pending Home Sales was -8%, compared to the market expectation of -10.2%.

Market reaction

The greenback continues to weaken against its rivals during the American trading hours and the US Dollar Index was last seen losing 0.47% on a daily basis at 93.40.

-

15:00

United States Pending Home Sales (YoY) above expectations (-10.2%) in September: Actual (-8%)

-

15:00

United States Pending Home Sales (MoM) below forecasts (0%) in September: Actual (-2.3%)

-

14:58

S&P 500 Index opens in the positive territory, closes in on all-time highs

- Wall Street's main indexes opened higher following Wednesday's slide.

- US economy grew at a softer pace than expected in Q3.

Following Wednesday's decline, major equity indexes in the US opened higher on Thursday despite disappointing growth data from the US. As of writing, the S&P 500 was up 0.6% on the day at 4,578, the Dow Jones Industrial Average was rising 0.5% at 35,664 and the Nasdaq Composite was gaining 0.66% at 15,337.

In its first estimate, the US Bureau of Economic Analysis said that the Real Gross Domestic Product expanded at an annualized rate of 2% in the third quarter. Although this reading came in lower than the market expectation of 2.7%, it doesn't seem to be having a negative impact on sentiment so far.

Among the 11 major S&P 500 sectors, the Real Estate Index is up 1% as the biggest gainer after the opening bell. On the other hand, the Communication Services Index is the only sector trading in the red, losing 0.15%.

S&P 500 chart (daily)

-

14:57

US Dollar Index drops to monthly lows around 93.50

- DXY loses the grip and recedes to the 93.50/45 band.

- Risk-on mood, steady US yields weigh on the dollar.

- Flash US Q3 GDP seen expanding 2.0% QoQ.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, accelerates the downside and challenges October lows near 93.50.

US Dollar Index looks supported near 93.50

The index extends the bearish note in the second half of the week and looks poised to challenge the area of decent contention in the mid-93.00s, where the monthly lows are located.

The dollar receded further following the steady activity in the US cash markets, where the flattening of the yield curve remains well in place. Indeed, yields in the front end surpassed the 0.56% level for the first time since March 2020, while longer-dated yields manage to marginally bounce off recent lows.

In addition, flash US GDP figures showed the economy is seen expanding at 2.0% QoQ in Q3 vs. expectations for a 2.7% expansion. On a brighter note, weekly Claims surpassed estimates at rose by 281K in the week to October 23.

Further weakness in the dollar came on the back of the firmer note in the euro after the ECB event.

US Dollar Index relevant levels

Now, the index is losing 0.40% at 93.48 and a break above 94.17 (weekly high Oct.18) would open the door to 94.56 (2021 high Oct.12) and then 94.74 (monthly high Sep.25 2020). On the flip side, the next down barrier emerges at 93.48 (monthly low October 28) followed by 93.31 (55-day SMA) and finally 92.98 (weekly low Sep.23).

-

14:37

GBP/USD to enjoy a gentle rise on a break above 1.38 – Scotiabank

GBP/USD gains marginally as Bank of England (BoE) hike pricing returns. Economists at Scotiabank see price action in the cable as marginally supportive and expect to see further gains on a break above 1.38.

GBP/USD to fall towards 1.36 on a break below 50-DMA at 1.3713

“After falling for three consecutive days, markets placed renewed bets on BoE tightening yesterday (likely as a consequence of the BoC’s hawkish announcement) which are continuing today to price in 17bps in hikes; December meeting OIS are pricing a similarly sized hike from November.”

“The 1.3770 area acted to limit further gains toward 1.38 that remains the key level to beat for the GBP to maintain its uptrend since early October.”

“The cable is being guided to the downside by its 50-day MA and to the topside by its 200-day MA (1.3713 and 1.3784, respectively), with a breach below the former and then the big figure leaving it at risk of declines to the 1.36 level.”

-

14:24

S&P 500 Index: Setback seen as corrective and temporary ahead of a move to 4750 – Credit Suisse

S&P 500 has extended its corrective setback and analysts at Credit Suisse see scope for slightly further near-term weakness. However this setback is very much seen as corrective ahead of a sustained break higher towards 4750 by year-end.

The current setback may extend slightly further

“The S&P 500 has reinforced its small bearish ‘shooting star’ candlestick reversal with a break below support from the recent small price gap at 4569/62, which suggests a short-term correction lower is underway, with supports seen at 4537, potentially 4524/20, but with fresh buyers expected again here for now.”

“Post this short-term setback, which we very much see as temporary and corrective, our core outlook stays higher.”

“A break above 4599/4604 is needed to reassert the prior strength for a move to the aforementioned 4622/25 ‘typical’ extreme. Although we look for a fresh pause here, above in due course can see resistance next at 4632, ahead of 4665/70, with 4750 our Q4 objective.”

-

14:22

EUR/USD probes tops above 1.1640 on Lagarde

- EUR/USD jumps to 3-day highs beyond 1.1640.

- The ECB sees inflation running hot for longer.

- Flash US Q3 GDP came at 2.0%; Claims rose by 281K.

The single currency manages well to keep the bid tone unchanged and pushes EUR/USD to fresh tops past the 1.1640 level on Thursday.

EUR/USD bid on Lagarde’s presser

EUR/USD gathers further traction as the press conference by Chairwoman Lagarde is under way on Thursday.

In fact, Lagarde said that the current phase of elevated inflation is expected to last longer than anticipated mainly due to the inability of supply to match the increasing demand. She noted that medium-term inflation is still below the bank’s 2% goal and admitted that elevated consumer prices will run hot for longer and are seen cooling down next year.

Still on the inflation issue, Lagarde said the ECB will be alert to the progress of wage inflation.

She once again reiterated that markets’ bets on a rates lift-off are not in line with the bank’s guidance.

On the data space, US flash Q3 GDP came short of estimates at 2.0% QoQ and weekly Claims rose by 281K.

EUR/USD levels to watch

So far, spot is losing 0.04% at 1.1597 and faces the next up barrier at 1.1669 (monthly high Oct.19) followed by 1.1699 (55-day SMA) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1584 (weekly low Oct.26) would target 1.1571 (low Oct.18) en route to 1.1524 (2021 low Oct.12).

-

14:17

US Pres. Biden: I think we have enough votes for spending plan

US President Joe Biden told reporters on Thursday that he thinks they will have enough votes for his spending plan, as reported by Reuters.

Earlier in the day, the White House released the revised proposal of Biden's economic plan that will cost around $1.75 trillion.

Commenting on the proposal, progressive US Representative Pramilya Jayapal said that it is very difficult to make a decision without seeing the legislative text.

Market reaction

US stock index futures are up between 0.25% and 0.55%, pointing to a positive opening in Wall Street following these developments.

-

14:00

Russia Central Bank Reserves $ up to $621.6B from previous $620.3B

-

13:55

Lagarde speech: Market bets on rate hikes are not in line with guidance

Christine Lagarde, President of the Europen Central Bank (ECB), added to her earlier comments on the monetary policy outlook at the post-meeting press conference:

Key quotes:

- Market bets on rate hikes are not in line with guidance.

- Our analysis certainly does not support that the conditions of our forward guidance are satisfied at the time of lift-off as expected by markets, nor any time soon thereafter.

- The slowdown of PEPP purchases isn't tapering.

About ECB President Lagarde

The European Central Bank's President Christine Lagarde, born in 1956 in France, has formerly served as Managing Director of the International Monetary Fund, and minister of finance in France. She began her eight-year term at the helm of the ECB in November 2019. As part of her job in the Governing Council, Lagarde holds press conferences in detailing how the ECB observes the current and future state of the European economy. Her comments may positively or negatively the euro's trend in the short-term. Usually, a hawkish outlook boosts the euro (bullish), while a dovish one weighs on the common currency (bearish).

-

13:48

Lagarde speech: Phase of rising inflation will last longer than originally expected

Christine Lagarde, President of the Europen Central Bank (ECB), added to her earlier comments on the monetary policy outlook at the post-meeting press conference:

Key quotes:

- The phase of rising inflation will last longer than originally expected.

- This reflects energy, recovery demand outpacing supply.

- Medium-term inflation is still seen below the 2% target.

About ECB President Lagarde

The European Central Bank's President Christine Lagarde, born in 1956 in France, has formerly served as Managing Director of the International Monetary Fund, and minister of finance in France. She began her eight-year term at the helm of the ECB in November 2019. As part of her job in the Governing Council, Lagarde holds press conferences in detailing how the ECB observes the current and future state of the European economy. Her comments may positively or negatively the euro's trend in the short-term. Usually, a hawkish outlook boosts the euro (bullish), while a dovish one weighs on the common currency (bearish).

-

13:44

US: Weekly Initial Jobless Claims decline to 281K vs. 290K expected

- Weekly Initial Jobless Claims in US declined by 10,000.

- US Dollar Index stays relatively quiet below 94.00 after the data.

There were 281,000 initial claims for unemployment benefits in the US during the week ending October 23, the data published by the US Department of Labor (DOL) revealed on Thursday. This reading followed the previous print of 291,000 (revised from 290,000) and came in better than the market expectation of 290,000.

Market reaction

The US Dollar Index continues to fluctuate below 94.00 after this data.

Additional takeaways

"The 4-week moving average was 299,250, a decrease of 20,750 from the previous week's revised average."

"The advance seasonally adjusted insured unemployment rate was 1.7 percent for the week ending October 16."

"The advance number for seasonally adjusted insured unemployment during the week ending October 16 was 2,243,000, a decrease of 237,000 from the previous week's revised level."

-

13:37

Lagarde speech: Inflation to rise further, then decline in 2022

Christine Lagarde, President of the Europen Central Bank (ECB), is delivering her remarks on the monetary policy outlook at the post-meeting press conference:

Key quotes:

- Momentum has moderated but Eurozone continues to recover strongly.

- Expects inflation to rise further, then decline in 2022.

- The grip of the pandemic has weakened.

- High energy prices may reduce purchasing power.

- Economy expected to exceed pre-pandemic level by year-end.

About ECB President Lagarde

The European Central Bank's President Christine Lagarde, born in 1956 in France, has formerly served as Managing Director of the International Monetary Fund, and minister of finance in France. She began her eight-year term at the helm of the ECB in November 2019. As part of her job in the Governing Council, Lagarde holds press conferences in detailing how the ECB observes the current and future state of the European economy. Her comments may positively or negatively the euro's trend in the short-term. Usually, a hawkish outlook boosts the euro (bullish), while a dovish one weighs on the common currency (bearish).

-

13:33

United States Gross Domestic Product Price Index came in at 5.7%, above expectations (5.5%) in 3Q

-

13:31

Breaking: US economy grows by 2.0% in Q3 vs. 2.7% expected

The United States' Real Gross Domestic Product (GDP) expanded at an annual rate of 2.0% in the third quarter of 2021, the first estimate released by the US Bureau of Economic Analysis showed this Thursday. This marked a sharp deceleration from the 6.7% growth recorded in the second quarter and also missed consensus estimates for a reading of 2.7%.

Follow our live coverage of the US GDP report and the market reaction.

Initial Market reaction

The disappointing data did little to provide any meaningful impetus to the US dollar amid firming expectations for an early policy tightening by the Fed. Hence, the focus remains on next week’s FOMC monetary policy meeting.

About US GDP

The Gross Domestic Product Annualized released by the US Bureau of Economic Analysis shows the monetary value of all the goods, services and structures produced within a country in a given period of time. GDP Annualized is a gross measure of market activity because it indicates the pace at which a country's economy is growing or decreasing. Generally speaking, a high reading or a better than expected number is seen as positive for equities, while a low reading is negative.

-

13:31

United States Personal Consumption Expenditures Prices (QoQ) came in at 5.3%, above forecasts (4%) in 3Q

-

13:31

United States Core Personal Consumption Expenditures (QoQ) meets forecasts (4.5%) in 3Q

-

13:31

United States Gross Domestic Product Annualized below expectations (2.7%) in 3Q: Actual (2%)

-

13:31

United States Continuing Jobless Claims below forecasts (2.415M) in October 15: Actual (2.243M)

-

13:30

United States Initial Jobless Claims below forecasts (290K) in October 22: Actual (281K)

-

13:30

United States Initial Jobless Claims 4-week average down to 299.25K in October 22 from previous 319.75K

-

13:04

Germany: Annual HICP rises to 4.6% in October vs. 4.5% expected

- HICP inflation in Germany rose sharply in October.

- EUR/USD continues to fluctuate in a tight range around 1.1600.