Notícias do Mercado

-

23:58

NZD/USD ignores NZ trade numbers below 0.6100 with eyes on US NFP

- NZD/USD defends the late Friday’s corrective pullback from seven-week low despite downside data.

- New Zealand’s Q2 Terms of Trade Index dropped to -2.4% versus -1.3% expected.

- China concerns, strong yields exert downside pressure amid a light calendar at home.

- US NFP will be the key as DXY refreshed the 20-year high ahead of the release.

NZD/USD holds onto the corrective bounce from the 1.5-month low near 0.6080 despite downbeat New Zealand (NZ) trade data during early Friday in Asia. In doing so, the Kiwi pair portrays the consolidation ahead of the key US Nonfarm Payrolls (NFP) while snapping a three-day downtrend.

As per the latest trade numbers from the Statistics New Zealand, the Terms of Trade fell 2.4% in the second quarter (Q2), reported Reuters. The details mentioned that Export prices rose 3.7 percent, while imports increased 6.5 percent. Economists were expecting the index to show a 1.3 percent fall, with export prices rising 0.8 percent and imports up 2.5 percent, according to a Reuters poll.

Although the quote remains ignorant of the data while taking rounds to 0.6080, it stays near the lowest levels in seven weeks as markets love the US dollar amid broad pessimism and hawkish Fed bets. Also, sour sentiment surrounding the world’s largest commodity user China exerts additional downside pressure on the NZD/USD prices.

A covid-led lockdown in China’s Chengdu city joins downbeat Caixin Manufacturing PMI to portray grim conditions for the world’s second-largest economy. On the same line could be the escalating geopolitical tension between Beijing and Washington, via Taiwan.

On the other hand, the hawkish Fedspeak and firmer US data underpins the US dollar demand. That said, Atlanta Fed President Raphael Bostic said that the Fed has work to do with inflation, a 'long way' from 2%. Also, the newly appointed Dallas Fed President Lory Logan joined the lines of hawkish fellow US central bankers while saying, “Restoring price stability is No. 1 priority.”

US ISM Manufacturing PMI reprinted the 52.8 figure for August versus the market expectations of 52.0. Further, the final reading of S&P Manufacturing PMI for August rose past 51.3 initial estimates to 51.5, versus 52.2 prior final for July. On the same line, US Initial Jobless Claims dropped to 232K versus 248K forecast and 237K prior. Further, the Unit Labor Cost rose 10.2% QoQ during the second quarter (Q2) versus 10.7% expected while Labor Productivity dropped by 4.1% during Q2 versus the anticipated fall of 4.5% and -4.6% prior.

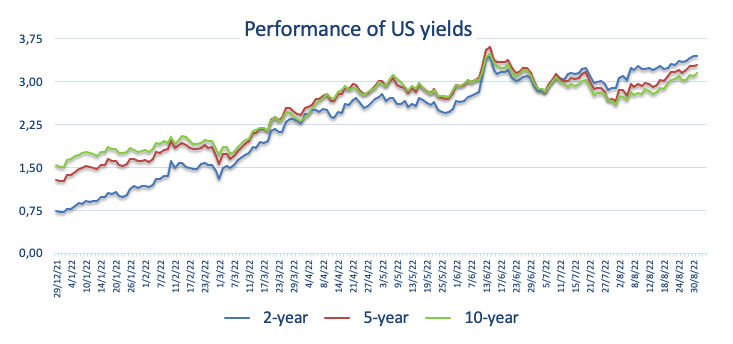

Against this backdrop, Wall Street closed mixed but the US 10-year Treasury yields rose to the highest levels since late June. More importantly, the 02-year counterpart jumped to the 15-year top. It should be noted that the CME’s FedWatch Tool signals 72% chance of the Fed’s 75 basis points of a rate hike in September versus nearly 69% previously.

Technical analysis

Unless bouncing back beyond the August 22 swing low, around 0.6155, NZD/USD remains vulnerable to refreshing the yearly bottom, currently surrounding 0.6060. In doing so, the 0.6000 psychological magnet and a downward sloping trend line from late January, near 0.5900 will be in focus.

-

23:45

New Zealand Terms of Trade Index registered at -2.4%, below expectations (-1.3%) in 2Q

-

23:38

USD/CHF turns sideways above 0.9800 after a minor correction, US NFP buzz

- USD/CHF is juggling in a 16-pips range as the focus shifts to US NFP data.

- Investors should brace for a third consecutive 75 bps rate hike by the Fed.

- Less-than-expected Real Retail Sales data have weakened the Swiss franc.

The USD/CHF pair is displaying back-and-forth moves in a narrow range of 0.9807-0.9823 in the Asian session. The asset has witnessed a time-based correction after printing a fresh six-week high at 0.9861. The pair is expected to resume its upside journey as the US dollar index (DXY) is displaying a stellar performance on a broader note.

Inflationary pressures in the US economy have already displayed signs of exhaustion after overstepping 9% for once as the inflation rate has scaled down to 8.5% in its prior reading. However, the ongoing rate is still extremely far from the desired rate of the Federal Reserve (Fed), which is 2%.

Therefore, the Fed will continue its path of hiking interest rates and a third consecutive rate hike by 75 basis points (bps) is highly likely in September monetary policy meeting.

In today’s session, investors’ entire focus will be on the more comprehensive and considered US Nonfarm Payrolls (NFP) data, which is expected to land at 300k for August vs. 528k, recorded in July.

Earlier, the US Automatic Data Processing (ADP) reported 132k job additions with the deployment of unconventional methodology for employment scrutiny. Considering the cues from US ADP, a vulnerable performance is expected from the US NFP data ahead.

Meanwhile, less-than-expected Real Retail Sales data have weakened the Swiss franc. The economic data landed at 2.6%, lower than the consensus of 3.3% but remained higher than the prior release of 0.7%. Also, the Consumer Price Index (CPI) has improved to 3.5% against expectations and the former print of 3.4% on an annual basis.

-

23:36

EUR/JPY Price Analysis: Meanders around 139.40 after hitting a weekly high at 139.99

- EUR/JPY snapped four days of gains on Thursday, losing 0.18%.

- A risk-off impulse bolstered the appetite for safe-haven, so the yen rose.

- Negative divergence in the 4-hour chart opens the door for a EUR/JPY pullback towards 138.00.

EUR/JPY refreshes a five-week high, for the fifth consecutive trading day, at around 139.99, but erased some gains as risk appetite decreased on China’s recession fears, alongside a tranche of positive US economic data that increased the odds of a 75 bps Fed rate hike. At the time of writing, the EUR/JPY is trading at 139.40 as the Asian Pacific session begins.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart portrays buyers’ failure to conquer the 140.00 mark. The cross-currency retreated towards the 50-day EMA at 138.83, a place sought by longs, which lifted the pair back above the 139.00 figure. Therefore, the EUR/JPY bias, from a daily scale perspective, is bullish.

Short term, the EUR/JPY is trending up on the four-hour scale. Still, the Relative Strength Index (RSI), shows buyers’ exhaustion, with the oscillator registering successive series of lower highs, contrarily to price action, printing higher highs. Hence, negative divergence on this time frame might deter EUR bulls from opening fresh longs positions ahead of a likely pullback toward lower prices.

Therefore, the EUR/JPY first support would be the S1 daily pivot at 138.92. Once cleared, the following support levels would be the S2 daily pivot point at 138.38, followed by the 200-EMA at 137.64.

EUR/JPY Key Technical Levels

-

23:32

USD/CAD dribbles around mid-1.3100s even as options market flashes bullish signs

USD/CAD seesaws around a seven-week high while pausing a three-day uptrend near the yearly peak marked in July. That said, the Loonie pair takes rounds to 1.3150-60 during Friday’s initial Asian session.

It should be noted that the softer prices of Canada’s main export WTI crude oil join the broadly firmer US dollar ahead of the US employment report for August to underpin the Loonie pair’s bullish bias. That said, the quote’s latest inaction could be linked to the pre-data inaction.

One-month risk reversal (RR) on USD/CAD, a measure of the spread between call and put prices, braces for the biggest weekly gain since mid-June per the data source Reuters.

A call option gives the holder the right but not the obligation to buy the underlying asset at a predetermined price on or before a specific date. A put option represents a right to sell. That said, the weekly RR jumps to 0.312 by the press time of early Friday. That said, the daily RR also rose during the last consecutive three days with the latest print being 0.057.

Also read: Nonfarm Payrolls Preview: Five reasons to expect a win-win release for the dollar

-

23:23

AUD/USD bears stay in dominant position below 0.6800, US NFP, RBA eyed

- AUD/USD holds lower ground after refreshing multi-day bottom, pauses three-week fall.

- Grim concerns surrounding China, downbeat data at home lead the bears.

- Strong yields, upbeat US statistics propel hawkish Fed bets and underpin US dollar demand.

- No major data at home but US jobs report for August will be crucial ahead of next week’s RBA.

AUD/USD licks its wounds at the lowest levels since mid-July as traders await the key US jobs report during early Friday morning in Asia. In doing so, the Aussie pair pauses the three-day downtrend while taking rounds to 0.6780-90 of late.

In addition to the strong run-up in the US Treasury yields, grim concerns from China and downbeat Aussie data offered an extra bearish blow to the AUD/USD prices. That said, the pair’s latest inaction could be linked to the pre-event anxiety.

A covid-led lockdown in China’s Chengdu city joins downbeat Caixin Manufacturing PMI to portray grim conditions for the world’s second-largest economy. On the same line could be the escalating geopolitical tension between Beijing and Washington, via Taiwan.

At home, the final readings of Australia’s S&P Global Manufacturing PMI for August dropped below 54.5 initial estimates to 53.8. Before that, the nation’s AiG Performance of Manufacturing Index marked the first activity contraction in seven months with 49.3 numbers, versus 52.5 prior, for the said month.

It should be noted that the firmer prints of the US ISM Manufacturing PMI and the last prints of the S&P Manufacturing PMI for August joined hawkish Fedspeak to propel the bets on the Fed’s next big rate hike, which in turn fuelled the US Treasury yields towards the fresh multi-month top.

The US ISM Manufacturing PMI reprinted the 52.8 figure for August versus the market expectations of 52.0. Further, the final reading of S&P Manufacturing PMI for August rose past 51.3 initial estimates to 51.5, versus 52.2 prior final for July. On the same line, US Initial Jobless Claims dropped to 232K versus 248K forecast and 237K prior. Further, the Unit Labor Cost rose 10.2% QoQ during the second quarter (Q2) versus 10.7% expected while Labor Productivity dropped by 4.1% during Q2 versus the anticipated fall of 4.5% and -4.6% prior.

Elsewhere, Atlanta Fed President Raphael Bostic said that the Fed has work to do with inflation, a 'long way' from 2%. Also, the newly appointed Dallas Fed President Lory Logan joined the lines of hawkish fellow US central bankers while saying, “Restoring price stability is No. 1 priority.”

Amid these plays, Wall Street closed mixed but the US 10-year Treasury yields rose to the highest levels since late June. More importantly, the 02-year counterpart jumped to the 15-year top.

Looking forward, the markets are likely to witness anxiety ahead of the key US Nonfarm Payrolls (NFP) and Unemployment Rate for August, expected 300K and 3.5% versus 528K and 3.5% respective priors. Should the job report print firmer data, the odds of witnessing further US dollar strength can’t be ruled out.

Following that, the next week’s monetary policy meeting of the Reserve Bank of Australia (RBA) will be important amid recent downbeat concerns for Canberra.

Also read: Nonfarm Payrolls Preview: Five reasons to expect a win-win release for the dollar

Technical analysis

AUD/USD pair’s sustained trading below May’s low surrounding 0.6830-25 directs the bears towards the yearly low near 0.6680. However, the 0.6760 and the 0.6700 threshold may offer intermediate halts during the south run.

-

22:56

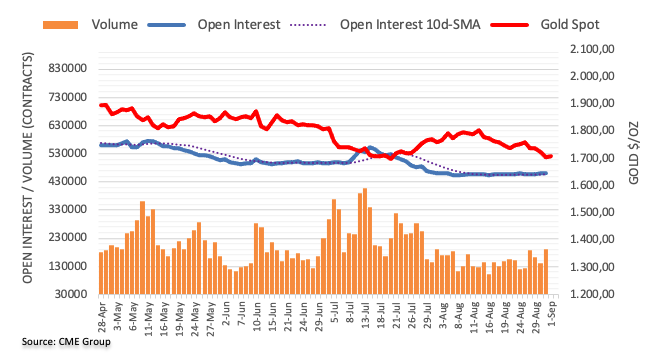

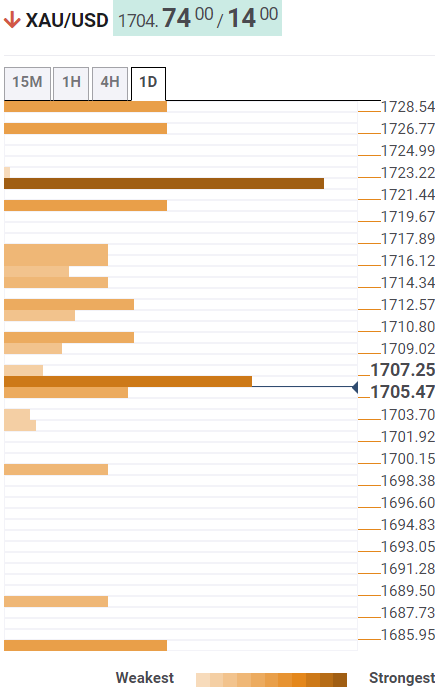

Gold Price Forecast: XAU/USD aims for a pullback above $1,700 on lower consensus for US NFP

- Gold price has faced the wrath amid a juggernaut rally in the DXY.

- A lower consensus for US NFP will result in a pullback move in the gold prices.

- Weaker earnings data could dampen the DXY’s dream rally.

Gold price (XAU/USD) has attempted to build a cushion around $1,690.00 on Thursday after displaying a sheer downside move. The precious metal is eyeing a pullback move, which might push the gold prices above the psychological resistance of $1,700.00. However, the downside will remain favored as the US dollar index (DXY) is hovering around its fresh two-decade high at 109.98.

The gold prices are facing wrath despite the lower consensus for the US Nonfarm Payrolls (NFP) data. According to the estimates, the US economy generated 300k jobs in August, lower than the prior release of 528k. Also, the Unemployment Rate is seen as stable at 3.5%. As the US economy is operating at full employment, room for more job additions has squeezed dramatically.

Apart from that, US corporate has also ditched the recruitment process due to an expectation of a slowdown in the overall demand.

Meanwhile, the DXY has turned sideways after remaining short of hitting the psychological resistance of 110.00. The catalyst that could halt the DXY’s dream rally is the Average Hourly Earnings, which is expected to improve by 10 basis points (bps) to 5.3%. Price pressures are soaring in the US economy and households need higher paychecks to offset higher payouts. Therefore, a subpar improvement in earnings data seems not lucrative for the DXY bulls.

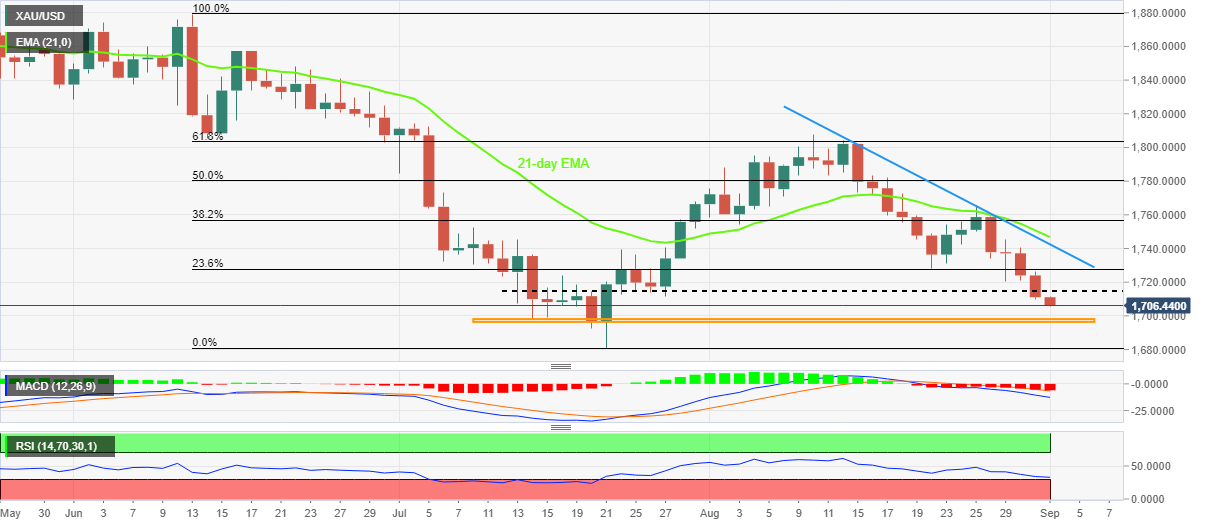

Gold technical analysis

Gold prices are declining firmly towards the monthly lows placed at $1,680.91, recorded on July 21. The 20-and 50-period Exponential Moving Averages (EMAs) at $1,715.12 and $1,730.00 respectively are scaling towards the south, which adds to the downside filters.

Also, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

-

22:36

USD/JPY Price Analysis: Trades at 24-year highs above 140.00, eyeing August 1998 highs

- The USD/JPY extended its gains during the week, up by almost 2%.

- The major’s first resistance would be 141.00, which, once cleared, would pave the way towards 147.67.

The USD/JPY rose to fresh 24-year highs on Thursday, spurred by a risk-off impulse and higher US Treasury bond yields, produced by higher expectations that the US Federal Reserve would further tighten monetary conditions. Therefore, the USD/JPY climbs 0.90% and exchanges hands at 140.20.

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart illustrates the strong uptrend, which began in March of 2022. On its first leg up, the major rallied towards the 130.00 area before registering a pullback towards 128.00, ahead of the most significant move towards the 139.39 previous YTD highs, reached July 14. Worth noting that a negative divergence between the Relative Strength Index (RSI) registering a successive series of lower highs, contrarily to price action, triggered the pullback towards the August 2 swing low at 130.39.

At the time of writing, the USD/JPY broke above the 140.00 mark, finishing Thursday’s session at around 140.19. The Relative Strength Index (RSI) is at the door of reaching overbought conditions, though it should be noted that the major retreated when the RSI reached 71.20.

The USD/JPY next resistance would be the psychological 141.00 figure. Once cleared, the USD/JPY next stop would be the August 1998 highs at 147.67.

USD/JPY Key Technical Levels

-

22:31

Fed’s Bostic: Fed has work to do with inflation, 'long way' from 2%

Atlanta Fed President Raphael Bostic said in an essay published on Tuesday, "I don't think we are done tightening. Inflation remains too high."

''That said, incoming data, if they clearly show that inflation has begun slowing - might give us reason to dial back ... We will have to see how those data come in."

A slowing of inflation in July "represented a reprieve," Bostic said.

"Moving either too aggressively or too timidly has downsides," Bostic wrote, with entrenched higher inflation looming if the Fed does not squeeze it from the economy, and lost growth and higher unemployment the outcome of "severe policy tightening."

The US dollar, meanwhile, was sent to a 20-year high on Thursday, and notched a 24-year peak against the rate-sensitive Japanese yen, after US data showed a resilient economy, giving the Federal Reserve more room to aggressively hike interest rates to quell inflation. The US dollar index, DXY, which measures the greenback against a basket of six currencies touched 109.99, its highest since June 2002.

-

22:27

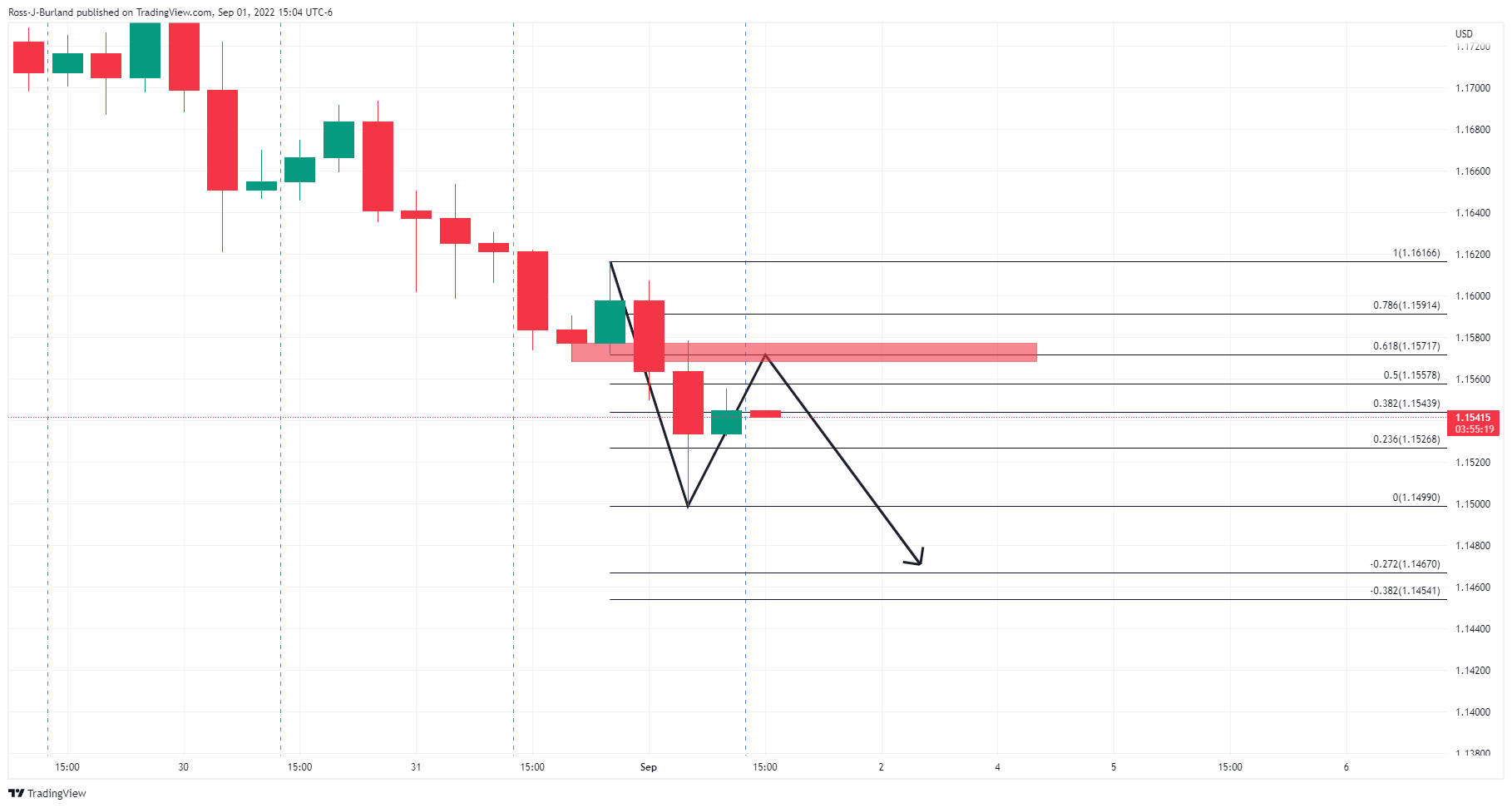

GBP/USD Price Analysis: Bulls are coming up for air but face strong bearish pressure

- GBP/USD bulls are taking up the baton but vs. string bearish momentum.

- Bears are pushing the bulls to the edge of the abyss on the longer-term time frames.

GBP/USD has been pushed into cycle lows on Thursday ahead of major data from the US on Friday. While there are no signs of an imminent correction on the longer time frames, the 4-hour chart is starting to pull back which gives rise to a potential opportunity to the upside.

The following illustrates the price action and structures on the weekly, daily and 4-hour charts.

GBP/USD weekly chart

The weekly chart has left an M-formation behind from the past few weeks of price action. This is a reversion pattern that would be expected to pull the price back towards the neckline in due course. Currently, prior lows of mid-August business align with a 38.25 Fibonacci level.

GBP/USD daily chart

From a daily perspective, the M-formation is over-extended and has started to correct the price higher.

GBP/USD H4 chart

The 4-hour chart sees the price moving in towards a prior support level that currently aligns with the 61.8% Fibonacci retracement level near 1.1570 which could be targetted for the day ahead.

However, the bulls will need to get over the 61.8% ratio on the hourly time frame first or face a potential downside continuation the forthcoming sessions:

-

21:45

NZD/USD re-tested YTD lows around 0.6060 post-upbeat US economic data, ahead of NFP

- NZD/USD stumbles below 0.6100 on risk-aversion after positive US data.

- Fed odds of a 75 bps increase increased to 91%, as shown by money market futures STIRs.

- New Zealand’s Trade data and US Nonfarm Payrolls report. Eyed.

The NZD/USD slides to multi-week lows around 0.6060 on Thursday as the New York session winds down, after US data portrays solid factory activity while the labor market continues to be robust, keeping Fed policymakers “hopeful” of achieving a soft landing, despite tightening conditions.

The NZD/USD is trading below its opening price after hitting a daily high of 0.6122. Still, it fell below the 0.6100 figure on sentiment shifting sour, spurred by weaker-than-estimated China’s Caixin Manufacturing PMI, dropping towards “recessionary” territory. At the time of writing, the NZD/USD is trading at 0.6075.

Wall Street finished the Thursday session paring losses, with a late jump on US equities. Meanwhile, expectations that the US Federal Reserve will tighten 75 bps at September’s monetary policy meeting increased, with odds lying at a 92% chance, after solid US employment and ISM figures.

The US Department of Labor reported that Weekly Initial Jobless Claims for the last week, which ended on August 27, declined. Later, the Institute for Supply Management (ISM) revealed that August’s Manufacturing PMI was unchanged, at 52.3, higher than forecasts Worth noting that the Price Index sub-component decelerated from 60 to 52.5, signaling that elevated prices are getting down.

Elsewhere, the US Dollar Index, a gauge of the buck’s value, hit a 20-year high at 109.997 during the day, though at press time, it is up 0.91%, at 109.675.

The abovementioned factors were a headwind for the NZD/USD, which leaned on the dynamics of the greenback and market sentiment due to the lack of NZ economic data. Worth noting the major tested the YTD low reached on July 14, but buyers moved in, and recovered some ground.

What to watch

The New Zealand economic calendar will feature Terms of Trade, and Export Volumes, alongside Import/Export Prices. On the US front, the docket will reveal the US Nonfarm Payrolls report, alongside the Unemployment Rate and Factory Orders.

NZD/USD Key Technical Levels

-

21:23

EUR/USD is pushed to the edge of the abyss ahead of NFP

- The single currency has been thrown under a bus in a risk-off environment.

- EUR/USD now depends on the US NFP data on Friday.

EUR/USD has been offered on the day and remains on the back foot into the final hour of trade in the North American forex session. At the time of writing, the single unit is down over 1% at 0.9947 and has fallen from a high of 1.0054 to a low of 0.9910 so far on the day.

Global quities and bonds continued to decline as hawkish central bank rhetoric and a shutdown in China further roiled investor jitters, supporting the US dollar. Pessimism on the news that Chengdu has become the latest Chinese city to be locked down as Beijing continues to pursue its controversial "zero-Covid" policy weighed on risk sentiment. Beijing's drive to ensure "zero Covid" has been accused of stifling economic growth and this has added to worries over high inflation and interest rate hikes.

As for domestic data, the EU manufacturing PMI slipped further below the breakeven point to a 26-year low in August, with similar declines in Spain, Italy, and Germany. However, other data showed that the EU Unemployment rate declined slightly in July. Meanwhile, the European Central Bank is still expected to raise rates by at least 50 basis points, and perhaps more, at its next meeting on Sept. 9. Nevertheless, that has done little to support the single currency of late.

In the US, in the countdown to the US Nonfarm Payrolls data, the highlights of Thursday's busy data schedule were an unchanged reading in the ISM's Manufacturing report for August, a decline in Initial Jobless claims and a drop in the monthly layoff intention totals from Challenger.

The ISM manufacturing index held steady at 52.8 in August, with higher readings for new orders and employment and lower readings for production and prices, though all still indicated expansion. The initial and continuing claims levels continued to rise in August, but at a slower pace than in previous months. Initial jobless claims decreased by 5,000 to 232,000 in week ended Aug. 27, a third straight decline that lowered the four-week moving average by 4,000. Insured claims rose by 26,000 to 1.438 million in the week ended Aug. 20.

As for growth expectations in the US, the Atlanta Fed GDP nowcast estimate for third-quarter growth has been revised up to 2.6% from the 1.6% pace in the previous calculation on Aug. 26. The next update is scheduled for Sept. 7.

For the showdown this week, as one of the most pivotal before the September FOMC meeting, the August Nonfarm payrolls report will be out on Friday. This data could be the tipping point that will cement a 75bps hike from the Fed should the number of new jobs beat the 300k consensus estimate.

NFP expectations

The jobless rate is projected to remain unchanged at 3.5% while the labour participation rate is seen ticking up to 62.2% from 62.1% the month prior. Average hourly earnings are expected to increase by 0.4% in August after a 0.5% gain in July, but the year-over-year rate would rise to 5.3% from 5.2% in the previous month due to base effects. The average workweek is expected to remain at 34.6 hours.

''We look for payrolls to have continued to advance strongly in August (TD: 370k), but at a more moderate pace following the eye-popping July increase,'' analysts at TD Securities said. ''We look for the solid gain in employment to be reflected in another decline in the UE rate to 3.4%. We are also forecasting wage growth to slow modestly to a still robust 0.4% MoM.''

''We think the market is priced for a strong report, investors penciling in 69bp of hikes in September and a terminal rate of 3.98%. Markets are likely to react more to a weaker report.''

-

20:53

Forex Today: Dollar on the loose

What you need to take care of on Friday, September 2:

Financial markets kick-started September on the back foot as recession-related concerns were exacerbated by China announcing Chengdu, a city of roughly 21 million people, has been put on coronavirus lockdown. The American dollar surged, helped by upbeat local data and the dismal market mood.

In Europe, the focus remains on the energy crisis. The EU Commission is working on a market intervention to cap energy prices and cut electricity demand after Russia slashed gas deliveries to the Union. President Ursula Von der Leyen will speak on the matter next September 14.

Meanwhile, Russian Deputy Prime Minister Alexander Novak noted the country might increase oil production this year, supporting OPEC+ deal extension beyond 2022. At the same time, Gazprom is cutting gas provision to France, while Germany fears the company will shut down the Nord Stream 1 pipeline once again by mid-October.

The EUR/USD pair trades around 0.9950, while GBP/USD plunged to 1.1497, now trading around 1.1540. Commodity-linked currencies finished the day mixed, as AUD/USD is down to 0.6780 while USD/CAD is steady at around 1.3160. The USD/JPY pair surged to 140.22, its highest in over twenty years, now trading a handful of pips below the level.

Stocks remained under pressure, although Wall Street’s losses were moderate. The DJIA managed to post a modest intraday advance. Nevertheless, the DXY soared to a multi-year high, while government bond yields also rose.

On Friday, the focus will be on the US Nonfarm Payrolls report. The country is expected to have added 300K new jobs in August, while the Unemployment Rate is foreseen steady at 3.5%.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: What Wall Street doesn't want you to know pt.2

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:17

USD/CAD Price Analysis: Bears move in for the kill at key hourly structure

- USD/CAD bears are moving in for a test below key hourly structure.

- The weekly W-formation could be a key feature for the days ahead.

As per the prior analysis, USD/CAD Price Analysis: Bulls take on critical resistance, the price has continued to chip away at the resistance. Still, there are now higher prospects of a move lower as the following charts illustrate:

USD/CAD, daily chart prior analysis

It was explained that from the daily time-frame perspective, there was still room to go until prior highs were met and the break of the last highs of 1.3135 left the bulls with the baton.

We have since seen an extension of the upside on Thursday to test above 1.3200. However, as the chart below demonstrates, the bears are attempting to take over:

USD/CAD weekly chart

The weekly chart, as its stands, leaves a bearish bias given the W-formation which is a reversion pattern. Should the bears commit at this juncture, then there will be the scope of a significant correction for days ahead forgetting the 38.25 Fibonacci retracements of the current bull leg that meets prior resistance looking left. Below there, we have the 50% and 61.8% ratios aligning with the neckline of the pattern.

USD/CAD H1 chart

From a nearer-term perspective, the hourly chart shows that the price is attempting a bearish breakout below the structure at 1.3150/56. A break here opens risk of a breakout to the downside as per the weekly chart above.

-

19:19

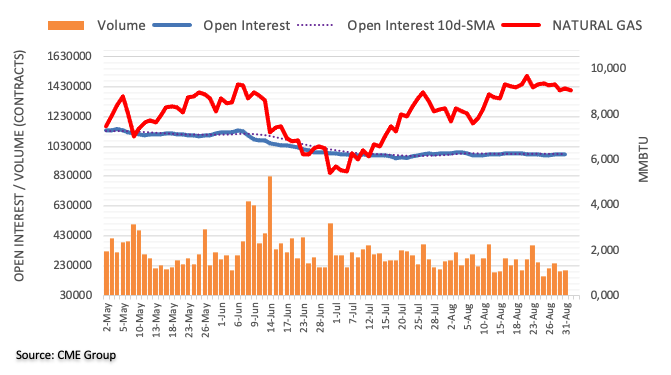

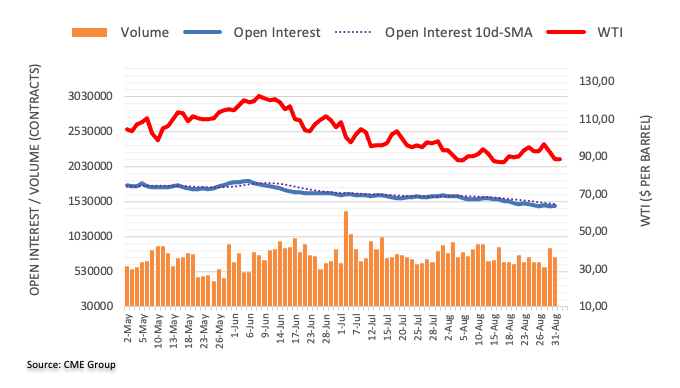

WTI bears move in for fresh lows below critical weekly structure

- Oil is marking fresh lows on the day as commodities take a hit on China's covid and lockdown risks.

- Global growth concerns and the Iran deal are weighing on the black gold.

Oil prices are carving out further downside on Thursday as a combination of the lockdowns in China and concerns over global growth take hold amid fading supply concerns. At the time of writing, the black gold is trading lower by some 3.1% having hit a fresh low for the session of $86.04bbls West Texas Intermediate (WTI).

West Texas Intermediate tumbled from a high of $89.63 on the day as Pessimism over demand took hold following news that Chengdu has become the latest Chinese city to be locked down as Beijing continues to pursue its controversial "zero-Covid" policy. Beijing's drive to ensure "zero Covid" has been accused of stifling economic growth and this has added to worries that high inflation and interest rate hikes are denting fuel and oil demand while supplies are expanding incrementally.

Factory activity slumped in August as China's zero-COVID curbs and cost pressures continued to hurt businesses. The PMIs released by CFLP (China Federation of Logistics & Purchasing) showed a second consecutive month of contraction in the manufacturing sector while the non-manufacturing outlook also moderated in August.

''China’s growth forecasts are poised for further downgrade as hopes for a turnaround in the coming months fade. We thus revise down our 2022 GDP growth forecast for China to 3.3% from 4.1% with 3Q22 at 3.4% YoY and 4Q22 at 4.5% YoY,'' analysts at UOB explained.

Commodity prices, in general, have moved lower this week following last Friday's hawkish speech from Federal Reserve chair Jerome Powell. He advocated for ongoing rate hikes until inflation is under control despite the costs to growth and jobs in the economy.

However, the price of oil is also falling as markets price the rising odds of an imminent resolution on the Iran file.''Wild gyrations in our gauge of energy supply risks, which extracts information from market prices, are overwhelmingly being driven by the potential for an Iran deal. This is the silver bullet that can kill the bull market in petroleum products, as it would immediately build the world's spare capacity, which in turn allows other producers to play catch-up in building a spare capacity buffer,'' analysts at TD Securities explained.

WTI technical analysis

The price is breaking a key structure level around 89.00 on the weekly chart and a breakout is set to target the $85.39 prior swing highs on the downside. This would be leaving behind an M-formation that could see the price retest the $89 level before a full breakdown into the $70s would occur for the rest of the year.

-

19:19

AUD/USD grinds lower, below 0.6800 ahead of US NFP

- AUD/USD continues to trade in the red, so far down 1.90%.

- Worldwide factory activity slowed down, except for the US, which is still in expansionary territory.

- AUD/USD: It could form an inverse head-and-shoulders if buyers keep prices above 0.6881; otherwise, 0.6402 is the next target.

AUD/USD falls to seven-week lows on Thursday amidst a risk-off impulse, while the US dollar, as shown by a measure of the greenback’s value against a basket of peers, namely the US Dollar Index, rises to 20-year highs around 109.997. At the time of writing, the AUD/USD exchanges hands at 0.6786.

US equities remain downbeat, a reflection of investors’ mood. US economic data led by the ISM Manufacturing PMI for August, which measures factory activity in the US, rose by 52.3, aligned with the previous month’s readings, above estimates, bolstering the greenback to new YTD highs. Also, US unemployment claims, known as Initial Jobless Claims, rose by 232K, lower than the 248K foreseen by analysts.

The AUD/USD plunged from around 0.6830 to the day’s lows at 0.6771. US employment indicators cement the Fed’s intentions of hiking rates aggressively at the September meeting.

Another factor weighing on risk sentiment and the Australian dollar is China’s Covid-19 lockdowns in Chengdu, which put 21.2 million residents in lockdown. Furthermore, China’s Caixin PMI for August. Contracted, fueling expectations that its economic slowdown could spread worldwide, a sign that could trigger a global recession.

What to watch

An absent Australian economic docket would leave AUD/USD traders leaning on US dollar dynamics. The US calendar will feature August’s Nonfarm Payrolls report, alongside the Unemployment Rate, and Average Hourly Earnings

AUD/USD Price Analysis: Technical outlook

The AUD/USD extended its losses for the third straight day, approaching a five-month-old downslope trendline, broken around July 27, which would turn support. If AUD/USD buyers stop the losses above the YTD low at 0.6681, an inverse head-and-shoulders chart pattern could form. Otherwise, the downtrend would resume, and AUD/USD sellers will target the May 15, 2020, lows at 0.6402.

-

19:00

Brazil Trade Balance came in at 4.2B, above expectations (3.8B) in August

-

17:46

Copper Price Analysis: Sinks almost 3%, eyeing a fall towards $3.2505 ahead of YTD lows

- Copper futures are nosediving due to fears of a worldwide economic slowdown, weighed by China’s PMI and other lockdowns in a 21.1 million city.

- Negative divergence in Copper’s daily chart, alongside fundamental, sent prices below the 20 and 50-DMA.

Copper futures are dropping to two-month lows at $3.4165, down almost 3%, on fears that China’s manufacturing activity contracted for the first time in three months, alongside expectations of a US economic deceleration prompted by the US Federal Reserve tightening monetary policy conditions.

Additionally, broad US dollar strength, alongside newswires that China’s Chengdu announced a lockdown of its 21.2 million residents, is a headwind for the red metal.

Also read: Copper drops from two-month highs due to global economic slowdown, speculators’ shorts

Copper Price Analysis: Technical outlook

The Copper daily chart depicts the pair as neutral-to-downward biased. It’s worth noting that the last copper article that I wrote noted that “the Relative Strength Index (RSI) recorded a successive series of lower highs, contrary to price action, meaning that prices are about to edge lower.” Since then, Copper tumbled below the 20 and 50-day EMAs, from around $3.6970. to $3.4105.

If Copper achieves a daily close below the August 4 daily low at 3.4160, it could send the red metal towards the July 21 swing low at $3.2505, followed by the YTD low at $3.1315. On the flip side, if Copper buyers reclaim the 50-day EMA at $3.6340, a re-test of the 20-day EMA at $3.6175 is on the cards.

-

17:03

USD/INR: Risks of crossing above 80.000 remain – MUFG

Analysts at MUFG Bank forecast the USD/INR pair will trade at 80.50 by the end of the third quarter, at 81.000 by the end of the year and at 80.50 by the first quarter of next year.

Key Quotes:

“The Indian rupee extended its losses against the US dollar in August, weighed down by US dollar strength as EUR/USD fell below parity as well as a surge in oil buying by local oil importers when oil prices dipped. USD/INR remained largely below the 80.000 mark in August, in part due to suspected RBI intervention as reported by newswires and a strong resurgence of net inflows into both Indian equities and bonds.”

“Renewed optimism in Indian risk assets may reflect market expectations of a slower pace of rate hikes by the RBI, further deceleration in India’s headline CPI, and the potential inclusion of Indian government bonds into the JPM GBI-EM Index for the first time. If this trend persists, net inflows into Indian equities could help dampen downward pressure on the rupee stemming from extended US dollar strength and India’s widening trade deficits.”

“India’s high reliance on China for imported raw and intermediate materials used as manufacturing inputs is also likely to keep India’s non-energy trade deficit elevated.”

-

16:57

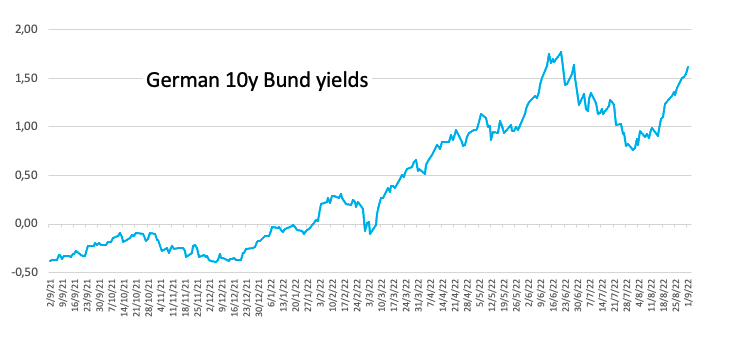

ECB cannot disappoint at next week’s meeting – Rabobank

The European Central Bank (ECB) will have its monetary policy next week. Analysts at Rabobank now expect a 75 basis points rate hike, but risk of 50bp remains significant.

Key Quotes:

“The hawkish shift in the ECB’s communication has led to a sharp repricing in EUR money markets, and we have subsequently changed our near-term call for a 75bp hike next week. However, Mrs. Lagarde will stress that this is not a precursor to more jumbo hikes.”

“Inflation expectations were already a key concern at the previous ECB meeting, and with yet another inflation surprise the risk of de-anchoring is growing. The ECB has to show that it will do what is necessary to return to 2% inflation, or it risks the much costlier challenge of having to re-anchor expectations. This means the ECB cannot disappoint at next week’s meeting, lest it risks giving off the impression that growth risks do still outweigh inflation in their decision making. At current market pricing, this means that the ECB has to deliver a 75bp hike.”

-

16:56

Gold Price Forecast: XAU/USD plummets to new two-month lows below $1690

- Gold price is plunging during the week by almost 2.50%.

- The US Dollar Index rises to 2-decade highs, 109.977, underpinned by higher US Treasury yields.

- Robust US data justifies a super-size 75 bps rate hike by the Fed.

Gold price drops sharply to two-month lows, under the $1700 figure, after upbeat US economic data justifies the Federal Reserve’s intentions to hike rates 75 bps in the September meeting. At the time of writing, the XAU/USD fluctuates around the $1688-$1690s area, below its opening price.

Global equities remain under pressure while the US dollar rises to 20-year highs, per the US Dollar Index. Positive US economic data, led by S&P Global and ISM Manufacturing PMIs for August, reinforced what Fed officials expressed: the US economy remained strong. The Institute for Supply Management (ISM) reported that the PMI was unchanged at 52.8, above 51.9 expectations. Meanwhile, the S&P Global PMI was at 51.5, above forecasts and the previous reading of 51.3.

Earlier, the US Department of Labor revealed that unemployment claims for the week that ended on August 27 increased by 232K, less than the 248K estimated.

Gold traders should be aware that US employment data released during the week support the idea of the Fed going for a 75 bps rate hike for the third straight meeting. JOLTs data, reporting 11 million vacancies, unemployment claims dropping, and US ISM manufacturing PMI comments about hiring increments the Fed’s soft landing possibilities.

Elsewhere, the US Dollar Index, a gauge of the buck’s value against a basket of peers, climbs 0.94%, refreshing 2-decade highs at 109.716, underpinned by high US T-bond yields. Also, a headwind for the yellow metal is the US 10-year Treasury Inflation-Protected Securities (TIPS), a proxy for real yields, which is rising eight bps, to 0.796%, after hitting a daily high at 0.823%.

What to watch

The US economic docket will feature the US Nonfarm Payrolls for August on Friday. Economists predict that the economy will add 298K jobs, and the Unemployment Rate will remain at 3.5%.

Gold Key Technical Levels

-

16:47

US: Atlanta Fed GDPNow for Q3 rises to 2.6%

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.6% in the third quarter, up from 1.6% in the previous estimate.

"After this morning’s construction spending release from the US Census Bureau and this morning’s Manufacturing ISM Report On Business from the Institute for Supply Management, the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth increased from 2.0% and -5.4%, respectively, to 3.1% and -3.5%, respectively," Atlanta Fed explained in its publication.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen rising nearly 1% on the day at 109.75.

-

16:37

US: August ISM Manufacturing offers plenty to like for Fed officials – Wells Fargo

The ISM Manufacturing PMI report showed better-than-expected numbers, helping dollar's rally. According to analysts at Wells Fargo, the report is very welcome by policymakers at the Federal Reserve. They point out the prices paid measure fell sharply to a more than two-year low, while the orders and employment components both returned to expansion territory.

Key Quotes:

“Manufacturing output rose 0.7% in July, the biggest monthly increase since March as motor vehicles and parts production surged 6.6% after back-to-back monthly declines in May and June. That had been presaged somewhat by shorter wait-times revealed in the trend decline in the supplier deliveries component of the ISM index and incipient signs of improvement with supply chains.”

“The ISM index was unchanged in August at 52.8, the slowest pace of expansion since June 2020. Still, the outcome was better than the 51.8 that had been expected by the consensus. Of particular interest to financial markets is the fact that the employment component rose 4.3 points to 54.2. That is the best number since March for this manufacturing job-market bellwether and increases the prospect of a fifth-straight upside surprise versus the consensus in tomorrow's August jobs report.”

-

16:33

United States 4-Week Bill Auction: 2.47% vs 2.31%

-

16:21

GBP/USD prints fresh 2-year lows below 1.1500 as US dollar soars

- US dollar strengthens following ISM Manufacturing PMI, ahead of NFP.

- GBP/USD drops for the fifth consecutive day.

- The multi-decade low waits at 1.1409 (March 2020).

A stronger US Dollar pushed GBP/USD to levels under 1.1500 for the first time since March 2020. The greenback is rising sharply following upbeat US economic data, amid risk aversion and higher yields. The pair bottomed at 1.1497 and then rebounded toward 1.1550, trimming losses.

The US Dollar Index is at the highest level since 2002, up 1% for the day. The dollar was trading in positive ground and rose further following the US ISM Manufacturing August report that showed better-than-expected numbers, including a recovery in the employment index and a slowdown in prices. Earlier, the weekly jobless claims report also came in above expectations. Attention now turns to the Non-farm payrolls report to be released on Friday.

The economic figures weighed on the demand for Treasuries sending US yields further to the upside. The US 10-year yield stands at 3.28%, a level last seen in June.

The last leg to the downside in GBP/USD was driven by the rally of the dollar across the board. Cable is falling for the fifth consecutive day on Thursday headed toward the lowest weekly close since 1985.

Despite showing some signs of stabilization, like a retreat in EUR/GBP, the pound remains among the weakest currencies of the G10 affected by the deteriorating outlook for the UK economy. Also market participants show concerns about the next prime minister. Liz Truss is holding the lead in the polls over Rishi Sunak. The winner of the Tory will be announced on Monday and will succeed PM Boris Johnson.

Despite the turmoil, there are still expectations of a 75 basis points rate hike from the Bank of England in September to curb inflation that, according to some a Goldman Sachs reports could reach 22% next year.

Technical levels

-

15:50

EUR/USD plummets below 0.9920 post upbeat US ISM/Jobs data justify Fed 75 bps hike

- EUR/USD collapses almost 1% after upbeat US economic data.

- The US ISM Manufacturing PMI shows the US economy remains in expansion territory.

- Money market futures odds of a 75 bps rate hike by the Fed lie at 75%.

EUR/USD breaks below parity, extending its losses after hitting on Wednesday a weekly high at 1.0079, but better-than-expected US S&P Global and ISM Manufacturing PMI further cement the case for a Fed’s jumbo 75 bps rate hike in the September meeting.

The EUR/USD opened near the highs of the day at 1.0050s but dived below the parity on the release of upbeat US economic data, which put recession fears in the backseat. Therefore, the EUR/USD trades around the day’s lows at 0.9910s, below its opening price.

EUR/USD plunges on goodish US economic data

Risk aversion keeps global equities tumbling. The US ISM Manufacturing report for August came aligned with July’s figure at 52.8, topping the street’s estimates of 51.9- Even though the data was positive, it’s the second lowest reading since June 2020. The Price Index sub-component edged 7.5 percentage points lower, to 52.5 from 60, portraying the effect of the Federal Reserve tightening policy.

Timothy R. Fiore, Chair of the ISM, “The US manufacturing sector continues expanding at rates similar to the prior two months,” and commented that new orders returned to expansion levels. He added that companies continued to hire at strong rates in August, with few indications of lay-offs.

Coincidentally, the US Initial Jobless Claims for the week ending on August 27 rose by 232K, lower than estimates of 248K, as the Department of Labor reported.

For two consecutive days, US employment data reinforces the Fed’s thesis that the US, even though in a technical recession, as shown by the GDP, the economy is strong. Wednesday’s JOLTs report, with vacancies above 11 million, alongside unemployment claims diminishing and ISM Manufacturing PMI hiring comments, could be a prelude to a solid US Nonfarm Payrolls report on Friday.

On Friday, the US Bureau of Labor (BLS) is expected to unveil additional employment data. Economists predict that the economy will add 298K jobs, and the Unemployment Rate will remain at 3.5%.

Meanwhile, expectations for a 75 bps rate hike in the September Federal Reserve monetary policy meeting pointed to a 75% chance of such an increase.

During the European session, most European countries’ Manufacturing PMIs revealed by S&P Global were in contractionary territory, except for France. German Retail Sales YoY exceeded estimates of -6.6%, dropped by -2.6%, while the EU’s unemployment rate was unchanged.

What to watch

The EU’s economic docket will feature the German Trade Balance alongside the common bloc Producer Price Index (PPI). On the US front, the US Nonfarm Payrolls report for August, alongside Unemployment Rate, will shed some light on the direction of the EUR/USD.

EUR/USD Key Technical Levels

-

15:43

USD/JPY hits levels above 140.00 for the first time since 1998

- US Dollar rises sharply across the board on higher yields, and upbeat US data.

- Japanese yen manages to hold steady versus other currencies amid risk aversion.

- USD/JPY holds bullish tone, but unable to consolidate above 140.00.

The USD/JPY reached levels above 140.00 for the first time since August 1998. The pair peaked at 140.12 and then pulled back to 139.70, amid an increase in volatility. A stronger US dollar across the board boosted the pair.

Another upbeat economic report from the US triggered more losses in Treasuries and boosted the dollar. The US Dollar Index is at 109.78, a level not seen in 20 years.

The US 10-year yield rose to 3.28%, the highest since June. The last report was the ISM Manufacturing which remained at 52.8 in August against expectations of a decline to 52. The Employment Index of the report jumped from 49 to 54.4. On Friday, the US official employment report is due, with market consensus suggesting an increase of 300K in payrolls.

Despite the rally in USD/JPY to fresh multi-decade highs the Japanese yen strengthened versus other currencies amid risk aversion. In Wall Street, the Dow Jones is falling by 0.75% and the Nasdaq drops by 1.70%.

Technical levels

-

15:35

USD/CAD to advance nicely towards next resistance at 1.3220 – Scotiabank

The USD/CAD’s grind higher extended to near 1.32. Economists at Scotiabank expect the pair to continue its advance.

Key support is 1.3075

“There is no letup in the USD’s broader drive higher on the short run charts and broader (daily, weekly) trend strength signals are aligned with intraday oscillators which tilt risks clearly towards more USD gains and limited losses in the short run at least.”

Support is 1.3140/50 intraday. Key support is 1.3075.”

“Resistance is 1.3220 and 1.3330.”

-

15:32

GBP/USD: There is little in terms of clear support ahead of the 2020 spike low at 1.1415 – Scotiabank

GBP/USD has nosedived to 1.15. Economists at Scotiabank expect the pair to remain under significant downside pressure.

Price action is weak and unrelenting

“Against the gloomy domestic context, defined by higher energy costs and the cost-of-living crisis that is bearing down on activity and the economic outlook, more equity market volatility can only mean more pressure on the GBP in a broad sense.”

“We are trading close to our year-end forecast of 1.15 and there are no clear reasons at this point to expect a significant improvement in the outlook.”

“Price action is weak and unrelenting; trend oscillators are aligned bearishly for the GBP across short, medium and long run DMIs and there is little in terms of clear support for the pound ahead of the 2020 spike low at 1.1415.”

-

15:30

United States EIA Natural Gas Storage Change came in at 61B, above forecasts (58B) in August 26

-

15:11

NFP Preview: Forecasts from eight major banks, employment growth still strong

The US Bureau of Labor Statistics (BLS) will release the August jobs report on Friday, September 2 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of eight major banks regarding the upcoming employment data.

Expectations are for a 300K rise in Nonfarm Payrolls following the 528K increase in July. Meanwhile, the Unemployment Rate is expected to remain steady at 3.5%.

Commerzbank

“We expect job growth in August to be lower than in July, but still in the range of previous months at a still high 375K and the unemployment rate to remain at just 3.5%. The labor market would thus remain tight, signaling to the Fed that further significant rate hikes are necessary to curb inflation.”

Westpac

“Come August, we again expect a materially softer outcome for nonfarm payrolls (250K), while recognising that risks remain to the upside. For the next few months, the unemployment rate can hold around 3.5%; but from the end of the year, it is likely to begin to trend higher as employment growth slows and participation rises as households seek relief from the loss of real spending capacity.”

ING

“A 250K would still be very respectable and will certainly keep the Fed in hiking mode. With the unemployment rate set to remain at 3.5% and wages continuing to push higher we favour a 50 bps hike on 21 September rather than 75 bps. However, should the economy add substantially more jobs, say 350K+, and the wage number posts a second consecutive 0.5% month-on-month increase, or higher, then it could swing the argument in favour of 75 bps.”

TDS

“We expect the series to have continued to advance strongly in August (370K), but at a more moderate pace following the eye-popping 528K increase registered in July, which was a five-month high. We look for the solid gain in employment to also be reflected in another decline in the unemployment rate to 3.4% (second consecutive one-tenth decline). We are assuming an improvement in the participation rate to 62.2% after falling to 62.1% in July. We are also looking for wage growth to slow modestly to a still robust 0.4% MoM after registering an unexpected 0.5% jump last month. The MoM leap should result in a one-tenth increase in the YoY measure to 5.3% in August.”

SocGen

“We project a 300K increase for August non-farm jobs. A gain near our forecast of 300K implies either a return of workers back into the workforce or further declines in the unemployment rate. We look for the unemployment rate to hold steady at 3.5%. The return of workers should lift the labor force participation rate from the 62.1 level posted for July.”

NBF

“Payroll growth may have come down to just 75K. The household survey is expected to show a stronger gain, a development which could leave the unemployment rate unchanged at 3.5%, assuming the participation rate increased one tick to 62.2%.”

CIBC

“After a stellar performance in July, the US labor market is poised for a slowdown in August, in line with the cooling in interest-sensitive sectors. The likely creation of 250K jobs would still be a healthy print, however, and that could leave the unemployment rate at a tight 3.5%, assuming some increase in labor force participation. We expect hiring to slow ahead as higher interest rates weigh on activity, something that is a precursor for the Fed to slow the pace of rate hikes. Market impact. We’re below the consensus which could be negative for the USD and see bond yields fall.”

Citibank

“Following a significant upside surprise to nonfarm payrolls in July, we expect a more moderate increase of 305K in August, with mostly balanced risks. Overall, the trend of job growth is likely to slow into the end of the year and 2023 as demand for labor moderates. We expects a 0.4% MoM increase in average hourly earnings in August, a modestly softer increase than in July and the base case is for the unemployment rate to fall further to 3.4% in August after a decline in July to 3.5%.”

-

15:05

US: ISM Manufacturing PMI unchanged at 52.8 in August vs. 52 expected

- US ISM Manufacturing PMI stayed unchanged at 52.8 in August.

- US Dollar Index climbed to a fresh multi-decade high after the data.

The ISM Manufacturing PMI arrived at 52.8 in August, showing that the business activity continued to expand at the same pace as it did in July. This data came in better than the market expectation of 52.

Key takeaways

"The New Orders Index registered 51.3%, 3.3 percentage points higher than the 48% recorded in July."

"The Production Index reading of 50.4% is a 3.1-percentage point decrease compared to July's figure of 53.5%."

"The Prices Index registered 52.5%, down 7.5 percentage points compared to the July figure of 60%; this is the index's lowest reading since June 2020 (51.3%)."

"The Backlog of Orders Index registered 53%, 1.7 percentage points above the July reading of 51.3%".

"After three straight months of contraction, the Employment Index expanded at 54.2%, 4.3 percentage points higher than the 49.9% recorded in July."

Market reaction

The US Dollar Index extended its daily rally after this data and was last seen trading at its strongest level in nearly two decades at 109.68.

-

15:01

United States ISM Manufacturing Prices Paid below forecasts (55.5) in August: Actual (52.5)

-

15:00

United States Construction Spending (MoM) below forecasts (-0.1%) in July: Actual (-0.4%)

-

15:00

United States ISM Manufacturing PMI above expectations (52) in August: Actual (52.8)

-

15:00

United States ISM Manufacturing New Orders Index above forecasts (48.5) in August: Actual (51.3)

-

15:00

United States ISM Manufacturing Employment Index came in at 54.2, above forecasts (49) in August

-

14:57

AUD/USD remains depressed near multi-week low amid stronger USD, risk-off mood

- AUD/USD remains depressed near a multi-week low and is pressured by a combination of factors.

- Hawkish Fed expectations, elevated US bond yields lift the USD back closer to a two-decade high.

- The risk-on mood further underpins the safe-haven buck and weighs on the risk-sensitive aussie.

The AUD/USD pair struggles to capitalize on its intraday bounce from sub-0.6800 levels, or the lowest level since June 18 and remains depressed through the early North American session. The pair is currently placed around the 0.6820 region and seems vulnerable to prolonging the recent descending trend witnessed over the past three weeks or so.

The US dollar regains positive traction on Thursday and inches back closer to a 20-year peak touched earlier this week amid hawkish Fed expectations. The markets seem convinced that the US central bank will stick to its aggressive policy tightening path to tame inflation and have been pricing in a 75 bps rate hike move in September. This remains supportive of a further rise in the US Treasury bond yields and continues to underpin the greenback, which, in turn, is seen exerting downward pressure on the AUD/USD pair.

In fact, the yield on the 2-year US government bond, which is highly sensitive to Fed rate hike expectations, hits a 15-year high. Apart from this, better-than-expected US Weekly Initial Jobless Claims data and the prevalent risk-off environment offers additional support to the safe-haven buck. The market sentiment remains fragile amid growing worries about a deeper global economic downturn. The fears were further fueled by Thursday's disappointing release of the Caixin/Markit Chinese Manufacturing PMI, which fell to 49.5 in August.

Furthermore, economic headwinds from fresh COVID-19 lockdowns temper investors' appetite for perceived riskier assets. This is evident from a generally weaker tone around the equity markets, which further contributes to the offered tone surrounding the risk-sensitive aussie. The fundamental backdrop suggests that the path of least resistance for the AUD/USD pair is to the downside and any attempted recovery could be seen as a selling opportunity. Traders now look to the US ISM Manufacturing PMI for short-term opportunities.

The focus, however, remains glued to the closely-watched US monthly employment details, due for release on Friday. The popularly known NFP will provide a fresh insight into the economy's health in the face of rising rates and stubbornly high inflation. This, in turn, will play a key role in influencing the near-term USD price dynamics and help determine the next leg of a directional move for the AUD/USD pair.

Technical levels to watch

-

14:51

US: S&P Manufacturing PMI declines to 51.5 (final) in August vs. 51.3 expected

- US S&P Manufacturing PMI edged lower to 51.5 in August.

- US Dollar Index continues to stretch higher toward 109.50.

The business activity in the US manufacturing sector expanded at a softer pace in August than it did in July with the S&P Manufacturing PMI falling to 51.5 from 52.2. This print came in slightly higher than the flash estimate and the market expectation of 51.3.

Commenting on the data, "US factory production was down for a second month running in August, with demand for goods having now fallen for three straight months amid the ongoing impact of soaring inflation, supply constraints, rising interest rates and growing economic uncertainty about the economic outlook," Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said.

Market reaction

The US Dollar Index preserves its bullish momentum after this data and was last seen gaining 0.65% on a daily basis at 109.39.

-

14:45

United States S&P Global Manufacturing PMI registered at 51.5 above expectations (51.3) in August

-

14:41

USD/TRY finally reaches 18.20 and beyond, new 2022 highs

- USD/TRY remains bid and advances above 18.20.

- Türkiye Manufacturing PMI improved to 47.40 in August.

- Markets’ attention remains on the CPI release next week.

The Turkish lira extends its march south and encourages USD/TRY to print fresh 2022 peaks above the 18.20 level on Thursday.

USD/TRY: The hunt for the all-time high at 18.25

USD/TRY posts gains for the second straight session on Thursday, this time surpassing the 18.20 level and recording fresh YTD highs. It is worth noting that the lira loses nearly 38% vs. the dollar so far this year and starts the ninth consecutive month with gains.

In the meantime, further strength in the dollar, which in turn remains propped up by expectations of extra tightening by the Federal Reserve in its battle to tame inflation, continues to underpin the relentless move higher in the pair.

In the Turkish calendar, the Manufacturing PMI improved to 47.40 in August (from 46.90). Despite the better reading, the manufacturing sector still navigates in the contraction territory (<50).

What to look for around TRY

The upside bias in USD/TRY remains unchanged and approaches the all-time high around 18.25. The uptrend in spot has been intensified following the unexpected interest rate cut by the CBRT on August 18.

In the meantime, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, there seems to be no other immediate alternative to attract foreign currency other than via tourism revenue, in a context where official figures for the country’s FX reserves remain surrounded by increasing skepticism among investors.

Key events in Türkiye this week: Manufacturing PMI (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.09% at 18.2013 and faces the immediate target at 18.2060 (2022 high September 1) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 17.7586 (monthly low August 9) would pave the way for 17.5948 (55-day SMA) and finally 17.1903 (weekly low July 15).

-

14:34

Canada: S&P Manufacturing PMI drops to 48.7 in August vs. 53.6 expected

- Canada S&P Global Manufacturing PMI fell into contraction territory below 50 on in August.

- USD/CAD clings to daily gains above 1.3150 after the data.

The business activity in Canada's manufacturing sector contracted in August with the S&P Global Manufacturing PMI dropping to 48.7 from 52.5 in July. This reading missed the market expectation of 53.6 by a wide margin.

Commenting on the data, "latest PMI data highlighted further concern for Canada's manufacturing sector midway through Q3 as high inflation and concerns over the long-term outlook hit demand hard," said Shreeya Patel, Economist at S&P Global Market Intelligence. "Both output and new orders fell at quicker rates while employment levels declined for the first time since the start of the pandemic over two years."

Market reaction

The USD/CAD pair edged slightly higher with the initial reaction to the disappointing data and was last seen rising 0.3% on the day at 1.3167.

-

14:30

Canada S&P Global Manufacturing PMI below forecasts (53.6) in August: Actual (48.7)

-

14:23

Fed will be forced to hike US economy into a recession in 2023 – Danske Bank

Despite the recession fears, the US economy performed relatively well over the summer. But in the view of economists at Danske Bank, the Federal Reserve continues to guide the US economy toward a recession.

Labour market shows few signs of cooling

“Despite falling into a technical recession during H1, the recent easing in gasoline prices will support positive real private consumption growth during H2.”

“Headline inflation has peaked, but labour market and underlying price pressures remain strong. Fed will be forced to hike US economy into a recession in 2023.”

“We adjust the GDP forecasts to +1.6% in 2022 (from +2.4%) and -0.2% for 2023 (from +0.1%). The downward revision for 2022 largely reflects the weaker-than-expected growth during H1, but risks remain tilted to the downside for 2023.”

-

14:08

When is the US ISM Manufacturing PMI and how could it affect EUR/USD?

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 14:00 GMT this Thursday. The index is anticipated to have edged down to 52 in August from 52.8 in the previous month. The gauge will provide a fresh update on the manufacturing sector activity amid rising borrowing costs and growing worries about a deeper economic downturn.

According to Valeria Bednarik, Chief Analyst at FXStreet: “Among the sub-components of the report, the most interesting forecast is that for Prices Paid as it reflects business sentiment around future inflation. The index is expected to retreat sharply from 60 in the previous month to 55.5. While lower-than-previous figures are usually understood as negative for the dollar, easing price pressures are for sure good news for the US.”

How could it affect EUR/USD?

Ahead of the key release, the US dollar climbs back closer to a two-decade high amid hawkish Fed expectations and attracts fresh selling around the EUR/USD pair on Thursday. A stronger-than-expected report will be enough to reaffirm bets for a supersized 75 Fed rate hike move in September. This, in turn, should provide an additional lift to the already elevated US Treasury bond yields and continue to boost the USD.

Conversely, softer data is more likely to be overshadowed by the prevalent risk-off environment, which should continue to lend some support to the safe-haven greenback. Apart from this, concerns over an extreme energy crisis in Europe might continue to undermine the shared currency. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside and any attempted move up should get sold into.

Eren Sengezer, Editor at FXStreet, offers a brief technical overview and writes: EUR/USD stayed above 1.0020 (Fibonacci 23.6% retracement of the latest downtrend, 20-period SMA). Additionally, the Relative Strength Index (RSI) indicator on the four-hour chart started to edge higher after having retreated to the 50 area earlier in the day, confirming the bullish tilt in the near-term technical outlook.”

Eren also outlines important technical levels to trade the EUR/USD pair: “On the upside, 1.0080 (Fibonacci 38.2% retracement, 100-period SMA) aligns as next resistance before 1.0130 (Fibonacci 50% retracement) and 1.0145 (200-period SMA). Supports are located at 1.0020, 1.0000 (psychological level, static level) and 0.9980 (50-period SMA).”

Key Notes

• US ISM Manufacturing PMI Preview: Slowing growth or recession?

• EUR/USD Forecast: Euro bears remain hesitant

• EUR/USD to decline towards the 0.95 over the coming month – Rabobank

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

-

14:00

Gold Price Forecast: XAU/USD to meltdown below the $1,675 mark – TDS

With every downtick, the risk of capitulation in gold is rising. Economists at TD Securities expect the yellow metal to slump below the $1,675 level.

China's appetite for gold has remained resilient

“The top players in Shanghai markets continue to add to their gold length, despite a depreciating CNY. These flows, alongside central bank demand, have likely kept gold from melting in a liquidity vacuum amid a hawkish Fed narrative, Nonetheless, the risk of capitulation from bloated prop-shop positioning is growing with every tick lower in prices as we approach this cohort's pandemic-era entry levels.”

“The downtrend in gold is gaining steam, as the breadth of technical signals short continues to firm.”

“The risk of a breakout in the broad dollar index could coincide with a meltdown below the $1,675 range in gold.”

-

14:00

Brazil S&P Global Manufacturing PMI registered at 51.9, below expectations (54.1) in August

-

14:00

Russia Central Bank Reserves $ dipped from previous $574B to $566.8B

-

13:52

USD/CNY to rise to 7 in the first quarter of next year – Rabobank

Between April 15 and end-August USD/CNY rose no less than 8.5% to a rate of 6.89. Economists at Rabobank expect the pair to hit 7 in the fisr quarter of 2023.

Chinese inflation to rise to 3.1% during the end of 2022

“After more promising data in June, China’s economy appeared to show signs of early recovery. However, this turned out to be a short-lived one.”

“We expect to see a USD/CNY exchange rate of 6.95 by year-end and expect USD/CNY to rise to 7 in the first quarter of next year.”

“Inflation is expected to rise to 3.1% during the end of 2022.”

-

13:50

Gold Price Forecast: XAU/USD weakens below $1,700 for the first time since July

- Gold slides below the $1,700 mark on Thursday, hitting its lowest level since July 21.

- Aggressive Fed rate hike bets, rising US bond yields and stronger USD exert pressure.

- The risk-off mood fails to impress bullish traders or lend any support to the commodity.

Gold prolongs this week's bearish trend for the third straight day on Thursday and drops to its lowest level since July 21 during the early North American session. The XAU/USD slips below the $1,700 round-figure mark and seems vulnerable to extending the downward trajectory.

Firming expectations that the Fed will continue to tighten its monetary policy more aggressively to tame inflation turns out to be a key factor driving flows away from the non-yielding gold. In fact, the markets are pricing in a greater chance of a 75 bps Fed rate hike at the September meeting and the bets were reaffirmed by Fed Chair Jerome Powell's hawkish remarks last Friday.

This, in turn, leads to an extended sell-off in the US debt markets and pushes the yield on the 2-year government bond, which is highly sensitive to rate hike expectations, to a nearly 15-year high. Elevated US Treasury bond yields lift the US dollar back closer to a two-decade peak touched earlier this week, which is exerting additional pressure on the dollar-denominated gold.

The ongoing downward trajectory, meanwhile, seems rather unaffected by the risk-off environment, which tends to benefit the traditional safe-haven gold. The market sentiment remains fragile amid worries about a deeper global economic downturn. The fears were further fueled by Thursday's disappointing release of the Caixin/Markit Chinese Manufacturing PMI, which fell to 49.5 in August.

Adding to this, headwinds stemming from fresh COVID-19 lockdowns in China further temper investors' appetite for perceived riskier assets. This is evident from a generally weaker tone around the equity markets, though did little to impress bullish traders or lend any support to gold. This, in turn, suggests that the path of least resistance for spot prices is to the downside.

Next on tap will be the release of the US ISM Manufacturing PMI, which might influence the USD and provide some impetus to gold. The focus, however, will remain on the closely-watched US monthly jobs report on Friday. The popularly known NFP will provide a fresh insight into the economy's health in the face of rising rates and stubbornly high inflation. This will play a key role in driving the near-term USD demand and help determine the next leg of a directional move for the yellow metal.

Technical levels to watch

-

13:46

EUR/USD Price Analysis: Solid support lies around 0.9900

- EUR/USD sees its rebound trimmed and returns to sub-parity levels.

- Firm contention is expected near the 0.9900 zone.

EUR/USD comes under renewed and marked downside pressure, slipping back below the key parity zone on Thursday.

Further consolidation looks the most likely scenario in EUR/USD for the time being, always within the 1.0100-0.9900 range. The pair is expected to keep this theme unchanged in the next hours, or at least until the key publication of US Nonfarm Payrolls (Friday).

The breakout of the weekly high at 1.0090 (August 26) could spark further gains to 1.0202 (August17 high) ahead of the 55-day SMA, today at 1.0213. Alternatively, the 0.9900 neighbourhood is expected to hold the bearish impulse for the time being.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0801.

EUR/USD daily chart

-

13:41

US: Unit Labor Costs rise 10.2% in Q2 vs. 10.7% expected

- Unit Labor Costs rose at a softer pace than expected in Q2.

- US Dollar Index stays in positive territory above 109.00.

Unit Labor Costs in the nonfarm business sector increased by 10.2% in the second quarter of 2022, the US Bureau of Labor Statistics (BLS)reported on Thursday. This reading came in lower than the market expectation of 10.7%.

Further details of the publication revealed that Labor Productivity in the nonfarm business sector declined by 4.1% in the second quarter of 2022.

"From the same quarter a year ago, nonfarm business sector labor productivity decreased 2.4%," the BLS said. "This is the largest decline in the series, which begins in the first quarter of 1948."

Market reaction

The dollar continues to outperform its rivals in the early American session with the US Dollar Index clinging to strong daily gains at 109.30.

-

13:34

US: Weekly Initial Jobless Claims decline to 232K vs. 248K expected

- Initial Jobless Claims fell by 5,000 in the week ending August 27.

- US Dollar Index continues to push higher toward 109.50.

There were 232,000 initial jobless claims in the week ending August 27, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 237,000 (revised from 243,000) and came in better than the market expectation of 248,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 241,500, a decrease of 4,000 from the previous week's unrevised average.

"The advance number for seasonally adjusted insured unemployment during the week ending August 20 was 1,438,000, an increase of 26,000 from the previous week's revised level," the DOL said.

Market reaction

The US Dollar Index extended its rally after this data and was last seen rising 0.6% on the day at 109.32.

-

13:31

United States Unit Labor Costs registered at 10.2%, below expectations (10.7%) in 2Q

-

13:31

United States Nonfarm Productivity registered at -4.1% above expectations (-4.5%) in 2Q

-

13:31

Chile IMACEC: 1% (July) vs previous 3.7%

-

13:30

United States Continuing Jobless Claims in line with expectations (1.438M) in August 19

-

13:30

United States Initial Jobless Claims below forecasts (248K) in August 26: Actual (232K)

-

13:30

United States Initial Jobless Claims 4-week average down to 241.5K in August 26 from previous 247K

-

13:30

Canada Building Permits (MoM) registered at -6.6%, below expectations (-0.5%) in July

-

13:17

EUR/USD to decline towards the 0.95 over the coming month – Rabobank

On Wednesday, EUR/USD closed at its highest level since mid-August. Nevertheless, economists at Rabobank expect the pair to slide towards 0.95 in the next month.

USD strength to remain in place for a further six months or so

“Going into the Jackson Hole meetings, the market was pricing in a full 1 ppt of ECB rate hikes by the October meeting and these expectations have only increased since then. However, rate hikes will do little to prop up the EUR vs. the USD given that investors are likely to remain focused on stagflation risks in the Eurozone and given the USD’s haven function.”

“We continue to expect broad-based USD strength to remain in place for a further six months or so.”

“We maintain our target of EUR/USD 0.95 on a one-month view.”

-

13:16

US Dollar Index Price Analysis: Further upside likely above 105.60

- DXY extends the upside and rises to 3-day highs near 109.20.

- Extra gains remain in place above the 105.60 region.

DXY reverses Wednesday’s downtick and resumes the buying interest north of the 109.00 mark on Thursday.

The prospects for extra rebound look well and sound while above the 7-month support line, today around 105.60. Against that, the breakout of the 2022 high at 109.47 (August 29) should pave the way for a challenge of the September 2002 top at 109.77 and the round level at 110.00.

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.93.

DXY daily chart

-

13:12

GBP/USD: There is more room on the downside amid risk-aversion

GBP/USD has failed to shake off the bearish pressure. The pair is likely to suffer additional losses with safe-haven flows dominating the markets, FXStreet’s Eren Sengezer reports.

Technical outlook shows sellers retain control of cable’s action

“The risk-averse market environment is not allowing the British pound to find demand and the near-term technical outlook shows that there is more room on the downside for the pair.”

“On the downside, 1.1550 (static level, mid-point of the descending channel) aligns as first support ahead of 1.1500 (psychological level).”