Notícias do Mercado

-

23:39

AUD/USD stays pressured towards 0.6800 ahead of China/US PMI, NFP

- AUD/USD holds lower ground at the lowest levels in six weeks marked the previous day.

- Risk-aversion, pessimism surrounding key customer China join downbeat data at home to weigh on prices.

- Hawkish Fed, recession woes keep bears hopeful ahead of top-tier statistics.

AUD/USD begins September month’s trading while keeping the two-day downtrend at the 1.5-month low, taking rounds to 0.6840 by the press time. In doing so, the Aussie pair justifies the market’s risk-off mood, as well as concerns surrounding Australia’s biggest customer China. Also keeping the quote pressured are the latest statistics from Australia.

Recently, Australia’s AiG Performance of Manufacturing Index marked the first activity contraction in seven months with 49.3 numbers for August, versus 52.5 prior. The same follows Wednesday’s second quarter (Q2) Construction Work Done that dropped to -3.8% versus 0.9% market forecasts and -0.9% prior. Further, Aussie Private Sector Credit eased in July to 0.7% MoM from 0.9% prior while staying intact at 9.1% YoY.

It should be noted that the US data wasn’t either too positive but could manage to keep the greenback buyers hopeful amid the recently loose links between ADP and Nonfarm Payrolls (NFP). That said, US ADP Employment Change rose by 132K versus 288K expected and 270K prior. However, the average wage increases in the US in August were 7.6% y/y and the same kept the Fed policymakers hawkish.

Following the data, Cleveland Federal Reserve Bank President Loretta Mester said on Tuesday that she was not anticipating the Fed to cut rates next year, as reported by Reuters.

On a different page, Taiwan’s first shooting at a Chinese drone and more virus-led lockdown on the dragon nation joined the second month of manufacturing activity contraction in China, per NBS Manufacturing PMI, to weigh on the AUD/USD prices, as well as risk appetite. On the same line was the latest statement from the United Nations (UN) Human Resource Office mentioning that the Chinese government has committed ‘serious human rights violations’ in Xinjiang.

Against this backdrop, Wall Street closed with losses while the US 10-year Treasury yields rose the most in two weeks while rising to the highest level since late June.

Looking forward, China’s Caixin Manufacturing PMI for August and the US ISM Manufacturing PMI could decorate the calendar before highlighting Friday’s US NFP. It should be observed that the pair’s downside appears to lose steam of late, which in turn could trigger the corrective pullback of the pair in case of positive surprise from China statistics and/or risk catalysts.

Technical analysis

May’s low near 0.6830 appears immediate support, a break of which could direct AUD/USD bears towards early July’s bottom around 0.6760. Alternatively, a downward sloping support-turned-resistance line from early August, close to 0.6850, probes corrective pullback ahead of the 50-DMA hurdle of 0.6910.

-

23:30

Australia AiG Performance of Mfg Index declined to 49.3 in August from previous 52.5

-

23:25

GBP/USD Price Analysis: Downside momentum loss to support cable, 1.1650 a critical hurdle

- A symmetrical triangle formation near monthly lows indicates a loss of momentum and supports a pullback move.

- Declining 20-and 50-EMAs still favor the downside bias.

- The RSI (14) is attempting to recapture the neutral range of 40.00-60.00

The GBP/USD pair is displaying back-and-forth moves in a narrow range of 1.1609-1.1623 in the early Tokyo session. The cable has turned sideways after defending the critical support of 1.1600. Broadly, the asset is oscillating in a wider range of 1.1607-1.1645 and is likely to display volumes and wider ticks.

A Symmetrical Triangle chart formation on an hourly scale near a two-year low is displaying signs of momentum loss, which may deliver a solid pullback move ahead. The upper portion of the above-mentioned chart pattern is placed from Tuesday’s high at 1.1761 while the lower portion is plotted from Monday’s low at 1.1645.

The 20-period Exponential Moving Average (EMA) at 1.1634 has acted as a major hurdle for the pound bulls. Also, the 50-EMA at 1.1661 is declining, which still favors a downside bias.

Meanwhile, the Relative Strength Index (RSI) is attempting to shift into the neutral range of 40.00-60.00 from the bearish range of 20.00-40.00 as exhaustion signals in the downside momentum are in play.

A break above Wednesday’s average price at 1.1650 will send the asset towards the round-level resistance at 1.1700, followed by Tuesday’s high near 1.1760.

Alternatively, a downside below Wednesday’s low near 1.1600 will drag the asset towards 19 March 2020 low at 1.1472. A breach of the latter will drag cable towards a 37-year low at 1.1410.

GBP/USD hourly chart

-637975814164567475.png)

-

23:09

EUR/USD begins September on softer foot above 1.0000, US PMI, NFP eyed

- EUR/USD struggles to extend three-month downtrend around nearly two-decade low.

- Markets turned dicey but hawkish central bankers, firmer EU inflation data kept bears in driver’s seat.

- Geopolitical, covid news also exerted downside pressure ahead of the key US data.

- German Retail Sales, US ISM Manufacturing PMI could offer intraday directions.

EUR/USD seesaws around 1.0050, probing a three-day rebound from the yearly low, after declining for three consecutive months. The pair’s latest inaction could be linked to the anxiety ahead of the key data/events while the daily gains could be attributed to the hawkish EU data versus softer US numbers. Even so, hawkish Fed bets and fears of recession kept the quote pressured.

As per the first readings of the Eurozone Harmonised Index of Consumer Prices (HICP) released for August, the inflation in the bloc rose to 9.1% YoY versus 9.0% expected and 8.9% prior. On Tuesday, Germany’s HICP for the stated month grew 8.8% while matching expectations, versus 8.5% prior.

Following the data, the European Central Bank (ECB) “urgently needs to act decisively next week,” the central bank’s Governing Council member and German central bank head Joachim Nagel said on Wednesday. “We need a strong rate hike in September,” the policymaker added.

Additionally, Germany’s Chancellor Olaf Scholz said that the government will present the next relief package soon.

On the other hand, US ADP Employment Change rose by 132K versus 288K expected and 270K prior. However, the average wage increases in the US in August were 7.6% y/y and the same kept the Fed policymakers hawkish.

Cleveland Federal Reserve Bank President Loretta Mester said on Tuesday that she was not anticipating the Fed to cut rates next year, as reported by Reuters. The policymaker also stressed that inflation must be brought under control, even if it means a recession. Restoring stability to consumer prices is now the clear priority for many key central banks, and with inflation so strong, that will come at the expense of growth.

It should be noted that the energy crisis in Germany and the fears of the US-China tussles, recently over Taiwan, join covid woes in China to also underpin the US dollar’s safe-haven demand.

Amid these plays, Wall Street closed with losses while the US 10-year Treasury yields rose the most in two weeks while rising to the highest level since late June.

Moving on, Germany’s Retail Sales for August and the US ISM Manufacturing PMI could entertain the EUR/USD traders ahead of Friday’s US Nonfarm Payrolls (NFP).

Also read: US ISM Manufacturing PMI Preview: Slowing growth or recession?

Technical analysis

Although 0.9900 puts a short-term floor under the EUR/USD prices, July’s low near the 1.000 threshold precedes a downward sloping trend line from February, near 1.0190, to restrict the pair’s upside momentum.

-

23:02

GBP/JPY Price Analysis: Bounces off a double-bottom in the H1, targets 162.00

- GBP/JPY daily chart shows the pair trading sideways due to the lack of fresh impetus.

- Near-term, the hourly chart formed a double-bottom, targeting 162.00.

The GBP/JPY extended its losses for the second straight day, stumbling below the 20-day EMA at 162.00, striking a new weekly low at 160.90. However, the British pound staged a recovery late in the session and trimmed earlier losses. The GBP/JPY is trading at 161.52, below its opening price as the Asian Pacific session begins.

GBP/JPY Price Analysis: Technical outlook

From a technical perspective, the GBP/JPY remains sideways. During the last 22 days, the cross-currency remains in the 159.44-162.84 range, unable to crack above/below it due to fundamental reasons linked to both currencies. The Relative Strength Index (RSI) paints a dull picture, trapped in the 38-49 reading, in bearish territory, directionless. Therefore, GBP/JPY intraday price action could be more entertaining.

Short term, the GBP/JPY one-hour chart illustrates the formation of a double-bottom on Wednesday, which targets the 162.00 mark. Nevertheless, the cross-currency pair would find crucial supply zones on its way north.

The GBP/JPY first resistance would be the 200-EMA at 161.71. Break above will expose the confluence of the 50 and 100-EMAs in the 161.75-76 area, followed by the R1 daily pivot at 161.96, ahead of the double-bottom’s target.

GBP/JPY Key Technical Levels

-

22:55

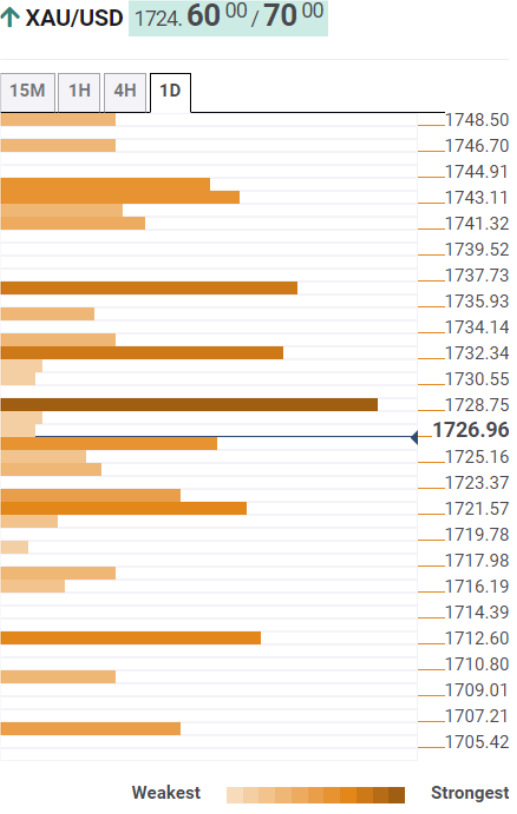

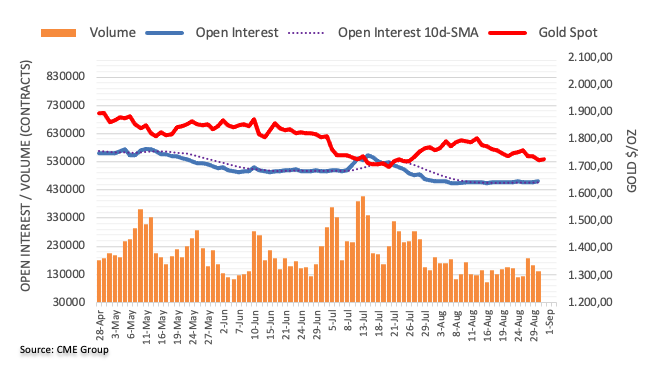

Gold Price Forecast: XAU/USD declines towards $1,700 on hawkish Fed bets, US NFP eyed

- Gold price is expected to extend its weakness to near $1,700.00 on hawkish Fed bets.

- A decline in US ADP employment data failed to weaken the DXY.

- The US NFP is seen lower at 300k vs. 528k reported earlier.

Gold price (XAU/USD) has displayed a less-confident pullback after hitting a fresh monthly low of $1,709.67 in the late New York session. The precious metal is expected to decline further to near the psychological support of $1,700.00 as investors ignored the weaker employment generation numbers and are focusing on more restrictive monetary policy by the Federal Reserve (Fed).

Ahead of more comprehensive and considered US Nonfarm Payrolls (NFP) data, the unconventional US Automatic Data Processing (ADP) has reported 132k new job additions in August in the private sector, much lower than the expectations of 288k. Investors were already expecting a fall in employment generation as big tech boys announced a halt in recruitment or retrenchment at a conference call after the release of second-quarter results.

Going forward, the mega event of US NFP is expected to land at 300k lower than the prior release of 528k. Also, the Unemployment Rate is expected to remain unchanged at 3.5%. As bringing price stability is the foremost priority of the Fed, softening labor market is not able to change the conviction of Fed policymakers towards hiking interest rates.

Gold technical analysis

Gold prices are declining firmly towards the monthly lows placed at $1,680.91, recorded on July 21. The 20-and 50-period Exponential Moving Averages (EMAs) at $1,726.40 and $1,738.32 respectively are scaling towards the south, which adds to the downside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

-

22:08

EUR/JPY Price Analysis: Trades at around five-week highs, eyeing 140.00

- EUR/JPY recorded a fresh weekly high each day of the week.

- The shared currency strengthened once it broke above the 139.00 mark on the high EU inflation data.

- EUR/JPY and RSI’s negative divergence in the 4-hour chart suggests the pair might pull back before testing 140.00.

The EUR/JPY extends its weekly gains for the fourth consecutive day, up almost 0.50% during the day as the New York session is about to end. At the time of writing, the EUR/JPY is trading at 139.60, refreshing five-week highs, for the fourth straight day.

EUR/JPY Price Analysis: Technical outlook

After consolidating around the 138.20-139.20 area, the cross-currency resumed its up trend. Data from the euro area, showing inflation around 9.1% YoY, caused a jump in the pair, clearing the 139.00 figure and hitting a fresh weekly high of 139.68.

Hence, the EUR/JPY path of least resistance is upwards. So, the EUR/JPY first resistance would be the 140.00 figure. A decisive break would pave the way toward July 21 cycle high at 142.32.

The EUR/JPY 4-hour chart illustrates the pair clearing the July 27 high at 139.50, further cementing the case for a 140.00 test. Nevertheless, the Relative Strength Index (RSI) shows signs of exhaustion, as the EUR/JPY reaches a fresh higher high, while the RSI’s peak is lower than the previous impulse to the upside. Therefore, a negative divergence could be forming, meaning that the EUR/JPY might drop soon before resuming the uptrend.

The EUR/JPY’s first resistance would be the 140.07 July 25 high. Once cleared, the next resistance would be the July 22 daily high at 141.09, followed by the YTD high at 142.35.

EUR/JPY Key Technical Levels

-

21:46

NZD/USD bulls could be about to make a significant move

- NZD/USD is pressured in a strong dollar environment.

- The price is carving out an M-formation on the 4-hour chart.

- A break of 0.6150 will leave the bulls back in control.

NZD/USD is under pressure by some 0.2% and falling into the final stage of the North American session at month's end. The bird has travelled between a high of 0.6154 and a low of 0.6110 so far on Wednesday.

''The Kiwi is little-changed this morning after bouncing around in a fairly confined range overnight as markets continued to digest more hawkish messaging from central banks, higher than expected European inflation, and further weakness in equities and cryptocurrencies,'' analysts at ANZ Bank explained.

The record-high inflation in parts of the world is compounding recession fears stalking markets on Wednesday which is serving as a bullish plate for the US dollar and US Treasury yields. this is a weight for the antipodeans, given their high beta status to global stocks.

Equities on Wall Street ended the month with their fourth straight daily decline on Wednesday, cementing the weakest August performance in seven years. Selling pressure accelerated on the back of last week's speech by the Fed Chair Jerome Powell who advocated for keeping monetary policy tight "for some time". This dashed hopes of more modest interest rate hikes, with the benchmark index down more than 5% over the past four trading sessions. Traders are now pricing in about a 70% chance of a 75 basis points Fed rate hike next month, according to data from Refinitiv.

On Wednesday, the two-year US Treasury yield, which is relatively more sensitive to the monetary policy outlook in the US, hit a 15-year high at 3.499% overnight but eased back to 3.446%. The 10-year Treasury yield, which hit a two-month high of 3.153% on Tuesday, stood at 3.123, easing back from 3.164%%.

''In this sort of environment, with global recession fears percolating, FX markets attuned to a risk-off vibe, UK gripped by political/energy/inflation woes, Europe struggling under the weight of energy prices, drought and a war on its back doorstep, and the Bank of Japan resolute in its desire to maintain an easy policy, markets will naturally be attracted to the USD, and in blunt terms, that is where the risks lie for the Kiwi,'' the analysts at ANZ Bank said.

''The idea that the RBNZ might be done after a couple more hikes isn’t helping either (we think the risks are skewed to more, but the market doesn’t think that).''

Meanwhile, much will depend on this week's US jobs data, in the Nonfarm Payrolls report. Analysts at TD Securities explained that ''employment likely continued to advance robustly in August but at a more moderate pace following the booming 528k print registered in July. High-frequency data, including Homebase, point to still above-trend job creation.'' The analysts also look for the Unemployment Rate to drop by a tenth for a second consecutive month to 3.4%, and for wage growth to advance at a firm 0.4% MoM (5.3% YoY).

NZD/USD technical analysis

Despie the bullish environment for the greenback, from a technical standpoint, there are prospects of a move up to complete a Gartley pattern on the 4-hour chart over the first part of the new month. In the meanwhile, the price is carving out an M-formation on the 4-hour chart that would be expected to result in a pullback to meet the neckline in a 50% mean reversion for the coming sessions. A break of 0.6150 will leave the bulls back in control.

-

20:57

Forex Today: The dollar stands victorious for one more month

What you need to take care of on Thursday, September 1:

The American dollar ended August with substantial gains across the FX board. On Wednesday, it edged higher against most major rivals, although the EUR/USD pair advanced for a third consecutive day and settled around 1.0050.

The EU Harmonised Index of Consumer Prices (HICP) rose by 9.1% YoY in August, up from 8.9% in July, while the core reading for the same period jumped to 4.3% from 4% in the previous month. Both figures were above the market's expectations and at record highs, somehow justifying the hawkish shift from European policymakers.

The USD suffered a temporal knee-jerk early in the US session as the ADP report disappointed, showing the private sector added just 132K new jobs in August. However, the currency recovered ahead of the close as US Treasury yields surged to fresh weekly highs while US indexes closed in the red for a second consecutive day.

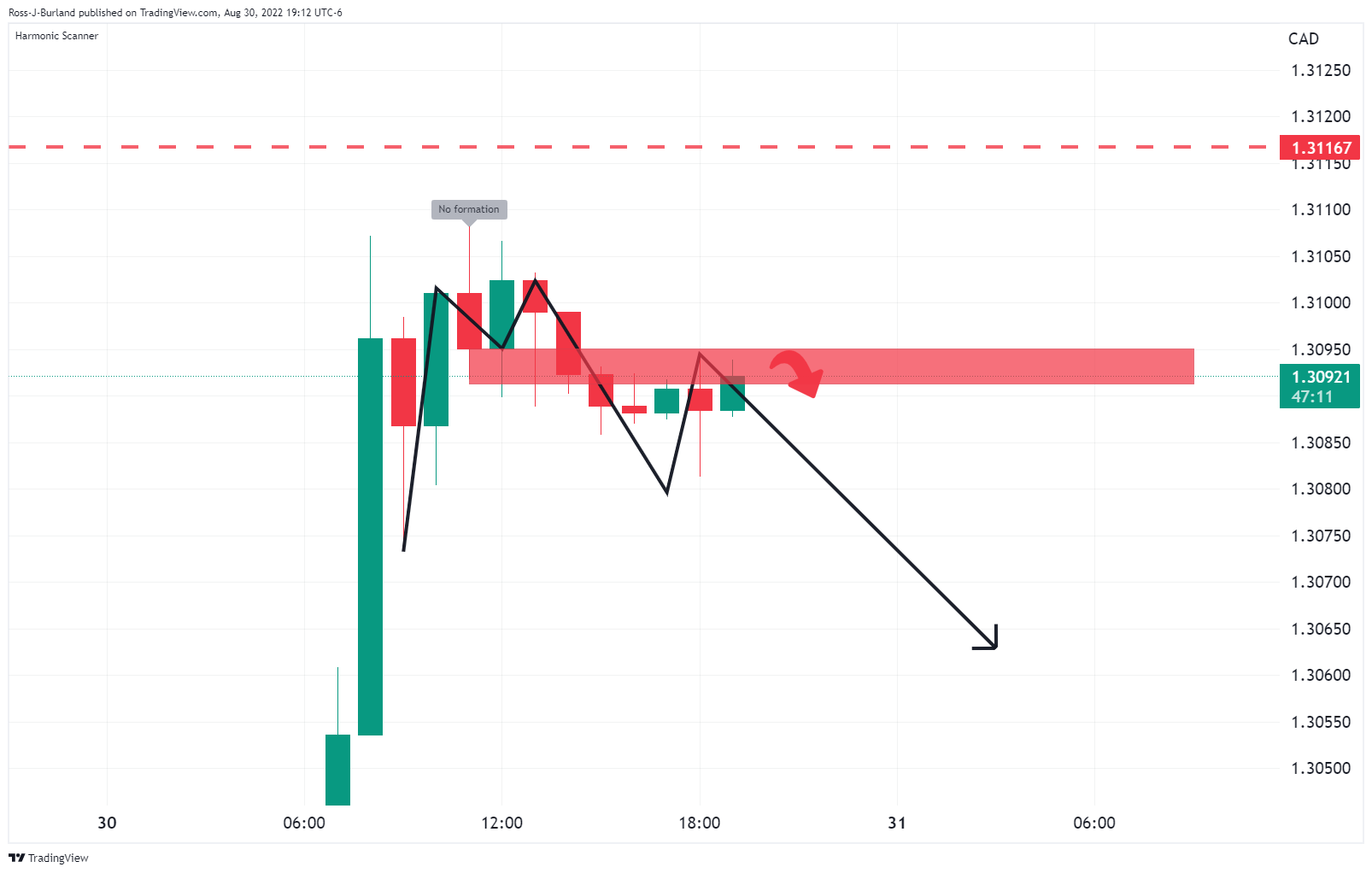

GBP/USD struggles to retain the 1.1600 threshold, while AUD/USD trades at weekly lows in the 0.6840 price zone. The USD/CAD pair soared and now hovers around 1.3130.

Safe-haven currencies eased modestly against their American rival, with USD/CHF now at 0.9780 and USD/JPY at 138.90.

Crude oil prices edged lower after the US Defence Department Spokesman announced that G7 finance ministers would discuss Russia's oil price cap on Friday. WTI settled at $89.10 a barrel. Spot gold heads into the Asian session, trading around $1,710 a troy ounce, its lowest in over a month.

Bitcoin price flaunts possible falling bullish wedge revival amid fears of decoupling from traditional markets

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:30

US dollar bears move in ahead of critical NFP

- The US dollar is pressured at month end and ahead of key US data.

- The focus stays on the prospects of a global recession and inflationary pressures.

The US dollar, as measured by the DXY index, is back under pressure on Wednesday in midday trade as traders count down to this week's US Nonfarm Payrolls data due on Friday that could make solidify the case for a 75bp rate hike by the Federal Reserve in September.

The dollar remains near the 2-decade high hit on Monday. The DXY, which measures the greenback against a basket of six currencies, was last down 0.1% at 108.66, after earlier coming within a whisker of Monday's two-decade peak of 109.48. The index is on track for a rise of around 2.6% in August, its third-straight monthly gain.

Record-high inflation in parts of the world is compounding recession fears stalking markets on Wednesday which is serving as a bullish plate for the US dollar and US Treasury yields. The two-year US Treasury yield, which is relatively more sensitive to the monetary policy outlook in the US, hit a 15-year high at 3.499% overnight but eased back to 3.446%. The 10-year Treasury yield, which hit a two-month high of 3.153% on Tuesday, stood at 3.123, easing back from 3.164%.

Traders are now pricing in about a 70% chance of a 75 basis points Fed rate hike next month, according to data from Refinitiv following Fed officials reiterating their support for further rate hikes. New York Fed President John Williams told Wall the Wall Street Journal that inflation expectations in the US were well anchored but added that it would take a few years to bring inflation back to 2%. Richmond Federal Reserve Bank President Thomas Barkin said on Tuesday that the United States is facing "post-war-like" inflation. The remarks made by officials have followed the comments from Fed Chair Jerome Powell who spoke at the Jackson Hole central banking symposium in Wyoming late last week that left the door wide open for ongoing rate hikes into mid-2023, which prompted a wave of US dollar strength.

Meanwhile, economic news remained grim with overnight data showing economic activity in China. The nation has extended its decline this month after new COVID-19 infections, the worst heatwaves in decades and struggles in the property sector. China’s PMI survey data for August showed a contraction in factory activity. The data has led some analysts to believe the world's second-largest economy will likely dip below 3.0% in the third quarter of this year. ''We have trimmed our 2022 GDP forecast to 3.0% from 4.0% as both domestic and external demand continues to weaken,'' analysts at ANZ Bank said.

Eyes on NFP

The data is expected to keep the yuan on the back foot, supporting a bullish outlook for the greenback. Meanwhile, for the US, PMI surveys already released point to a deceleration in manufacturing activity for August, with 4 out of 5 registering notable declines on an ISM-equivalent basis. There will be data tomorrow that analysts at TD Securities explained a sharp drops in shipments/new orders doesn't bode well for current/future manufacturing output. ''We look for a decline in the ISM index, but may revise the forecast as more surveys are released.''

The showdown for the start of the month, however, will be Friday's jobs data. The analysts at TD Securities explained that ''employment likely continued to advance robustly in August but at a more moderate pace following the booming 528k print registered in July. High-frequency data, including Homebase, point to still above-trend job creation.'' The analysts also look for the UE rate to drop by a tenth for a second consecutive month to 3.4%, and for wage growth to advance at a firm 0.4% MoM (5.3% YoY).

DXY technical analysis

The above two charts are the daily outlook from a bullish and bearish perspective. Both scenarios are determined by either a W or an M formation. Should the current support in the 106.60s hold up, then the focus will be on the upside for the immediate future. On the other hand, a break below and tests of recent lows could result in a wave of selling pressure for a run on the prior bullish impulses.

-

19:28

AUD/USD hovers around 0.6850 below the daily high at around 0.6900

- The AUD/USD stays positive, although off the day’s highs.

- Fed’s Mester: Expects the Federal Funds Rate (FFR) to end at around 4% in 2023.

- Mixed US economic data, a tailwind for the AUD/USD.

The AUD/USD is almost flat, though off the day’s highs after hitting a daily high above the 0.6900 mark. Factors like risk aversion courtesy of month-end flows, alongside Fed speakers reiterating the need to get into the restrictive mode. At the time of writing, the AUD/USD is trading at 0.6858, just above its opening price.

US equities remain heavy due to risk-off. Fed policymakers continue to grab the spotlight. On Wednesday, Loretta Mester expressed that rates in the US need to be above 4% by the next year while adding that she does not estimate rate cuts in the next year. She added that recession fears had risen but are not part of her baseline.

Data-wise, the US economic calendar was light, though it featured the August ADP Employment Change, the first one, after pausing due to some changes made to the survey. Private hirings rose by 132K less than July’s 270K. Later, the Chicago PMI for August increased more than estimated, topping 52.2 vs. 52 expected by analysts.

Meanwhile, on the Australian side, the Australian Construction Work Done for the second quarter, plunged by 3.8% QoQ vs. estimates of a 0.9% expansion.

Analysts at ANZ said, “The weakness was widespread across states and sectors. This raises concerns that construction activity will not be as strong as we had expected this year, despite the extensive pipelines of work yet to be done, particularly across the residential and infrastructure sectors. Demand is still there, capacity utilization in the industry is running well above average, but supply constraints don’t explain the extent of the weakness in Q2.

What to watch

The Australian economic docket will feature the S&P Global Manufacturing PMI alongside the AIG Manufacturing Index, both readings expected to slow down. On the US front, the calendar will feature unemployment claims, the S&P Global PMI, and, most importantly, the ISM Manufacturing PMI.

AUD/USD Key Technical Levels

-

19:17

GBP/USD bulls could be about to take over from fresh bear cycle lows

- GBP/USD has been pressured to fresh cycle lows on US dollar strength.

- The daily chart's M-formation is a reversion pattern that could see the price revert to the 50% mean reversion point near 1.1750.

GBP/USD bleeds out on Wednesday following a brief recovery vs. the nightly greenback. At the time of writing, GBP/USD is trading at 1.1609 and is recording a 0.4% loss on the day so far having fallen from a high of 1.1693 to a low of 1.1598. The pound has pierced the psychological 1.16 round level and is set for its worst month since late 2016 against the greenback as UK inflation is already at 10% and rising, with the Bank of England set to increase rates next month.

Record-high inflation in parts of the world is compounding recession fears stalking markets on Wednesday which is serving as a bullish plate for the US dollar and US Treasury yields. The two-year US Treasury yield, which is relatively more sensitive to the monetary policy outlook in the US, hit a 15-year high at 3.499% overnight but eased back to 3.446%. The 10-year Treasury yield, which hit a two-month high of 3.153% on Tuesday, stood at 3.123, easing back from 3.164%%.

The dollar index gained around 0.4% to 109.20, after starting the week by marking a two-decade high at 109.48. Nevertheless, the greenback remains on track for its third-straight monthly rise, with markets bracing for more oversized interest rate hikes from the US Federal Reserve. The index is on track for a rise of over 3% in August, and its highest end-of-month closing level since May 2002. Traders are now pricing in about a 70% chance of a 75 basis points Fed rate hike next month, according to data from Refinitiv.

The hawkish sentiment was underpinned this week by Fed officials reiterating their support for further rate hikes. New York Fed President John Williams told Wall the Wall Street Journal that inflation expectations in the US were well anchored but added that it would take a few years to bring inflation back to 2%. Richmond Federal Reserve Bank President Thomas Barkin said on Tuesday that the United States is facing "post-war-like" inflation. The comments followed the speech from Fed Chair Jerome Powell at the Jackson Hole central banking symposium in Wyoming late last week that shut left the door wide open for ongoing rate hikes into mid-2023, which prompted a wave of dollar strength.

Global growth risks weigh on GBP

Meanwhile, economic news remained grim with overnight data showing economic activity in China. The nation has extended its decline this month after new COVID-19 infections, the worst heatwaves in decades and struggles in the property sector. China’s PMI survey data for August showed a contraction in factory activity. The data has leads some analysts to believe the world's second-largest economy will likely dip below 3.0% in the third quarter of this year. '' We have trimmed our 2022 GDP forecast to 3.0% from 4.0% as both domestic and external demand continues to weaken,'' analysts at ANZ Bank said.

Such bearish sentiment is a risk for risk currencies, such as the pound as recessions loom. The BoE's recent forecast of recession underpins the vulnerability of the pound going forward. ''The warnings on growth over-rode any support for the currency that may otherwise have been derived from the Bank’s 50 bps rate hike, the largest incremental move in 27 years,'' analysts at Rabobank said.,

''The UK is facing months of astoundingly high inflation levels faced by a period of disinflation during potentially 5 quarters of negative GDP growth.''

''We see risk that cable could print as low at 1.14 on a 1 to 3-month view. This assumes a continued period of broad-based USD strength.''

GBP/USD technical analysis

The pound has extended the daily decline in a classic continuation from a 50% mean reversion of the prior bearish impulse on the hourly chart:

However, as illustrated on the chart above, we could be in for some consolidation between support and resistance and ultimately, this could lead to a bullish correction, as per the daily chart's analysis:

The daily chart's M-formation is overextended, but it is a reversion pattern that could see the price revert to the 50% mean reversion point near 1.1750 in due course.

-

18:42

USD/CHF Price Analysis: Marches firmly towards the 0.9800 figure

- USD/CHF extends its rally to four straight days, refreshed seven-week highs.

- Solid resistance lies around the confluence of a top-trendline of an ascending channel and a psychological price level of around 0.9800.

The USD/CHF advances sharply after hitting a daily low at 0.9726. in the North American session, the USD/CHF is trading at 0.9758 after hitting a seven-week high at 0.9807.

USD/CHF Price Analysis: Technical outlook

During the day, the USD/CHF printed a seven-week high, above the 0.9800 figure, though it was short-lived. The major retreated toward current exchange rates. Nevertheless, oscillators, particularly the Relative Strength Index (RSI), signal buyers still have some fuel left in the tank to re-test the abovementioned level, which, once cleared, could pave the way towards July’s 14 swings high at 0.9886.

Otherwise, the USD/CHF might consolidate around the 0.9700-0.9800 range ahead of the release of Swiss CPI figures on Thursday, alongside Friday’s US Nonfarm Payrolls.

Short term, the USD/CHF 4-hour chart depicts the pair trending up in an ascending channel. The high of the day was the second test of the top-trendline of the channel, with sellers stepping in. dragging the major 50 pips lower. USD/CHF traders should note that the high of the day, was reached when the Relative Strength Index (RSI) peaked at overbought conditions. Therefore, once the RSI dipped, then a re-test of the 0.9800 figure is on the cards.

The USD/CHF first resistance would be the R1 pivot at 0.9777. Once cleared, the next supply zone would be the figure and top-trendline of the channel around 0.9800. On the flip side, the USD/CHF First support would be the daily pivot at 0.9722. A breach of the latter will send the major tumbling towards the 20-EMA at 0.9709, followed by the 0.9700 mark.

USD/CHF Key Technical Levels

-

17:21

EUR/USD hovers around 1.0057 after reaching new week highs

- EUR/USD advances sharply ahead of US NFP and next week’s ECB monetary policy decision.

- Cleveland’s Fed Mester expects Fed funds rates above 4% and would like to hold them higher for longer.

- ECB’s hawks expect at least a 50 bps increase at September 8 meeting.

- Money market futures estimate the ECB would hike 125 bps by October.

EUR/USD is recording decent gains in the North American session amidst a risk-off mood, courtesy of further hawkish Fed commentary, with Cleveland’s Fed Mester taking the stand. At the same time, month-end flows weighed on the greenback.

The EUR/USD opened near parity before sliding towards the day’s lows at 0.9971 before climbing sharply, reaching a daily high at 1.0076 on month-end flows. At the time of writing, the EUR/USD is trading at 1.0059, above its opening price.

During the New York session, Cleveland’s Fed President Loretta Mester emphasized that rates in the US need to be above 4% by 2023 and reiterated the Fed needs to “hold it there.” Mester added that she does not foresee rate cuts in 2023 while acknowledging that even though recession fears had risen, they are not part of her baseline.

In the meantime, the US economic docket featured the US ADP August’s figures, the first one, after pausing due to changes made to the report. Private hirings rose by 132K less than July’s 270K. Later, the Chicago PMI for August increased more than estimated, topping 52.2 vs. 52 expected by analysts.

In the meantime, the Euro area energy crisis continues to worsen. The Nordstream 1 pipeline entered three-day maintenance, as reported by Gazprom, keeping investors uneasy amid a period of high energy prices. In the meantime, EU’s inflation rose 9.1% YoY, higher than estimates, while core readings, which extract volatile items, also rose 4.3%.

Last reports about the Nordstream 1, Gazprom commented that Siemens could not hold regular equipment maintenance for the pipeline via Interfax. The natural gas pipeline works at a 20% capacity.

Elsewhere, ECB’s hawks are all over the place, crossing wires. The first one was Rehn, which expressed that although the economic outlook has darkened, monetary policy needs to normalize. He foresees further rate hikes coming. Later ECB’s Holtzmann commented that 50 bps is the minimum for September while adding that 75 bps need to be thrown into discussions.

What to watch

The euro area economic calendar will reveal German Retail Sales, amongst a tranche of S&P Global Manufacturing PMIs readings. On the US front, the docket will feature unemployment claims, the S&P Global PMI, and, most importantly, the ISM Manufacturing PMI.

EUR/USD Key Technical Levels

-

17:00

Russia Unemployment Rate came in at 3.9%, below expectations (4.1%) in July

-

16:51

Gold Price Forecast: XAU/USD rebounds as US yields turn to the downside

- XAU/USD rises more than $10 from monthly lows.

- US yields retreat after ADP data, DXY turns negative.

- Stocks in Wall Street fail to hold to gains.

Gold prices are modestly down on Wednesday but off lows. During the American session, XAU/USD rebounded from the one-month low at $1,709 and rose to $1,723. It is hovering around $1,720.

The rebound in gold is preventing a daily close under $1,715 which would be a negative technical development suggesting more losses ahead, targeting $1,700. Below, the next level to watch is the July low at $,1680. The immediate resistance on the upside is located at $1,725; above the bearish pressure would ease.

Yields down

US yields are now falling on Wednesday. Following the August ADP employment report, the demand for Treasuries rose. The employment numbers came in below expectations with the private sector adding 132K jobs versus the 288K of market consensus. On Thursday the ISM Manufacturing is due and on Friday, the Non-farm payroll (consensus: 300K).

The US 10-year yield peaked at 3.16%, the highest level in two months and then pulled back to 3.10%; the 2-year yield retreat from the highest since 2007 at 3.49% to 3.43%. The decline in yields weakened the greenback, helping XAUUSD. The US Dollar Index falls 0.35% on Wednesday and is back under 108.50. The DXY continues to move sideways, holding between 108.00 and 109.00.

Despite the move lower in yields, the doors for a 75 basis points rate hike from the Federal Reserve are still open. Also, despite the rebound, the primary trend in XAU/USD is still bearish.

Technical levels

-

16:42

Colombia National Jobless Rate fell from previous 11.3% to 11% in July

-

16:26

Canada: As the weather heated up, the economy was cooling down – CIBC

Data released on Wednesday showed a solid growth rate in Canada during the second quarter of 3.3%, however, it was below expectations of 4.5%. Analysts at CIBC point out the numbers were far from a disaster and continue to show solid growth. They expected a 75 basis point rate hike from the Bank of Canada next week.

Key Quotes:

“As the weather heated up, the Canadian economy was cooling down. While growth in Q2 as a whole was solid at an annualized +3.3%, and little changed from Q1's pace, it was disappointing relative to consensus expectations (+4.4%) and was largely driven by an acceleration in early spring. The latest monthly GDP figures, including an advance estimate for a slight decline in July, have shown a broadly flat trend starting in May. While we still expect that the Bank of Canada will hike interest rates further to combat high inflationary pressures, a cooling economy supports our view that the peak will be lower than financial markets have been pricing in

“Today's GDP figures were far from a disaster, and still show that the Canadian economy managed to achieve solid growth during a period of time that the US economy was contracting. However, somewhat cooler growth in Q2 and Q3 than the Bank of Canada recently forecasted should give policymakers comfort that inflation will start to ease more meaningfully later in the year without interest rates needing to move too far into restrictive territory.”

“We still forecast a 75bp hike from the Bank next week, that will take the overnight rate to 3.25% and into a range that policymakers think is restrictive (above 3%). However, we also expect a pause after that as the Bank reassess the impact of these restrictive rates on growth and inflation.”

-

16:14

EUR/GBP rallies toward fourth straight day, hits monthly highs near 0.8650

- Pound remains under pressure on negative UK economic outlook.

- Euro keeps rising amid expectations of a 75 rate hike from the ECB.

- EUR/GBP gains momentum after breaking key technical levels.

The EUR/GBP broke above 0.8605 and jumped to 0.8640, reaching the highest level since July 1. The cross remains near the top, with a strong bullish tone as EUR/USD breaks above 1.0050.

The euro is rising for the fourth consecutive day against the pound, accumulating a gain of more than 200 pips. The impressive rally can have more legs to go particularly if EUR/GBP holds above 0.8630. The next resistance stands at 0.8650 followed by 0.8670 and then 0.8720.

Inflation in EZ, fear in UK

Earlier on Wednesday, Eurozone inflation data showed a new record with the annual rate reaching 9.1% (above the 9% of market consensus). The numbers favored expectations of a “jumbo” rate hike of 75 basis points from the European Central Bank at next week’s meeting. Also, more ECB officials offered hawkish remarks. UK and EZ bond yields continue to rise ahead of rate hikes from central banks. European bonds are on track for their worst month ever.

In the UK, the negative economic outlook, the energy crisis and soaring inflation keep hitting the pound. The currency is about to post the biggest monthly drop versus the US dollar since October 2016.

Also weighing on GBP is the cautious tone across financial markets that usually affect the pound more than the euro. Wall Street is flat on Wednesday with main indices at the lowest level in a month while the FTSE 100 is about to end with a 0.70% decline.

Technical levels

-

16:08

USD/JPY remains subdued around 138.60s ahead of Friday’s US NFP

- USD/JPY remains trading within a narrow range as traders brace for August’s US NFP.

- The US ADP Employment change disappointed, but Chicago’s PMI exceeded estimates.

- The BOJ would conduct purchasing operations of 10-year JGB notes in September, further confirming its dovish stance.

The USD/JPY is almost in the North American session, unable to crack a fresh YTD high, amidst a dismal sentiment, with US data led by the ADP report below estimates, while the Chicago PMI exceeds estimates. Today’s data, alongside Tuesday’s JOLTs report and consumer confidence, justifies additional tightening by the Fed.

The USD/JPY opened near the day’s highs, around 138.80, and struck a daily low at 138.26. However, buyers stepped and lifted the major towards its daily high at 138.90 before retreating toward current exchange rates. At the time of writing, the USD/JPY is trading at 138.62.

USD/JPY unfazed amid a lack of catalyst

The US ADP report for August showed that private hirings rose by 132K, less than the previous month’s 270K jobs. Worth noting that it’s the first release under a new survey format, so it should not be viewed as a prelude to Friday’s Nonfarm Payrolls report. According to Nela Richardson, ADP Chief Economist, “our data suggest a recent shift towards a more conservative hiring pace,” companies are at an inflection point. She added that hirings could shift from “supercharged job gains” to a more regular cycle.

Later, the Chicago PMI for August increased more than estimated, topping 52.2 vs. 52 expected by analysts.

Earlier, Cleveland’s Fed President Loretta Mester crossed newswires, reiterated her view of the Federal funds rate (FFR) being above 4% by 2023 and “hold it there.” She commented that she does not “anticipate the Fed cutting the FFR next year.”

In the meantime, the US Dollar Index tumbles 0.25% down at 108.547, while the US 10-year benchmark note rate is unchanged at 3.106%, a headwind for the USD/JPY.

Elsewhere, during the Asian session, Japanese retail sales exceeded estimates in July in tandem with consumer and industrial production. Meanwhile, the Bank of Japan (BoJ) announced that it would conduct purchasing operations of 10-year JGB notes, committed to its ultra-loose monetary policy stance.

USD/JPY Key Technical Levels

-

15:30

United States EIA Crude Oil Stocks Change came in at -3.326M below forecasts (-1.483M) in August 26

-

14:51

Downside risks for GBP/USD to the 1.10 zone in the next few months – Scotiabank

How low can the pound go? The GBP/USD pair could dive as low as 1.10, in the opinion of economists at Scotiabank.

GBP will not react well to renewed equity market weakness

“Beyond the stagflation risk, the GBP will not react well to renewed equity market weakness as central banks persist with interest rate increases while the domestic political backdrop remains unhelpful (a new PM, Brexit issues unresolved and independence movements at home stirring again).”

“The broad, trade-weighted index (TWI) measure of the pound could fall another 4-5% broadly or so before reaching the lows seen around the 1992 Exchange Rate Mechanism debacle, the 2008 financial crisis, the 2016 Brexit vote and the 2020 pandemic. The fact that broad TWI losses stalled around 73.5 on each of those very different calamities for the pound suggests it is a point worth keeping a close eye on moving forward. A return to that point in this cycle might imply – roughly – downside risks for GBP/USD to the 1.10 zone and upside risks for EUR/GBP to the 0.90 area in the next few months.”

-

14:45

United States Chicago Purchasing Managers' Index above forecasts (52) in August: Actual (52.2)

-

14:45

EUR/USD to retest the 0.9900/10 zone on a sustained push under 0.9985 – Scotiabank

EUR/USD is capped at around 1.0050. Analysts at Scotiabank expect the world’s most popular currency pair to retest the 0.9900/10 area on a drop below 0.9985.

Swaps are not yet fully priced for a 75 bps hike

“After another failed test of 1.0050 earlier in the session (minor double top), a sustained push under 0.9985 (neckline trigger) will tilt risks towards a retest of the 0.9900/10 area.”

“Swaps are not yet fully priced for a 75 bps hike, reflecting 67 bps of tightening at the Sep meeting, but the trend is leaning towards the risk of a more aggressive hike which may provide the EUR with some underpinning below 1.00 for now.”

-

14:41

GBP/USD: The only major point of note is the 1.1425 low from 2020 – Scotiabank

GBP/USD is floundering in the low 1.16s. Economists at Scotiabank expect the pair to continue its slide.

GBP to retain a weak undertone

“Short, medium and long-term trend oscillators remain aligned bearishly against the GBP, implying that GBP rebounds are liable to remain shallow (1.17/1.18 range) and short-lived.”

“There is little in terms of notable support for the GBP below the market – the 1.16 and 1.15 points provide some psychological support but the only major point of note is the 1.1425 low from 2020.”

“Sterling is liable to retain a soft undertone at least until the new government team and its policies take shape.”

-

14:37

Gold Price Forecast: Every tick lower in XAU/USD is raising the risk of a capitulation event – TDS

Gold has come under renewed bearish pressure and hit a fresh monthly low below $1,710. Strategists at TD Securities note that any dip in the yellow metal increases the odds of a massive capitulation event in gold.

Silver prices are vulnerable

“Gold markets still feature an extremely concentrated and bloated position held by family offices and proprietary trading shops. Few traders are now holding an extremely bloated position. Further, this position does not appear to be associated with a stagflationary narrative. As prices approach this cohort's pandemic-era entry levels, the risk of a large-scale capitulation is growing. This fits well with the risk of a breakout in the broad dollar index, which could coincide with a meltdown below the $1,675 range.”

“Considering that industrial demand has also resumed its slump, after the mean-reversion in demand signals showed signs of overshooting, silver prices are also vulnerable given little exposure to the rise in supply risk premia that has supported the base metals complex.”

“While palladium also proved vulnerable to demand headwinds, a recent CTA selling program has been whipsawed, translating to modest buying support that should soon run out of steam. Unless prices break north of $2,133, we expect a CTA selling program to imminently weigh on palladium.”

-

14:33

EUR/USD leaves behind daily lows near 0.9970

- EUR/USD bounces off earlier lows in the 0.9970 zone.

- The dollar gives away part of the recent advance past 109.00.

- EMU flash inflation figures surprised to the upside in August.

Following a knee-jerk to the 0.9970 region, EUR/USD managed to regain traction and reclaim the parity zone on Wednesday.

EUR/USD meets support around 0.9970

EUR/USD now looks to add to the positive start of the week, although it remains at the mercy of inconclusive risk appetite trends for the time being.

In the meantime, higher-than-expected inflation figures in the euro area for the current month appear to have lent further conviction to the investors’ perception of a 75 bps rate hike at the ECB event in September, which seems to have lent some wings to the single currency.

In the US docket, the revised ADP report showed the US private sector added 132K jobs in August, less than initially estimated.

What to look for around EUR

EUR/USD now treads water amidst the renewed bid bias in the greenback as well as some worsening conditions in the risk complex.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. However, potential shifts to a more hawkish stance from ECB’s policy makers regarding the bank’s rate path could be a source of strength for the euro.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: EMU Flash Inflation Rate, Germany Unemployment Change, Unemployment Rate (Wednesday) – Germany Retail Sales, Final Manufacturing PMI, EMU Final Manufacturing PMI, EMU Unemployment Rate (Thursday) – Germany Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, spot is losing 0.11% at 1.0001 and the breach of 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low). On the other hand, the next up barrier comes at 1.0090 (weekly high August 26) seconded by 1.0202 (high August 17) and finally 1.0223 (55-day SMA).

-

14:21

USD/CAD clings to modest gains near 1.3100 after Canada GDP data

- USD/CAD touched its highest level since mid-July above 1.3100.

- Canadian economy expanded at a softer pace than expected in Q2.

- Greenback struggles to gather strength after weak employment data.

The USD/CAD pair gathered bullish momentum and touched its highest level since mid-July at 1.3132 before erasing a portion of its daily gains. As of writing, the pair was up 0.1% on the day at 1.3107.

Canadian economy loses momentum

The data from Canada showed on Wednesday that the economy expanded at an annualized rate of 3.3% in the second quarter. This reading came in weaker than the market expectation for a growth of 4.4% and caused the loonie to lose interest.

On the other hand, the ADP reported that employment in the US private sector rose by 132,000 in August, missing the market expectation for an increase of 288,000 by a wide margin. This data caused the US Dollar Index (DXY) to lose its traction and made it difficult for USD/CAD to preserve its bullish momentum. Ahead of Wall Street's opening bell, DXY stays flat on the day at around 108.90.

Meanwhile, crude oil prices started to rebound, helping the commodity-related CAD show some resilience against its rivals. The barrel of West Texas Intermediate, which dropped to a nine-day low of $88.20 earlier in the day, was last seen trading above $90.

There won't be any other high-tier macroeconomic data releases in the remainder of the session but month-end flows toward the London fix could ramp up the market volatility.

Technical levels to consider

-

14:03

Chile Industrial Production (YoY) down to -5.1% in July from previous -1.5%

-

13:40

Canada: Annualized real GDP grows by 3.3% in Q2 vs. 4.5% expected

- Canadian economy expanded at a softer pace than expected in the second quarter.

- USD/CAD trades in positive territory above 1.3100 after the data.

Real Gross Domestic Product (GDP) in Canada expanded at an annualized rate of 3.3% in the second quarter, the data published by Statistics Canada showed on Wednesday. This print followed the 3.1% growth recorded in the first quarter and missed the market expectation of 4.5%.

On a quarterly basis, real GDP was up 0.8%. "Growth in the second quarter was moderated by declines in housing investment and household spending on durable goods and by a rise in imports that exceeded exports," Statistics Canada noted in its publication. "Final domestic demand rose by 0.7%, following a 0.9% increase in the first quarter."

Market reaction

The USD/CAD pair edged higher after this data and was last seen gaining 0.25% on the day at 1.3123.

-

13:32

Brazil Nominal Budget Balance registered at -22.498B above expectations (-36B) in June

-

13:32

Brazil Primary Budget Surplus came in at 20.44B below forecasts (21.4B) in June

-

13:30

Canada Gross Domestic Product Annualized (QoQ) below forecasts (4.4%) in 2Q: Actual (3.3%)

-

13:30

Canada Gross Domestic Product (MoM) in line with forecasts (0.1%) in June

-

13:20

USD/TRY inches higher and approaches 18.20

- USD/TRY extends the gradual march north to the 18.20 region.

- The better tone in the dollar lifts the pair to fresh YTD highs.

- Türkiye GDP expanded 7.6% YoY during the second quarter.

Further upside in the US dollar keeps USD/TRY near the 2022 tops in levels just shy of 18.20 on Wednesday.

USD/TRY still targets the all-time top around 18.25

In the meantime, the bullish bias is unlikely to abandon USD/TRY for the time being, with the immediate target at the all-time high around 18.25 (December 20 2021).

Furthermore, the pair posted gains in every month since the start of the year and the lira advanced in only one out of the last nine weeks vs. the dollar.

Positive news from the domestic docket also failed to lend some wings to the Turkish currency after GDP figures showed the economy expanded at an annualized 7.6% during the April-June period, surpassing expectations at the same time.

What to look for around TRY

The upside bias in USD/TRY remains unchanged and trades closer to the all-time high around 18.25. The uptrend in spot has been underpinned following the unexpected interest rate cut by the CBRT on August 18.

In the meantime, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate alternative to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism among investors.

Key events in Türkiye this week: Economic Confidence Index, Trade Balance (Monday) – Q2 GDP (Wednesday) – Manufacturing PMI (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.07% at 18.1741 and faces the immediate target at 18.1973 (2022 high August 29) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.5781 (55-day SMA) and finally 17.1903 (weekly low July 15).

-

13:17

Breaking: Private sector employment rises by 132,000 in August vs 288,000 expected

The data published by Automatic Data Processing (ADP) showed on Wednesday that private sector employment in the US rose by 132,000 in August. This reading came in weaker than the market expectation for an increase of 288,000.

Commenting on the report, “our data suggests a shift toward a more conservative pace of hiring, possibly as companies try to decipher the economy's conflicting signals,” said Nela Richardson, chief economist, ADP. “We could be at an inflection point, from super-charged job gains to something more normal.”

"Year-over-year change in annual pay was 7.6% in August, in line with monthly readings since Spring 2022," the ADP's publication further read. "In early 2021, annual pay increases were running at about 2%. While the pace of pay increases is elevated, its growth has flattened."

Market reaction

With the initial market reaction, the US Dollar Index edged lower and was last seen trading flat on the day at 108.85.

Developing story...

-

13:15

United States ADP Employment Change below expectations (288K) in August: Actual (132K)

-

13:08

ECB to hike 75 bps as inflation has not yet peaked, first response to be a stronger EUR – Nordea

The inflation rate in the eurozone rose further in August from 8.9% to 9.1%. Economists at Nordea now expect the European Central Bank (ECB) to hike by 75 bps next week – even if new staff projections for growth are approaching the downside scenario – lifting the euro.

ECB likely to deliver 75 bps in Sep

“Inflation remained almost unchanged at high levels in Aug, but will rise in the coming months as gas prices pass through.”

“ECB to deliver 75 bps in Sep. Risk of 75 bps again in Oct.”

“ECB’s staff projections nearing downside risk scenario, but no recession likely in forecast.”

“Given that a 75 bps rate hike is not fully in prices in financial markets and that the tone of the press conference is likely to be hawkish, we expect the first response in financial markets to be a higher rates, wider bond spreads and a stronger EUR.”

-

13:05

Fed's Mester: I don't anticipate Fed rate cuts next year

Cleveland Federal Reserve Bank President Loretta Mester said on Tuesday that she was not anticipating the Fed to cut rates next year, as reported by Reuters.

Additional takeaways

"We need to raise the policy rate to somewhat above 4% by early next year; hold it there."

"Real rates will need to move into positive territory; remain there for some time."

"Bringing down inflation will be painful in the near term; requires a lot of fortitude."

"I see the unemployment rate rising somewhat above 4% by the end of next year."

"Size of rate increases at each meeting depends on the inflation outlook."

"I have not incorporated recession into my base outlook for the US economy."

"Risks of recession over the next year or two have moved up."

"I expect inflation in the range of 5-6% for this year, then to make more progress back down over next 2 years."

"Wage pressures show little sign of abating."

"Without asset sales, reduction of the balance sheet could take 3 years or so."

"Far too soon to conclude inflation has peaked."

Market reaction

These comments don't seem to be having a significant impact on the dollar's valuation. As of writing, the US Dollar Index was up 0.15% at 109.00.

-

13:02

South Africa Trade Balance (in Rands) came in at 24.76B below forecasts (25.5B) in July

-

13:01

India Gross Domestic Product Quarterly (YoY) below expectations (15.2%) in 2Q: Actual (13.5%)

-

13:00

Brazil Unemployment Rate meets forecasts (9.1%) in July

-

13:00

India Infrastructure Output (YoY) dipped from previous 12.7% to 4.5% in July

-

13:00

Norges Bank will sell more NOK, this points towards a weaker krone ahead – Nordea

Norges Bank announced that they will raise their NOK selling to 3.5bn from 1.5bn NOK per day. This large shift points toward a weaker Norwegian krone ahead, according to economists at Nordea.

Norges Bank shifts gears, expect a weaker NOK

“We see EUR/NOK trading above 10.00 in the months to come.”

“Norges Bank will sell 3.5bn NOK/day going forward on behalf of the Government, due to a larger petroleum tax flow. At the same time, equity markets will likely continue to be choppy after the hawkish messages from central bankers, well-illustrated by Fed’s Kashari's comment that he was ‘happy’ with falling stocks. Both of these factors point towards a weaker NOK, while high energy prices should soften the blow.”

“We see EUR/NOK around 10.30 by year-end.”

-

12:20

Iran Foreign Minister: Carefully reviewing EU-drafted text for revival of 2015 nuclear pact

Iran's Foreign Minister Hossein Amirabdollahian said on Wednesday that Tehran is carefully reviewing the EU-drafted text for the revival of the 2015 nuclear pact, as reported by Reuters.

"We need stronger guarantees from the other party to have a sustainable deal," Amirabdollahian added. "The (U.N.) agency should close its politically-motivated probes."

Market reaction

Crude oil prices showed no immediate reaction to these comments. As of writing, the barrel of West Texas Intermediate was trading at $89.10, where it was down 3.5% on a daily basis.

-

12:00

United States MBA Mortgage Applications declined to -3.7% in August 26 from previous -1.2%

-

11:58

US Dollar Index Price Analysis: Next on the upside comes the 2022 peak

- DXY adds to Tuesday’s uptick and reclaims the area above 109.00.

- Immediately to the upside comes the cycle high at 109.47 (August 29).

DXY trades on a firmer note and extends the rebound past the 109.00 hurdle on Wednesday.

The index seems to have moved into a consolidative phase, with the lower bound in recent lows near 107.60 (August 26 low). On the other hand, further gains initially target the 2022 high at 109.47 (August 29) prior to the September 2002 top at 109.77 and the round level at 110.00.

In the meantime, while above the 6-month support line around 105.50, DXY is expected to keep the short-term positive stance.

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.87.

DXY daily chart

-

11:38

India Federal Fiscal Deficit, INR fell from previous 3518.71B to 3408.31B in June

-

11:22

EUR/JPY Price Analysis: Extra gains seen on a close above 140.00

- EUR/JPY sparks a corrective decline just above the 139.00 mark.

- Further advance looks likely once 140.00 is cleared.

EUR/JPY comes under downside pressure following three consecutive sessions with gains on Wednesday.

The continuation of the uptrend now shifts the focus to the key level at 140.00. Beyond this zone, the cross might attempt another test of the weekly peak at 142.32 (July 21), which is deemed as the latest defense of the 2022 high at 144.27 (June 28).

While above the 200-day SMA at 134.37, the prospects for the pair should remain constructive.

EUR/JPY daily chart

-

11:01

Portugal Gross Domestic Product (QoQ) rose from previous -0.2% to 0% in 2Q

-

11:01

Italy Producer Price Index (MoM) came in at 5%, above forecasts (2.9%) in July

-

11:01

Portugal Gross Domestic Product (YoY) rose from previous 6.9% to 7.1% in 2Q

-

11:01

Italy Producer Price Index (YoY) came in at 36.9%, above forecasts (33.5%) in July

-

10:58

USD/CAD Price Analysis: Bulls eye 1.3135 resistance ahead of US/Canadian data

- USD/CAD is underpinned by the USD rebound and WTI sell-off.

- Markets remain risk-averse ahead of key US ADP, Canadian GDP.

- Daily technical setup favors bulls, 1.3135 guards immediate upside.

USD/CAD is posting moderate gains in the European session this Wednesday, helped by widespread risk-aversion on increased bets of super-sized rate hikes by the ECB and the Fed.

Aggressive tightening by major global central banks to tame inflation could risk tipping their economies into recession. These fears are dominating and weighing negatively on investors’ risk appetite.

Fresh covid lockdowns and the energy crisis in China are also adding to the risk-off market environment and triggering a 3.50% sell-off in WTI prices. The oil price weakness is fuelling further upside in the major at the cost of the resource-linked CAD.

Markets also prefer to hold the safe-haven US dollar in the lead-up to the critical ADP jobs data and the Canadian Q2 GDP release. The data set could play a pivotal role in altering the Fed and Bank of Canada’s (BOC) rate hike pricing.

From a short-term technical perspective, USD/CAD is primed to challenge the horizontal trendline resistance marked at 1.3135, which is the first hurdle on the move higher.

The next relevant barrier is seen at the July 14 high of 1.3223. Ahead of that, bulls will challenge the 1.3200 round number.

The 14-day Relative Strength Index (RSI) is edging higher, comfortable above the midline, backing the bullish potential.

Further, the 21-Daily Moving Average (DMA) and 50 DMA bullish crossover remains in play, adding credence to the upside.

USD/CAD: Daily chart

On the flip side, the immediate support is aligned at the 1.3100 threshold, below which sellers will need to take out the daily low of 1.3063.

A sharp sell-off below the latter could kick in, opening floors for a test of the rising trendline support at 1.3000.

USD/CAD: Additional levels to consider

-

10:42

ECB’s Nagel: We need a strong rate hike in September

The European Central Bank (ECB) “urgently needs to act decisively next week,” the central bank’s Governing Council member and German central bank head Joachim Nagel said on Wednesday.

“We need a strong rate hike in September,” Nagel added.

Separately, Germany’s Chancellor Olaf Scholz said that the government will present the next relief package soon.

Meanwhile, EUR/USD remains pressured below parity on these comments, down 0.18% on the day.

Related reads

- EUR/USD Price Analysis: Further range bound likely… until Payrolls?

- Eurozone Preliminary Inflation rises 9.1% YoY in August vs. 9.0% expected

-

10:40

EUR/USD Price Analysis: Further range bound likely… until Payrolls?

- EUR/USD comes under some modest pressure below parity.

- Solid contention remains around the 0.9900 neighbourhood.

EUR/USD sheds some ground following Tuesday’s 2-day tops in the 1.0050/55 band.

Further consolidation looks the most likely scenario in EUR/USD for the time being, always within the 1.0100-0.9900 range. The pair is expected to keep this theme unchanged in the next couple of sessions, or at least until the key publication of US Nonfarm Payrolls (Friday).

The breakout of the weekly high at 1.0090 (August 26) could spark further gains to 1.0202 (August17 high) ahead of the 55-day SMA, today at 1.0222. Alternatively, the loss of the YTD low at 0.9899 (August 23) could put the December 2002 low at 0.9859 back on the radar.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0807.

EUR/USD daily chart

-

10:34

Gold falls to fresh monthly low below $1,720

- Gold came under renewed bearish pressure in the European session Tuesday.

- The 10-year US Treasury bond yield is pushing higher, weighing on XAU/USD.

- The US Dollar Index gains traction ahead of the employment data.

After having spent the Asian session fluctuating in a relatively tight channel above $1,720, gold turned south during the European trading hours and fell to its lowest level in a month below $1,715.

Rising US yields, dollar strength weigh on gold

The renewed dollar strength amid the souring market mood seems to be weighing on XAU/USD on Wednesday. US stock index futures dropped into negative territory in the European session, suggesting that safe-haven flows are starting to dominate the market action. In turn, the US Dollar Index climbed above 109.00.

Meanwhile, the benchmark 10-year US Treasury bond yield is up nearly 1% on the day at 3.138%, not allowing gold to shake off the bearish pressure.

Moreover, investors grow increasingly worried about gold's demand outlook with China clinging to its zero-Covid policy and imposing renewed restrictions in a number of cities.

In the second half of the day, the ADP will release its private sector employment report for August. Fed policymakers have repeatedly said that they will assess the data before deciding on the size of the September rate hike. The CME Group FedWatch Tool shows that markets are currently pricing in a 71.5% probability of a 75 basis points rate increase at the next FOMC meeting. A stronger-than-expected ADP print could allow hawkish Fed bets to continue to drive the dollar's valuation ahead of Friday's highly-anticipated Nonfarm Payrolls (NFP) report.

Market participants will also pay close attention to the performance of Wall Street's main indexes after the opening bell. Unless there is a noticeable improvement in risk mood, the dollar is likely to preserve its strength during the American session.

Technical levels to watch for

-

10:33

GBP/USD turns south towards 1.1600 as dollar rebounds ahead of US ADP

- GBP/USD comes under fresh selling pressure as the USD firms up.

- UK energy crisis, soaring Fed big rate hike bets dent risk appetite.

- Cable bears remain on track to test the wedge support at 1.1570.

GBP/USD is trading on the back foot in the European session, undermined by an impressive rebound staged by the US dollar across its major rivals.

The renewed dollar strength comes on the back of a fresh round of risk-aversion, as investors continue to reprice aggressive ECB and Fed rate hike expectations, which raise concerns over higher borrowing costs at a time when the global economies are at risk of recession.

Additionally, the worsening energy crisis in the euro area and the UK, falling British business confidence and raging inflation exert downward pressure on the pound, in turn, dragging GBP/USD lower.

All eyes now turn towards the US ADP private sector employment data, which could bolster the dollar rally on an upside surprise in the job additions.

From a short-term technical perspective, GBP/USD remains on track to test the falling wedge support at 1.1570, below a sustained break of the 1.1600 round level.

The 14-day Relative Strength Index (RSI) is probing the oversold territory, suggesting that there is still room for additional declines.

GBP/USD: Daily chart

On the flip side, bulls need to crack the 1.1700 barrier to initiating any recovery momentum towards the 1.1750 psychological mark.

Further up, a fresh advance towards the wedge resistance at 1.1791 cannot be ruled out.

GBP/USD: Additional levels to consider

-

10:01

Breaking: Eurozone Preliminary Inflation rises 9.1% YoY in August vs. 9.0% expected

The annualized Eurozone Harmonised Index of Consumer Prices (HICP) rose by 9.1% in August vs. July’s 8.9%, the latest data published by Eurostat showed on Wednesday. The market forecast was for a 9.0% print.

The core figures jumped to 4.3% YoY in August when compared to 4.1% expectations and 4.0% recorded in July.

On a monthly basis, the old continent’s HICP accelerated to 0.5% in August vs. 1.1% expectations and 0.1% previous. The core HICP jumped 0.5% this month against 0.4% expected and -0.2% seen in July.

The Euro area figures are reported a day after Germany’s annual inflation for August, which rose to 8.8% and matched estimates following an 8.5% rise reported in July.

The bloc’s HICP figures hold significance, as it helps investors assess the European Central Bank’s (ECB) monetary policy normalization course. The ECB inflation target is 2%.

Key details (via Eurostat)

“Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in August (38.3%, compared with 39.6% in July), followed by food, alcohol & tobacco (10.6%, compared with 9.8% in July), non-energy industrial goods (5.0%, compared with 4.5% in July) and services (3.8%, compared with 3.7% in July).”

EUR/USD reaction

The shared currency is little changed on the mixed Eurozone inflation data, as EUR/USD is holding the lower ground near 0.9980, down 0.30% on the day.

-

10:01

European Monetary Union HICP (MoM) registered at 0.5%, below expectations (1.1%) in August

-

10:01

European Monetary Union HICP-X F,E,A,T (MoM) registered at 0.5% above expectations (0.4%) in August

-

10:01

Greece Retail Sales (YoY): 1.2% (June) vs -4.2%

-

10:01

Italy Consumer Price Index (MoM) above forecasts (0.6%) in August: Actual (0.8%)

-

10:01

Italy Consumer Price Index (EU Norm) (MoM) above expectations (0.1%) in August: Actual (0.8%)

-

10:01

Belgium Gross Domestic Product (QoQ): 0.2% (2Q)

-

10:01

European Monetary Union HICP-X F,E,A,T (YoY) above expectations (4.1%) in August: Actual (4.3%)

-

10:01

European Monetary Union HICP (YoY) came in at 9.1%, above forecasts (9%) in August

-

10:01

Italy Consumer Price Index (YoY) registered at 8.4% above expectations (8%) in August

-

10:01

Italy Consumer Price Index (EU Norm) (YoY) registered at 9% above expectations (8.3%) in August

-

09:57

GBP/USD could target 1.1550 with a drop below 1.1620

GBP/USD has failed to shake off the bearish pressure. The near-term outlook suggests that the pair could suffer additional losses, FXSTreet’s Eren Sengezer reports.

Additional losses are likely

“The Relative Strength Index on the four-hour chart stays above 30, suggesting that there is more room on the downside before GBP/USD turns technically oversold. Additionally, the pair has returned within the descending regression channel coming from early August, confirming the sellers' willingness to retain control of the action.”

“1.1620 (multi-year lows, mid-point of the descending channel) aligns as first support. Below that level, 1.1600 (psychological level) could act as interim support before the pair could extend its losses toward 1.1550 (lower-limit of the descending channel).”

“On the upside, 1.1670 (upper-limit of the descending channel) forms key resistance. With a four-hour close above that hurdle, buyers could show interest and lift the pair toward 1.1700 (psychological level, 20-period SMA) and 1.1750 (static level, 50-period SMA).”

-

09:49

AUD/USD pares gains below 0.6900 as risk-aversion gathers steam

- AUD/USD bears making a comeback below 0.6900, as risk-off flows ramp up.

- US dollar extends rebound with yields, as rate hike fears and gas crisis spook markets.

- China’s PMIs-led upside appears elusive ahead of critical US ADP jobs data.

AUD/USD is paring back gains towards 0.6850, turning south following a rejection above the 0.6900 round figure. Bears are fighting back control amid strengthening risk-off flows in the European session.

The European stocks erased early gains and trade negative, as fears over the ECB and Fed aggressive tightening combined with the worsening European gas crisis spook markets. Investors seek refuge in the safe-haven US dollar at the expense of the higher-yielding aussie in times of market panic.

Concerns over fresh covid lockdowns in China compounded as many cities are under shutdown already due to the energy crisis in the world’s second-largest economy. The health of China’s economy is back under question, adding to the weight on the Chinese proxy, the AUD.

The aussie traders also refrain from placing any large bets ahead of the critical US ADP Employment Change data, as any upside surprise in the print could trigger a fresh dollar buying and catch AUD bulls off guard.

The ADP is likely to show an addition of 200K jobs in the American private sector this month. The data could be seen as a percussor to Friday’s NFP release and have a significant impact on the market’s pricing of the 75 bps September Fed rate hike, which now stands at 70%.

Earlier in the Asian session, AUD/USD caught a sold bid and briefly recaptured the 0.6900 level, as bulls cheered upbeat official Chinese Manufacturing and Services PMIs. Both the gauge surpassed market expectations and sparked hopes for a turnaround in Chinese business activity.

AUD/USD: Technical levels to consider

-

09:36

Portugal Consumer Price Index (YoY) down to 9% in August from previous 9.1%

-

09:36

Portugal Consumer Price Index (MoM): -0.3% (August) vs previous 0%

-

09:33

BOJ announces fixed-rate purchase plan for cheapest-to-deliver JGB notes

In a statement released on Wednesday, the Bank of Japan (BOJ) said it will conduct fixed-rate purchase operations for cheapest-to-deliver 357th Japanese government bonds (JGBs) notes for an extended period of time from September 1.

Additional details

Fixed-rate purchase operations for 356th 10-year JGBs to be conducted for consecutive days through Sept 20.

Decides to relax terms, and conditions for securities lending facility for cheapest-to-deliver JGB notes.

To increase the upper limit on consecutive-day purchases of cheapest-to-deliver issues to 75 business days from the current 50 days.

Relaxed terms, conditions to take effect from Sept 1.

Market reaction

USD/JPY is holding steady around 138.75, showing little to no reaction to the above headlines.

-

09:07

US Dollar Index: Reaching 110.00 in the coming days is still a tangible possibility – ING

The ADP report had been temporarily discontinued after the May release, and will now resume with an updated methodology and a wider range of data. All in all, economists at ING expect the US Dollar Index (DXY), which continues to move sideways below 109.00, to reach the 110.00 level in the coming days.

Eyes on new ADP methodology

“It will be interesting to see whether the alleged higher accuracy of the new APD index will trigger a larger-than-normal market reaction.”

“We think the dollar direction today may mostly hang on ADP figures, although the underlying narrative should continue to be a moderately bullish one if nothing else because the two major alternative markets to the US one – Europe and China – remain broadly unattractive despite the partial easing in gas prices and a slump in Chinese PMIs proved not as bad as expected this morning.”

“DXY reaching 110.00 in the coming days is still a tangible possibility.”

-

09:02

USD/CAD: Solid Canadian GDP report to fuel a loonie recovery – ING

Statistics Canada will release the second-quarter Gross Domestic Product (GDP) data later in the session, which is expected to show that the Canadian economy expanded at an annualized rate of 4.4% in the second quarter. The data could drag the USD/CAD pair below the 1.30 level, economists at ING report.

GDP numbers should endorse 75 bps hike by BoC