Notícias do Mercado

-

23:59

USD/CAD traces oil’s struggle around six-week top near 1.3100, US ADP, Canada GDP in focus

- USD/CAD retreats from a multi-day high, sidelined of late.

- Oil prices struggle to justify talks of the US-Iran deal on OPEC+ hints from Russia.

- Risk-off mood, hawkish Fedspeak underpin bullish bias ahead of the key US/Canada data.

USD/CAD grinds higher around 1.3090 during Wednesday’s Asian session as traders jostle with the US dollar’s strength amid sour sentiment and hawkish Fed bets, as well as mixed moves in oil prices, Canada’s main export item.

That said, WTI crude oil prices remain pressured around $92.00, after declining the most in seven weeks the previous day. The black gold’s downside could be linked to the statements from Iraq's State Organization for Marketing of Oil (SOMO) said on Tuesday that their delegation plans to travel to Germany for oil export talks. “Iraq ready to boost oil exports to Europe, if asked,” adds Iraq’s SOMO.

On the same line could be the headlines from OPEC and its allies, the group known as OPEC+, which stated, per the Russian news TASS, “Potential OPEC+ output cuts not under discussion now.” Also weighing on the black gold prices were expectations that Iran may release more oil.

Elsewhere, chatters surrounding the US-Iran oil deal appeared to have battled the oil bears.

It should be noted that the firmer US data and hawkish Fedspeak should have ideally fuelled the USD/CAD prices. That said, the US Consumer Confidence for August improved to 103.2 versus 95.3 in July, per the Conference Board’s (CB) latest survey details. Also, US Housing Price Index (HPI) rose by 0.1% MoM in June compared to May's increase of 1.3% and market expectation of 1.1%. Further, the S&P/Case-Shiller Home Price Indices eased to 18.6% YoY during the stated month versus 19.5% forecast and 20.5% previous readings. It should be noted that the US JOLTS Job Openings grew to 11.239M in July versus 10.475M expected and 11.04M prior (revised from 10.698M).

Following the data, Richmond Federal Reserve Bank President Thomas Barkin said, "I don't expect inflation to come down predictably." On the same line was Atlanta Fed President Raphael Bostic who said, “Slowing inflation data 'may give us reason' to slow interest rate hikes.” Recently, New York Fed President John Williams said, per the WSJ, “We are not at restrictive policy yet.” The policymaker also added, “We need to get interest rates higher than longer run a neutral level.”

Also, fears of the Sino-American war escalated as Taiwan fired the first warning shots at Chinese drones, which in turn favored the USD/CAD buyers. On the same line was the Wall Street Journal’s news stating that the US Army grounds entire fleet of Boeing-made Chinook helicopters.

While portraying the mood, the US 10-year Treasury yields rose to the highest levels in two months and Wall Street closed in the red while the US dollar regained upside momentum.

Moving on, the US ADP Employment Change for August, the early signal for Friday’s US Nonfarm Payrolls (NFP), expected 200K versus 128K prior, will be important to watch for fresh impulse. Also crucial will be Canada’s Gross Domestic Product (GDP) for the second quarter (Q2), expected 4.5% annualized versus 3.1% prior. Additionally, the monthly Canadian GDP is expected to grow 0.1% versus 0.0% previous readouts. Furthermore, China’s NBS Manufacturing PMI for August, expected 49.2 versus 49.0 prior, might offer immediate directions to the pair.

Also read: ADP Jobs Preview: Three reasons to expect the data to drive the dollar higher

Technical analysis

USD/CAD remains vulnerable to declining towards the 1.3000 psychological magnet unless providing a daily closing beyond the 13-day-old ascending resistance line, near 1.3110 by the press time.

-

23:59

GBP/JPY Price Analysis: Tumbles below the 162.00 figure on risk aversion

- Drops below the 20-day EMA at 162.01 after hitting a daily high at 162.59.

- GBP/JPY’s failure to break below 161.23, opened the door for further buying pressure.

The GBP/JPY is subdued as Wednesday’s Asian Pacific session begins, trading within familiar levels, unable to break above/below the 160.80-162.83 region for nine consecutive days. At the time of writing, the GBP/JPY is trading at 161.76, below the 20-day EMA.

GBP/JPY Price Analysis: Technical outlook

The GBP/JPY daily chart illustrates the 162.80 resistance as a solid supply zone, ahead of the 100 and the 50-day EMAs, each at 162.98 and 163.23, respectively. Also, the Relative Strength Index (RSI) slope is horizontal, further cementing the pair’s consolidation for the last 14 days.

If the GBP/JPY breaks above 162.80, it will expose the 100 and 50-day EMAs on the upper side. Once cleared, the next stop will be a three-month-old downslope trendline, drawn from the YTD highs around 168.00, which passes around the 163.70 area, ahead of the 164.00 mark.

On the other hand, the GBP/JPY’s first support would be the August 23 daily low at 161.82, followed by the 161.00 mark, followed by the August 16 low at 160.08.

GBP/JPY Key Technical Level

-

23:55

USD/CHF advances towards 0.9750 as DXY strengthens ahead of US NFP

- USD/CHF is marching towards the immediate hurdle of 0.9750 on hawkish Fed commentary.

- An improvement in the US JOLTS Job Openings data and Consumer Confidence has supported the DXY.

- Swiss’s Real Retail Sales data is expected to land at 3.3% vs. 1.2% recorded earlier.

The USD/CHF pair is marching towards the immediate hurdle of 0.9750 after a time-based correction to near 0.9726 on Tuesday. The asset has remained in the grip of bulls after a firmer rebound from Friday’s low at 0.9577. In the early Tokyo session, the major is displaying signs of volatility contraction, which is expected to turn into volumes and wider ticks.

The US dollar index (DXY) has turned sideways after a minor correction from Tuesday’s high of 109.11. Broadly, the asset is extremely bullish led by a solid improvement in the US JOLTS Job Openings data, upbeat Consumer Confidence, and hawkish commentary from Federal Reserve (Fed) policymakers.

The JOLTS Job Openings data landed at 11.239M, higher than the expectations of 10.475M and the prior release of 11.04M. This indicates that the labor market is rock solid, which will boost the confidence of the Fed in announcing more rate hikes. Also, the US CB Consumer Confidence improved dramatically to 103.2 vs. 95.3 reported in July.

The commentary from New York Fed Bank President John Williams that interest rates are needed to elevate further above 3.5% to tame the soaring price pressures. This has strengthened the odds of a third consecutive 75 basis points (bps) rate hike by the Fed in its September monetary policy meeting.

Going forward, the release of the US Nonfarm Payrolls (NFP) data will be of significant importance. As per the market expectations, the US economy has added 300k in August vs. 528k reported in July. While, the Real Retail Sales data from the Swiss zone will be keenly watched, which is expected to improve dramatically to 3.3% from the prior release of 1.2%. A decent improvement in the economic data indicates an acceleration in the overall demand.

-

23:45

New Zealand Building Permits s.a. (MoM): 5% (July) vs -2.3%

-

23:40

AUD/USD appears vulnerable near 0.6850 amid risk-aversion, China/US data eyed

- AUD/USD holds lower grounds near six-week low after recalling the bears the previous day.

- Headlines surrounding China, Taiwan join hawkish Fedspeak, strong US data to challenge early-week optimism.

- Downbeat Aussie Building Permits for July also facilitated seller’s return.

- China’s official PMIs for August will be crucial ahead of US ADP, NFP statistics.

AUD/USD remains pressured around 0.6860, after calling in bears the previous day, as traders await activity data from the key customer China during Wednesday’s Asian session. In doing so, the Aussie pair also takes clues from the risk-off mood, as well as justifies the cautious sentiment before important US employment data is released.

Having witnessed a mildly positive start to the day, AUD/USD returned to the seller’s radar as fears of the Sino-American war escalated as Taiwan fired the first warning shots at Chinese drones. On the same line was the Wall Street Journal’s news stating that the US Army grounds entire fleet of Boeing-made Chinook helicopters.

Also weighing on the quote were the strong US data releases and hawkish Fedspeak that propelled the bets on the Federal Reserve’s (Fed) 75 basis points of a rate hike in September.

US Consumer Confidence for August improved to 103.2 versus 95.3 in July, per the Conference Board’s (CB) latest survey details. Also, US Housing Price Index (HPI) rose by 0.1% MoM in June compared to May's increase of 1.3% and market expectation of 1.1%. Further, the S&P/Case-Shiller Home Price Indices eased to 18.6% YoY during the stated month versus 19.5% forecast and 20.5% previous readings. It should be noted that the US JOLTS Job Openings grew to 11.239M in July versus 10.475M expected and 11.04M prior (revised from 10.698M).

Following the data, Richmond Federal Reserve Bank President Thomas Barkin said, "I don't expect inflation to come down predictably." On the same line was Atlanta Fed President Raphael Bostic who said, “Slowing inflation data 'may give us reason' to slow interest rate hikes.” Recently, New York Fed President John Williams said, per the WSJ, “We are not at restrictive policy yet.” The policymaker also added, “We need to get interest rates higher than longer run a neutral level.”

At home, Australia’s Building Permits for July declined to -17.2% versus -2.0% market forecasts and -0.6% revised prior.

Against this backdrop, the US 10-year Treasury yields rose to the highest levels in two months and Wall Street closed in the red while the US dollar regained upside momentum.

Looking forward, AUD/USD traders may bear the burden of the sour sentiment to stay depressed. However, any surprise positives from China’s NBS Manufacturing PMI for August, expected 49.2 versus 49.0 prior, might offer an intermediate rebound to the pair. After that, the US ADP Employment Change for August, the early signal for Friday’s US Nonfarm Payrolls (NFP), expected 200K versus 128K prior, will also be important to watch for fresh impulse.

Also read: ADP Jobs Preview: Three reasons to expect the data to drive the dollar higher

Technical analysis

A clear downside break of the upward sloping support line from the mid-June, now resistance around 0.6870, directs AUD/USD bears towards the early July’s bottom surrounding 0.6760.

-

23:28

GBP/USD Price Analysis: Downside looks imminent near 20-EMA at 1.1680

- A Falling Channel formation indicates that the broader context of cable is weak.

- Declining 20-and 50-EMAs signal more weakness ahead.

- A bearish range shift by the RSI (14) adds to the downside filters.

The GBP/USD pair has turned sideways after witnessing a steep fall below the crucial support of 1.1700 on Tuesday. The cable is auctioning in a narrow range of 1.1646-1.1670 after a short-lived pullback from Tuesday’s low at 1.1626. The pullback move looks less confident and is likely to turn into a fresh fall after the momentum oscillators will turn overbought.

The formation of a Falling Channel chart pattern on an hourly scale is indicating more downside ahead. The upper portion of the above-mentioned chart pattern is placed from August 11 high at 1.2249 while the lower portion is plotted from August 5 low at 1.2003.

A decent deviation in declining 20-and 50-period Exponential Moving Averages (EMAs) at 1.1677 and 1.1702 respectively is indicating more weakness ahead.

Also, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more downside ahead.

A pullback move towards the 20-EMA at 1.1677 will trigger a bargain sell and will drag the asset towards Tuesday’s low at 1.1626, followed by 19 March 2020 low at 1.1472.

Alternatively, the pound bulls could regain their mojo and may drive the asset higher towards August 3 low and high at 1.2135 and 1.2200 after violating the psychological resistance of 1.2000 decisively.

GBP/USD hourly chart

-637974952316638669.png)

-

23:11

EUR/USD stays defensive above 1.0000 despite hawkish ECBspeak ahead of EU inflation

- EUR/USD struggles to extend two-day rebound ahead of the key data/events.

- Strong German inflation allowed ECB policymakers to back higher rates.

- Hawkish Fedspeak, risk-aversion challenges the upside momentum.

- China data/news may entertain traders ahead of EU inflation numbers.

EUR/USD fades upside momentum, after printing mild gains in the last two days, as the pair traders await Eurozone inflation data on Wednesday. That said, the major currency pair edged higher on Tuesday after upbeat statistics from Germany, as well as hawkish comments from the European Central Bank (ECB) policymakers. That said, the quote seesaws around to 1.0015 by the press time.

Germany’s Consumer Price Index (CPI) rose to 7.9% YoY in August from 7.5% in July, compared to the market expectation of 7.8%. Further, the Harmonised Index of Consumer Prices (HICP) for the nation, the ECB’s preferred gauge of inflation, rose to 8.8% from 8.5% as expected. Following the data, Reuters mentioned that near 50-Year high German inflation strengthens case for a larger ECB rate rise.

That said, policymaker Klaas Knot said on Tuesday that he was leaning toward a 75 basis points rate hike in September and also added that he was open to discussion. On the same line, ECB Chief Economist Philip Lane said on Tuesday, “We need to keep raising interest rates.” Further, ECB Governing Council member Madis Muller told Reuters on Tuesday that he thinks 75 basis points should be among the options for September given that the inflation outlook has not improved. Additionally, ECB member Joachim Nagel also said, “We shouldn’t delay the next interest-rate steps for fear of a potential recession”.

On the other hand, US Consumer Confidence for August improved to 103.2 versus 95.3 in July, per the Conference Board’s (CB) latest survey details. Also, US Housing Price Index (HPI) rose by 0.1% MoM in June compared to May's increase of 1.3% and market expectation of 1.1%. Further, the S&P/Case-Shiller Home Price Indices eased to 18.6% YoY during the stated month versus 19.5% forecast and 20.5% previous readings. It should be noted that the US JOLTS Job Openings grew to 11.239M in July versus 10.475M expected and 11.04M prior (revised from 10.698M).

Talking about the Fedspeak, "I don't expect inflation to come down predictably," said Richmond Federal Reserve Bank President Thomas Barkin. Following him was Atlanta Fed President Raphael Bostic who said, “Slowing inflation data 'may give us reason' to slow interest rate hikes.” Moving on, NY Fed President John Williams spoke to the Wall Street Journal (WSJ) while saying, “We are not at restrictive policy yet.” The policymaker added, “We need to get interest rates higher than longer run a neutral level.”

Elsewhere, Taiwan’s firing of the warning shots for 1st time at a Chinese drone, per Reuters, joined the Wall Street Journal’s news stating that the US Army grounds entire fleet of Boeing-made Chinook helicopters to also weigh on the market sentiment and the EUR/USD prices.

Amid these plays, yields renewed cycle high and Wall Street closed in the red while the US dollar regained upside momentum.

Moving on, the flash/preliminary readings of the Eurozone HICP for August, expected at 9.0% versus 8.9% prior, will be crucial for the EUR/USD pair buyers amid talks of higher rates and recession. Also important to watch will be the headlines surrounding China due to the latest geopolitical fear surrounding the dragon nation, as well as energy concerns relating to the old continent.

Also read: Eurozone Inflation Preview: Hotter HICP to cement a 75 bps ECB hike next week

Additionally, the US ADP Employment Change for August, the early signal for Friday’s US Nonfarm Payrolls (NFP), expected 200K versus 128K prior, will also be important to watch for fresh impulse.

Also read: ADP Jobs Preview: Three reasons to expect the data to drive the dollar higher

Technical analysis

A two-week-old descending resistance line restricts immediate EUR/USD upside ahead of late July’s bottom around 1.0100. On the contrary, pullback remains elusive beyond the recently flashed multi-year low near 0.9900.

-

23:03

EUR/JPY Price Analysis: Refreshes five-week highs, above the 139.00 mark

- EUR/JPY is recording gains of almost 1.50% during the week.

- Buyers reclaiming the 100 and the 50-DMA is exacerbating a move towards 140.00.

The EUR/JPY slightly rises as the Asian Pacific session began, following Tuesday’s positive trading session, which witnessed the cross reclaiming the 100-day EMA at 138.31. Nevertheless, the cross-currency faced solid resistance around the 50-day EMA at 138.85, achieving a close above the former. At the time of writing, the EUR/JPY is trading at 139.00.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart illustrates the pair breaking a market structure to the upside when the pair cleared the 138.39 mark. That opened the door for further gains, once longs stepped in, as the EUR/JPY gets ready to test the 140.00 mark ahead of the ECB’s next week’s monetary policy meeting.

Worth noting that the Relative Strength Index (RSI) lies at 57.77, with enough room to spare, before reaching overbought territory; hence, the EUR/JPY bias is upwards.

The EUR/JPY’s first resistance would be the 140.00 mark. Once cleared, the next resistance would be the July 21 daily high at 142, 32, followed by the YTD high at 144.27

EUR/JPY Key Technical Levels

-

22:59

Gold Price Forecast: XAU/USD sees downside below $1,720 ahead of US Employment Change

- Gold price is oscillating in a $1,723.03-1,727.20 range as investors await US Employment Change data.

- An upbeat US JOLTS Job Openings data strengthened the DXY.

- Fed Williams sees interest rates above 3.5% to cool down price pressures.

Gold price (XAU/USD) is displaying lackluster performance after a bearish perpendicular move on Tuesday. The precious metal is oscillating in a narrow range of $1,723.03-1,727.20 in the Asian session. The yellow metal is auctioning around Monday’s low and is likely to witness a steep fall after violating the critical support of $1,720.00.

The precious metal went through some severe pain after the US dollar index (DXY) picked bids on better-than-expected US job openings data and hawkish commentary from New York Federal Reserve (Fed) Bank President John Williams. The JOLTS Job Openings data landed at 11.239M, higher than the expectations of 10.475M and the prior release of 11.04M. While Fed’s Williams sees the inflation rate scaling lower to 2.5-3% next year and has raised targets for interest rates above 3.5%.

Going forward, investors’ entire focus will remain on US Automatic Data Processing (ADP) Employment data, which is expected to improve to 200k, against the prior release of 128k. The US labor market is extremely tight, which is delighting Fed policymakers in raising interest rates unhesitatingly.

Gold technical analysis

On an hourly scale, gold prices have slipped below the 61.8% Fibonacci retracement (placed from July 21 low at $1,680.91 to August 10 high at $1,807.93) at $1,729.72. The 20-and 50period Exponential Moving Averages (EMAs) at $1,728.89 and $1,733.33 are declining, which adds to the downside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more downside ahead.

Gold hourly chart

-

22:24

Silver Price Forecast: XAG/USD drops sharply below the $18.50 mark on Fed’s aggressive tightening

- Silver price slid almost 2% on Tuesday due to risk aversion.

- An improvement in consumer confidence, amongst an increase in job openings, would not deter the Fed from hiking rates.

- Most Fed officials estimate a 50 or 75 bps rate hike in the September meeting.

Silver price edges lower, hitting six-week lows below the $18.50 mark, extending its losses for three consecutive days, amidst a sour market sentiment spurred by expectations of a hawkish Fed, according to Powell’s speech at Jackson Hole. Echoing the same remarks are ECB’s Governing Council members, adding to a worldwide hawkish choir where higher rates, and high inflation, could trigger a recession.

XAG/USD git a daily high, near $18.84, but broad US dollar strength, spurred by three Fed regional bank presidents, alongside renewed China’s Covid-19 lockdowns, weighed on the white metal. Therefore, tXAG/USD tumbled towards the day’s lows at $18.32 before settling around current prices. At the time of writing, XAG/USD is trading at $18.40, down almost 1.70%.

XAG/USD stumbles on positive US consumer confidence, sour sentiment

During the New York session, the US Conference Board revealed that consumer confidence in the US was better than estimated. August’s figures came at 103.2, topping expectations of 98. At the same time, the US Department of Labor reported that job openings on the JOLTs Openings report rose by 11.2 million, exceeding all the forecasts, while quits diminished.

Aside from this, three Fed officials stressed the need for the US central bank to hike rates into restrictive territory. The New York Fed Williams expressed the need to increase rates beyond the 3.5% threshold, adding that once rates peak, they will need to stay higher for longer. Later, Richmond’s Fed Barkin expressed that the Fed’s goal is 2% and reiterated the Fed will “do what it takes to get there.”

Earlier, Atlanta’s Fed Bostic wrote that the Fed’s duty to curb inflation is “unshakable” while adding that he would be open to lower rate hikes.

On the ECB’s side, most Governing Council members, seven crossing newswires, expressed the need to front-load rates, some expecting a 75 bps rate hike, while others a 50. Some of the speakers said that the Euro area would enter a recession.

Aside from this, market participants’ focus turns to the US economic calendar. The docket will feature the US ISM Manufacturing PMI for September, alongside the US Nonfarm Payrolls report, which would shed some light on the employment situation.

XAG/USD Key Technical Levels

-

22:01

Mexico Fiscal Balance, pesos: -49341.7B (July) vs previous -146.39B

-

21:52

NZD/USD bulls need to stay above 0.6120

- NZD/USD is beaten down but bullish prospects are above the 0.6120s.

- A move beyond 0.6150 would be expected to see the 0.6180s.

NZD/USD is ending the North American day down by some 0.35%, sliding from a high of 0.6194 to a low of 0.6123 on the day. The day has been dominated by global recession fears and movement in the US dollar and yields.

''This intraday volatility broadly reflects moves in US bond yields and equity index futures; the former had drifted off yesterday, but are back up again as markets weigh the prospects of stickier inflation, and that’s weighing on the NZD,'' analysts at ANZ Bank said.

''Markets remain attuned to the first in, first out thematic in relation to the policy cycle, and NZ has become the unwitting poster child of that concept, and it’s natural that markets have become cautious about the NZD with the Reserve Bank of New Zealand also hinting that they may pause after the next couple of hikes (while the Fed keeps hiking).''

NZD/USD technical analysis

Meanwhile, from an hourly perspective, the price is finding support in what could turn out to be the base of the last leg of a potential Gartley pattern. If the bulls commit above the 0.6120s, a move beyond 0.6150 would be expected to see the 0.6180s as price mitigates a price imbalance and heads towards the 0.6190s as the last defence for a move into the 0.6220s.

-

21:34

United States API Weekly Crude Oil Stock rose from previous -5.632M to 0.593M in August 26

-

20:45

Gazprom says halted gas supplies to Engie due to insufficient payments for gas supplies in July

reuters reports that Russia's gas giant Gazprom will fully suspend natural gas supplies to Engie, one its main European utilities, from Sept. 1 until it receives all payments for gas in full, the company said on Tuesday.

''Gazprom is further squeezing gas deliveries to Europe in a dispute over contracts, deepening concerns about Europe's winter energy supply.''

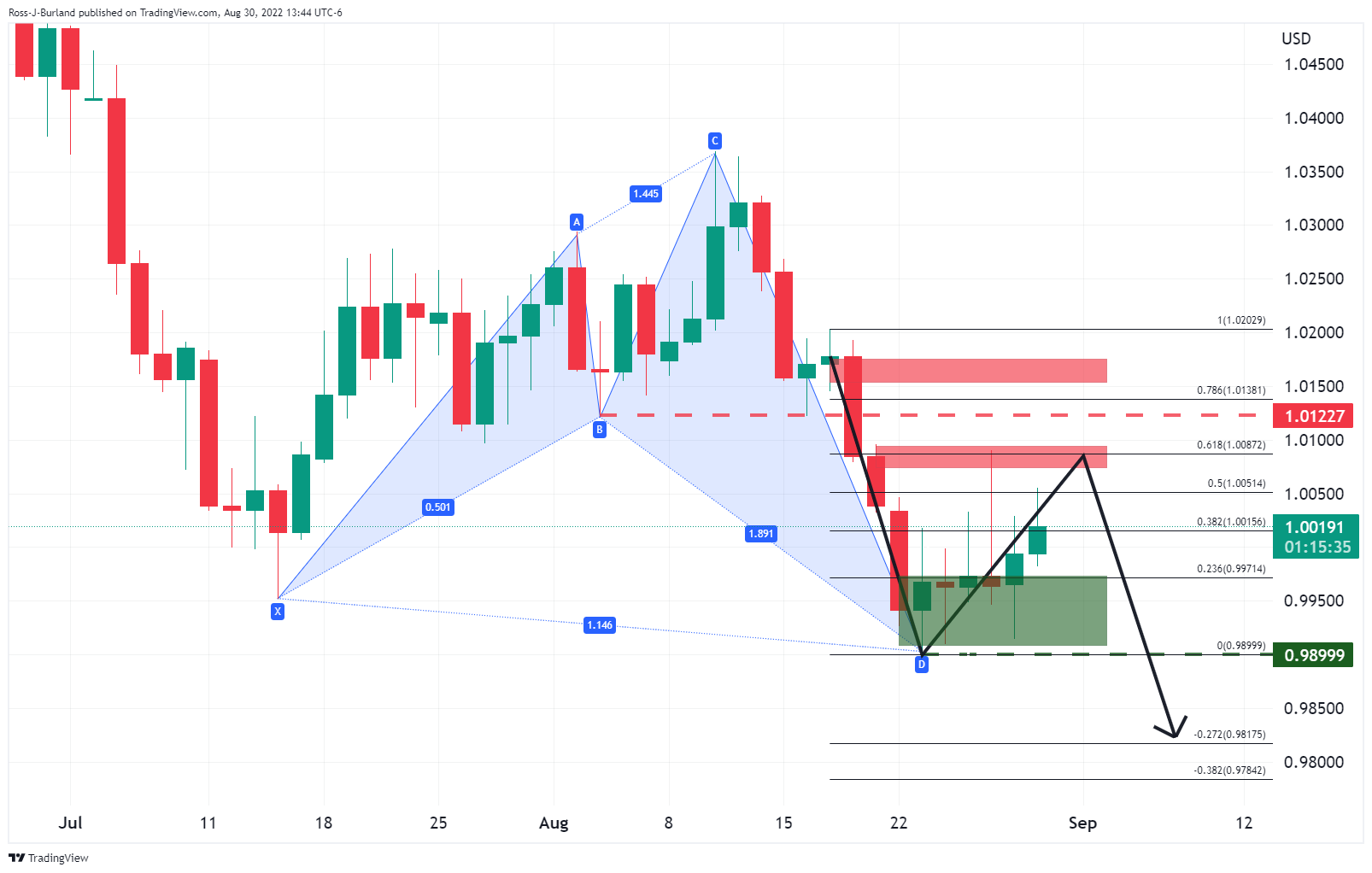

This is troublesome for the euro given that, Germany, the region’s largest economy and traditional growth driver, has a particular reason to worry as it’s largely reliant on Russian gas and is sliding toward a recession. Technically, however, the euro is holding in a bullish corrective formation on the daily chart, although while below 1.0120, the focus is on a bearish continuation:

The Gartley is a reversion pattern but the price could find pressures again in due course while below the neckline of the formation.

-

20:39

Forex Today: Beware of overheating inflation in the EU

What you need to take care of on Wednesday, August 31:

The dismal market mood eased early on Tuesday, although investors are far from optimistic. The greenback shed some ground throughout the first half of the day, particularly against high-yielding rivals, but posted a comeback during US trading hours, edging higher against most major rivals but the EUR.

The EUR/USD pair settled at around 1.0010, marginally higher for a second consecutive day, as odds for a 75 bps rate hike in September continued to increase. Several European Central Bank officers are jawboning on moving faster with quantitative easing to tame inflation. German CPI jumped by 7.9% YoY in August, according to preliminary estimates, while the EU will release inflation figures on Wednesday.

The GBP/USD pair, on the other hand, fell to a fresh two-year low of 1.1620, ending the day a handful of pips above the level.

Commodity-linked currencies suffered the most amid weaker oil and gold prices. The AUD/USD pair struggles around 0.6860, while USD/CAD topped at 1.3107, now trading a handful of pips below such a high.

The bright metal trades near its August low at $1,720.28 and is technically poised to extend its slump. Crude oil prices fell on news that Iran and the US have reached an agreement on the Iranian nuclear deal that would be announced in two or three weeks. Furthermore, Tehran reported exports had not been affected by political clashes in Baghdad. The barrel of WTI currently trades at $91.70.

USD/CHF is marginally higher and trades around 0.9730, while USD/JPY is little changed on a daily basis hovering around 138.60.

Asian and European indexes posted modest intraday gains, but Wall Street turned south and closed in the red, with major indexes shedding roughly 1% each.

Shiba Inu new release: Shytoshi Kusama teases the launch of Shibarium

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:17

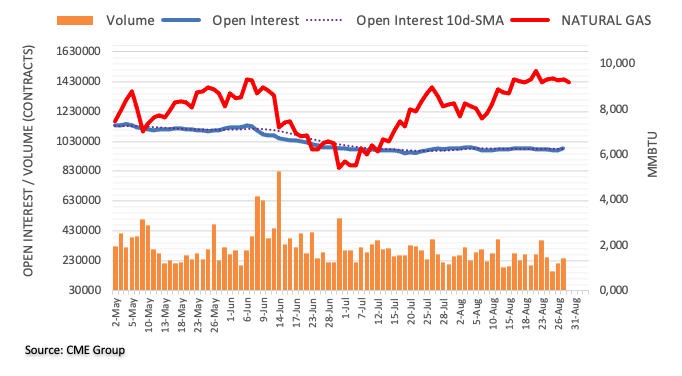

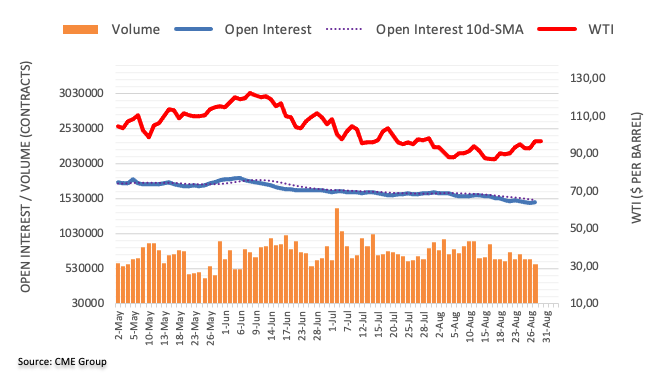

WTI licks its wounds following strong recession worries drop

- Oil attempts to correct a strong sell-off on Tuesday.

- WTI is weighed by prospects of an economic slowdown that will likely that could slow demand.

The price of oil was sold off heavily on Tuesday, losing over 5% after falling from a high of $97.65 to a low of $90.55 on the day so far. Recession concerns have moved back to the fore at the same time that we have oversupply and while the potential for OPEC+ production cuts ease.

Friday's hawkish speech from Federal Reserve chair Jerome Powell and weekend comments from European officials saying an economic slowdown is likely that could slow demand. As a consequence, West Texas Intermediate crude for October delivery was last seen down US$2.31 to US$94.70 per barrel, while October Brent crude, the global benchmark, was down US$3.11 to US$101.98.

Meanwhile, the weekend reports of militia fighting in Libya raised concerns that the country's 1.2-million barrels per day of oil exports would again be at threat should oilfields and ports again be at threat, though shipments have not yet been impeded. "Following months of blockades of oilfields and oil terminals, production had only just normalised again at a level of 1.2 million barrels per day," Commerzbank said in a note.

Nevertheless, analysts at TD Securities argued, ''energy supply risk is soaring once again. Energy market participants are increasingly sceptical that a potential Iran deal is imminent, with final-hour negotiations showing signs of a potential impasse. President Raisi's recent comments suggest that the safeguards issue remains a point of contention that could derail a potential agreement if Iran does not concede.''

''We reiterate that failure to reach a deal with Iran would suggest that oil is still on a runaway train, as even slowing demand growth would still continue to sap the world's spare capacity. Further, signs that Saudi Arabia and Gulf nations are reviving the OPEC+ put reinforce the likelihood that energy supply risks will continue to insulate prices from demand-side headwinds as oil markets stare down the barrel of a recession.''

-

19:39

USD/CAD Price Analysis: Hits seven-week highs above 1.3100, as a rising-wedge looms

- USD/CAD is climbing sharply, above 1.3100, as a rising wedge threatens to drag the spot price below 1.3100.

- Solid resistance around 1.3110 could pave the way for a USD/CAD fall below the 1.3100 figure.

The USD/CAD rallied to seven-week highs, above the 1.3100 figure, but retreated as buyers lacked the strength to hold the fort above the latter during the North American session. At the time of writing, the USD/CAD is trading at 1.3103, up 0.71%.

USD/CAD Price Analysis: Technical outlook

The USD/CAD daily chart depicts the pair in a solid uptrend as buyers decisively conquered the 1.3000 mark when the major hit a daily high at 1.3108, but a pullback keeps the major around the 1.3090s area. If the USD/CAD achieves a daily close above 1.3100, that will pave the way for a re-test of the YTD highs at 1.3223. Otherwise, the major could consolidate in the 1.3000-1.3100 area ahead of the Bank of Canada’s (BoC) monetary policy meeting on September 7.

It is worth noting that a rising wedge in the daily chart formed, meaning that short-sellers could be adding to their positions, as the “wedge” targets a fall towards 1.2770.

Short term, the USD/CAD 4-hour chart portrays a negative divergence between price action and the Relative Strength Index (RSI(. While the USD/CAD is trending up, with successive series of higher highs/lows, the RSI’s last peak is lower than the previous, meaning buyers are losing steam. Aldo, the weekly high facing the R2 daily pivot at 1.3110, opened the door for a pullback.

Therefore, the USD/CAD first support would be the 1.3100 figure. Once cleared, the next demand zone would be the R1 daily pivot at 1.3060, followed by the daily pivot point at 1.3020.

USD/CAD Key Technical Levels

-

19:17

GBP/USD is pressured into fresh daily lows

- GBP/USD is in the hands of the bears testing the 1.1650s.

- From an hourly perspective, GBP/USD is decelerating into a 38.2% Fibonacci retracement level.

GBP/USD is down some 0.45% on the day so far while risk assets see some recovery following the bumpy ride into Jackson Hole Meeting. The pound climbed to 1.1760 from 1.1621 on Tuesday in what was a US dollar move across the board. The greenback has sunk as per DXY from the session highs of 109.111 and now idles at 108.80, up slightly on the day after rising from a low of 108.286.

The US dollar is softer despite world stocks retreating again on Tuesday amid concerns about the chance of more interest rate hikes in Europe and the United States. Data this week so far has kept the hawkish sentiment going while economic growth and inflation readings have remained firm on either side of the pond despite the policy tightening so far. US data showed on Tuesday that job openings increased in July, underpinning the case for the Federal Reserve to stick to its aggressive monetary policy tightening path. In other data, August’s US CB Consumer Confidence rose to 103.2, topping expectations of 98. At the same time, the US Department of Labor reported that job openings on the JOLTs Openings report rose by 11.2 million, exceeding all the forecasts, while quits diminished.

We have also heard from Fed speakers on Tuesday. New York Fed President John Williams told Wall the Wall Street Journal that inflation expectations in the US were well anchored but added that it would take a few years to bring inflation back to 2%. Richmond Federal Reserve Bank President Thomas Barkin said on Tuesday that the United States is facing "post-war-like" inflation.

There were no UK data scheduled for release on Tuesday, but the focus is on the Bank of England which is expected to raise interest rates by another 50 basis points at its Sept. 15 meeting.

GBP/USD technical analysis

GBP/USD has continued to bleed out but the M-formation being left behind on the daily chart is a reversion pattern that would be expected to see the price retrace at least to a 38.2% Fibonacci retracement in due course.

GBP/USD H1 chart

From an hourly perspective, the price has extended in a bearish impulse and the correction is decelerating into a 38.2% Fibonacci retracement level that could see the price revert to the downside again.

-

18:32

EUR/USD bounces above parity on hawkish ECB comments, despite US dollar strength

- EUR/USD advances underpinned by ECB’s Governing Council members expressing the need for a 75 bps rate hike in September.

- US Consumer Confidence surprisingly rose, while job vacancies topped estimations.

- August’s German inflation figures were aligned with estimations, except for headline inflation, closing to the 8% threshold.

The EUR/USD regains parity for the second time in the week, up 0.33%, despite a downbeat market mood, though a softer US dollar and ECB’s hawkish rhetoric bolstered the EUR/USD. At the time of writing, the EUR/USD is trading at 1.0021 above its opening price after hitting a daily high at 1.0054.

EUR/USD is firm amid ECB hawkish comments, despite mixed US data

EUR/USD is underpinned by ECB hawkish commentary of seven ECB speakers during the day. Meanwhile, August’s US CB Consumer Confidence rose to 103.2, topping expectations of 98. At the same time, the US Department of Labor reported that job openings on the JOLTs Openings report rose by 11.2 million, exceeding all the forecasts, while quits diminished.

Fed speakers led by New York Fed President Williams, Richmond's Barkin, and Atlanta's Bostic, crossed wires. They all reiterated the Fed's commitment to bringing inflation down while adding that the Fed needs to get to the restrictive territory. Williams stated that he wants rates above 3.5%, while Barkin said that the Fed would do "what it takes" to get to the 2% target. Meanwhile, Bostic said that if indeed inflation is moving down, then the Fed might refrain from the 75 bps rate hikes.

The ECB speakers parade was led by ECB Knot, who said he’s leaning towards a 75 bps rate hike, adding that normalization of rates is an “essential” first phase while adding that an economic slowdown later this year is unavoidable. Echoing some of his comments was ECB Vasle, adding that inflation is more persistent and backs a higher increase than 50 bps, while ECB Muller said the bank should discuss 75 bps.

Earlier in the day, ECB Wunsch said the bank has to act quickly on rate hikes to a level that may be restrictive, even if the EU’s economy enters a recession. ECB’s Muller said price stability is our main concern and has to come first, adding that the ECB needs to continue hiking.

During the European session, the EU’s economic and industrial sentiment missed expectations, but German inflation figures showed prices increasing as expected, except for the year-over-year reading, with German inflation at 7.9%, higher than 7.8% estimates.

EUR/USD Key Technical Levels

-

17:30

ECB's Stournaras: Inflation to gradually decline in 2023

European Central Bank (ECB) Governing Council member Yannis Stournaras said on Tuesday that he expects inflation to peak this year before starting gradually decline in 2023, as reported by Reuters.

Commenting on the economic outlook, Stournaras acknowledged that risks to growth are tilted to the downside.

Market reaction

These comments don't seem to be having a significant impact on the shared currency's performance against its major rivals. As of writing, the EUR/USD pair was trading at 1.0020, where it was up 0.25% on a daily basis.

-

17:03

USD/CHF Price Analysis: Climbs sharply towards six-week highs around 0.9760s

- The USD/CHF reclaims the 0.9700 figure, advancing towards the 0.9800 mark, up by 0.70%.

- USD/CHF Price Analysis: A daily close above 0.9740 opens the way towards 0.9900; otherwise, a fall to 0,9600 is on the cards.

The USD/CHF climbs during the North American session, hitting a six-week high at around 0.9762, leaving below the 20-day EMA, widening the gap from the long-term daily moving averages (DMAs). At the time of writing, the USD/CHF exchanges hands at 0.9746, up 0.70%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF weekly chart illustrates the pair extended its gains above the 20-EMA, lying at 0.9676, following Monday’s unsuccessful break. Additionally, the Relative Strength Index (RSI) crossed above the 7-week RSI’s SMA, aiming higher, showing buyers are gathering momentum. Therefore, the USD/CHF is resuming its upward bias in the near term.

The USD/CHF daily chart illustrates the major bouncing off the 100-day EMA, after Monday’s failure to do, and extended its gains to hit a daily high at 0-9762 before retreating toward current price levels, just above the July 21 high at 0.9739. If the USD/CHF achieves a daily close below tie latter, a retracement towards the 0.9600 figure is on the cards. Otherwise, the USD/CHF could continue its way north, towards the 0.9886 mark, ahead of the 0.9900 psychological level.

Hence, the USD/CHF first resistance would be the 0.9800 figure, followed by the July 14 daily high at 0.9886, ahead of the psychologically 0.9900 mark. On the other hand, the USD/CHF first support would be the 0.9700 figure. Once cleared, the next demand area would be the 100-day EMA at 0.9665, followed by the 50-day EMA at 0.9616, and then the August 26 daily low at 0.9577.

USD/CHF Key Technical Levels

-

16:53

EUR/GBP rises above 0.8600 for the first time since early July

- Euro among top performers on Tuesday on ECB rate hike expectations.

- Pound under pressure amid risk aversion.

- EUR/GBP gains more than 170 pips during the last three trading days.

The EUR/GBP accelerated the move to the upside and jumped to 0.8601, reaching the highest level since July 6. While the euro is among the best performers, the pound is under pressure amid risk aversion.

No more range

The rally in EUR/GBP started on Friday, on the back of comments from European Central Bank officials suggesting a 75 basis points rate hike at the next meeting. On Tuesday, Governing Council members Muller and Knott spoke about the possibility of a significant hike, boosting the euro further.

The pound is under pressure across the board. Cable hit a new two-year low. Concerns about UK’s economic outlook are growing as energy costs soar. Also the decline in equity prices in Wall Street weighs on GBP. The Dow Jones is falling by 0.80% and the Nasdaq by 1.17%.

Since last Friday, the cross has risen 175 pips. On Monday it broke the 0.8500 resistance area and the upper limit of a consolidation range. Now it is holding above 0.8540 and testing levels above the critical 0.8600 mark. The next resistance stands at 0.8640.

Technical levels

-

16:41

Fed's Williams: Will take a few years to get back to 2% inflation

New York Fed President John Williams told Wall the Wall Street Journal on Tuesday that inflation expectations in the US were well anchored but added that it would take a few years to bring inflation back to 2%, as reported by Reuters.

Additional takeaways

"Some positive momentum into the second half of this year."

"Inflation is still way too high."

"We will look across data ahead of the next meeting including inflation, employment data, job openings and others."

"We clearly have an imbalance in the economy."

"We need to slow demand enough to meet supply."

"We will weigh all of this in the next meeting; the decision on the rate hike will depend on the totality of the data."

"Fed has to think about where we want to see interest rates both this and next year."

"If we need to get interest rates significantly higher by the end of the year, of course, that informs decisions at each meeting."

"We need to think about the path of policy; that depends on jobs, inflation data."

"We need to get real interest rates above zero."

"How high rates need to go depends on economic data; my baseline is we need rates somewhat above 3.5%."

"Financial conditions have tightened quite a bit since the beginning of the year."

"That tightening is consistent with the Fed's direction on policy."

"There will be a time when policy actions will change."

Market reaction

The US Dollar Index retreated from session highs following these comments and was last seen trading flat on the day at 108.75.

-

16:27

US: Consumer Confidence recovers as gas prices decline – Wells Fargo

A report from Conference Board showed a recovery in consumer confidence in August according to preliminary data. Analysts at Well Fargo point out the rebound in confidence to its highest level since May took pace as gas prices fell throughout the month and stock prices rose during the first half of it.

Key Quotes:

“Lower gas prices throughout the month and a rebound in equities through the first half of it breathed some fresh life into consumer confidence in August. The headline print of 103.2 was a bigger gain than the consensus had expected and returns confidence to a level last seen in May.”

“While gasoline prices have continued to trend lower throughout the month, stock prices have not. The roughly 6.5% decline in the S&P 500 since August 16 could weigh on confidence if markets remain under pressure.”

“While it is true that employers report difficulty finding help these days, monetary policymakers are charting a course that is intended to bring labor supply and demand more into balance. On Friday of this week the official employment report will be released, and we would be surprised by job growth continuing anywhere near the July pace in the months ahead. We expect employers added 325K people to their payrolls in August.”

-

16:15

USD/JPY hits six weeks highs above 139.00 despite risk aversion

- US dollar gains momentum despite another decline in Wall Street.

- Higher US yields keep the yen under pressure.

- USD/JPY approaches again the 140.00 zone.

The USD/JPY is gained momentum during the American session and climbed to 139.08, reaching the highest level since mid-July. The pair remains bullish amid a stronger US Dollar across the board.

The greenback rose sharply supported by higher US yields. The 10-year yields climbed to 3.14% while the 2-year rose to 3.49%. Bonds dropped even as US equities turned sharply lower. The Dow Jones drops by 0.89% and the Nasdaq falls by 1.25%.

Economic data in the US showed an improvement in Consumer Confidence with the CB index rising from 95.3 in July to 108.80 in August. The numbers helped the US dollar.

Earlier on Tuesday, Japan reported labor market data. The Unemployment rate held steady at 2.6%. While market participants still see possible a 75 basis points rate hike from the Federal Reserve, they expect the Bank of Japan to maintain its ultra-loose policy.

The divergence in monetary policy has been driving USD/JPY to the upside during 2022. If the pair holds above 139.00, the next level to watch is the multi-decade high at 139.38; and then attention would turn to 140.00. On the flip side, support levels might be located at 138.70, followed by 138.05 (daily low) and 137.65.

Technical levels

-

16:08

AUD/USD stumbles from weekly highs, back below the 50-DMA

- AUD/USD hit a weekly high of around 0.6956, but data and sentiment bolstered the greenback.

- Higher US Treasury bond yields underpinned the US dollar, a headwind for the AUD/USD.

- US consumer confidence improves while job openings increase.

The AUD/USD faced solid resistance at around the 20-day EMA at 0.6959, diving below the 0.6900 figure amid a risk-off impulse, with the US dollar regaining composure edging higher, underpinned by rising US Treasury bond yields. Global equities remain heavy due to expectations of an aggressive Federal Reserve following Chair Powell’s remarks.

The AUD/USD hit a daily high early in the European session, climbing towards the 0.6956 figure, though it retreated as sentiment shifted sour. Meanwhile, mixed US economic data turned out to be bad news for the AUD/USD, sliding towards its daily low at 0.6858 in the North American session. At the time of writing, the AUD/USD is trading at 0.6878, below its opening price.

AUD/USD edges lower on US dollar strength after mixed US data

The US Dollar Index, a gauge of the buck’s performance vs. a basket of six currencies, advances 0.21%, up at 198.976, while the US 10-year benchmark note sits at 3.13%, up two bps.

Meanwhile, US consumer confidence surprised to the upside, to 103.2, higher than estimates of 98, according to Reuters. “Looking ahead, August’s improvement in confidence may help support spending, but inflation and additional rate hikes still pose risks to economic growth in the short term,” said Lynn Franco, senior director at the Conference Board.

Additionally, the US Department of Labor reported that job openings, as released by the JOLTs Opening report, unexpectedly uptick in July, with vacancies increasing up to 11.2 million, above all estimates. The same report showed that quits easied from 2.8% to 2.7%.

Elsewhere, in the Asian session, Australia’s consumer confidence, as reported by the ANZ Morgan Consumer Confidence, softened by 0.7%. At the same time, housing data showed the impact of higher rate hikes, which increased mortgage rates.

Analysts at ANZ bank commented that rate hikes and increases in the cost of debt contributed to the decline in Building Approvals. They added, “We expect total building approvals to keep falling as more rate hikes put downward pressure on the borrowing capacity of both developers and individual home builders.”

What to watch

The Australian economic docket is light, contrarily to the US, where ADP figures, Fed speaking, ISM PMI, and the Nonfarm Payrolls report, are expected to offer fresh impetus to AUD/USD traders.

AUD/USD Key Technical Levels

-

15:15

ECB's Muller: 75 bps should be among options for September hike – Reuters

"I think 75 basis points should be among the options for September given that the inflation outlook has not improved," European Central Bank (ECB) Governing Council member Madis Muller told Reuters on Tuesday.

"Still, I’m going into the meeting with an open mind and I want to both see the new projections and hear my colleague’s arguments," Muller added.

Market reaction

These comments failed to provide a boost to the shared currency and the EUR/USD pair was last seen posting small daily gains at 1.0008.

-

15:04

US: CB Consumer Confidence Index improves to 103.2 in August

- Consumer confidence in the US improved in August.

- US Dollar Index turned positive on the day near 108.80 after the data.

The data published by the Conference Board showed on Tuesday that the Consumer Confidence Index improved to 103.2 in August from 95.3 in July.

Further details of the publication revealed that the Consumer Present Situation Index climbed to 145.4 from 139.7 and the Consumer Expectation Index rose to 75.1 from 65.6. Finally, the Jobs Hard-to-Get Index edged lower to 11.4 from 12.4.

Market reaction

The greenback gathered strength against its rivals on the upbeat data and the US Dollar Index was last seen posting small daily gains at 108.80.

-

15:01

United States JOLTS Job Openings came in at 11.239M, above forecasts (10.475M) in July

-

14:56

Gold Price Forecast: XAU/USD remains under pressure, seems vulnerable near one-month low

- Gold meets with a fresh supply on Tuesday and drifts back closer to a one-month low.

- Aggressive Fed rate hike bets continue to drive flows away from the non-yielding metal.

- Retreating US bon9d yields, a weaker USD does little to impress bulls or lend any support.

Gold struggles to capitalize on the previous day's goodish bounce from the $1,720 area and meets with a fresh supply on Tuesday. The steady intraday descent extends through the early North American session and drags the XAU/USD to the $1,730 region, well within the striking distance of over a one-month low touched on Monday.

Despite modest US dollar weakness and a further decline in the US Treasury bond yields, gold, so far, has struggled to gain any meaningful traction amid expectations for more aggressive Fed rate hikes. In fact, the current market pricing point to a great chance of a 75 bps rate increase at the September FOMC policy meeting. The bets were reaffirmed by Fed Chair Jerome Powell's hawkish remarks on Friday, which, in turn, is seen exerting some pressure on the non-yielding yellow metal.

The downside, however, seems cushioned, at least for the time being, amid growing worries about a deeper global economic downturn, which continues to weigh on investors' sentiment. This is evident from the fact that the intraday optimistic move in the equity markets has already started losing steam. Recession fears could drive some haven flows and turn out to be the only factor that could help limit deeper losses for gold. That said, the emergence of fresh selling favours bearish traders.

Hence, a subsequent slide back towards the $1,700 round-figure mark, en route to the $1,680 region or the YTD low touched in July, looks like a distinct possibility. That said, traders might prefer to wait for a fresh catalyst before positioning for any further downside. Hence, the focus will remain glued to the release of the closely-watched US monthly jobs data on Friday. The popularly known NFP report will influence the USD price dynamics and provide a fresh directional impetus to gold.

In the meantime, traders will take cues from other important US macro data, starting with Tuesday's release of the Conference Board's Consumer Confidence Index and JOLTS Job Openings. Apart from this, the US bond yields, the USD and the broader market risk sentiment will be looked upon to grab short-term opportunities around gold.

Technical levels to watch

-

14:46

EUR/USD Price Analysis: Next on the upside comes 1.0090

- EUR/USD adds to the positive start of the week above parity.

- Firm resistance is seen near the 1.0100 region so far.

EUR/USD rises to 2-day highs further north of the parity barrier on Tuesday.

Extra upside appears in store for the pair for the time being. Therefore, the recent weekly high at 1.0090 (August 26) now emerges as the next hurdle of significance prior to another weekly peak at 1.0202 (August 17).

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0813.

EUR/USD daily chart

-

14:21

US Dollar Index Price Analysis: Further consolidation seems favoured

- DXY adds to Monday’s pullback and retreats to the low-108.00s.

- The downside appears limited by the 107.60 zone (August 26).

DXY keeps correcting lower following Monday’s rejection from fresh cycle highs around 109.50.

The index seems to have moved into a consolidative phase, with the lower bound in recent lows near 107.60 (August 26 low). On the other hand, the surpass of the 2022 high at 109.47 (August 29) could encourage the dollar to revisit the September 2002 top at 109.77 ahead of the round level at 110.00.

In the meantime, while above the 6-month support line around 105.40, DXY is expected to keep the short-term positive stance.

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.80.

DXY daily chart

-

14:18

GBP/USD struggles to preserve modest intraday gains and retreats to 1.1700 mark

- GBP/USD surrenders its modest intraday gains and retreats to the lower end of its daily range.

- A combination of factors helps the USD to pare intraday losses and exerts downward pressure.

- A bleak UK economic outlook supports prospects for a further near-term depreciating move.

The GBP/USD pair struggles to capitalize on its modest intraday uptick to the 1.1760 area and retreats to the daily low during the early North American session. The pair is currently placed near the 1.1700 mark and remains well within the striking distance of its lowest level since March 2020 touched the previous day.

The intraday optimism in the equity markets run out of steam amid growing worries about a deeper global economic downturn. Apart from this, growing acceptance that the Fed would continue to tighten its monetary policy at a faster pace assists the safe-haven US dollar to recover its early lost ground. This turns out to be a key factor that attracts selling around the GBP/USD pair at higher levels.

In fact, Fed Chair Jerome Powell, during his speech at the Jackson Hole Symposium on Friday, signalled that interest rates would be kept higher for longer to bring down inflation. The markets were quick to price in a supersized 75 bps Fed rate hike move at the upcoming policy meeting in September. This helps offset a further decline in the US Treasury bond yields and acts as a tailwind for the greenback.

The British pound, on the other hand, continues to be undermined by a bleak outlook for the UK economy. It is worth recalling that the Bank of England had predicted earlier this month that the UK economy will enter a prolonged recession from Q4 of 2022. This suggests that the path of least resistance for the GBP/USD pair is to the downside and any attempted recovery could be sold into.

Next on tap is the US economic docket, featuring the release of JOLTS Job Openings and the Conference Board's Consumer Confidence Index for the current month. This, along with the broader market risk sentiment and the US bond yields, might influence the USD and provide some impetus to the GBP/USD pair. The focus, however, remains on the US jobs report (NFP), scheduled on Friday.

Technical levels to watch

-

14:15

EUR/JPY Price Analysis: A visit to 140.00 appears likely

- EUR/JPY extends the uptrend and challenges the 139.00 mark.

- Next on the upside now emerges the key round level at 140.00.

EUR/JPY advances for the third session in a row and prints multi-week peaks near 139.00 at the same time.

The continuation of the uptrend now shifts the focus to the key level at 140.00. Beyond the latter, the cross might attempt another test of the weekly peak at 142.32 (July 21).

While above the 200-day SMA at 134.15, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

14:15

US: Housing Price Index rises by 0.1% in June vs. 1.1% expected

- House prices in the US rose at a softer pace than expected in June.

- US Dollar Index stays on the backfoot in the American session.

The monthly data published by the US Federal Housing Finance Agency showed on Tuesday that the Housing Price Index rose by 0.1% on a monthly basis in June. This print followed May's increase of 1.3% and came in lower than the market expectation of 1.1%.

Meanwhile, the S&P/Case-Shiller Home Price Index arrived at 18.6% on a yearly basis in June, compared to analysts' estimate of 19.5%.

Market reaction

The US Dollar Index stays in negative territory near 108.50 after these data releases.

-

14:00

Chile Unemployment rate rose from previous 7.8% to 7.9% in July

-

14:00

United States Housing Price Index (MoM) below expectations (1.1%) in June: Actual (0.1%)

-

14:00

United States S&P/Case-Shiller Home Price Indices (YoY) came in at 18.6% below forecasts (19.5%) in June

-

13:55

United States Redbook Index (YoY): 14.2% (August 26) vs 13.5%

-

13:36

USD/CAD recovers early lost ground, retakes 1.3000 amid a sharp fall in oil prices

- USD/CAD reverses an intraday dip and is supported by a combination of factors.

- A sharp pullback in crude oil prices undermines the loonie and acts as a tailwind.

- A modest USD rebound from the daily low contributes to the intraday move up.

- Retreating US bond yields, the risk-on mood might cap the USD and the major.

The USD/CAD pair bounces a few pips from the daily low and moves back above the 1.3000 psychological mark ahead of the Wall Street opening.

Crude oil prices retreat sharply from a one-month high touched earlier this Tuesday amid concerns that a deeper global economic downturn would hurt fuel demand. Apart from this, hopes for the resumption of sanctioned Iranian oil exports overshadow expectations that major oil producers could cut output and weigh on the black liquid. This, in turn, undermines the commodity-linked loonie and assists the USD/CAD pair to attract some dip-buying near the 1.2970 region.

The US dollar, on the other hand, trims a part of its modest intraday losses and further contributes to the USD/CAD pair's intraday bounce. Growing acceptance that the Fed will continue to tighten its policy at a faster pace turn out to be a key factor acting as a tailwind for the greenback. That said, a further decline in the US Treasury bond yields, along with the risk-on impulse, might keep a lid on any meaningful upside for the safe-haven buck and cap the upside for the major.

This, in turn, makes it prudent to wait for some follow-through buying beyond the daily swing high, around the 1.3025 region, before positioning for any meaningful intraday appreciating move. Market participants now look forward to the US economic docket - featuring JOLTS Job Openings and the Conference Board's Consumer Confidence Index. The data might influence the USD demand, which, along with oil price dynamics, should produce short-term opportunities around the USD/CAD pair.

Technical levels to watch

-

13:34

ECB's Knot: Leaning towards 75 bps hike in September

European Central Bank (ECB) policymaker Klaas Knot said on Tuesday that he was leaning toward a 75 basis points rate hike in September but added that he was open to discussion.

Knot further argued that going back to neutral would not be enough to tame inflation and added that they could see labour hoarding in the initial phase of economic slowdown.

Market reaction

EUR/USD retreated from daily highs in the early American session but was last seen moving in positive territory above parity.

-

13:30

Canada Current Account below expectations (6.6B) in 2Q: Actual (2.69B)

-

13:25

Fed's Barkin: Inflation not expected to come down predictably

Richmond Federal Reserve Bank President Thomas Barkin said on Tuesday that the United States is facing "post-war-like" inflation.

"I don't expect inflation to come down predictably," Barkin noted and reiterated that the Federal Reserve is committed to returning inflation to the 2% target.

Commenting on the growth outlook, "we are not today in a recession," Barkin said and added that a recession does not have to be calamitous.

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen trading in negative territory near 108.50.

-

13:22

Malaysia: Inflation rose to 14-month high in July – UOB

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest inflation figures in Malaysia.

Key Takeaways

“Headline inflation accelerated for the fourth straight month to a 14-month high of 4.4% y/y in Jul (from +3.4% in Jun), in line with our estimate (4.5%) and Bloomberg consensus (4.4%). This big jump in headline inflation largely reflected upward adjustments in prices of some essential food items (i.e. chicken, eggs, and cooking oil) and services, the lapse of low base effects in electricity tariffs, and costlier vehicle purchases after the sales tax exemption expired on 30 Jun 2022 as planned.”

“We raise our 2022 full-year inflation estimate to 3.5% (from 3.0% previously, BNM est: 2.2%-3.2%) following the full reflection of price adjustments for various price-administered items in the reporting month and higher-than-expected inflation outturns in May-Jun. The combination of factors including year-ago low base effects, still-high commodity prices, persistent currency weakness and intensifying cost pass-through effects will continuously keep headline inflation above 4.0% levels for the remaining months of the year. Our revised inflation outlook has yet to factor in the impact of the new targeted fuel subsidy mechanism that is currently under pilot testing.”

“Given a robust GDP growth print in 2Q22, signs of further economic expansion in 2H22 albeit at a moderate pace, and broadening second-round effects on inflation, Bank Negara Malaysia (BNM) will likely follow-through with a third 25bps rate hike at the coming monetary policy meeting on 7-8 Sep. This will bring the Overnight Policy Rate (OPR) to 2.50%. Besides internal factors, we believe the expected outsized Fed rate hikes in the coming months and global monetary conditions would also be taken into consideration by BNM at the Sep meeting.”

-

13:11

CAD/JPY: Clear push above 107.65 to trigger rapid rally towards 112/114 – Scotiabank

CAD/JPY has traded positively through August so far. A clear break above 107.65 would trigger a significant rise towards 112/114, economists at Scotiabank report.

New cycle highs to reinvigorate broad bull tone

“The daily studies are leaning neutral still but new cycle highs here would certainly reinvigorate the broader bull tone of this cross which was obvious earlier this year.”

“A clear and sustained push above 107.65 would suggest scope for additional – and relatively rapid, we believe – CAD gains towards 112/114.”

“Support is 105.15 (40-day moving average) and 102.95/00.”

-

13:10

ECB's Knot: Front-loading should not be excluded

"A swift normalization of interest rates is an essential first phase, and some front-loading should not be excluded," European Central Bank (ECB) policymaker Klaas Knot said on Tuesday, as reported by Reuters.

"We must forcefully tackle the growing problem of persistently high inflation," Knot added and argued that an economic slowdown alone would be unlikely to bring inflation back to the ECB's objective over the medium term.

"I see several upside risks to inflation; expectations could become de-anchored," Knot warned.

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and was last seen rising 0.35% on the day at 1.0030.

-

13:06

EUR/CAD: Dip under last week's low at 1.2875/80 to trigger a substantial drop to 1.2470 – Scotiabank

EUR/CAD rebounds from sub-1.30 test but undertone remains weak. Economists at Scotiabank note that the pair could plummet until 1.2470 on a break under last week’s low at 1.2875/80.

EUR/CAD retains a lot of underlying, downward momentum

“Short-term (intraday and daily) trend oscillators have moderated but bearish weekly and monthly DMI readings imply that this market retains a lot of underlying, downward momentum which will leave the EUR facing firm resistance on minor gains and ongoing downside risk.”

“Stiff resistance above the market remains intact at 1.3290/00. At the very least, the EUR needs to regain – and hold above – this point to establish a stronger base for a reversal in what is now a very extended run lower in the EUR.”

“Below last week’s low at 1.2875/80, there is nothing of note in terms of EUR support until 1.2470.”

-

13:06

Germany: Annual CPI inflation rises to 7.9% in August vs. 7.8% expected

- Inflatiın in Germany continued to rise in August.

- EUR/USD clings to modest daily gains above parity after the data.

Annual inflation in Germany, as measured by the Consumer Price Index (CPI), rose to 7.9% in August from 7.5% in July, Germany's Destatis reported on Tuesday. This reading came in slightly higher than the market expectation of 7.8%.

Meanwhile, the Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, edged higher to 8.8% from 8.5% as expected.

On a monthly basis, the CPI and the HICP arrived at 0.3% and 0.4%, respectively, matching analysts' estimates.

Market reaction

These figures don't seem to be having a significant impact on the euro's performance against its major rivals. As of writing, EUR/USD was up 0.35% on the day at 1.0030.

-

13:03

Germany Harmonized Index of Consumer Prices (YoY) in line with forecasts (8.8%) in August

-

13:03

Germany Consumer Price Index (YoY) registered at 7.9% above expectations (7.8%) in August

-

13:03

Germany Consumer Price Index (MoM) meets forecasts (0.3%) in August

-

13:03

Germany Harmonized Index of Consumer Prices (MoM) meets forecasts (0.4%) in August

-

13:00

GBP/USD remains heavy and on track to test the March 2020 low near 1.1410 – BBH

GBP/USD traded at a new low for this move on Monday near 1.1650 but has rebounded to trade just above 1.17. Economists at BBH expect the pair to test the March 2020 low near 1.1410.

The notion of a Truss-led UK government is concerning

“Cable remains heavy and on track to test the March 2020 low near 1.1410.”

“We’ve been pointing out for a while that the notion of a Truss-led UK government is concerning. The main planks of her platform are 1) large-scale tax cuts, 2) BoE mandate review, and 3) hard Brexit. None of these can be seen as positive for sterling and gilts and so along with likely recession in Q4, the reasons to be underweight UK assets are piling up.”

-

12:00

Mexico Jobless Rate s.a down to 3.2% in July from previous 3.3%

-

12:00

Mexico Jobless Rate below expectations (3.5%) in July: Actual (3.4%)

-

12:00

Brazil Inflation Index/IGP-M below expectations (-0.54%) in August: Actual (-0.7%)

-

11:58

AUD/USD climbs to mid-0.6900s amid modest USD weakness, risk-on impulse

- AUD/USD gains traction for the second straight day and recovers further from a six-week low.

- Retreating US bond yields, the risk-on impulse weighs on the USD and offers support to the pair.

- Aggressive Fed rate hike bets should limit any deeper USD losses and keep a lid on the major.

The AUD/USD pair attracts some dip-buying near the 0.6875 region on Tuesday and turns positive for the second successive day. The momentum allows spot prices to recover further from a six-week low touched on Monday and climbs to mid-0.6900s during the first half of the European session amid the emergence of fresh US dollar selling.

A further decline in the US Treasury bond yields turns out to be a key factor dragging the USD away from a 20-year high touched the previous day. Apart from this, the risk-on impulse - as depicted by the strong rally in the equity markets – further underpins the safe-haven greenback and benefits the risk-sensitive aussie.

Chinese authorities pledged to stimulate the world’s second-largest economy and boosted investors' confidence. That said, growing worries about a deeper global economic downturn could keep a lid on any optimistic move in the markets. Furthermore, hawkish Fed expectations should limit the USD losses and cap the AUD/USD pair.

The markets seem convinced that the Fed will stick to its aggressive policy tightening path and have been pricing in a 75 bps rate hike at the September FOMC meeting. The bets were reaffirmed by Fed Chair Jerome Powell's hawkish remarks on Friday, signalling that interest rates would be kept higher for longer to bring down inflation.

The fundamental backdrop favours the USD bulls and warrants some caution before positioning for any further appreciating move for the AUD/USD pair. Moving ahead, traders now look forward to the US economic docket - featuring JOLTS Job Openings and the Conference Board's Consumer Confidence Index - for a fresh impetus.

The data, along with the US bond yields, will influence the USD price dynamics. Apart from this, the broader market risk sentiment might further contribute to producing short-term trading opportunities around the AUD/USD pair. The focus, however, remains on the closely-watched US monthly jobs report (NFP), due on Friday.

Technical levels to watch

-

11:20

Silver Price Analysis: XAG/USD bears have the upper hand below $19.00 mark

- Silver remains on the defensive near a one-month low touched on Monday.

- The set-up favours bearish traders and supports prospects for further losses.

- Any attempted recovery move above the $19.00 mark is likely to get sold into.

Silver struggles to gain any traction on Tuesday and remains well within the striking distance of over a one-month low touched the previous day. The white metal is currently trading around the $18.70 region and seems vulnerable to prolonging its recent downtrend witnessed over the past two weeks or so.

Given last week's failure near the 200-period SMA on the 4-hour chart, acceptance below the $19.00 mark adds credence to the near-term bearish outlook for the XAG/USD. Furthermore, technical indicators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone.

Hence, a subsequent slide towards retesting the YTD low, around the $18.20-15 area touched on July 14, looks like a distinct possibility. This is closely followed by the $18.00 round-figure mark, which if broken decisively will be seen as a fresh trigger for bearish traders and set the stage for a further depreciating move.

On the flip side, any attempted recovery move is more likely to confront stiff resistance and attract fresh sellers near the $19.00 mark. This should cap the XAG/USD near the 200-period SMA on the 4-hour chart. The said barrier is currently pegged near the $19.45-$19.50 region, which should now act as a pivotal point.

Sustained strength beyond will negate the near-term negative bias and prompt some short-covering move. The XAG/USD might then aim to surpass an intermediate hurdle near the $19.80 region and aim back to reclaim the $20.00 psychological mark.

Silver 4-hour chart

-637974515768008486.png)

Key levels to watch

-

10:57

Fed: Powell delivers a hawkish message, as expected – UOB

Senior Economist at UOB Group Alvin Liew reviews Chief Powell’s speech at the Jackson Hole Symposium on Friday.

Key Takeaways

“The key takeaway from FOMC Chair Powell’s succinct speech at Jackson Hole Symposium last Fri (26 Aug) is that inflation is still the focus and the Fed will press on in its painful inflation fight with more rate hikes as ‘Our [the Fed’s] responsibility to deliver price stability is unconditional’.”

“Powell’s comments were widely interpreted as hawkish. He stated the Fed’s resolute commitment to ‘price stability’ even if it takes time (i.e. prolonged policy tightening) and forceful measures (i.e. larger than usual rate hikes), at the expense of a long period of sub-par growth outcome and ‘some pain’ in the short term for households and businesses. And while Powell reiterated a recent statement that ‘At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases’, it was unmistakable that Powell’s immediate message was that policy rates are going to continue higher into the restrictive realm and could stay there for some time.”

“FOMC Outlook – No Change To Our 50bps Rate Hike Expectations For Sep FOMC For Now, But Aug Jobs & Aug CPI Data Key To Sep Outlook: Powell’s latest speech reaffirmed the broad market view that the Fed is still on a tightening path and it does not change our view for the Fed Funds Target Rate (FFTR) to be hiked by 50 bps in the Sep 2022 FOMC, followed by another 50 bps rate hike in Nov FOMC before ending the year with a 25bps hike in Dec, implying a cumulative 350bps of increases in 2022, bringing the FFTR higher to the range of 3.50-3.75% by end of 2022, a range largely viewed as well above the neutral stance (which is further confirmed in Powell’s speech as 2.25-2.50%, the Fed’s long run projection of FFTR). Market’s attention will now fall on data, specifically the US Aug Employment (2 Sep) and Aug CPI inflation (13 Sep) reports from the Bureau of Labor Statistics (BLS) which may shape Fed expectations before Sep’s FOMC decision day.”

-

10:52

USD/JPY keeps the red below mid-138.00s, downside potential seems limited

- USD/JPY meets with some supply on Tuesday and erodes a part of the overnight strong gains.

- Retreating US bond yields weigh on the USD and exert some downward pressure on the major.

- The risk-on impulse, Fed-BoJ policy divergence could undermine the JPY and help limit losses.

The USD/JPY pair edges lower on Tuesday and for now, seems to have snapped a two-day winning streak to its highest level since mid-July, around the 139.00 mark touched the previous day. The pair remains on the defensive through the first half of the European session and is currently hovering around the 138.30-138.25 area, just a few pips above the daily high.

The US dollar drifts lower for the second straight day and turns out to be a key factor exerting some downward pressure on the USD/JPY pair. The ongoing USD profit-taking slide from a 20-year high touched the previous day could be solely attributed to a further decline in the US Treasury bond yields. This, in turn, results in the narrowing of the US-Japan yield differential, which benefits the safe-haven Japanese yen and further contributes to the offered tone surrounding the major.

That said, the risk-on impulse, along with a big divergence in the monetary policy stance adopted by the Bank of Japan and the Federal Reserve, should cap gains for the safe-haven JPY. In fact, the Bank of Japan Governor Haruhiko Kuroda reiterated on Monday that the central bank will stick to its easing policy stance until wages and prices rise in a stable and sustainable manner. In contrast, the Fed is expected to deliver another supersized 75 bps rate hike at its September policy meeting.

The prospects for a more aggressive policy tightening by the Fed were reaffirmed by Fed Chair Jerome Powell's hawkish remarks on Friday. During his speech at the Jackson Hole Symposium, Powell signalled that interest rates would be kept higher for longer to bring down inflation. This, in turn, suggests the path of least resistance for the USD/JPY pair. Hence, any subsequent downtick might still be seen as an opportunity for bullish traders and is more likely to remain limited.

Market participants look forward to the US economic docket - featuring JOLTS Job Openings data and the Conference Board's Consumer Confidence Index later during the early North American session. This, along with the US bond yields, might influence the USD. Apart from this, the broader risk sentiment might contribute to producing short-term trading opportunities around the USD/JPY pair.

Technical levels to watch

-

10:40

Kremlin: Nothing hinders Russian gas exports besides technical problems from sanctions

On upcoming three-day maintenance at the Nord Stream 1 gas pipeline, the Kremlin said on Tuesday, “nothing hinders Russian gas exports besides technical problems from sanctions.”

Additional quotes

“Western sanctions against Russia are preventing maintenance and return of equipment to the place of work.”

“Russia is ready to fulfill its obligations on gas exports.”

Related reads

- EUR/USD extends the advance north of the parity level

- France’s Engie: Gazprom is to reduce gas deliveries starting Tuesday

-

10:39

EUR/USD extends the advance north of the parity level

- EUR/USD confirms the positive start of the week above parity.

- Germany preliminary inflation figures next on tap later in the euro docket.

- The US Consumer Confidence will be in the limelight across the pond.

The single currency adds to the auspicious start of the week and lifts EUR/USD further north the psychological parity level on turnaround Tuesday.

EUR/USD up on USD-selling, looks to data

EUR/USD is up for the second session in a row and continues to capitalize the renewed selling pressure hurting the greenback, which saw the US Dollar Index (DXY) print new 20-year peaks around 109.50 early on Monday, just to give away those gains afterwards.

The pair embarked on a corrective upside and reclaimed the area above the key parity level, as investors appear to have already digested the hawkish tilt from Powell’s message at the Jackson Hole Symposium on Friday.

The recovery in spot comes amidst a weak performance of the German 10y Bund yields, which retreats from Monday’s multi-week highs around 1.55%.