Notícias do Mercado

-

23:47

GBP/JPY Price Analysis: Dip buyers emerge at the 20-hour EMA as traders eye 166.00

- GBP/JPY registers minimal losses as the Asian session begins, down 0.08%.

- The cross-currency pair needs to break above 166.00 to open the door for upward prices.

- Deterioration in traders’ mood and failures to crack 166.00 could send the GBP/JPY tumbling towards 163.00.

The GBP/JPY registers minimal losses as the Asian Pacific session begins. On Tuesday, the GBP/JPY opened below the 164.00 figure and rose towards the daily high at 165.54 before retracing some of its gains, finishing Tuesday’s trading session positive by 1%. At the time of writing, the GBP/JPY is trading at 165.24.

GBP/JPY Price Analysis: Technical outlook

Even though the cross-currency pair printed six days of gains, the GBP/JPY needs to clear September’s high at 167.94 to cement its upward bias. GBP/JPY traders should be aware that the Relative Strength Index (RSI) shifted from aiming upwards to flat, suggesting buyers’ exhaustion. Therefore, as buyers get a respite, the GBP/JPY might correct lower to challenge the YTD high at 168.73.

Short term, the GBP/JPY one-hour chart delineates prices advancing steadily, with the 20-hour EMA, as dynamic support, previously tested four times. Still, the GBP/JPY managed to stay on the bullish side of the moving average (MA), used for dip buyers to re-enter longs.

If the GBP/JPY is going to extend its gains, the first resistance would be 166.00. Once cleared, the next resistance would be the R1 daily pivot at 166.14, followed by the R2 pivot point at 167.00.

GBP/JPY’s failure to decisively break 166.00 and deterioration in sentiment could pave the way for further losses. Therefore, the first support would be the confluence of the daily pivot point and the 20-hour EMA at 165.26. Break below will expose the S1 pivot at 164.02, followed by the 50-hour EMA at 163.47 and the 163.00 mark.

GBP/JPY Key Technical Levels

-

23:34

GBP/USD Price Analysis: Bulls cross 200-EMA above 1.1400, more gains ahead

- The cable has entered the highest auction area which was recorded in the downside journey.

- Bulls have crossed the 200-EMA for the first time in the past 11 weeks.

- The RSI (14) has established into the bullish range of 60.00-80.00 comfortably.

The GBP/USD pair is struggling to smash the psychological resistance of 1.1500 after a juggernaut rally. The asset is gathering momentum at elevated levels and is expected to continue its six-day winning streak after overstepping Tuesday’s high at 1.1490. The major witnessed a responsive buying action after forming a buying tail on September 26.

On a four-hour scale, the cable has entered into the demon’s arena where most of the trading activity took place while the downside journey of the asset. The major has poked the prior balanced area in a 1.1370-1.1770 range, which serves as the highest auction territory.

The asset has crossed the 200-period Exponential Moving Average (EMA) at 1.1400 for the first time after a period of 11 weeks. Also, a bullish crossover delivered by the 20 and 50-EMAs at 1.1051 adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has been established in the bullish range of 60.00-80.00, which indicates that bullish momentum has been activated.

A minor pullback to near September 19 low at 1.1355 will serve as a bargain buy to the market participants, which will drive the asset towards the psychological resistance at 1.1500, followed by an August 31 high at 1.1694.

On the flip side, a downside break of the September 30 low at 1.1235 will drag the cable towards September 28 high at 1.0916. A slippage below the latter will drag the asset further towards September 29 low at 1.0763.

GBP/USD four-hour chart

-638005196153946407.png)

-

23:05

Australia S&P Global Services PMI came in at 50.6, above expectations (50.4) in September

-

23:05

Australia S&P Global Composite PMI rose from previous 50.8 to 50.9 in September

-

22:57

AUD/USD shifts auction above 0.6500 amid weaker DXY, US ISM Services PMI eyed

- AUD/USD is eyeing the establishment of an auction profile above 0.6500.

- The RBA trimmed its pace of hiking interest rates to keep the growth prospects intact.

- A lower-than-expected US ISM Services PMI reading could weaken the DXY further.

The AUD/USD pair is oscillating majorly above the psychological resistance of 0.6500 in the early Tokyo session. The asset is aiming to comfortably establish above 0.6500 as the US dollar index (DXY) has extended its losses after dropping below the cushion of 111.00. The major is displaying signs of volatility contraction after the announcement of the interest rate decision by the Reserve Bank of Australia (RBA).

On Tuesday, RBA Governor Philip Lowe announced a rate hike by 25 basis points (bps). The extent of the rate hike was lower than the expectations of 50 bps as the central bank preferred to take growth prospects along with the foremost agenda of bringing price stability to the economy. This has pushed the Official Cash Rate (OCR) to 2.6%. RBA policymaker ditched the ongoing pattern of accelerating interest rates by 50 bps.

Now, the deviation between current rates at 2.6% and desired rate of 3.85% is extremely low, therefore the RBA has scaled down the pace of hiking interest rates.

Meanwhile, the DXY has slipped to near the psychological support of 110.00. The asset is expected to display a pullback move as short covering will kick-start after a sheer weakness.

In today’s session, the DXY will dance to the tunes of US ISM Services PMI data. The economic data is seen lower at 56 vs. the previous reading of 56.9. Also, the New Orders Index data will trim significantly to 58.9 against the prior release of 61.8.

-

22:38

NZD/USD traders sit tight ahead of the RBNZ

- NZD/USD traders await the RBNZ for clarity.

- Should the RBNZ outcome be dovish, then this could lead to a hefty sell-off towards 0.5650 and then 0.5600.

- On a hawkish outcome, NZD/USD could head towards a 50% mean reversion of the daily bearish impulse near 0.5800 and beyond.

The knee jerk to the RBA on Tuesday was a 50 pip sell-off before a 100 pip rally that was faded by the bears in London back to the post-RBA lows until the US dollar was sold off in New York.

It is the Reserve Bank of New Zealand's turn today and NZD/USD was unable to benefit as well as its counterparts in Europe due to the Reserve Bank of Australia's dovish tilt. The kiwi moved higher but was little changed on the day despite softer US yields and a much weaker US dollar.

NZD/USD moved up from a low of 0.56795 to score a high of 0.5783. The bird has since fallen back to the middle of the range and idles in the 0.5720 awaiting the next catalyst.

''The RBA’s surprise smaller 25bp hike yesterday has gotten FX markets wondering if the Reserve Bank of New Zealand might be the next central bank to slow the pace of tightening,'' analysts at ANZ Bank said.

''That and NZD/AUD relatives is weighing on the Kiwi this morning. Still, it won’t be long (2pm) before the RBNZ get the chance to make their views known. We expect a 50bp hike and hawkish tone, but the market is already pricing in a lot, so the bar is high.''

''While officials in Australia may be taking a more cautious approach we expect the RBNZ will lift the official cash rate by 50bps today. The Quarterly Survey of Business Opinion released by the NZIER yesterday shows inflationary pressures remain very strong.

Capacity pressures are only easing slowly and the labour market remains very tight. In this inflationary environment we see the RBNZ has little choice but to focus on dampening inflation pressures by delivering another 50bp rate hike,'' the analysts explained.

NZD/USD technical analysis

The price is leaning over the top of a 100 pip box and resisted by the 0.5750s. Should the RBNZ outcome be dovish, then this could lead to a hefty sell-off towards the middle of the 100 pip box near 0.5650 and then 0.5600.

On the other hand, the price could shoot up on a hawkish outcome towards a 50% mean reversion of the daily bearish impulse near 0.5800 and beyond.

The knee jerk to the RBA on Tuesday was a 50 pip sell-off before a 100 pip rally that was faded by the bears in London back to the post-RBA lows until the US dollar was sold off in New York.

-

22:27

EUR/USD Price Analysis: Marches firmly towards parity, though remains downward biased

- EUR/USD is closing towards the parity on speculations that the Fed could shift “dovish.”

- The EUR/USD continues its recovery, though shy of breaking the 50-day EMA above parity.

- For the EUR/USD to shift neutral, it needs to clear 1.0226; otherwise, the bias remains downwards.

The shared currency continues its recovery against the greenback, as the EUR/USD cleared the 20-day EMA at 0.9891 and climbed towards the 50-day EMA, though it fell short of reaching it, printing a daily high at 0.9997. At the time of writing, the EUR/USD is trading at 0.9984, up by 1.66%.

The EUR/USD extended its recovery due to some fundamental reasons. US Treasury bond yields edge lower as speculations of central banks tightening at a slower pace grew as reflected by a risk-on impulse. Therefore, as shown by the US Dollar Index, the greenback dropped from its YTD high at 114.77, to 110.184, at the time of typing.

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart delineates that the euro, even though it recovered from two-decade lows, it is still downward biased. The major could shift its bias to neutral if it clears the 100-day EMA at 1.0226 and would shift bullish if the pair is back above 1.0615, which could pave the way for a 200-day EMA test at 1.0632. That said, failure at parity or the 50-day EMA at 1.0015 would expose the EUR/USD to selling pressure.

Therefore, the EUR/USD first support would be 0.9900, closely followed by the 20-day EMA at 0.9890. A breach of the latter will expose the 0.9800 figure, followed by the YTD low at 0.9635.

EUR/USD Key Technical Levels

-

21:41

United States API Weekly Crude Oil Stock fell from previous 4.15M to -1.77M in September 30

-

21:04

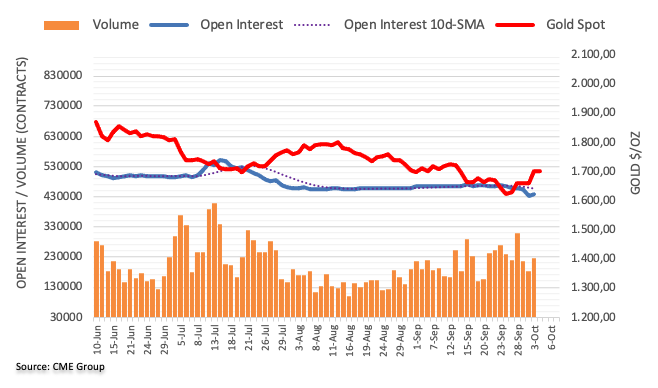

Gold Price Forecast: XAU/USD bears are lurking in daily moving average cloud and confluence of resistance

- Gold has rallied towards last week's highs as the US dollar and yields drop, risk rallies.

- Gold bears focus on the downside and a 50% mean reversion near the $1,685/75 area.

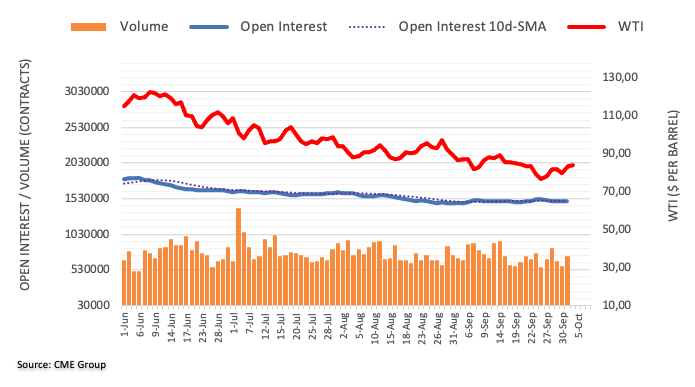

The gold price rallied on Tuesday printing a fresh high for the week so far around $1,730 and traders have their sights set on September's high of $1,735. The yellow metal rallied from a low of $1,695.24 on the day as the US yields made fresh lows of 3.564% in the benchmark 10-year Treasury yield while the US dollar got smacked down on yet further data disappointments.

The DXY, which measures the greenback vs. a basket of currencies fell from a high of 111.886 for the day, or 110.870 on the following JOLTS data:

-638005016651390367.png)

US job openings fell to almost 10.1 million in August, according to the Bureau of Labor Statistics, below the consensus on Econoday for 11.15 million and down from 11.17 million reported in July. The larger-than-expected decline could be the first sign that demand for labour is falling ahead of this week's main event in the US Nonfarm Payrolls data. The weaker data has caused traders to bet the Federal Reserve may raise interest rates less than previously expected as the central bank turns more dovish as the US economy slows.

Elsewhere, also weighing on the greenback, US stocks advanced on signs that the supply-demand gap in the labour market was narrowing, a dovish factor that is supportive of risk appetite on Wall Street. The Dow Jones Industrial Average jumped 2.7% to 30,308.63, while the S&P 500 gained nearly 3% to 3,789.49. The Nasdaq Composite was over 3.5% higher at 11,609 with all sectors in the green after midday Tuesday.

All in all, risk appetite is back in vogue. Volatility is helping to elevate the price of gold, buoyed by expectations that central banks may ease the pace at which they tighten monetary policy resulting in US equity markets recording their strongest rebound since November 2020. However, views are mixed as to whether markets have now bottomed out or whether this recovery will be short-lived.

''We expect another beat on this week's nonfarm payroll data on Friday, which could present be a catalyst for a repricing lower,'' analysts at TD Securities argued. ''The pain trade is still to the downside in precious metals, and the latest positioning data highlighted that other reportables started to meaningfully liquidate their gold length, suggesting pressure towards a capitulation in gold is indeed building.''

Gold technical analysis

The daily chart has seen the price rejected higher as per the harmonic Crab which is a bullish pattern. The bulls are running into an area of potential resistance as per the weekly M-formation and prior week's highs as well as a 21/50 smoothed moving average cloud. For the day ahead, being the middle of the week, if this is going to be the highs of the week, then there will be a focus on the downside and that exposes a 50% mean reversion near the $1,685/75 area.

-

21:03

Forex Today: Will hopes resist recession fears?

What you need to take care of on Wednesday, October 5:

Optimism prevailed for a second consecutive day, leading to a continued dollar sell-off. The catalyst this time was the Reserve Bank of Australia, as it came out with a dovish surprise. Australian policymakers hiked the cash rate by a modest 25 bps, below the 50 bps expected, being the first to halt the ultra-aggressive quantitative tightening.

However, the global worrisome scenario remains the same. Inflation remains stubbornly high, while the risk of recessions is present among most major economies. For the record, the EU published the August Producer Price Index, which soared by 43.3% YoY, a record high.

The decision fueled hopes central banks are approaching the end of aggressive quantitative tightening. Global stocks rallied on relief, with US indexes sharply up for a second consecutive day as major indexes added over 2% each.

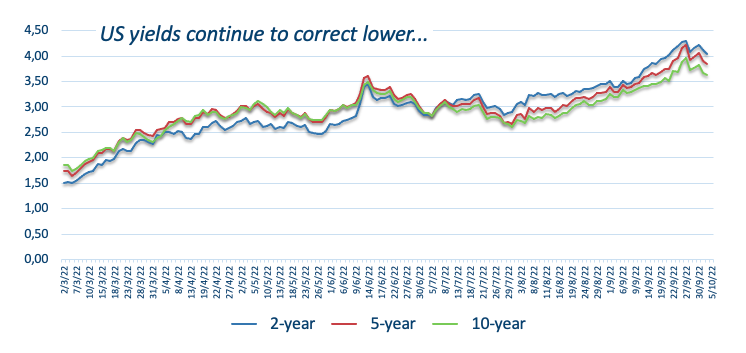

Government bonds kept recovering ground, keeping yields under modest pressure, which weighed on the greenback.

The EUR/USD pair trades just below parity and at its highest in over two weeks. GBP/USD is also up, currently trading in the 1.1470 price zone.

The aussie was the worst performer after RBA’s monetary policy decision, with AUD/USD now hovering at around 0.6500. The USD/CAD plunged towards 1.3500, trading nearby at the end of the American session.

The Swiss Franc edged higher against the greenback, with USD/CHF now trading at around 0.9790, while USD/JPY kept consolidating, now trading at around 144.00.

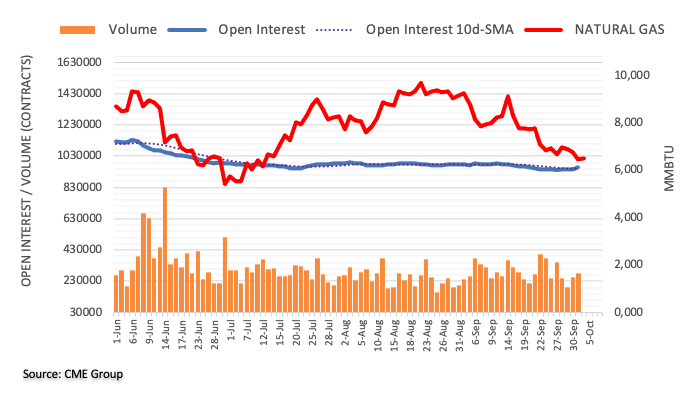

Gold benefited from the broad greenback weakness, trading at around $1,725 a troy ounce. Crude oil prices were also up, with WTI now changing hands at $86.20 a barrel.

Market players now await the Reserve Bank of New Zealand monetary policy decision. The central bank is expected to hike the main rate by 50 bps to 3.5%, and any decision different to that should spur volatility across the FX board.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Turbulence en route to the moon

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:32

USD/JPY Price Analysis: Turns bearish, sliding below the one-hour 200-EMA, as sellers eye 143.00

- USD/JPY drops on a risk-on impulse due to equities rising amidst a falling greenback and US T-bond yields.

- If the USD/JPY clears 144.00, the pair could tumble to 143.00.

- Even though RSI is at oversold conditions, the break of the 200-EMA in the hourly chart shifted the bias downwards.

USD/JPY is subdued, falling for the second straight day as global equities extended their rally, following actions of some central banks, like the Bank of England (BoE) and the Reserve Bank of Australia (RBA), taking a “dovish” stance. Therefore, speculations that the Fed might follow suit sent US T-bond yields and the greenback diving. At the time of writing, the USD/JPY is trading at 144.07, shy of the 144.00 figure, down 0.32%.

USD/JPY Price Analysis: Technical outlook

From a technical analysis perspective, the USD/JPY is still upward biased, even though it is approaching the 20-day EMA at 143.76. Upside lies resistance at around 144.00, followed by Monday’s high at 144.93, ahead of the Bank of Japan’s (BoJ) line on the sand at 145.00.

For the major to shift neutral, the USD/JPY would need to collapse below the September 22 low of 140.34. Once cleared, the next support would be the 50-day EMA at 139.11.

The USD/JPY one-hour scale shows the majors tumbled below 144.67, Tuesday’s daily pivot, and the confluence of the 20, 50, and 100-EMAs, opening the door for further losses. Furthermore, as the USD/JPY heads south, it surpassed the 200-EMA at 144.19, shifting the short-term bias downwards. Albeit the Relative Strength Index (RSI) is at oversold conditions, a fall towards the S2 pivot point at 143.49, ahead of a test of the 143.00 figure.

USD/JPY Key Technical Levels

-

19:34

GBP/USD bulls run into a wall of critical resistance

- GBP/USD bears are lurking at a key confluence area of resistance.

- The tables could be turning in terms of the outlook for the Fed and UK politics.

- Bulls eye a significant breakout on higher time frames.

GBP/USD has been whipsawed on Tuesday in a day that ran through a vast territory for a fresh high for the week so far at 1.1489 from a low of 1.1280. The US dollar was hit hard on the back of poor JOLTS data that has accompanied weak Manufacturing data and prospects of a less hawkish Federal Reserve.

The bears are out to get the greenback and have pushed the pound towards extremes as per the longer-term charts in what has been a very strong bullish correction over the past two weeks from record lows.

The dollar slid against major currencies and along with yields, it would appear to reflect the market participants' views on the outlook for interest rates. At the same time, participants in the sterling money markets welcomed the British government's U-turn on some tax cuts. The pound dropped to a record low of $1.0327 on Sept. 26 and bond prices tumbled following the unveiling of the new government's plans to slash taxes, particularly for the rich, and ramp up borrowing.

However, it was not a popular plan and the plans to get rid of the 45% top rate of income tax has helped the pound to recover, adding to gains that were sparked by the Bank of England (BoE) last week restarting its bond-buying programme following a dramatic plunge in long-dated gilts.

Meanwhile, US yields, which move inversely to prices, were pressured at the start of the week and stayed low on Tuesday on more weak data in the JOLTS Job Openings. This is a survey done by the US Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers and different offices each month:

-638005016651390367.png)

US job openings fell to almost 10.1 million in August, according to the Bureau of Labor Statistics, below the consensus on Econoday for 11.15 million and down from 11.17 million reported in July. The larger-than-expected decline could be the first sign that demand for labour is falling ahead of this week's main event in the US Nonfarm Payrolls data. The weaker data has caused traders to bet the Federal Reserve may raise interest rates less than previously expected.

GBP/USD technical analysis

The weekly outlook is bullish as per the strong recovery. However, the price is running into a wall of a confluence of resistances that include old lows, highs, trendline and high volumes. This would open the prospects of a meanwhile correction for the immediate future which could mean that we have seen the high of the week on Tuesday's trade.

The hourly chart's structures could come under pressure should the price now start to decelerate on the bid and chip into and consequently break the trendline support as the first bearish leading indicator in terms of price action.

-

19:21

Silver Price Forecast: XAG/USD reaches three-month highs above $21.00 on a risk-on impulse

- Silver price clears the $21.00 mark, courtesy of broad US dollar weakness amidst falling US bond yields.

- Speculations that the Fed would tighten at a slower pace spurred the equities recovery since Monday.

- US factory orders remained unchanged, while job openings, fell.

Silver price continues to extend its recovery during the week, climbing above the $21.00 figure for the first time since June 2022, spurred by a soft US dollar and falling US Treasury bond yields. At the time of writing, XAG/USD is trading at $21.02, up by 1.66%, as the North American session progresses.

US equities are trading in the green, signaling investors appetite improving. The greenback remains heavy due to speculations that the Fed might tighten at a slower pace of increases after a reading of US manufacturing activity flashed signs of tempering.

That said, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, creeps lower by 1.14%, at 110.389, undermined by US Treasury bond yields. The US 10-year benchmark note rate coupon is down two bps at 3.619%.

Data-wise, the US economic docket featured factory orders for August, reported by the US Commerce Department. Figures came at 0%, after July’s reading of -1%. Meanwhile, the US Labor Department revealed that job openings in the US dropped, though they remained at higher levels. The US JOLTs report for August showed that vacancies dropped from 11.239M in July to 10.053M in August.

In the meantime, Fed policymakers continued to grab the headlines as Fed Williams, Barkin, Jefferson, and Daly crossed wires.

New York Fed President John Williams said that the Fed’s “job is not yet done” while adding that rates are “not yet in a restrictive place for growth.” Richmond’s Fed Barkin said that a strong dollar has potential spillover effects on the global economy but stressed that the Fed is focused on the US economy.

San Francisco Fed Mary Daly said that further rates are needed, and then the Fed needs to hold restrictive policies in place until “we are truly done” on reaching the Fed’s goal. Earlier in his first remarks, Philip Jefferson said that inflation is the most serious problem facing the Fed. He added, “Restoring price stability may take some time and will likely entail a period of below-trend growth.”

What to watch

The US economic docket will feature the ADP Employment change, alongside the US International Trade and the S&P Global Services and Composite PMIs for September.

Silver (XAG/USD) Key Technical Levels

-

18:45

Fed's Daly: Pace of hiring should slow with job market vacancies falling

San Francisco Federal Reserve Bank President Mary Daly on Tuesday said inflation is causing pain in the economy for many Americans and is a corrosive disease.

Her comments follow the drop in US JOLTS today that sent the US dollar off a cliff to 110.11.

JOLTS Job Openings is a survey done by the US Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers and different offices each month:

-638005016651390367.png)

Earlier, Daly explained that the US central bank needs to push borrowing costs higher and then hold those restrictive policies in place until "we are truly done" on getting inflation back down to the Fed's 2% target.

Key comments

''Rising inflation is corrosive, weighs on disadvantaged.

Inclusive economy means jobs and price stability.

Inflation is not a risk, it is a reality.

Seeing job market vacancies fall, pace of hiring should slow.

We are working toward balancing both side of Fed mandate.

Fortunate economy was so strong ahead of pandemic.

Financial conditions have responded swiftly to changes in Fed outlook.

Always room for fed to do things better.

Did not fully appreciate how long it would take to deal with covid pandemic.

Also didnt appreciate how strong demand was going to be.

Didn't appreciate strength of demand amid pandemic period.

Fed has tools and knowledge to fight high inflation.

We have the tools to fight high inflation, we know how to do that.

Good to see relative stability of long term inflation expectations.

We can't be complacent but so far have not lost inflation anchor.''US dollar update

Meanwhile, the US dollar slid against major currencies on Tuesday as the yield on the benchmark US 10-year Treasury fell to 3.564% as a new low for the week so far. DXY dropped from a high of 111.886 for the day, or 110.870 on the JOLTS data.

-

17:58

USD/CAD drops below 1.3600 on soft US dollar and higher oil prices

- USD/CAD drops 100 pips on Tuesday, extending its weekly losses to almost 2%.

- Broad US dollar weakness and high crude oil prices undermine the USD/CAD, a tailwind for the CAD.

- The US economy is slowing as the Fed wishes, as portrayed by the JOLTs report missing estimations.

- Fed policymakers continue to emphasize the need for higher rates amidst recent US data showing the economy is slowing.

The USD/CAD extended its losses for two-consecutive trading days, courtesy of a soft US dollar and rising oil prices, which underpinned the commodity-linked Loonie amidst a risk-on impulse.

Therefore, the USD/CAD is trading at 1.3553 after hitting a daily high of 1.3664, at around the 200-hour EMA, before the major tumbled towards the 1.3530s area.

On Tuesday, investors’ sentiment improved. US economic data released by the US Department of Labor reported that vacancies edged lower from around 11.239M in July to 10.053M in August. In the meantime, the US Department of Commerce revealed that factory orders for August remained unchanged at 0%, after July’s 1% fall.

After Monday’s ISM, PMI reported that manufacturing activity slowed but remained in expansionary territory. Sub-components showed that the price index dropped while new orders began to fall.

A slew of Fed officials, led by the New York Fed John Williams, crossed newswires since Monday. Williams said that the Fed’s job is “not yet done” while adding that policy “is not yet in a restrictive place for growth,” emphasizing the need for higher rates.

Atlanta’s Fed President Raphael Bostic said that supply chains are putting upward pressure on prices, while Richmond’s Barkin said that a strong dollar has potential spillover effects on the global economy but stressed that the Fed is focused on the US economy.

Of late, the San Francisco Fed Mary Daly said that the Fed is committed to getting inflation low and echoed the NY Fed Williams comments of needing additional rate hikes.

In the meantime, one of the newest Fed board members, Philip Jefferson, said, “Restoring price stability may take some time and will likely entail a period of below-trend growth.”

Aside from this, missing Canadian economic data reported left USD/CAD traders adrift to US dollar dynamics and commodity prices. The US Dollar Index is falling off the cliff after hitting a YTD high at 114.77, though it is down 1.27% at 110.246.

Contrarily, US crude oil prices surged on speculations that OPEC+ could lower global oil production by as much as 2 million barrels per day. Hence, WTI jumped and reached a daily high at around $86.95, shy of the $87 mark, up by more than 3.60%. The cartel is scheduled to meet in October 5.

Therefore, the USD/CAD continued its downtrend, though lately bounced off the lows at around 1.3521 toward the S1 daily pivot point.

What to watch

The Canadian docket will feature Building Permits and Trader Balance on Wednesday, followed by the Bank of Canada (BoC) Tiff Macklem’s speech on Thursday. On the US front, the calendar will reveal US S&P Global PMIs, and the ADP Employment Change report, alongside Fed speaking.

USD/CAD Key Technical Levels

-

17:02

EUR/USD keeps rising amid a weaker USD, approaches parity

- EUR/USD extends gains above 0.9900, next barrier at 1.0015.

- Euro gains more than 400 pips from last week's low.

- US Dollar tumbles across the board on risk appetite and lower US yields.

The EUR/USD rose even further during the American session and climbed to 0.9977, reaching the highest level in a week. It remains near the top, up more than 150 pips for the day and 440 above last week's low.

The next critical level on the upside is the parity area and the 1.0015 resistance area. On the flip side, now 0.9900 has become the initial support followed by 0.9850/55.

Weaker dollar driving EUR/USD higher

On Tuesday, the August JOLTS (Job Openings report) showed the largest monthly decline on record from 11.17 million to 10.05, a possible sign of a slowdown in the job market. The negative report follows the larger-than-expected slide in the September ISM Manufacturing Index released on Monday. On Wednesday, the ADP report is due and on Friday the critical NPF report.

The latest round of US data below expectations contributed to the rally in EUR/USD by weakening the US dollar. The combination of lower US yields and higher equity prices are still affecting the greenback. The DXY is falling by more than 1% trading under 110.50. The US 10-year yield stands at 3.61% near weekly lows, and significantly away from levels above 4% it reached six days ago. In Wall Street, the Dow Jones is rising by 2.50% and the Nasdaq by 3.15%.

Despite the latest data, the Federal Reserve is still seen raising interest rates in order to curb inflation. The same situation applies to the European Central Bank. In a speech on Wednesday, Christine Lagarde said it is difficult to tell if inflation is at a peak. "The minimum that we have to do is to stop stimulating demand," Lagarde added.

Technical levels

-

16:59

United States 52-Week Bill Auction rose from previous 3.46% to 3.955%

-

16:39

AUD/USD: Could drop back to the 0.64 area on 1-3M – Rabobank

The Reserve Bank of Australia on Tuesday rose the key interest rate by 25 basis points, below the market consensus of 50 bps. The Australian dollar initially dropped but then rebounded. AUD/USD is hovering around 0.6500, marginally lower for the day. Analysts at Rabobank consider the AUD/USD could drop back to the 0.64 area in a one to three months period and then could rise toward 0.69 in the middle of 2023.

Key Quotes:

“Today’s decision by the RBA to surprise the market with a smaller than expected 25 bp rate hike brought relief to the Australian stock market. It may also have brought relief to other ‘smaller’ G10 central banks who have been caught up in rush of large incremental rate hikes in recent months probably designed to prevent their currencies falling too far against the mighty USD. Unsurprisingly, AUD/USD did initially drop back on the news of the RBA’s policy decision this morning, though it is now trading off its lows.”

“Various models suggest that the AUD is far less undervalued vs. the USD than the majority of other G10 currencies, while Australia’s CPI inflation rate is at the lower end of the range of G10 economies. This likely afforded the RBA with the breathing room to move away from large incremental rate hikes. That said, the trigger for a more conservative pace of policy tightening is likely rooted in the Australian property market.”

“We retain our view that AUD/USD could dip back to the 0.64 region on a 1-to-3-month view, with scope to recover to 0.69 in the middle of next year.”

“Australia’s current account surplus, strong terms of trade and positive growth outlook are supportive AUD factors. Although AUD/USD may struggle to hold its own vs. the mighty USD on a 1-to-6-month view, we see scope for a recovery into the middle of next year.”

-

16:29

EUR/DKK: Danish central bank likely to hike and widen the spread to ECB’s policy rate - Danske Bank

The Danish central bank intervened significantly in September to defend the fixed exchange regime between the Danish krone and the euro. It was the first intervention since December. Analysts at Danske Bank now expected the Danish central bank to hike 10bp less than the Europan Central Bank over the coming three months. They forecast the key policy rate at 1.80% by the end of the year and at 2.30% in February next year.

Key Quotes:

“Danmarks Nationalbank (DN) resumed FX intervention selling of DKK in September to floor EUR/DKK. DN intervened for DKK23bn - it has not intervened since December last year - and increased the FX reserve to DKK554bn. In our view, the downwards pressure on EUR/DKK is of persistent nature and warrants a widening of the spread to ECB's policy rate. We now expect DN to hike 10bp less than ECB over the coming 3M, i.e. to raise the deposit rate to 1.80% in December and further to 2.30% in February next year.”

“We think it is time for DN to make it more expensive to sell EUR/DKK and push it up towards the middle of the 7.43-7.47 trading range, which would end the need for intervening in the FX market. A 10bp widening of the policy rate spread should be enough, but DN may need to widen it an additional 10bp in our view.”

“We expect ECB to raise interest rates at the coming three meetings, i.e. in October, December and February, by a total of 175bp. We think it is most likely DN uses one of the upcoming two hikes as an opportunity to widen the spread to ECB's policy rate by raising its policy rate 10bp less, but it may also opt to cut its policy rate 10bp at any given Thursday at 17:00CET. DN may need to continue to sell DKK in FX intervention until it widens the policy rate spread.”

-

16:27

Lagarde speech: Difficult to say if inflation is at peak

European Central Bank (ECB) President Christine Lagarde said on Tuesday it was difficult to say whether or not inflation has peaked in the euro area, as reported by Reuters.

"The minimum that we have to do is to stop stimulating demand," Lagarde added.

Market reaction

These comments don't seem to be having a noticeable impact on the shared currency's performance against its major rivals. As of writing, the EUR/USD pair was trading at 0.9972, where it was up 1.5% on a daily basis.

-

16:22

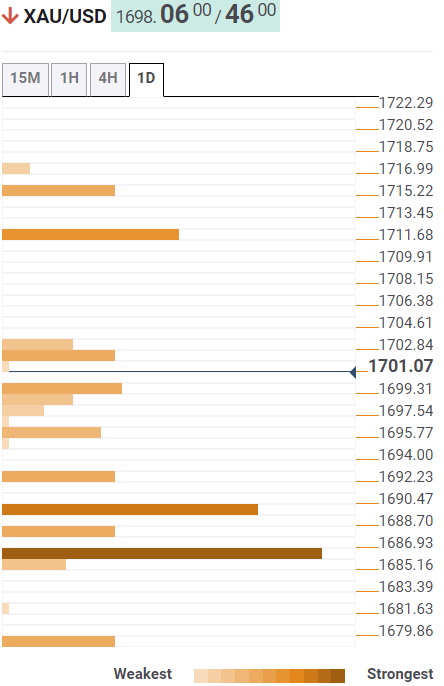

Gold Price Forecast: XAU/USD climbs above $1700, as US T-bond yields plunge

- Gold price rises courtesy of falling US T-bond yields undermining the greenback.

- Sentiment improvement keeps global equities in the green.

- US manufacturing data weakening and Tuesday’s job vacancies falling depict the economy is feeling the Fed’s job.

- Fed officials repeatedly said the need to for higher rates amidst a high inflation environment.

Gold price advanced to three-week highs on Tuesday, as US T-bond yields continue to fall amidst US economic data showing that the Federal Reserve increases to the Federal funds rate (FFR) started to impact the economy as the US central bank scrambles to tame inflation. At the time of writing, XAU/USD is trading at $1723 a troy ounce, up by 1.40%.

Market sentiment swings, keep global equities on the right foot. The greenback is weakening as US treasury bond yields dropped like a stone, with the US 10-year bond yield down six bps at 3.587%. Following suit is the US 10-year Treasury Inflation-Protected Securities (TIPS) yield, a proxy for real yields, creeping lower to 1.367% after hitting a yearly high of 1.70%.

US economic data released on Monday flashed signs that manufacturing activity in the country is slowing. Sub-components of the ISM’s reports portrayed that new orders are contracting while prices are easing.

During the Tuesday session, the US docket featured factory orders for August were unchanged, following July’s drop of 1%, as the Department of Commerce reported. At the same time, job openings in the US fell, though they remained at higher levels, as reported by the Labor Department. The US JOLTs report for August showed that vacancies dropped from 11.239M in July to 10.053M in August.

Therefore, the Federal Reserve decisions are beginning to function, but Fed officials remain laser-focused on bringing inflation down.

Reflection of the aforementioned is the NY Fed President John Williams saying that even though tighter monetary policy has begun to control demand and reduce inflation, “our job is not yet done.” Williams added that policy “is not yet in a restrictive place for growth,” according to him, rates need to go higher.

Later, Atlanta’s Fed Bostic said shifts in global supply chains exert upward pressure on prices. Meanwhile, Richmond’s Fed Barkin added that a strong dollar has potential spillover effects on the global economy but stressed that the Fed is focused on the US economy.

On Tuesday, the San Francisco Fed Mary Daly said that the Fed is committed to getting inflation down and echoed the NY Fed Williams comments of needing additional rate hikes.

What to watch

The US economic docket will feature the ADP Employment change, alongside the US International Trade, and the S&P Global Services and Composite PMIs for September.

XAU/USD Key Technical Levels

-

16:18

NZD/USD rises back to test weekly highs ahead of RBNZ

- US Dollar falls across the board amid risk appetite.

- NZD/USD keeps facing strong resistance around 0.5750.

- RBNZ to decide on monetary policy on Wednesday.

The NZD/USD rose during the American session boosted by a broad-based decline of the US dollar across the board. The pair climbed to 0.5747 and it is hovering around 0.5735, up less than 20 pips for the day, with a bullish momentum.

The kiwi needs to make a clear break above 0.5750 in order to open the doors to further gains. The next barrier is seen at 0.5805. On the flip side, the immediate support might be seen at 0.5725 while the key intraday level is 0.5680, the daily low. A break under 0.5680 would leave the kiwi vulnerable.

The rally of the NZD/USD continues to be driven by a decline of the US dollar across the board. The DXY is falling again on Tuesday, about to post the fourth decline out of the last five days. It is trading at 110.48, the lowest level since September 22.

The improvement in market sentiment and lower US yields weakened the demand for the greenback during the last session. US employment reports due on Wednesday (ADP) and Friday (NFP) will be watched closely.

Next stop: RBNZ

On Tuesday the Reserve Bank of Australia surprised market participants with a rate hike of 25 basis points instead of the 50 bps expected. “Quite clearly, today's RBA decision may stoke speculation that other central banks will begin slowing the pace of hikes”, wrote analysts at TD Securities.

The Reserve Bank of New Zealand will announce its decision on Wednesday (01:00 GMT). A 50 basis points rate hike to 3.50% is expected. It would be the fifth consecutive hike in a row. Any changes to the statement could have a large impact on the kiwi.

Technical levels

-

16:02

New Zealand GDT Price Index below expectations (-0.1%): Actual (-3.5%)

-

16:00

Denmark Currency Reserves rose from previous 531.7B to 554.2B in September

-

15:57

WTI climbs to multi-week highs near $87 on OPEC headlines

Crude oil prices surged higher during the American trading hours on Tuesday and the barrel of West Texas Intermediate (WTI) reached its highest level since mid-September near $87. As of writing, WTI was trading at $86.50, where it was up 3.8% on a daily basis.

Reports suggesting that OPEC+ could lower the oil production by as much as 2 million barrels per day seem to have provided a boost to oil in the second half of the day on Tuesday. The group is scheduled to meet on Wednesday, October 5.

Later in the session, the American Petroleum Institute will release the crude oil inventory data for the week sending September 30.

-

15:49

EUR/USD: Seasonality in October poses another headwind – SocGen

A steady downtrend has led EUR/USD below parity. Economists at Société Générale note that weak seasonals suggest the pair could remain under downside pressure.

Limited upside potential

“A sustained rebound in oil prices after the OPEC+ meeting on Wednesday and strong US payrolls should limit upside for EUR/USD before the US CPI release on 13 October.”

“The bearish seasonality in October could be another headwind. The pair declined in seven of the last ten years in October and by an average of 0.6%.”

-

15:12

US: JOLTS Job Openings fall to 10.1 million in August

- US JOLTS Job Openings declined more than expected in August.

- US Dollar Index stays deep in negative territory below 111.00.

The number of job openings decreased to 10.1 million on the last business day of August, the US Bureau of Labor Statistics (BLS) reported in its Job Openings and Labor Turnover Summary (JOLTS) on Tuesday. This print came in slightly lower than the market expectation of 10.4 million.

"Hires and total separations were little changed at 6.3 million and 6.0 million, respectively," the BLS further noted in its publication. "Within separations, quits (4.2 million) and layoffs and discharges (1.5 million) were little changed."

Market reaction

The US Dollar Index extends its daily slide during the American trading hours and was last seen losing 0.88% on the day at 110.68.

-

15:07

US: Factory Orders virtually unchanged at $548.4 billion in August

- Factory Orders in the US declined modestly in August.

- The dollar continues to weaken against its major rivals.

The data published by the US Census Bureau revealed on Tuesday that new orders for manufactured goods, Factory Orders, declined by less than $0.1 billion in August and remained virtually unchanged at $548.4 billion. This print followed July's contraction of 1% and came in worse than the market expectation for an increase of 0.3%.

"New orders for manufactured durable goods in August, down two consecutive months, decreased $0.5 billion or 0.2%, to $272.7 billion, unchanged from the previously published decrease," the publication further read.

Market reaction

The dollar selloff continues after this data and the US Dollar Index was last seen losing 0.9% on the day at 110.67.

-

15:00

United States JOLTS Job Openings below expectations (10.45M) in August: Actual (10.053M)

-

15:00

United States Factory Orders (MoM) below expectations (0.3%) in August: Actual (0%)

-

15:00

GBP/USD Price Analysis: Bulls struggle to find acceptance above descending trend-line

- GBP/USD gains traction for the sixth successive day and climbs to a two-week high.

- Failure to find acceptance above a descending trend-line warrants caution for bulls.

- Positive technical indicators on the daily chart support prospects for further gains.

The GBP/USD pair prolongs its recent recovery move from an all-time low and gains traction for the sixth successive day on Tuesday. The momentum lifts spot prices to a two-week high, though falter near the 1.1430 region.

From a technical perspective, bulls seem to struggle to find acceptance above a downward-sloping trend-line resistance extending from the August monthly swing high. Technical indicators, meanwhile, have just started gaining positive traction on the daily chart and support prospects for further gains.

That said, it will still be prudent to wait for a sustained move beyond the daily high, around the 1.1430 area before positioning for an extension of the appreciating move. The GBP/USD pair might then comb to the 1.1500 psychological mark and extend the move towards the 1.1530-1.1540 supply zone.

Some follow-through buying will suggest that the GBP/USD pair has formed a near-term bottom. This, in turn, should pave the way for a move towards the 1.1600 round-figure mark en route to the 1.1670 hurdle. The latter coincides with the 50-day SMA and should act as the next key pivotal point.

On the flip side, any meaningful pullback could attract some buyers near the 1.1300 round-figure mark and find decent support around the 1.1280-1.1260 region. Failure to defend the said support will shift the bias back in favour of bears and prompt aggressive technical selling around the GBP/USD pair.

The subsequent downfall has the potential to drag spot prices below the 1.1200 round-figure mark, towards testing the next relevant support near the 1.1160-1.1155 region. The downward trajectory could further get extended towards the 1.1100-1.1085 zone, or the weekly low touched on Monday.

GBP/USD daily chart

-638004887285780050.png)

Key levels to watch

-

14:51

Silver Price Analysis: XAG/USD needs to breach $22.60 to attract additional buyers – TDS

Silver prices are surging. However, strategists at TD Securities note that XAG/USD needs to surpass the $22.60 mark to alleviate downside pressure.

Explosive silver prices are reminiscent of a #silversqueeze2.0

“Our CTA Position tracker highlights that a break above $19.32 likely sparked a CTA buying program. As a result of the break, CTAs are set to cover ~10% of their maximum historical short, exacerbating upside flows with few participants taking the other side.”

“We estimate that prices would need to breach $22.60 to catalyze additional CTA buying, suggesting that the #silversqueeze2.0 won't see much follow through.”

“We expect another beat on this week's nonfarm payroll data on Friday, which could present be a catalyst for a repricing lower.”

-

14:49

Fed's Daly: There's a lot of room to slow labor market

In an interview with CNN on Wednesday, San Francisco Fed President Mary Daly reiterated that the Federal Reserve is committed to getting inflation down, as reported by Reuters.

Additional takeaways

"Inflation hasn't gotten into Americans' psychology."

"Americans have faith Fed can bring inflation down."

"We need further rate hikes, hold policies until we are truly done with getting inflation down."

"There's a lot of room to slow labor market, I expect unemployment to rise to 4.5%."

"We have a narrow path for softer landing."

Market reaction

These comments did little to nothing to help the dollar find demand. As of writing, the US Dollar Index was down 0.6% on the day at 110.97.

-

14:44

USD/CAD set to climb towards 1.41 by end Q4 – Credit Suisse

Further CAD weakness is likely if the inflation data slowdown is confirmed – economists at Credit Suisse now see USD/CAD at 1.4100 by the end of Q4.

Markets eye an early end to Bank of Canada tightening

“Markets now anticipate the BoC to hike rates at the next two meetings and start easing as early as Q1 2023. If the BoC were to validate this shift in expectations, USD/CAD price action would likely become mainly a function of US yields. Conversely, pushback from the BoC against the early priced in end to the tightening cycle can bring local idiosyncrasies back to the fore in USD/CAD. This calls for a wide range approach: we see USD/CAD trading between 1.3250 and 1.4300 in Q4.”

“Uncertainty about BoC policy and high realized sensitivity to risk sentiment lead us away from the resilient CAD view we held in Q3: we now see USD/CAD ending Q4 around 1.4100.”

-

14:22

AUD/USD keeps the red below 0.6500 mark, weaker USD/risk-on offers some support

- AUD/USD continues to be weighed down by the RBA’s smaller than expected 25 bps rate hike.

- The prevalent USD selling bias offers some support to the major and helps limit the downside.

- Retreating US bond yields and the risk-on mood is seen weighing on the safe-haven greenback.

The AUD/USD pair struggles to capitalize on its intraday move up to over a one-week high and meets with a fresh supply near the mid-0.6500s on Tuesday. The pair maintains its offered tone through the early North American session and is currently placed around the 0.6475 area, just a few pips above the daily low.

The Australian dollar continues to be weighed down by the fact that the Reserve Bank of Australia (RBA) delivered a dovish surprise and lifted the cash rate by 25 bps. The increase was smaller than the 50 bps already priced in the markets and disappointed investors, which, in turn, is seen as a key factor weighing on the AUD/USD pair.

The downside, however, remains cushioned, at least for the time being, amid the prevalent selling bias surrounding the US dollar. The US Treasury bond yields prolong their recent pullback from a multi-year high touched last week. This, along with the risk-on impulse, undermines the safe-haven buck and benefits the risk-sensitive aussie.

Despite the supporting factor, the AUD/USD pair, so far, has been struggling to attract any meaningful buying. This, in turn, suggests that the path of least resistance for spot prices is to the downside. Hence, some follow-through weakness back below the 0.6400 mark, towards retesting the YTD low near the 0.6365 area, remains a distinct possibility.

Next on tap is the US economic docket, featuring JOLTS Job Openings and Factory Orders data. This, along with speeches by influential FOMC members and the US bond yields, will influence the USD price dynamics and provide some impetus to the AUD/USD pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities.

Technical levels to watchc

-

14:19

EUR/USD extends the upside to 2-week highs past 0.9900 ahead of Lagarde

- EUR/USD picks up extra pace and trespasses 0.9900.

- The dollar remains well under pressure, as DXY breaks 111.00.

- ECB’s Lagarde is due to speak later in the session.

While the greenback accelerates its daily decline, EUR/USD exacerbates its march north and breaks above the key 0.9900 hurdle on Tuesday.

EUR/USD now targets the parity zone

Indeed, EUR/USD now navigates the area of fresh 2-week highs past the 0.9900 hurdle, always propped up by the weaker tone surrounding the buck, which appears in turn under pressure against the backdrop of declining US yields across the curve.

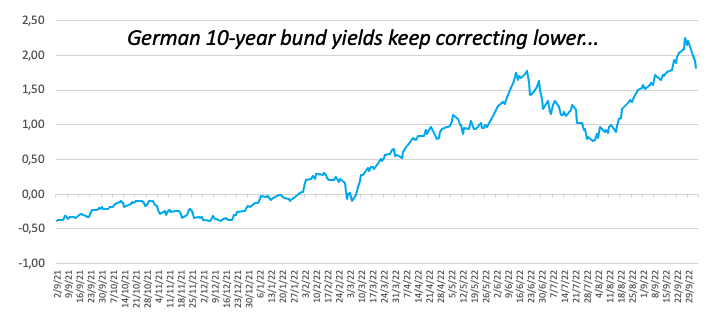

However, the decline in yields is by no means exclusive to the US debt market. In fact, the German 10-year bund yields retreat to multi-session lows in the vicinity of 1.75% after climbing to levels last seen in August 2011 just few sessions ago.

Data wise in Euroland - and while market participants wait for Chairwoman Lagarde – Producer Prices in the euro zone rose more than expected 5% MoM in August and 43.3% over the last twelve months.

In the US, all the attention will be on the release of Factory Orders and speeches by FOMC’s Logan, Williams, Mester, Jefferson and Daly.

What to look for around EUR

EUR/USD keeps the strong recovery well and sound with the renewed target at the 0.9900 neighbourhood, always against the backdrop of the intense drop in the greenback.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The latter has been exacerbated further following the latest rate hike by the Fed and the persevering hawkish message from Powell and the rest of his rate-setters peers.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: Eurogroup Meeting, Germany, EMU Final Manufacturing PMI (Monday) – ECB Lagarde (Tuesday) – Germany Balance of Trade, EMU, Germany Final Services PMI (Wednesday) – Germany Construction PMI, EMU Retail Sales, ECB Accounts (Thursday) – Germany Retail Sales (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian post-elections developments. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.95% at 0.9918 and the breakout of 0.9934 (weekly high October 3) would target 1.0032 (55-day SMA) en route to 1.0050 (weekly high September 20). On the other hand, the next support appears at 0.9535 (2022 low September 28) ahead of 0.9411 (weekly low June 17 2002) and finally 0.9386 (weekly low June 10 2002).

-

13:55

United States Redbook Index (YoY) climbed from previous 11% to 12.3% in September 30

-

13:39

GBP/JPY eases from multi-week high, still well bid around mid-164.00s amid risk-on

- GBP/JPY gains traction for the sixth successive day and climbs to a nearly three-week high.

- The UK government's U-turn on planned tax cut continues to underpin the British pound.

- The risk-on mood weighs on the safe-haven JPY and contributes to the appreciating move.

The GBP/JPY cross builds on last week's strong recovery from its lowest level since February 2021 and scales higher for the sixth successive day on Tuesday. Spot prices, however, trim a part of intraday gains to a nearly three-week high and retreat to mid-164.00s during the mid-European session.

Investors welcomed the UK government's U-turn on a controversial tax cut plan announced in its mini-budget last week. Furthermore, the Bank of England reaffirmed its willingness to buy up to £5 billion of long-dated gilts, which continues to act as a tailwind for the British pound and the GBP/JPY cross.

The Japanese yen, on the other hand, is undermined by the dovish adopted by the Bank of Japan, which marks a big divergence in comparison to other major central banks. This, along with the risk-on impulse, weighs on the safe-haven JPY and provides an additional lift to the GBP/JPY cross.

Japan's Finance Minister Shunichi Suzuki, meanwhile, said on Monday that the country stands ready to take decisive steps in the foreign exchange market if excessive yen moves persist. This, in turn, helps limit losses for the JPY and keeps a lid on the GBP/JPY cross, at least for the time being.

From a technical perspective, the overnight sustained strength beyond the 163.00 supply zone, which coincides with the 100-day SMA, favours bullish traders and supports prospects for additional gains. Hence, any meaningful pullback could still be seen as a buying opportunity and remain limited.

Technical levels to watch

-

13:21

AUD/USD: Tighter financial conditions to pressure aussie before recovery in 2023 – MUFG

The Australian dollar weakened sharply in September as financial conditions tightened globally. This trend is set to persist for the rest of the year, economists at MUFG Bank report.

Sharp housing market correction is a clear downside risk

“The economy in Australia remains resilient but there are signs of weakness in the housing market. While the still strong labour market is reason for optimism on the outlook for the economy, a sharp housing market correction is a clear downside risk.”

“With global equities and commodities set for further declines before year-end as major central banks continue to tighten aggressively, we see all currencies weakening further against the US dollar through to year-end. Assuming equities then bottom and central banks are allowed to pause, some reversal for AUD/USD next year seems likely.”

-

13:11

ECB' Villeroy: Will raise rates as much as necessary to bring core inflation down

European Central Bank (ECB) policymaker Francois Villeroy de Galhau reiterated on Tuesday that they will raise interest rates as much as necessary to bring core inflation down, as reported by Reuters.

Additional takeaways

"This will have a positive effect on banks’ net income, European banks are hence more solid than feared by some."

"We should go to neutral rate without hesitation, by the end of the year."

"We could start then a second part of the journey, a more flexible and possibly slower one."

"I don’t say that rate hikes will stop there but we will have to comprehensively assess inflation and economic outlook."

"We are no longer gradual, but it is important to remain orderly."

"It means that you neither excessively surprise markets, nor tighten financial conditions too abruptly."

Market reaction

EUR/USD preserves its bullish momentum after these comments and was last seen gaining 0.65% on the day at 0.9888.

-

12:56

S&P 500 Index: Next potential supports at 3500/3460 – SocGen

S&P 500 has resumed its downtrend. Analysts at Société Générale note that the technical outlook denotes prevalence in downward momentum.

Failure to reclaim 3900 can lead to continuation in decline

“Monthly RSI is now close to the lower limit of its bullish territory (near 40 levels); this band has cushioned the declines since 2010. However, signals of a trend reversal are still not visible in price action.”

“Short-term resistance is located at 3860/3900, the 38.2% retracement from August. Failure to reclaim 3900 can lead to continuation in decline.”

“Next potential supports are at projections of 3500/3460 and February 2020 levels of 3393.”

-

12:27

EUR/USD to enjoy a deeper recovery on a break above 0.9945 – BBH

EUR/USD traded as high as 0.9905 today. The pair could rally towards 1.02 on a break past 0.9945, economists at BBH report.

ECB tightening expectations have fallen in recent days

“Break above 0.9945 would set up a deeper recovery to the September 12 high near 1.02.”

“The eurozone reported August PPI. It came in a tick higher than expected at 43.3% YoY vs. a revised 38.0% (was 37.9%) in July. After some relief in May and June, PPI inflation has resumed climbing to new record highs and points to continued upward pressure to CPI. However, ECB tightening expectations have fallen in recent days.”

-

12:16

USD/TRY: Risks remain heavily tilted to the downside for the lira – MUFG

The Turkish lira has remained relatively more stable against the US dollar for most of September. Despite recent stability, the trend remains in favour of a faster sell-off resuming, in the opinion of economists at MUFG Bank.

Lira’s recent resilience unlikely to last

“We do not expect the lira’s recent resilience to last. Turkey’s weak economic fundamentals still favour further lira weakness.”

“The widening current account deficit, elevated inflation, and negative real policy rate remain a recipe for further lira weakness.”

See: USD/TRY will continue to rise gradually for now, breaking above 19 – Credit Suisse

-

11:43

EUR/USD Price Analysis: The hunt for parity

- EUR/USD pushes higher and already surpasses the 0.9900 mark.

- Extra gains now target the key barrier at the parity zone.

EUR/USD advances further and breaks above the key 0.9900 hurdle on turnaround Tuesday.

Considering the ongoing strong rebound, further upside should remain on the table and with the immediate hurdle now at the psychological parity level. Beyond the latter, there is a temporary resistance at the 55-day SMA, today at 1.0033.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0639.

EUR/USD daily chart

-

11:40

RBNZ Preview: Forecasts from eight major banks, hawkish stance warrants 50 bps

The Reserve Bank of New Zealand (RBNZ) will announce its monetary policy decision on Wednesday, October 5 at 01:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of eight major banks.

RBNZ is expected to hike the Official Cash Rate (OCR) by 50 basis points (bps) to 3.50%. Such a hike would mean the central bank hiked policy rates by 50 bps for the fifth meeting in a row. The focus will be on RBNZ’s policy guidance.

ANZ

“We expect the RBNZ will raise the OCR 50 bps to 3.50%. On balance, local data since the August MPS has not brought any large surprises. But global central banks have become a lot more hawkish. We continue to expect OCR to reach a peak at 4.75% by mid-2023.”

Westpac

“We now expect the OCR to reach a peak of 4.5% (previously 4%). This week, the RBNZ is likely to hike by another 50 basis points to 3.5%, and signal further increases ‘at pace’.

TDS

“Employment is above sustainable levels and Q2 GDP handily beat expectations. We think the RBNZ needs to bring the OCR well above 4% to cool demand in line with supply, so as to ease inflation pressures. Markets will watch if the RBNZ retains its forward guidance of tightening ‘at pace’ for any indication of a step down to 25 bps hikes.”

Citibank

“With expectations of further global central bank tightening and New Zealand’s labor market characterized by record-high demand for labor, we expect a 50 bps hike from the RBNZ together with a hawkish statement. A move to 3.50% by the RBNZ this week is likely to be followed by a further 50 bps hike to be delivered on 23 November 2022 and a final 25 bps OCR increase on 22 February 2023 to a terminal rate of 4.25% with rate cuts expected starting Q1 2024.”

Wells Fargo

“We expect the RBNZ to hike rates by 50 bps to 3.50%. Seeing as the RBNZ now expects inflation to remain elevated for longer, we expect additional rate hikes in the months to come until we are closer to the 4% range.”

Danske Bank

“We expect another 50 bps hike to 3.50% in line with consensus.”

NAB

“We expect the MPC to lift the OCR 50 bps, to 3.50%, and sanction the likelihood of another 50 bps, to 4.00% at November’s MPS.”

UOB

“At this RBNZ meeting, we are penciling in a 50 bps hike in the OCR to 3.50%. We believe the RBNZ is on track to hike the OCR to 4.00% by the end of this year, though risks remain skewed towards more rate hikes in 1Q23, and thus an OCR higher than 4%, before the RBNZ pauses in the current tightening cycle.”

-

11:36

USD/CAD recovers early lost ground to sub-1.3600 levels, lacks follow-through

- USD/CAD stages a modest intraday bounce from over a one-week low touched earlier this Tuesday.

- Bullish crude oil prices underpin the loonie and cap the upside amid the prevalent USD selling bias.

- Retreating US bond yields and the risk-on mood continues to dent demand for the safe-haven buck.

The USD/CAD pair reverses an intraday dip to sub-1.3600 levels, or over a one-week low and inches back closer to the daily high during the mid-European session. The uptick, however, lacks follow-through and the pair remains below the mid-1.3600s amid the heavily offered tone surrounding the US dollar.

In fact, the USD Index, which measures the greenback's performance against a basket of currencies, hits a one-and-half-week low amid the ongoing downfall in the US Treasury bond yields. The Bank of England's reaffirmation to buy up to £5 billion of long-dated gilts drags the US Treasury bond yields away from a multi-year top touched last week.

This, along with the risk-on impulse, forces the safe-haven USD to prolong its recent pullback from a two-decade high. Apart from this, bullish crude oil prices, bolstered by expectations for the biggest supply cut by OPEC+ since the 2020 COVID crisis, underpin the commodity-linked loonie and act as a headwind for the USD/CAD pair.

That said, growing acceptance that the Federal Reserve will stick to its aggressive rate hiking cycle could help limit the downside for the greenback. Furthermore, concerns that a deeper global economic downturn will dent fuel demand should cap the black liquid and supports prospects for the emergence of some buying around the USD/CAD pair.

Market participants now look forward to the US economic docket, featuring the release of JOLTS Job Openings and Factory Orders data later during the early North American session. This, along with speeches by influential FOMC members, the US bond yields and the broader risk sentiment, will drive the USD and provide some impetus to the USD/CAD pair.

Technical levels to watch

-

11:32

EUR/NOK: Short-term drivers favour further krone weakness – MUFG

The krone has been one of the worst performing G10 currencies in September resulting in EUR/NOK hitting a fresh year to date high of 10.682. In the view of economists at MUFG Bank, risks are titled to downside for the Norwegian currency.

Lower oil prices undermine NOK

“The renewed sell-off for the krone has coincided with the ongoing hawkish repricing of central bank rate hike expectations. It has triggered a further sell-off in global equity markets that have hit fresh year to date lows as fears over a hard landing for the global economy have intensified.The NOK has been one of the most sensitive G10 currencies this year to the performance of global equity markets.”

“The krone has been undermined as well by the correction lower in the price of oil which has almost reversed all of the gains from the 1H of this year. The developments leave the krone vulnerable to further weakness in the near-term.”

“The Norges Bank’s decision to deliver another 50 bps hike at their latest policy meeting provides only limited support for the krone in current market conditions.”

-

11:30

USD Index Price Analysis: Further decline could revisit 109.35

- DXY exacerbates the losses amidst broad-based risk appetite.

- A deeper retracement could see the weekly low at 109.35 revisited.

DXY adds to the sour start of the week and puts the 111.00 neighbourhood to the test on Tuesday.

In the current context, the continuation of the corrective decline appears likely and with the next target at the weekly low at 109.35 (September 20). The loss of the latter could retest the interim support at the 55-day SMA at 108.61.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 107.20.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.60.

DXY daily chart

-

11:22

EUR/JPY Price Analysis: Above 144.00 comes the 2022 high

- EUR/JPY extends the sharp bounce beyond the 143.00 mark.

- The breakout of 144.04 should open the door to the YTD high.

EUR/JPY remains well bid and trades in multi-session peaks above the 143.00 yardstick on Tuesday.

The continuation of the rebound from last week’s lows remains well in place for the time being. That said, if the cross breaks above the weekly top at 144.04 (September 20), it could then challenge the 2022 peak at 145.63 (September 12).

In the meantime, while above the key 200-day SMA at 135.97, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

11:03

AUD/USD to tumble towards 0.61 on a dip under 0.6365 – SocGen

The AUD/USD pair breached July lows of 0.6680 extending the decline towards the lower limit of a steep channel at 0.6365. Analysts at Société Générale highlight the next levels that the aussie could target.

Gradual downtrend could persist while below 0.6680

“July trough of 0.6680 is expected to be a short-term resistance. Holding below this hurdle, the gradual downtrend could persist.”

“Below 0.6365, next potential supports are at projections of 0.6210 and 0.6100, the 76.4% retracement from 2020.”

See – AUD/USD: Little upside scope after dovish RBA – Commerzbank

-

10:54

USD/JPY struggles for a firm direction, remains confined in range below 145.00 mark

- USD/JPY edges higher on Tuesday, though lacks follow-through and remains below the 145.00 mark.

- The Fed-BoJ policy divergence, the risk-on mood undermines the safe-haven JPY and offers support.

- Retreating US bond yields continues to weigh on the USD and caps any meaningful gains for the pair.

The USD/JPY pair extends its consolidative price move on Tuesday and remains confined in a one-week-old trading range, below the 145.00 psychological mark through the first half of the European session.

A big divergence in the monetary policy stance adopted by the Bank of Japan and other major central banks, along with the risk-on impulse, undermines the safe-haven Japanese yen. This, in turn, acts as a tailwind for the USD/JPY pair. That said, a combination of factors is holding back bulls from placing aggressive bets and capping the upside, at least for the time being.

Japan's Finance Minister Shunichi Suzuki said on Monday that the country stands ready to take decisive steps in the foreign exchange market if excessive yen moves persist. This, along with the prevalent selling bias surrounding the US dollar and the narrowing of the US-Japan rate differential, further contributes to keeping a lid on any meaningful gains for the USD/JPY pair.

The Bank of England's reaffirmation to buy up to £5 billion of long-dated gilts drags the US Treasury bond yields away from a multi-year top touched last week. This, in turn, forces the USD to prolong its recent sharp pullback from a two-decade high. That said, expectations for a more aggressive policy tightening by the Fed support prospects for the emergence of some USD dip-buying.

The markets seem convinced that the Fed will continue to hike interest rates at a faster pace to tame inflation and have been pricing in another supersized 75 bps increase in November. The USD bulls, however, await a fresh catalyst before placing bets. Hence, the focus will remain glued to the release of the closely-watched US monthly employment details or the NFP report on Friday.

In the meantime, traders on Tuesday will take cues from the US economic docket, featuring JOLTS Job Openings and Factory Orders data later during the early North American session. This, along with speeches by influential FOMC members and the USD bond yields, will drive the USD demand. Apart from this, the broader risk sentiment should provide some impetus to the USD/JPY pair.

Technical levels to watch

-

10:21

GBP/USD: Buyers could continue to dominate in case 1.1440 resistance fails

GBP/USD advanced to a fresh two-week high above 1.1400 on Tuesday. The pair needs to clear 1.1440 to keep its bullish bias, FXStreet’s Eren Sengezer reports.

Cable needs to clear 1.1440 to extend rally

“On the upside, 1.1440 (200-period SMA) aligns as key resistance. In case buyers flip that level into support, GBP/USD could target 1.1500 (psychological level) and 1.1600 (psychological level).”

“The ascending trend line coming from September 28 aligns as key support at 1.1350 ahead of 1.1300 (psychological level, Fibonacci 61.8% retracement of the latest downtrend) and 1.1225 (100-period SMA).”

-

10:15

Gold Price Forecast: XAU/USD sits near three-week high, above $1,700 amid weaker USD

- Gold gains strong follow-through traction and rallies to a three-week high on Tuesday.

- Retreating US bond yields weighs heavily on the USD and offers support to the metal.

- Bulls shrug off the risk-on impulse, though hawkish Fed expectations could cap gains.

Gold is extending the overnight breakout momentum through the $1,680-$1,685 supply zone and building on its recovery from the lowest level since April 2020. The strong follow-through positive move lifts the XAU/USD to a three-week high, around the $1,710 region during the first half of the European session on Tuesday.

The US dollar retreats further from a two-decade top touched last week and turns out to be a key factor driving flows towards the dollar-denominated commodity. The Bank of England's willingness to buy up to £5 billion of long-dated gilts drags the US bond yields away from a multi-year top and continues to weigh on the greenback.

Apart from this, growing worries about a deeper economic downturn in the US and Europe offer additional support to the safe-haven gold. The fears were further fueled by Monday's disappointing US data, which showed that manufacturing activity grew marginally in September, at its slowest pace in nearly 2-1/2 years.

This, to a larger extent, helps offset the risk-on mood and does little to dent the prevalent bullish sentiment surrounding gold. That said, the prospects for a more aggressive policy tightening by major central banks could act as a headwind for the non-yielding yellow metal and keep a lid on any further gain, at least for now.

Market participants now look forward to the US monthly employment details, scheduled for release on Friday. The popularly known NFP report will play a key role in influencing the Fed's future rate hike path. This, in turn, should help investors to determine the next leg of a directional move for the greenback and gold.

In the meantime, Tuesday's US economic docket features JOLTS Job Openings and Factory Orders data. This, along with speeches by FOMC members and the US bond yields, will drive the USD demand and provide impetus to the XAU/USD. Traders will also take cues from the broader risk sentiment for short-term opportunities around gold.

Technical levels to watch

-

10:04

One further leg higher before any reversal of USD strength – MUFG

The US dollar continued to strengthen sharply in September. Economists at MUFG Bank expect the greenback to remain strong for the rest of the year.

Equity markets to decline further before year-end

“We expect equity markets to decline further before year-end. A full drawdown of between 30% and 35% from the record high in January is feasible if global yields continue to move higher and US dollar strength persists. These conditions worsen the outlook, resulting in earnings downgrades which fuels further asset price declines and further US dollar strength.”

“With the Fed seemingly indifferent to US dollar strength and declining asset prices, it is clear the Fed is content to see tighter financial conditions play a role in driving inflation lower. Hence, we see US dollar appreciation being sustained through Q4 and only once there is a clear sense of the Fed pausing can we expect US dollar momentum to turn. We assume Q1 2023 will see the start of that.”

-

10:02

Saudi Aramco’s CEO: Our expectation is that oil demand will pick up

Amin H. Nasser, CEO of Saudi Aramco, in his latest comments on Tuesday, touches upon the European energy crisis and global oil demand outlook.

Key quotes

The issue for Europe is gas and LNG given lack of spare capacity.

The oil market is focusing on short-term rather than long-term economics.

The oil market is not focusing on tight supply fundamentals.

Oil spare capacity is extremely low, around 1.5% of total supply.

13 mln bpd Saudi production will come in 2027.

It takes 30 days to reach saudi maximum capacity of 12 mln bpd.

Our expectation is that oil demand will pick up.

Having spare oil capacity is not just responsibility of Saudi Arabia.

Market reaction

WTI was last seen trading near daily highs of $83.85, cheering the upbeat remarks from Aramco Chief. The US oil is up 1.10% on the day.

-

10:02

New Zealand: Further tightening expected from the RBNZ – UOB

Economist at UOB Group Lee Sue Ann suggests the RBNZ could hike the OCR by 50 bps at its meeting on October 5.

Key Quotes

“We believe the RBNZ is on track to hike the OCR to 4.00% by the end of this year, though risks remain skewed towards more rate hikes in 1Q23, and thus an OCR higher than 4%, before the RBNZ pauses in the current tightening cycle.”

“At this RBNZ meeting in Oct, we are penciling in a 50bps hike in the OCR to 3.50%.”

-

10:01

European Monetary Union Producer Price Index (YoY) came in at 43.3%, above forecasts (43.2%) in August

-

10:00

European Monetary Union Producer Price Index (MoM) meets expectations (5%) in August

-

09:53

EUR/USD: Recovery looks quite fragile, high risk of a return to 0.95 – ING

EUR/USD is near to smash the critical hurdle of 0.9900. However, economists at ING note that the pair could see a substantial correction at any time.

No idiosyncratic support

“The euro has still failed to show any substantial idiosyncratic bullish push. This is hardly surprising given the still very challenging outlook for the eurozone and elevated uncertainty about the energy crisis heading into the cold months.”

“The EUR/USD recovery is looking quite fragile, which means that any slight dollar recovery could trigger a wider correction in the pair.”

“We still see a high risk of a return to 0.9500 over the coming weeks.”

-

09:45

China: Mixed readings from PMIs in September – UOB

UOB Group’s Economist Ho Woei Chen, CFA, reviews the latest PMI results in the Chinese economy.

Key Takeaways

“China’s official manufacturing PMI released by CFLP unexpectedly rebounded to expansion in Sep but the private sector Caixin manufacturing PMI which tracked smaller private companies fell deeper in contraction.”

“The CFLP non-manufacturing PMI remained in expansion but moderated by a much larger than expected 2.0 points to 50.6 in Sep (Bloomberg est: 52.4; Aug: 52.6). The strengthening in construction index to its highest since Aug 2021 (60.2 from 56.5 in Aug) likely due to the realisation of government’s infrastructure spending failed to offset a sharp decline in the services activity index (48.9 from 51.9 in Aug) which tumbled into contraction for the first time since May this year.”