Notícias do Mercado

-

23:54

NZD/USD fades bounce off six-week low near 0.6150 ahead of US Consumer Confidence, NFP

- NZD/USD struggles to extend corrective pullback from 1.5-month low, steadies of late.

- Recession woes, hawkish central bankers underpin bearish bias.

- Market’s consolidation amid a light calendar triggered the Kiwi pair’s corrective bounce.

- US CB Consumer Confidence for August, Fedspeak will be important for intraday directions.

NZD/USD treads water around 0.6150, after bouncing off a 1.5-month low and retreating from 0.6168, as traders await fresh clues during Tuesday’s Asian session. Alike other major currencies, the Kiwi also cheered the US dollar’s pullback from nearly a two-decade high amid Monday’s volatile session. The recovery moves, however, remain elusive amid fears of economic slowdown and hawkish central bankers.

Markets began the US Nonfarm Payrolls (NFP) week on a sour note and underpinned the US dollar as global central bankers raised economic slowdown fears but refrained from stepping back on the rate hike trajectory. Among them, the US Federal Reserve (Fed) Chairman Jerome Powell gained major attention and propelled the hawkish Fed bets, which in turn fuelled the US Dollar Index (DXY) to a fresh high in late 2002.

However, the corrective pullback in prices and a light calendar joined firmer US data to help portray a consolidation in the US dollar’s latest gains and favored the NZD/USD prices to recover. Even so, economic fears and nearly 73% chances of a 75 bps Fed rate hike in September, per CME’s FedWatch Tool, exert downside pressure on the quote of late.

That said, Dallas Fed Manufacturing Business Index improved to -12.9 versus -20.2 expected and -22.6 prior.

It should be noted that Minneapolis Federal Reserve Bank President Neel Kashkari stated that people now understand how serious we are about getting inflation back to 2%.

On a different page, China’s economic slowdown fears escalate amid the fresh Sino-American tussles over the Taiwan Strait and doubts about the capacity of stimulus to help trigger the economic recovery also weighed on the NZD/USD prices.

Against this backdrop, equities remain downbeat but the US 10-year Treasury yields grew nearly eight basis points (bps) to 3.11% at the latest.

Moving on, a light calendar at home emphasizes US Consumer Confidence for August and comments from Fed speakers as the main catalysts to watch for fresh impulse.

Technical analysis

A 12-day-old resistance line around 0.6185 restricts immediate NZD/USD upside ahead of the key 50-DMA hurdle surrounding 0.6230. That said, the 0.6100 round figure appears to restrict the short-term downside of the pair.

-

23:38

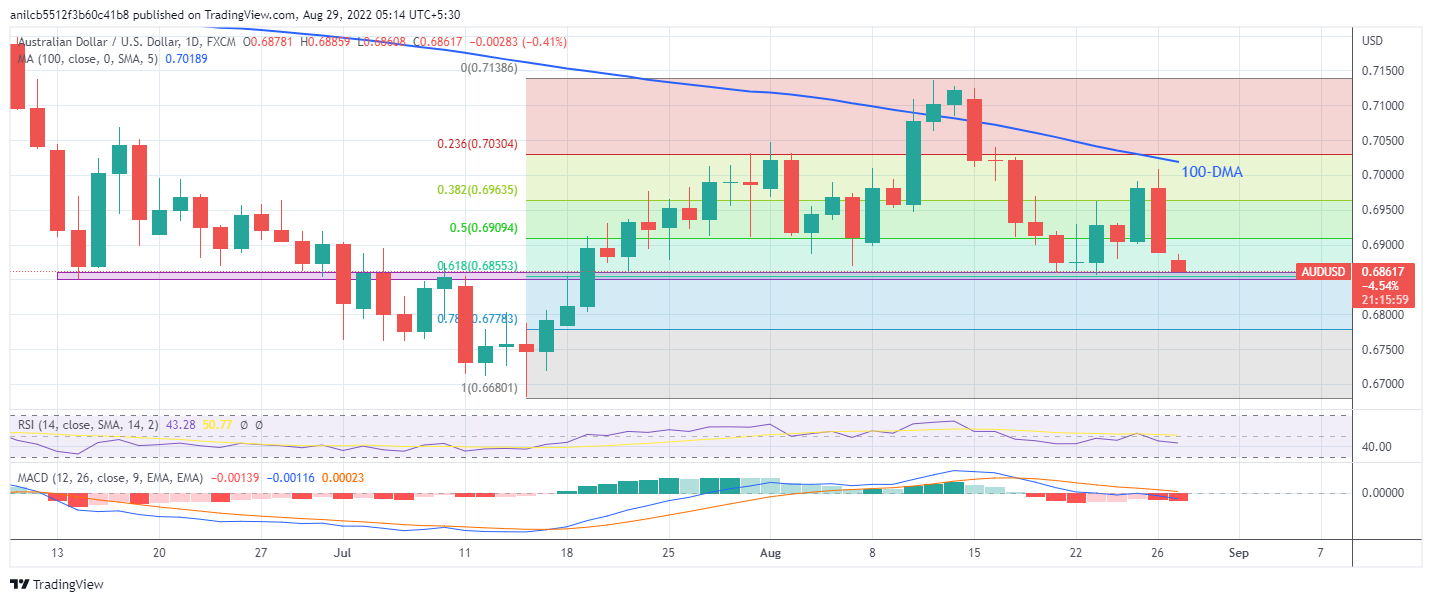

AUD/USD Price Analysis: Establishes above 50-EMA for a fresh rally, 0.7000 eyed

- Aussie bulls look comfortable after establishing above the 50-EMA at 0.6894.

- The RSI (14) needs to shift into the bullish territory of 60.00-80.00 for a fresh rally.

- AUD/USD is marching towards the psychological resistance of 0.7000.

The AUD/USD pair is displaying a balanced profile after a meaningful pullback from Monday’s low near 0.6840. The asset is indicating signs of a squeeze in volatility amid a consolidation phase after failing to overstep the immediate hurdle of 0.6920.

On an hourly scale, the asset is hovering around the 38.2% Fibonacci retracement (placed from Aug 26 high at 0.7009 to Aug 29 low at 0.6841) at 0.6905. Earlier, the asset faced barricades around 50% Fibo retracement, which is placed near 0.6925.

The establishment of the asset above the 50-period Exponential Moving Average (EMA) at 0.6894, is bolstering conviction signs for a sheer upside ahead. However, the 20-EMA near 0.6903 is overlapping with the asset, which indicates a consolidation ahead.

Also, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates that the asset is awaiting a potential trigger for further upside.

For more upside, a decisive move above 100-EMA at 0.6915 will drive the asset towards 61.8% Fibo retracement at 0.6945, followed by Aug 26 high at 0.7009.

Alternatively, a decline below 23.6% Fibo retracement near 0.6880 will drag the asset towards Aug 29 low at 0.6841. A downside move below the latter may drag the asset towards the round-level support at 0.6800.

AUD/USD hourly chart

-637974094358887415.png)

-

23:34

EUR/JPY Price Analysis: Rallies and threatens to negate a head-and-shoulders on the daily chart

- EUR/JPY advanced sharply towards the 139.00 figure, though retraced some, as the 50-day EMA emerged as resistance.

- Expect consolidation in the near term, as the EUR/JPY 4-hour chart RSI’s is overbought.

The EUR/JPY rallies to fresh six-week highs around 138.97 during the North American session on Monday. As the Asian Pacific session begins, the EUR/JPY is trading at 138.72, so far invalidating a head-and-shoulders chart pattern in the daily chart.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY faced solid resistance at the 50-day EMA around 138.86 after reaching 139.00 on Monday. Worth noting that if the EUR/JPY breaks above the July 21 high at 143.32, it will invalidate the chart pattern, paving the way for further gains.

The EUR/JPY resistance levels lie at the 50-day EMA, followed by 139.00 and 140.00 psychological levels. On the flip side, the EUR/JPY first support would be the 100-day EMA at 138.28, followed by the 138.00 figure, followed by the 20-day EMA at 137.00.

EUR/JPY Daily chart

The EUR/JPY 4-hour chart illustrates the par breaking above the August 10 high at 138.39, opening the door to further gains. However, the Relative Strength Index (RSI) is in overbought territory, meaning the cross-currency could consolidate before resuming upwards.

On its way north, a break above 139.00 will expose the confluence of the July 27 high and the R1 daily pivot around 137,50, followed by the July 25 daily high at 140.07, ahead of the R2 pivot point.

EUR/JPY 4-hour chart

EUR/JPY Key Technical Levels

-

23:27

EUR/USD struggles around parity amid hawkish ECB/Fed speakers, German inflation eyed

- EUR/USD fades the bound off one-month low, sidelined of late.

- Growing chatters over energy crisis in Europe, hawkish ECBspeak underpinned recovery.

- Increasing bets on 75 bps Fed rate hike in September, firmer US data keep US dollar buyers hopeful.

- Flash readings of Germany’s HICP data for August, US Consumer Confidence and Fedspeak will be in focus for intraday directions.

EUR/USD buyers seem to catch a breather after a volatile start to the NFP week. That said, the major currency pair initially slumped towards the one-week low before closing the day with mild gains around the parity levels, not to forget the retreat from 1.0029. In doing so, the quote struggled to justify multiple catalysts comprising recession fears in the eurozone and hawkish comments from the European Central Bank (ECB) officials, as well as firmer US data and hopes of faster rate hikes from the US Federal Reserve (Fed).

Fed Chair Jerome Powell led the policy hawks towards ignoring the economic slowdown fears in a mission to tame inflation, which in turn propelled the US Dollar Index (DXY) to a fresh 19-year high, before stepping back to 108.80. While praising the market’s reaction to the Jackson Hole speeches of the Fed policymakers, Minneapolis Federal Reserve Bank President Neel Kashkari stated that people now understand how serious we are about getting inflation back to 2%.

It should be noted that Dallas Fed Manufacturing Business Index improved to -12.9 versus -20.2 expected and -22.6 prior.

On the other hand, ECB Chief Economist Philip Lane appeared hawkish on the policy outlook as he said, “a steady pace - that is neither too slow nor too fast - in closing the gap to the terminal rate is important for several reasons," Lane explained. "The appropriate size of the individual increments will be larger the wider the gap to the terminal rate and the more skewed the risks to the inflation target."

Additionally, European Commission President Ursula von der Leyen renewed fears over the energy crisis as she reported that the EU is preparing an emergency intervention in its energy market to drive down skyrocketing electricity prices

Amid these plays, equities remain downbeat but the US 10-year Treasury yields grew nearly eight basis points (bps) to 3.11% at the latest.

Looking forward, the preliminary readings of August month German Harmonized Index of Consumer Prices (HICP), expected 8.7% YoY versus 8.5% prior, will offer immediate directions. Following that, US Consumer Confidence for the stated month and comments from various Fed policymakers will be important for the EUR/USD rate guidance. It should be noted that the hawkish central banks and recession woes keep the US dollar on the front foot, making sellers hopeful.

Technical analysis

A clear downside break of the 0.9900 threshold appears necessary for the EUR/USD bears to retake control. The recovery moves, however, need validation from a 10-DMA hurdle surrounding 1.0015.

-

23:04

GBP/USD oscillates around 1.1700, spotlight shifts to US NFP

- GBP/USD is displaying back-and-forth moves around 1.1700 as investors await US NFP.

- The US NFP is seen lower at 290k vs. 528k reported earlier.

- A minute improvement in earnings data is not lucrative for US households.

The GBP/USD pair has turned sideways after facing barricades around 1.1750 on Monday. The cable is oscillating in a narrow range of 1.1700-1.1710 in the early Tokyo session as investors are arranging their trades ahead of the US Nonfarm Payrolls (NFP), which will release later this week. On a broader note, the asset has displayed a pullback move after remaining in a negative trajectory. The asset printed a fresh two-year low at 1.1648 and a pullback move lacks conviction as the context is still bearish.

Federal Reserve (Fed)’s restrictive stance over guidance on interest rates dictated at Jackson Hole Economic Symposium is still haunting the risk-perceived currencies. Fed chair Jerome Powell is clear with his focus on bringing price stability first despite sacrificing growth prospects and unemployment. Although, it is necessary to tackle the inflation monster first as the price rise index has reached a whopping figure of 8.5% and is impacting the savings and consumption pattern of the households.

As per the preliminary estimates, the US Nonfarm Payrolls (NFP) is seen at 290k, lower than the prior release of 528k. Also, the Unemployment Rate is expected to remain stable at 3.5%. The economic data which could impact the greenback is the Average Hourly Earnings, which is likely to shift higher by 10 basis points (bps) at 5.3%. As price pressures are advancing dramatically, earnings have remained subdued. Therefore, households are facing headwinds amid higher payouts for inflation-adjusted goods and services.

On the UK front, investors are gearing up ahead of the elections season. The UK economy is going through a rough phase of political instability after the resignation of UK Prime Minister Boris Johnson. The UK markets will still remain in turmoil as energy crisis are crossing rooftops and may impact the households’ consumption further.

-

22:27

USD/CHF Price Analysis: Double-top in the 4-hour chart, targets 0.9500

- USD/CHF from a long-term perspective remains upward biased, though solid resistance around 0.9700 sent the pair lower.

- Double-top in the 4-hour chart, to keep the pair below the 0.9700 figure, the highest high of August.

The USD/CHF marches firmly as Wall Street closes, finishing Monday’s session with gains of 0.16%, after hitting a daily high around the 0.9700 figure above August’s 23 high at 0.9692. Still, solid resistance at the latter dragged prices down towards the 0.9670s region at the time of writing.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart illustrates the major facing support at the 100-day EMA at 0.9665, which, once cleared, would pave the way to further losses. The Relative Strength Index (RSI) at 58.26, stays in bullish territory, though almost flat, meaning that consolidation lies ahead. Unless the USD/CHF records a decisive break below 0.9600 or above the 0.9700 figure, the USD/CHF will remain range-bound.

USD/CHF Daily chart

USD/CHF Daily chartWhen looking at the 4-hour scale, the USD/CHF formed a double-top in the 0.9700 figure, suggesting that the Swiss franc might strengthen soon, targeting the 0.9500 figure. Oscillators have a downslope, with the RSI being in bullish territory, approaching the 50-midline, meaning a cross under would indicate sellers gaining momentum.

Therefore, the USD/CHF first support would be the S1 daily pivot at 0.9640. A break below will expose the S2 pivot point at 0.9610, immediately followed by the 200-EMA at 0.9600.

USD/CHF 4-hour chart

USD/CHF 4-hour chartUSD/CHF Key Technical Levels

-

21:39

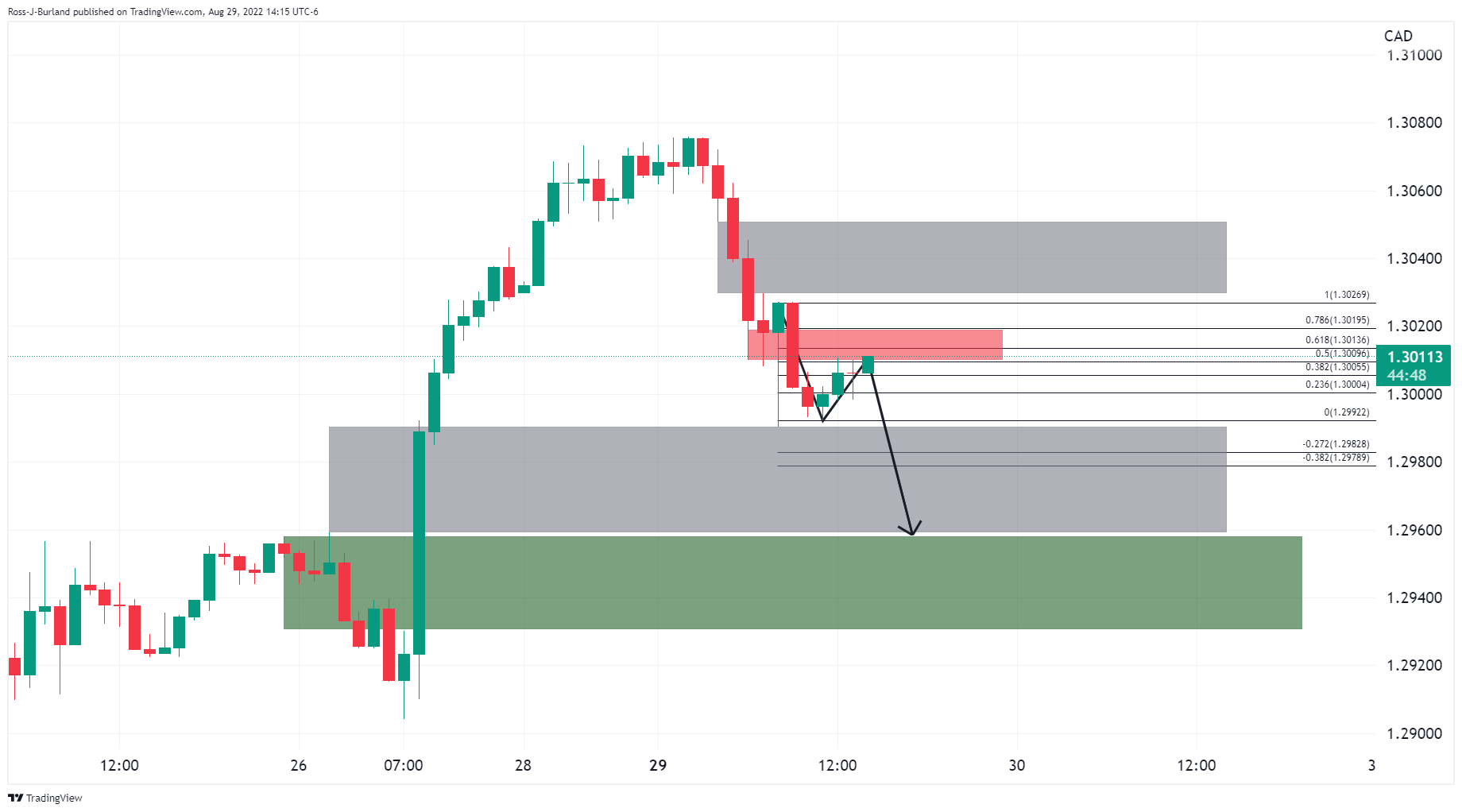

USD/CAD Price Analysis: Bears are moving in and eye 1.2980s

- USD/CAD bears move in at the start of the week leaving a reversion pattern in play on the daily chart.

- The 1.2980s area is exposed as a key area in the bearish formation.

USD/CAD has started out the week on the wrong foot exposing territories in a prior resistance area that would be expected to offer some support for the days ahead. The following illustrates the meanwhile bearish bias.

USD/CAD daily chart

The W-formation is a reversion pattern that leaves the neckline exposed near 1.2980. Below there, the 1.2920s guard 1.2895 formation lows.

USD/CAD H1 chart

USD/CAD is meeting a near 61.8% Fibonacci retracement of the hourly bearish impulse near 1.3100 the figure with prospects of a downside continuation in the near future that would mitigate the space between the prior highs and current lows.

-

21:08

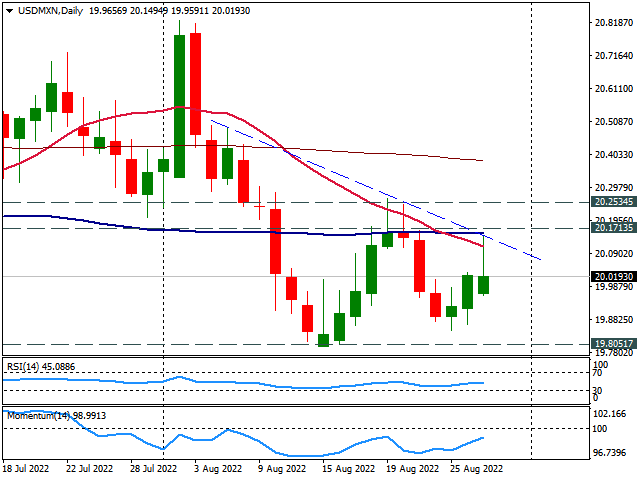

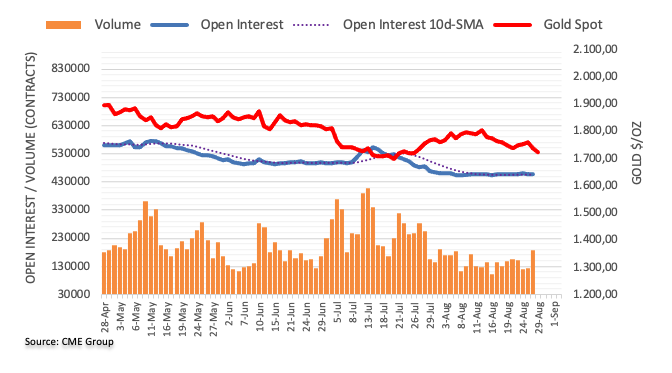

Gold Price Forecast: XAU/USD bulls pull out at key daily resistance

- Gold trades heavy in a bearish territory with potential demand sighted at around $1,710.

- Powell's Jackson Hole speech has reinforced the message that multiple and sizable hikes are still in the pipeline, supporting the greenback.

The gold price has been put back under pressure in New York trade and is wilting below the European highs of $1,745.55. The yellow metal is now losing 0.10% at the time of writing while the greenback firms again, basing itself on a key measure vs a basket of rival currencies.

Powell's Jackson Hole speech has reinforced the message that multiple and sizable hikes are still in the pipeline and that easing should not be expected to be on the horizon anytime soon. The outcome has weighed on precious metals that have dropped on the back of a surge in US dollar, making them more expensive for overseas buyers.

The prospects of higher interest rates and a jump in yields took the US dollar to a fresh two-decade peak at 109.478 on Monday after Powell stated that the central bank would raise rates as high as needed to restrict growth, and would keep them there "for some time" to bring down inflation that is running at more than three times the Fed's 2% goal.

A capitulation on the gold price took effect on the back of his comments, chipping its way through the August lows and the week ahead could offer further catalysts from key economic data and Fed speakers. To start, embedding the hawkish sentiment, on Monday, in response to the market's reaction to last week's Jackson Hole, Minneapolis Federal Reserve Bank President Neel Kashkari crossed the wires emphasizing a seriousness about getting inflation back to 2%.

We will hear from other Fed officials and the data will be key with this Friday's US job report the highlight. The data is likely to show a robust outcome for August, according to analysts at TD Securities.

Nevertheless, the euro could benefit should the report show a more moderate pace following the booming 528k print registered in July. ''High-frequency data, including Homebase, point to still above-trend job creation the analysts say. ''We also look for the UE rate to drop by a tenth for a second consecutive month to 3.4%, and for wage growth to advance at a firm 0.4% MoM (5.3% YoY),'' the analysts said.

Gold technical analysis

Meanwhile, the price closed heavily in the red at the end of the week and there is little sign of it stalling for the near-term on the approach to presumed support near $1,710. The price has also recovered 50% of the prior bearish impulse which adds further weight to the downside outlook. If the bears commit to the course, a move below the said support area opens the risk of a test of the 2021 lows as far down as $1,678. On the flip side, $1,745 should be key.

-

21:07

Forex Today: Dollar buyers between a rock and a hard place

What you need to take care of on Tuesday, August 30:

The dollar started the week with a strong footing but ended the day with modest losses across the FX board. Market players were trapped between recession fears and hawkish policymakers hinting at tighter monetary policies.

Following the Jackson Hole Symposium, odds for a US Federal Reserve 75 bps rate hike rose above 70% according to the CME FedWatch tool, while across the pond, market players are now seeing odds for a similar hike in Europe at 67%, up from 48% on Friday.

The macroeconomic calendar was scarce, although encouraging US data limited the dismal mood during US trading hours, helping Wall Street to trim most of its early losses.

Government bond yields, on the other hand, edged higher, with European indexes soaring after hawkish hints from ECB officials.

The President of the European Commission, Ursula von der Leyen, put back on the table the energy crisis as she reported that the EU is preparing an emergency intervention in its energy market to drive down skyrocketing electricity prices

The EUR/USD pair battles around parity, while the GBP/USD pair settled just above 1.1700 after falling to a two-year low of 1.1647. AUD/USD surged towards 0.6900 while USD/CAD eased to currently trading around 1.3000. Safe-haven currencies are little changed against the greenback, with USD/CHF trading at around 0.9680 and USD/JPY at 138.70

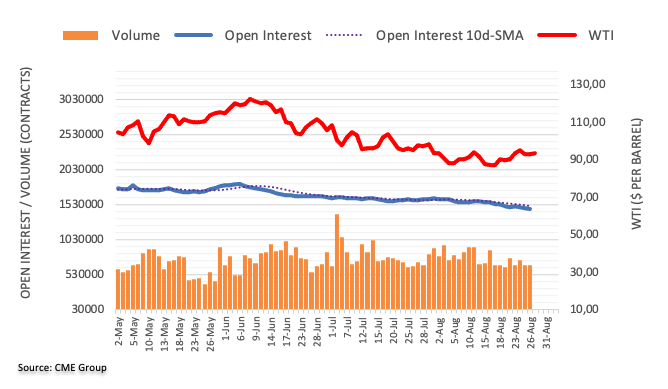

Gold posted modest intraday gains and settled at $1,737 a troy ounce, while crude oil prices firmed up, with WTI now changing hands at around $96.90 a barrel.

Ripple proponents take the bull by its horns, XRP price struggles to recover

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:24

NZD/USD buyers recover some ground, but they are not out of the woods

- NZD/USD jumped from six-week lows on Monday, from around 0.6100.

- The Fed’s favorite inflation gauge ticked lower, though Powell disregarded the data, saying that one month’s data is not enough to pause.

- NZD/USD Price Analysis: Remains downward-biased, so a test of the YTD lows around 0.6060 is on the cards.

NZD/USD bounces from 6-week lows, recovering ground during the North American session, amid a risk-off trading session, courtesy of Fed’s Powell hawkish rhetoric, commenting that even with the US economy slowing down, the Fed would keep hiking rates to temper inflation down.

During the day, the NZD/USD opened near the day’s lows, around 0.6100. However, as the US dollar weakened, the New Zealand dollar rose, hitting a daily high at 0.6167k, some 20 pip higher than current price levels. At the time of writing, the NZD/USD is trading at 0.6154,

NZD/USD gains are courtesy of broad US dollar losses. The fall in US 2-year Treasury yields after refreshing 15-year highs spurred some weakness on the greenback, bolstering most G8 currencies against the US dollar, despite the hawkish speech of the US Federal Reserve Chair Jerome Powell at Jackson Hole.

He said that the Fed’s primary goal is to bring inflation down towards its 2% goal even if it spurs slow growth and “pain to households and businesses.” He added that “without price stability, the economy does not work for anyone.”

Elsewhere, Friday’s US economic data revealed that the core PCE deflator, the Fed’s favorite inflation measure, increased by 0.1% MoM, less than estimated. Nevertheless, the three-month annualized figure is still high, and as Powell welcomed the data, he reiterated that the Fed needs to go into restrictive territory. Later, the UoM consumer sentiment improved to 58.2, reflecting lower gasoline prices.

What to watch

The New Zealand economic calendar will reveal the ANZ Business Confidence for August, estimated at 52. Meanwhile, the US economic docket will feature the US Consumer Confidence, Fed speakers, and the ISM Manufacturing PMI, alongside the US Nonfarm Payrolls report.

NZD/USD Price Analysis: Technical outlook

The NZD/USD daily chart portrays the pair as downward biased. Confirmation of the previously mentioned is that the daily EMAs are above the spot price, the RSI is in negative territory, and successive series of lower highs/lows cement the downtrend. Therefore, the NZD/USD first support would be the 0.6100 figure. Once cleared, the next support would be the YTD Low at 0.6060.

-

20:05

EUR/USD ducks away from pressures through parity, but bulls remain in play

- EUR/USD bulls are under pressure around psychological resistance.

- EUR/USD bulls eye a break above 1.0030 while above 0.9950.

EUR/USD trades parity at the time of writing, higher by 0.35% on the day thus far and hugging the psychological level while beaten down US stocks attempt to firm up in midday trade. The single currency has travelled between 0.9914 and 1.0029 so far.

A the start of the week, the dollar touched a fresh 20-year high fuelled by hawkish rhetoric by Federal Reserve Chair Jerome Powell last week although the euro has held its own on the back of growing expectations for European Central Bank (ECB) rate hikes. European Central Bank board member Isabel Schnabel said over the weekend that central banks must act forcefully to combat inflation, even if that drags their economies into a recession.

“Even if we enter a recession, we have little choice but to continue the normalization path,” Schnabel told the U.S. Federal Reserve’s Jackson Hole Economic Symposium.

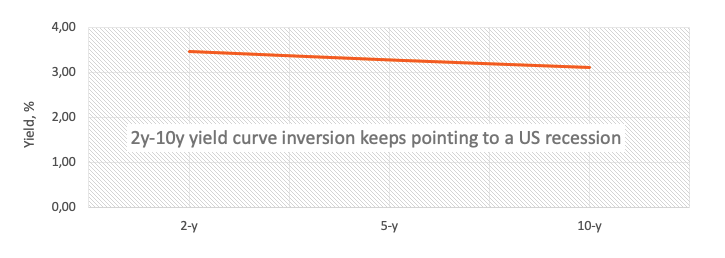

At the same conference, Powell reinforced that hawkish bias saying that the Fed will raise rates as high as needed to restrict growth, and would keep them there "for some time" to bring down inflation that is running at more than three times the Fed's 2% goal. This has seen the money markets ramping up bets for a more aggressive rate hike from the central bank in September, with the chances of a 75 basis point hike now seen around 70%, fuelling the greenback in the main. US Treasury yields have consequently seen the two-year bond yields extend to a 15-year high at near3.49%.

EUR/USD technical analysis

The price is consolidating the prior bearish trend at the Gartley's endpoint with a focus on the upside while above 0.9900.

Zooming in the euro is being pressured to the potentially firm support, with the next bullish objective being a break above 1.0030. On the downside, the bears could be in the clear on a break of 0.9950.

-

19:54

Fed's Kashkari: People now understand how serious we are about getting inflation back to 2%

In response to the market's reaction to last week's Jackson Hole, Minneapolis Federal Reserve Bank President Neel Kashkari has crossed the wires saying people now understand how serious we are about getting inflation back to 2%.

Kashkari's comments

''Was not thrilled to see the stock market rally following our most recent federal open market committee meeting.''

''I am delighted by the market's reaction to the Jackson Hole.''

''I know how serious we are about lowering inflation and I believe the markets were misinterpreting that at the last FOMC meeting.''In forex, the dollar has touched a fresh 20-year high to start the week fuelled by hawkish comments by Federal Reserve Chair Jerome Powell. DXY, which measures the greenback vs. a basket of rival currencies, is back to 108.80m pulling back from the 109.48 high scored earlier.

-

19:04

USD/JPY Price Analysis: Rallies to multi-week highs around 139.00

- USD/JPY reached a fresh 7-week high at the 139.00 figure.

- Once the 139.00 figure is broken, the USD/JPY YTD high is next at 139.38, as the pair aims towards 140.00.

The USD/JPY extends its rally, underpinned by higher US Treasury bond yields, on Monday, amidst a downbeat sentiment propelled by last Friday’s Jerome Powell speech. He reiterated the Fed’s commitment to tackle inflation to the 2% goal, despite causing slower economic growth, alongside “pain to households and businesses.” At the time of writing, the USD/JPY is trading at 138.73, above its opening price.

USD/JPY Price Analysis: Technical outlook

Since the beginning of August, the USD/JPY resumed its upward bias after diving towards fresh two-month lows at 130.39. Worth noting that on its way toward current exchange rates, the USD/JPY cleared the 20 and 50-day-EMAs, opening the door to further gains.

The bias is further supported by the Relative Strength Index (RSI), which downtick under the 60 reading, made a U-turn, and broke above its 7-day RSI’s SMA, showing buyers gathering momentum.

In the short term, the USD/JPY is neutral-upward biased, but as the RSI entered overbought conditions, the USD/JPY retraced from daily highs, hitting 139.00. However, the USD/JPY’s first resistance would be the 139.00 figure. Once cleared, the next supply zone will be the YTD high at 139.38, followed by the psychological 140.00 mark.

On the other hand, the USD/JPY first support would be the R2 daily pivot at 138,41. Break below will expose subsequent pivot point levels, like the R1 at 137.95, followed by the 20-EMA at 137.39, before tumbling to the daily pivot at 137.07.

USD/JPY Key Technical Levels

-

18:55

GBP/USD is firming up into key resistance but lacks conviction

- GBP/USD stalls at a key area of daily confluence-resistance.

- Eyes on US data following Powell's hawkish message.

GBP/USD is down on the day but reviving. At 1.1717, the pound is making its way from the lows of the day which has been 1.1648, travelling to 1.1743 at the star of new York. Markets in the UK being closed for Summer Bank Holiday have left volumes thin but the US dollar has been pressured supporting its rivals thus far.

Currently, stocks on Wall Street are showing their fragility to last week's speech from the Federal Reserve's chairman Jerome Powell which dominates the start of the weeks business leaving US data as the key focus. Markets are focused on the end of the week, when the ISM's national manufacturing reading for August will be released on Thursday followed by the all important monthly employment report on Friday ahead of the long holiday weekend. Additionally, there will be various Fed speakers this week and traders will be tentative to complimentary rhetoric to Powell's hawkish message.

For US obs, analysts at TD Securities expect employment to advance robustly in August but at a more moderate pace following the booming 528k print registered in July. ''High-frequency data, including Homebase, point to still above-trend job creation. We also look for the UE rate to drop by a tenth for a second consecutive month to 3.4%, and for wage growth to advance at a firm 0.4% MoM (5.3% YoY).''

Domestically, analysts at TD Securities expect the Bank of England's price stability mandate will force them to continue to hike even with a recessionary path forecasted by the BoE for 2023. This follows the recent double-digit UK Consumer Price Index print that confirmed the rates market's bias, supporting cable even in the face of a dollar in demand.

Looking ahead, the analysts at TD Securities expect the Monetary Policy Committe to hike by 50bps at both its September and November meetings, and by 25bps in December, before an 8-month pause. ''From August 2023, we expect a series of cuts, returning Bank Rate to its neutral rate of around 1.75% in 2024.''

GBP/USD technical analysis

Cable is in a forceful downtrend, as per the weekly chart above, and there is plenty of momentum. That being said, in due course, the M-formation will be a pull to the upside, perhaps as a nearterm temporary pause in the trend.

The daily outlook is pointing to a move lower, as per the 38.2% ratio aligning with prior lows. This appears to be bearish for the near term sessions.

-

17:51

AUD/USD climbs above 0.6900, boosted by Australian Retail Sales and soft US dollar

- AUD/USD advances close to 0.25% on Monday, trimming some of last Friday’s losses.

- Last week’s Fed’s rhetoric put a lid on the AUD/USD gains.

- Australian Retail Sales were better-than-expected, propelled by tourism.

AUD/USD reclaims the 0.6900 figure after hitting a six-week low at around 0.6840 in the North American session amidst a risk-off mood, spurred by last Friday’s Fed’s Powell hawkish rhetoric, sending US equities tumbling on average almost 3%, between the S&P 500, Nasdaq and the Dow.

The AUD/USD opened below last Friday’s close and edged towards 0.6840 before recovering some ground, reaching a daily high at 0.6925 before settling around current spot prices. At the time of writing, the AUD/USD is trading at 0.6907, above its opening price by almost 1%.

AUD/USD edges higher on positive AUS data, weaker US dollar

The Australian dollar gains are courtesy of a weaker US dollar, as shown by the US Dollar Index, down 0.09%, at 108.736. Additionally, commodity prices led by crude oil and Iron Ore are bolstering commodity-linked currencies, like the AUD, the NZD, and the CAD.

US equities are extending their losses following Jerome Powell’s last Friday remarks, saying that the Fed’s primary goal is bringing inflation to its 2% goal even if it spurs slow growth and “pain to households and businesses.” He added that “without price stability, the economy does not work for anyone.”

On Friday, US economic data revealed that the core PCE deflator, the Fed’s favorite inflation measure, increased by 0.1% MoM, less than estimated. Nevertheless, the three-month annualized figure is still high, and as Powell welcomed the data, he reiterated that the Fed needs to go to restrictive territory. Later, the UoM consumer sentiment improved to 58.2, reflecting lower gasoline prices.

In the Asian session, Australian Retail Sales for July, on its preliminary reading, came better than estimated, up by 1.3%, bolstering the AUD/USD. According to ANZ analysts, Aussie sales were bolstered by tourism and returning residents.

“We noted last month that very negative net arrivals in June may have been key to the weakness in retail sales growth, rather than the start of a consumer slowdown. We will be watching net arrivals as a signal for retail sales growth in the near term since the two datasets have been moving together in recent months,” ANZ analysts wrote.

AUD/USD Key Technical Levels

-

17:44

NFP: Looking for a 325K increase in payrolls in August – Wells Fargo

The key economic report of the week will be the US official employment report on Friday. Market consensus point to an increase in payrolls by 285K; analysts at Wells Fargo forecast a larger increase by 325K in August.

Key Quotes:

“July's employment report was a blowout, with nonfarm payrolls increasing 528K despite consensus expectations for "just" a 250K gain. Job growth was broad-based across most industries, and revisions to employment over the prior two months were mildly positive. However, the report likely still caused some indigestion for members of the FOMC. Wage growth came in stronger than expected, and the labor force participation rate fell by a tenth of a percentage point, putting it three-tenths of a percentage point below its March 2022 level.”

“Job growth of more than half a million new jobs per month is consistent with an economy that is experiencing robust economic growth. Yet, other indicators suggest the economy is slowing down, and monetary policymakers are charting a course that bring labor supply and demand more into balance. As a result, we would be surprised by job growth continuing anywhere near the July pace in the months ahead. We look for nonfarm payrolls to have risen 325K in August.”

-

17:32

Colombia National Jobless Rate down to 2.88% in July from previous 11.3%

-

17:27

ECB: We now expect a 75bp rate hike at the meeting next week – Danske Bank

After hawkish comments from European Central Bank (ECB) policymakers during the week, analysts at Danske Bank now expected the central bank to raise key interest rates by 75 basis points at next week’s meeting.

Key Quotes:

“We now expect ECB to hike 75bp next week, which will be followed by 50bp in October and 25bp in December, but acknowledge the increased uncertainty on the two latter hike size expectations. This is +25bp for our previous rate hike expectations at both the September and the October meetings, respectively, and we now see the endpoint of the ECB deposit rate at 1.5%.”

“We believe the euro area will face a recession and ECB will hike into that, however, we also acknowledge that even without the ECB tightening, the European economy was in a severe situation to begin with a worsening energy crisis.”

-

17:23

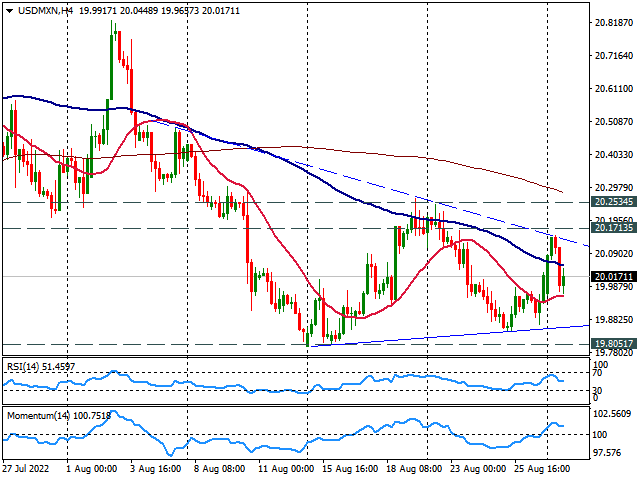

USD/MXN Price Analysis: Resistance area at 20.15/20 holds after first test

- USD/MXN fails to break key resistance near 20.20.

- Break above 20.20 to give momentum to the dollar.

- Price continues to consolidate around 20.00.

The USD/MXN is flat on Monday as it pulled back after reaching the highest level in almost a week at 20.16. The pair tested a critical resistance area around 20.17, the convergence of a short-term downtrend line and the 20 and 200-day Simple Moving Average.

A break above 20.20 should give momentum to the US Dollar and a close above 20.25 would point to more gains, with the next resistance located at 20.45.

A slide under 19.98 should put the Mexican peso to test the 19.90 support area. A break lower would expose the August low around 19.80, a strong support level that would likely hold, favoring a rebound to 19.90 before a break lower.

On a wider perspective, USD/MXN continues to consolidate around 20.00, moving without a clear direction. With the price under key daily moving average the bias is to the downside with momentum under 100. Although other technical indicators like the RSI are flat around midlines.

USD/MXN 4-hour chart

USD/MXN daily chart

-

16:51

USD/CHF hits one-month highs above 0.9700

- Swiss franc among worst performers amid higher yields.

- USD/CHF breaks key range and extends rally.

- EUR/CHF at the highest level in 11 days.

The USD/CHF is holding onto daily gains on tis was to the highest close in a month. The pair peaked during the Asian session at 0.9707 and then pulled back, finding support at 0.9655/60.

The bias in USD/CHF is bullish in the short-term but while it remains unable to hold above 0.9700, the upside seems limited. A slide under 0.9600 could change the bias to bearish.

Dollar erases gains, Swissy fails to recover

The US dollar weakened during the American session and kept USD/CHF below 0.9700. The DXY is flat on Monday, hovering around 108.80, after hitting a multi-decade high at 109.47.

Comments from European Central Bank policymakers during the weekend pushed European yields to the upside and weighed on the Swiss franc. The German 10-year yield is at 1.50%, about to post the highest close since late June.

The EUR/CHF is up for the second day in a row and peaked at 0.9696, the highest since August 18. It is back above the 20-day Simple Moving Average. A key resistance area is located around 0.9700 and a break higher could trigger more gains.

Technical levels

-

16:23

Gold Price Forecast: XAU/USD hovers around $1740, post Jackson Hole hawkish rhetoric

- Gold price recovers some ground, jumping from July 25 lows around $1720.

- Worldwide central bank hawkish rhetoric, weighed on market sentiment, a tailwind for gold price.

- Gold Price Forecast: It could test $1800 if buyers reclaim $1770; otherwise, it could fall towards $1700.

Gold price bounced from five-week lows on Monday, amidst a downbeat market mood, after last Friday's hawkish remarks by Federal Reserve Chair Jerome Powell, spurred a fall in equities, propelling the greenback and US Treasury bond yields to fresh weekly highs. At the time of writing, XAU/USD is trading at $1740 slightly above its opening price.

Gold advances in tandem with the greenback

Global equities are trading in negative territory. Since Wall Street opened, the US Dollar Index a gauge of the buck’s value vs. a basket of six peers is almost flat exchanging hands at 108.831, a tailwind for the non-yielding metal, which is up by almost 0.80%, despite climbing US Treasury yields.

Meanwhile, the US 10-year Treasury yield stays edges up almost eight bps, sitting at 3.119%, at a time that market players expect that the US Federal Reserve would hike 75 bps, as shown by the CME FedWatcht tool, with odds lying at 70%.

On Monday, a light calendar keeps market participants reflecting on the Jackson Hole symposium. The US Fed Chair Jerome Powell said that the Fed would increase the rate to restrictive territory and would keep them there “for some time” as the US central bank tries to tame inflation down. Powell acknowledged that growth will slow down, and added that “it will also bring some pain to households and businesses.”

Adding to further central bank hawkish rhetoric, it should be noted that ECB’s members led by Schnabel, Villeroy, Kazaaks, and Rehn, echoed concerns about inflation, with Villeroy stating that a significant rate increase is needed in September, while Kazaaks commented that the ECB should discuss 50 or 75 bps rate hikes. Meanwhile, ECB’s Rehn commented that it’s time for the central bank to act with a weak euro and expect a “significant” interest rate hike.

Therefore, XAU/USD traders should buckle up their seatbelts, as the yellow metal braces for periods of high volatility, with incoming data that could reignite fears of a worldwide recession.

What to watch

The US economic docket will feature the US Consumer Confidence, Fed speakers, the ISM Manufacturing PMI, alongside the US Nonfarm Payrolls report.

Gold Price Forecast (XAU/USD): Technical outlook

From a daily chart, perspective, the XAU/USD is still neutral to downward, biased. Monday’s jump from multi-week lows threatens to form a hammer (a reversal candlestick pattern), signifying that the yellow metal is forming a bottom, before shifting upwards. Hence, if gold buyers reclaim $1770, a test of the $1800 is on the cards. Otherwise, a daily close below Friday’s low of $1734, would pave the way for further losses.

-

15:31

United States Dallas Fed Manufacturing Business Index came in at -12.9, above expectations (-20.2) in August

-

15:25

IEA's Birol: Russia's oil production hasn't fallen as much as previously expected

International Energy Agency (IEA) Chief Fatih Birol noted on Monday that Russia's oil production hasn't fallen as much as previously expected because it managed to find new markets outside Europe and added domestic demand remained robust, per Reuters. "Going forward, it would be difficult for Russia to maintain oil production due to the absence of western companies," Birol said.

Birol further noted that a further strategic petroleum reserve release was not off the table. He also reiterated that he stands by the IEA's report suggesting no new investments in oil and gas fields are needed if the world wants to achieve net zero emissions by 2050.

Market reaction

Crude oil prices edged modestly lower from session highs following these comments. The barrel of West Texas Intermediate (WTI) was trading at $95.70, where it was still up 3% on a daily basis.

-

14:51

ECB's Lane: Inflation is expected to remain high in the near term

European Central Bank (ECB) Chief Economist Philip Lane noted on Monday that inflation in the eurozone is expected to remain high in the near term but added that long-term inflation expectations stay close to 2%, as reported by Reuters.

Commenting on the policy outlook, "a steady pace - that is neither too slow nor too fast - in closing the gap to the terminal rate is important for several reasons," Lane explained. "The appropriate size of the individual increments will be larger the wider the gap to the terminal rate and the more skewed the risks to the inflation target."

Market reaction

The shared currency preserves its strength after these comments and EUR/USD was last seen gaining 0.53% on a daily basis at 1.0013.

-

14:49

USD/TRY gradually approaches the all-time high around 18.25

- USD/TRY keeps the uptrend well in place near 18.20.

- Türkiye Economic Confidence improved further in August.

- Türkiye trade deficit widened near TL11B in July.

The Turkish lira remains on the back foot and helps USD/TRY advance to the boundaries of 18.20, or new 2022 highs, on Monday.

USD/TRY keeps targeting the YTD tops

USD/TRY fades Friday’s small downtick and started the fourth consecutive week with gains, trading at shouting distance from the all-time highs around 18.25 (December 20 2021) on Monday.

The lira prolongs its march south, as investors continue to hold a negative view of the currency, particularly following the latest decision by the Turkish central bank (CBRT) to reduce the policy rate, always in a context of persistent global and domestic elevated inflation and the relentless tightening bias in global central banks.

In the domestic calendar, the Economic Confidence Index improved a tad to 94.30 in August (from 93.40), while the trade deficit broadened to TL10.69B during July.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and trades closer to the all-time high around 18.25. The uptrend in spot has been intensified after the unexpected interest rate cut by the CBRT on August 18.

In the meantime, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate alternative to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism among investors.

Key events in Türkiye this week: Economic Confidence Index, Trade Balance (Monday) – Q2 GDP (Wednesday) – Manufacturing PMI (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.30% at 18.1835 and faces the immediate target at 18.1973 (2022 high August 29) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.5444 (55-day SMA) and finally 17.1903 (weekly low July 15).

-

14:17

GBP/USD rebounds from its lowest level since March 2020, lacks follow-through buying

- A dramatic USD turnaround from a 20-year high prompts some short-covering around GBP/USD.

- Hawkish Fed expectations, rising US bond yields and the risk-off mood should limit the USD losses.

- The UK’s gloomy economic outlook suggests that the attempted recovery is likely to be short-lived.

The GBP/USD pair stages a goodish bounce from the 1.1650-1.1645 region, or its lowest level since March 2020 touched earlier this Monday. The pair hits a fresh daily high during the early North American session, though lacks follow-through buying and is currently placed just above the 1.1700 mark.

A dramatic US dollar turnaround from a fresh 20-year high is seen as a key factor that prompted some intraday short-covering around the GBP/USD pair. In the absence of any fundamental catalyst, the USD pullback could be solely attributed to some profit-taking and is more likely to remain cushioned amid hawkish Fed expectations.

The bets were reaffirmed by Fed Chair Jerome Powell's remarks on Friday, signalling that interest rates would be kept higher for longer to bring down inflation. In fact, the markets are currently pricing in a greater chance of a 75 bps Fed rate hike in September. This is reinforced by a further rise in the US Treasury bond yields.

Apart from this, the prevalent risk-off environment - as depicted by a generally weaker tone around the equity markets - supports prospects for the emergence of some dip-buying around the safe-haven buck. This, along with a bleak outlook for the UK economy, warrants some caution before confirming that the GBP/USD pair has formed a bottom.

The fundamental backdrop still seems tilted firmly in favour of bearish traders, suggesting that any subsequent recovery could be seen as a selling opportunity and runs the risk of fizzling out rather quickly. The market focus now shifts to the release of the closely-watched US monthly jobs report, popularly known as NFP on Friday.

Technical levels to watch

-

14:00

EUR/USD to fall to 0.9600 or lower – Wells Fargo

Economists at Wells Fargo expect the euro to remain under downside pressure. Subsequently, the EUR/USD pair is expected to slide to 0.9600 or even lower.

Further downside in the euro

“We still expect further downside in the euro.”

“Given energy supply disruptions, earlier Eurozone recession and a relatively limited monetary tightening cycle from the European Central Bank (ECB), we expect the EUR/USD exchange rate to fall to 0.9600 or lower.”

-

13:55

USD/JPY to reach 140.00 or higher by early next year – Wells Fargo

USD/JPY gains traction for the second straight day and climbs to its highest level since mid-July. Economists at Wells Fargo expect the pair to surge above 140 by early 2023.

BoJ to maintain the easy monetary policy

“Given modest Japanese growth and limited inflation, we expect the Bank of Japan to maintain the easy monetary policy and to continue to cap Japanese bond yields for the foreseeable future.”

We expect the USD/JPY exchange rate to reach 140.00 or higher by early next year.”

-

13:48

USD/CAD retreats from multi-week high, eyes 1.3000 amid rising oil prices/sharp USD pullback

- A combination of factors prompts some intraday selling around USD/CAD on Monday.

- Rising oil prices underpin the loonie and exert pressure amid a sharp USD pullback.

- Aggressive Fed rate hike bets should limit the USD losses and lend support to the pair.

The USD/CAD pair surrenders its early gains to the 1.3075 area, or the highest level since mid-July and refreshes the daily low during the early North American session. The intraday downfall is sponsored by a combination of factors and drags spot prices to the 1.3015 area in the last hour.

Expectations that major oil producers could cut output to stall the recent fall in oil prices provide a modest lift to the black liquid. This, in turn, underpins the commodity-linked loonie and acts as a headwind for the USD/CAD pair. Apart from this, a dramatic US dollar turnaround from a fresh 20-year peak attracts some selling around the pair and contributes to the intraday decline.

The USD pullback, meanwhile, lacks any obvious fundamental catalyst and could be solely attributed to some profit-taking. That said, rising bets for a supersized 75 bps Fed rate hike at the September meeting, along with the prevalent risk-off environment, should help limit the USD losses. This, in turn, warrants some caution before placing fresh bearish bets around the USD/CAD pair.

The market bets for a more aggressive policy tightening by the Fed were reaffirmed by hawkish remarks by Fed Chair Jerome Powell on Friday. During his speech at the Jackson Hole Symposium, Powell signalled that interest rates would be kept higher for longer to bring down inflation. A further rise in the US Treasury bond yields reinforces market expectations and favours the USD bulls.

In the absence of any major market moving-economic releases, either from the US or Canada, the fundamental backdrop supports prospects for the emergence of some dip-buying around the USD/CAD pair. This further makes it prudent to wait for strong follow-through selling before confirming that last week's goodish bounce from sub-1.2900 levels has run out of steam.

Technical levels to watch

-

13:43

Singapore: Industrial Production disappointed in July – UOB

Senior Economist at UOB Group Alvin Liew comments on the latest Industrial Production figures in Singapore.

Key Takeaways

“Singapore’s industrial production (IP) came in below expectations for the second month in a row as it declined by -2.3% m/m SA in Jul, which translated to a weaker growth of 0.6% y/y, matching the low print recorded in Jan 2022 (from the revised Jun readings of -8.0% m/m, 2.6% y/y) and fell short of Bloomberg survey estimates but perhaps closer to UOB’s internal estimates.”

“The weaker IP result for Jul was due to 6.3% y/y contraction in electronics output and a 25.7% y/y fall in pharmaceutical production while the main sources of IP growth were from the continued expansions in transport engineering (18.6% y/y), general manufacturing (14.6% y/y), and precision engineering (13.9% y/y), and a surprise rebound in chemicals (5.3% y/y), more than offsetting the drags from electronics and pharmaceuticals.”

“Accounting for the Jul’s increase, Singapore’s IP expanded 4.9% in the first seven months of 2022. We continue to be cautiously positive on the outlook for transport engineering, general manufacturing, and precision engineering, to drive overall IP growth but we are now also cognizant about a potentially much slower electronics performance in the remaining months of 2022. We maintain our IP growth forecast at 4.5% in 2022 (from 13.2% in 2021) but we note the increased risk of a weaker IP trajectory due to the faltering outlook for electronics. In the same vein, our full year 2022 and 2023 GDP growth forecasts are also unchanged at 3.5% and 2% respectively but the manufacturing outlook indicates the risk to our growth outlook is on the downside, as well. In addition, another dampener to headline growth is the relatively higher base levels for the rest of 2022, as IP expanded by double digit growth rates between May and Dec 2021 (except for Sep 2021).”

-

13:25

US 10-year Treasury yields to slide to 2.55% in Q4 – ABN Amro

The benchmark 10-year US Treasury bond yield is trading above 3%. But economists at ABN Amro expect yields to slump to 2.55% by the end of the year.

10y Bund yield to fall to 1.1% by Q4

“We expect both Treasury and German bonds to rally from Q4 until mid-2023. We expect the 10y US Treasury yield to slide to 2.55% in Q4 2022. Similarly, we expect 10y Bund yield to fall to 1.1% by Q4 due to US spill-over effects and markets shifting back to risk-off mode, increasing safe-haven demand.”

“However, as short-term inflation expectations continue to rise, we expect a stronger inversion of the Treasury curve and the Bund curve to bear-flatten in the near-term before steepening again in H2 2023.”

-

13:20

DN to hike the key policy rate to 1.40% – Danske Bank

Economists at Danske Banke now expect Danmarks Nationalbank (DN) to raise its key policy by 75 bps next week followed by 50 bps rate hike in October and 25 bps in December.

EUR/DKK below 7.4360 may force DN to cut rates or raise it by less than ECB

“We now expect a 75 bps hike in September followed by a 50 bps hike in October and 25 bps in December. It brings the key policy rate to 1.40% in December.”

“High inflation may force ECB, and thus DN, to make additional policy rate hikes in 2023.”

“Should EUR/DKK fall to 7.4360 again and trigger renewed DKK selling in FX intervention, DN may opt to cut its key policy rate or raise it by less than ECB – likely by 10bp. It is not our base case, but a reasonable possibility given the persistent low EUR/DKK.”

-

13:15

EUR/USD Price Analysis: Interim top in place?

- EUR/USD regains composure after the earlier drop near 0.9900.

- Bullish attempts should meet initial hurdle near 1.0100.

EUR/USD reverses the initial pessimism, including a test of the vicinity of the 0.9900 zone on Monday.

The recent failure to advance beyond 1.0100 leaves this region as a potential near-term top, while the 0.9900 neighbourhood seems to offer quite a decent contention for the time being. The breach of the 2022 low at 0.9899 (August 23) could sponsor a deeper pullback to the December 2002 low at 0.9859.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0819.

EUR/USD daily chart

-

13:14

Stronger dollar, lower equities, and flatter yield curve – BBH

The dollar continues to build on its gains after Jackson Hole. Economists at BBH maintain their strong dollar call.

Fed officials to continue their aggressive communication efforts

“The swaps market is pricing in a terminal rate close to 4.0% and we think that process is likely to continue. It's not a coincidence that Fed officials keep bringing up Paul Volcker, as the implications are clear.”

“The real 10-year yield is trading near 0.53%, the highest since July 21. Further gains would set up a test of the June 1 high near 0.82%. Elsewhere, the 3-month to 10-year curve is trading near 35 bps, the steepest since last Wednesday and off the 21 bps low from August 10. While recession risks are palpable, this key metric does not yet signal that one is imminent.”

“As we saw after the July FOMC decision and then after the FOMC minutes, Fed officials blanketed the markets with a hawkish message. We expect a similar effort after Jackson Hole. We expect each and every Fed official to stick to Powell’s hawkish script.”

-

13:08

EUR/USD: Unlikely to suffer a substantial drop below parity – ABN Amro

Eurozone economy is set to tip into recession in the coming quarters. Nonetheless, the EUR/USD pair is unlikely to see a sustained move under parity.

Narrowing yield spreads between the US and Germany to support the EUR in 2023

“A recession in the eurozone combined with a more aggressive path of rate hikes in the US compared to the eurozone will probably keep the euro under pressure versus the US dollar this year.”

“But we still think that a sustained move in EUR/USD below parity will be difficult. Therefore, we keep our forecasts for EUR/USD for end-2022 at 1.00.”

“In 2023, we expect narrowing yield spreads between the US and Germany to support the euro, with our end-2023 forecast at 1.10 (was 1.15).”

-

13:02

USD/JPY to reach the August 1998 high at 147.65 – BBH

USD/JPY has touched its highest level in over a month at 139.00. The pair could climb as high as the August 1998 peak of 147.65, economists at BBH report.

Bank of Japan stood out at Jackson Hole as the Lonesome Dove

“USD/JPY is trading at the highest since July 15 near 139 and will soon test the July 14 high near 139.40.”

“We maintain our medium-term target of 147.65, the August 1998 high, as the BoJ stood out at Jackson Hole as the Lonesome Dove.”

-

12:59

A perfect storm is gathering over Europe – ABN Amro

European energy crisis has intensified. Therefore, a deep recession is likely in Europe, economists at ABN Amro report.

Winter is coming

“We expect the energy crisis to tip European economies into recession over the coming months.”

“Even if gas rationing is somehow avoided, sky-high energy prices, weak consumer and business confidence and tighter financial conditions will be enough to put growth into reverse.”

“The silver lining is that, outside of energy, weaker demand is helping to ease supply bottlenecks.”

-

12:56

EUR/USD: Moves above 1.00 will be hard to sustain – BBH

EUR/USD has tested the 0.99 area. However, the pair is set to remain under parity, in the opinion of economists at BBH.

Raising recession risks

“Moves above 1.00 will be hard to sustain and so the single currency remains on track to test the September 2002 low near 0.9615.”

“Germany, Italy, and now France are contracting and it's only going to get worse this fall/winter when energy shortages really bite. Sure, the US faces recession risks too but we still think that Europe is in much weaker fundamental shape.”

-

12:38

South Korea: BoK increased the policy rate in August – UOB

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest interest rate decision by the Bank of Korea (BoK).

Key Takeaways

“As expected, Bank of Korea (BoK) raised its benchmark base rate by 25bps to 2.50% at its meeting … as it dialed down from the 50bps hike in Jul. In total, BoK has hiked interest rate for seven meetings since Aug 2021, by a cumulative 200 bps. The decision was again unanimous in Aug.”

“BoK upped its inflation forecast for 2022 and 2023 and revised down the GDP growth forecasts for the two years.”

“BoK’s concerns that inflation will stay high for a longer period of time even after it peaks will keep its focus on combating price pressures in order to bring headline inflation rate to a comfortable level of around 3% by end-2023.”

“We keep our forecast that the BoK will continue to raise the base rate by 25bps per meeting in Oct and Nov to bring the benchmark base rate to 3.00% by year-end. Thereafter, we expect the BoK to stay on hold through 2023 but there remains prospect of further tightening if the inflation trajectory continues along a path that exceeds 3% by end-2023.”

-

12:12

US Dollar Index Price Analysis: Immediately to the upside comes 109.77

- DXY prints fresh cycle highs near 109.50 on Monday.

- Further upside could revisit the September 2002 high at 109.77.

DXY extends the post-Powell rally to the area of 109.50, recording at the same time new cycle highs.

Further upside remains on the cards for the index in the near term. Against that, the surpass of the 2022 high at 109.47 (August 29) should open the door to the September 2002 top at 109.77 prior to the round level at 110.00.

In the meantime, while above the 6-month support line around 105.40, the index is expected to keep the short-term positive stance.

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.74.

DXY daily chart

-

11:58

USD/JPY Price Analysis: Faces rejection near 139.00 mark, bullish potential intact

- USD/JPY gains traction for the second straight day and climbs to its highest level since mid-July.

- The risk-off impulse offers support to the safe-haven JPY and caps any further gains for the pair.

- The Fed-BoJ policy divergence, sustained USD buying, rising US bond yields favour bullish traders.

- Sustained break through the 136.65-136.70 resistance zone adds credence to the positive outlook.

The USD/JPY pair stalls its intraday positive move near the 139.00 mark and retreats a few pips from the highest level since mid-July touched earlier this Monday. The pair slips back below mid-138.00s during the first half of the European session, though any meaningful pullback still seems elusive.

The risk-off impulse offers some support to the safe-haven Japanese yen and acts as a headwind for the USD/JPY pair. That said, a big divergence in the monetary policy stance adopted by the Fed and the Bank of Japan should cap gains for the JPY. Apart from this, the blowout US dollar rally to a fresh 20-year high and rising US Treasury bond yields should help limit the downside for the major.

From a technical perspective, the strong follow-through buying for the second successive day on Monday confirmed a breakout through the 137.65-137.70 resistance zone. This comes on the back of the recent strong bounce from the 100-day SMA and favours bullish traders. Hence, any subsequent downtick might be seen as a buying opportunity and is likely to remain limited, at least for the time being.

Traders now look to the 138.00 round-figure mark to offer some support ahead of the aforementioned resistance breakpoint, around the 137.70-137.65 region. A convincing break below might trigger some technical selling and accelerate the slide towards the 137.00 mark. The USD/JPY pair could eventually drop to the 136.80-136.75 intermediate support en route to the 136.45 support zone.

On the flip side, the 139.00 round figure now seems to have emerged as immediate resistance. This is followed by the 24-year high, around the 139.40 region touched in July. Some follow-through buying has the potential to lift the USD/JPY pair further towards the 140.00 psychological mark, which if cleared decisively should pave the way for a further near-term appreciating move.

USD/JPY daily chart

-637973669358999176.png)

Key levels to watch

-

11:26

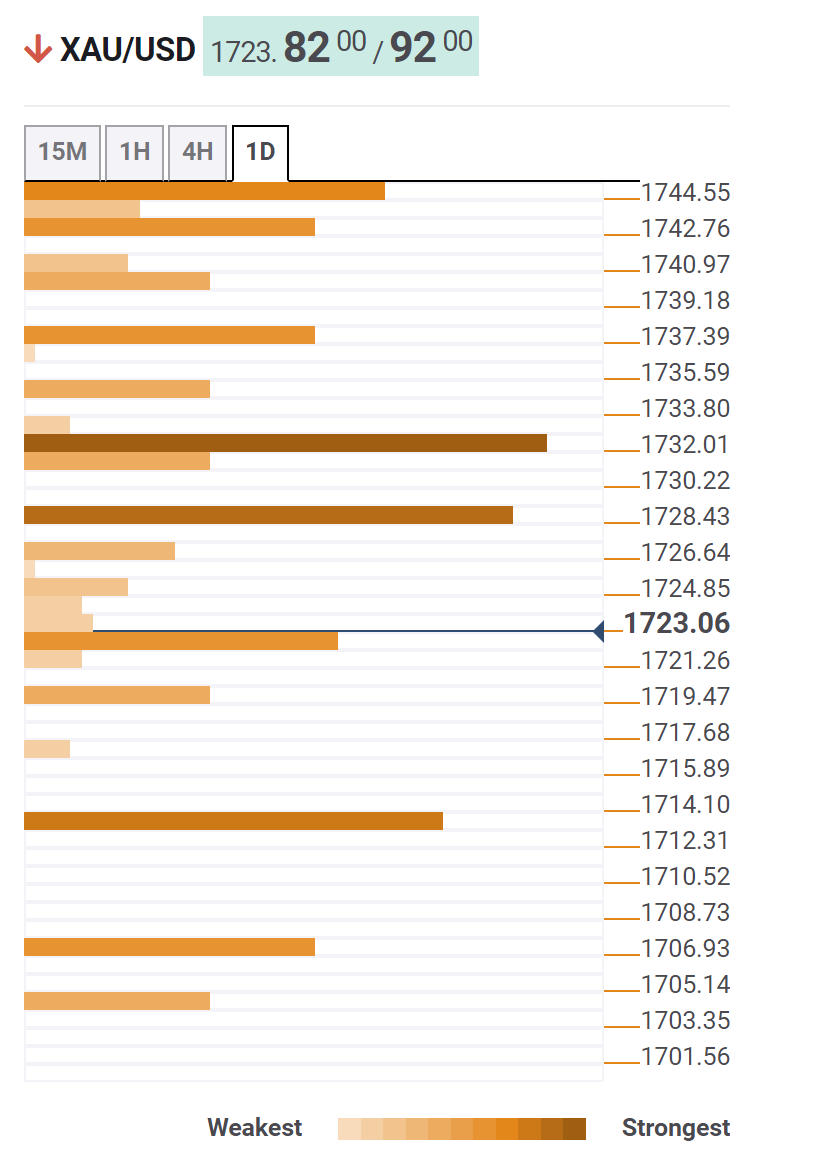

Gold Price Forecast: XAU/USD looks to $1,700 amid Fed rate hike bets – Confluence Detector

- Gold continues losing ground for the second straight day and drops to over a one-month low.

- Strong follow-through USD buying, rising US bond yields continue to weigh on the commodity.

- The risk-off impulse might turn out to be the only factor that might help limit any further losses.

Gold remains under heavy selling pressure for the second successive day on Monday and drops to over a one-month low, around the $1,720 area during the early part of the European session. The US dollar hits a fresh two-decade high amid rising bets for more aggressive Fed rate hikes and continues to weigh on the dollar-denominated commodity.

In fact, the markets are pricing in a greater chance of a 75 bps rate increase at the September FOMC meeting. A further rise in the US Treasury bond yields reinforces market expectations, which is seen as another factor driving flows away from the non-yielding yellow metal. That said, the prevalent risk-off environment could offer some support to the safe-haven gold and help limit any further losses, at least for the time being.

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the next relevant support for gold is pegged near the $1,719 area - Pivot Point One Day S2. This is closely followed by $1,714-$1,713 zone - Fibonacci 23.6% One month. A convincing break below will expose the $1,706-$1,705 support - Pivot Point One Week S2 and the $1,700 round-figure mark. Some follow-through selling might make the XAU/USD vulnerable to retesting the YTD low, around the $1,680 region touched in July.

On the flip side, attempted recovery moves might now confront stiff resistance near the $1,728-$1,729 confluence support breakpoint, comprising Previous Week Low and Pivot Point One Day S1. The next relevant hurdle is pegged near the $1,732-$1,733 region - Fibonacci 38.2% One Month. Sustained strength beyond could trigger a short-covering rally towards the $1,737 zone - Fibonacci 23.6% One Week - en route to the $1,741-$1,742 region - Fibonacci 38.2% One Week - and the $1,745 barrier.

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

-

11:01

Ireland Retail Sales (YoY) fell from previous -6.6% to -8.1% in July

-

11:00

Ireland Retail Sales (MoM) down to -1.6% in July from previous -1.3%

-

10:43

GBP/USD finds some support near mid-1.1600s, not out of the woods yet amid bullish USD

- GBP/USD drifts lower for the second successive day and drops to its lowest level since March 2020.

- Rising bets for more aggressive Fed rate hikes, the risk-off mood continues to underpin the USD.

- A bleak outlook for the UK economy weighs on the GBP and further contributes to the selling bias.

The GBP/USD pair extends Friday's sharp retracement slide from the 1.1900 round figure and continues losing ground for the second straight day. The downward trajectory drags spot prices to the lowest level since March 2020, around mid-1.1600s during the first half of trading on Monday and is sponsored by strong follow-through US dollar buying.

During his speech at the Jackson Hole Symposium, Fed Chair Jerome Powell squashed hopes of a dovish pivot and signalled that interest rates would be kept higher for longer to bring down inflation. This, in turn, lifts bets for a supersized 75 bps rate hike at the September FOMC meeting and triggers a fresh leg up in the US Treasury bond yields. Apart from this, the prevalent risk-off mood pushes the safe-haven USD to a 20-year peak and turns out to be a key factor exerting pressure on the GBP/USD pair.

The British pound, on the other hand, continues to be weighed down by worries about a deeper economic downturn amid the recent absurd surge in energy prices and the persistent rise in inflation. In fact, the Bank of England had predicted earlier this month that the UK economy will enter a prolonged recession from the fourth quarter of 2022. This, along with some technical selling below the previous YTD swing low, around the 1.1720-1.1715 region, further contributed to the GBP/USD pair's downward trajectory.

That said, slightly oversold conditions on intraday charts seem to hold back bearish traders from placing fresh bets and helping limit further losses, at least for the time being. Nevertheless, the fundamental backdrop supports prospects for an extension of the depreciating move. This, in turn, suggests that any attempted recovery move might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly amid absent relevant market-moving economic releases.

Technical levels to watch

-

10:32

USD/IDR: Bias leans towards further upside – UOB

FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research notes USD/IDR could still edge higher in the short term.

Key Quotes

“We highlighted last week that USD/IDR ‘has scope to rise above the trend-line resistance at 14,925’. Our expectations did not materialize as it retreated from a high of 14,918. USD/IDR traded on a firm note today and the bias for this week is on the upside.”

“A break of the trendline (currently at 14,910) would not be surprising. For this week, the next resistance at 14,990 is unlikely to come under threat. On the downside, a break of 14,790 would indicate that USD/IDR is not ready to head higher.”

-

10:24

EUR/JPY Price Analysis: Extra recovery now targets the 55-day SMA

- EUR/JPY adds to the ongoing rebound and retakes 138.00.

- Further upside could see the 55-day SMA near 138.90 retested.

EUR/JPY extends recent gains and reclaims the area above the 138.00 mark at the beginning of the week.

The continuation of the uptrend initially targets the August high at 138.39 (August 10) ahead of the temporary 55-day SMA, today at 138.89. The surpass of this level should shift the attention to the weekly peak at 142.32 (July 21).

While above the 200-day SMA at 134.27, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

10:09

AUD/USD flirts with multi-week low, around mid-0.6800s amid sustained USD buying/risk-off

- AUD/USD falls to a multi-week low on Monday and is pressured by a combination of factors.

- Bets for aggressive Fed rate hikes, elevated US bond yields push the USD to a 20-year peak.

- The risk-off mood also benefits the safe-haven buck and weighs on the risk-sensitive aussie.

The AUD/USD pair witnessed some follow-through selling for the second straight day on Monday and drops to a six-week low during the early part of the European session. Currently placed around mid-0.6800s, spot prices have now retreated over 150 pips from levels just above the 0.7000 psychological mark touched on Friday amid a blowout US dollar rally.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies, shot to a fresh 20-year high amid expectations for a more aggressive policy tightening by the Fed. The markets are pricing in a greater chance for a supersized 75 bps Fed rate hike move in September and the bets were reaffirmed by Fed Chair Jerome Powell's hawkish remarks on Friday.

During his speech at the Jackson Hole Symposium squashed hopes of a dovish pivot and signalled that interest rates would be kept higher for longer to bring down soaring inflation. A further rise in the US Treasury bond yields reinforces market expectations, which, along with the risk-off mood, offers additional support to the safe-haven buck and weighs on the risk-sensitive aussie.

The combination of aforementioned factors offset the upbeat Australian Retail Sales, which surpassed expectations by a big margin and rose 1.3% in July. Even the prospects for another 50 bps rate hike by the Reserve Bank of Australia at the next policy meeting on September 6 did little to impress bullish traders or provide any respite to the AUD/USD pair, favouring bearish traders.

In the absence of any major market-moving economic releases from the US, the prevalent strong bullish sentiment surrounding the USD adds credence to the near-term negative outlook. This, in turn, suggests that the path of least resistance for the AUD/USD pair is to the downside and any meaningful recovery attempt could now be seen as a selling opportunity.

Technical levels to watch

-

09:55

USD/MYR: Strong resistance emerges at 4.4980 – UOB

Further upside in USD/MYR should meet a tough hurdle at the 4.4980 region, suggests FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“Last Monday (22 Aug, spot at 4.4800), we held the view that USD/MYR ‘could strengthen further but the 2017 high at 4.4980 is likely out of reach’. However, USD/MYR did not strengthen but dipped to 4.4650 last Friday (26 Aug).”

“USD/MYR soared upon opening today (29 Aug) and the bias for this week still appears to be tilted to the upside. That said, 4.4980 could still be out of reach, at least for this week. On the downside, support is at 4.4650 followed by the major level at 4.4615.”

-

09:33

Silver Price Analysis: XAG/USD struggles near one-month low, around $18.60-50 zone

- Silver drifts lower for the second straight day and dives to over a one-month low.

- The technical set-up supports prospects for a further near-term depreciating move.

- A slightly oversold RSI on hourly charts warrants some caution for bearish traders.

Silver continues losing ground for the second successive day on Monday and drops to over a one-month low during the early European session. The white metal is currently trading around mid-$18.00s, down over 1.80% for the day and seems vulnerable to sliding further.

The XAG/USD faced rejection near the 200-hour SMA on Friday. Furthermore, acceptance below the $19.00 round-figure mark and a subsequent break through the previous monthly low, around the $18.70 region, could be seen as a fresh trigger for bearish traders.

The negative outlook is reinforced by the fact that technical indicators on the daily chart are holding deep in bearish territory. That said, RSI (14) on hourly charts is flashing oversold conditions and warrants some caution for aggressive traders.

Nevertheless, the technical set-up supports prospects for an extension of the depreciating move towards the YTD low, around the $18.15 area touched in July. This is closely followed by the $18.00 mark, which if broken will set the stage for additional losses.

On the flip side, any attempted recovery move now seems to confront resistance and attract some sellers near the $18.70 support breakpoint. This, in turn, should keep a lid on any further gains for the XAG/USD near the $19.00 round-figure mark.

The latter should act as a pivotal point, above which the XAG/USD could climb back to the 200-hour SMA hurdle, currently near the $19.30 zone. Some follow-through buying will negate the bearish outlook and trigger a fresh bout of a short-covering move.

Silver 1-hour chart

-637973587227089167.png)

Key levels to watch

-

09:15

USD/THB faces prospects for extra upside – UOB

FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research noted USD/THB is poised to extend the upside in the near term.

Key Quotes

“Last Monday (22 Aug, spot at 35.85), we highlighted ‘further USD/THB strength appears likely even though overbought conditions suggest that 36.36 is unlikely to come into the picture’. Our view was not wrong as USD/THB subsequently rose to 36.34 before dropping to 35.78. USD/THB rebounded strongly from the low and today (29 Aug), it out 36.36. The rapid improvement in momentum suggests USD/THB could strengthen further.”

“That said, July’s high at 36.95 is unlikely to come into the picture for this week (there is another resistance level at 36.70). Overall, USD/THB is expected to trade on a firm footing as long as it does not move below 35.90 (minor support is at 36.10).”

-

09:11

EUR/USD extends the consolidation below parity on dollar strength

- EUR/USD remains on the defensive below the parity level.

- The bid tone in the greenback has magnified following Powell’s speech.

- Markets’ attention now looks to the speech by FOMC’s Brainard.

EUR/USD stays under pressure in the lower end of the recent range well below the parity zone on Monday.

EUR/USD could revisit the 2022 lows

EUR/USD adds to Friday’s rejection from the vicinity of the 1.0100 level and trades at shouting distance from the 0.9900 area at the beginning of the week amidst investors’ reassessment of Powell’s speech last Friday.

Indeed, Powell’s speech fell on the hawkish side as widely expected, leaving well in place the odds for the continuation of the current stance to bring down inflation and also talking down the possibility of a shift to a looser monetary stance at some point in 2023 (rate cuts).

As market participants continue to adjust to Powell’s comments, US yields extend the mover higher – particularly in the short end of the curve – and the dollar gathers further traction to levels last seen nearly two decades ago.

Nothing scheduled data wise in Euroland on Monday, whereas the speech by FOMC’s L.Brainard will take centre stage across the pond.

What to look for around EUR

Occasional bullish attempts in EUR/USD remain unconvincing and appear to have resulted in selling opportunities for the time being.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. However, potential shifts to a more hawkish stance from ECB’s policy makers regarding the bank’s rate path could be a source of strength for the euro.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: EMU Final Consumer Confidence, Economic Sentiment, Germany Flash Inflation Rate (Tuesday) – France Flash Inflation Rate, Italy Flash Inflation Rate, EMU Flash Inflation Rate, Germany Unemployment Change, Unemployment Rate (Wednesday) – Germany Retail Sales, Final Manufacturing PMI, EMU Final Manufacturing PMI, EMU Unemployment Rate (Thursday) – Germany Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, spot is losing 0.26% at 0.9938 and a break below 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low). On the flip side, the next resistance aligns at 1.0090 (weekly high August 26) seconded by 1.0202 (high August 17) and finally 1.0237 (55-day SMA).

-

09:06

EUR/USD: Hawkish comments from ECB officials could help the euro limit its losses

EUR/USD has staged a rebound after having declined toward 0.9900. Hawkish ECB commentary could help the shared currency to limit its losses, FXStreet’s Eren Sengezer reports.

0.9920 aligns as first support before 0.9900

“The risk-averse market environment favors the greenback at the beginning of the new week but hawkish comments from European Central Bank (ECB) officials could limit the pair's downside in the near term.”