Notícias do Mercado

-

18:20

European stocks close

European stocks gained, extending a five-year high, as Lawrence Summers withdrew from consideration as Federal Reserve chairman, paving the way for Janet Yellen, who investors say will favor slower stimulus reduction.

The Stoxx Europe 600 Index rallied 0.6 percent to 313.42 at the close of trading, the highest level since June 2008. The gauge has risen 5.4 percent this month as Chinese economic reports beat forecasts and the U.S. backed away from military action against Syria over a chemical-weapons attack that America says killed more than 1,400 people.

National benchmark indexes gained in 16 of the 18 western European markets today. Germany’s DAX surged 1.2 percent, while the U.K.’s FTSE 100 added 0.6 percent and France’s CAC 40 rose 0.9 percent. The volume of shares changing hands in Stoxx 600-listed companies was 8.8 percent lower than the 30-day average, data compiled by Bloomberg show.

EasyJet added 2.4 percent to 1,331 pence, while IAG, the owner of British Airways, climbed 3.3 percent to 325 pence. Air France-KLM Group surged 5.5 percent to 7.15 euros and Ryanair Holdings Plc rallied 4.2 percent to 6.44 euros.

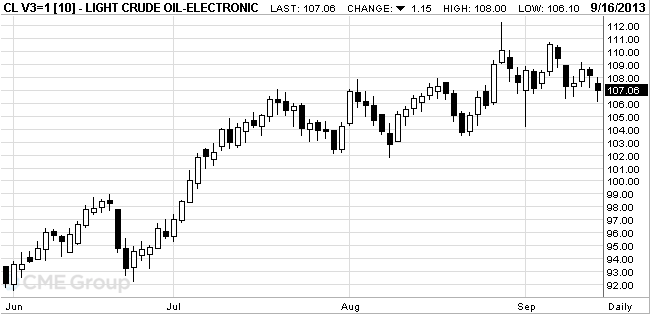

West Texas Intermediate crude fell to a two-week low as the threat of imminent military strikes against Syria eased.

H&M jumped 4 percent to 259.20 kronor, the highest since September 2010. Europe’s second-biggest clothing retailer said revenue at stores open at least a year rose 4 percent in August compared with the same month last year. The average estimate in a SME Direkt survey was for a 2.5 percent increase.

Remy Cointreau surged 7 percent to 84.10 euros for the biggest gain in the Stoxx 600 and largest advance since October 2009. Chinese cognac shipments rose 20.5 percent in August, increasing for the first time since January, according to UBS AG, quoting data from BNIC, a trade association of cognac makers.

Fresnillo Plc and Polymetal International Plc sank at least 7 percent to lead declines in the Stoxx 600 after the precious-metals producers were not included in the NYSE Arca Gold Miners Index. Fresnillo tumbled 13 percent to 1,045 pence. Polymetal plunged 7.1 percent to 659.5 pence. African Barrick Gold Plc also fell, losing 12 percent to 143.9 pence.

NYSE Euronext announced which companies will be added and deleted from the gauge of gold stocks after changing the methodology to include non-U.S. listed companies. Centamin Plc, the only U.K.-based company added to the index, advanced 2.3 percent to 45.5 pence. The changes will be effective Sept. 23., according to a statement by NYSE Euronext.

-

17:01

European stocks closed in plus: FTSE 100 6,621.7 +37.90 +0.58 %, CAC 40 4,151.22 +36.72 +0.89 %, DAX 8,612.4 +102.98 +1.21 %

-

16:40

Oil fell to a two-week low

West Texas Intermediate crude declined to a two-week low as a plan to eliminate Syria’s chemical weapons reduced the risk of a disruption in Middle East oil exports.

Futures fell as much as 1.9 percent after the U.S.-Russian accord reached Sept. 14 in Geneva. U.S. Secretary of State John Kerry met with French President Francois Hollande and Kerry’s counterparts from France and the U.K. today to build support for a plan to eliminate Syria’s chemical arsenal. Libya’s El Feel and Sharara oil fields resumed output, the state-run news agency Lana reported.

“The agreement between the U.S. and Russia eliminates any chance of a U.S. military strike on Syria in the near term along with all the spillover concerns,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. “This coupled with the return of some Libyan crude production is sending prices lower.”

WTI crude for October delivery decreased $1.32, or 1.2 percent, to $106.89 a barrel at 10:50 a.m. on the New York Mercantile Exchange. Futures touched $106.10, the least since Sept. 3. The volume of all futures traded was 14 percent above the 100-day average.

Brent oil for November settlement fell $1.76, or 1.6 percent, to $109.91 a barrel on the London-based ICE Futures Europe exchange. Futures touched $108.73, the lowest level since Aug. 20. Volume was 77 percent above the 100-day average. The European benchmark traded at a $3.65 premium to November WTI. The front-month contracts were $4.57 apart on Sept. 13.

-

16:20

Gold fell

Gold prices decline as investors' confidence that the Fed will begin reducing incentives in September.On Tuesday and Wednesday, the Fed will hold a two-day meeting, which will determine the duration and the rate of reduction of bond buying program by $ 85 billion a month. According to economists, the original scope of the program will be reduced by $ 10-15 billion .

Gold prices briefly rose after the announcement of the exit of the former U.S. Treasury Secretary Lawrence Summers, the number of applicants for the post of head of the Fed. Summers recused himself , which the market considers a supporter of tight monetary policy , increases the chance of being elected chairman of the central bank's current Vice Chairman Janet Yellen , from which the market tends to expect continuation of soft policy . However, according to players, this will not prevent the reduction of incentives in the short term.

The appeal of gold as a low-risk assets suffered after an agreement between the U.S. and Russia on the destruction of the chemical weapons stockpile of Syrian President Bashar al-Assad. Due to this, managed to prevent a U.S. military strike on Syria and alleviate concerns about the involvement in the conflict in the Middle East oil-producing countries .

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Friday fell by 0.66 percent to 911.12 tons , the biggest decline since Aug. 1.

The cost of the October gold futures on COMEX today dropped to $ 1307.20 per ounce

-

14:45

Option expiries for today's 1400GMT cut

EUR/USD $1.3215, $1.3240, $1.3250, $1.3280, $1.3300, $1.3325, $1.3345

USD/JPY Y97.90, Y98.50, Y99.20, Y99.30, Y99.40, Y99.50, Y100.00, Y101.00

GBP/USD $1.5750, $1.5860

GBP/AUD A$1.7150

USD/CHF Chf0.9450

EUR/CHF Chf1.2355, Chf1.2400

AUD/USD $0.9200, $0.9210, $0.9300, $0.9315, $0.9400

USD/CAD C$1.0245, C$1.0350

-

14:34

U.S. Stocks open: Dow 15,452.32 +76.26 +0.50%, Nasdaq 3,753.61 +31.43 +0.84%, S&P 1,695.47 +7.48 +0.44%

-

14:15

U.S.: Capacity Utilization, August 77.8% (forecast 77.8%)

-

14:15

U.S.: Industrial Production (MoM), August +0.4% (forecast +0.5%)

-

13:30

U.S.: NY Fed Empire State manufacturing index , September 6.3 (forecast 9.2)

-

13:30

Canada: Foreign Securities Purchases, July +6.09 (forecast -2.23)

-

13:15

European session: the euro against the dollar has increased markedly

Data

00:00 Japan Bank holiday

08:00 Eurozone ECB President Mario Draghi Speaks

09:00 Eurozone Harmonized CPI, Y/Y (Finally) August +1.3% +1.3% +1.3%

09:00 Eurozone Harmonized CPI August -0.5% +0.1% +0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y August +1.1% +1.1% +1.1%

The dollar fell sharply against most major currencies , which in the first place was due to the refusal of the former U.S. Treasury Secretary Larry Summers to participate in the race for the post of chairman of the Federal Reserve System. In a letter to Barack Obama , he wrote that "I have reluctantly decided that any process of approval and adoption of my candidacy will be in a very difficult and acrimonious atmosphere that is not in the interest of the Fed ." Obama issued a statement the former head of the Ministry of Finance . Note also that the appointment of Summers argued by some influential Democrats . Experts pointed out that for Summers were most likely to change as the head of the Federal Reserve Ben Bernanke , whose mandate expires in January 2014. Now that Summers out of the race for the post of head of the Fed , the focus is now aimed at Janet Yellen , the current Deputy Chairman of the Federal Reserve as the main candidate for a seat Bernanke. If the appointment is approved Yellen , the markets seem to lay in the prices of a clear continuation of the current policy regime Bernanke , suggesting a less aggressive approach to the " rapid narrowing ."

We also add that there is to assess the dynamics of the euro against the dollar , we can see that a small influence on the bidding had Draghi speech and data for the euro area . European Central Bank President Mario Draghi reiterated benchmark for future policy ECB interest rates remain at current or lower levels for an extended period, as the economy is still fragile. Speaking at a conference organized by the European business lobbyists , Draghi urged eurozone countries to stimulate economic growth , employment and competitiveness in a region where economic recovery is still at an early stage. According to Draghi , a program of bond purchases in the secondary markets to improve market conditions helped to restore the normal functioning of markets and eliminated the uncertainty that has paralyzed the economy of some countries.

As for the data, they showed that on an annualized basis the August consumer price index rose by 1.3 % (the same as the preliminary estimate), while slowing the pace of its growth compared to July , when the value of this index increased by 1 , 6%. Monthly inflation , meanwhile, was 0.1 in August , which completely corresponded to experts . Recall that in July consumer price index fell by 0.5 %. We also add that in the same period last year the figure was 2.6 %. The data also showed that core consumer price index , which excludes prices of energy , food, alcohol and tobacco rose 1.1 percent, while confirming the assessment of experts, and was flat compared to the previous month .

Value of the pound rose sharply against the dollar, also responding to the gathering of the race of the candidates for the post of head of the Fed . Meanwhile, we add that the course of trade is also affected by information from Rightmove. As it became known today, online real estate portal Rightmove raised its forecast for UK house prices , which was primarily due to the fact that demand continues to exceed supply , amid concerns that the new scheme the government to increase the activity in the housing market will fuel the "bubble" real estate. The agency Rightmove expects housing prices in the country will grow by 6 percent this year , which is much faster than the earlier forecast of 4 percent growth. However , the market continues to record a fall in prices , which is part of the summer traffic. In September, house prices fell by 1.5 percent on a monthly basis , thus reaching the level of 245,495 pounds, which was followed , after falling 1.8 percent in August. Compared to the same period last year, housing prices increased by 4.5 percent in September, which was slower than the 5.5 - percent growth , recorded in August. In addition, it was reported that the number of new sellers in the housing market fell by 9 percent from last month , dropping to its lowest level since February of this year.

EUR / USD: during the European session, the pair rose to $ 1.3373

GBP / USD: during the European session, the pair rose to $ 1.5958 , and then retreated to $ 1.5910

USD / JPY: during the European session, the pair fell to Y98.68

At 12:30 GMT Canada will report on the volume of transactions with foreign securities in July. Also at this time, the U.S. will present manufacturing Empire Manufacturing Index for September. At 13:15 GMT the U.S. will release the capacity utilization rate for August, as well as announce the change in the volume of industrial production in August.

-

13:00

Orders

EUR/USD

Offers $1.3452, $1.3400, $1.3382

Bids $1.3330/20, $1.3305/00, $1.3285/80, $1.3255/50

GBP/USD

Offers $1.6000, $1.5975/95, $1.5958

Bids $1.5930/25, $1.5910/00, $1.5880

AUD/USD

Offers $0.9500, $0.9470/75, $0.9440-60, $0.9415/20, $0.9400

Bids $0.9275/70, $0.9225/20, $0.9216, $0.9205/00

EUR/GBP

Offers stg0.8460/65, stg0.8440/50, stg0.8425/30, stg0.8390/400

Bids stg0.8350, stg0.8320, stg0.8300

EUR/JPY

Offers Y133.80, Y133.50, Y133.00/10, Y132.70, Y132.50

Bids Y131.50, Y131.30/20, Y130.80, Y130.00/9.80, Y129.50

USD/JPY

Offers Y100.80, Y100.60/65, Y100.20/30, Y100.00

Bids Y98.65/60, Y98.00, Y97.80, Y97.65

-

11:30

European stock indices rose

European stocks gained, extending a five-year high, after Lawrence Summers withdrew from consideration as Federal Reserve chairman, paving the way for Janet Yellen, who investors say will favor a slower reduction of stimulus. U.S. index futures and Asian shares also rose.

The Stoxx Europe 600 Index climbed 0.8 percent to 313.87 at 9:47 a.m. in London, the highest level since June 2008. The gauge has climbed 5.6 percent this month as Chinese economic reports beat forecasts and the U.S. backed away from military action against Syria over a chemical-weapons attack that America says killed more than 1,400 people.

Former Treasury Secretary Summers withdrew his nomination to lead the Fed before a two-day policy meeting starting tomorrow at which the central bank is forecast to reduce its stimulus. Summers would tighten Fed policy more than Yellen, who was his main rival to replace Chairman Ben S. Bernanke, according to Global Poll of investors, analysts and traders last week.

Fifty-seven percent of investors surveyed Global Poll say they don’t expect a sudden change in the markets if the Fed cuts its bond purchases because they already anticipate tapering action.

Syrian Weapons

U.S. Secretary of State John Kerry and Russian Foreign Minister Sergei Lavrov reached an agreement over the weekend on a framework for finding, securing and destroying Assad’s stock of poison gas. The deal calls for early signs of progress, giving Assad one week to submit an inventory of his toxic weapons, and calls for initial inspections in Syria by November.

The Stoxx 600 may climb to 345 by the end of 2014, an 11 percent gain from last week’s close, Gareth Evans and Thomas Pearce, strategists at Deutsche Bank AG in London, wrote in a report dated Sept. 13. Earnings can increase by 10 percent next year, they said.

EasyJet added 2.2 percent to 1,328 pence, while IAG, the owner of British Airways, climbed 2.5 percent to 322.6 pence. West Texas Intermediate crude fell for a second day amid speculation that the threat of imminent military strikes against Syria has eased as the U.S. pursues a plan to confiscate the nation’s chemical weapons.

H&M rallied 3.5 percent to 257.90 kronor, the highest since September 2010. Europe’s second-biggest clothing retailer said revenue at stores open at least a year rose 4 percent in August compared with the same month last year. The average estimate in a SME Direkt survey was for a 2.5 percent increase.

Retailers posted the third-biggest gain out of 19 groups in the Stoxx 600, climbing 1.2 percent. Chemical companies surged 1.6 percent for the largest advance.

K+S added 2.7 percent to 23.20 euros. Kogan, a longtime ally of President Vladimir Putin is seeking to buy out Uralkali’s three main shareholders, according to people familiar with the situation.

K+S has still plummeted 13 percent since July 29 as Uralkali, the world’s largest potash producer, decided to end output restrictions that underpinned world prices and halt exports through the Belarusian Potash Co. trading venture.

SGS SA added 1.8 percent to 2,221 Swiss francs. The world’s largest product inspector was raised to a buy from neutral at Citigroup Inc., which also added the Geneva-based company to its most favored list.

FTSE 100 6,635.34 +51.54 +0.78%

CAC 40 4,151.17 +36.67 +0.89%

DAX 8,612.84 +103.42 +1.22%

-

10:24

Option expiries for today's 1400GMT cut

EUR/USD $1.3215, $1.3240, $1.3250, $1.3280, $1.3300, $1.3325, $1.3345

USD/JPY Y97.90, Y98.50, Y99.20, Y99.30, Y99.40, Y99.50, Y100.00, Y101.00

GBP/USD $1.5750, $1.5860

GBP/AUD A$1.7150

USD/CHF Chf0.9450

EUR/CHF Chf1.2355, Chf1.2400

AUD/USD $0.9200, $0.9210, $0.9300, $0.9315, $0.9400

USD/CAD C$1.0245, C$1.0350

-

10:18

Asia Pacific stocks close

Asian stocks rose after Lawrence Summers withdrew from consideration to be the next Federal Reserve chairman, paving the way for Janet Yellen, who some investors say may favor a slower reduction in U.S. stimulus.

Nikkei 225 14,404.67 +17.40 +0.12%

Hang Seng 23,219.19 +303.91 +1.33%

S&P/ASX 200 5,247.99 +28.36 +0.54%

Shanghai Composite 2,231.4 -4.82 -0.22%

The MSCI Asia Pacific excluding Japan Index increased 1.6 percent to 464.04 as of 2:32 p.m. in Hong Kong, heading for its highest close since May 30.

Newcrest Mining Ltd. , Australia’s biggest gold producer, jumped 5.1 percent in Sydney as the bullion’s price rose.

Tencent Holdings Ltd., China’s biggest Internet company, rose 1.6 percent in Hong Kong, on course for a record close.

SK Hynix Inc., the world’s No. 2 maker of computer-memory chips, gained 2.8 percent in Seoul after a report that U.S. rival Micron Technology Inc. is cutting its production by about 30 percent.

-

10:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, August +1.1% (forecast +1.1%)

-

10:00

Eurozone: Harmonized CPI, August +0.1% (forecast +0.1%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, August +1.3% (forecast +1.3%)

-

08:41

FTSE 100 6,627.7 +43.90 +0.67%, CAC 40 4,146.43 +31.93 +0.78%, Xetra DAX 8,592.97 +83.55 +0.98%

-

07:00

Asian session: The dollar dropped

00:00 Japan Bank holiday

The dollar dropped to its lowest in more than two weeks versus the euro as the exit of former Treasury Secretary Lawrence Summers from the race to lead the Federal Reserve damped expectations for an early halt to expansionary monetary policy. Summers until yesterday was the president’s favorite to take over from Bernanke. The Syria debate worked against Summers, giving those opposed to his nomination time to keep pressure on the administration, according to a person familiar with the process who asked for anonymity.

A report due today is forecast to show manufacturing in the New York region expanded at a faster pace in September with a general economic index rising to 9 from 8.2 last month, according to the median in a Bloomberg News survey. Separate data may show industrial production grew 0.4 percent in August, according to a separate poll of economists.

Gains in the euro may be limited before European Central Bank President Mario Draghi speaks in Berlin today. Draghi said on Sept. 12 that policy makers are committed to keeping interest rates low for an extended period and the economy doesn’t justify the rise in some money-market rates.

The yen slid against the growth-sensitive currencies of Australia and New Zealand as the U.S. builds support for a plan to eliminate Syrian chemical weapons. Financial markets are closed in Japan today for a holiday.

EUR / USD: during the Asian session the pair rose to $ 1.3370

GBP / USD: during the Asian session, the pair rose to $ 1.5960

USD / JPY: during the Asian session the pair fell to Y98.80

-

06:00

Schedule for today, Monday, Sep 16’2013:

00:00 Japan Bank holiday

08:00 Eurozone ECB President Mario Draghi Speaks

09:00 Eurozone Harmonized CPI, Y/Y (Finally) August +1.3% +1.3%

09:00 Eurozone Harmonized CPI August -0.5% +0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y August +1.1% +1.1%

12:30 Canada Foreign Securities Purchases July -15.41 -2.23

12:30 U.S. NY Fed Empire State manufacturing index September 8.24 9.2

13:15 U.S. Capacity Utilization August 77.6% 77.8%

13:15 U.S. Industrial Production (MoM) August 0.0% +0.5%

-