Notícias do Mercado

-

23:48

Silver Price News: XAG/USD treads water near $25.00 amid mixed options market signals

Silver price (XAG/USD) remains sidelined around $24.90-95 during the early hours of Friday, following a volatile day that allowed the bright metal to have a positive close despite an initial fall.

In doing so, the Silver price tracks mixed signals from the options markets as the latest data suggests a bullish bias of the market players even as the longer range figures keep teasing the XAG/USD bears.

That said, a one-month risk reversal (RR) of the Silver price, a gauge of the spread between the call and put options, printed a mild daily gain to +0.020 by the end of Thursday’s North American session. With that, the daily RR marked the first daily positive print in five.

However, the weekly RR braces for the second consecutive negative numbers, with the latest figures being -0.230, whereas the monthly options market signals also print the downbeat numbers of -0.635, versus the previous +2.660.

Not only the mixed options market signals but the cautious mood ahead of the US Core PCE Price Index for March, the Fed’s preferred inflation gauge, limit prod the Silver price.

Also read: Silver Price Analysis: XAG/USD falls but remains capped by the 20-DMA at $24.70

-

23:40

USD/CAD attempts recovery from below 1.3600 ahead of Canadian GDP and US PCE Price Index

- USD/CAD has shown some recovery after building a base below 1.3600.

- S&P500 ended Thursday with immense gains amid upbeat quarterly earnings from US tech stocks, portraying a risk-on mood.

- Monthly Canadian GDP (Feb) might show a growth rate of 0.2% vs. 0.5% released earlier.

The USD/CAD pair has made efforts for a rebound after building a base around 1.3590 in the Asian session. The Loonie asset has shown a recovery move, however, the US Dollar Index (DXY) is still in corrective action and has not shown any sign of recovery yet.

The USD Index is gradually correcting after a strong upside move on Thursday to near 101.80. A significant decline in United States Gross Domestic Product (GDP) data has propelled fears of economic slowdown. The US GDP (Q1) data landed at 1.1% while the street was anticipating a decline in the pace of growth rate to 2.0% from the former expansion of 2.6%.

According to the US GDP report, utilization of entire inventory by businesses amid fears of economic slowdown indicates that firms are losing confidence in the US economy due to higher interest rates from the Federal Reserve (Fed).

S&P500 ended Thursday’s session with significant gains as investors focused on upbeat quarterly performance from US tech-savvy stocks and ignored recession fears, portraying a solid risk appetite of the market participants. Tech stocks beat earnings estimates and revenue guidance, indicating that consumer spending is extremely solid.

Going forward, the US Dollar will dance to the tunes of core Personal Consumption Expenditure (PCE) Price Index data (March). As per the consensus, monthly data is expected to sustain at a pace of 0.3% while annual data would soften to 4.5% from the former release of 4.6%.

The Canadian Dollar is expected to show sheer volatility amid the release of the GDP data. Monthly GDP data (Feb) might show a growth rate of 0.2% vs. 0.5% released earlier.

-

23:37

GBP/USD Price Analysis: Cable buyers approach 1.2520 hurdle amid three-day uptrend

- GBP/USD grinds higher after two-day uptrend, defends bounce off 100-SMA.

- Firmer RSI (14), sustained trading beyond the key SMAs allow buyers to aim for three-week-old horizontal resistance.

- Fortnight-old ascending trend line adds to the downside support.

GBP/USD gradually marches towards the key upside hurdle as it grinds higher following a two-day winning streak, floating near 1.2500 during the initial hours of Friday’s Asian session.

In doing so, the Cable pair defends the previous day’s rebound from the 100-bar Simple Moving Average (SMA) while also justifying the firmer Relative Strength Index (RSI), placed at 14, not overbought.

With this, the quote’s further upside towards a horizontal area comprising multiple levels marked since April 04, around 1.2505-20, can’t be ruled out. However, the pair’s additional run-up will depend upon how well it can stay beyond the stated hurdle as the Year-To-Date (YTD) peak surrounding 1.2550 could challenge GBP/USD buyers afterward.

In a case where the Cable pair remains firmer past 1.2550, a run-up towards the May 2022 peak of around 1.2665 becomes appealing.

Meanwhile, pullback moves need to break the 100-SMA support of 1.2440 to convince intraday sellers.

Following that, a fortnight-old ascending support line and the 200-SMA, respectively near 1.2410 and 1.2360, may prod the GBP/USD bears.

It’s worth noting, however, that the GBP/USD pair’s weakness past 1.2360 will make it vulnerable to visiting the monthly low of around 1.2275.

GBP/USD: Four-hour chart

Trend: Further upside expected

-

23:20

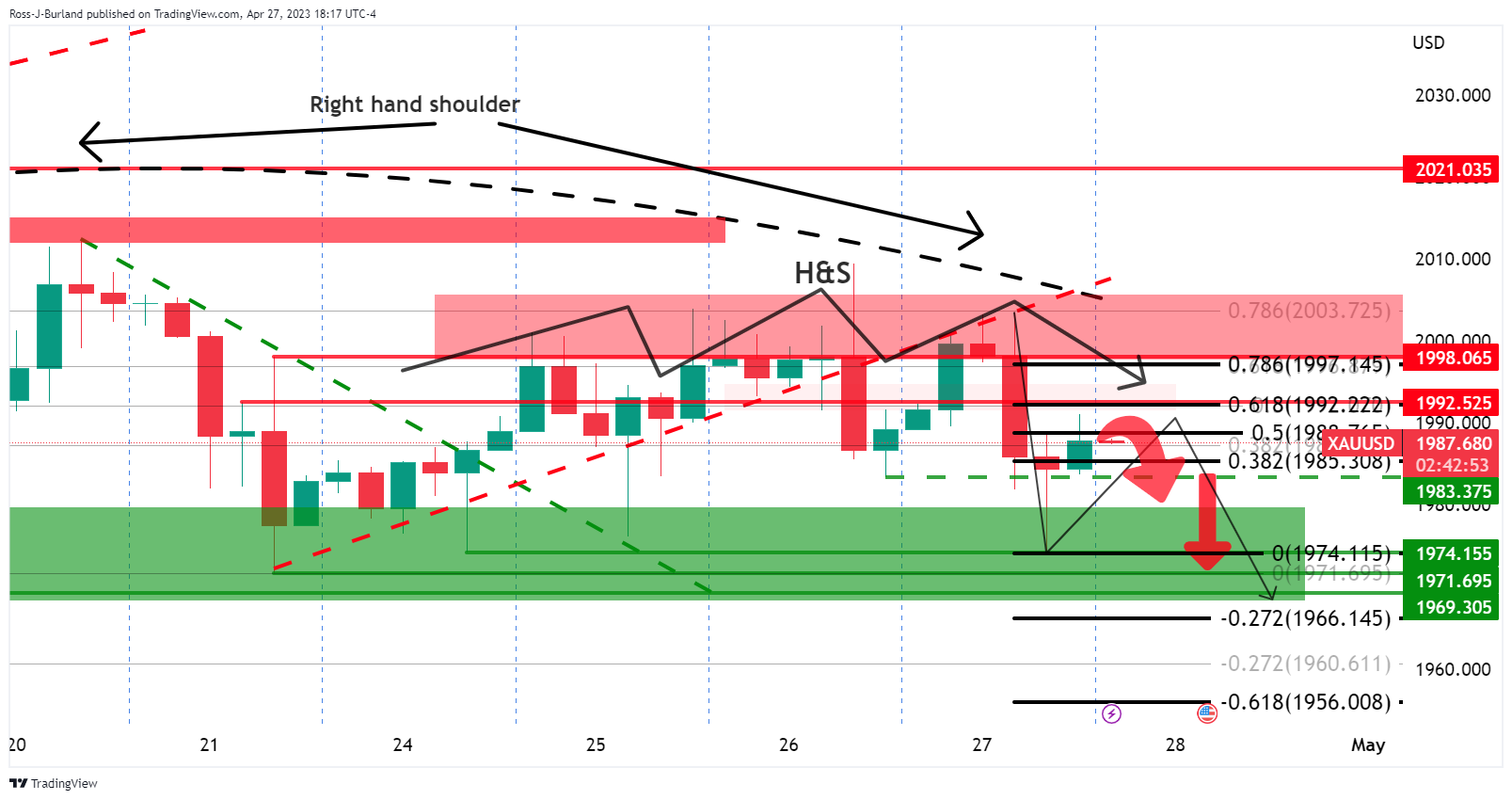

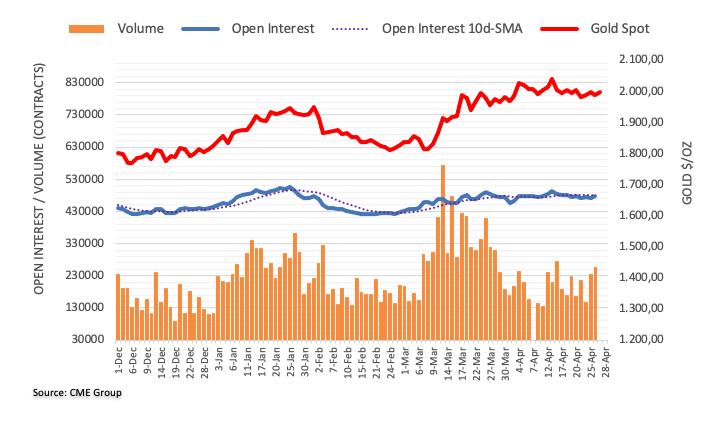

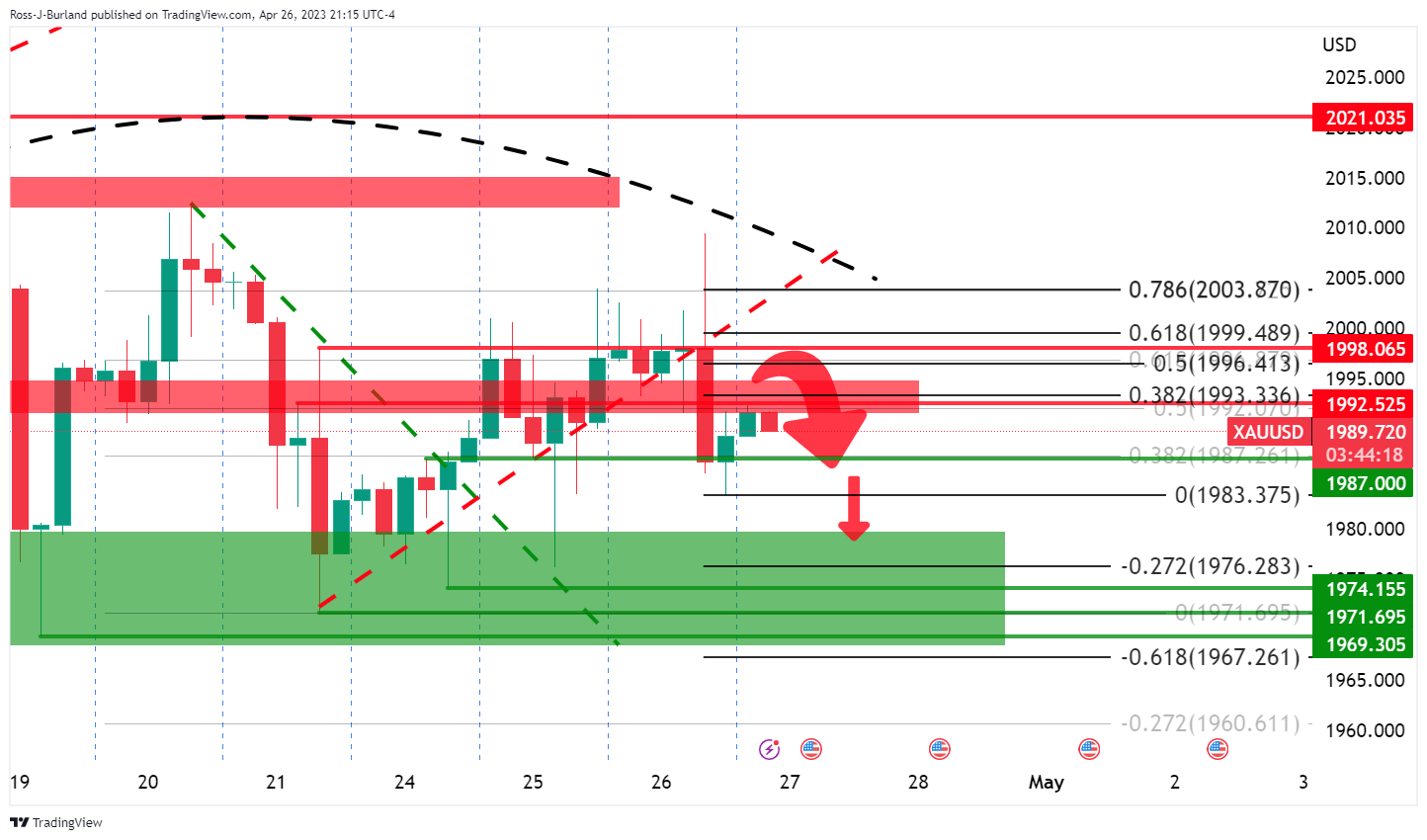

Gold Price Forecast: XAU/USD bears eye downside breakout of tight structure

- Gold price bearish while below $2,000 and the 61.8% around $1,992.

- Despite poor data, US Dollar stronger, making gold more expensive for international buyers.

Gold price was ending flat on the day in choppy trade while the US Dollar and bond yields climbed a touch following the weaker-than-expected first-quarter Gross Domestic Product

At the time of writing, the Gold price is trading around $1,987.80 and has traveled between a low of $1,974.11 and $2,003.41 following data that showed inflation was stronger than anticipated helping the US 10-yr Treasury note to rally 8bp to 3.53%, bearish for gold since it offers no interest. The US two-year note was last seen paying 4.080%, up 14.4 basis points.

The US Dollar was also stronger, making gold more expensive for international buyers. The ICE dollar index was last seen up 0.06 points to 101.53.

In the data, the United States on Thursday reported its GDP rising by 1.1% in the first quarter, the third-straight quarterly rise but under the consensus estimate for a 2% rise. However, the core inflation measure lifted 4.9%.

Meanwhile, the Federal Reserve´s policy committee is expected to raise interest rates by 25 basis points when its two-meeting ends next Wednesday. ´´WIRP suggests nearly 80% odds of 25 bp hike at the May 2-3 meeting, down from 90% at the start of this week and back to the 80% at the start of last week. We continue to believe that a 25 bp hike next week is a done deal,´´ analysts at Brown Brothers Harriman explained.

´´Between the May 2-3 and June 13-14 meetings, the Fed will have digested two more job reports, two CPI/PPI reports, and one retail sales report. At this point, a pause in June might just be the most likely outcome but it really will depend on how all that data come in,´´ the analysts explained.

Meanwhile, analysts at TD Securities argued that ´´discretionary traders are still sitting on the sidelines, which suggests cuts pricing is still not feeding through to interest. In the near term, weaker longs still remain vulnerable, but we don't expect the first selling meaningful program to kick in until prices break $1,964 in gold.´´

Gold technical analysis

Gold price has been topping out on a number of attempts to stay above $2,000 but bears keep showing up. We now have a potential peak formation here on the 4-hour chart within the right-hand shoulder. Zooming in, we have another head and shoulders:

The bias is very much bearish while below $2,000 and the 61.8% around $1,992.

-

23:09

EUR/JPY Price Analysis: Holds steady at around 147.60s as a doji emerges

- EUR/JPY is set to finish the week with minimal gains of 0.18%.

- EUR/JPY Price Analysis: Trades sideways, with buyers unable to crack 148.00, which, once broken, could pave the way for further upside.

The EUR/JPY prints back-to-back positive sessions but stays at around 147.62, almost unchanged, as Thursday’s price action formed a doji. Once the EUR/JPY reached a multi-year high at around 148.63, it was followed by a mean reversion move, ahead of the BoJ’s monetary policy decision, later in the day. At the time of writing, the EUR/JPY is trading at 147.64, gains 0.03%, as the Asian session starts.

EUR/JPY Price Action

From a daily chart perspective, price action looks headed upward. However, sellers stepped in as the RSI indicator exited from overbought conditions, dragging the EUR/JPY’s price toward its weekly low of 146.28. Since then, the EUR/JPY reclaimed 147.00, though the pair is trading sideways within the 147.10-90s area.

Near-term, the EUR/JPY 4-hour chart suggests the pair is consolidating at around the 50 and 20-EMAs. After dropping to its weekly low, the EUR/JPY recovered some ground and aimed toward 147.49, clearing the 50 and 20-EMA. Since then, the EUR/JPY has faced solid resistance at around 147.90-147.99, unable to reclaim 148.00. If EUR/JPY cannot crack 148.00, expect further downside, with the pair testing support at the confluence of the 50-EMA and the S1 pivot at 147.16-24, followed by the S2 pivot at 146.72. additional downside risks are expected at 146.47, followed by the S3 pivot at146.31.

EUR/JPY 4-Hour Chart

-

23:08

EUR/USD stays defensive above 1.1000 as Eurozone GDP, Fed’s favorite inflation loom

- EUR/USD struggles to defend late Thursday’s corrective bounce after a volatile day.

- US Real GDP came in softer but details bolstered hawkish Fed concerns and allowed US Dollar to initially rise.

- Risk catalysts, key growth and inflation data can offer another active day ahead of next week’s ECB, Fed meeting.

EUR/USD seesaws around 1.1030 after a whippy day that initially convinced bears before paring some of the losses during the American session. While the US data could be held responsible for Thursday’s volatility, the Euro pair’s latest inaction is logical ahead of the Eurozone Gross Domestic Product (GDP) for the first quarter (Q1), as well as the US Core Personal Consumption Expenditure (PCE) Price Index details for March.

On Thursday, the first readings of the US Gross Domestic Product (GDP) for the first quarter (Q1) of 2023, also known as Advance readings, marked mixed outcomes. That said, the headline US GDP Annualized eased to 1.1% from 2.0% expected and 2.6% prior but the GDP Price Index inched higher to 4.0% on an annualized basis from 3.9% prior and 3.8% market consensus. Further, the Personal Consumption Expenditure (PCE) Prices for Q1 rallied to 4.2% from 3.7% in previous readouts whereas the Core PCE figures also crossed 4.8% market forecasts and 4.4% prior with 4.9% mark for the said period.

With this, a stronger-than-expected increase in the inflation component of the GDP renewed hawkish concerns about the Federal Reserve (Fed) and helped the US Dollar to pick up bids after the release. However, the downbeat prints of headline GDP allowed markets to turn optimistic and favored the EUR/USD pair buyers.

It’s worth noting that the banking fallout risks also prod the Euro bulls previously while the mixed EU data defended the buyers. That said, US banking fallout fears regain momentum amid reports that the First Republic Bank (FRB) plans to sell half its loan book to fill a $100B deposit flight gap. That said, Eurozone Consumer Confidence improved for April but Business Climate eased for the said month.

Amid these plays, Wall Street closed positive and yields rose but the US Dollar retreated during the later part of the day and ended Thursday with mild gains.

Looking forward, the first readings of the Q1 GDP growth figures from the old continent will be crucial to watch ahead of the US Core PCE Price Index for March, the Fed’s preferred inflation gauge. These figures are likely to print softer data but any positive surprise will be helpful to determine the next week’s monetary policy decision from the European Central Bank (ECB) and the Federal Reserve (Fed) monetary policy meeting

Also read: US Core PCE Preview: Why this is a lose-lose situation for the US Dollar

Technical analysis

EUR/USD buyers appear to run out of steam as they battle with an upward-sloping resistance line from early February, close to 1.1075 by the press time.

-

23:08

AUD/USD faces barricades above 0.6630 as focus shifts to RBA monetary policy

- AUD/USD has failed to sustain above 0.6630 as investors are shifting their focus toward the RBA policy.

- S&P500 settled Thursday’s session with bumper gains as upbeat performance from US tech stocks outweighed fears of slowdown.

- US businesses unwind their inventories and offset solid consumer spending amid dismal economic outlook.

The AUD/USD pair has sensed mild selling pressure after failing to sustain above the crucial resistance of 0.6630 in the early Asian session. The Aussie asset is expected to remain on the tenterhooks as investors are shifting their focus toward the interest rate decision by the Reserve Bank of Australia (RBA), which is scheduled for Tuesday.

S&P500 settled Thursday’s session with bumper gains as upbeat quarterly earnings performance from United States technology stocks outweighed fears of economic slowdown. After solid performances from Google, Microsoft, and Meta Platforms, Amazon reported higher-than-expected earnings with strong revenue guidance, which indicates that consumer spending would remain upbeat ahead. Overall cheerful market mood has strengthened the appeal for risk-sensitive assets.

The US Dollar Index (DXY) has corrected to near 101.48 after an upside move to near 101.80 posts the release of downbeat United States Gross Domestic Product (GDP) data. Scrutiny of the US GDP (Q1) report showed that businesses unwind their inventories and offset solid consumer spending amid a dismal economic outlook as fears of a recession are deepening due to higher interest rates from the Federal Reserve (Fed).

Meanwhile, weekly jobless claims dropped to 230K from the consensus of 248K for the week ending April 21, which indicates that the labor market conditions are still solid.

On the Australian Dollar front, consistently softening Australian inflation would allow the Reserve Bank of Australia (RBA) to keep the interest rate policy unchanged on Tuesday. RBA Governor Philip Lowe would keep rates steady at 3.60%.

-

23:03

New Zealand ANZ – Roy Morgan Consumer Confidence climbed from previous 77.7 to 79.3 in April

-

22:14

NZD/USD bulls have stepped in trying to correct with eyes on 0.62s

- NZD/USD bulls in the market eyeing continued correction.

- Still bearish while below weekly trendline resistance.

NZD/USD has been trying to make its way higher on Thursday and is up by some 0.5% into the close in the New York FX session. The pair traveled from a low of 0.6114 to a high of 0.6161 on the day in what was choppy trading.

´´The Kiwi is a touch higher this morning after a whippy night that saw it recover, then slide, then bounce through mixed US data, and a rebound in equities and commodities,´´ analysts at ANZ Bank explained.

´´Yesterday’s comments by the PM suggesting we’re in for a no-frills Budget, with the estimated $9-14.5bn cyclone rebuild costs met by a mix of savings, reprioritization, and debt may have cooled the nerves of those worried about a debt blowout,´´ the analysts said. ´´But the current account deficit remains a key concern, and may weigh on NZD sentiment for some time.´´

´´AUD price action has been a key driver (by correlation) for the Kiwi, and on that score, we are mindful of the RBA decision next week. We expect a pause, but if we are surprised, it’ll only be one way, and that’s a hike (which could boost the AUD),´´ their note concluded.

Meanwhile, the Reserve Bank of New Zealand is around the corner. The analysts at ANZ Bank said that they forecast a follow-up 25bp OCR hike at the May MPS, taking the OCR to 5.5%, ´´which appears to be the Committee’s ‘happy place’, where they can ‘watch, worry and wait’.´´

In US data, economic growth in the first quarter of this year was weaker than what markets had been built up to expect. The advance estimate of Q1 Gross Domestic Product increased just 1.1%, well below the 1.9% forecast.

NZD/USD technical analysis

NZD/USD is on the front side of the downtrend still and submerged below horizontal resistance as well as per the weekly chart above.

The 38.2% Fibonacci comes in near 0.6215 for the bulls to target.

-

22:07

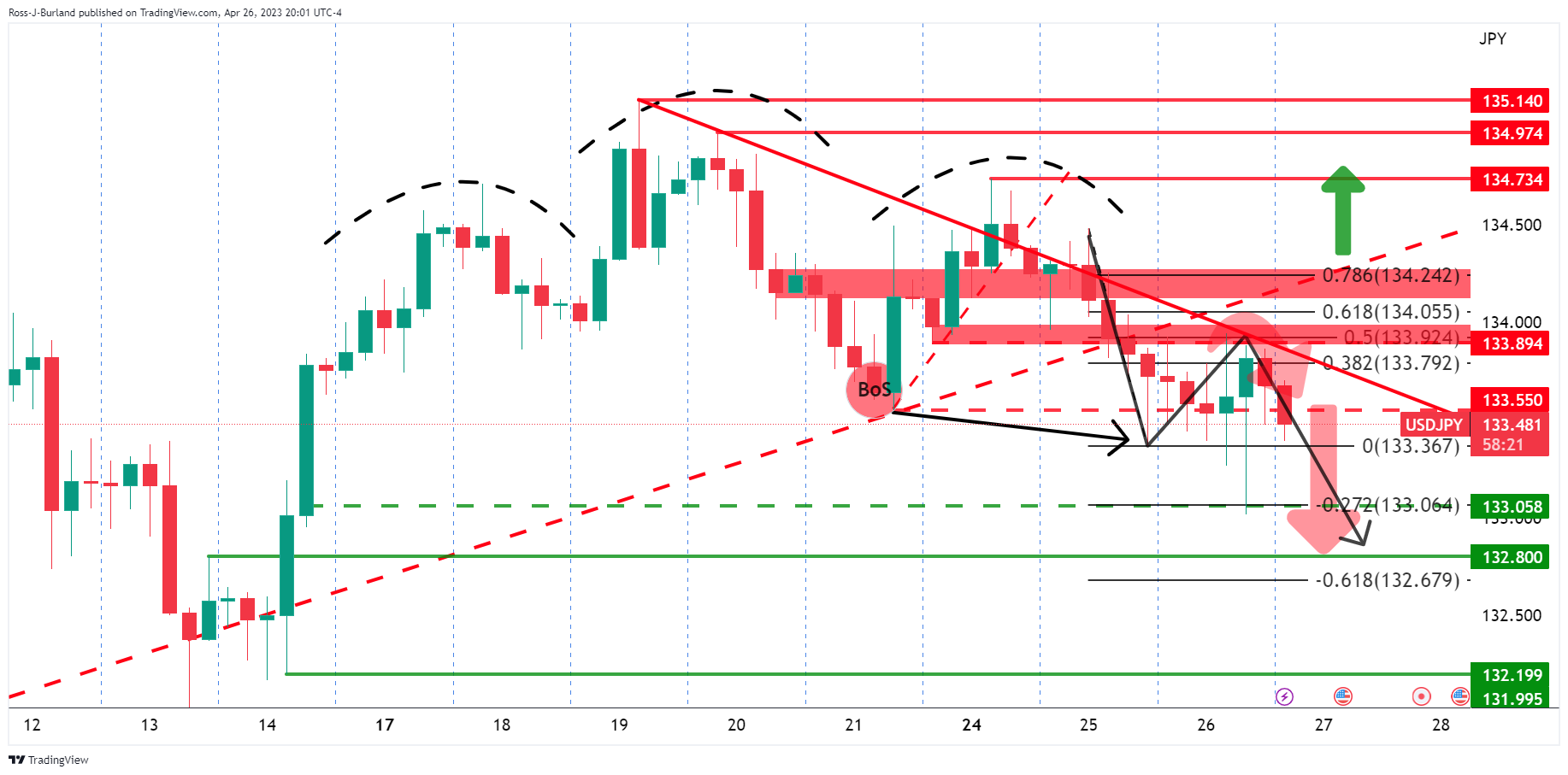

USD/JPY rallies to a two-day high above 134.00 amidst mixed US data ahead of BoJ’s decision

- USD/JPY pierced the 134.00 figure, though it still hovers below the former.

- US economic growth slowed in Q1, while core inflation soared nearly 5%.

- BoJ expected to hold rates and keep the YCC intact amidst Ueda’s first decision.

The USD?JPY snaps two days of losses after falling to two-week lows around 133.01 and rises toward the 133.90s area as the New York session wanes. Mixed US economic data propelled the USD/JPY towards daily highs above 134.00, ahead of the BoJ’s monetary policy decision. The USD/JPY is trading at 133.96 and gains 0.23%.

USD/JPY edge higher ahead of the Bank of Japan’s policy decision

Wall Street finished with substantial gains. The US Bureau of Economic Analysis (BEA) revealed that the US economy slowed to 1.1% in the first quarter of 2023, below estimates of 2%. Although the reading remained positive, it trailed the 2.6% rise in Q4 2022; we should remember that the Federal Reserve (Fed) projections estimate growth at 0.4%.

The same report showed that inflation in the first three months of 2023 rose by 4.9% QoQ, exceeded estimates of 4.8%, and smashed the 4.4% reported in Q4 2022. Given the backdrop, odds for an interest rate increase recovered from 72.1% registered on Wednesday to 87.4% as of writing.

As a reaction, the USD/JPY edged higher, printing a two-day high of 134.19, before retracing some gains. The US 10-year Treasury bond yield, which correlates closely to the USD/JPY pair, climbs 7.5 bps, at 3.524%, a tailwind for the major.

On the Japanese front, its economic agenda will be busy, with the main stage being the Bank of Japan (BoJ) monetary decision, the first for the new Governor, Kazuo Ueda. Analysts estimate some tweak to the message about Covid-19, though they’re not estimating a change in the Yield Curve Control (YCC).

The BoJ will update its economic projections, with investors estimating upward revisions in inflation. However, economic growth is estimated to take a hit amidst the ongoing global economic slowdown.

Further data will be revealed, with Job / Applicants Ration for March, alongside the Tokyo CPI and core CPI readings. Additionally, Industrial Production and Retail Sales would keep USD/JPY entertained ahead of the US inflation data release on Friday.

USD/JPY Technical Levels

-

21:33

Forex Today: Market sentiment improves; Ueda's first BOJ meeting

The Bank of Japan will announce its decision at Ueda's first meeting; market participants will pay close attention to the details. In addition, Australia will release its report on wholesale inflation, and Japan will publish several reports. Later in the day, the focus will shift to the Eurozone, where GDP and inflation figures will be released.

Here is what you need to know on Friday, May 5:

On Thursday, Wall Street had its best day in a week, with the Dow Jones gaining 1.57% and the Nasdaq 2.43% boosted by earnings reports. Meta Platforms surprised and jumped almost 14% on Thursday. More earnings are coming on Friday from companies such as Exxon Mobil, Chevron, PetroChina, China Construction Bank, Sony and Mercedes-Benz.

The improvement in market sentiment favored currencies like AUD, NZD and CAD, while weakening CHF, JPY and the US Dollar. US yields rose sharply, driven more by risk sentiment than by monetary policy expectations.

US real GDP increased by 1.1% during the first quarter, below the 2% of markets consensus. On the positive side, Jobless Claims dropped more than expected. Pending Home Sales tumbled 5.2% in March. On Friday, the US will report Fed’s preferred inflation measure: the Core Personal Consumption Expenditures Price Index.

We continue to forecast that the U.S. economy to slip into recession, which we expect will be of moderate severity, in the second half of the year.

The Japanese Yen was among the worst performers on Thursday amid higher yields. USD/JPY rose to 134.15 and then pulled back.

The Bank of Japan (BoJ) will announce its monetary policy decision, the first under Kazuo Ueda. No change is expected; however, comments or signs about the future path can have a significant impact. The BoJ will release new macro forecasts. Japan will report Unemployment, Tokyo inflation, Retail Trade, Industrial Production and Housing Starts.

Bank of Japan Preview: New governor but old policy

EUR/USD fell modestly on Thursday, closing above 1.1000. The trend is up but gains remain limited by 1.1050. On Friday, Spain, France and Germany will release inflation figures (April preliminary) and also Eurozone growth numbers are due. Those reports are critical ahead of next week’s European Central Bank (ECB) meeting, which is seen rising rates by 25 basis points, but a 50 bps is not ruled out.

GBP/USD rose for the second day, staying below the recent high and slightly below 1.2500. The Pound outperformed on Thursday with EUR/GBP having the biggest daily loss in a month, falling from 0.8875 to 0.8825.

USD/CAD had the worst day in two weeks, pulling back under 1.3600 on risk sentiment and steady crude oil prices. Canada will report monthly GDP growth, with the economy expected to have expanded at a 0.2% rate in February and flash estimates for March are expected to show slowing activity.

NZD/USD advanced, finding resistance around the 200-day Simple Moving Average at 0.6160. AUD/USD also recovered after being able to defend 0.6600. Both pairs are moving with a bearish bias. Australia will report Q1 Producer Price Index (PPI) on Friday.

The Central Bank of the Republic of Turkey (CBRT) kept the policy rate unchanged at 8.5%, as expected, ahead of May 14 elections. USD/TRY posted a new record high close above 19.43.

The Colombian peso is the worst performer so far this week as political risk picked up in Colombia. President Petro ousted a moderate finance minister, replacing him with a key leftist ally, raising concerns about the economic policies from now on. USD/COP rose to 4,670, the highest level in four weeks. If the depreciation of the Peso continues it could force the central bank to raise rates further.

Crude oil prices recovered moderately after days of sharp declines, closing the gap created after the OPEC+ production cut announcement at the beginning of April. WTI surpassed $75.00 but failed to hold above. Crude remains under pressure, even amid larger inventory draws, reflecting concerns about the global economic outlook.

Gold and Silver continued to move sideways, ending unchanged at $1,987 and $24.90, respectively.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

21:00

USD/CHF Price Analysis: Bulls trying to take back control, building up for short squeeze to 0.9000 eyed

- USD/CHF bulls are in the market and broke the 4-hour structure at 0.8926.

- Meanwhile, a bearish 61.8% Fibonacci retracement aligns with the potential support structure.

USD/CHF is higher by some 0.4% and has rallied from a low of 0.8900 to a high of 0.8976 in a market that is trying to break higher in a short squeeze. The following illustrates the corrective bias for the meanwhile within a bearish trending market.

USD/CHF weekly charts

USD/CHF is offered and on the way to test the monthly support. However, the price is stalling and a correction could be on the cards for the coming days. A 50% mean reversion comes in at 0.9100.

USD/CHF daily chart

However, we are yet to see a bullish schematic playout on the daily chart with the price submerged below the trendline resistance without closing on the back side of it yet. The horizontal structure is located at 0.9003.

USD/CHF H4 charts

Then again, the bulls are in the market and broke the 4-hour structure at 0.8926. So long as the bulls commit, then a pullback into test the structure could be met with demand and a subsequent bullish structure will be put in. A 61.8% Fibonacci retracement aligns with the potential support structure. Below there, we have the 78.6% Fibo aligning with the neckline of the W-formation:

-

20:21

WTI bears taking control below the gap on demand concerns

- WTI bears are in the market below the gap.

- Demand concerns are driving the oil price lower.

West Texas Intermediate, WTI, is up by some 0.6% and has traveled within a range of between $75.24 and $74.08 so far. Following two days of losses that cut prices to the lowest since late March, the black gold is back on the mend in a mini short squeeze.

WTi has closed the gap that was put on the charts after OPEC+'s surprise 1.1-million barrel per day production cut. However, demand fears played in on Thursday after the United States reported its first-quarter Gross Domestic Product rose less than expected.

Real Gross Domestic Product advanced at a slower 1.1% QoQ AR clip in the first quarter with activity posting its first below-trend expansion since the second quarter of 2022, analysts at TD Securities noted. ´´First-quarter growth fell below consensus expectations at 1.9%, but it was largely in line with our 1.2% forecast. Under a context of rising uncertainty, we continue to look for activity to advance at a below-trend pace through the end of the year, with a recession likely starting in Q4 2023.´´

´´Still,´´ the analysts explained, ´´strong consumer-price data continue to underscore the stickiness of underlying inflation.´´

Nevertheless, the weak economic data continues to raise demand concerns and a recession in the United States could spark demand worries in other OECD nations. Meanwhile, the OPEC+ cuts will take effect on May 1. Today OPEC Secretary-General Haitham al-Ghais said the group was not looking to manage prices but is focusing on market fundamentals, according to reports.

Next up will be a weekly Baker Hughes rig-count report tomorrow at 1 pm ET.

WTI technical analysis

While below the gap resistance, the price is bearish on the front side of the trendline. A correction to the 38.2% Fibonacci has taken place already- on the 4-hour charts. However, there is plenty of support coming in which leaves the market in a sideways chop:

-

19:46

USD/MXN falls below key technical levels amidst US growth slowdown, Mexican record exports

- US Q1 2023 GDP Advances by 1.1% QoQ, falls short of 2% estimates as inflation surges to 4.9%.

- Fed May meeting: CME FedWatch tool predicts 87.1% chance of rate hike; stagflation looms.

- Mexico’s exports hit a record high of $53.6 billion, boasting a surplus.

The USD/MXN erased its Wednesday’s gains, dropping below crucial technical levels, after growth in the United States (US) decelerated, via a report for the Commerce Department. That, alongside a tranche of US economic data, softened the greenback. At the time of writing, the USD/MXN is trading at 18.0548, down 0.50%.

USD/MXN at two-day lows, eyeing 18.0000

The Mexican Peso (MXN) regained its strength, underpinned by lower-than-estimated growth in the US. The US Department of Commerce revealed the GDP Advance for Q1 2023 rose by 1.1% QoQ, below estimates of 2%. In the same report, quarterly core inflation aimed towards 5%, at 4.9%, exceeded forecasts and justified the Fed’s May rate rise increase.

The CME FedWatch Tool predicts there’s a chance of 87.1% for a 25 bps at the May meeting by the Fed. That paints a possible scenario of stagflation: the US economy decelerates while inflation continues to be sticky above the Fed’s target twice and a half.

On another data, the US Department of Labor (DoL) revealed that Initial Jobless Claims were lower than estimated, snapping three consecutive reports that flashed signs that the labor market was easing.

Aside from this, Mexico’s exports reached a record $53.6 billion, with the country printing a surplus, due to the arrival of investments and factories across the US border.

USD/MXN Technical Analysis

After hitting a weekly high of 18.1968, the USD/MXN tumbled below the 20-day EMA at 18.1106 and accelerated towards 18.0500. An upslope trendline drawn from March lows that passes around the 18.0450-18.0500 area capped the USD/MXN fall. Though a bearish continuation remains in play, the RSI indicator accelerated its downward trajectory, while the Rate of Change (RoC) portrays buying pressure waning. IF USD/MXN breaks below 18.0500 in the coming days, the pair could head toward the 17.9505 area. Once broken, the YTD low is up for grabs at 17.8968. Conversely, USD/MXN is climbing above the 20-day EMA, but upside risks remain.

-

19:11

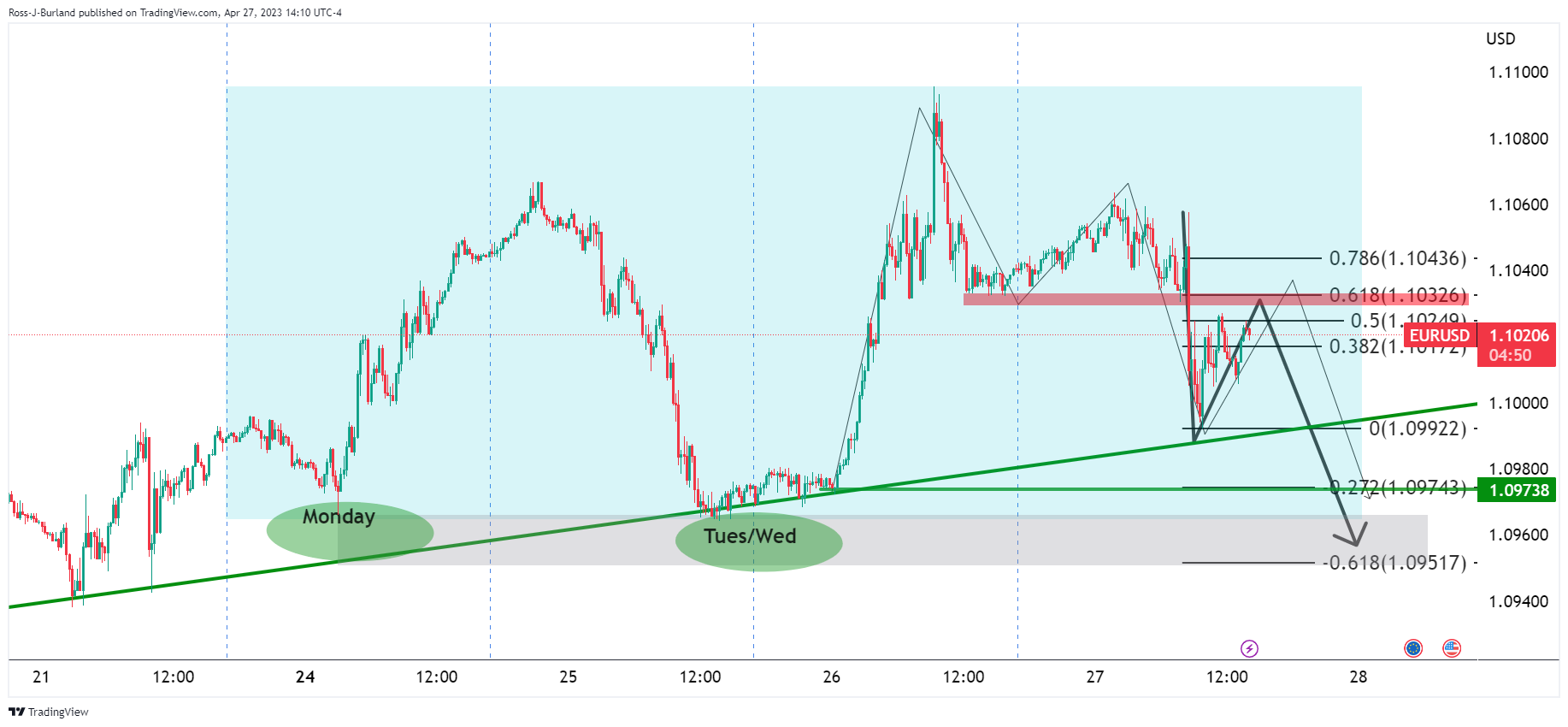

EUR/USD Price Analysis: Bears are moving in and eye a run on length

- EUR/USD bulls ready to throw in the towel?

- EUR/USD bearish technical analysis points to a test and break of key structures.

The Euro hovered near a one-year high vs. the US Dollar on Thursday. At the time of writing, EUR/USD is trading at 1.1020 as the market rallies in a short squeeze in the New York session. The following illustrates a bearish bias in a multi-timeframe analysis.

EUR/USD weekly chart

The rising wedge is a compelling feature on the longer-term charts. This is a bearish geometrical pattern and we can see the market has been driven back into shorts taken out in late March in a short squeeze. Perhaps we will see a long squeeze in the coming days?

EUR/USD daily charts

We have the first layer of structure in the 1.0960s and this would be breaking the micro trendline to tip the bias further to the downside.

EUR/USD H4 charts

Zooming into the 4-hour charts, we have the M-formation which could mean that we will see a test of the neckline resistance near the 1.1030s before a strong test of the trendline support. An engulfment would be an encouraging feature for the bears in that regard.

EUR/USD H1 chart

On the hourly chart, we can see the thesis playing out in faster motion with the current bid in play. A 61.8% Fibonacci retracement meets the neckline resistance. Everything above is trapped volume, so the long squeeze thesis is a reasonable one into 1.0950s stops and the week´s lows.

EUR/USD week template, M15 chart

Monday and mid week longs are still in the money with stop losses below eyed.

-

18:50

USD/CAD breaks losing streak, poised for a dip below 1.3600 on mixed US data

- USD/CAD snaps six days of losses, eyeing a drop below 1.3600.

- The Gross Domestic Product in the US expanded less than estimates, while unemployment claims rose less than forecast.

- USD/CAD Price Analysis: An evening star candlestick pattern warrants further downside; otherwise, a re-test of 1.3650 is likely.

The USD/CAD retraces after hitting a daily high of 1.3645 after the release of the United States (US) Gross Domestic Product (GDP) triggered fears of an upcoming recession in the United States (US). Consequently, the US Dollar (USD) advanced, but also the Canadian Dollar. Therefore, the USD/CAD is trading at 1.3619, below its opening price by 0.13%.

USD/CAD ignored the data and fell despite the US Dollar strength

As mentioned above, the US Department of Commerce revealed the Advance GDP for Q1 2023, which came at 1.1% QoQ, missing estimates of 2.0%. The print is the preliminary reading, though it’s the most market-moving. In addition, the US Department of Labor (DoL) revealed that Initial Jobless Claims were lower than estimated, snapping three consecutive reports that flashed signs that the labor market was easing.

Of note, on the GDP report, the core Personal Consumption Expenditure (PCE) for the first quarter rose by 4.9%, above estimates, justifying the Fed’s intention to raise rates by 25 bps next week. The CME FedWatch Tool shows that the swaps markets depict that odds for a quarter of a percentage hike lie at 87.1%, above yesterday’s intentions.

After the data release, the USD/CAD edged toward 1.3640 before falling toward the daily low of 1.3591, correcting upwards and exceeding 1.3600. OF late, the rise in crude oil prices of more than 1% underpins the Canadian Dollar (CAD), with the USD/CAD threatening to break below the 1.3600 mark.

On the Canadian front, Payrolls rose 62.5K in February, and Weekly Earnings increased by 1.8% YoY.

USD/CAD Technical Analysis

From a technical stance, the USD/CAD is upward biased. However, an evening star three-candlestick pattern is emerging, which could pave the way for a pullback before resuming the uptrend. Hence, if USD/CAD drops below 1.3600, a dip towards the confluence of the 20 and 50-day EMAs at 1.3526/35 is on the cards. Once cleared up next is the 100-day EMA at 1.3509. Conversely, if USD/CAD holds the spot price above 1.3600, upside risks lie at April 26, high at 1.3651.

-

18:02

United States 7-Year Note Auction: 3.563% vs previous 3.626%

-

17:26

Silver Price Analysis: XAG/USD falls but remains capped by the 20-DMA at $24.70

- Silver price continues to trade below the $25.00 figure as support takes hold around $24.80.

- XAG/USD has been trading sideways, bracing around the 20-day EMA at $24.70 for the last three days.

Silver price trends downwards for the third straight day, though it stays above the 20-day Exponential Moving Average (EMA) after dipping to a daily low of $24.51. At the time of writing, the XAG/USD is trading at $24.81, below its opening price by 0.25%.

XAG/USD Price Action

The XAG/USD is trading sideways, as it has been since April 18. Also, the Relative Strength Index (RSI), after bolstering the XAG/USD towards its YTD high of $26.08, has retreated, aiming towards the neutral area, as sellers continue to enter the market, as XAG/USD so far had failed to crack the 20-day EMA at $24.70. if XAG/USD sellers break below the latter, the next support would be a downslope resistance trendline, turned support, drawn from January highs, that passes around $24.20-30, ahead of posing a challenge to the $24.00 figure.

On the flip side, the XAG/USD first resistance would be the April 25 daily high at $25.23, followed by the April 20 cycle high at $25.49. The next resistance remains the YTD high at $26.08, followed by the last year’s high at $26.94.

XAG/USD Daily Chart

-

16:55

ECB Preview: Another hike next week, likely 50 bps – Danske

The European Central Bank (ECB) will have its monetary policy meeting next week. Another rate hike is widely expected. Analysts at Danske Bank point out that the question is whether it will slow the hiking pace to 25 basis points or continue to hike once more by 50bp. They see a 50bp more likely, with no specific forward guidance but repeating a data-dependent approach to future policy decisions.

Key quotes:

“This time, the question is whether it will slow the hiking pace to 25bp or continue to hike once more by 50bp. We believe it will be a 50bp compromise deal with no specific forward guidance (nor guidance on balance sheet normalisation in H2 yet), but repeating a data-dependent approach to future policy decisions.”

“Economic developments since the ECB meeting, coinciding with the banking turmoil, have shown resilient economic activity and another record-high core inflation print. Headline inflation has declined on the back of base effects, but the stickiness of core inflation and wages should pave the way for another 50bp rate hike, in our view.”

“A 50bp rate hike would implicitly also be a signal for a July hike in our reading. Hence, the risk for lower medium-to long-term rates, irrespective of the hiking, is prominent, in a bearish flattening move of the curves.”

“With a 25bp rate hike, we find it difficult for Lagarde to communicate a rate hike beyond June, which could take around 15bp out of the peak policy rate pricing, and in this case we see further lowering on the real rates and as such easing of the monetary policy stance.”

-

16:32

United States 4-Week Bill Auction: 3.83% vs 3.19%

-

16:29

NZD/USD stays firm amidst mixed US economic data, sparks recession concerns

- NZD/USD is firm after the release of mixed US economic data.

- US Q1 2023 GDP grows but misses estimates, while unemployment claims fell to 230K, below forecasts.

- NZD/USD faces the threat of reaching the YTD low at 0.6084 if support at 0.6100 is breached, though upside risks remain.

NZD/USD advances in the North American session after hitting a daily low of 0.6114 though recession fears sparked by US economic data augmented appetite for the US Dollar (USD). The NZD/USD is trading at 0.6131, down by a minuscule 0.09%.

NZD/USD climbs even though the US Dollar rises

Wall Street is not reflecting a dampened economic outlook in the United States (US). However, in the FX space, the antipodeans are erasing previous losses after the US Department of Commerce revealed the Advanced Gross Domestic Product (GDP) for Q1 in 2023 rose by 1.1% QoQ, below estimates of 2%, and trailed 2022 last quarter at 2.6%. Delving into the report, the US Core Personal Consumption Expenditure (PCE) rose by 4.9% QoQ vs. estimates of 4.8%. That would keep the US Federal Reserve (Fed) tightening monetary policy as inflation continues to edge h

Meanwhile, the US Department of Labor revealed that Initial Jobless Claims snapped three straight weeks of beating estimates, rose by 230K for the week ending April 22, less than forecasts of 248K.

After the data release, the NZD/USD seesawed between the day’s high and 0.6130 before dropping toward the 0.6120 area. Then, the pair recovered some ground and is sitting at around 0.6130s. The US Dollar Index, a measure of the buck’s value vs. a basket of peers, rises 0.20%, at 101.650.

US Treasury bond yields advanced as data justified Fed’s May rate hikes. Odds for a 25 bps interest rate increase for the May meeting climbed to 84.8%, higher than April 26 at 72.2%, according to the CME Fed WatchTool.

On the New Zealand front, April’s ANZ Activity and Business Confidence report showed mixed readings, with the former improving. However, it remained in negative territory, while the latter plummeted below the prior’s reading.

NZD/USD Technical Analysis

After bottoming around 0.6114 nearby the weekly low, the NZD/USD snapped two days of losses and bounced toward the 0.6130s area. Nevertheless, the top wick of today’s candlestick suggests that sellers are in control. If NZD/USD buyers want to get in control, they must reclaim the 20-day Exponential Moving Average (EMA) At 0.6188. Once broken, they could pose a threat toward 0.6200. Conversely, the NZD/USD first support would be 0.6100. A breach of the latter will expose the YTD low at 0.6084.

-

16:02

United States Kansas Fed Manufacturing Activity came in at -21, below expectations (3) in April

-

15:54

AUD/USD erases gains after US data, slides toward 0.6600

- US growth data comes in below expectations.

- US Dolla rises across the board boosted by US yields.

- AUD/USD up marginally, off highs after losing ground for four days in a row.

The AUD/USD is rising marginally on Thursday after it trimmed gains on the back of US economic data. The pair peaked on Asian hours at 0.6635 and recently fell to 0.6594. It is hovering around 0.6610, with a bearish bias amid a stronger US Dollar.

Dollar and Wall Street up despite US growth numbers

The US Dollar strengthened following the US Q1 GDP report. The economy grew at an annualized rate of 1.1%, below expectations. Personal Consumption Expenditures Prices rose by more than anticipated by 4.2%. Initial Jobless Claims for the week ended April 21 resulted in 230K, better than the expected 248K. Pending Home Sales declined by 5.2% on a monthly basis in March.

The numbers pointed to slower growth and somewhat persistent inflation pressures. US yields are sharply higher, boosting the US Dollar across the board. The 10-year yield is at 3.52% and the 2-year at 4.06%.

More US data is due on Friday with the Core Personal Consumption Expenditures Price Index and Income and Spending figures. Next week is the FOMC meeting. Market participants looks for a final 25 basis points rate hike.

The Reserve Bank of Australia will also have its monetary policy meeting next week. The RBA is expected to keep rates unchanged for the second meeting in a row.

The AUD/USD is moving sideways on Thursday, after posting the lowest daily close in a month around 0.6600. The pair has fallen during the last four days, and is attempting to stabilize.

A consolidation below 0.6600 would expose March lows at 0.6560/65; with a break lower likely to trigger a downside acceleration.

Technical levels

-

15:30

United States EIA Natural Gas Storage Change above forecasts (75B) in April 21: Actual (79B)

-

15:08

US: Pending Home Sales decline by 5.2% in March vs. +0.5% expected

- Pending Home Sales in the US fell sharply in March.

- US Dollar Index holds in positive territory above 101.50.

Pending Home Sales in the US declined by 5.2% on a monthly basis in March, the data published by the National Association of Realtors showed on Thursday. This reading followed February's no-change (revised from +0.8%) and came in much worse than the market expectation for an increase of 0.5%.

On a yearly basis, Pending Home Sales fell by 23.2%, compared to analysts' estimate for a decline of 22.8%.

Market reaction

The US Dollar Index showed no immediate reaction to these data and was last seen rising 0.2% on the day at 101.65.

-

15:05

USD Index returns to the positive territory near 101.70

- The index leaves behind the initial pessimism and moves to 101.70.

- Advanced US GDP surprised to the downside in Q1.

- Weekly Claims rose more than expected last week.

The greenback regained sudden upside traction and advanced to fresh daily highs near 101.80 when measured by the USD Index (DXY) on Thursday.

USD Index stronger on data, yields

The choppy trade around the index – and the rest of the global assets – remains well and sound on Thursday.

Indeed, the US Dollar manages to gather fresh steam after the US docket showed the flash GDP Growth Rate is expected to have expanded at an annualized 1.1% in Q1 vs. expectations for a 2.0% expansion.

However, the GDP Price Index came in hotter than estimated at 4.0% and the PCE Prices rose 4.2% QoQ and 4.9% when it comes to the Core PCE Prices, both prints also surpassing consensus.

In the meantime, the labour market continued to show signs of cooling after Initial Claims rose by 230K in the week to April 22.

Following the US data releases, US yields edge further up across the curve and underpin further the recovery in the Buck.

What to look for around USD

The dollar shrug off some of the initial selling pressure and now sets aside the strong pullback witnessed in the previous session.

Looking at the broader picture, the index continues to navigate in a consolidative phase against steady expectations of another rate increase in May by the Fed.

In favour of a pivot in the Fed’s hiking cycle following the May event appears the persevering disinflation and nascent weakness in some key fundamentals.

Key events in the US this week: Flash Q1 GDP Growth Rate, Initial Jobless Claims, Pending Home Sales (Thursday) – PCE/Core PCE, Employment Cost, Personal Income, Personal Spending, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is up 0.19% at 101.63 and faces the next resistance level at 102.80 (weekly high April 10) followed by 103.05 (monthly high April 3) and then 103.17 (55-day SMA). On the flip side, the breach of 100.78 (2023 low April 14) would open the door to 100.00 (psychological level) and finally 99.81 (weekly low April 21 2022).

-

15:00

United States Pending Home Sales (YoY) below expectations (-22.8%) in March: Actual (-23.2%)

-

15:00

United States Pending Home Sales (MoM) below expectations (0.5%) in March: Actual (-5.2%)

-

14:58

Expect no changes in policy from the BoJ on Friday – TDS

The Global Strategy Team at TD Securities (TDS) offers a brief preview of the upcoming Bank of Japan (BoJ) monetary policy meeting, scheduled during the Asian session on Friday.

Key quotes:

“We expect no changes in policy from the BoJ at its 28 April meeting. Governor Ueda has maintained the BoJ's dovish stance, highlighting that the Bank will stay the course until 2% inflation is sustainably reached (which we deem as a positive output gap).”

“While we think Ueda's next move will be a further adjustment of the yield curve target band, he appears in no rush to make such an adjustment, saying it's appropriate to maintain YCC "for now". Recent reports suggest BoJ officials are also wary of adjusting policy so soon after recent banking stress overseas. That said, we think the BoJ will not provide advance warning of a change and think the risk of a YCC shift should not be fully ruled out at this meeting.”

“At a minimum, we would expect the BoJ to offer guidance on YCC and announce a review. This should not come as a surprise as this has been communicated recently, but this time Ueda will have more flexibility to nuance the messaging now that he is fully in charge. And with the Shunto wage negotiations revealing higher than expected salary increases, and a back-up in 10y yields to close to the 0.5% top end of the YCC band, it suggests that the BoJ may still act in the months ahead. We think a move by June appears likely, which may take the form of a further widening to 0.75% or even 1%.”

-

14:50

EUR/SEK: Swedish Krona with potential to soften versus the Euro – Wells Fargo

Sweden's central bank raised its key interest rate by 50 basis points to 3.50% as expected. Analysts at Wells Fargo point out that the Riksbank faces something of a dilemma in that while inflation has been extremely rapid, economic activity has been particularly weak. They see the potential for the Swedish Krona to soften versus the Euro over the medium term.

Key quotes:

“We believe the Riksbank will, despite elevated inflation, take a cautious approach to further rate hikes. To be sure, after this week's announcement, we do expect some further monetary tightening. However, much like the Riksbank, we expect that tightening to be modest, and see just one final 25 bps rate increase in June to 3.75%.”

“This cautious approach to monetary tightening, which will leave real policy interest rates still deeply in negative territory, along with the underwhelming performance of the economy, means we are also turning less constructive on the Swedish krona.”

“We now see potential for the Swedish krona to soften versus the euro over the medium-term, targeting a EUR/SEK exchange rate of SEK11.5500 by end-2023 and SEK11.7000 by Q3-2024. Given our outlook for euro strength versus the U.S. dollar, that should still equate to modest krona strength versus the greenback over time. We target a USD/SEK exchange rate of SEK10.1325 by end-2023 and SEK9.7500 by Q3-2024.”

-

14:40

US economy is losing steam – Commerzbank

Dr. Christoph Balz, Senior Economist at Commerzbank, offers his views on the Advance US GDP report released this Thursday, which showed that growth in the world's largest economy decelerated to a 1.1% annualized pace during the first quarter.

Key quotes:

“Private consumption, which accounts for two-thirds of GDP, still grew by 3.7% in the first quarter. Households benefited from the continued strength of the labor market as well as special effects such as the social security increase and income tax relief as the tax code was adjusted for inflation. Disposable income increased by a strong 12.5% in Q1.”

“It is striking that housing construction, after seven sharp negative quarters (most recently -25%), is showing signs of stabilization with a comparatively small decline of 4.2%. Home builders have obviously now largely adjusted to the higher level of mortgage rates.”

“Stronger GDP growth was prevented by companies restocking their inventories much less than before. This in fact depressed the GDP growth rate by a whopping 2.3 percentage points. This effect should not be repeated in the current quarter.”

“Measured against the difficult environment, the US economy has thus still held up reasonably well at the beginning of 2023. We still expect it to contract slightly in the second half of the year. This is because the full impact of the Fed's interest rate hikes will probably not be felt until then due to the usual lags. It also fits in with this that growth in the first quarter was mainly based on very good January figures. The data for February and March were already weaker. In addition, a number of survey-based indicators such as the ISM purchasing managers' indices are pointing clearly downward.”

-

14:34

GBP/USD hangs near daily low, around mid-1.2400s amid fresh USD buying

- GBP/USD meets with some supply on Thursday amid the emergence of some USD buying.

- A further rise in the US bond yields turns out to be a key factor lending support to the buck.

- The USD maintains its bid tone and moves little following the Advance US Q1 GDP report.

The GBP/USD pair attracts some sellers near the 1.2500 psychological mark during the early North American session and drops to a fresh daily low following the release of the US macro data. Spot prices, however, manage to rebound a few pips in the last hour and now trade with a mild negative bias, around the mid-1.2400s.

The US Bureau of Economic Analysis reported this Thursday that the economic growth decelerated from 2.6% annualized pace to 1.1% during the January-March period, missing estimates for a reading of 2.0%. Further details of the report revealed that the GDP Price Index edged higher to 4% in the same period from 3.9%, compared to estimates for a reading of 3.8%. On a quarterly basis, the Personal Consumption Expenditures (PCE) Prices rose to 4.2% from 3.7%, indicating an unexpected pickup in price pressures.

Furthermore, data published by the US Department of Labor (DOL) showed that Initial Jobless claims fell to 230K in the week ended April 22 as compared to the 246K previous and the 248K anticipated. This also marks the lowest level in three weeks. Nevertheless, the upbeat macro data reaffirms bets for another 25 bps lift-off at the next FOMC meeting in May and remains supportive of a further rise in the US Treasury bond yields, which underpins the US Dollar (USD) and exerts some pressure on the GBP/USD pair.

The downside, however, remains cushioned, at least for the time being, amid growing acceptance that the Bank of England (BoE) will also hike interest rates by 25 bps in May. This, in turn, warrants some caution before placing aggressive bearish bets around the GBP/USD pair and positioning for any meaningful downside. Traders also seem reluctant and now look forward to Friday's release of the US Core PCE Price Index, the Fed's preferred inflation gauge, which will play a key role in influencing the near-term USD price dynamics.

Technical levels to watch

-

14:01

EUR/USD challenges 1.1000 post-US GDP figures

- EUR/USD recedes to the vicinity of the key 1.1000 mark.

- EMU Consumer Confidence came in at -17.5 in April.

- US Flash GDP disappointed expectations in Q1.

EUR/USD fades the initial upbeat mood and retreats to the boundaries of 1.1000 the figure on the back of the marked bounce in the Greenback on Thursday.

EUR/USD weaker on USD-buying

EUR/USD now looks offered in the low-1.1000s against the backdrop of the strong bout of strength in the Dollar and the continuation of the march north in US yields across the curve.

The move lower in the pair came soon after advanced US GDP Growth Rate saw the economy expand less than estimated by 1.1% YoY and 4.0% inter-quarter in the January-March period. In addition, Initial Claims rose by 230K in the week to April 22.

Earlier in the session, the Consumer Confidence measured by the European Commission in the broader Euroland matched the preliminary reading at -17.5 in April.

What to look for around EUR

EUR/USD comes under pressure and threatens to breach the key 1.1000 support on Thursday.

Meanwhile, price action around the single currency should continue to closely follow dollar dynamics, as well as the incipient Fed-ECB divergence when it comes to the banks’ intentions regarding the potential next moves in interest rates.

Moving forward, hawkish ECB-speak continue to favour further rate hikes, although this view appears in contrast to some loss of momentum in economic fundamentals in the region.

Key events in the euro area this week: Final Consumer Confidence, Economic Sentiment (Thursday) – Euro group Meeting, Germany labour market report/ Advanced Inflation Rate/Flash Q1 GDP Growth Rate, EMU Flash Q1 GDP Growth Rate (Friday).

Eminent issues on the back boiler: Continuation (or not) of the ECB hiking cycle. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.25% at 1.1010 and faces the initial support at 1.0909 (weekly low April 17) seconded by 1.0831 (monthly low April 10) and finally 1.0788 (monthly low April 3). On the other hand, the breakout of 1.1075 (2023 high April 14) would target 1.1100 (round level) en route to 1.1184 (weekly high March 21 2022).

-

14:01

Russia Central Bank Reserves $ dipped from previous $600.2B to $597.1B

-

13:58

Gold Price Forecast: XAU/USD tumbles toward $1,980 after US data

- US economy expanded less than expected during Q1.

- US Dollar and Treasury yields rise after data.

- XAU/USD drops from $2,000 to test $1,980; key support stands at $1,970.

Gold price dropped sharply following the release of US Q1 GDP growth data. XAU/USD hit levels above $2,000 and then lost almost $20, falling to the $1,980 area.

Economic data from the US showed the economy grew at an annualized rate of 1.1% during the first quarter, below the 2% of market consensus and under the 2.6% of the previous quarter. The Core PCE rose 4.9%, above the expected 4.7%. The GDP deflator also exceeded expectations at 4% versus 3.7%. A different report showed a decline in Jobless Claims.

The numbers showed slower growth and persistent inflation. US yields rose after the economic figures. The 2-year Treasury yield climbed above 4% to 4.03% while the 10-year spiked to 3.49% and then pulled back. The US Dollar Index turned positive for the day, rising above 101.60. Wall Street futures remained in positive territory.

XAU/USD reached a two-day low at $1,981 and rebounded modestly. It remains with a bearish bias. The critical support is located around $1,970 and a break lower could trigger an acceleration.

A rebound in XAU/USD could face resistance at $1,990 and $1,995. Gold bulls need price to consolidate above $2,005 in order to point to a sustainable extension.

Technical levels

-

13:50

USD/JPY spikes to 134.00 mark, fresh daily high post-US GDP report

- USD/JPY catches aggressive bids following the release of the Advance US Q1 GDP report.

- The US economic growth decelerated from 2.6% to 1.1% during the first quarter of 2023.

- Traders now look to the BoJ meeting and the US Core PCE Price Index for a fresh impetus.

The USD/JPY pair rebounds over 80 pips from the daily low touched during the early North American session and climbs to the 134.00 mark, a fresh daily high following the release of the US GDP report.

The US Bureau of Economic Analysis reported this Thursday that the economic growth decelerated from 2.6% annualized pace to 1.1% during the January-March period, missing estimates for a reading of 2.0%. That said, the price index component - the Core Personal Consumption Expenditure - rose more than expected, by 4.9% during the reported period and pointed to a further pickup in price pressures, reaffirming bets for another 25 bps lift-off at the next FOMC meeting in May. This remains supportive of a further rise in the US Treasury bond yields, which continues to act as a tailwind for the US Dollar (USD) and lends support to the USD/JPY pair.

The sharp intraday spike could also be attributed to a goodish recovery in the global risk sentiment, which tends to undermine the safe-haven Japanese Yen (JPY). Furthermore, the Bank of Japan's (BoJ) dovish stance is seen weighing on the JPY and contributing to the move up. It, however, remains to be seen if the USD/JPY pair can capitalize on the move or if bulls opt to move to the sidelines ahead of the crucial BoJ policy meeting on Friday. Apart from this, the Fed's preferred inflation gauge - the US Core PCE Price Index - will play a key role in influencing the USD and help investors to determine the near-term trajectory for the major.

Technical levels to watch

-

13:35

US: Weekly Initial Jobless Claims decline to 230K vs. 248K expected

- Initial Jobless Claims in the US decreased by 16,000 in the week ending April 22.

- Continuing Jobless Claims declined by 3,000 in the week ending April 15.

- US Dollar Index rises modestly after economic reports.

Initial Jobless claims totaled 230,000 in the week ending April 22, the weekly data published by the US Department of Labor (DOL) showed on Thursday. The print follows the previous week’s 246,000 (revised from 245,000) and came in below market expectations of 248,000. it is the lowest level in three weeks.

“The 4-week moving average was 236,000, a decrease of 4,000 from the previous week's revised average.”

Continuing Claims decreased by 3,000 in the week ended April 15 to 1.858 million, below the 1.878 million of market consensus.

“The 4-week moving average was 1,836,500, an increase of 10,250 from the previous week's revised average. This is the highest level for this average since December 18, 2021 when it was 1,838,000.”

Market reaction

At the same time, the US reported Q1 GDP that triggered a decline of the US Dollar. The DXY rose modestly after the numbers, erasing daily losses, toward 101.50.

-

13:31

United States Personal Consumption Expenditures Prices (QoQ) above expectations (0.5%) in 1Q: Actual (4.2%)

-

13:31

United States Core Personal Consumption Expenditures (QoQ) came in at 4.9%, above forecasts (4.8%) in 1Q

-

13:31

United States Gross Domestic Product Price Index came in at 4%, above forecasts (3.8%) in 1Q

-

13:30

United States Gross Domestic Product Annualized came in at 1.1% below forecasts (2%) in 1Q

-

13:30

United States Continuing Jobless Claims registered at 1.858M, below expectations (1.878M) in April 14

-

13:30

United States Initial Jobless Claims came in at 230K, below expectations (248K) in April 21

-

13:30

United States Initial Jobless Claims 4-week average: 236K (April 21) vs previous 239.75K

-

13:25

EUR/USD Price Analysis: A test of 1.1100 emerges on the horizon

- EUR/USD looks to extend the uptrend beyond 1.1000.

- Further gains could see the 1.1100 barrier retested near term.

EUR/USD adds to Wednesday’s strong upside and consolidates further the recent breakout of the key 1.1000 mark on Thursday.

The pair looks poised to extend the recovery further in the near term. That said, the immediate hurdle is expected at the 2023 high at 1.1095 (April 25) closely followed by the round level at 1.1100.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0408.

EUR/USD daily chart

-

13:06

US Dollar is treading water as markets await fresh drivers – BBH

Economists at BBH offer a brief preview of Thursday's key US macro data, the Advance first-quarter GDP report, due for release during the early North American session. The data will play will influence the US Dollar (DXY), which is trading flat near 101.48 amid ongoing concerns about First Republic, higher global equity markets and global bond yields.

Key quotes:

“Consensus currently is at 1.9% SAAR vs. 2.6% in Q4. Personal consumption is expected at 4.0% vs. 1.0% in Q4. The mix of Q1 growth will be important because in Q4, the bulk of growth came from inventories while personal consumption and net exports slowed. Of note, the Atlanta Fed’s GDPNow model is tracking Q1 growth at 1.1% SAAR, down from 2.5% before yesterday’s weak data. This is the final model update for Q1 and now the model will start tracking Q2, with the first estimate coming tomorrow.”

-

13:02

Mexico Trade Balance, $ came in at $1.169B, above expectations ($-1.189B) in March

-

13:01

Mexico Trade Balance s/a, $ registered at $0.081B above expectations ($-1.809B) in March

-

12:12

USD Index Price Analysis: Further losses not ruled out

- DXY extends the consolidative phase for yet another session.

- Extra retracements could see the 101.00 region breached near term.

DXY alternates gains with losses in the low-101.00s on Thursday.

In the meantime, the index is expected to keep the choppy performance unchanged. The loss of the 101.00 region should spark further bouts of weakness to, initially, the 2023 lows in the 100.80/75 band (April 14).

Looking at the broader picture, while below the 200-day SMA, today at 106.10, the outlook for the index is expected to remain negative.

DXY daily chart

-

12:00

Brazil Inflation Index/IGP-M came in at -0.95%, below expectations (-0.74%) in April

-

12:00

Turkey CBRT Interest Rate Decision remains at 8.5%

-

11:55

EUR/JPY Price Analysis: Next on the upside comes the YTD high

- EUR/JPY falters just ahead of the 148.00 mark on Thursday.

- The immediate target of note emerges the 2023 top at 148.63.

EUR/JPY looks to extend Wednesday’s uptick, although there seems to be a tough barrier around the 148.00 neighbourhood so far on Thursday.

The underlying strong upside momentum in the cross appears unchallenged for the time being. Against that, once the 148.00 hurdle is cleared, the cross could then attempt a move to the 2023 high at 148.63 (April 25).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 142.38.

EUR/JPY daily chart

-

11:48

Singapore: Industrial sector remains healthy – UOB

Senior Economist Alvin Liew at UOB Group reviews the latest industrial production results in Singapore.

Key Takeaways

“Singapore’s industrial production (IP) rebounded with a 9.3% m/m SA expansion in Mar, from a downwardly revised -12.5% m/m decline in Feb. This translated to a markedly smaller decline of -4.2% y/y in Mar, from the -9.7% y/y contraction in Feb. Both measures were better than Bloomberg’s median forecast of +6.2% m/m, -6.1% y/y and much better than our forecasts of -12.6% m/m SA, -24.8% y/y. Despite the improvement, this was still the sixth consecutive month of y/y decline and the worst streak since 2015 (11 months of y/y declines). Excluding the volatile biomedical manufacturing, IP contracted by a larger -6.0% y/y in Mar (from -5.8% y/y in Feb).”

“Based on advance estimates released by Ministry of Trade and Industry on 14 Apr, Singapore’s economy grew by just 0.1% y/y in 1Q 2023 (from 2.1% in 4Q 2022) with growth being dragged down by the manufacturing sector (which contracted by -6.0% y/y) while services (+1.8% y/y) and construction activity (8.5% y/y) supported GDP. However, based on the Mar IP report, the manufacturing sector is likely to have contracted by a smaller -5.6% y/y in 1Q. Assuming no major changes to the other sectors, we now expect 1Q GDP growth to be revised slightly higher by 0.1 ppt to 0.2% y/y, taking into account the milder manufacturing contraction.”

“IP Outlook – Notwithstanding the uplift brought by the biomedical technology and transport engineering components, the latest Mar IP print continues to affirm our downbeat manufacturing outlook due to the worsening electronics downcycle and weaker external demand. We maintain our forecast for Singapore 2023 manufacturing to contract by 5.4%.”

-

11:32

USD/CHF recovers further from over two-year low, trades above 0.8900 ahead of US GDP

- USD/CHF attracts some buyers on Thursday and draws support from a combination of factors.

- A positive risk tone undermines the safe-haven CHF and lends support amid a modest USD uptick.

- Investors now look forward to the Advance US Q1 GDP report to grab short-term opportunities.

The USD/CHF pair gains some positive traction on Thursday and builds on the previous day's late recovery from the vicinity of mid-0.8800s, or its lowest level since January 2021. The pair sticks to its positive bias through the first half of the European session and is currently placed near the weekly high, around the 0.8930-0.8935 region.

A modest recovery in the global risk sentiment - as depicted by a generally positive tone around the equity markets - undermines the safe-haven Swiss Franc (CHF) and acts as a tailwind for the USD/CHF pair. The US Dollar, on the other hand, draws support from a further rise in the US Treasury bond yields, bolstered by bets for another 25 bps Fed rate-hike in May, and turns out to be another factor lending some support to the major.

That said, fresh concerns about banking contagion risks in the US, along with the debt ceiling standoff and looming recession risks, have been fueling speculations about an imminent rate cut by the Fed later this year. This might hold back the USD bulls from placing aggressive bets and keep a lid on any meaningful upside for the USD/CHF pair. Traders also seem reluctant ahead of the release of the Advance US Q1 GDP report.

The first estimate is anticipated to show that growth in the world's largest economy decelerated to a 2.0% annualized pace during the January-March period from the 2.6% recorded in the previous quarter. Any significant divergence from the expected reading could infuse some volatility around the USD and provide some impetus to the USD/CHF pair. Apart from this, the broader risk sentiment could produce short-term opportunities.

The market focus will then shift to the Fed's preferred inflation gauge - the US Core PCE Price Index - due on Friday, which will play a key role in influencing the USD price dynamics and help determine the near-term trajectory for the USD/CHF pair. This makes it prudent to wait for strong follow-through buying before confirming that spot prices have formed a bottom around the 0.8850 region and positioning for any further gains.

Technical levels to watch

-

11:11

Australia: Lower inflation justifies unchanged rates by the RBA – UOB

Economist at UOB Group Lee Sue Ann assesses the latest inflation figures in Australia and the prospects for a potential pause by the RBA of its hiking cycle.

Key Takeaways

“Australia’s headline CPI growth came in at 1.4% q/q for 1Q23, a tad higher than expectations of 1.3% q/q, but lower than the reading of 1.9% q/q in 4Q22. Compared to the same period a year ago, CPI advanced 7.0% y/y, also lower than the 7.8% y/y print in 4Q22, though still a tad higher than expectations of 6.9% y/y.”

“Underlying inflation also eased. Annual trimmed mean inflation was 6.6%, down from 6.9% in 4Q22.The trimmed mean measure rose at a slower pace of 1.2% q/q, compared to 1.7% q/q in 4Q22. The strength of the underlying inflation was also evident in the Reserve Bank of Australia (RBA)’s weighted median CPI, which was up 1.2% q/q, but down from the previous reading of 1.6% q/q.”

“Following today’s inflation figures, the RBA is likely to remain on the sidelines at the upcoming monetary policy meeting on 2 May. As such, we continue to see the current 3.60% cash rate as the likely peak. Focus will nonetheless continue to be on incoming economic data, including 1Q23 wage price index (17 May), followed by Apr employment (18 May).”

-

10:50

US: Q1 GDP growth to register a meaningful deceleration to 1.2% - TDS

The Global Strategy Team at TD Securities (TDS) offers a brief preview of Thursday's key release of the Advance first-quarter US GDP report, due later during the early North American session.

Key Quotes:

“We now expect the first estimate of Q1 GDP growth to register a meaningful deceleration to 1.2% q/q AR (consensus: 2.0%) following a solider, above-trend 2.6% expansion in Q4. We had initially projected output to have increased by 2.3% for Q1, but Wednesday's advanced indicators for March pointed to a larger-than-expected drag from inventories. We continue to expect the US consumer to have acted as a major positive driver of economic activity. However, recent downward revisions to Q1 retail sales data may temper the pace of spending.”

-

10:45

GBP/USD remains confined in a range, holds above mid-1.2400s ahead of US GDP

- GBP/USD lacks any firm intraday direction and seesaws between tepid gains/minor losses.

- A further rise in the US bond yields lends support to the USD and caps gains for the major.

- Rising bets for another 25 bps BoE rate hike in May continue to underpin the British Pound.

The GBP/USD pair struggles to gain any meaningful traction on Thursday and oscillates in a narrow trading band through the first half of the European session. The pair is currently placed just above mid-1.2400s, nearly unchanged for the day, though the downside seems cushioned amid subdued US Dollar (USD) price action.

The uncertainty over the Federal Reserve's rate-hike path, along with a slight recovery in the global risk sentiment, fail to assist the safe-haven buck to capitalize on the overnight bounce from a nearly two-week low and lend support to the GBP/USD pair. Fresh concerns about banking contagion risks in the United States (US), along with the debt ceiling standoff and looming recession fears, have been fueling speculations about an imminent rate cut by the Fed later this year.

The markets, however, have been pricing in a greater chance of another 25 bps lift-off at the next FOMC policy meeting in May. This remains supportive of a further rise in the US Treasury bond yields, which acts as a tailwind for the Greenback and seems to cap the upside for the GBP/USD pair, at least for the time being. Moreover, the recent repeated failures to find acceptance above the 1.2500 psychological mark warrants some caution before positioning for any further gains.

Traders also seem reluctant and wait on the sidelines ahead of the release of the Advance US Q1 GDP report, due later during the early North American session. The data, along with the US bond yields and the broader risk sentiment, might influence the USD price dynamics and produce short-term trading opportunities around the GBP/USD pair. The market attention will then shift to the release of the Fed's preferred inflation gauge - the US Core PCE Price Index on Friday.

In the meantime, expectations for another 25 bps interest rate hike by the Bank of England (BoE) in May could underpin the British Pound and further contribute to liming the downside for the GBP/USD pair. The bets were lifted by last week's release of stronger UK wage growth data and consumer inflation figures, which, in turn, favours bullish traders and supports prospects for some meaningful near-term appreciating move for the major.

Technical levels to watch

-

10:31

Italy 10-y Bond Auction fell from previous 4.12% to 3.77%

-

10:31

Italy 5-y Bond Auction rose from previous 3.59% to 4.42%

-

10:30

OPEC’s Al Ghais: OPEC and OPEC+ are not targeting oil prices

Haitham Al Ghais, the Secretary-General of the Organization of the Petroleum Exporting Countries (OPEC), said on Thursday, “OPEC and OPEC+ are not targeting oil prices.”

Additional quotes

The IEA should be very careful about "further undermining" oil industry investments.

OPEC and OPEC+ are focusing solely on market fundamentals and enabling "vital" investments.

Finger-pointing and misrepresenting OPEC and OPEC+ actions is counterproductive.

Blaming oil for inflation was erroneous and technically inaccurate, given that there were other reasons contributing to inflation.

The international energy agency's repeated demands to avoid investing in oil could contribute to future market turbulence.

Market reaction

WTI was last seen trading at $74.44, up 0.20% on the day. The US oil is retreating from intraday highs of $74.79.

-

10:30

Belgium Consumer Price Index (MoM): 0.67% (April) vs 0.57%

-

10:30

Belgium Consumer Price Index (YoY): 5.6% (April) vs previous 6.67%

-

10:06

European Monetary Union Business Climate dipped from previous 0.7 to 0.54 in April

-

10:01

European Monetary Union Services Sentiment came in at 10.5, above expectations (9.4) in April

-

10:01

European Monetary Union Industrial Confidence came in at -2.6, below expectations (0.1) in April

-

10:01

European Monetary Union Consumer Confidence in line with forecasts (-17.5) in April

-

10:01

European Monetary Union Economic Sentiment Indicator registered at 99.3, below expectations (99.9) in April

-

10:00

Belgium Gross Domestic Product (QoQ) above expectations (0.3%) in 1Q: Actual (0.4%)

-

09:55

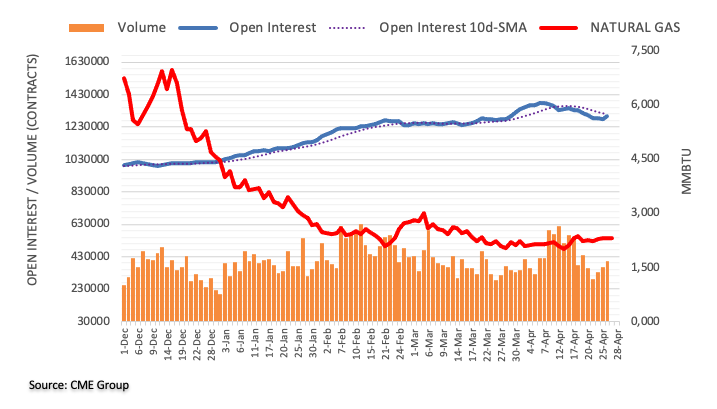

Crude Oil: Recession fears weigh but no sustained rout in the cards – TDS

Bart Melek, Head of Commodity Strategy at TD Securities (TDS) beileves that there is no sustained downtrend in crude oil prices, despite the latest sell-off sparked by fears over a global economic recession.

Key quotes

“Despite unexpectedly large crude oil (5.05 MM bbls) and gasoline (2.48 MM bbls) inventory draws, concerns surrounding global economic weakness, diminishing crack spreads and a lackluster appetite for risk have kept crude oil prices from bouncing meaningfully higher following the EIA data.”

“A sharp rise in US product demand (+891k b/d) also did little to lift prices. With WTI crude trading near $76.50/b and Brent trending near $80/b, worried traders have largely erased all the gains from the OPEC+ production cut announcement.”

“Specs are no doubt aggressively cutting the recently acquired long exposure amid growing concerns that the petroleum complex will become oversupplied, as demand moderates in response to weakening economic conditions.”

-

09:42

AUD/USD sticks to modest intraday gains above 0.6600 mark, US GDP awaited

- AUD/USD gains some positive traction on Thursday, albeit lacks bullish conviction.

- A modest recovery in the risk sentiment undermines the USD and lends support.

- Traders now look to the Advance US Q1 GDP report for short-term opportunities.

The AUD/USD pair once again shows resilience below the 0.6600 mark and attracts some buying on Thursday, snapping a two-day losing streak to its lowest level since mid-March touched the previous day. The pair maintains its bid tone through the early part of the European session, albeit lacks bullish conviction.

The uncertainty over the Federal Reserve's rate-hike path fails to assist the US Dollar (USD) to capitalize on the overnight bounce from a nearly two-week low, which, in turn, is seen lending some support to the AUD/USD pair. Fresh concerns about banking contagion risks in the United States (US), along with the debt ceiling standoff and looming recession fears, have been fueling speculations about an imminent rate cut by the Fed later this year. Apart from this, a slight recovery in the global risk sentiment - as depicted by a stable performance around the equity markets - further undermines the safe-haven buck and benefits the risk-sensitive Aussie.

The markets, meanwhile, seem convinced that the US central bank will hike interest rates by another 25 bps at the next FOMC policy meeting in May. This remains supportive of a further rise in the US Treasury bond yields, which acts as a tailwind for the Greenback and keeps a lid on any further gains for the AUD/USD pair. Traders also seem reluctant and preferred to wait on the sidelines ahead of the release of the Advance US Q1 GDP report, due later during the early North American session. The growth in the world's largest economy is anticipated to slow to a 2% annualized pace during the January-March period from the 2.6% rise in the previous quarter.

Any significant divergence from the expected reading might infuse some volatility around the USD and provide a fresh impetus to the AUD/USD pair. The focus will then shift to the US Core PCE Price Index - the Fed's preferred inflation gauge - on Friday, which will play a key role in influencing the near-term USD price dynamics and help determine the near-term trajectory for the major.

Technical levels to watch

-

09:37

Russia’s Novak: OPEC+ sees no need for further oil output cuts

Russian Deputy Prime Minister Alexander Novak said on Wednesday, “OPEC and its allies (OPEC+) sees no need for further oil output cuts despite lower than expected Chinese demand.”

Additional takeaways

The global oil market is balanced.

OPEC+ is always able to adjust deal parameters.

We don't see oil market deficit after OPEC+ cuts starting from May.