Notícias do Mercado

-

16:40

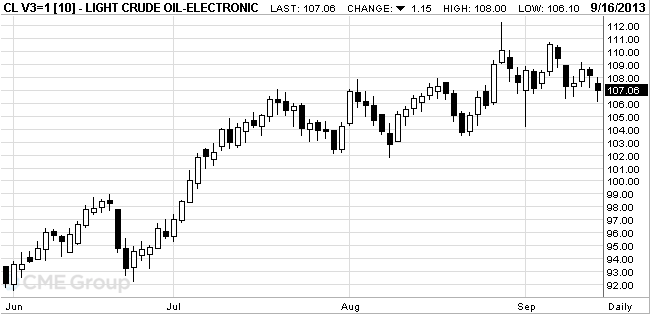

Oil fell to a two-week low

West Texas Intermediate crude declined to a two-week low as a plan to eliminate Syria’s chemical weapons reduced the risk of a disruption in Middle East oil exports.

Futures fell as much as 1.9 percent after the U.S.-Russian accord reached Sept. 14 in Geneva. U.S. Secretary of State John Kerry met with French President Francois Hollande and Kerry’s counterparts from France and the U.K. today to build support for a plan to eliminate Syria’s chemical arsenal. Libya’s El Feel and Sharara oil fields resumed output, the state-run news agency Lana reported.

“The agreement between the U.S. and Russia eliminates any chance of a U.S. military strike on Syria in the near term along with all the spillover concerns,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. “This coupled with the return of some Libyan crude production is sending prices lower.”

WTI crude for October delivery decreased $1.32, or 1.2 percent, to $106.89 a barrel at 10:50 a.m. on the New York Mercantile Exchange. Futures touched $106.10, the least since Sept. 3. The volume of all futures traded was 14 percent above the 100-day average.

Brent oil for November settlement fell $1.76, or 1.6 percent, to $109.91 a barrel on the London-based ICE Futures Europe exchange. Futures touched $108.73, the lowest level since Aug. 20. Volume was 77 percent above the 100-day average. The European benchmark traded at a $3.65 premium to November WTI. The front-month contracts were $4.57 apart on Sept. 13.

-

16:20

Gold fell

Gold prices decline as investors' confidence that the Fed will begin reducing incentives in September.On Tuesday and Wednesday, the Fed will hold a two-day meeting, which will determine the duration and the rate of reduction of bond buying program by $ 85 billion a month. According to economists, the original scope of the program will be reduced by $ 10-15 billion .

Gold prices briefly rose after the announcement of the exit of the former U.S. Treasury Secretary Lawrence Summers, the number of applicants for the post of head of the Fed. Summers recused himself , which the market considers a supporter of tight monetary policy , increases the chance of being elected chairman of the central bank's current Vice Chairman Janet Yellen , from which the market tends to expect continuation of soft policy . However, according to players, this will not prevent the reduction of incentives in the short term.

The appeal of gold as a low-risk assets suffered after an agreement between the U.S. and Russia on the destruction of the chemical weapons stockpile of Syrian President Bashar al-Assad. Due to this, managed to prevent a U.S. military strike on Syria and alleviate concerns about the involvement in the conflict in the Middle East oil-producing countries .

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Friday fell by 0.66 percent to 911.12 tons , the biggest decline since Aug. 1.

The cost of the October gold futures on COMEX today dropped to $ 1307.20 per ounce

-