Notícias do Mercado

-

23:45

AUD/USD picks bids around 0.6400 ahead of US NFP, risk-off still active

- AUD/USD finds a short-term cushion around 0.6400 as the risk-off impulse is still sold.

- Hawkish commentaries from Fed policymakers will strengthen the DXY further.

- The US NFP will remain a mega event for the currency market ahead.

The AUD/USD pair has sensed buying interest from 0.6400 and is marching higher gradually in early Tokyo. The aussie bulls have attempted a rebound despite the stability of the risk-off impulse in the market. The 10-year US Treasury yields are solid around 8.3% and have not displayed any sign of correction yet. Also, S&P500 is hovering around lower levels and is still far from any pullback move. Therefore, odds are favoring a mere pullback in the commodity-linked currency after a vertical fall.

The mighty US dollar index (DXY) is expected to strengthen further on hawkish commentary from Federal Reserve (Fed) policymakers.

Chicago Fed Bank President Charles L. Evans has provided crisp guidance for rate hikes in the remaining 2022. Fed policymaker believes that the central bank will reach the targeted rate of 4.5-4.75% by the spring of 2023. He sees no impact on Unemployment Rate and believes a good amount of strength in the US economy. He further added that policymakers are looking to raise borrowing rates by 125 basis points (bps) collectively in the remaining two monetary policy meetings in 2023.

Also, Fed Governor Christopher Waller crosses wires on Thursday, stating that he sees little reason for the slow down of policy tightening pace by the central bank. He further added that "Inflation is far from the FOMC’s goal and not likely to fall quickly,"

In today’s session, investors will keep an eye on US Nonfarm Payrolls (NFP) data. The payroll data is expected to land at 250k, lower than the prior release of 315k. While the Unemployment Rate is seen as stable at 3.7%.

Aussie bulls are still in the hangover of weak Trade Balance data. The economic data landed lower at 8,324M, lower than the projections of 10,500M and the prior release of 8,733M. Going forward, the Australian Westpac Consumer Confidence data will remain in focus.

-

23:06

EUR/USD senses downside momentum loss around 0.9800 as focus shifts to US NFP

- EUR/USD is attempting to rebound from below 0.9800, downside seems favored.

- The DXY could stay sideways ahead of the US NFP data.

- EU officials to discuss more on price cap of Russian oil shipments for third countries with G7.

The EUR/USD pair is attempting to defend the extension of weakness below 0.9790 and is sensing buying interest in the early Tokyo session. The asset is displaying sigs of exhaustion in the downside momentum, which could result in a pullback move ahead. Risk sentiment is still negative and the US dollar index (DXY) has not displayed any sign of exhaustion in the uptrend, therefore, the downside momentum in the asset could resume sooner.

The major could shift into a chartered territory as investors are awaiting the release of the US Nonfarm Payrolls (NFP) data. As per the consensus, the employment generation data is expected to underperform. The job additions are seen at 250k, lower than the prior release of 315k. The US labor market is extremely tight, therefore, jobs will continue to rise but at a diminishing rate.

Apart from that, the Average Hourly Earnings data will be of utmost importance. The projections display a downward shift to 5.1%, 10 basis points (bps) lower than the prior release. Price pressures in the US economy have yet not displayed a meaningful downward shift yet, therefore, lower earnings won’t be able to offset the higher payouts by the households.

Odds of a bigger rate hike by the Federal Reserve (Fed) have become strong as Fed Governor Christopher Waller crosses wires on Thursday, stating that he sees little reason to slow down the policy tightening pace by the central bank. He further added that "Inflation is far from the FOMC’s goal and not likely to fall quickly,"

On the Eurozone front, the discussions over the implementation of a price cap for Russian oil shipments for third countries with G7 countries will stretch to work out the exact mechanism to set a specific cap, EU officials told Reuters on Thursday. On the economic data front, weaker Eurozone Retail Sales data weakened the shared currency bulls. The Retail Sales data is contaminated with inflationary pressures but still has declined by 2% vs. the projections of a decline of 1.7%.

-

22:55

GBP/USD Price Analysis: Bears ready to pounce and eye 1.0900, but NFP matters most

- GBP/USD bears are lurking and eye a run into the 1.0900s.

- The focus will be on the US NFP data and how US yields and the US dollar react.

GBP/USD has been sold heavily towards the remaining sessions of the week. On Thursday, the bears moved in below the countertrend line on the hourly chart.

The price moved into the low 1.1100s with the groundwork being done in London. Traders in the US session finished off what the bears started in Europe and there could be more to come depending on the outcome of Friday's key US event in Nonfarm Payrolls:

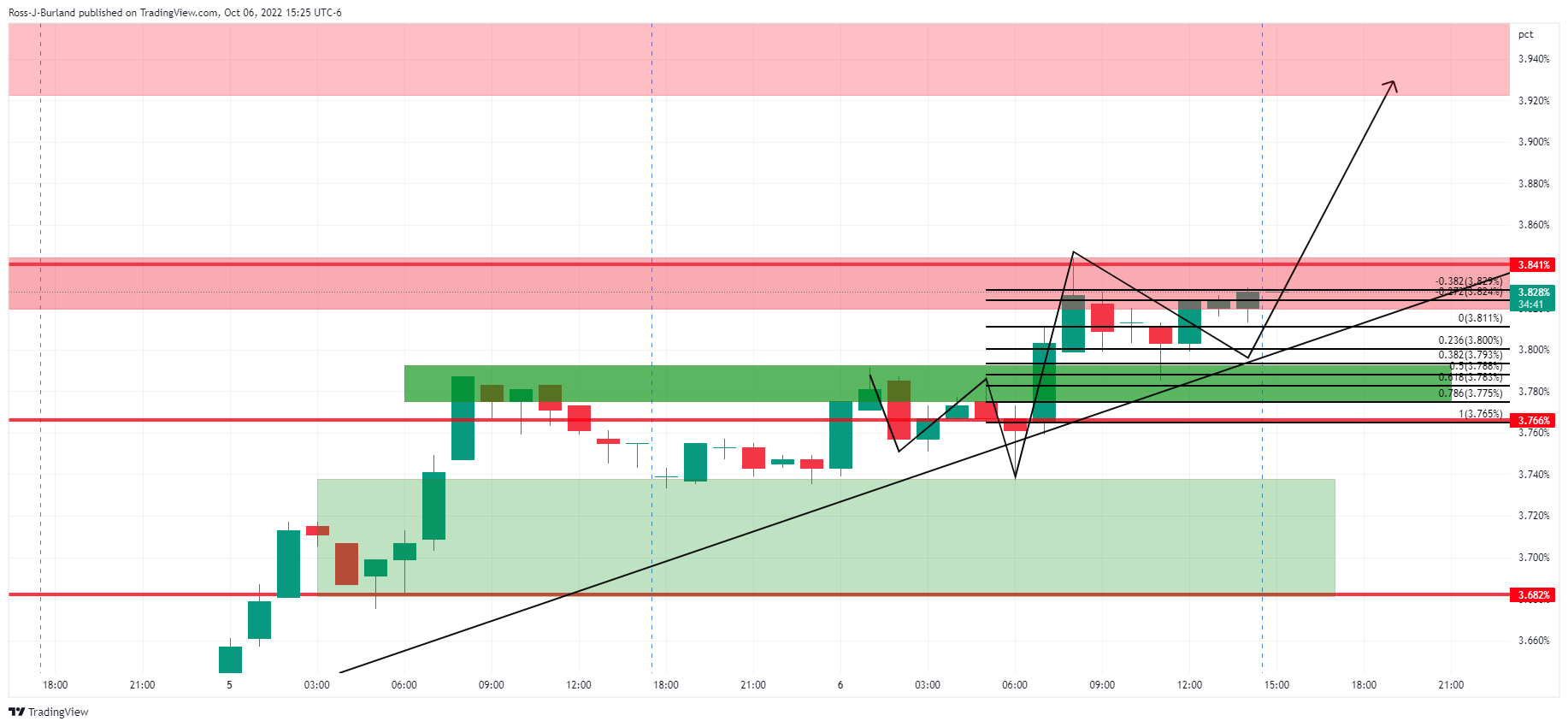

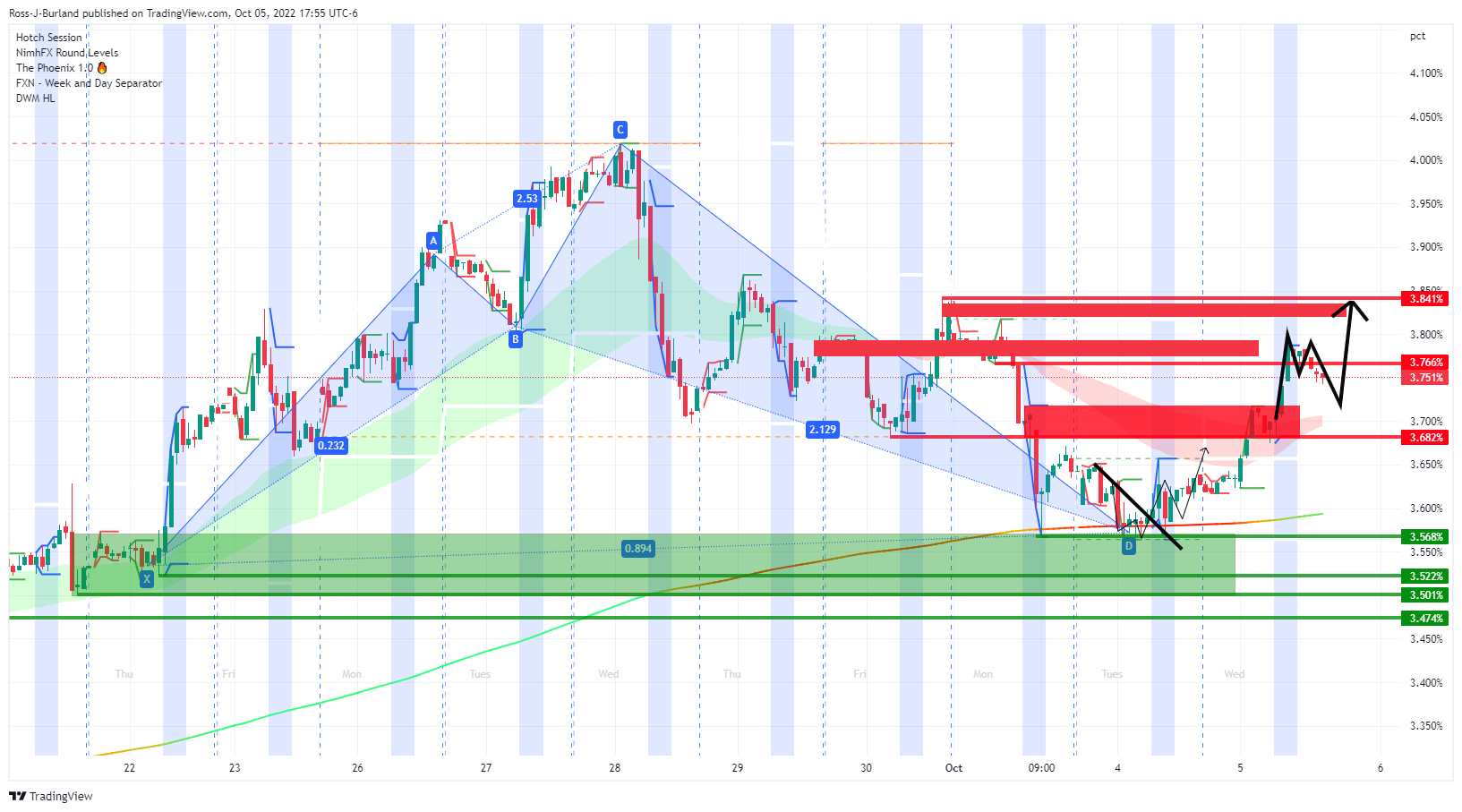

US 10-year yield H1 charts

The W-formation, zoomed in, is bullish as price meets support at the neckline. This is a bearish scenario for cable.

DXY H1 chart

Despite downbeat Initial Jobless Claims, the DXY index, which measures the US dollar vs a basket of currencies, including the pound, rose and extended its gains from the previous day.

On Thursday, the greenback is back above 112.00, recovering from when it was initially falling against most majors at the start of the week before regaining ground. The question here is whether it can extend the gains towards the high of the week through 112.50. If Friday's NFP is terrible, then the 111 level will potentially come under pressure, whereas if the data is in line, it will be another disappointment for those looking for a Fed pivot and positive for the greenback, bearish for GBP:

GBP/USD weekly chart

The price has come up to test the trendline in a strong move through key Fibonacci levels. However, there is a daily price imbalance, as per the greyed area and while below resistance, the focus remains on the downside.

GBP/USD daily chart

On the other hand, should the bears stay the course and a bullish outcome for the US dollar in today's Nonfarm Payrolls, then the following illustrates the prospects of a move into the 1.0900s according to the hourly structure:

-

22:47

GBP/JPY Price Analysis: Oscillates around 162.00 on risk-off impulse

- GBP/JPY remains positive in the week, up by 0.32%, despite falling in the last couple of days.

- The cross-currency failure to crack the 200-EMA in the 4-hour chart will exacerbate a fall toward 160.00.

The GBP/JPY extended its losses amid worries that a Fed dovish pivot should be put on a drawer, with US economic data giving mixed signals ahead of a crucial US employment report on Friday. Therefore, sentiment shifted sour as US equities finished with substantial losses. At the time of writing, the GBP/JPY is trading at 162.05, testing the confluence of several DMAs.

GBP/JPY Price Forecast

From a daily chart perspective, the GBP/JPY is testing a busy area, with the 20 and 50-day EMAs hoovering around the 162.05-18 region. Notably, the GBP/JPY tumbled below the 100-day EMA, exacerbating a fall toward the daily low of 161.08. Nevertheless, buyers stepping in around the 161.00 figure trimmed some of Thursday’s losses, trying to achieve a daily close above important DMAs.

Near-term, the GBP/JPY four-hour chart portrays the pair as neutral-to-downward biased due to the cross falling below the 20 and the 200-EMAs. At the time of typing, the GBP/JPY is testing the 200-EMA at 162.13, which, once cleared, could open the door for a rally toward the 20-EMA at 163.90.

Nevertheless, the path of least resistance is downwards, so failure to crack the 200-EMA will expose essential support levels. Therefore, the GBP/JPY first support will be the 142.00 mark. A breach of the latter will expose the confluence of the S2 and the 100-EMA at 161.12, followed by the 50-EMA at 160.22.

GBP/JPY Additional Technical Levels

-

22:17

Fed's Waller: Sees further aggressive rate hikes in inflation battle

Governor Christopher Waller said on Thursday in a hawkish speech that he sees little reason to ease the pace of Fed policy tightening.

The US Federal Reserve needs to keep raising interest rates into early next year to bring down stubbornly high inflation, he argued.

"Inflation is far from the FOMC’s goal and not likely to fall quickly," Waller said.

"I imagine we will have a very thoughtful discussion about the pace of tightening at our next meeting," he said, noting that there has been little progress on inflation and "until that progress is both meaningful and persistent, I support continued rate increases, along with ongoing reductions in the Fed’s balance sheet, to help restrain aggregate demand."

Key notes

I support continued rate hikes until we see meaningful, persistent progress on US inflation.

Monetary policy can and must be used aggressively to bring down inflation.

Likely not enough data before the November meeting to significantly alter my view of economy.

I anticipate additional rate hikes into early next year.

The stance of policy is slightly restrictive, beginning to see some adjustment in sectors like housing.

Will have a 'very thoughtful discussion' about the pace of tightening at the next meeting.

The availability of swap lines, and the existence of standing repo facilities are stabilizing forces.

Not considering slowing rate increases or halting them due to financial stability concerns.

Markets are operating effectively.

US economy set for below-trend growth in 2h 2022.

The labour market is strong and very tight.

The focus of monetary policy needs to be fighting inflation.

Cannot dismiss the possibility of a larger drop in demand, and house prices before the market normalize.

Friday's jobs report likely will not alter the view fed should be 100% focused on reducing inflation.

Inflation is much too high, and not likely to fall quickly.US dollar update

The US dollar, despite downbeat Initial Jobless Claims, rose and extended its gains from the previous day.

On Thursday, ahead of today's Nonfarm Payrolls data in the US session, the greenback is back above 112.00, recovering from when it was initially falling against most majors at the start of the week before regaining ground:

-

21:05

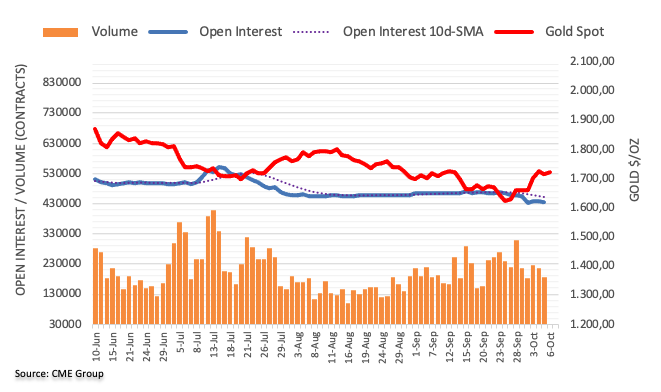

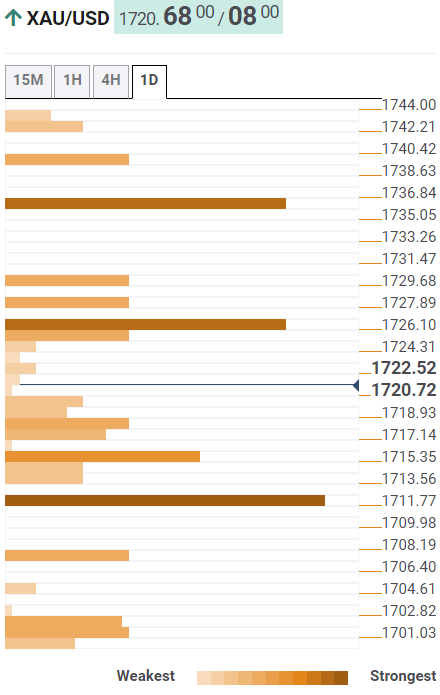

Gold Price Forecast: XAU/USD bulls beaten back by the US dollar bulls at key daily resistance

- Gold bears move in at critical daily restaice.

- The focus will be on the US jobs market at the end of the week.

The price of gold is back to flat on the day in what has been a correction of this week's rally into daily resistance near $1,730. The price fell from a high of $1,725.60 to a low of $1,706.95 but held above the prior day's lows despite firmer US yields and a stronger US dollar.

Overall, the yellow metal has been more robust of late, making its way back into the $1,700's this week, recovering from last month's lows that were made as US bond yields surged to multi-year highs. The sentiment surrounding the Federal Reserve has been the driver, as fickle as it is. However, with data ebbing and flowing in and out of the inflationary territory, the yellow metal has been able to benefit at times of less hawkish speculation surrounding the Fed's next moves with participants betting on a pivot at the start of the week.

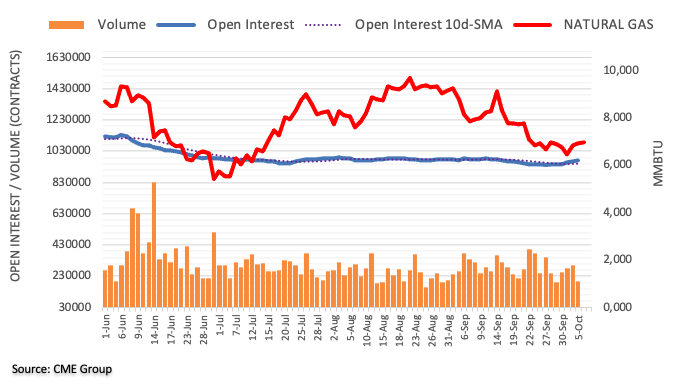

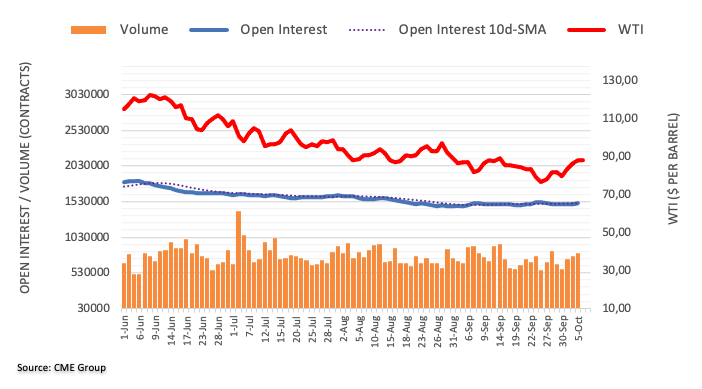

However dovish hopes were dashed following the OPEC+ announcement of big oil production cuts to support oil prices, thereby sending other commodity prices, such as lumber higher:

The classic falling wedge and M-formation is bullish for the outlook in lumber. From sawmills to store shelves, lumber can tell the markets a lot about what’s going on in the US economy and with prospects of higher prices in oil and lumber, inflation would be expected to stay elevated. This in turn coincides with a chorus of Fed's hawkish speakers this week.

Charles L. Evan who is the chief executive officer of the Federal Reserve Bank of Chicago has said in recent trade that inflation is very high right now and that's the issue that's top of mind for the Fed. ''At Fed's next meeting will discuss whether 50 bps or 75 bps,'' he said, adding, ''policymakers are looking for 125 bps of rate hikes over next two meetings.''

Meanwhile, analysts at TD Securities argued that ''in reality, inflation's rising persistence suggests the Fed is unlikely to stop hiking preemptively.''

''A prolonged period of restrictive rates suggests traders should ignore gold's siren calls, as a sustained downtrend will likely prevail, while quantitative tightening continues to drive real rates higher.''

''In the meantime, however, the margin of safety against a change in trend signals has eroded, which places a low bar for additional buying activity from CTAs. While the cohort has continued to add to their silver length in recent sessions, gold prices need only rise north of $1755/oz to catalyze a trend following buying program.''

As for price action on the day, so far, the US dollar, despite downbeat Initial Jobless Claims, rose and extended its gains from the previous day. On Thursday, the greenback is back above 112.00, recovering from when it was initially falling against most majors at the start of the week before regaining ground:

As for the 10-year yield, this too headed higher and there could be more to come before the week is out:

US benchmark Treasury yields whose recent gains have helped to drive the greenback higher, were up to test the prior resistance at 3.841%. The yield was piercing those highs on Thursday and printing 3.844% as Wall Street cash markets fell in the open.

NFP in focus

The focus will be on the Nonfarm Payrolls to close out the week. ''Employment likely continued to advance strongly in September but at a less robust pace compared to recent months,'' analysts at TD Securities explained.

''We also look for wage growth to moderate to 0.3% m/m. Separately, regional surveys continue to point to the loss of momentum in mfg activity. While we look for a decline in the ISM index, we note that it has failed to match prior weakness suggested by other indicators.''

Gold technical analysis

A break of the recent $1,735 highs opens the risk of a significant bullish extension. However, it is make-or-break time and the price could easily retreat, depending on Friday's NFP and next week's inflation data.

-

20:58

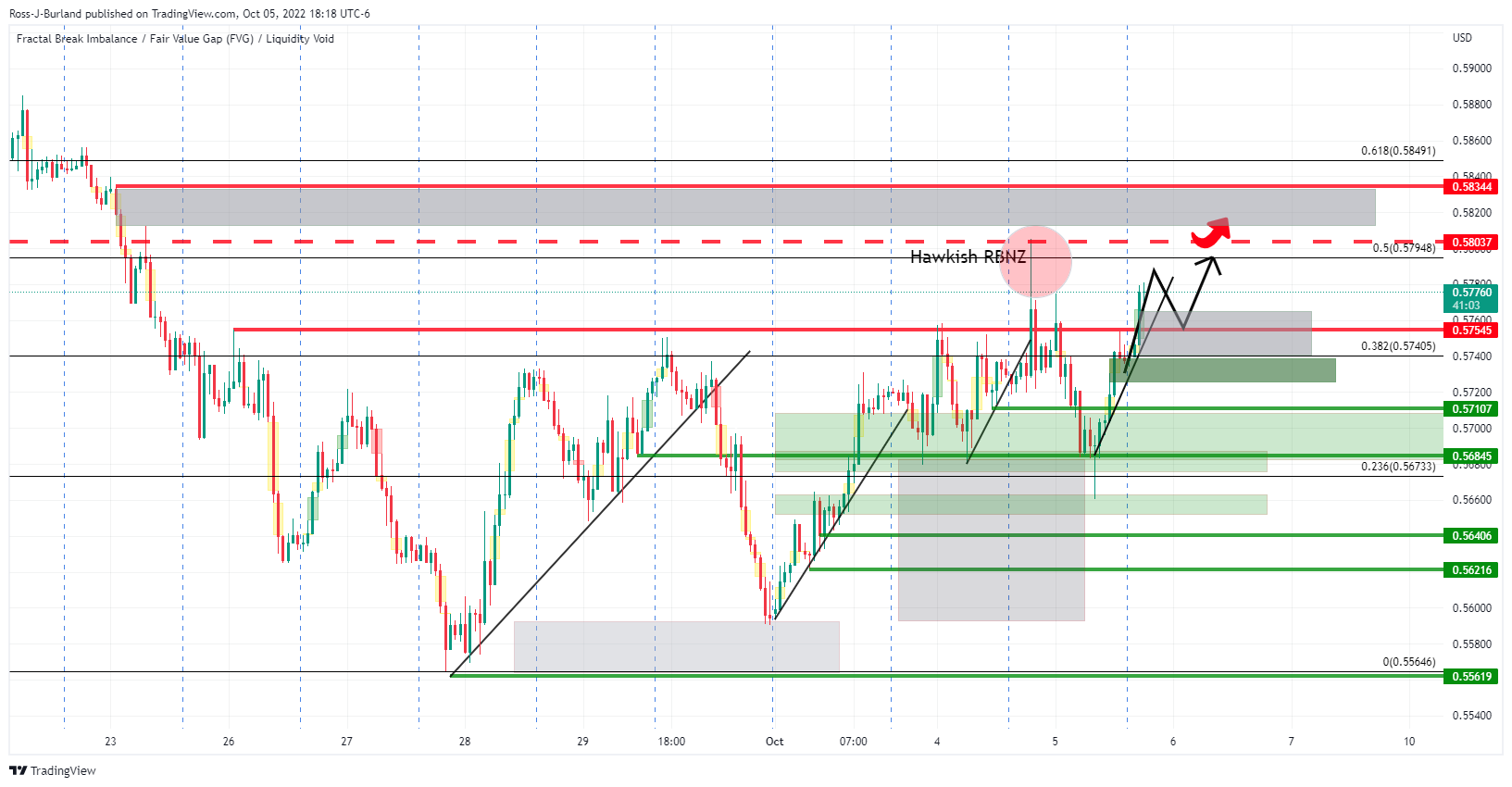

NZD/USD declines below 0.5660, on Fed speaking, ahead of US NFP

- NZD/USD remains gaining during the week, more than 1%.

- US central bank policymakers continued with the higher interest rates-for-longer narrative for the fourth consecutive day.

- Fed’s Evans estimates the Federal funds rate (FFR) to peak around 4.50-4.75%.

The NZD/USD plummeted as Wall Street’s entered its last hour of trading due to risk aversion, as US jobs data was mixed, while Fed officials’ hawkish narrative persists, as stubbornly as high inflation impacting the US economy.

A the time of writing, the NZD/USD is trading at around 0.5650s after hitting a daily high of 0.5813, shy of the 20-day EMA, diving close to 100 pips in the day, despite Wednesday’s RBNZ 50 bps rate hike, which bolstered the NZD/USD, keeping price action above the 0.5700 thresholds.

The Fed parade continued on Thursday. Fed Governor Lisa Cook expressed that inflation is “stubbornly and unacceptably high” and added that she supported the three 0.75% rate hikes, as front loading will accelerate the impact of the monetary policy.

Of late, the Chicago Fed President Charles Evans said that the Federal funds rate (FFR) is headed towards 4.5-4.75% by March 2023 and added, “we have further to go in rates.” According to him, the Federal Reserve needed to hike 125 bps in the last two meetings of the year, emphasizing the need to get more restrictive.

Earlier, the Minnesota Fed President Neil Kashkari expressed that the fed needs “more work to do” to temper inflation down while adding that a pause in hiking rates is “quite a ways away.” Kashkari commented that he’s not “comfortable saying that we (the Fed) are going to pause” unless they see compelling evidence that inflation is cooling.

Data-wise, the US Initial Jobless Claims for the week that ended on October 1, rose by 219K, above estimates of 204K, signaling that the labor market is cooling. Nevertheless, it should be noted that Wednesday’s ADP Employment Change showed that private hiring increased by 208K. Exceeding estimates of just 132K. All that said, traders’ focus is on the Nonfarm Payrolls report.

In the meantime, the US Dollar Index, a measure of the buck’s value against its peers, is climbing almost 1%, at 112.233, a headwind for the NZD/USD.

Elsewhere, on Wednesday, the Reserve Bank of New Zealand hiked rates by 50 bps. Initially, the NZD/USD was contained from falling and recorded a weekly high at 0.5813. However, as the Fed pivot narrative dissipated and sentiment shifted sour, broad US dollar strength was a headwind for the NZD/USD.

What to watch

An absent New Zealand docket will leave traders leaning on the US Nonfarm Payrolls report, alongside further Fed speaking, led by NY Fed John Williams, Minnesota Fed Neil Kashkari and Atlanta’s Fed Raphael Bostic.

NZD/USD Key Technical Levels

-

20:49

Forex Today: Dollar returns ahead of the Nonfarm Payrolls report

What you need to take care of on Friday, October 7:

The American dollar recovered its positive momentum and closed Thursday with gains against most major rivals. The tepid tone of global equities and rising US Treasury yields underpinned the greenback while reflecting investors’ concerns.

The EUR/USD pair trades just below the 0.9800 figure, as worse-than-anticipated EU data added pressure on the EUR. German Factory Orders declined by 2.4% MoM in August. The annual reading, however, was better than anticipated, still down by 4.1%. Meanwhile, EU Retail Sales contracted a modest 0.3% MoM in August but were sharply down compared to a year earlier, shedding 2%.

Also, the European Central Bank published the Monetary Policy Meeting Accounts, which showed that some officials preferred a bigger rate hike of 50 bps. Additionally, the median three-year inflation expectations remained at 3%. Policymakers noted that the EUR depreciation could exacerbate inflationary pressures, adding that acting “decisively” now will prevent the need to hike at a more aggressive pace later.

Bank of Canada Governor Tiff Macklem hit the wires and said that while easing inflation is welcome news, it would not disappear on its own. Market players rushed to price in higher chances of the BOC hiking rates by 50 bps in October. The USD/CAD pair is up to 1.3740.

In the US several US Federal Reserve officials were on the wires, all of them aligned with the aggressive monetary tightening. Wall Street extended its slide after starting the day with modest losses. US Treasury yields, on the other hand, reached fresh weekly highs.

The Australian dollar was among the worst performers, trading against the dollar at around 0.6400 and not far from the 2022 low at 0.6362. GBP/USD also resumed its decline and is now hovering at around 1.1150.

The greenback appreciated against its safe-haven rivals. USD/CHF is hovering around 0.9910, while USD/JPY ticked higher and stands just above 145.00.

Spot gold shed some ground but held above the critical $1,700 threshold. It currently changes hands at $1,713 a troy ounce. Crude oil prices kept advancing, with WTI now trading at $88.80 per barrel.

The focus on Friday will be on US employment data, as the country will publish the September Nonfarm Payrolls report.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: The next move could surprise us all

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:01

Argentina Industrial Output n.s.a (YoY) increased to 7.6% in August from previous 5.1%

-

19:40

EUR/JPY Price Analysis: Extends its losses, drops towards 142.20s

- EUR/JPY tumbles but remains above the 20-day EMA, despite RSI’s shifting bearish.

- Short term, the EUR/JPY might re-test the October 5 low of 142.44 before resuming its downtrend towards 141.00.

EUR/JPY continues to fall for the second straight day due to market sentiment turning sour, as portrayed by Wall Street’s set to finish with losses, while US Federal Reserve policymakers remain committed to crushing inflation. At the time of writing, the EUR/JPY is trading at 142.24, down by 0.51%.

EUR/JPY Price Forecast

The EUR/JPY daily chart portrays the pair’s faced solid support at the 20-day EMA around 142.08. Even though Thursday’s daily low was 141.95, sellers could not hold the fort, so the EUR/JPY reclaimed 142.00. It should be noted that the Relative Strength Index (RSI) just crossed below the 7-day RSI’s SMA, indicating that sell orders could be beginning to pile in the pair. Unless the EUR/JPY registers a daily close below 142.00, the pair is still neutral-to-upward biased.

Short term, the EUR/JPY is neutral to downward biased, hoovering around the S1 daily pivot at 142.28. On Thursday, the pair stumbled below the 50, 20, and 100-EMAs, opening the door for further losses, but the fall stalled at 142.00.

Although the cross-currency is downward biased, the Relative Strength Index (RSI) crossed above its 7-RSI’s SMA, meaning buyers are gathering some strength. So a re-test of October 5 daily low at 142.44 is on the cards before continuing downwards.

If that scenario plays out, the EUR/JPY first support would be 142.00. Break below will expose the S2 daily pivot at 141.50, ahead of the next demand zone, and the 200-EMA at 141.28, followed by the 141.00 figure.

EUR/JPY Hourly Chart

EUR/JPY Key Technical Levels

-

19:29

USD/JPY Price Analysis: Bulls looking for a break towards 146.00

- USD/JPY bulls have moved up into the 145.00 area and eye a run towards 146.00.

- The US dollar and US yields are running higher.

On Thursday, despite downbeat Initial Jobless Claims, the US dollar rallied as per the DXY index which measures the greenback vs. a basket of currencies. This is turn has seen USD/JPY rally on the back of higher US yields, extending their gains from the previous day as illustrated in the technical analysis below.

Fundamentally, the focus is now going to be on the Nonfarm Payrolls (NFP) tomorrow and then next week, the Fed receives the latest report on consumer inflation.

US 10-Year Yield H1 chart

US benchmark Treasury yields whose recent gains have helped to drive the greenback higher, were up to test the prior resistance at 3.841%. The yield was piercing those highs on Thursday and printing 3.844% as Wall Street cash markets fell in the open.

Meanwhile, forex has been volatile this week and the US dollar along with it. The greenback has struggled to find a clear direction following a dramatic third quarter, but on Thursday, higher by some 0.8% and back above 112.00, it has been regaining ground and is up about 17% for the year so far:

DXY H1 chart

USD/JPY H1 chart

As for USD/JPY, if the dollar starts to fold at the top of the rising channel, as illustrated above, then there will be prospects of a move lower to test the bulls commitments at the trendline support between 144.90 and 144.70. The bears will be back in charge below 144.35 and 144.05.

-

19:02

AUD/USD falls below 0.6430 due to dovish RBA’s and Fed officials’ hawkish commentary

- AUD/USD dives more than 1% but remains above the 0.6400 figure.

- Fed’s Governor Cook expressed that inflation is “stubbornly high” and said more interest rate increases are needed.

- US claims for unemployment exceeded forecasts but remained at lower levels.

- Australia’s Trade Balance was positive but was short of estimations.

The AUD/USD extended its losses to three consecutive days after the Reserve Bank of Australia (RBA) lifted rates by “just” 25 bps, seeing as a dovish hike by market participants and the source of a possible Fed pivot. Nevertheless, Fed officials’ hawkish posture remains, reiterated by Fed’s Cook and Kashkari Thursday’s speeches.

At the time of writing, the AUD/USD is trading at 0.6418 after hitting a daily high of 0.6540, plunging more than 100 pips, weighed by the RBA’s dovish posture and a strong US dollar.

US unemployment jobs data revealed by the US Labor Department showed signs that the labor market might be easing. Unemployment claims for the week ending on October 1 jumped by 219K, exceeding estimates and the third increase since the end of July.

Aside from this, at the time of typing, one of the newest Fed Governor Lisa Cook expressed that inflation is “stubbornly and unacceptably high,” according to her, still needing interest rate increases to ensure that it begins to fall towards the Fed goal. Cook said that she backed the three-quarter points increases at her first meetings as governor, agreeing that “front-loading” will quicken the policy impact on the economy.

Earlier, the Minnesota Fed President Neil Kashkari crossed newswires. He said that the Fed is “quite a ways away from pausing rates,” adding that the Fed has “more work to do” to tackle inflation down.

All that said, the US Dollar Index, a gauge of the buck’s performance against six currencies, edges up by 0.31%, at 112.082, a headwind for the AUD/USD.

The interest rate differential would likely favor the USD vs. the AUD. Money market futures expect the Federal funds rate (FFR) to peak around 4.5%, while the RBA Cash Rate is expected to top around 3.6%, a headwind for the AUD/USD.

Elsewhere, Australia reported its Trade Balance, which showed a surplus of $8.3 billion, shorter than estimated, and according to ANZ analysts, “the days of record trade surpluses are over.” Imports jumped by 4.5% MoM, and Exports also increased at a modest 2.6% MoM.

According to ANZ analysts, the already battered China’s real estate sector weighed on lower demand for Iron ore, but “strong coal and LNG exports counterbalanced sluggish iron ore exports.”

What to watch

An absent Australia’s economic docket would leave traders leaning on US economic data. On the US front, the calendar will feature September’s Nonfarm Payrolls report and the Unemployment Rate.

AUD/USD Price Forecast

The AUD/USD consolidates for the eighth consecutive day, within the 0.6400-0.6550 range. However, the Relative Strength Index (RSI) shifted downwards in the last four trading days, meaning sellers are gathering momentum. Still, unless the exchange rate tumbles below 0.6400 and challenges the YTD low at 0.6363, the AUD/USD bias will remain subdued.

-

18:44

Fed's Evans: ‘Good amount of strength in US economy’

Charles L. Evan who is the chief executive officer of the Federal Reserve Bank of Chicago has said in recent trade that inflation is very high right now and that's the issue that's top of mind for the Fed.

He joins a chorus of hawkish Fed officials speaking today advocating for rate rise.

Key comments

''There is a good amount of strength in the US economy.

I suspect the unemployment rate will creep up.

The labour market is still good and will be more challenging with higher interest rates.

We will bring inflation down by making policy restrictive.

At momentum of core inflation, and that's what has us most nervous.

Need a more restrictive seeing of monetary policy because inflation is high.

We should have started rate hikes earlier.

We have further to go on rate hikes.

We are headed to 4.5%-4.75%, likely by springtime.''I believe the balance sheet reduction will be completely within 3 years.

At Fed's next meeting will discuss whether 50 bps or 75 bps.

Policymakers are looking for 125 bps of rate hikes over next two meetings.US dollar update

On Thursday, despite downbeat Initial Jobless Claims, the US dollar rose, extending its gains from the previous day.

Forex has been volatile this week and the US dollar with it. It has struggled to find a clear direction following a dramatic third quarter. On Thursday, the greenback is higher by some 0.8% and back above 112.00. The dollar initially fell against most majors at the start of the week before regaining ground:

The focus is now going to be on the Nonfarm Payrolls tomorrow and then next week, the Fed receives the latest report on consumer inflation.

-

18:08

Fed's Cook: Critical to stop inflationary psychology from taking hold

Federal Reserve governor Lisa Cook said in her first public remarks on monetary policy since joining the central bank's Washington-based board "inflation remains stubbornly and unacceptably high, and data over the past few months show that inflationary pressures remain broad-based."

"The widespread nature of the inflation pressures suggests that the overall economy is very tight," she said.

"The path of policy should depend on how quickly we make progress toward our inflation goal," Cook said.

Cook said she "fully supported" the large rate increases of three-quarter points approved at her first meetings as a governor, and she also agreed with the policy of "front-loading" monetary tightening to quicken its impact and felt changes in policy needed to be rooted in inflation actually falling, not on forecasts of it doing so.

Key comments

''Restoring price stability will likely require ongoing rate hikes, then the restrictive policy for some time.

Need to keep the restrictive policy until confident inflation is firmly on the path to 2%.

Inflation is too high, will keep at it until the job is done.

I fully supported the front-loading of policy over the past three FOMC meetings.

Front-loading puts restraint in place more quickly, and may rein in inflation expectations; this preemptive approach is appropriate.

At some point will be appropriate to slow the pace of rate hikes to assess the effects of tightening.

The labour market is 'very strong,' inflation remains 'stubbornly and unacceptably high, the overall economy is 'very tight'.

My focus is on bringing inflation back down to 2%.

Focused on the lag between signs of easing price pressures and actual inflation coming down.

Policy judgments must be based on inflation falling in the data, not just forecasts.

The risk management approach requires a strong focus on taming inflation.

Critical to preventing inflationary psychology from taking hold; I have revised up my assessment of the persistence of high inflation.

There are reasons to expect core goods inflation to slow in the coming months.

Cannot assume an improvement in supply constraints will be steady.

My colleagues and I are very attuned to foreign developments including monetary policy abroad.

Financial market spillovers are a two-way street, and there is substantial uncertainty about the size.''US dollar update

The focus is on the Nonfarm Payrolls tomorrow and then next week, the Fed receives the latest report on consumer inflation. On Thursday, despite downbeat Initial Jobless Claims, the US dollar rose, extending its gains from the previous day. All in all, forex has been volatile and the greenback has struggled to find a clear direction this week, following a dramatic third quarter. The dollar initially fell against most majors, before regaining ground:

-

18:04

Silver Price Forecast: XAG/USD stumbles towards $20.50s on higher US T-bond real yields

- Silver price retreats from its daily highs around $20.85, down by 0.50% on Thursday.

- Fed policymakers remain “resolute” to tackle inflation, pushing back against rate cuts in 2023.

- US unemployment claims exceeded estimates for the first time since July 2022.

- Silver Price Forecast: Neutral-to-upward biased, but the RSI’s is flashing that buyers are getting a respite before attacking $21.00.

Silver price retraces from daily highs of $20.85 as US Treasury bond yield rise due to US central bank policymakers, led by the Minnesota Fed President Kashkari commenting that it would take longer for the Fed to pause rate hikes. At the time of writing, the XAG/USD is trading at $20.54, losing 0.92%.

XAG/USD drops as US bond yields edge up; traders focus on Friday’s jobs report

US equities trading in the red portrays a sour market sentiment. In the last couple of days, Fed officials have reiterated that inflation is too high and that it would be premature to pause or slash rates, even if the economy gets into a recession. Nevertheless, Fed members have been cautious when speaking about the “R” word, though they acknowledged that the US economy is slowing.

In the meantime, US employment data, revealed by the Bureau of Labor Statistics, reported that Initial Jobless Claims for the week ending on October 1 rose by 219K, more than estimates of 204K. Of note that the rise in claims was just the third increase since the end of July 2022.

Even though bad data is perceived as good data for market players, meaning that as the labor market deteriorates, the Fed would likely tighten at a slower pace. Nevertheless, risk aversion persists, as the greenback remains in the driver’s seat as the US Dollar Index rises 0.42%, back above the 112.000 thresholds, ahead of Friday’s US Nonfarm Payrolls report.

Furthermore, elevated US Treasury bond yields keep the precious metals heavy. The US 10-year T-bond rate yields 3.813%, up by five basis points, while the 10-year Treasury Inflation-Protected Securities (TIPS) bond yield, a proxy for real yields, gains the same amount of bps as the nominal bond, remains at 1.60%.

What to watch

The US docket will feature the Nonfarm Payrolls report. Expectations for September’s figure are that 250K new jobs would be added to the economy, while the Unemployment Rate is expected to remain unchanged at 3.7%.

Also read: NFP Preview: Forecasts from nine major banks, employment trend slows down

Silver (XAG/USD) Price Forecast

The white metal is neutral-to-upward biased. Silver recovered from around $18.00, reclaimed the 20, 50, and 100-day EMAs, and is facing solid resistance at $21.00 a troy ounce on its way north. The Relative Strength Index (RSI) shows that buyers might be getting a respite before challenging the 200-day EMA at $21.90, but first will need to surpass the $21.00 mark.

-

17:39

BoC's Macklem: Path to a soft landing in Canada is a narrow path

"We've been pretty clear that interest rates need to continue to move up," Bank of Canada (BoC) Governor Tiff Macklem reiterated on Thursday, as reported by Reuters.

Key takeaways

"How high interest rates need to go and for how long is going to really depend on how inflation and the economy evolve."

"We are more concerned about the upside shocks to inflation than the downside."

"We certainly wouldn't want to see inflation go up further."

"When we assess impact of higher interest rates on demand, will factor in high household indebtedness levels."

"Interest rates might have a bit more traction because of high levels of household indebtedness."

"Below trend growth is low growth, it doesn't need to be a recession."

"Whether we can get to a soft landing or not will depend in part on how sticky inflation is in Canada."

"Path to a soft landing in Canada is a narrow path and there are risks."

Market reaction

USD/CAD preserves its bullish momentum after these comments and was last seen rising 0.92% on the day at 1.3740.

-

17:14

USD/CAD rallies sharply, towards 1.3720 despite BoC's Macklem hawkish posture

- USD/CAD climbs above 1.3700 as traders eye a break of 1.3800 as they focus on Friday’s NFPs.

- The Bank of Canada’s Governor Macklem said, “further interest rate increases are warranted,” reiterating the BoC’s hawkish stance.

- USD/CAD Price Forecast: An inverted head-and-shoulders in the hourly chart remains in play.

The USD/CAD climbs sharply during the North American session, as Fed officials remained focused on bringing inflation down, disregarding a possible US recession, while markets’ expectations for a Fed pivot dwindled, as shown by US equities, registering losses. Therefore, the USD/CAD is trading at 1.3722, above its opening price by 0.81%.

At the time of writing, the Bank of Canada’s Governor Tiff Macklem expressed in prepared remarks that while Canada’s economy begins to slow, the labor market remains tight, while demand is still eclipsing supply. Macklem commented that the bank needs clear evidence that inflation is coming down.

Hence, BoC’s Macklem added that “there is more to be done,” paving the way for additional rate hikes. The next Bank of Canada’s interest rate decision would be October 26.

Also read: BoC’s Macklem: More rate hikes will be needed

Market’s reaction

The USD/CAD reacted downwards on his remarks crossing newswires, dropping below 1.3700, but quickly reversed its move and testing the daily highs.

Earlier, Canada’s Ivey PMI index for September rose by 55.9 in September, unadjusted, while seasonally adjusted, came at 59.5, below previous figures.

Aside from this, US data, even though it flashed signs that the labor market might begin to feel the Fed’s monetary policy, traders remain at bay, waiting for Friday’s Nonfarm Payrolls figures. Initial Jobless Claims reported by the US Labor Department outpaced expectations in the week ending on October 1, rising to 219K, higher than estimates of 203K, while the 4-week average persisted unchanged at 206.5K.

Before Wall Street opened, the Minnesota Fed President Neil Kashkari said that the Fed is “quite a ways away from pausing rates,” reiterating the that there’s “more work to do” to bring inflation towards the Fed 2% target. Elsewhere, on Wednesday, Atlanta’s Fed Bostic and San Francisco Fed Daly expressed the need to hike rates higher for longer, disregarding possible rate cuts in 2023.

USD/CAD Price Forecast

The USD/CAD one-hour chart grabbed the attention as an inverted head-and-shoulder chart pattern emerged. Earlier, the USD/CAD dived towards its daily low at 1.3564 but is staging a recovery, above 1.3720, testing the previously mentioned head-and-shoulders pattern neckline around current exchange rates. Once cleared, it could open the door for further gains, with the R2 daily pivot being the immediate target at 1.3800, ahead of the 1.3877 head-and-shoulders targets.

-

17:04

EUR/GBP jumps to three-day highs above 0.8800 as pound tumbles

- Pound among worst performers on Thursday.

- Euro drops versus dollar, remains firm against Swiss franc.

- EUR/GBP is up for the third day in a row, back above the 20-day SMA.

The EUR/GBP is rising for the third day in a row and recently reached a three-day high at 0.8818 before pulling back to 0.8790. A weaker GBP is driving the cross to the upside on Thursday. The cross bottomed on Tuesday at 0.8644, and since then, it had been moving to the upside. It is back above the 20-day Simple Moving Average. The next resistance area is seen at the weekly top around 0.8830, followed by 0.8895. The critical support for the current bias might be seen at 0.8740, an uptrend line from Wednesday’s low.

The euro and the pound are falling versus the dollar, trimming weekly gains. The decline in GBP/USD is faster and is approaching 1.1100, while EUR/USD is moving toward 0.9800. EUR/CHF remains steady near 0.9700.

Market participants see the Bank of England and the European Central Bank on the path of further rate hikes over the coming meetings. Although, the actions from the BoE are not only to curb inflation but also to preserve stability in the gilt market.

The BoE defended on Thursday last week’s interventions in the gilt market, mentioning it prevented a £50bn fire sale of UK bonds that would have led to the brink of a financial crisis. The pound is not yet out of the woods. It remains among the most volatile currencies, and after a sharp recovery, weakness is emerging again.

The minutes of the ECB released on Thursday showed discussions about the magnitude of rate hikes and concerns about the impact of the depreciation of the euro on inflation expectations. “The account of the ECB Council meeting in September point to a growing number of arguments for further significant ECB rate hikes in the near term, while the exact level of the terminal rate remains unclear,” said analysts at Commerzbank.

Technical levels

-

16:40

BoC's Macklem: More rate hikes will be needed

Bank of Canada (BoC) Governor Tiff Macklem said on Thursday more rate hikes will be needed to since there is more to be done on inflation, as reported by Reuters.

Additional takeaways

"We need additional information before we consider moving to a more finely balanced decision-by-decision approach."

"We have yet to see clear evidence that underlying inflation in Canada has come down; domestic inflationary pressures have yet to ease."

"Even after stripping out CPI components that are volatile or don't reflect generalized price changes, inflation is running at about 5%; that's too high."

Forward-looking indicators suggest the Canadian economy is slowing but labor markets remain tight and the economy is in excess demand."

"Recent decline in overall Canadian inflation is welcome news but inflation will not fade away by itself; price pressures remain high and continue to broaden."

"Inflation increasingly reflects what we are seeing in Canada; there is some evidence global inflationary pressures have begun to ease."

"Surveys show consumers and businesses are more uncertain about inflation and more of them expect it to be higher for longer."

"So far, longer-term inflation expectations remain reasonably well-anchored but Canadians will need to see inflation clearly coming down to sustain this confidence."

"We can't count on easing global price pressures to lower inflation in Canada."

"Recent depreciation of C$ vs USD will offset some of the global improvement in inflation trends by making US goods and vacations more expensive."

"Bank will focus more on CPI trim and CPI median measures of inflation; the bank is reassessing CPI common measure, which is becoming more difficult to use."

Market reaction

The USD/CAD pair largely ignored these comments and was last seen rising 0.8% on the day at 1.3725.

-

16:34

NFP could disappoint those looking for a pivot at the Fed – TD Securities

On Friday, the US official employment report will be released. Market consensus is for an increase in payrolls of 250K. Analysts at TD Securities see another strong advance in September and warn that such a scenario would represent another disappointment for those looking for a pivot at the Federal Reserve.

Key Quotes:

“We look for payrolls to have continued to advance strongly in September (TD: 300k), which would represent little change vs the 315k increase registered in August. We look for this solid net gain in employment to be reflected in a decline in the UE rate to 3.6% following its unexpected 0.2pp jump to 3.7% in August.”

“Stronger payrolls would be another disappointment for those looking for a Fed pivot. USD dips are an opportunity to accumulate longs against currencies that have yet to be hit by that wrecking ball. We set our sights on CAD again. Expect EURUSD downtrend channel to remain intact, though a disappointment in payrolls could see a test above parity.”

“We think the rates market is priced for a strong report, as the terminal rate has risen to 4.5% and the market has pushed out the timing and magnitude of rate cuts.”

-

16:31

United States 4-Week Bill Auction climbed from previous 2.66% to 2.92%

-

16:28

BoE's Haskel: Rise in economic inactivity will hold UK growth back

The Bank of England's (BoE) Monetary Policy Committee (MPC) has the tools and the resolve to return inflation to target in the medium term, BoE policymaker Jonathan Haskel said on Thursday, as reported by Reuters.

Key takeaways

"A sidelined Office for Budget Responsibility (OBR) generates more uncertainty by worsening everyone’s information base."

"We welcome the usual close involvement in the budget process of the OBR."

"Government is right to stress the importance of economic growth."

"Changes in labour force participation are emerging as the key economic legacy of covid in the UK."

"Rise in economic inactivity will hold UK growth back."

Market reaction

These comments failed to help the British pound find demand and the GBP/USD pair was last seen losing 1.25% on the day at 1.1184.

-

16:28

USD/CNY to rise to 7.1 by year-end – BBVA

According to the Research Department at BBVA, the RMB to USD exchange rate is set to depreciate due to the diverging monetary policy between China and the United States. They see the USD/CNY at 7.1 at the end of the year.

Key Quotes:

“Chinese economy has experienced a bumpy recovery after the Shanghai lockdown was lifted. We lowered our 2022 prediction from 4.5% to 3.6%.”

“RMB to USD exchange rate is anticipated to depreciate to 7.1 at end-2022 reflecting the recent interest rate cut and the recent breaking-7 trend, amid the diverging monetary policy between China and the US, a stronger USD DXY, slower exports, and capital outflows etc.”

“Depreciation pressure is not only for RMB, but for all EM currencies AM currencies that have a slower pace of rate hike than the FED (JPY, GBP, Euro etc.) , and among all EM currencies, RMB probably depreciated modestly due to capital control measures.”

“We predict RMB to USD exchange rate will be tightly related to USD DXY trend. Based on our forecast of FED interest rate hike path, RMB will depreciate to 7.1 at end-2022, 7 at end-2023 and 6.9% at end-2024.”

-

16:15

GBP/USD plunges below 1.1200 as Fed dovish pivot hopes abate

- GBP/USD fails to hold to gains above 1.1300 and tumbles below 1.1200.

- Fed’s Kashkari said that the Fed has “ways away from pausing rates,” killing Fed pivot hopes.

- US jobless claims jumped, but the focus shifted to Friday’s Nonfarm Payrolls.

The GBP/USD extends its losses to two-consecutive days after snapping six days of gains, which bolstered the major towards the 1.1500 area. Sentiment deterioration amidst a possible Fed pivot waning, as Fed policymakers insist on higher rates, alongside good US data, being bad data, keeps the GBP/USD heavy.

Therefore, the greenback is appreciating against most G8 currencies. At the time of writing, the GBP/USD is trading at 1.1180 below its opening price by almost 1.30% after hitting a daily high of 1.1383.

GBP/USD drops due to further Fed hawkish commentary

Early Thursday, the Minnesota Fed President Neil Kashkari crossed newswires. He said that the Fed is “quite a ways away from pausing rates,” adding that the Fed has “more work to do” to tackle inflation down. He echoed Wednesday’s comments of San Francisco Fed Mary Daly and Atlanta’s Fed Bostic, both not expecting to cut rates through 2023, contrary to what money market futures expect.

Data-wise, the US Department of Labor reported that unemployment claims increased, a positive sign for the Federal Reserve. Initial Jobless Claims for the week ending on October 1 rose by 219K, higher than the 203K estimated by analysts. The four-week moving average, which smooths volatile week-to-week results, was almost unchanged at 206.5K.

On the UK’s front, businesses inflation expectations rose to 9.5% in September, from 8.4% in August, according to a Bank of England Survey on Thursday. Even though the Bank of England is expected to keep rates higher, Wells Fargo analysts expect further British pound weakness.

“We expect further significant weakness in the pound. With the UK still seen falling into recession and CPI inflation expected to peak lower than previously, we expect BoE rate hikes to fall well short of the Fed.”

Traders should be aware that EU and UK officials are re-engaging in Brexit negotiations regarding the Northern Ireland Protocol, as the Irish Foreign Minister Simon Coveney said on Wednesday.

What to watch

The UK calendar will feature Halifax House Prices. On the US front, further Fed speaking for the remainder of the day, alongside Friday’s Nonfarm Payrolls and the Unemployment Rate.

GBP/USD Technical Analysis

The GBP/USD tumbled below the 20-day EMA, extending its losses beyond the 61.8% Fibonacci retracement at 1.1210, exposing the 50% Fibonacci retracement at 1.1047. Traders should note that the Relative Strength Index (RSI) is back below the 50-mid line aiming downwards and recently crossed below its 7-day RSI’s SMA, showing that sellers are gathering momentum.

Therefore, the GBP/USD first support would be the 1.1100 figure, followed by the 50% Fibonacci level at 1.1047, ahead of the 38.2% Fibonacci retracement at 1.0884.

-

16:12

EUR/USD drops to two-day lows near 0.9800 as USD strengthens

- US dollar gains impulse on American hours as US yields keep rising.

- US Jobless Claims below expectations, focus turns to NFP.

- EUR/USD down for the second day in a row.

The EUR/USD dropped further after the beginning of the American session and bottomed at 0.9817, the lowest level in two days. The intraday bias is bearish with the US dollar looking stronger ahead of the NFP.

Dollar gains, despite data

On Thursday, economic data released in the US showed a larger-than-expected increase in Initial Jobless Claims to the highest level in five weeks. Despite the numbers, the dollar remains firm. Fed talk about the need to continue rising rates, keeps giving the dollar support.

The key drivers of dollar’s strength on Thursday are US yields. The US 10-year yield rose to the highest level in a week at 3.84% and the 2-year climbed above 4.20%. The DXY is up by 0.90%, at 111.20.

In Wall Street, US stocks area falling with the Dow Jones losing 0.47% and the Nasdaq down by 0.20%. The cautions tone also helps the dollar ahead of critical data on Friday. The US official employment report is due and its numbers could trigger more volatility. Market consensus is for an increase in payrolls of 250K.

At the 0.9830 zone

The EUR/USD bottomed at 0.9817 and then bounced back above the 0.9830 area. A consolidation under 0.9830 would leave the euro vulnerable. The next support stands at 0.9800 and then 0.9780 before the barrier around 0.9750.

On the upside, at 0.9855 emerges a resistance area, followed by the 0.9900 zone. A recovery above would alleviate the bearish pressure.

Technical levels

-

16:01

EU price cap on Russian oil shipments to third countries to be discussed with G7 – Reuters

The European Union's decision to implement a price cap for Russian oil shipments for third countries needs to be discussed more with G7 to work out the exact mechanism to set a specific cap, EU officials told Reuters on Thursday.

Additional takeaways

"27 EU countries will need another unanimous decision to approve price-setting mechanism under the cap once that clear within G7."

"Eighth round of sanctions adds oil cap for transport services, on top of banking and insurance services already agreed under the sixth package; price cap on top affects all areas."

"Cap will have to adapt to market prices, be set below market but at a level Russia would still want to sell."

"Oil price cap for transport services has exemptions for pilot services to avoid accidents."

"New oil cap must be agreed in full before December 5 or otherwise the previous blanket ban on banking and insurance services kicks in."

"Still discussing with G7 ways to avoid reflagging as a way around the oil cap."

"Level playing field important for EU seafaring nations vis-a-vis countries like Panama."

Market reaction

These remarks don't seem to be having a noticeable impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was down 0.4% on the day at 0.9840.

-

15:51

Gold Price Forecast: XAU/USD to settle around $1,700 in Q4 – Erste Bank

Gold price decreased by 8.3% in the third quarter, extending the year-to-date loss to -9.0%. Nevertheless, strategists at Erste Group Research expect XAU/USD to stablize around $1,700 in the coming quarter.

Uncertain economic environment supports the gold price

“The strong USD and the rising US Fed funds rate and yields are a negative factor for the gold price performance. However, the global slowdown in economic growth and the falling earnings growth among companies should support demand for gold in the medium-term. The high geopolitical risks remain an important factor as well, facilitating a positive performance.”

“We expect the price to increase to about $1,700 in the fourth quarter.”

-

15:30

United States EIA Natural Gas Storage Change above forecasts (103B) in September 30: Actual (129B)

-

15:19

NFP Preview: Forecasts from nine major banks, employment trend slows down

The US Bureau of Labor Statistics (BLS) will release the September jobs report on Friday, October 7 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of nine major banks regarding the upcoming employment data.

Economists expect a slowdown in US job growth to 250K in September following the 315K increase in August. Meanwhile, the Unemployment Rate is expected to remain steady at 3.7%.

NBF

“Hiring could have slowed down in the month if previously released soft indicators such as S&P Global’s Composite PMI are any guide. Layoffs may also have eased judging from a decrease in initial jobless claims. With these two trends cancelling each other, payroll growth come in at a still decent 250K. The household survey is expected to show a smaller gain, a development which could nonetheless leave the unemployment rate unchanged at 3.7%, assuming the participation rate stayed put at 62.4%.”

Commerzbank

“We expect the labor market to continue to lose momentum only slowly and, from the Fed's perspective, to probably still be too strong. Thus, we forecast a job gain of 280K, after 315K in August. The unemployment rate is likely to remain at an extremely low 3.7%.”

CIBC

“Early indications of the health of the US labor market in September suggest that hiring continued at a brisk pace, with 240K jobs likely added. That’s consistent with the improvement seen in initial jobless claims and the Conference Board’s labor differential measure. While that pace of hiring would typically cause the unemployment rate to fall, there is still room for participation gains in the prime-age group, and the unemployment rate could have remained at 3.7% with some increase in participation. We’re not far enough from the consensus to see a material market reaction.”

SocGen

“We project a 280K gain. The unemployment rate for September is expected to decline to 3.6% from 3.7% in August. The monthly flows are volatile. If there are no returnees, or if there is a net exodus from the labor force rather than re-entrants, the unemployment rate could drop even more than the 3.6% we project. Wages are expected to rise 0.5% MoM in September. We view the shortfall seen in August, when wages rose 0.3%, as noise in the data rather than the beginning of a new trend.”

Citibank

“US September Nonfarm Payrolls – Citi: 265K, prior: 315K; Private Payrolls – Citi: 245K, prior: 308K; Average Hourly Earnings MoM – Citi: 0.4%, prior: 0.3%; Average Hourly Earnings YoY – Citi: 5.1%, prior: 5.2%; Unemployment Rate – Citi: 3.6%, prior: 3.7%. An overall slowing trend in monthly payroll growth should continue in September and as the Fed acts to weigh on activity, slowing job growth into 2023 will likely also reflect falling demand for labor and likely job losses. The change in the unemployment rate will also be one of the most important aspect of the jobs report. We expect the unemployment rate to decline modestly to 3.6% but with risk that it remains at 3.7%.”

ING

“We for a solid 200K increase in jobs and the unemployment rate staying low at 3.7% – both pointing to another 75 bps hike from the Federal Reserve on 2 November.”

Wells Fargo

“We look for another solid 275K increase. Another sizable increase in labor force participation would be a welcome development for Fed officials as they attempt the high wire act of bringing labor supply and demand into a healthy balance.”

TDS

“We expect more moderation in payrolls in September to 300K, which still represents a strong pace of job growth. We look for this still very solid gain in employment to also be reflected in a decline in the unemployment rate to 3.6%.”

Barclays

“We expect 250K in NFP, steady unemployment and participation rates, and average hourly earnings to move up 0.4% MoM (5.0% YoY). A strong report could drive the market to fully price a 75 bps rate hike in November, expectations of which had declined recently, and this would further support the dollar.”

-

15:00

Canada Ivey Purchasing Managers Index: 55.9 (September) vs previous 57.1

-

15:00

Canada Ivey Purchasing Managers Index s.a came in at 59.5, below expectations (60.9) in September

-

14:53

AUD/USD Price Analysis: Fall to trading range support near 0.6400 remains on the cards

- AUD/USD struggles to capitalize on its early uptick and attracts fresh sellers near the 0.6540 area.

- A combination of factors lifts the USD for the second straight day and exerts pressure on the pair.

- The recent range-bound price action marks a consolidation phase and favours bearish traders.

The AUD/USD pair meets with a fresh supply following an early uptick to the 0.6540 area and turns lower for the third straight day on Thursday. The intraday downfall extends through the early North American session and drags spot prices to a fresh daily low, around the 0.6440 region in the last hour.

The US dollar catches fresh bids and looks to build on the overnight goodish bounce from a two-week low, which, in turn, is seen exerting pressure on the AUD/USD pair. The prospects for a more aggressive policy tightening by the Fed, along with the risk-off mood, act as a tailwind for the safe-haven buck and drive flows away from the risk-sensitive aussie.

Looking at the broader picture, the AUD/USD pair has been oscillating in a narrow trading band over the past two weeks or so. The range-bound price action constitutes the formation of a rectangle and points to indecision over the next leg of a directional move. Given a sharp fall from the August swing high, this could be categorized as a bearish consolidation phase.

Furthermore, technical indicators on the daily chart - though have been recovering from lower levels - are still holding in the bearish territory. This, in turn, suggests that the path of least resistance for the AUD/USD pair is to the downside. Hence, a subsequent fall towards the trading range support, around the 0.6400 mark, remains a distinct possibility.

Some follow-through selling will expose the YTD low, around the 0.6365 region touched in September. A convincing break below the latter will be seen as a fresh trigger for bearish traders and pave the way for an extension of the downward trajectory. The AUD/USD pair could then drop towards challenging the next relevant support near the 0.6300 round-figure mark.

On the flip side, the 0.6500 psychological mark now seems to act as an immediate hurdle ahead of the 0.6530-0.6540 supply zone. Sustained strength beyond will negate the bearish bias and set the stage for some meaningful appreciating move in the near term. The AUD/USD pair might then aim to reclaim the 0.6600 round-figure mark and test the 0.6620-0.6625 resistance zone.

AUD/USD 4-hour chart

Key levels to watch

-

14:52

EUR/USD to tank towards the lower end of a 0.90-0.95 range – ING

The eurozone is entering a recession and economists at ING expect a deeper downturn over the winter months. Therefore, the EUR/USD pair is set to tumble toward the 0.90 level.

Potential turnaround in 2Q23

“Three-quarters of negative growth in the eurozone into 2Q23 and a still hawkish Fed is a bearish cocktail for EUR/USD.”

“EUR/USD is not particularly cheap and a pick-up in gas prices this winter will keep the eurozone trade balance under pressure. This could see the pair falling towards the lower end of a 0.90-0.95 range over the next three to six months before a potential turnaround in 2Q23 if the Fed is more dovish and both the US and the eurozone exit recession.”

-

14:43

USD Index rose to 3-day highs around 111.80, shifts the focus to NFP

- The index looks bid and gathers further traction around 111.80.

- Further upside in US yields also bolsters the upbeat mood in the buck.

- Initial Claims rose more than expected by 219K WoW.

The greenback, in terms of the USD Index (DXY) extends the weekly recovery to the 111.80 region on Thursday, or 3-day tops.

USD Index now focuses on NFP

The index looks to extend the advance following Wednesday’s strong bounce, while it remains supported by the continuation of the upside momentum in US yields across the curve.

In addition, further loss of momentum in the risk-associated universe collaborates with the second consecutive daily gains in the buck, all ahead of the key Nonfarm Payrolls for the month of September due on Friday.

In the calendar, Initial Claims increased by 219K in the week to October 1, while Challenger Job Cuts went up by 29.989K in September.

What to look for around USD

The index suffers the recovery in the risk complex and returns to the area below the 111.00 level on Thursday.

While the near-term outlook for the dollar looks somewhat dented, the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market continues to prop up the underlying positive tone in the index.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Initial Jobless Claims (Thursday) – Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change, Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.38% at 111.62 and faces the next up barrier at 114.76 (2022 high September 28) seconded by 115.00 (round level) and then 115.32 (May 2002 high). On the other hand, a breach of 110.05 (weekly low October 4) would open the door to 109.35 (weekly low September 20) and finally 107.68 (monthly low September 13).

-

14:40

IMF's Georgieva: Risks of global recession are rising

International Monetary Fund (IMF) Managing Director Kristalina Georgieva said on Thursday that they will downgrade the global growth forecast of 2.9% for 2023 and noted risks of a global recession were rising, as reported by Reuters.

Key takeaways

"Countries accounting for one-third of the global economy expected to report at least 2 consecutive quarters of contraction this year or next."

"IMF expects global output loss of $4 trillion by 2026."

"Fiscal measures should be targeted, temporary, policymakers must avoid indiscriminate response."

"Central banks should continue to respond to high inflation even as the economy slows."

"China, private creditors must act to address the risk of widening debt crisis in emerging markets."

"Probability of portfolio outflows from emerging markets has risen to 40%."

Market reaction

These comments don't seem to be impacting the market mood in a noticeable way. As of writing, the S&P 500 was trading near Wednesday's closing level at around 3,785.

-

14:28

Fed's Kashkari: I hope we can do so without causing a recession

"If we get help from the supply side, I'm more optimistic about avoiding a recession," Minneapolis Fed President Neel Kashkari said on Thursday and reiterated that he was hopeful they could bring inflation down without causing a recession, as reported by Reuters.

"We have more work to do on inflation," Kashkari added and noted that he was not worried about stagflation.

Market reaction

The greenback continues to gather strength against its rivals during the American trading hours on Thursday. As of writing, the US Dollar Index was up 0.55% on a daily basis at 111.80.

-

14:25

USD/CHF: Only a break below 0.9737 would mark a shift lower – Credit Suisse

USD/CHF continues to fluctuate in its range. Only a move below 0.9737 would signal further near-term downside and change Credit Suisse’s house view outlook to tactically bearish.

USD/CHF stays seen in a sensitive near-term range

“Further near-term consolidation is likely before making a more significant move higher/lower. Nonetheless, with daily MACD now rolling over, a fall below 0.9737 would still be seen as a signal that further near-term weakness is likely to follow.”

“A move below 0.9737 would shift our outlook to bearish on a near-term tactical basis, whereby we would look for a decline towards the bottom of the broader range, with next support at 0.9557/24.”

“Resistance moves to 0.9888/964, and then to the recent price highs at 0.9943/66, a break above which would instead signal a potential bullish triangle pattern for a move towards 1.0052/98.”

-

14:18

Gold Price Forecast: XAU/USD consolidates below $1,725, stronger USD acts as headwind

- Gold attracts some intraday selling at higher levels amid a modest USD strength.

- Aggressive Fed rate hike bets, elevated US bond yields underpin the greenback.

- Recession fears, risk-off mood might offer support to the safe-haven XAU/USD.

Gold struggles to gain any meaningful traction on Thursday and seesaws between tepid gains/minor losses through the early North American session. The XAU/USD is currently placed in neutral territory, around the $1,715 region as traders await a fresh catalyst before positioning for the next leg of a directional move.

The US dollar edges higher for the second straight day and is looking to build on the overnight bounce from a two-week low, which, in turn, acts as a headwind for the dollar-denominated gold. The recent hawkish remarks by several Fed officials reinforced market expectations that the US central bank will continue to tighten its monetary policy at a faster pace to tame inflation. In fact, the markets have been pricing in another supersized 75 bps Fed rate hike move in November, which remains supportive of elevated US Treasury bond yields and continues to underpin the greenback.

Market players, meanwhile, remain concerned about the economic headwinds stemming from rapidly rising borrowing costs. Adding to this, the risk of a further escalation in the Russia-Ukraine conflict takes its toll on the global risk sentiment. This is evident from a generally weaker tone around the equity markets, which is seen offering some support to the safe-haven gold. The mixed fundamental backdrop is holding back traders from placing aggressive bets around the XAU/USD. Investors also prefer to move on the sidelines ahead of the closely-watched US monthly employment details.

The popularly known NFP report is due for release on Friday and will play a key role in influencing the near-term USD price dynamics. This, in turn, should provide some meaningful impetus to the non-yielding gold. In the meantime, the US bond yields and speeches by influential FOMC members will drive the USD demand. Apart from this, the broader market risk sentiment could provide some impetus to the yellow metal and allow traders to grab short-term opportunities.

Technical levels to watch

-

14:00

Russia Central Bank Reserves $ down to $540.7B from previous $549.7B

-

13:54

German government expects recession in 2023 – Reuters

The German government expects the Gross Domestic Product (GDP) to contract by 0.4% in 2023, Reuters reported on Thursday, citing a source who has knowledge of provisional figures of the government's autumn projections.

The government is also said to lower the 2022 growth forecast to 1.4% while projecting inflation at 7.9% and 8% in 2022 and 2023, respectively.

A spokesperson for the German economy ministry noted that figures were not finalized and that they would present the latest projections next week.

Market reaction

The EUR/USD pair showed no immediate reaction to this headline and was last seen posting small daily losses at 0.9870.

-

13:48

EUR/USD Price Analysis: Further losses likely below parity

- EUR/USD treads water in the sub-0.9900 region on Thursday.

- Further pullbacks remain on the cards while below parity.

EUR/USD trades without a clear direction below the 0.9900 region on Thursday.

The pair failed to test/surpass the parity level in the last couple of sessions, opening the door to further weakness in the short-term horizon.

Ideally, EUR/USD should leave behind that key resistance zone in the near term to allow for the continuation of the rebound. The inability to break above the parity zone could leave the pair vulnerable to further pullbacks. That said, another visit to the 20-year low in the mid-0.9500s should not be ruled out for the time being.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0625.

EUR/USD daily chart

-

13:34

US: Weekly Initial Jobless Claims rise to 219K vs. 200K expected

- Initial Jobless Claims in the US rose by 29,000 in the week ending October 1.

- US Dollar Index clings to modest daily gains above 111.00 after the data.

There were 219,000 initial jobless claims in the week ending October 1, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 190,000 (revised from 193,000) and came in worse than the market expectation of 200,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1% and the 4-week moving average was 206,500, an increase of 250 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending September 24 was 1,361,000, an increase of 15,000 from the previous week's revised level," the DOL reported.

Market reaction

The US Dollar Index retreated from session highs after this report and was last seen rising 0.2% on the day at 111.42.

-

13:30

United States Initial Jobless Claims came in at 219K, above forecasts (200K) in September 30

-

13:30

United States Continuing Jobless Claims came in at 1.361M, above expectations (1.286M) in September 23

-

13:30

United States Initial Jobless Claims 4-week average fell from previous 207K to 206.5K in September 30

-

13:28

GBP/USD Price Analysis: Flirts with 1.1235-40 confluence, bearish flag spotted on H4

- GBP/USD turns lower for the second straight day amid the emergence of some USD buying.

- Aggressive Fed rate hike bets and the risk-off mood acts as a tailwind for the safe-haven buck.

- The formation of a bearish flag supports prospects for the resumption of the pair’s downtrend.

The GBP/USD pair meets with a fresh supply following an uptick to the 1.1385 region and turns lower for the second successive day on Thursday. The downtick drags spot prices to mid-1.1200s, closer to the overnight swing low during the mid-European session and is sponsored by the emergence of some US dollar dip-buying.

Several Fed officials reaffirmed the US central bank's commitment to bring inflation under control and the prospects for another supersized 75 bps lift-off in November. This remains supportive of elevated US Treasury bond yields, which, along with growing recession fears, continue to act as a tailwind for the safe-haven greenback.

From a technical perspective, the 1.1235 area marks confluence support comprising the 200-period SMA and the 23.6% Fibonacci retracement level of the recent bounce from an all-time low. A convincing break below will suggest that the corrective rally has run out of steam already and shift the bias back in favour of bearish traders.

The GBP/USD pair might then turn vulnerable to weaken further below the 1.1200 mark and accelerate the downfall towards testing the 1.1100 round figure. The latter coincides with the lower end of a nearly two-week-old ascending trend channel, which now seems to constitute the formation of a bearish flag pattern on hourly charts.

Some follow-through selling, leading to a subsequent slide below the 38.2% Fibo. level around the 1.1050-1.1045 area will confirm the negative outlook and prompt aggressive technical selling. The downward trajectory could then drag the GBP/USD pair towards 50% Fibo. level, around the 1.0900 round-figure mark.

On the flip side, the 1.1375-1.1385 region now seems to have emerged as an immediate hurdle ahead of the 1.1400 mark. Sustained strength beyond should allow the GBP/USD pair to aim back to conquer the 1.1500 psychological mark, above which bulls might target the ascending channel resistance, currently around the 1.1625 zone.

GBP/USD 4-hour chart

-638006559616110154.png)

Key levels to watch

-

13:15

Gold Price Forecast: XAU/USD to sustain a move downward – TDS

Gold price has extended its gains above $1,720. Nonetheless, strategists at TD Securities still believe that XAU/USD is likely to trend lower.

Shanghai traders start to shy away from gold

“A prolonged period of restrictive rates suggests traders should ignore gold's siren calls, as a sustained downtrend will likely prevail, while quantitative tightening continues to drive real rates higher.”

“Money managers hold their largest net short in gold since 2018, driven by trend followers. We expect a break north of $1,740 could fuel CTA stop-outs, suggesting the squeeze could run further.”

“Shanghai traders have shied away from precious metals, leaving the market with fewer offers.”

-

12:43

AUD/NZD to slide towards the 1.12 level – OCBC

AUD/NZD continued to trade with a heavy downside bias amid growing policy divergence between the Reserve Bank of Australia and the Reserve Bank of New Zealand. Economists at OCBC Bank maintain a short bias targeting 1.12.

Risks remained skewed to the downside

“RBNZ’s accompanying MPS was slightly more hawkish than expected as it noted that the MPC considered 50, 75 bps at this meeting; core CPI is ‘too high’ and lower NZD if sustained poses further upside risk to CPI.”

“We maintain our tactical short play on AUD/NZD, targeting 1.12, 1.1050 objectives.”

“Daily momentum is bearish while RSI fell. Risks remained skewed to the downside.”

“Support at 1.1240, 1.1210 levels.”

“Resistance at 1.1305 (21 DMA), 1.1380 levels.”

-

12:42

ECB Accounts: Euro depreciation could add to inflationary pressures

The accounts of the European Central Bank's (ECB) September policy meeting revealed on Thursday policymakers saw that euro depreciation could add to inflationary pressure for the euro area.

Key takeaways as summarized by Reuters

"Inflation was far too high and likely to stay above the governing council’s target for an extended period."

"Inflation expectations were still anchored and wage growth remained moderate, with little evidence of second-round effects."

"Risks surrounding the projected inflation path remained tilted to the upside over the entire projection horizon."

"The size of the upward revision in the staff inflation projection for 2024 was not seen as sufficiently large as to require a more aggressive response."

"Expected weakening in economic activity would not be sufficient to reduce inflation to a significant extent."

"A response that was too aggressive could also exacerbate a recession, with few benefits for inflation in the short term."

"Some members expressed a preference for increasing the key ecb interest rates by 50 basis points. while a 25 basis point increase was seen as clearly insufficient."

"Acting forcefully now could avoid the need to increase interest rates more sharply later."

"It was argued that policy would remain expansionary after a 75 basis point rate hike."

"A very large number of members expressed a preference for raising the key ECB interest rates by 75 basis points."

"Without a timely reduction in monetary policy accommodation, inflationary pressures resulting from a depreciation of the euro might increase."

"Acting forcefully now could avoid the need to increase interest rates more sharply later in the economic cycle when the economy was slowing."

"Expected decline in inflation towards the end of the projection horizon was therefore seen to be surrounded by a higher than usual degree of uncertainty."

Market reaction

EUR/USD edged slightly lower with the initial reaction and was last seen losing 0.1% on the day at 0.9875.

-

12:30

United States Challenger Job Cuts climbed from previous 20.485K to 29.989K in September

-

12:24