Notícias do Mercado

-

23:59

EUR/JPY Price Analysis: A bearish harami in the daily chart could pave the way towards 142.00

- EUR/JPY sellers stepped in around 144.00, sending the pair sliding below 143.00.

- A bearish harami candle pattern in the daily chart suggests the EUR/JPY might be headed to the downside.

- Short term, the EUR/JPY hourly chart portrays the 20-EMA crossing under the 50-EMA, opening the door for a resumption of the downtrend.

The EUR/JPY retreats from weekly highs, as traders dump riskier assets, as market participants assess that a Fed “dovish” pivot might not happen, as Fed policymakers reiterated that further rate hikes are coming. At the time of writing, the EUR/JPY is trading at 142.88, below its opening price as the Asian session begins.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY rally stalled around 144.00 as Wednesday’s price action opened near Tuesday’s close and hit a daily low at 142.44 before closing at 142.98. Traders should be aware that a bearish-harami candle chart pattern emerged, as shown by the EUR/JPY daily chart. Therefore, if the EUR/JPY breaks decisively, October’s 5 low of 142.44 could pave the way for further losses.

The EUR/JPY’s first support would be the 20-day EMA at 142.11, which, once cleared, will expose the 142.00 mark.

In the one-hour scale, the EUR/JPY depicted a double top chart pattern, fulfilled through Wednesday’s session, falling towards the October 3 high at 142.46 before bouncing off toward the current exchange rate. Nevertheless, the 20-EMA is about to cross under the 50-EMA around 143.18, which coupled with the RSI’s aiming lower in bearish territory, could open the door for a resumption of the downtrend.

Therefore, the EUR/JPY first support would be the confluence of October’s 3 low and the 100-EMA at 132.44/48. The break below will expose the S1 daily pivot at 142.26, followed by the S2 pivot point at 141.50, ahead of the 200-EMA at 140.88.

EUR/JPY Key Technical Levels

-

23:51

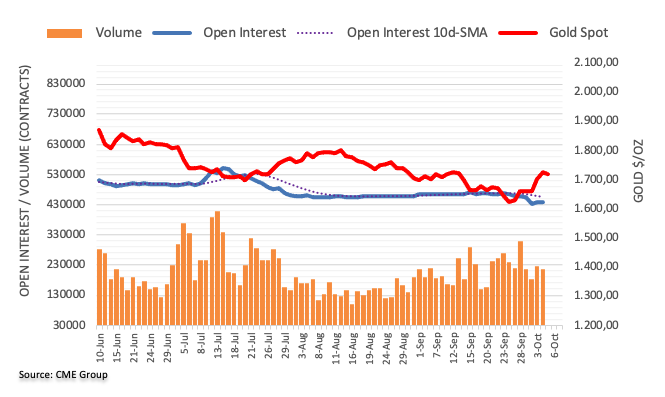

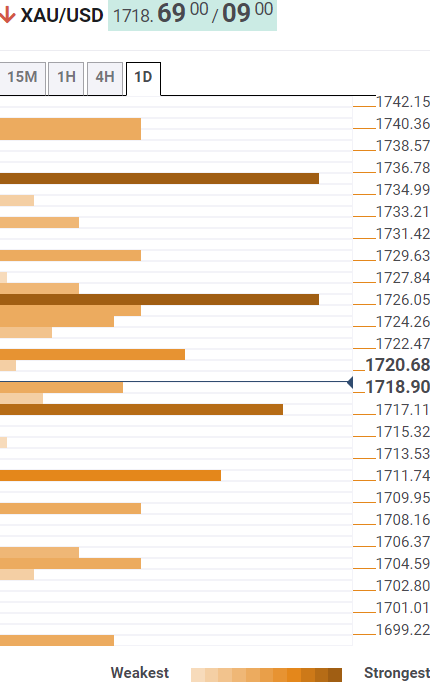

Gold Price Forecast: XAU/USD aims to extend recovery above $1,720 as focus shifts to US NFP

- Gold price has resumed its upside journey after a pullback to near $1,700.00.

- Escalating Japan-North Korea tensions are turning the risk-profile wheel to the negative side.

- After bumper US ADP data, upbeat NFP numbers would soar the odds of a 75 bps rate hike further.

Gold price (XAU/USD) has turned sideways after sensing demand around the critical support of $1,700.00. The precious metal is aiming to cross the $1,720.00 hurdle and will find its next barricade around $1,730.00. The yellow metal is holding its gains while the market sentiment is turning negative on escalating tensions between Japan and North Korea.

The option of announcing a third consecutive 75 bps rate hike by the Federal Reserve (Fed) is getting votes now. Earlier, the San Francisco Fed President Mary Daly said that inflation remains high, adding that more rate hikes are needed. She emphasized that the Fed is “resolute” on raising rates further to bring inflation down.

Apart from that, upbeat payroll data dictated that the pace of hiring by the corporate is not slowed down yet. The US Automatic Data Processing (ADP) data reported higher at 208k vs. the prior release of 200k. Also, a better-than-projected US ISM non-manufacturing gamut is hinting that the overall demand is still solid.

On Friday, the release of the US Nonfarm Payrolls (NFP) will display a true picture of the labor market status. As per the consensus, the economy has added 250k fresh jobs lower than the reading of 315k reported for August.

Gold technical analysis

Gold prices have bounced back sharply after sensing a significant buying interest around the horizontal support placed from October 10 high at $1,702.62. The 200-period Exponential Moving Average (EMA) has acted as major support for the counter. Also, the termination of a corrective move to near $1,700.00 has pushed the gold prices back above the 50-EMA at around $1,714.00.

Meanwhile, the Relative Strength Index (RSI) (14) is hovering around 60.00 and is looking to establish above the same.

Gold intraday chart

-

23:17

AUD/USD corrects to near 0.6500 as hawkish Fed bets soar

- AUD/USD has surrendered the 0.6500 cushion as firmer US ADP has spurted the hawkish Fed bets.

- The release of better-than-projected payroll data and ISM Services PMI data soared DXY’s appeal.

- Market mood has turned sour as North Korea launched a missile in early Tokyo.

The AUD/USD pair has dropped marginally below the psychological support of 0.6500 after facing barricades around the usual resistance of 0.6520, acting firmer for the past few trading sessions. The risk-off profile has got traction back amid escalating Japan-North Korea tensions. Kim Jong-un region is continuously firing missiles and one has been reported outside Japan’s EEZ-NHK in early Tokyo. Also, the 10-year Treasury yields are holding them at elevated levels above 3.75% while writing.

Meanwhile, the US dollar index (DXY) is expected to oscillate above 111.20 and will later resume recovery further. A firmer demand has been recorded at around 110.00, which will continue its upside momentum on higher-than-expected US ISM Services PMI data. The economic data has landed at 56.7, higher than the expectations of 56.0. Also, the New Order Index that illustrates forward demand has been reported higher at 60.6 vs. the projections of 58.9.

Apart from that, a release of better-than-projected US Automatic Data Processing (ADP) Employment data has spurted the odds of a fourth consecutive 75 basis point (bps) rate hike by the Federal Reserve (Fed). According to US ADP payroll data, the US economy has added 208k jobs than the estimates of 200k which has pushed the odds for a 75 bps rate hike to 67.8%, showed by the CME Fedwatch tool.

On the Aussie front, investors are still in a hangover from an initial extent rate hike announcement by the Reserve Bank Australia (RBA). It is worth noting that the alternative of 25 bps rate hike was in consideration of RBA policymakers as it was discussed in September monetary policy meeting but was not announced.

-

23:02

USD/CAD Price Analysis: Inverted head-and-shoulders in the hourly chart targets 1.3877

- USD/CAD found support around 1.3500, some pips above the 20-day EMA.

- In the short term, the USD/CAD one-hour chart formed an inverse head-and-shoulders, which targets the pair to hit 1.3877.

The USD/CAD cuts two days of losses and rises almost 0.80% as the New York session winds down due to some factors. Firstly, market sentiment deteriorated as traders assessed that a Fed “dovish” pivot was nowhere near to happening, so the greenback recovered against most G8 currencies. Therefore, the USD/CAD is trading at 1.3620, above its opening price.

USD/CAD Price Analysis: Technical outlook

The USD/CAD faced solid support at 1.3500, the 38.2% Fibonacci retracement, 50-pips above the 20-day EMA, after plunging from the YTD high above 1.3800. Traders should be aware that price action in the last couple of days formed a tweezers-bottom, meaning that prices would likely increase. However, after dropping from oversold levels, RSI’s flat slope suggests the pair might consolidate before determining its direction.

The USD/CAD one-hour chart portrays the pair as forming an inverted head-and-shoulders chart pattern, though to validate it, the major needs to clear the neckline at around the R1 daily pivot at 1.3707. Once broken, the next resistance would be the R2 pivot at 1.3797, followed by the inverted head-and-shoulders chart pattern target at 1.3877.

USD/CAD Key Technical Levels

-

22:40

GBP/USD Price Analysis: Bears engage at a key 61.8% ratio

- GBP/USD bears firm-up in early Asia and eye a test below 1.1300.

- There are risks of lower still while below a 61.8% ratio on the hourly chart.

GBP/USD has come under pressure to test the 1.1300 level following a resurgence in the US dollar on Wednesday. The US dollar index, DXY, was last seen up near to 1% at 111.21 but it had been as high as 111.735 overnight.

US yields rallying has helped to prop up the US dollar as the money markets price out overall optimistic speculation over a Federal Reserve pivot. The yield on the US 10-year note was up a high of 3.78%.

The following illustrates the price action across the assets resulting in the sell-off in the pound and offers scenarios for the rest of the week leading to the Nonfarm Payrolls event on Friday.

US yields

US dollar

The greenback, as measured by the DXY index, has consequently rallied on the day but corrected into a support structure.

This structure would be expected to see the index extend the bullish correction and move in on the 112 area.

GBP/USD H1 chart

GBP/USD will remain bearish while below the 61.8% Fibonacci retracement level near 1.1350 and there are prospects of a downside continuation for the day ahead putting heat on committed bulls near 1.1200.

-

22:33

Australia AiG Performance of Construction Index fell from previous 47.9 to 46.5 in September

-

22:28

North Korea appears to have fired missiles again towards Japan

North Korea appears to have fired missiles again according to the Japanese coast guard.

Earlier in the week, Japan urged residents to take shelter after North Korea had been reported to have fired a ballistic missile over the north of the country.

It was the North's first missile launch over Japan since 2017.

The US, Japan and South Korea conducted their own military drills in response.

This escalation of Pyongyang’s missile tests has prompted immediate backlash from Tokyo and has put markets on risk-off alert.

-

22:21

Fitch Revises the Bank of England's Outlook to Negative; affirms at 'AA-'

Fitch Ratings has revised the Outlook on the Bank of England's (BoE) Long-Term Foreign-Currency (LTFC) Issuer Default Rating (IDR) to Negative from Stable and affirmed the IDR at 'AA-'.

Fitch reports that it has ''revised the Outlook on the UK's sovereign rating of 'AA-' to Negative from Stable. The BoE's Long-Term Foreign-Currency IDR is directly aligned with that of the UK sovereign. The BoE is the monetary arm of the UK sovereign and as such its credit profile is aligned with that of the sovereign government.

Fitch currently only rates the BoE's three-year maturity US dollar bonds. The rating does not apply to typical central bank liabilities of the BoE, such as bank notes or commercial bank reserves that are monetary liabilities rather than rateable debt.

The BoE's rating reflects the bank's central role in the UK and international financial system. The rating is underpinned by support from the UK sovereign. The near certainty of sovereign support for the BoE derives from its national strategic importance, as well as its ownership by the UK Treasury.''

GBP/USD update

Meanwhile, the price of cable is bearish while below the 61.8% Fibonacci retracement level near 1.1350 and there are prospects of a downside continuation for the day ahead:

-

22:14

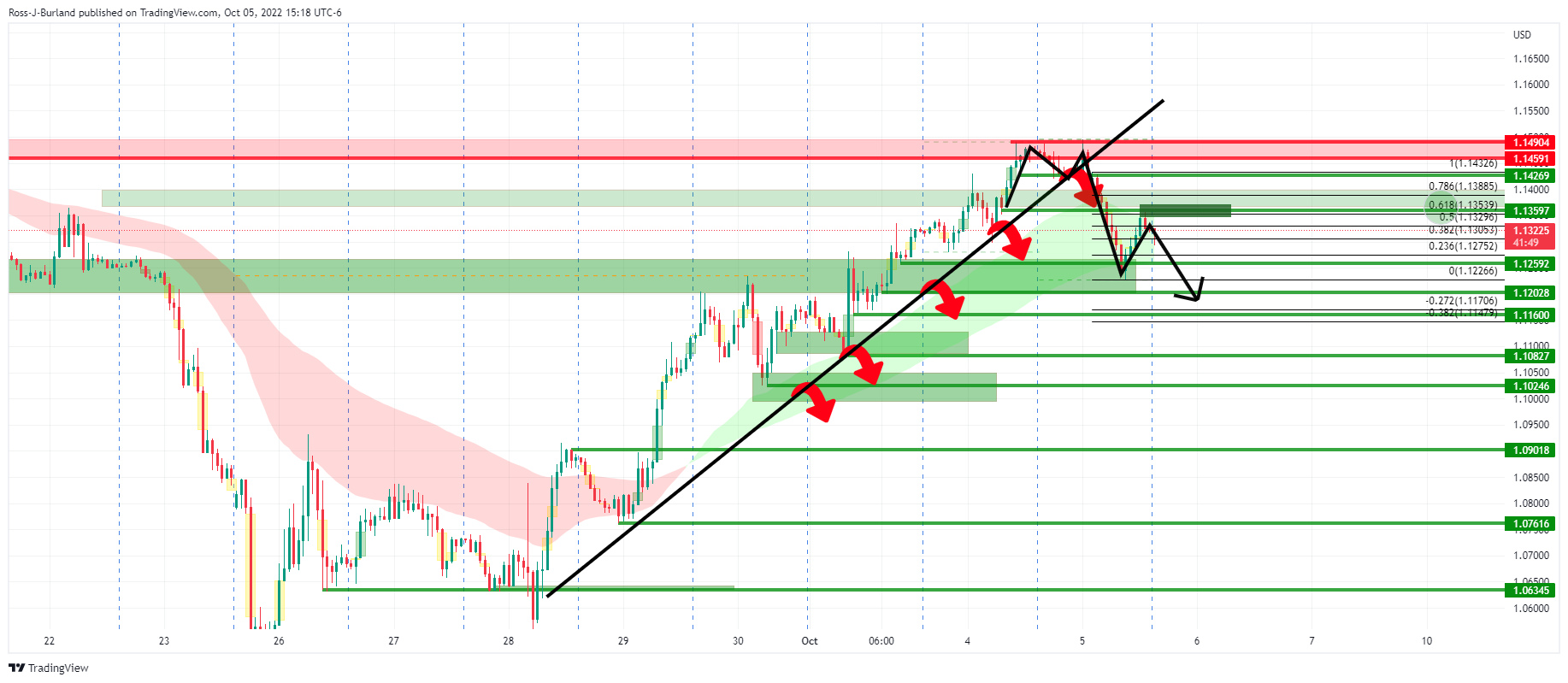

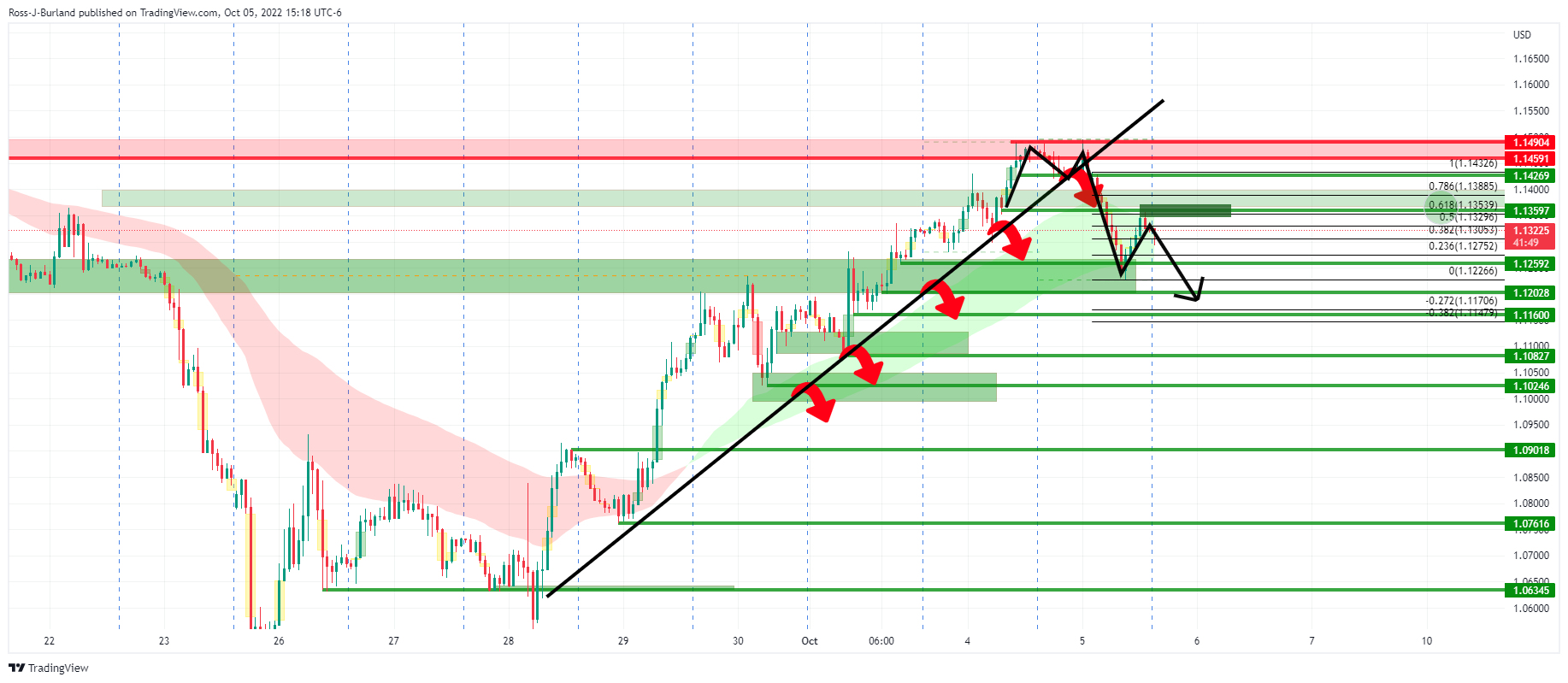

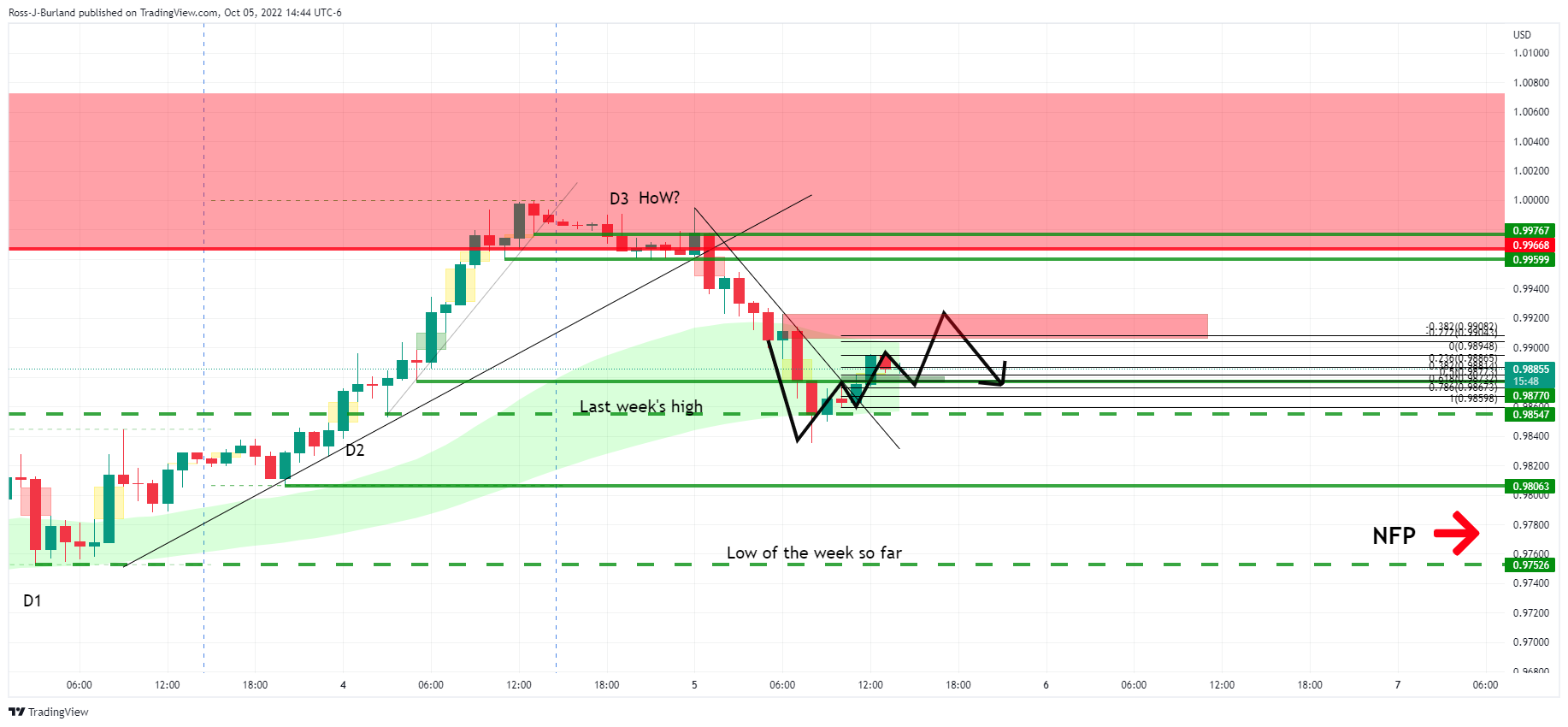

EUR/USD Price Analysis: Bears take the Day-2 bulls to the cleaners

- EUR/USD bears move in on day 3 of the weekly template and crush committed bulls.

- The day 2 trend traders were wiped out on Wednesday, but bulls are trying to reemerge.

The euro has come under pressure following a resurgence in the US dollar on Wednesday. The US dollar index, DXY, was last seen up 1% at 111.20 but it had been as high as 111.735. A tear in US yields has helped to prop up the US dollar as the money markets to price out overall optimistic speculation over a Federal Reserve pivot. The yield on the US 10-year note was up a high of 3.78%.

The following illustrates the price action across the assets resulting in the sell-off in the euro and offers scenarios for the rest of the week leading to the Nonfarm Payrolls event on Friday.

US yields

US dollar

The greenback, as measured by the DXY index, has consequently rallied on the day but corrected into a support that would be expected to see the index extend the bullish correction and move in on the 112 level.

However, should the index's support crumble, the euro will start to correct the recent sell-off significantly:

EUR/USD weekly template

The price has followed a 1,2,3 day count and has potentially put in a high for the week at resistance, as illustrated on the chart above. The price broke out of the front side of the trendline support on day 2 and crumbled on day 3 putting in a peak formation in Asia following two days of rising from the low of the week, so far.

EUR/USD H1, zoomed

We are waiting for this week's Nonfarm Payrolls, NFP, on Friday, but the price action is teeing up a move higher given the low's pin and the hourly W-formation that has formed. A restest into the neckline, or close to it, can be expected and is already underway. Thereafter, the bulls could be encouraged for a move up towards 0.9920 with the price creeping out of the front side of the trendline resistance.

If, on the other hand, the bears stay the course, on a break of 0.9800, we will be looking at a move towards the week's lows at 0.9752:

-

22:00

South Korea FX Reserves dipped from previous 436.43B to 416.77B in September

-

21:46

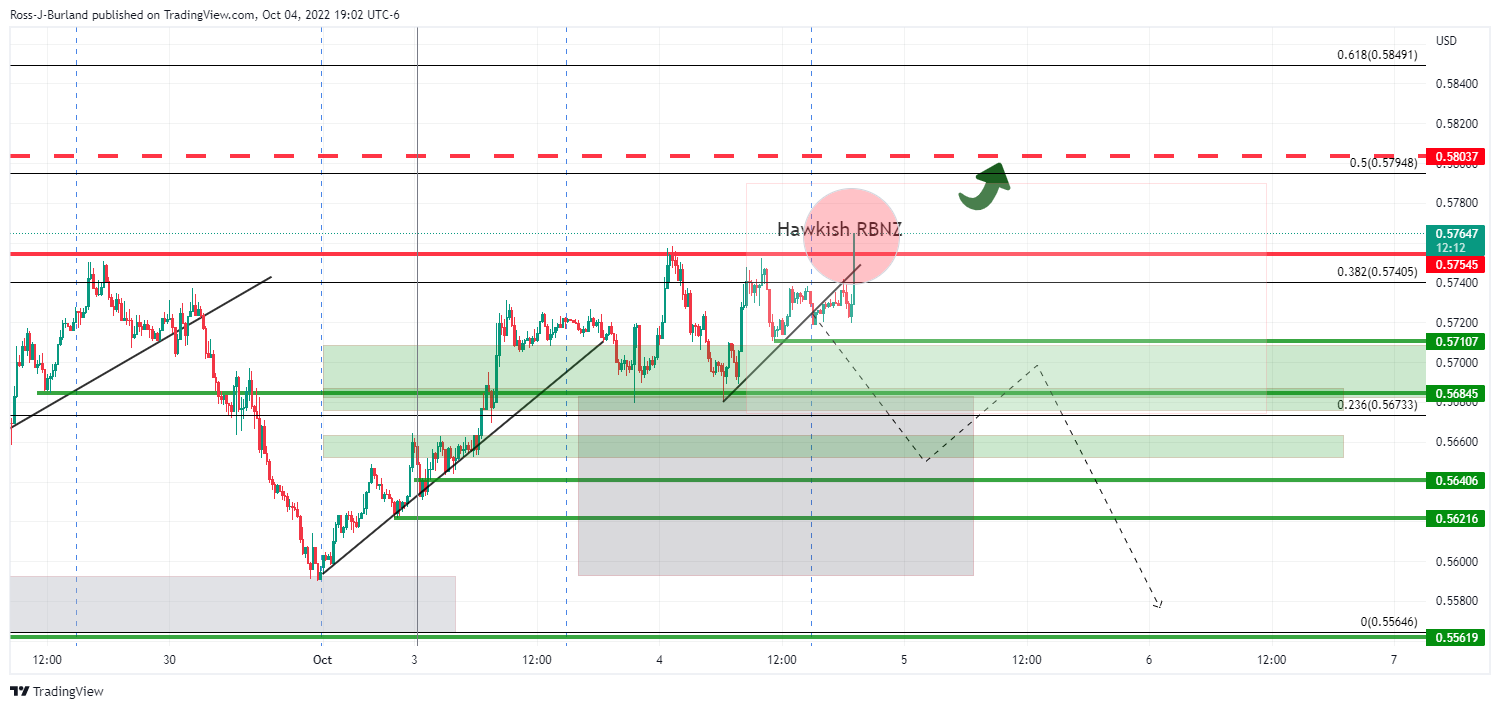

NZD/USD hovers around 0.5730s, almost flat amidst a risk-off impulse

- NZD/USD gains some 0.15% after hitting a daily low at 0.5660.

- The RBNZ’s hiking 50 bps on Wednesday capped the NZD/USD fall, despite US dollar strength.

- US employment data shows solid hiring continues; Services PMIs were mixed.

The NZD/USD erases some of its earlier losses as Wall Steers closes with minimal losses, as sentiment improved in the last hour of the New York session. Nevertheless, traders’ narrative for a possible pivot should be set aside as Fed officials continue their hawkish rhetoric. At the time of writing, the NZD/USD is trading at 0.5746, above its opening price by 0.28%.

NZD/USD trims earlier losses, despite a solid US dollar

Earlier, the San Francisco Fed President Mary Daly said that inflation remains high, adding that more rate hikes are needed. She emphasized that the Fed is “resolute” on raising rates further to bring inflation down.

Data-wise, the US economic docket revealed that S&P Global Services and Composite PMIs, improved but remained below the 50 expansion/contraction level. Contrarily, the ISM Non-Manufacturing PMI remained at expansionary territory, at 56.7, exceeding expectations, but below August’s 56.9.

Meanwhile, the ADP National Employment data portrayed that US companies remain hiring at a solid pace, adding 208K jobs to the labor force, exceeding estimates of 132K and a prelude to Friday’s Nonfarm Payrolls figures. Some minutes later, the US Commerce Department revealed that the US Trade deficit narrowed by 4.3% to $67.4 billion in August, the lowest since May 2021.

The NZD/USD traded as low as 0.5660 before jumping back above the 0.5700 figure, pairing the earlier drop. In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of peers, gains 0.90%, at 111.187, snapping five days of losses.

On the New Zealand side, the Reserve Bank of New Zealand (RBNZ) hiked rates as expected, 50 bps. Additionally, the RBNZ’s Governor Orr commented that further rate hikes were coming and added that the board discussed going 50 or 75 bps, contrary to what the RBA did a day before.

What to watch

The New Zealand Economic docket is empty. On the contrary, the US calendar will feature Initial Jobless Claims, alongside further Fed speaking.

NZD/USD Key Technical Levels

-

21:03

Fed's Bostic: Federal Reserve's fight against inflation is likely “still in early days”

In prepared remarks to the Northwestern University Institute for Policy Research, Atlanta Fed president Raphael Bostic said on Wednesday that the US Federal Reserve's fight against inflation is likely "still in early days."

Despite "glimmers of hope" in recent data, Bostic said "the overarching message I’m drawing...is that we are still decidedly in the inflationary woods, not out of them," with the Fed's target funds rate needing to rise to around 4.5% by the end of the year.

Bostic said he would like to cap rates at that point long enough to assess where the economy is heading. But that does not imply rate cuts would follow. The Fed's singular focus is that inflation head decisively back to the central bank's 2% target.

There is "considerable speculation already that the Fed could begin lowering rates in 2023 if economic activity slows and the rate of inflation starts to fall," Bostic said. "I would say: not so fast."

"We should not let the emergence of (economic) weakness deter our push to lower inflation," Bostic said. "We must remain vigilant because this inflation battle is likely still in early days."

The Fed meets again on Nov. 1-2 with policymakers expected to approve another three-quarter point rate hike even in the face of global market volatility.

US dollar update

Meanwhile, the US dollar resurged on Wednesday. The US dollar index, DXY, was last seen up 1% at 111.15 but it had been as high as 111.735. A tear in US yields has helped to prop up the US dollar as the money markets to price out overall optimistic speculation over a Federal Reserve pivot. The yield on the US 10-year note was up to a high of 3.78%.

Today's data went some ways in supporting the greenback as it failed to buttress recent hopes the Fed might adopt a less hawkish policy stance.

The September ISM services index showed significant resilience in the face of rapid Fed tightening since March. ''At 56.7, the index rose for the 28th consecutive month and is more or less in line with the 20-year long-run average (57.5). In sum, service sector activity is not yet sufficiently below trend to exert strong downward pressure on inflation. Indicators of price pressures are slowing. The prices component was 68.7 vs 71.5 and the supplier deliveries index eased 0.6 to 53.9. Employment rebounded to 53.0 (+2.8) and new exports rose (+3.2 to 65.1), despite the strength in the US,'' analysts at ANZ Bank explained.

-

21:03

Forex Today: Optimism fade, but dollar bears remain

What you need to take care of on Thursday, October 6:

The dollar made a short-lived comeback on Wednesday, ending the day mixed across the FX board. Risk-off flows returned amid tensions between Europe and Russia, although the sentiment improved during US trading hours as the country released upbeat macroeconomic figures.

The European Union approved the eighth package of sanctions against Russia, including a price cap on Moscow’s crude oil and refined products. Russia’s Deputy PM Alexander Novak responded by saying his country would be willing to cut production to compensate for price caps, adding an oil price of $70 per barrel would be comfortable.

The United Kingdom is also planning to implement sanctions banning Russian services and limiting exports to the country.

At the same time, OPEC+, alongside key ministers from the involved nations, usually known as the Joint Ministerial Monitoring Committee, decided a cut oil production by 2 million barrels per day. They also announced they would no longer meet on a monthly basis.

Meanwhile, European Commission President Ursula von der Leyen also announced the Union is ready to discuss a temporary price cap on gas used to generate electricity, while the US White House reported the Department of Energy would release another 10 million oil barrels from the Strategic Petroleum Reserve. Finally, the Biden administration will consult with Congress on tools to reduce OPEC’s control over energy prices.

The EUR/USD pair currently trades around 0.9890, while GBP/USD trades around 1.1330. The USD/CAD finished the day with losses at around 1.3610, despite resurgent crude oil prices. WTI is now trading at around $87.90.

The AUD/USD pair, on the other hand, trimmed most of its early losses and hovers around 0.6500. USD/CHF is up to 0.9830, while USD/JPY remains pat at around 144.50.

Spot gold met buyers on a dip to $1,700, finishing the day at around $1,716.

Wall Street is mixed, with the Dow Jones Industrial Average posting modest gains, but the S&P500 and the Nasdaq Composite are currently in the red. Finally, US Treasury yields picked up, with the 10-year Treasury note currently yielding 3.75%.

Why Binance’s BUSD market cap growth is bullish for the BNB price

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:00

Argentina Tax Revenue (MoM): 2127.181B (September) vs 1731.319B

-

20:32

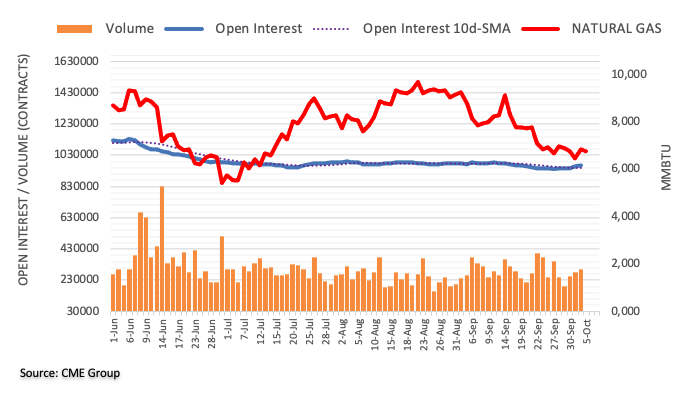

WTI bulls eye a break of highs to target Sep highs, back above critical $90bbls

- US oil prices rally higher on the OPEC cut and a drop in US oil inventories.

- US data improves this week, money markets price out overall optimistic speculation over a Federal Reserve pivot,

West Texas Intermediate crude is higher by some 1.58% having climbed from a low of $87.52 to a high of $88.41 breaking the prior day's highs like a knife through butter with a significant cut to production expected from OPEC+ that meets in Vienna. The cartel looks to buoy oil prices that have dropped by nearly 30% from their July highs.

Fears of slowing global demand had dragged the price of WTI down 37% from its peak in June," economist Jenny Duan at TD Economics said in a note, " and reports have said the group is considering cutting quotas by as much as two million barrels per day at the same time that Russia seeks to handicap a G7 initiative to cap the price paid for the country's oil to hamper its ability to fund its war in Ukraine.

''While the effective cut would be closer to 750k bpd, given OPEC's struggles to meet existing quota levels, an agreement of that magnitude would be bullish for the oil market nonetheless.''

''Indeed, it would translate to a production cut from current levels, while also highlighting the spare capacity concerns that elevate supply risks over a longer-term horizon,'' analysts at TDSecurities explained.

'The analysts argue that ''the bottom could be in for crude prices,'' given Dec22/Dec23 spreads have rallied substantially since fears of an 'imminent' Iran deal pushed time-spreads to their lows in August.

''Our return decomposition framework has suggested that crude markets are now dysfunctionally ignoring supply risks amid a broad-based decline in participation,'' the analysts argued further.

''While physical traders have continued to hold onto their elevated positioning in crude markets, an exodus from money managers has distorted price action. Open interest from swap dealers has also collapsed, pointing to limited client hedging flows. In turn, the group of producers may attempt to send a strong signal that prices have now reached the strike on the OPEC+ put in an attempt to encourage participation to return to futures markets.''

Meanwhile, the US dollar has resurged, making black gold more expensive for overseas buyers. The US dollar index, DXY, was last seen up 1% at 111.20 but it had been as high as 111.735. A tear in US yields has helped to prop up the US dollar as the money markets to price out overall optimistic speculation over a Federal Reserve pivot. The yield on the US 10-year note was up a high of to 3.78%.

Today's data went some ways in supporting the greenback as it failed to buttress recent hopes the Fed might adopt a less hawkish policy stance. The September ISM services index showed significant resilience in the face of rapid Fed tightening since March. ''At 56.7, the index rose for the 28th consecutive month and is more or less in line with the 20-year long-run average (57.5). In sum, service sector activity is not yet sufficiently below trend to exert strong downward pressure on inflation. Indicators of price pressures are slowing. The prices component was 68.7 vs 71.5 and the supplier deliveries index eased 0.6 to 53.9. Employment rebounded to 53.0 (+2.8) and new exports rose (+3.2 to 65.1), despite the strength in the US,'' analysts at ANZ Bank explained.

However, oil prices were also supported after the American Petroleum unexpected drop in US oil inventories of 1.77-million barrels last week, against analyst expectations for a 333,000-barrel rise. The Energy Information Administration will release official inventory figures later on Wednesday morning.

WTI technical levels

Moving down onto the hourly time frame, we can see that the price has been supported by an hourly 20/50 smoothed moving average cloud. It reacted by leaving a bullish pin-bar and a series of W-formations that have concreated in a bullish structure, the latest of which is seeing a correction that would be expected to drive in demand from the bulls that are awaiting a discount:

Zooming in, the structure in focus shows that there has already been a move by the bulls at a 38.2% Fibonacci retracement.

Zooming out, we can see the time template and last month's high as a potentially key target for the days ahead:

-

19:25

EUR/GBP Price Analysis: Faces solid resistance around 0.8770s, falls to 0.8720

- EUR/GBP drops below the 20-day as buyers’ momentum abate.

- The Relative Strength Index (RSI) pierced the 50-midline but is almost flat.

- The EUR/GBP 4-hour chart portrays a rising-wedge formed, targeting a fall towards 0.8600.

The EUR/GBP bounces off Tuesday’s close price and is edging higher, though solid resistance at around the 20-day EMA at 0.8768 put a lid on the cross-currency uptrend, retreating just below Tuesday’s high. However, the EUR/GBP remains positive, trading at 0.8726, above its opening price by 0.31%.

EUR/GBP Price Analysis: Technical outlook

During the last seven days, the pair’s volatility increased after the UK’s tax cut budget. Nevertheless, once the government backpedaled, the EUR/GBP tumbled from around 0.9277 to 0.8647 before recovering some ground. Given that the cross-currency pair dropped below the 20-day EMA and has been unable to crack it, the EUR/GBP is neutral bias. Additionally, the Relative Strength Index (RSI) entered the bearish territory but so far recovered and pierced the 50 mid-line. Nevertheless, price action’s failure to hold to gains above the 20-day EMA shows buyers might be losing momentum.

Short term, the EUR/GBP 4-hour chart depicts a rising-wedge formation, opening the door for further losses. If the EUR/GBP breaks below the bottom-trendline of the wedge, it could pave the way for further losses.

Therefore, the EUR/GBP first support would be the daily pivot at 0.8699. Once cleared, the next support would be the 200-EMA at 0.8679, followed by the S1 daily pivot at 0.8650, followed by the S2 daily pivot at 0.8600.

EUR/GBP Key Technical Levels

-

19:20

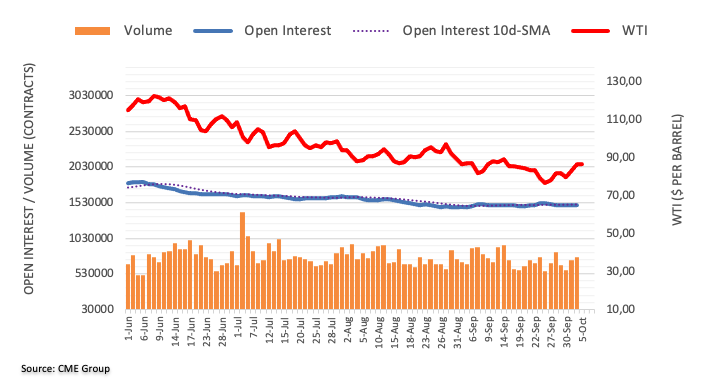

Gold Price Forecast: XAU/USD bears burst the gage as US yields tear higher

- Gold is back under pressure in a resurgence in the US dollar.

- DXY has been as high as 111.735, making gold more expensive for international buyers.

- The yield on the US 10-year note was up a high of to 3.78%, bearish for gold since it offers no interest.

The gold price was down some 0.7% by midday in New York, trading below the highs of the day of $1,727.84 and reaching as low as the psychological $1,700 level. The greenback has caught up with the robustness in US yields which is putting a barrier up against gold's recent resurgence.

The yellow metal broke the $1,700 level at the start of the week as investors started to discount the Fed premium due to poor manufacturing data that was accompanied by a massive miss in the JOLTS data ahead of this week's showdown event in Nonfarm Payrolls. ''With money manager positioning skewed short, the easing of rates and the USD, amid weaker US economic data, sparked a bout of short covering in precious metals,'' analysts at TD Securities said.

US JOLTS

-638005016651390367.png)

US job openings fell to almost 10.1 million in August, according to the Bureau of Labor Statistics, below the consensus on Econoday for 11.15 million and down from 11.17 million reported in July. The larger-than-expected decline could be the first sign that demand for labour is falling. The weaker data has caused traders to bet the Federal Reserve may raise interest rates less than previously expected as the central bank turns more dovish as the US economy slows, offering a tailwind to gold.

However, the analysts at TD Securities said that they expect another beat on this week's NFP on Friday, ''which could present a catalyst for a repricing lower.''

''The pain trade is still to the downside in precious metals, and the latest positioning data highlighted that other reportables started to meaningfully liquidate their gold length, suggesting pressure towards a capitulation in gold is indeed building''

Meanwhile, as illustrated in the following technical analysis, the US dollar index, DXY, was last seen up 1% at 111.20 but it had been as high as 111.735, making gold more expensive for international buyers, while the yield on the US 10-year note was up a high of to 3.78%, bearish for gold since it offers no interest.

Gold technical analysis

In yesterday's analysis, it was explained that the daily chart had seen the price rejected higher as per the harmonic Crab which is a bullish pattern.

However, the potential resistance as per the weekly M-formation and prior month's highs as well as a 21/50 smoothed moving average cloud were flagged.

It was explained that if this is going to be the highs of the week, then there would be a focus on the downside and that exposes a 50% mean reversion near the $1,685/75 area.

Gold update:

The price has started to correct in what could be the start of the run towards the 50% mean reversion near the $1,685/75 area.

Looking to the 10-year yield, it had been finding support throughout the start of the week and might have been considered a leading indicator of the US dollar's advance:

Consequently, the US dollar index, below, is breaking higher and back into line of the harmonic bullish pattern:

-

18:39

AUD/USD stumbles towards 0.6480s on dovish RBA, risk-off impulse

- AUD/USD is falling due to risk-aversion and heightened US T-bond yields underpinning the greenback.

- Fed’s Daly commented that she would like to see core prices down and foresees inflation would likely drop to 3% by 2023.

- US Services PMIs indices were mixed, though the ISM showed the resilience of the US economy.

- The RBA’s dovish 25 bps rate hike keeps the Australian dollar heavy.

The AUD/USD drops for the second consecutive day as the greenback snaps five days of losses, as risk aversion takes center stage. The speculation that central banks would pivot following the Reserve Bank of Australia’s dovish hike of 25 bps faded as Fed policymakers emphasized the need to tame inflation. The AUD/USD is trading at 0.6482 after hitting a daily high of 0.6526 at the time of typing.

AUD/USD falls on broad US dollar strength, dovish RBA

On Wednesday, Fed officials led by San Francisco’s Fed President Mary Daly crossed newswires. She said she would like to see core prices “stay flat or come down” and added that inflation would likely end in the next year at around 3% rather than 2%. Regarding the labor market, she said that “if Friday’s data shows hiring is slowing, that would be a welcome piece of news.”

Macroeconomic-wise, the US docket revealed the ISM Services PMI, which continued at expansionary territory, came at 56.7, above the street’s forecast but below the previous month’s reading. In the meantime, albeit improving, S&P Global PMIs for Services and Composite indices stayed below the 50-expansion/contraction line, at 49.3 and 49.5, respectively.

Earlier, the September US ADP National Employment data depicted that the economy added 208K private jobs to the economy, which could be a prelude for the US Nonfarm Payrolls report on Friday.

At the same time, the US Department of Commerce reported that the US Trade deficit narrowed by 4.3% to $67.4 billion in August, the lowest since May 2021.

On the Australian dollar side, the RBA’s decision to hike 25 bps caught traders by surprise, as they expected a 50 bps increase. AUD/USD traders reacted to the decision, sending the major sliding towards 0.6465.

RBA’s Governor Philip Lowe said, “The cash rate has been increased substantially in a short period of time,” and added that the board expects further tightening over the period ahead.

Elsewhere the US Dollar Index, a measurement of the buck’s value vs. a basket of peers, rallies more than 1%, reclaiming the 111.00 figure at 111.480, reflecting higher US Treasury bond yields. The US 10-year benchmark note rate edged up by almost 15 bps, at 3.779%, as market participants began to price in a 75 bps rate hike at Fed’s November meeting.

What to watch

The Australia economic docket will feature the AIG Construction Index and the Trade Balance, later in Thursday’s Asian session.

The US economic calendar will feature Initial Jobless Claims on Thursday, alongside Fed speaking, led by Chicago’s President Charles Evans, Cleveland’s Loretta Mester, and Board Members Lisa Cook and Christopher Waller.

AUD/USD Key Technical Levels

-

17:32

USD/JPY rises toward 145.00 as US yields climb further

- US Dollar losses impulse,holds onto important daily gains.

- US economic data surpasses expectations, the focus turns to NFP.

- USD/JPY rises more than a hundred pips from weekly lows.

The USD/JPY rose further during the American session and following US economic data. The pair peaked at 144.84, hitting a fresh daily high, 136 pips above the Asian session low.

The rebound in USD/JPY took place amid a stronger US dollar across the board. After an initial impulse to 144.55, the pair consolidated until the US ISM report, that surpassed expectations. The dollar jumped finding resistance around the 144.85 area and pulled back.

The 144.90 zone continues to be a critical resistance area and a break higher should open the way for 145.00 and more. On the flip side, a slide below 144.50 should weaken the dollar in the very short term. Then emerges the 143.70 zone, a critical support.

Better-than-expected economic data from the US on Wednesday helped the greenback. Private jobs rose by 208K in September according to ADP, above market expectations of 200K. ISM Services PMI came in at 56.7, above the expected 56 with the Employment Index rising unexpectedly from 50.2 to 53. On Friday, the US official employment report is due; market consensus is for an increase in payroll by 250K.

Higher US yields supported the move to the upside in USD/JPY. The US 10-year rose from 3.62% to 3.78% while the 2-year hit 4.20%. More recently, an improvement in risk sentiment added support to the pair. US stocks move off lows, trimming losses.

Technical levels

-

17:17

Silver Price Forecast: XAG/USD trips down below $20.50 on high US bond yields

- Silver price retraces from two-month highs while the US dollar recovers.

- Fed’s Daly: The US central bank is “resolute” on raising rates to tame inflation.

- US Services activity decelerates yet remains to expand despite US Federal Reserve tightening cycle.

- XAG/USD is neutral-biased and faced support at the 100-day EMA at $20.00.

Silver price retreat from two-month highs reached on Tuesday at $21.23 a troy ounce, as investors’ expectations of a Fed pivot fade, as US equities are tumbling, while the greenback gains traction after five days of losses. At the time of writing, XAG/USD is trading at $20.35, below its opening price by 3.15%.

XAG/USD falls due to elevated US T-bond yields

Investors’ mood shifted sour as US equities dropped. Of late, Fed officials crossing wires, led by the San Francisco Fed President Mary Daly, said that the Fed might step in if there’s an event of market dislocation while emphasizing that markets are right, and the Fed is “resolute” on raising rates further to bring inflation down.

“We definitely don’t raise rates until something breaks; we actually are forward-looking,” Daly said in a Bloomberg TV interview.

In the meantime, US economic data revealed that service sector activity showed some resilience, with the ISM Non-Manufacturing PMI rising to 56.7, less than August’s reading but above expectations. Contrarily, the S&P Global Services and Composite indices remained in contractionary territory, each at 49.3 and 49.5.

Earlier, the September US ADP National Employment data depicted that the economy added 208K private jobs to the economy, which could be a prelude for the US Nonfarm Payrolls report on Friday.

At the same time, the US Department of Commerce reported that the US Trade deficit narrowed by 4.3% to $67.4 billion in August, the lowest since May 2021.

Elsewhere the US Dollar Index, a measurement of the buck’s value vs. a basket of peers, rallies more than 1%, reclaiming the 111.00 figure at 111.480, reflecting higher US Treasury bond yields. The US 10-year benchmark note rate edged up by almost 15 bps, at 3.779%, as market participants began to price in a 75 bps rate hike at Fed’s November meeting.

What to watch

The US economic calendar will feature Initial Jobless Claims on Thursday, alongside Fed speaking, led by Chicago’s President Charles Evans, Cleveland’s Loretta Mester, and Board Members Lisa Cook and Christopher Waller.

Silver (XA/USD) Technical Analysis

XAG/USD prices had rallied more than $2 in the last three days, except for today’s price action. On its way north, XAG/USD cleared the 20, 50, and 100-day EMAs and tested the 100-day at $20.00 but jumped towards current spot prices. It should be noted that the 20-day EMA is closing its distance from the 50-day EMA, and once it crosses over, it will keep silver buyers hopeful for higher prices. Therefore, XAG/USD is neutral-biased unless it breaks above the 200-day EMA at $21.92.

-

16:43

US ISM: Service sector activity remained solid in September – Wells Fargo

Data released on Wednesday showed the ISM Services Index dropped in September to 56.7, a reading above the 56 expected. Analysts at Wells Fargo point out the report is still consistent with expansion in the sector. They argue most of the details indicate continued growth with some modest giveback in the pace of activity.

Key Quotes:

“Service sector activity remained solid in September. The headline reading on the ISM Services Index declined, signaling a slower pace of activity last month, but at 56.7 it was higher than the consensus expectation and still signals expansion.”

“Most major components of the index declined last month, with the employment index being one of the lone bright spots. The employment component rose 2.8 points to 53.0, marking the highest reading in six months. Squaring this with the pullback in the manufacturing employment counterpart indicates another solid but slightly slower gain in hiring last month compared to August.”

“Continued upward pressure on wages is perhaps partly behind the more modest decline in the prices paid component for services industries compared to manufacturing. The prices paid component slid 2.8 points to 68.7, whereas the counterpart in the manufacturing ISM currently sits at 51.7.”

-

16:40

White House: US Pres. Biden disappointed by shortsighted decision by OPEC+

US President Joe Biden is disappointed by the OPEC+ group's 'shortsighted decision', the White House said on Wednesday, as reported by Reuters.

Following its 33rd Ministerial Meeting, OPEC+ announced that they will adjust downward the overall production by 2 million barrels per day starting November from the August-2022 required production levels.

Additional takeaways

"OPEC+ decision will have most negative impact on lower- and middle-income countries."

"Biden is directing Energy Secretary to explore additional responsible actions to increase domestic production."

"Biden is calling on US Energy companies to bring gasoline pump prices down."

"Biden administration will consult with Congress on additional tools and authorities to reduce OPEC’s control over energy prices."

Market reaction

Crude oil prices continue to push higher and the barrel of West Texas Intermediate was last seen rising 2.25% on the day at $88.30.

-

16:33

GBP/USD tumbles toward 1.1200 as pound weakens and DXY soars

- US Dollar comes back into play, DXY up by 1.25%.

- UK PM Truss sticks to her plan, pound resumes slide.

- GBP/USD drops by more than 200 pips on Wednesday.

The GBP/USD is trading at the lowest level in two days around 1.1230, after falling more than 270 pips from the intraday high. Earlier the pair peaked at 1.1496, the highest level since September 15.

The combination of the dollar being back into play and the pound's weakness sent cable sharply on Wednesday. It has erased more than half of the week's gains and is approaching the 1.1200/05 support area.

The pound was already trading with some weakness that started around UK PM Liz Truss's speech. She spoke at the Conservative Party conference defending his plan. She said that cutting taxes was the "right thing to do "morally and economically". Truss mentioned that it is correct that the Bank of England sets interest rates independently. His words did not bring support for the pound.

GBP/USD started to decline from above 1.14000 and then accelerated amid a stronger US dollar. The DXY is rising by 1.25%, as US yields move sharply to the upside. The US 10-year year is at 3.77%, far from the 3.56% seen on Tuesday.

Economic data from the US came in better-than-expected on Wednesday helping the US Dollar rise across the board. Private sector employment rose by 208K in September according to ADP, above the market expectation of 200K. ISM Services PMI came in at 56.7, above the expected 56; the Employment Index rose unexpectedly to 53 from 50.2. On Friday, the US official employment report is due.

Technical levels

-

16:11

EUR/USD plunges from around parity to 0.9850 amid a strong US dollar

- EUR/USD plummets as speculation of a Fed pivot abated.

- US Services PMIs were mixed, though the ISM remained at expansionary territory.

- EU’s services activity weakened, except for France, growing at a mild pace.

The EUR/USD is erasing some of Tuesday’s gains as speculations of a Fed pivot towards a dovish stance faded, as shown by US T-bond yields rising again, while US Services PMI data, even though slowed, remains at expansionary territory. At the time of writing, the EUR/USD is trading at 0.9852 after hitting a daily high close to parity.

EUR/USD dropped on a strong US dollar

Sentiment deteriorated, as previously mentioned, as a possible Fed pivot faded. US economic data revealed during the day showed that private payrolls increased by 208K, as depicted by the ADP National Employment for September. Later in the day, economic activity in the Services sector showed mixed readings, though the ISM flashed that the economy is still expanding at a slower pace.

The S&P Global Services and Composite PMIs came at 49.3 and 49.5, respectively. Nevertheless, the ISM Non-Manufacturing PMI dived to 56.7, less than August’s 56.9 but exceeded estimations of 56.0. Given the backdrop, the US economy stayed resilient amidst an aggressive tightening cycle by the US Federal Reserve, therefore bolstering the greenback.

Hence, the EUR/USD dipped 130 pips on the day towards current exchange rates. In the meantime, the US 10-year Treasury bond yield is rising 16 bps, up at 3.781%, a headwind for the EUR/USD.

At the same time, the US Department of Commerce reported that the US Trade deficit narrowed by 4.3% to $67.4 billion in August, the lowest since May 2021.

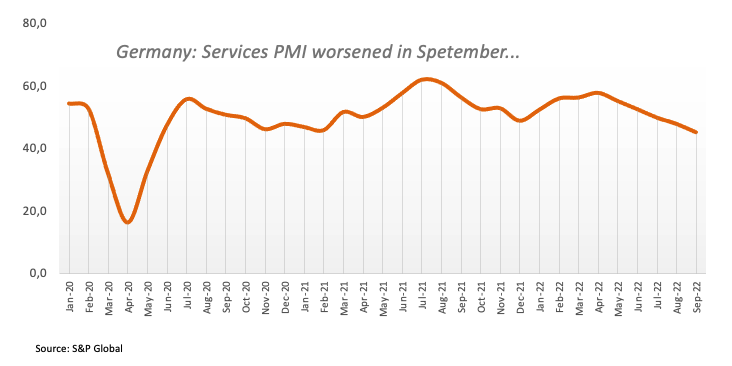

Aside from this, the Eurozone reported that business activity slowed, as shown by the S&P Global PMI survey, further cementing the case of the EU’s getting into a recession as a stagflation scenario looms. Services activity weakened in Germany, Italy, and Spain, except for France, though it grew weaker than estimated.

EUR/USD Key Technical Levels

-

15:58

USD/CAD ignores rising oil prices, closes in on 1.3700

- USD/CAD extended its daily rally in the American session.

- WTI turned positive on the day above $87 on OPEC+ decision.

- DXY is up more than 1% on a daily basis after US data.

USD/CAD preserved its bullish momentum in the second half of the day and touched a daily high of 1.3696 before edging slightly lower. As of writing, the pair was up 1.2% on the day at 1.3670.

Crude oil prices rebound

Crude oil prices gained traction during the American trading hours and the barrel of West Texas Intermediate (WTI), which spent a large portion of the day in negative territory, climbed above $87. News confirming OPEC+ decision to lower the group's output by 2 million barrels per day provided a boost to WTI. Additionally, the EIA reported a larger-than-expected decline in the US' crude oil stocks in the week ending September 30.

The dollar strength, however, dominated USD/CAD's action after the upbeat US data. The US Dollar Index was last seen rising 1.2% on the day at 111.55.

The ADP announced that private sector employment increased by 208,000 in September, higher than analysts' estimate of 200,000. Additionally, the Employment component of the ISM's Services PMI survey rose to 53 from 50.2, revealing that employment in the service sector expanded at a stronger pace in September than it did in August.

Following these data, the probability of a 75 basis points rate hike in November climbed above 70%, suggesting that hawkish Fed bets are driving the market action.

On Friday, September jobs reports from the US and Canada will be watched closely by market participants.

Nonfarm Payrolls Preview: Five scenarios for trading King Dollar as markets plead for pain.

Technical levels to watch for

-

15:47

Gold Price Forecast: XAU/USD path downgraded to $1,700 by year-end, $1,800 end-2023 – Commerzbank

Gold price is set to remain under pressure due to the strongly appreciating US dollar. Therefore, strategists at Commerzbank downgrade their XAU/USD forecasts.

USD to remain strong for quite some time yet

“We expect the Fed Funds Rate to climb to 5% by the spring of 2023, i.e. by another 175 basis points from its current level. The US dollar is therefore likely to remain strong for quite some time yet. The headwind facing gold will thus persist for some considerable time.”

“We are downwardly revising our gold price forecast for the end of this year to $1,700 per troy ounce (previously $1,800).”

“The lower starting level, noticeably higher interest rate forecast and lower prediction for the EUR/USD exchange rate also translate into a lower path for the gold price next year. We expect gold to climb to $1,800 per troy ounce by the end of 2023 (previously $1,900).”

-

15:30

United States EIA Crude Oil Stocks Change below forecasts (0.097M) in September 30: Actual (-1.356M)

-

15:29

Fed's Daly: I see more rate increases as necessary

San Francisco Fed President Mary Daly reiterated on Wednesday that the Fed is resolute at raising rates to restrictive territory, as reported by Reuters.

Additional takeaways

"We are committed to bringing inflation down, staying course until we are well and truly done."

"I don't see a hump shape in rates, I see us raising rates, holding them there until we get inflation close to 2%."

"More policy adjustments are required to get it restrictive."

"I see more rate increases as necessary."

"Expect inflation to end next year closer to 3% than 2%."

"Have to be prepared for inflation to be more persistent than we expect."

"Still seeing about 50% of inflation coming from demand."

"Markets are finding their footing."

"For us, the path is clear: we are going to raise rates to restrictive territory, then hold them there for a while."

"We don't raise rates until something breaks."

"We are constantly calibrating to risks."

"If market dislocation comes about, we would be prepared to address it."

Market reaction

The dollar rally continues following these comments and the US Dollar Index was last seen rising 1.3% on the day at 111.65.

-

15:25

Gold extends slide toward $1,700 after US data

- Gold is down more than 1% on a daily basis on Wednesday.

- 10-year US Treasury bond yield surges higher in the American session.

- Hawkish Fed bets provide a boost to the greenback after latest data releases.

Gold came under renewed bearish pressure and dropped toward $1,700 during the American trading hours on Wednesday. As of writing, XAU/USD was down 1.25% on the day at $1,705.

USD rises alongside US yields

The impressive rebound witnessed in US Treasury bond yields amid hawkish Fed bets weighs heavily on the precious metal mid-week. Following the sharp decline seen earlier in the week, the benchmark 10-year US Treasury bond yield is up more than 4% on a daily basis at 3.78%. According to the CME Group FedWatch Tool, markets are pricing in a 68% probability of a 75 basis points rate hike in November.

The data from the US showed on Wednesday that private sector employment rose by 208,000 in September, higher than the market expectation of 200,000.

Additionally, the ISM Services PMI came in at 56.7, showing that the business activity in the service sector continued to expand at a healthy pace in September. More importantly, the Employment Index of the PMI survey recovered to 53 from 50.2, reviving expectations for another strong Nonfarm Payrolls report on Friday. The US Dollar Index is up 1.33% on the day, reflecting the positive impact of Wednesday's data on the dollar's valuation.

There won't be any other high-tier macroeconomic data releases later in the day and the US yields' movements are likely to continue to impact the inversely-correlated XAU/USD's action.

Technical levels to watch for

-

15:04

S&P 500 Index: Scope for a deeper but still corrective rally to 3867 – Credit Suisse

S&P 500 has successfully held key support at 3595. With bullish RSI momentum divergences into the low, analysts at Credit Suisse look for a deeper but still corrective rally to emerge. Big picture though, they maintain a core negative outlook.

Strength seen as temporary and corrective

“With bullish daily and weekly RSI momentum divergences into the low and with sentiment and breadth measures pointing to a highly oversold condition we see scope for a deeper corrective rally to emerge, or at least a more protracted consolidation.”

“Big picture, our bias remains to view strength as temporary and corrective and we maintain our 3-6 month negative outlook.”

“Resistance is seen initially at 3790/92, above which should clear the way for further strength to resistance next at 3828, then the 38.2% retracement of the August/September fall at 3867. With the 23.6% retracement of the entire 2022 fall just above at 3875 and with the late September high at 3907 we will look for a cap in this 3867/3907 zone.”

“Support is seen at the price gap from yesterday, starting at 3726 and stretching down to 3678. Below this latter level is needed to ease thoughts of a corrective recovery for a retest of the 200-week average at 3595.”

-

15:02

US: ISM Services PMI declines to 56.7 in September vs. 56 expected

- Business activity in the US service sector continued to expand in September.

- US Dollar Index continues to push higher in the American session.

The business activity in the US service sector expanded at a slightly softer pace in September than it did in August with the ISM Services PMI declining to 56.7 from 56.9. This reading, however, came in better than the market expectation of 56.

Further details of the publication revealed that the Employment Index improved to 53 from 50.2 and the Prices Paid Index declined to 68.7 from 71.5. Finally, the New Orders Index edged lower to 60.6 from 61.8.

Commenting on the data, "the services sector had a slight pullback in growth for the month of September due to decreases in business activity and new orders," said Anthony Nieves, Chair of the ISM Services Business Survey Committee.

"Employment improved and supplier deliveries slowed at a slightly slower rate," Nieves added. "Based on comments from Business Survey Committee respondents, there have been improvements regarding supply chain efficiency, operating capacity and materials availability; however, performance remains less than ideal."

Market reaction

The US Dollar Index extended its rally after this report and was last seen rising 1.3% on the day at 111.62.

-

15:00

United States ISM Services PMI came in at 56.7, above expectations (56) in September

-

15:00

United States ISM Services New Orders Index above forecasts (58.9) in September: Actual (60.6)

-

15:00

United States ISM Services Prices Paid came in at 68.7, below expectations (69.8) in September

-

15:00

United States ISM Services Employment Index came in at 53, above expectations (49.6) in September

-

14:51

US: S&P Global Services PMI rises to 49.3 (final) in September from 43.7

- S&P Services PMI rose in September but stayed below 50.

- US Dollar Index clings to strong daily gains above 111.00.

The S&P Global Services PMI for the US recovered to 49.3 (final) in September from 43.7 in August. This reading came in slightly better than the flash estimate and the market expectation of 49.2.

Additionally, the Composite PMI rose to 49.5 (final) from 44.6 in August, compared to the previous estimate of 49.3.

Commenting on the data, "with service sector activity declining for a third straight month in September, businesses have faced a tough third quarter," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. "Economic growth has come under pressure from falling output in both the manufacturing and service sectors, though in both cases September has seen some encouraging signals that business conditions may be starting to improve."

Market reaction

The US Dollar Index preserves its bullish momentum and was last seen rising 1.05% on the day at 111.35.

-

14:48

United States S&P Global Services PMI came in at 49.3, above expectations (49.2) in September

-

14:48

United States S&P Global Composite PMI came in at 49.5, above expectations (49.3) in September

-

14:25

USD/JPY rises above 144.50 as US yields stretch higher

- USD/JPY trades in positive territory above 144.50 on Wednesday.

- 10-year US Treasury bond yield is up more than 2% on the day.

- Focus shifts to ISM's Services PMI survey for September.

USD/JPY continued to edge higher in the early American session on Wednesday and was last seen rising 0.35% on the day at 144.55.

10-year US yield is back above 3.7%

Although the risk-averse market environment allows the JPY to stay resilient against its rivals, rising US Treasury bond yields help USD/JPY preserve its bullish bias.

Following the sharp decline witnessed on Monday, the benchmark 10-year US Treasury bond yield is up more than 2% on the day slightly above 3.7%. The data from the US showed that the ADP Employment Change arrived at +208,000 in September, surpassing the market expectation of 200,000, providing a boost to the greenback and US yields.

According to the CME Group FedWatch Tool, markets are currently pricing in a 66.5% probability of one more 75 basis points Fed rate hike in November, compared to 50% on Tuesday.

Later in the session, the ISM will release the Services PMI report for September. Market participants will pay close attention to the Prices Paid and Employment components of the survey.

Meanwhile, major equity indexes in the US look to open significantly lower after having registered impressive gains on Monday and Tuesday. Escalating geopolitical tensions force investors to stay away from risk-sensitive assets mid-week.

Technical levels to watch for

-

14:23

USD/TRY adds to recent gains and approaches 18.60… again

- USD/TRY extends the weekly upside to the vicinity of 18.60.

- The upbeat tone in the greenback lends extra legs to the pair.

- US ADP report came on the strong side in September.

The resumption of the buying interest around the greenback pushes USD/TRY to the 18.58 region on Wednesday, just a tad below Tuesday’s all-time peaks.

USD/TRY keeps targeting 19.00

USD/TRY trades with gains for the second session in a row and remains close to the 18.60 region on the back of the recovery in the dollar following a negative start of the new trading week.

On the domestic front, the depreciation around the lira appears unabated, particularly after inflation figures released on Monday showed the CPI rose at a new 24-year high past 83% in the year to September.

In the US calendar, the ADP report showed the US private sector added 208K jobs in September, surpassing expectations and adding to August’s 132K gain. Later in the session, all the attention is expected to be on the publication of the ISM Non-Manufacturing.

What to look for around TRY

USD/TRY keeps navigating the area of all-time tops near 18.60 amidst the combination of omnipresent lira weakness and the renewed bid bias in the dollar.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in July and August), real interest rates remain entrenched well in negative territory and the political pressure to keep the CBRT biased towards low interest rates remains omnipresent.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth (via higher exports and tourism revenue) and the improvement in the current account.

Key events in Türkiye this week: CPI, Producer Prices, Manufacturing PMI (Monday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.10% at 18.5772 and faces the next hurdle at 18.5908 (all-time high October 4) followed by 19.00 (round level). On the downside, a break below 18.1142 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

14:07

OPEC+ JMMC agrees oil output cuts of 2 million bpd – Reuters

Joint Ministerial Monitoring Committee (JMMC) of the Organization of the Petroleum Exporting Countries and allies including Russia, known collectively as OPEC+, has agreed to lower oil output by 2 million barrels per day, Reuters reports, citing sources.

No additional details on the group's output strategy has been shared yet.

Market reaction

Crude oil prices edged higher on this headline and the barrel of West Texas Intermediate (WTI) was last seen trading near $87, where it was up 1% on a daily basis.

-

14:04

AUD/USD drops to fresh daily low below 0.6450 after US data

- AUD/USD extended its daily slide in the American session.

- ADP reported a bigger than expected increase in private sector employment in September.

- Wall Street's main indexes remain on track to open deep in negative territory.

AUD/USD came under renewed bearish pressure and dropped to a fresh daily low below 0.6440 before recovering modestly in the early trading hours of the American session on Wednesday. As of writing, the pair was down 0.75% on the day at 0.6452.

Dollar capitalizes on upbeat ADP data

The data published by Automatic Data Processing (ADP) revealed that private sector employment in the US rose by 208,000 in September, compared to the market expectation of 200,000. Additionally, August's print got revised higher to 185,000 from 132,000. On the back of upbeat employment data, the US Dollar Index extended its rally and was last seen rising 0.75% on the day at 111.05.

Meanwhile, safe-haven flows continue to dominate the financial markets and put additional weight on AUD/USD's shoulders in the second half of the day.

Wall Street's main indexes remain on track to open deep in negative territory with US stock index futures losing between 0.95 and 1.1% on the day, suggesting that safe-haven flows are likely to continue to dominate the market action.

Later in the session, the ISM will release the Services PMI survey for September. Atlanta Fed President Raphael Bostic is scheduled to speak at a virtual conference titled "Staying Resolute in the Battle Against Inflation."

Technical levels to watch for

-

13:58

EUR/CHF: Key 0.9867/84 zone to hold to avoid strength towards 0.9950/parity – Credit Suisse

EUR/CHF has broken the 55-day moving average (DMA) at 0.9686. Economists at Credit Suisse see scope for a recovery to 0.9867/84, though with this ideally holding to avoid a move back to 0.9950/parity.

Move below 0.9644/41 needed to ease the current upside pressure

“We think that further near-term upside to 0.9867 is now a likely scenario.”

“Support is seen at 0.9742/40 initially, though a move below 0.9644/41 is needed to ease the current upside pressure and put the market back on track towards a retest of the YTD low at 0.9409.”

“Resistance now moves to 0.9831 and then above at the key 0.9867/84 zone, which ideally now curbs any further rise to avoid a potential move to 0.9950/parity.”

-

13:48

US: Goods and services deficit narrow to $67.4 billion in August vs. $68 billion expected

- US Goods and Services Trade Balance rose to -$67.4 billion in August.

- US Dollar Index clings to strong daily gains above 111.00.

The data published by the US Census Bureau showed on Wednesday that the US' goods and services deficit narrowed by $3.1 billion to $67.4 billion in August from $70.5 billion in July. This reading came in lower than the market expectation for a deficit of $68 billion.

"August exports were $258.9 billion, $0.7 billion less than July exports," the publication further read. "August imports were $326.3 billion, $3.7 billion less than July imports."

Market reaction

This report doesn't seem to be having a noticeable impact on the dollar's performance against its rivals. As of writing, the US Dollar Index was up 0.85% on the day at 111.13.

-

13:32

United States Goods Trade Balance increased to $-87.28B in August from previous $-87.3B

-

13:32

United States Goods Trade Balance climbed from previous $-87.3B to $-87.2B in August

-

13:30

United States Goods and Services Trade Balance registered at $-67.4B above expectations ($-68B) in August

-

13:30

Canada International Merchandise Trade came in at $1.52B, below expectations ($3.5B) in August

-

13:30

Canada Imports declined to $63.86B in August from previous $64.2B

-

13:30

Canada Exports down to $65.38B in August from previous $68.25B

-

13:30

Canada Building Permits (MoM) above forecasts (-0.8%) in August: Actual (11.9%)

-

13:19

US: Private sector employment rises by 208,000 in September vs 200,000 expected

- US private sector employment rose at a slightly stronger pace than expected in September.

- US Dollar Index clings to strong daily gains at around 112.00.

The data published by Automatic Data Processing (ADP) showed on Wednesday that private sector employment in the US rose by 208,000 in September. This reading followed August's increase of 185,000 (revised from 132,000) and came in slightly better than the market expectation of 200,000.

Commenting on the data, "we are continuing to see steady job gains," said Nela Richardson, chief economist, ADP. "While job stayers saw a pay increase, annual pay growth for job changers in September is down from August.”

Wage inflation

"Job changers, who have been notching double-digit, year-over-year gains since the summer of 2021, lost momentum in September," the ADP noted in its publication. "Their annual pay rose 15.7%, down from a revised 16.2% gain in August. It's the biggest deceleration in the three-year history of our data. For job stayers, annual pay rose 7.8% in September from a year ago, up from a revised 7.7% in August."

Market reaction

The US Dollar Index preserves its bullish momentum after this report and was last seen rising 0.7% on the day at 110.95.

-

13:16

Gold Price Forecast: XAU/USD to avert downtrend on heroic recovery north of $2,000 – TDS

Gold has rallied above the $1,700 level. Nonetheless, strategists at TD securities remain confident that the downtrend will prevail with a high margin of safety against a trend reversal.

Ignore the siren song

“The margin of safety against a sustained change in trend in gold is extremely elevated.”

“Unless the yellow metal stages a heroic recovery north of $2,000 before year-end, we remain confident that the downtrend in prices will prevail.”

“Gold prices have yet to price in the final stages of the hiking cycle, in which restrictive rates contribute to a significant underperformance relative to the earlier stages of the hiking cycle.”

-

13:15

United States ADP Employment Change came in at 208K, above expectations (200K) in September

-

13:00

Brazil Industrial Output (YoY) above expectations (-0.5%) in August: Actual (2.8%)

-

13:00

Brazil Industrial Output (MoM) registered at -0.6%, below expectations (-0.1%) in August

-

12:35

EUR/USD could challenge 0.90 before settling around 0.93-0.94 – Standard Chartered

EUR/USD is set to move downward in the near-term but economists at Standard Chartered expect the pair to turn back higher over a 12-month period.

Downward pressure on the euro in the near-term

“EUR/USD is likely to weaken over next 1-3 months, potentially testing support around 0.90, before settling around 0.93-0.94.”

“While European gas inventories have reached nearly 85% of capacity, energy security and rationing concerns along with relatively slower pace of rate hikes from ECB are likely to exert downward pressure on the euro in the near-term.”

“Over a 12-month horizon, we expect a reduction in interest rate differentials between US and Europe and a reversal of its current undervaluation to push the EUR higher.”

-

12:26

Colombia Consumer Price Index (YoY) climbed from previous 10.84% to 11.44% in September

-

12:26

Colombia Consumer Price Index (MoM) fell from previous 1.02% to 0.93% in September

-

12:20

EUR/USD Price Analysis: Upside capped by the parity zone so far

- EUR/USD’s strong upside meets resistance around parity.

- Sustained gains are likely once the parity level is cleared.

EUR/USD has so far met quite a solid hurdle in the proximity of the parity level on Wednesday.

Considering the recent strong rebound, further upside seems likely once the pair leaves behind the parity region on a sustainable fashion. Further up comes the interim hurdle at the 55-day SMA, today at 1.0030.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0632.

EUR/USD daily chart

-

12:02

Mexico Consumer Confidence s.a registered at 41, below expectations (41.1) in September

-

12:02

Mexico Consumer Confidence rose from previous 40.3 to 40.8 in September

-

12:00

USD Index Price Analysis: Solid contention appears around 110.00... for now

- DXY manages to gather some upside traction after testing 110.00.

- The loss of 110.00 exposes a potential decline to 109.35.

DXY reverses two consecutive daily retracements and bounces off fresh lows in the proximity of the 110.00 support on Wednesday.

Despite the ongoing rebound, further weakness should not be ruled out just yet. That said, the breach of the 110.00 yardstick should open the door to a probable visit to the weekly low at 109.35 (September 20).

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 7-month support line near 107.40.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 102.67.

DXY daily chart

-

12:00

United States MBA Mortgage Applications fell from previous -3.7% to -14.2% in September 30

-

11:49

S&P 500 Index: Bounce could extend above 4000 on a break past 3900 – SocGen

S&P 500 rebounded 2.6% on Monday after falling to a year-to-date low at the end of last week. Periodic rebounds are to be expected but the 3900 level is set to prove a tough barrier, analysts at Société Générale report.

Holding 3636 is crucial for persistence in up move

“S&P 500 briefly violated the lows of June at 3636 but has quickly clawed back above denoting a false break. It is worth noting that similar price action occurred in June when the index failed to establish below the trough of May and experienced a phase of rebound.”

“Gap-up on daily chart points towards possibility of a bounce.”

“Recent pivot high at 3900 is first layer of resistance. If this is crossed, the bounce could extend towards recent bearish gap near 4040 and 4120.”

“Defending 3636 would be crucial for persistence in up move.”

-

11:43

EUR/JPY Price Analysis: Further upside could revisit the 2022 high

- EUR/JPY corrects lower after briefly surpassing the 144.00 mark.

- Extra gains are expected to challenge the YTD top past 145.00.

EUR/JPY comes under pressure following five consecutive daily advances on Wednesday, including a test of the key resistance zone around 144.00.

The continuation of the rebound from last week’s lows remains well in place for the time being. That said, if the cross extends the breakout of the weekly top at 144.04 (September 20), it could then dispute the 2022 high at 145.63 (September 12).

In the meantime, while above the key 200-day SMA at 136.04, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

11:14

US Dollar Index to rise towards 116.50-117.00 in the next few months – Standard Chartered

Over the past month, the US dollar has surged sharply higher. Economists at Standard Chartered expect the US Dollar Index (DXY) to reach the 116.50-117.00 area but see the greenback peaking over a 6-12 month horizon.

USD to peak over a 6-12 month horizon

“On a three-month horizon, DXY is likely to rise towards 116.50-117.00.”

“Near-term USD strength is likely to be driven by (i) the likelihood of Fed hiking rates at a faster pace relative to the other major centralbanks, which can continue to push interest rate differentials in favour of the USD, (ii) greater global growth concerns that are likely to fuel safe-haven USD demand, and (iii) elevated geopolitical concerns, especially in Europe and the Middle East.”

“Over a 6-12 month horizon, we expect the USD to peak. In our assessment, (i) we expect US inflation to gradually turn lower over 2023, which should give the Fed the leeway to slow or even pause rate hikes, (ii) rate hikes from other major central banks through 2023 should narrow the interest rate differentials with the US, (iii) capital flows are likely to turn away from the US on slower US growth and robust growth in Asia, and (iv) easing of geopolitical uncertainty around Europe and improving Chinese growth could potentially reduce the safe-haven demand.”

-

10:53

IEA’s Birol: Europe will have 25-30% gas left if there are no surprises

International Energy Agency (IEA) Chief Fatih Birol said on Wednesday that “Europe will have 25-30% gas left if there are no surprises and if the winter is normal.”

Additional quotes

This winter will be difficult, but the next winter will be very difficult.

We need solidarity among European countries.

If we fail this energy test, the negative implications may go beyond energy and weaken the EU’s political weight.

We're seeing a significant decline in energy use in Europe.

Market reaction

The shared currency is failing to find any positive boost from the above comments, as EUR/USD is trading at near-daily lows of 0.9921, down 0.60% on the day.

-

10:46

NZD/USD: Failure to overcome 0.6010/0.6060 can lead to continuation in downtrend – SocGen

NZD/USD has failed to sustain the upside above 0.5800. While below 0.6010/0.6060, the downtrend is set to persist, economists at Société Générale report.

50-day moving average near 0.6010/0.6060 to be an important hurdle near-term

“NZD/USD recently formed an interim low near the lower limit of a multi-month down sloping channel at 0.5565 which is also a trend line drawn since 2009.”

“An initial bounce is taking shape; the 50 DMA near 0.6010/0.6060 which is also the low of July is expected to be an important hurdle near-term. Failure to overcome this resistance can lead to continuation in downtrend towards last month trough of 0.5565 and 2020 levels of 0.5495/0.5470.”

-

10:45

Singapore: Unexpected drop in the Manufacturing PMI – UOB

Senior Economist at UOB Group Alvin Liew assesses the recently published Manufacturing PMI in Singapore.

Key Takeaways

“Singapore’s manufacturing Purchasing Managers’ Index (PMI) edged slightly below 50.0, at 49.9 in Sep, marking the first contraction in overall activity for the manufacturing sector after 26 straight months of expansion in overall activity since Jun 2020 (48.0 in Jun 2020).”

“More importantly, the electronics sector PMI slipped further into contraction territory, by another 0.2 point to 49.4, the second contraction in a row after two years of continuous expansion, and the lowest reading since Jul 2020 (at 49.2). The dismal electronics reading was due to a faster rate of contraction in many of the key metrics including the sub-indexes of new orders, new exports, output, finished goods and imports. In comparison to the overall employment index (which rose further to 50.3 from 50.2), the electronics employment index slipped below 50 (to 49.8) for the first time since Oct 2020.”

“Manufacturing Outlook – The latest headline and electronics PMI number painted a consistent picture from what we saw in the latest non-oil domestic exports (NODX) and industrial production (IP) data. We are cautiously positive on the outlook for transport engineering, general manufacturing, and precision engineering, to drive overall manufacturing growth (which will provide some support to overall PMI) but we see a weaker electronics performance and slowing demand from North Asian economies that could increasingly weigh on NODX momentum and manufacturing activity. We maintain our Singapore manufacturing growth forecast at 4.5% in 2022 (from 13.2% in 2021) but we expect the sector to contract by 3.7% in 2023 due to the faltering outlook for electronics and weaker external demand. In the same vein, our full year 2022 GDP growth forecasts are unchanged at 3.5% but growth will likely slow significantly to 0.7% for 2023, as we now project the US and European economies (which are key end demand markets for Singapore) to enter into a recession in the next 6-12 months amidst aggressive monetary policy tightening stance among these advanced economies, while the electronics manufacturing outlook looks precarious as we head toward end2022/early 2023.”

-

10:44

Gold Price Forecast: XAU/USD drops to $1,710 as US dollar rises with yields ahead of data

- Gold Price holds lower ground after US dollar recovers ground after Tuesday’s steep sell-off.

- Risk tone remains tepid amid geopolitical issues while Treasury yields recover.

- XAU/USD corrects from three-week highs after rejection at the 50 DMA barrier.

Gold Price is in the red for the first time so far this week, as the US dollar is seeing a sweeping demand amid a risk-off market profile. The greenback is unwinding the 1.3% overnight sell-off, which marked its biggest drop since March 2020 ahead of the critical US ADP employment report and ISM Services PMI.

Hopes for aggressive Fed rate hikes are back on the table after the hawkish RBNZ 50 bps rate increase, fuelling a fresh upswing in the US Treasury yields across the curve. The non-yielding gold feels the heat from the upsurge in the dollar alongside the yields.

Escalating geopolitical tensions between Russia and the West are doing little to offer any respite to XAU bulls, as risk-off flows and the dollar demand dominate across the financial market. Investors await the top-tier US economic releases and Fedspeak for fresh hints on the size of the next Fed rate hike.

Also read: Gold Price Forecast: 50 DMA appears a tough nut to crack for XAU/USD bulls ahead of US data

Technically, the bearish 50-Daily Moving Average (DMA) at $1,724 has tempered the gold price rally. A sustained break above the 50 DMA is needed to challenge the September highs at $1,735, above which the $1,750 psychological level will come into play.

On the downside, the previous critical resistance now support at $1,700 could offer temporary reprieve to buyers, below which the previous day’s low of $1,695 could be revisited.

Gold Price: Daily chart