Notícias do Mercado

-

23:24

AUD/USD Price Analysis: Weekly close below 0.6200 would expose YTD lows

- AUD/USD finished the week with substantial losses of 2.61%.

- On Friday, the AUD/USD seesawed on a 200-pip range, notably reaching a weekly close below 0.6200.

- AUD/USD Price Forecast: To tumble to 0.6100 if sellers clear the YTD low; otherwise, a move towards 0.6300 is on the cards.

On Friday, the Australian dollar finished the week on the wrong foot, tumbling below 0.6200 amidst a dampened market mood, with investors dumping everything risk-perceived in the FX space, the Aussie dollar. Therefore, the AUD/USD accelerated its downfall, trading at 0.6199, below Friday’s opening price by 1.58%.

AUD/USD Price Forecast

The AUD/USD daily chart depicts the pair seesawed in a 220-pip range after hitting a daily high of 0.6347 before tumbling under the 0.6200 figure. Worth noting that on its way down, the AUD/USD Friday close was 0.6199, exposing crucial support levels, like the YTD low of 0.6169, which, if cleared, could open the door towards 0.6100.

Oscillators are at oversold conditions, though registering higher lows, while price action is registering lower lows. That said, a positive divergence might be forming.

In the short term, the AUD/USD is neutral biased, though oscillators in negative territory and price action could open the door for further downside action. Therefore, the AUD/USD first support would be the YTD low of 0.6169, followed by the 0.6100 figure. The break below will expose the figure at 0.6000.

Contrarily, if the AUD/JPY bounces from below 0.6200, it would expose essential resistance levels, like 0.6250, followed by the confluence of the 100, 20 and 50-EMAs, around 0.6276/77, followed by the 0.6300 mark.

AUD/USD Key Technical Levels

-

21:21

GBP/JPY Price Analysis: Oscillates around 166.11 amid a risk-off impulse

- GBP/JPY erases some of its gains, set to finish the week with more than 3% gains.

- GBP/JPY traders mainly ignored UK’s political turmoil.

- The cross-currency is range-bound, as depicted by the one-hour chart.

The GBP/JPY trims some of its Thursday’s losses but remains nearby weekly highs at around the 166.00 area, despite UK’s political turmoil, weighing on the GBP/USD, the GBP/JPY continues to hold to gains due to the Bank of Japan dovish stance. Therefore, the GBP/JPY is trading at 166.16, below its opening price by 0.33%.

GBP/JPY Price Forecast

The GBP/JPY daily chart was unchanged compared to Thursday, though it should be noted that the exchange rate is above the October 5 high of 165.71, which could keep the GBP/JPY trading within the 165.71-167.27 range. Oscillators remain in positive territory, keeping the neutral-to-upward bias intact, though a break above 167.27 would pave the path to 167.94, ahead of challenging the YTD high at 168.73.

The GBP/JPY one-hour scale portrays the pair consolidating between the 20 and 50-EMAs, while the Relative Strength Index (RSI) is almost flat but at bullish territory. Upwards, the first resistance would be the 20-EMA at 166.42, followed by the daily high at 167.21, ahead of the 168.00 figure.

On the other hand, the GBP/JPY first support would be the daily pivot at 165.45, immediately followed by the 50-EMA at 165.27. Once that 18-pip area cleared, the GBP/JPY could tumble to the 165.00 area, followed by the S1 pivot at 163.59.

GBP/JPY Key Technical Levels

-

21:09

USD/CHF above 1.0000 pushing against 1.0065 two-year high

- The dollar breaks above parity and reaches a two-year high at 1.0065.

- Hopes of Fed tightening are boosting the US dollar.

- USD/CHF: Above 1.0074/98, higher targets are likely – Credit Suisse.

The US dollar has extended its rally against the Swiss Franc on Friday, breaking finally above the parity level, to test May highs at 1.0065. The pair is on track to close its fifth consecutive positive week after rushing 5% up from mid-September lows.

The greenback surges on Fed tightening hopes

The US consumer price data released on Thursday confirmed the resilient inflationary pressures on Thursday and boosted confidence in a fourth consecutive 0.75% Fed hike in November. This has increased the attractiveness of the US dollar for investors.

Furthermore, the growing concerns about a global recession on the back of a series of downbeat figures are also favoring the US dollar, seen as a safe haven in times of uncertainty.

USD/CHF: Breach of 1.0074/98 will open the path for higher targets – Credit Suisse

FX analysts at Credit Suisse point out a key resistance area at 1.0074/98: “Above the 1.0074/98 major barrier would be seen to clear the way for strength to the highs of 2019 at 1.0226/35.”

Technical levels to watch

-

20:38

United States CFTC S&P 500 NC Net Positions climbed from previous $-209.3K to $-164.1K

-

20:38

United Kingdom CFTC GBP NC Net Positions: £-39.2K vs £-49.5K

-

20:37

Australia CFTC AUD NC Net Positions declined to $-31.3K from previous $-27.8K

-

20:37

European Monetary Union CFTC EUR NC Net Positions fell from previous €43.7K to €37.5K

-

20:37

Japan CFTC JPY NC Net Positions increased to ¥-77.4K from previous ¥-81.6K

-

20:37

United States CFTC Oil NC Net Positions rose from previous 242K to 259.2K

-

20:37

United States CFTC Gold NC Net Positions: $94.4K vs $88.4K

-

20:37

USD/JPY hits a fresh 34-year high at 148.85 before ticking down

- The dollar takes a breather after reaching 148.85 high.

- Monetary policy divergence crushes the yen.

- USD/JPY: Potential top at 149.17/150.00.

The dollar accelerated its rally against the Japanese yen on Friday to hit session highs at 148.85. The pair has surged beyond 3% in an eight-day rally, reaching its highest levels since 1990.

Yen hammered by monetary policy divergence

The Japanese yen is dropping like a stone weighed by the monetary policy divergence between the Bank of Japan and the Federal Reserve, and also the rest of the world’s major central banks.

While the Fed is expected to hike interest rates by 0.75% for the fourth consecutive time in November, the Bank of Japan remains committed to its ultra-expansive policy, which makes the yen less attractive for investors.

At this point, the pair has appreciated well above the level that triggered intervention by the Bank of Japan last month. So far the bank has remained inactive, however, the Japanese finance minister Suzuki reiterated on Thursday the government’s commitment to take action against excessive currency volatility.

USD/JPY: Potential top at 149.17/150.00 area – Credit Suisse

According to FX analysts at Credit Suisse, the pair might be near a potential top: “Our bias remains for a deeper push higher into the 147.62/153.01 zone with resistance above 147.62/68 seen next at 148.42 ahead of trend resistance from April at 149.17. With rare gap resistance from August 1990 seen at 149.31 and the psychological 150.00 barrier just above, we look for a potential top in this 149.17/150.00 zone.”

Technical levels to watch

-

20:15

Argentina Consumer Price Index (MoM) dipped from previous 7% to 6.2% in September

-

20:00

NZD/USD’s revesal from 0.5680 high extends to 0.5550 area

- New Zealand's dollar dives from 0.5680 high to 0.5550 area.

- The kiwi approaches long-term lows at 0.5475.

- The US dollar appreciates on expectations of another 0.75% FED rate hike.

The New Zealand dollar is going through a strong reversal on Friday, weighed by the overall USD strength. The kiwi turned down from session highs near 0.5700 to 0.5550 so far, approaching the 2020 low at 0.5475.

The kiwi plunges on US dollar strength

The greenback is rallying across the board on Friday, paring losses seen earlier this week, with investors anticipating the fourth consecutive 75 basis points rate hike in November. The higher-than-expected US inflation data seen on Thursday has offered additional reasons for the bank to maintain its aggressive monetary tightening cycle.

Beyond that, investors concerns about an upcoming global recession have also favoured the US dollar on the back of its safe-haven status.

In the macroeconomic docket, New Zealand’s Business NZ PMI data showed a larger-than-expected deceleration in September. Business activity slowed down to 52 from 52.5 in August, against expectations of a 52.5 reading.

Technical levels to watch

-

19:54

GBP/USD plunges more than 100-pips amidst UK political turbulence

- GBP/USD plummets below 1.1200 due to political/economic turmoil in the UK.

- US Consumer Sentiment improved while inflation expectations arose.

- UK’s PM Liz Truss makes a U-turn on corporate tax, increasing it to raise GBP 18 billion.

The British pound extends its loss amidst two weeks of turmoils, courtesy of UK’s PM Liz Truss’s mini-budget, which ended with the Chancellor of Exchequer, Kwasi Kwarten, replaced by James Hunt, as the PM Truss tries to calm the markets. Additionally, the Bank of England finished its emergency bond-buying program as scheduled, buying close to GBP 2 billion on Friday.

At the time of writing, the GBP/USD is trading at 1.1177, below its opening price, after hitting a daily high of 1.1366.

GBP/USD plunges on political turmoil in the UK; mixed US economic data

US equities are tumbling sharply, a U-turn from Thursday’s reaction to US CPI. Fed officials reiterated that inflation is high, the labor market tight and that further rate hikes are coming. San Francisco’s Fed Mary Daly said that the Federal funds rate (FFR) could peak at around 4.5-5.0% as the US central bank does its best to tame inflation.

Therefore, the GBP/USD tumbled as the greenback got bolstered by investors, on ramping expectations for further Fed tightening. Meanwhile, the US Dollar Index advances 0.75%, at 113.303, underpinned by rising US Treasury yields. Worth noting that the US 10-year yield gains five bps, up at 4.0%.

Data-wise, US Retail Sales disappointed investors, while the University of Michigan Consumer Sentiment exceeded August’s figures. However, American inflation expectations rose by 5.1% in the one-year horizon, above last month’s 4.7%.

On the UK’s side, Prime Minister Liz Truss replaced the former Chancellor Kwarteng with James Hunt while increasing the corporate tax from 18% to 25%, which will raise GBP 18 billion a year. At the same time, the Bank of England finished its bond-buying program, aimed to stabilize the markets, though Gilts, namely the 30-year, is up 26 bps, yielding 4.80%,

Given that backdrop, further volatility will hit the GBP/USD next week. Traders should be aware of over-the-weekend developments in the UK, as speculations mount that Liz Truss could step down as Prime Minister, which is perceived as bullish for the pound. Otherwise, hawkish Fed expectations, and political uncertainty in the UK, would favor the greenback.

GBP/USD Key Technical Levels

-

19:30

EUR/GBP returns above 0.8700 after UK’s finance minister’s dismissal

- Euro recovery from the 0.8600 area extends past 0.8700.

- The pound weakens after PM Truss sacks her finance minister.

- EUR/GBP faces resistance at 0.8750 and 0.8865.

The euro is picking up on Friday after the sharp declines seen over the previous two days. The pair returned above 0.8700 on the confirmation that Prime Minister, Liz Truss, has dismissed the finance minister Kwasi Kwarteng.

The pound pulls back after a two-day rally

The euro is capitalizing on the pound’s weakness to appreciate about 0.8% on Friday, with the cable giving away previous gains triggered by speculation about a U-turn on the UK Government’s controversial tax cuts plan.

In the absence of relevant macroeconomic data in the UK or the EU, investors have remained cautious regarding GBP longs, wary about potential volatility. Friday is the deadline set by the Bank of England to end its bond-purchasing program.

EUR/GBP should breach 0.8750 to gain traction

On the upside, above 0.8700, the pair should extend beyond 0.8750, where the 100 and 200-hour SMA meet, to aim towards the October 12 high at 0.8865.

On the downside, the support at 86.15 is holding bears so far. Below here, the next potential targets could be at 85.65 (September 6 low) and 83.90/00 (August 8, 17, and 24 lows).

Technical levels to watch

-

18:44

EUR/USD drops from around the 20-day EMA as sentiment deteriorates

- EUR/USD erases Thursday’s gains, losing 0.53% on Friday.

- US Consumer Sentiment improved, though Retail Sales slowed down.

- EUR/USD Price Forecast: Break above the 20-day EMA, the major could challenge 0.9800; otherwise, it could test the YTD low.

The EUR/USD losses its grip around the 20-day EMA and edges lower as the North American session progresses, amidst a firm US dollar, following the release of a US hot inflation report on Thursday, while mixed US economic data, and hawkish Fed commentary, bolstered the buck. At the time of writing, the EUR/USD is trading at 0.9724.

Friday’s price action witnessed the EUR/USD opening around the highs of the day of 0.9808, above the 20-day EMA, but buyers unable to hold the fort paved the way for further losses.

EUR/USD falls despite weaker US Retail Sales; consumer sentiment improved

The US Commerce Department reported that Retail Sales stagnated in September, with figures coming at 0% MoM, below estimates of 0.2%, while on an annual based, decelerated even further, from 9,15% to 8.41%, reflecting the shock of Fed’s monetary policy.

Later, the University of Michigan Consumer Sentiment improved steadily in October, as the index jumped to 59.8 from 58.6., though inflation expectations were upward revised, with prices foreseen to rise 5.1% from 4.7%.

The data barely moved the EUR/USD, though Fed speaking, boosted the greenback. Fed’s Geroge, Daly, and Cook reiterated that inflation is too high and that monetary policy needs to be restrictive for longer to tackle inflation. Daly added that she estimates the Federal funds rate (FFR, peaking at 4.50-5.0%, while Lisa Cook expressed that the Fed should avoid a “stop and go” approach to raising interest rates.

Aside from this, the International Monetary Fund (IMF) predicted recessions in Italy and Germany in 2023. Therefore, if it looked gloomier, the Eurozone scenario now looks even worse. Eurozone data revealed in the European session saw Spain’s inflation heightening less than estimates, while France’s data followed suit.

Some ECB speakers crossed wires. ECB’s Vasle said 75 bps in October and December might be appropriate, while ECB’s Centeno added that the ECB must be “tough” on inflation while suggesting that QT discussions should be pushed to the following year.

EUR/USD Price Forecast

The EUR/USD daily chart illustrates the major stalled at the 20-day EMA, which exacerbated a fall towards the 0.9720 area. Key support lies at 0.9700, which, once cleared, could open the door for YTD low re-test at 0.9535. On the flip side, if the EUR/USD reclaims 0.9786, the major could challenge 0.9800.

-

18:36

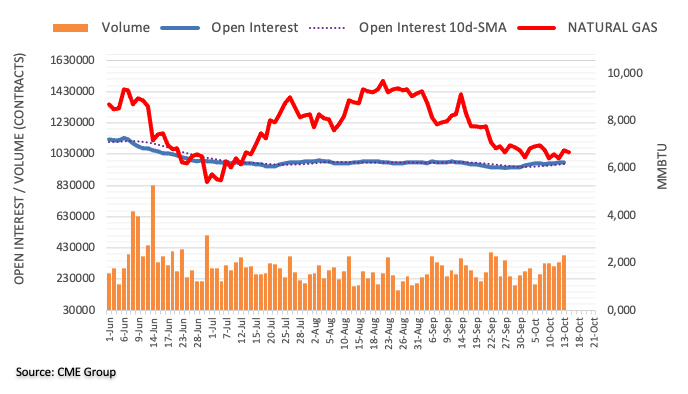

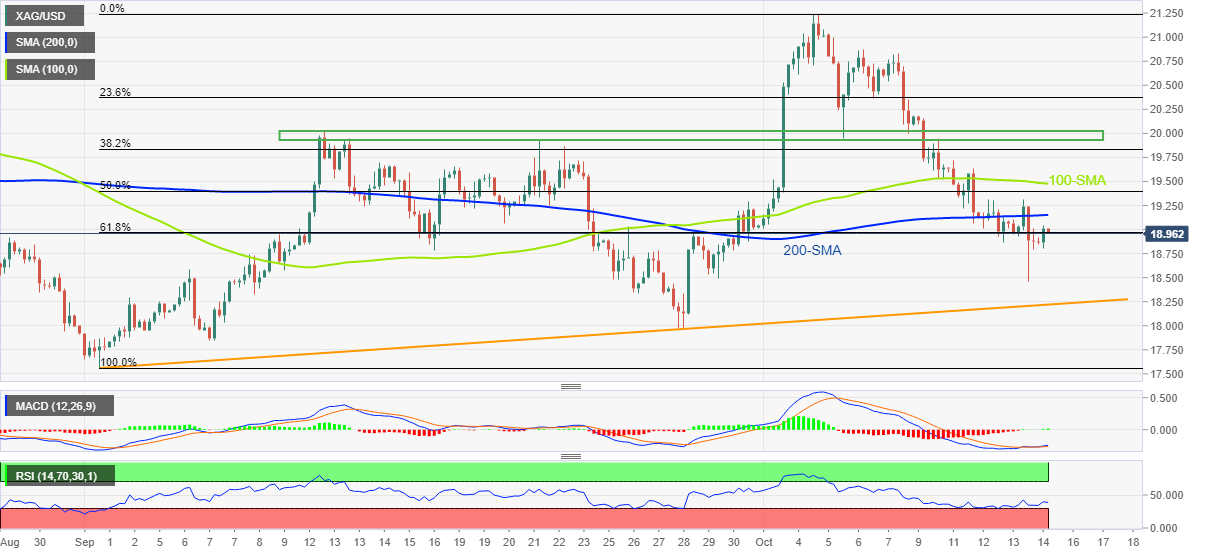

Silver Price Analysis: XAG/USD reaches key support area at $18.10

- Silver prices accelerate their downtrend to approach the support area at $18.10.

- Precious metals lose ground amid US dollar strength.

- Below $17.60 XAG/USD will be exploring two-year lows.

Silver futures have accelerated their downtrend on Friday, weighed by the overall US dollar recovery. XAG USD has lost more than 4% so far today and is on track to complete a six-day sell-off.

Approaching mid-term lows at the $18.00 area

Precious metals are on the back foot on Friday, with the US dollar appreciating amid hopes that the Federal Reserve will announce the fourth consecutive 75 bp rate hike in November. US CPI figures released on Monday confirmed the resilient inflation pressures paving the path for the Fed to keep ramping up interest rates.

Furthermore, increasing fears of a global recession, on the back of a set of downbeat macroeconomic data is also pushing wary investors towards the safe-haven greenback.

Against this backdrop, silver prices have plummeted from prices beyond $21 in early October to the lower range of $18 on Friday, entering a narrow area between $18.10 and $17.60, which contains July, August, and September’s lows.

With technical indicators highlighting the strong bearish momentum, a successful breach of $17.60 might take the pair to explore June 2020 lows at the $17.00 area and Apr 14, 2020 high at S15.85.

On the upside immediate the pair should breach the 50 and 100-days SMAs, at $19.25 and $19.85 respectively to regain bullish traction and test the $230.00 psychological level.

XAG/USD daily chart

Technical levels to watch

-

18:08

United States Baker Hughes US Oil Rig Count rose from previous 602 to 610

-

17:57

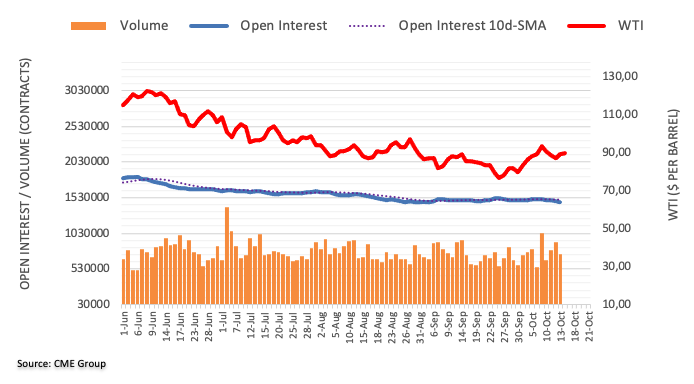

WTI, on retreat, testing 10-day lows at $85.50 area

- WTI oil prices drop 8% on the week to test $85.50 lows.

- Recession fears are weighing on crude prices.

- WTI price forecast upgraded to $94 in Q4 – TDS.

WTI futures resumed their downward trend on Friday, and are on track to an 8% weekly depreciation after having peaked at $93.58 on Monday. The US oil benchmark is retracing gains from Thursday’s rebound to test the support area at $85.50.

Oil prices drop amid increasing recession fears

Crude prices have gone through a strong reversal this week with the market increasingly concerned about the potential impact on demand of a global recession combined with aggressive monetary tightening by most of the major central banks.

The CPI report released in the US earlier this week has confirmed the resilience of inflation pressures, which offers additional reasons for the Federal Reserve to approve another aggressive rate hike in November.

As a matter of fact, Federal Funds futures priced in a 13% chance of a 100 basis point hike immediately after the release of the US inflation data. These tightening hopes increase the attractiveness of the US dollar to investors, weighing further on oil prices.

This week’s events have offset the positive impact on oil prices of the production cuts announced by OPEC+ last week. The club of the world’s largest oil suppliers agreed slashing production by 2 million barrels per day, the largest cut since the outbreak of the COVID-19 pandemic.

WTI price forecasts upgraded to $94 in Q4 – TDS

From a wider point of view, strategists at TD Securities remain confident about the chances that OPEC+ cuts will end up pushing prices higher: “We are comfortable in saying that the most recent production targets from OPEC+ have very convincingly tilted price risks to the upside. For that reason, we have upgraded our Q4-22 WTI forecast to $94/b ($99/b Brent) and the 2023 average to $97/b ($101/b).”

Technical levels to watch

-

17:41

AUD/USD stumbles towards 0.6220, eyeing the YTD low of 0.6169

- AUD/USD remains heavy, extending its weekly losses by 2.28%.

- Mixed US economic data bolstered the greenback, which trimmed Thursday’s losses.

- Australia’s non-farm average earnings jumped 5.0%, opening the door for inflation’s upside.

The AUD/USD is erasing Thursday’s gains after a hotter-than-estimated US inflation report, dropping below 0.6300 due to a risk-off impulse in the markets as traders re-position themselves for another jumbo-size Fed rate hike in November, while the greenback advanced. At the time of writing, the AUD/USD is trading at 0.6225, below its opening price, after hitting a daily high of 0.6349 in the early European session.

AUD/USD gives way below 0.6300 on deteriorated sentiment and broad US dollar strength

Sentiment remains dampened, as shown by falling stocks in the US. Further US economic data showed that consumer spending is weakening, as demonstrated by September’s Retail Sales coming at 0% MoM, below estimates, and August’s 0.3%. Annually based sales slowed by 8.41% annually, while the University of Michigan Sentiment improved edged higher to 59.8, exceeding estimates, though inflation expectations for one year heightened to 5.1%, up from August’s 4.7%.

In the meantime, Fed officials George, Daly, and Cook crossed news wires. The Fed’s rhetoric stays the course, with the three of them repeating that inflation is too high, that rates need to get into restrictive territory, and that the Federal funds rates (FFR) must be at around 4%.

In the meantime, the US Dollar Index, a measure of the buck’s value vs. six currencies, trims Thursday’s losses, up 0.72% at 113.250, a headwind for the AUD/USD.

On the Australian side, non-farm average earnings climbed 5.0% YoY in the second quarter, almost double the Wage Price Index at 2.6% YoY. Therefore, it increases the likelihood of higher inflation in Australia amid a deceleration of the RBA’s rate hikes, despite futures traders expecting rates to peak above 3%.

AUD/USD Key Technical Levels

-

17:33

US: Atlanta Fed GDPNow for Q3 declines to 2.8%

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.8% in the third quarter, down slightly from 2.9% in the previous estimate.

"After recent releases from the US Bureau of Labor Statistics and the US Census Bureau, the nowcast of third-quarter real personal consumption expenditures growth decreased from 1.3% to 1.2%," the Atlanta Fed explained in its publication.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen rising 0.65% on the day at 113.20.

-

17:24

AUD/USD: Hard landing fears and RBA to weigh on the aussie – MUFG

Analysts at MUFG Bank see the AUD/USD pair falling back toward 0.6000 from current levels on the back of global recession fears, and a wider divergence between the Federal Reserve and the Reserve Bank of Australia (RBA).

Key Quotes:

“We continue to expect the USD to strengthen further in the near-term as global financial conditions continue to tighten. The much stronger-than-expected US CPI report for September has reinforced our view that it is premature to expect a dovish Fed policy pivot. The Fed remains on track to continue faster rate hikes through the rest of this year.”

“The sharp tightening of financial conditions will reinforce fears over a hard landing for the global economy which is dragging raw industrial commodity prices closer to bear market territory. The RBA acknowledged that global slowdown risks are becoming more important in setting monetary policy at their last policy meeting, and slowed the pace of rate hikes. A wider policy divergence between the Fed and RBA in the near-term will reinforce downward pressure on the AUD.”

“We expect the AUD/USD to fall back towards the 0.6000-level and closer to the COVID lows from March 2020. One potential risk to our short trade idea is posed the upcoming Communist party Congress in China if it signals a shift to more growth friendly policies such as easing the strict zero-COVID strategy.”

-

17:21

GBP/USD: Despite recent news, still seen at 1.06 in a three-month perspective – Rabobank

Analysts at Rabobank continue to see difficult times ahead for the British pound. They point out that while expectations of a more prudent fiscal stance by the government inspired some bargain-hunters this week, the outlook for the pound remains troubled.

Key Quotes:

“The release earlier in the week of a much worse than expected print for UK August GDP data suggests that the economy is already sliding into recession. The economy shrank by -0.3% m/m following a downwardly revised expansion of just 0.1% in July. Given the extra bank holiday in September, which will weigh on output, it now appears very likely that GDP for the whole of the quarter will show a contraction.”

“The Bank of England warned in the summer of the risk of a five quarter recession starting in Q4 this year. Even without the debacle created by the government, an earlier start to recession would be a factor worthy of downside pressure on the pound.”

“The removal of unfunded tax cuts will come as a relief, but the line-up of UK fundamentals is still worse than they were ahead of the September mini budget. Over the coming days it will become more obvious whether the PM’s U-turns and the intervention by the BoE have done enough to reassure investors.”

“We haven’t seen enough good news to alter our 3 month forecast of GBP/USD1.06, though this assumes continued broad-based USD strength.”

-

17:16

EUR/JPY rallies past 144.00, eyes long-term high at 145.45

- The euro breaks above 144.00 to approach September's peak of 145.45.

- The yen remains weak, with the USD/YPY at a 34-year high.

- Investors are wary about the possibility of a BoJ intervention.

The euro maintains its firm tone against a battered Japanese yen on Friday. The pair has extended its recovery from levels sub 141.00 earlier this week, to extend beyond 144.00, with September’s peak, at 145.45 on sight

The Japanese yen drops across the board

The common currency has capitalized on the broad-based Japanese yen’s weakness, to appreciate nearly 2.5% so far this week. The yen is suffering against its main peers, with the USD/JPY reaching a 34-year high on Friday.

The greenback has actually broken past the level that triggered an intervention by the Bank of Japan last Month, which has set investors on alert. On Thursday, Japanese finance minister Suzuki reiterated the government’s commitment to take action against excessive currency volatility.

The yen is under strong negative pressure, weighed by the Fed – BoJ monetary policy divergence. With most of the major central banks immerse in a steep monetary tightening cycle, and the Federal Reserve expected to increase rates by 0.75% for the fourth consecutive time in November, the ultra-expansive policy of the Japanese Central bank is crushing demand on the yen.

Technical levels to watch

-

17:12

US: Consumer sentiment off the ropes, infaltion expectations tick up – Wells Fargo

The preliminary October report of the University of Michigan's Consumer Sentiment showed an increase in sentiment and also in inflation expectations. According to analysts at Wells Fargo, critical long-term inflation expectations remain at a level the Federal Reserve will still consider well-anchored.

Key Quotes:

“The preliminary release of consumer sentiment from the University of Michigan for September revealed a modest increase in optimism. Overall sentiment rose to 59.8, a 1.2 point gain from 58.6 a month earlier. Sentiment was lifted by consumer views of current conditions specifically, which jumped by the most in over a year and a half to a reading of 65.3.”

“Short-term expectations remain more volatile and are still at an elevated level of 5.1%. More importantly, longer-term expectations remain well-within the past decades range. At 2.9%, the Fed will still view expectations as "well-anchored", a topic it puts great emphasis on when setting monetary policy.”

“Even with expectations remaining well-anchored, we expect the Fed will continue with another super-charged 75 bps rate hike at its November 2 meeting.”

-

17:11

US Treasury asks banks whether it should buy back bonds to improve liquidity – Reuters

As part of its regular survey ahead of the quarterly refunding announcements, the US Treasury Department is asking major banks whether the government should buy back government bonds to improve the market liquidity, Reuters reported on Friday.

"The Treasury is also querying whether reduced volatility in the issuance of Treasury bills as a result of buybacks made for cash and maturity management purposes could be a meaningful benefit for Treasury or investors," Reuters further noted.

Market reaction

Safe-haven flows continue to dominate the financial markets in the last session ahead of the weekend. As of writing, the S&P 500 Index was down 1.9% on a daily basis at 3,600 points.

-

16:54

Colombia Retail Sales (YoY) came in at 8.1%, above forecasts (7.5%) in August

-

16:54

EUR/USD: Risks remain titled to the downside – MUFG

The EUR/USD pair is about to end the week at the same level it had a week ago. The main trend is bearish. Analysts at MUFG Bank remain bearish on the euro despite the policy support and even as the European Central Bank hikes interest rates further.

Key Quotes:

“EUR a clear beneficiary of successful energy storage action ahead of winter.”

“Further fiscal support lowers the negative macro impact risks but risks still remain high.”

“ECB concerns over inflation intensifying.”

“We remain bearish EUR despite the policy support and further ECB hikes. Those hikes are fully priced and along with Fed action only reinforce the risks related to tighter financial conditions. Recent EUR performance suggests declines could prove more modest than say the declines versus USD for the higher beta G10 currencies.”

-

16:39

USD/CAD resumes the upside to reach session highs at 1.3785

- The US dollar appreciates again on Friday and approaches 1.3800.

- A mixed US Retail Sales report has been overlooked.

- USD/CAD seen appreciating beyond 1.4000 – TDS.

The US dollar firmed up on Friday to retrace most of the previous day’s losses. The pair has reached a session high at 1.3875, after bouncing near 1.3700 earlier today, and is on track to close the week with a moderate advance.

Subdued reaction to a mixed retail sales report

The greenback has been little changed by the release of a mixed consumption report. Retail sales remained flat in September, against expectations of a 0.2% monthly increase, in a sign that higher food and energy prices might be starting to bite into the cash available for big-ticket purchases.

Consumption data, however, has also shown some positive aspects. The core retail sales (excluding automobiles) increased against expectations at a 0.1% pace.

Beyond that, the USD ends the week in a positive tone, following the strong US inflation figures seen on Thursday, which have boosted expectations for the fourth 0.75% rate hike at November’s monetary policy meeting.

USD/CAD could easily appreciate beyond 1.40 – TDS

Currency analysts at TD Securities see the CAD dropping further which might push the pair beyond 1.40: Even if the next phase of USD strength is not as linear as it has been for much of this year, there is a lot of negative idiosyncratic risk coming the CAD's way with the debt servicing problem for households only in the early days (…) While we have forecast 1.40 into year-end, it is no ceiling and it could very easily get worse for the CAD.”

Technical levels to watch

-

16:31

US: Overall spending to continue to moderate as inflation persists and rates rise – Wells Fargo

Data released on Friday showed retail sales remained unchanged in September compared to August. Stripping volatile retail segments suggests some modest upward risk to third-quarter goods spending, explain analysts at Wells Fargo. They point out that the report adds to recent evidence that consumer staying power may be waning, but it's showing few signs of breaking.

Key Quotes:

“Consumer goods purchases are slowing, but not collapsing. Inflation-adjusted retail sales have more or less moved sideways for the past year and a half; an impressive feat when inflation is running at a 40-year high.”

“The next few months of spending are going to be influenced by a few factors. As consumers start to spend for the holidays, goods spending may see another near-term boost, and it will likely show up somewhat in the October data as households pull purchases forward. That, however, may be modestly offset by the effects from Hurricane Ian which made landfall in Florida on September 28. This disruption may be more apparent on the services side of spending.”

“Households have broadly looked past elevated inflation and continued to spend by relying on their balance sheets and accumulated savings. We expect overall spending to continue to moderate as inflation persists and tighter monetary policy begins to weigh more meaningfully on consumption.”

-

16:24

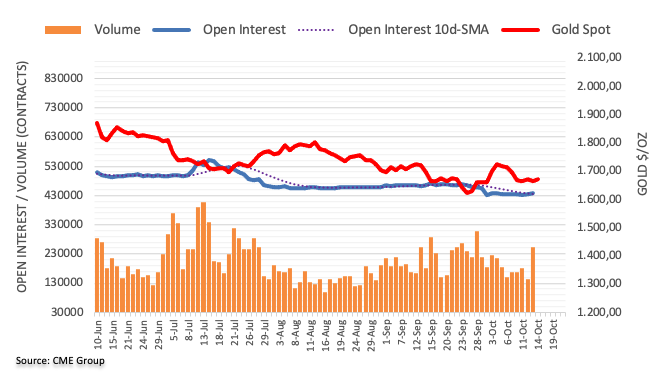

Gold Price Forecast: XAU/USD losses traction, down below $1650 as US bond yields recover

- Gold price extended its weekly losses by 2.8%, below $1650.

- US data reported that retail sales disappointed while consumer sentiment improved.

- XAU/USD Price Forecast: The break below $1660 opened the door for a test of the weekly low at $1642.49.

Gold price extends its losses, while the greenback recovered some ground following Thursday’s US inflation report, which will keep the Fed’s pedal to the metal as traders brace for big rate hikes in November and December FOMC’s meetings. The XAU/USD is trading at $1646 a troy ounce after hitting a daily high of $1671.

XAU/USD tumbles as the US dollar strengthens, underpinned by high US T-bond yields

US equity indices opened in the red, portraying a negative sentiment. US Retail Sales showed consumers are beginning to feel the shock of higher interest rates, with September’s sales decelerating from 0.3% to 0% MoM, below expectations, and slowed by 8.41% annually. Of late, the University of Michigan Consumer Sentiment edged higher to 59.8, exceeding estimates but inflation expectations for one year rose to 5.1%, above forecasts of 4.7%.

Meanwhile, a slew of Fed policymakers are crossing newswires, led by Fed’s George, Daly, and Cook. The Kansas City Fed, Esther Goerge, said that the only piece of clear data is that inflation is high in the US. She echoed previous commentaries of her colleagues, saying that the rates need to get into restrictive territory, though she’s not clear on where rates will peak.

Later the San Francisco Fed Mary Daly said that inflation is not cooling, while today’s retail sales flashed some signs of easing. She reiterated what Fed’s George expressed the need to get policy restrictive and foresees the Federal funds rate (FFR) to peak at around 4.5%-5%.

At the same time, one of the Fed’s new members Lisa Cook, repeated some of its last week’s speech, saying that inflation remains “stubbornly and unacceptably high” and added that she does not want a “stop and go” policy.

Given the backdrop, XAU/USD ignored most Fed officials’ comments, hovering just below $1650. US Treasury bond yields, namely the 10-year, edge up three and a half bps, at 3.987%, capping the recovery of the yellow metal.

What to watch

Next week, the US economic docket will feature the NY Empire State Manufacturing Index, the Philadelphia Fed Index, Industrial Production, and unemployment claims. Additionally, Fed speakers will continue to dominate the headlines.

XAU/USD Price Forecast

XAU/USD’s consolidated during the week around the $1660-80 range until Thursday when it dived toward the weekly low of $1642.49. nevertheless, trimmed losses and closes within the previously mentioned range. On Friday, XAU/USD has decisively broken below the range after facing solid resistance at the 20-day EMA, opening the door for a weekly low test, which, once cleared, could send XAU/USD sliding towards the September 28 low of $1614.92.

-

16:24

USD/JPY unstoppable, at highest level since August 1990 above 148.40

- Japanese yen continues its decline across the board.

- USD/JPY at levels not seen since 1990, approaches 150.00.

- Intervention is unlikely over the next hours but Monday is another story.

The USD/JPY rose further during the American session and printed a fresh 32-year high around the 148.50 area. US economic data showed increased inflation expectations and boosted the pair further.

The University of Michigan Consumer Confidence report showed an increase in long-term inflation expectation from 2.7% to 2.9%, triggering a new run in US yields that weighed on the Japanese yen.

No matter what, USD/JPY keeps going up

The USD/JPY is about to post the ninth weekly gain in a row. Since mid-August, it has risen by more than 1500 pips and there are no signs of stopping. Neither the intervention from the Bank of Japan/Finance Minister nor the threats of more action alleviated the bearish pressure.

The divergence between the ultra-accommodative Bank of Japan and the tightening from the Federal Reserve (and many more central banks) is being ratified daily, leading to an everyday gain in USD/JPY.

No intervention seems likely over the following hours, even as the USD/JPY approaches 150.00. On Monday, the story could be a different one.

Technical levels

-

16:12

Colombia Industrial output (YoY) came in at 9.1%, above expectations (6.1%) in August

-

15:53

S&P 500 Index: Scope for a deeper recovery and lengthier consolidation phase – Credit Suisse

A rollercoaster session post the US Consumer Price Index (CPI) data saw S&P 500 completing a large bullish “reversal day.” Analysts at Credit Suisse expect the index to enjoy a deeper recovery phase.

Holding above the key 200-week average to allow a deeper recovery

“We have probably seen a low for now and we can look for a consolidation phase and more likely a deeper recovery.”

“Above 3688 can see the immediate risk stay higher for 3707 next, then the top of the price gap from last Friday at 3745. A close above here is needed to reinforce the likelihood a more important low is indeed in place for a test of the current October high and 38.2% retracement of the August/October fall at 3807/10. Beyond here is needed to mark a near-term base.”

“Support from the 200-week average at 3600 needs to hold on a closing basis to avoid an immediate retest of 3505/3492.”

-

15:30

Fed's Daly: We will have to be data-dependent on rate hikes

In an interview with Yahoo Finance on Friday, San Francisco Fed President Mary Daly said that this week's Consumer Price Index (CPI) data was not that surprising, noting that it's a lagging indicator, as reported by Reuters.

Additional takeaways

"Today's retail sales report is another sign of some cooling."

"We will have to be data-dependent on rate hikes."

"We are working in a global economy, lots of uncertainty and risks."

"No doubt that we need more restrictive policy."

"Fed's Summary of Economic Projections is not stale; it is a good guidepost for policy."

"I still think September projections are really reasonable."

"We are tightening into a strong economy."

"Data are coming in about what we would expect."

"Mindful about making sure inflation doesn't become embedded."

"We'll stop raising rates when appropriate, and then will hold it for a while."

"We can correct our course if needed."

"4.5%-5% is most likely top fed funds rate, then will hold it there."

"Not hearing signs of recession when talking with contacts in the district."

"People expect the slowdown to be short-lived, not deep."

"Labor market needs to cool further."

"We are committed to bringing demand back in line with supply."

Market reaction

The US Dollar Index was seen rising 0.55% on the day at 113.08 after these comments.

-

15:17

USD/JPY: Potential top in the 149.17/150.00 zone – Credit Suisse

USD/JPY has finally achieved Credit Suisse’s long-held core objective from April at 147.62/153.01 – the 1998 high and 38.2% retracement of the 1982/2011 bear trend. The pair is set to see an important top here.

Initial support seen at 146.86

“Our bias remains for a deeper push higher into the 147.62/153.01 zone with resistance above 147.62/68 seen next at 148.42 ahead of trend resistance from April at 149.17. With rare gap resistance from August 1990 seen at 149.31 and the psychological 150.00 barrier just above, we look for a potential top in this 149.17/150.00 zone.”

“Support is seen at 146.86 initially with the immediate bias seen higher whilst above 146.52. A break can see a deeper setback to the 13-day exponential average at 145.70/64, but wit h fresh buyers expected here.”

-

15:14

Fed's George: Only piece of clear data is that we have high inflation

Kansas City Fed President Esther George said on Friday that they have no clear narrative on the outlook for growth in today's murky economic landscape and added that the only piece of clear data is that high inflation, as reported by Reuters.

Additional takeaways

"We are operating in a tight economy."

"I am watching if persistently high inflation seeps into expectations. If it does, trade-offs become more costly."

"Faster supply growth unlikely to take care of inflation problem."

"Financial conditions have tightened considerably this year, but clear more to be done."

"We need to move into restrictive territory."

"How restrictive remains to be seen."

"I expect rates will have to move higher for a sustained period, but moving too fast could disrupt financial markets."

"Policy actions also have a lag, impact on the real economy is still likely playing out."

Market reaction

The US Dollar Index preserves its bullish momentum following these comments and was last seen rising 0.65% on the day at 113.18.

-

15:09

US: UoM Consumer Confidence Index improves to 59.8 in October vs. 59 expected

- Consumer confidence in the US improved modestly in early October.

- UoM's long-run inflation outlook edged higher to 2.9% from 2.7%.

Consumer sentiment in the US improved slightly in early October with the University of Michigan's (UoM) Consumer Confidence Index edging higher to 59.8 (flash) from 58.6 in September. This print came in better than the market expectation of 59.

The Current Conditions Index rose to 65.3 from 59.7 and the Expectations Index declined to 56.2 from 58.

The report further revealed that the one-year inflation expectation rose to 5.1% and the five-year inflation expectation edged higher to 2.9% from 2.7%.

Market reaction

The greenback preserves its strength after this report and the US Dollar Index was last seen rising 0.55% on the day at 113.08.

-

15:01

United States Michigan Consumer Sentiment Index registered at 59.8 above expectations (59) in October

-

15:01

United States Business Inventories came in at 0.8%, below expectations (0.9%) in August

-

15:00

United States UoM 5-year Consumer Inflation Expectation rose from previous 2.7% to 2.9% in October

-

14:49

EUR/USD could test parity in the next few days – Scotiabank

EUR/USD was capped around 0.98 again. Nevertheless, the world's most popular currency pair could develop a test of parity in the coming days, in the view of economists at Scotiabank.

Key resistance for the euro aligns at 0.9810

“The charts are really dominated by yesterday’s huge swing and a bullish – for the EUR – outside range session which may set the pair up for a test of parity in the next few days.”

“Key resistance is at 0.9810 intraday.”

“Support is seen at 0.9710/20.”

-

14:45

UK PM Truss: We have decided to keep corporation tax rise

British Prime Minister Liz Truss said on Friday that they have decided to keep the corporation tax rise and added that this will act as a downpayment on the medium-term fiscal plan, confirming the earlier reports of a U-turn on the mini-budget.

Additional takeaways

"I am not prepared to accept a lack of growth for our country."

"I want to deliver a low tax, high wage, high growth economy."

"Global economic conditions are worsening."

"It is clear that parts of our mini budget went further and faster than markets were expecting."

"We need to act now to reassure markets of our fiscal discipline."

"We will do whatever is necessary to ensure the debt is falling as a share of GDP in the medium term."

Market reaction

These comments failed to help the British pound find demand and GBP/USD was last seen losing 1.2% on the day at 1.1195.

-

14:44

Gold Price Forecast: XAU/USD could print a new low on continued dollar strength – TDS

Gold turns lower and remains vulnerable. The chance of yet another supersized 75 bps rate hike at the November FOMC meeting is set to help the US dollar, economists at TD Securities report.

Disinflation everywhere but the CPI data

“Disinflation everywhere but the CPI data. That is the narrative emerging from the sharp U-turn in risk sentiment following the hot inflation print, which acknowledges that the soaring shelter components of inflation hold long lags to the disinflation observed in real-time rent data. However, this fails to acknowledge that private rents have been slowing for months, with the relief observed in private rents only likely to appear in the CPI data by the second half of next year.”

“Stripping out shelter, core services inflation printed a new post-covid high and continues to run hot. In turn, the recovery in risk assets and precious metals may instead be a symptom of market illiquidity, which cuts both ways.”

“Gold prices still need to break above $1,730 to extend the short squeeze. Nonetheless, with markets already fully pricing in a 75 bps hike for the next FOMC meeting, gold prices will need continued dollar strength to print a new low.”

-

14:39

USD/TRY: Upside remains capped by 18.6000

- USD/TRY extends the side-lined trading below 18.60.

- Türkiye’s End Year CPI Forecast came at 67.78%.

- The CBRT is expected to cut the policy rate next week.

USD/TRY keeps the range bound theme well in place for yet another session on Friday.

USD/TRY now shifts the focus to the CBRT

No changes to the snail-paced depreciation of the Turkish currency, as USD/TRY remains stuck within the multi-session consolidative theme just below the 18.60 region.

The current recovery of the greenback keeps the upside pressure around the pair unchanged, while the relentless exodus from the lira also continues to play its part in the ongoing price action.

In the meantime, investors are expected to shift their attention to the CBRT meeting next week, when the central bank is seen reducing further the One-Week Repo Rate (likely by another 100 bps) amidst the “Türkiye Economic Model”, aimed at boosting exports, production and investment to achieve a current account deficit, all via lower rates.

In the domestic calendar, the End Year CPI Forecast was revised marginally up to 67.78% (from 67.73%).

What to look for around TRY

USD/TRY keeps navigating the area of all-time highs near 18.60 amidst the combination of omnipresent lira weakness and bouts of strength in the dollar.

So far, price action around the Turkish lira is expected to keep gyrating around the performance of energy and commodity prices - which are directly correlated to developments from the war in Ukraine - the broad risk appetite trends and the Fed’s rate path in the next months.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating (despite rising less than forecast in the last three months), real interest rates remain entrenched well in negative territory and the omnipresent political pressure to keep the CBRT biased towards a low-interest-rates policy.

In addition, the lira is poised to keep suffering against the backdrop of Ankara’s plans to prioritize growth and shift the current account deficit into surplus following a lower-interest-rate recipe.

Key events in Türkiye this week: End Year CPI Forecast (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress of the government’s scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.32% at 18.5872 and faces the next hurdle at 18.5980 (all-time high October 11) followed by 19.00 (round level). On the downside, a break below 18.2082 (55-day SMA) would expose 17.8590 (weekly low August 17) and finally 17.7586 (monthly low).

-

14:28

USD/CHF: Break below 0.9876 to raise the prospect of weakness – Credit Suisse

USD/CHF has rejected a major resistance at 1.0074/98. Analysts at Credit Suisse look for the pair to remain capped here for a potential near-term move lower.

Break past 1.0074/98 to clear the way for further gains

“USD/CHF’s surge was capped at the major resistance at the trendline from 2016 at 1.0075. This strong reversal lower paired with daily RSI holding a bearish divergence continues to strengthen the case for a near-term weakness, though with the recent volatility in mind, and with an absence of a more material break lower, we stay near-term neutral for now.”

“Immediate support is seen at the recent low and the 13-day exponential average at 0.9929/13, though only a close below 0.9876 would raise more serious thoughts of the near-term risk shifting lower again.”

“Above the 1.0074/98 major barrier would be seen to clear the way for strength to the highs of 2019 at 1.0226/35.”

-

14:27

USD/CAD retreats to mid-1.3700s amid modest USD pullback, downside seems cushioned

- USD/CAD retreats from daily peak amid the emergence of fresh selling around the USD.

- Sliding US bond yields and the risk-on impulse is seen weighing on the safe-haven buck.

- Falling crude oil prices undermine the loonie and help limit the downside for the major.

The USD/CAD pair quickly retreats around 75-80 pips during the early North American session and is currently placed in neutral territory, around mid-1.3700s.

The US dollar surrenders its strong intraday gains and slides back closer to the weekly low touched earlier this Friday, which, in turn, prompts fresh selling around the USD/CAD pair. A fresh wave of the risk-on trade, along with retreating US Treasury bond yields, turn out to be key factors exerting some downward pressure on the safe-haven greenback. That said, the prospects for a more aggressive policy tightening by the Fed should act as a tailwind for the US bond yields and the buck.

In fact, the fed fund futures indicate a greater chance of the fourth successive 75 bps supersized rate hike by the US central bank at the next policy meeting in November. The bets were reaffirmed by the stronger US consumer inflation figures released on Thursday. Apart from this, a sharp intraday fall in crude oil prices is seen undermining the commodity-linked loonie and offering support to the USD/CAD pair. This, in turn, warrants some caution for aggressive bearish traders.

The markets, meanwhile, reacted little to mixed US Retail Sales figures for September, suggesting that the path of least resistance for the USD is to the upside. Hence, any subsequent pullback could be seen as an opportunity to initiate fresh bullish positions around the USD/CAD pair. That said, a convincing break below the 1.3700 mark will negate the near-term positive bias and set the stage for an extension of the previous day's dramatic turnaround from the highest level since May 2020.

Technical levels to watch

-

14:12

USD/TWD to hit the 32.10 mark by year-end – MUFG

USD/TWD is trading slightly below the 32 level. Economists at MUFG Bank the pair to reach 32.10 by the end of the year.

Modest pick-up in China’s growth momentum might limit TWD’s depreciation

“In Q4, the TWD is likely to be weighted by a stronger dollar, weaker exports growth and a potential softer electronic industry activity.”

“Global growth concerns and geopolitical tensions will continue to hurt market sentiment and prompt persistent capital outflows, pressuring on TWD to the downside. However, the modest pick-up in China’s growth momentum in Q4 might limit the degree of TWD’s depreciation, as it is the largest export destination of Taiwan products.”

“We see USD/TWD to reach 32.10 by the end of 2022.”

-

13:48

Jeremy Hunt appointed as Britain's new finance minister – Times

Former British foreign minister Jeremy Hunt has been appointed as the new finance minister by Prime Minister Liz Truss, Times Political Editor Steven Swinford reported via Twitter on Friday.

PM Truss is expected to make the official announcement at a press conference.

UK's Finance Minister Kwasi Kwarteng officially resigns.

Market reaction

This development doesn't seem to be helping the British pound find demand. As of writing, GBP/USD was trading at 1.1200, where it was down 1.1% on a daily basis. Meanwhile, the UK's FTSE 100 Index is up more than 1% on the day.

-

13:45

GBP/USD recovers few pips from sub-1.1200 levels, still down nearly 1% for the day

- A combination of factors prompts aggressive selling around GBP/USD on Friday.

- The UK political development weighs on sterling amid resurgent USD demand.

- The mixed US Retail Sales report does little to provide any meaningful impetus.

The GBP/USD pair come under aggressive selling pressure on Friday and snaps a two-day winning streak to a one-week high touched the previous day. The intraday downfall is sponsored by a combination of factors, though spot prices show some resilience below the 1.1200 round-figure mark.

The British pound is pressured by the latest UK political developments, wherein reports confirmed that finance minister Kwasi Kwarteng has been sacked, making him the shortest-serving chancellor since 1970. This comes amid the emergence of aggressive US dollar buying, which, in turn, is seen exerting downward pressure on the GBP/USD pair.

The stronger US consumer inflation figures released on Thursday reaffirmed market expectations that the Fed will continue to tighten its monetary policy at a faster pace. In fact, the fed fund futures indicate a greater chance of another supersized 75 bps rate hike at the next FOMC meeting in November, which is seen underpinning the greenback.

The USD sticks to its strong intraday gains and seems unaffected by mixed US monthly Retail Sales data. The US Census Bureau reported that the headline sales were flat MoM in September, missing estimates, while sales excluding autos unexpectedly climbed by 0.1%. Furthermore, the previous month's readings were also revised slightly higher.

That said, retreating US Treasury bond yields, along with signs of stability in the equity markets, hold back the USD bulls from placing aggressive bets. This, in turn, offers some support to the GBP/USD pair, at least for the time being. Traders now look to the Prelim Michigan US Consumer Sentiment and Inflation Expectations Index for a fresh impetus.

Technical levels to watch

-

13:35

US: Retail Sales stay unchanged at $684 billion in September

- Retail Sales in the US stayed unchanged in September.

- US Dollar Index clings to strong daily gains above 113.00.

The data published by the US Census Bureau showed on Friday that Retail Sales in the US, adjusted for seasonal variation, holiday and trading-day differences but not for price changes, stayed virtually unchanged at $684 billion in September. This reading followed August's increase of 0.4% and came in below the market expectation of +0.2%.

"Total sales for the July 2022 through September 2022 period were up 9.2% from the same period a year ago," the publication further read. "The July 2022 to August 2022 percent change was revised from up 0.3% to up 0.4%."

Market reaction

The US Dollar Index showed no immediate reaction to this data and was last seen rising 0.55% on the day at 113.08.

-

13:31

United States Export Price Index (YoY) came in at 9.5%, above forecasts (7.3%) in September

-

13:31

United States Import Price Index (YoY) came in at 6%, below expectations (6.1%) in September

-

13:31

United States Retail Sales (MoM) registered at 0%, below expectations (0.2%) in September

-

13:31

Canada Wholesale Sales (MoM) registered at 1.4% above expectations (0.8%) in August

-

13:30

United States Retail Sales ex Autos (MoM) above expectations (-0.1%) in September: Actual (0.1%)

-

13:30

United States Export Price Index (MoM) came in at -0.8%, above expectations (-1%) in September

-

13:30

United States Import Price Index (MoM) came in at -1.2%, below expectations (-1.1%) in September

-

13:30

Canada Manufacturing Sales (MoM) below expectations (-1.8%) in August: Actual (-2%)

-

13:30

United States Retail Sales Control Group above forecasts (0.3%) in September: Actual (0.4%)

-

13:10

UK's Finance Minister Kwasi Kwarteng officially resigns

British Finance Minister Kwasi Kwarteng announced his resignation via Twitter on Friday, confirming earlier reports.

"It is important now as we move forward to emphasis your government's commitment to fiscal discipline," Kwarteng said in the letter addressed to Prime Minister Liz Truss. "The Medium-Term Fiscal Plan is crucial to this end, and I look forward to supporting you and my successor to achieve that from the backbenchers."

Market reaction

The GBP/USD pair showed no immediate reaction to this announcement and was last seen losing more than 1% ı the day at 1.1202.

-

13:10

Gold Price Forecast: XAU/USD to plummet towards $1,600 by year-end – ANZ

Gold is losing its glitter. Aggressive monetary tightening and a stronger US dollar are keeping the backdrop challenging for the gold market. Strategists at ANZ Bank expect XAU/USD to tank toward $1,600 by the end of the year.

The backdrop for gold remains challenging

“Persistently high inflation is likely to keep the US Federal Reserve on an aggressive monetary tightening cycle for an extended period. This should keep real rates positive across the curve; a key drag for gold.”

“The USD’s relationship with gold has strengthened recently. This is likely to put pressure on gold, as further rate hikes should seethe USD continue to strengthen. The wildcard is central banks defending their currencies by selling US Treasury bonds. That would be an upside risk to our view.”

“Rising geopolitical and economic risks are having limited impact haven buying. Instead, investors continue to seek protection in the USD.”

“We see the gold price falling to $1,600 by end of this year.”

-

12:57

EUR/USD Price Analysis: Rising bets for a drop to 0.9630

- EUR/USD fades part of the post-CPI sharp upside on Friday.

- Next on the downside now comes the weekly low near 0.9630.

EUR/USD gives aways most of its recent advance to the area just above the 0.9800 mark at the end of the week.

The continuation of the pullback appears on the cards and carries the potential to challenge the recent weekly low at 0.9631 (October 13) in the short-term horizon.

In the longer run, the pair’s bearish view should remain unaltered while below the 200-day SMA at 1.0576.

EUR/USD daily chart

-

12:46

USD Index Price Analysis: Further recovery targets 114.00

- DXY reverses the recent weakness and regains the 113.00 mark.

- Above the 114.00 region comes the 2022 high near 114.80.

DXY advances markedly and reclaims the area beyond the 113.00 mark at the end of the week.

In case bulls regain the initiative and the index surpasses 114.00, then the next target of note should appear at the 2002 high at 114.78 (September 28) prior to the round level at 115.00.

The prospects for extra gains in the dollar should remain unchanged as long as the index trades above the 8-month support line near 107.90.

In the longer run, DXY is expected to maintain its constructive stance while above the 200-day SMA at 103.27.

DXY daily chart

-

12:41

ECB's Vasle: 75 bps rate hikes at both October, December meetings may be appropriate

European Central Bank (ECB) policymaker Bostjan Vasle said on Friday that 75 basis points rate hikes at the October and December meetings may be appropriate, as reported by Reuters.

Additional takeaways

"Appropriate to discuss QT once rates reach the neutral level, discussion and decision should happen in 2023."

"Rates need to enter restrictive territory; decisions should be made meeting by meeting after December."

"Inflation may be close to peak if there are no new shocks; longer-term expectations still anchored."

Market reaction

EUR/USD stays on the backfoot despite these hawkish remarks and was last seen losing 0.45% on the day at 0.9730.

-

12:27

Breaking: UK Finance Minister Kwarteng has been sacked – BBC

According to the BBC, British Finance Minister Kwasi Kwarteng has been sacked by Prime Minister Liz Truss.

Reporting on the matter, "The Telegraph now understands that Liz Truss is set to remove Kwasi Kwarteng as Chancellor this afternoon," The Telegraph tweeted. "It was thought that the PM's press conference would be held at 2pm, but the exact timing is now up in the air."

Market reaction

As markets await the details on the mini budget following this development, the GBP/USD pair continues to trade deep in negative territory at around 1.1250.

-

12:24

AUD/USD bounced higher, resistance aligns around the 0.64 level – OCBC

The aussie rebounded sharply amid a broad USD pullback. Economists at OCBC Bank note that resistance level aligns around the 0.64 area.

Key support seen at 0.6170

“Signs of bullish divergence on MACD while RSI has moderated and turned higher from near-oversold conditions.”

“Resistance at 0.6402 (23.6% fibo retracement of Aug high to Oct low), 0.6477 (21DMA) levels.”

“Support at 0.6170. Break below puts next support at 0.6116 and 0.6030 levels.”

See – AUD/USD: A break below 0.60 this year is entirely possible – ING

-

12:18

US: Elevated inflation opens the door to further large rate hikes – UOB

Alvin Liew, Senior Economist at UOB Group, comments on the latest results from US inflation figures.

Key Takeaways

“US headline consumer price index (CPI) inflation was off from recent highs but still elevated at 8.2% y/y in Sep (from 8.3% y/y in Aug), above Bloomberg’s estimate of 8.1%. On a m/m basis, the headline CPI picked up pace, increasing 0.4% m/m (versus 0.1% in Aug) and faster against Bloomberg’s estimate of an increase by 0.2% m/m.”

“The bigger concern was the core CPI inflation (which excludes food and energy) which continued to race higher sequentially, reflecting unabating underlying momentum for price pressures. On a m/m basis, core inflation rose by a faster pace of 0.6% in Sep (same pace as Aug, and above Bloomberg estimate of 0.4%). Compared to a year ago, it rose 6.6% y/y in Sep, up from 6.3% y/y in Aug, above Bloomberg estimate for 6.5% and highest since Aug 1982 (7.06%).”

“While the latest US headline inflation printed further below the 9.1% recorded in Jun, this reflected mainly the decline in gasoline prices but core inflation continued to climb as the cost of living is still materially high, reflected by the persistent rise of food and shelter costs, and that services inflation is rising amidst ample demand. Risks from several potential inflation shocks include rising labor tensions, a new round of global energy price increases, further disruptions in supply chains, on-going impact from the Russian-Ukraine conflict, and a larger-than-expected pass-through of wage increases into price increases. We maintain our headline CPI inflation forecast to average 8.5% and our core CPI inflation forecast at 6.5% for 2022. Subsequently, we still expect both headline and core inflation to ease in 2023, but it will likely average at 3.0%, above the Fed’s 2% objective. The balance of risk on inflation remains on the upside.”

“The latest inflation print is in line with our US inflation outlook and does not change our Nov Fed view, and we maintain our expectations for the FFTR to be hiked by another 75 bps rate hike in Nov FOMC to the range of 3.75-4.00%. We expect the Fed to end the year with a 50bps hike in Dec but admittedly the market sentiment has shifted firmly to another jumbo hike in Dec following the latest CPI developments. Including the hikes so far in 2022, this implies a cumulative 425bps of increases in 2022, bringing the FFTR higher to the range of 4.25-4.50% by end of 2022 with risks for a bigger hike in Dec versus our current projection. We maintain our forecast for one more 25bps rate hike in Feb 2023, bringing our terminal FFTR higher to 4.504.75% by end 1Q-2023, and a pause to the current rate hike cycle until 1Q 2024.”

-

12:12

EUR/JPY Price Analysis: Next on the upside comes the 2022 high

- EUR/JPY meets initial resistance near 144.40 on Friday.

- Further gains could challenge the YTD peak near 145.60.

EUR/JPY reaches new monthly highs around 144.40, although it loses some ground afterwards.

So far, the recovery appears underpinned by the 141.00 region, which stands as quite a decent support for the time being. The continuation of the uptrend could see the 2022 top at 145.63 (September 12) revisited sooner rather than later.

In the meantime, while above the key 200-day SMA at 136.44, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

-

12:05

When are US monthly retail sales figures and how could they affect EUR/USD?

US Monthly Retail Sales Overview

Friday's US economic docket highlights the release of monthly Retail Sales figures for September, due later during the early North American session at 12:30 GMT. On a monthly basis, the headline sales are estimated to register a modest 0.2% rise during the reported month. Excluding autos, core retail sales probably declined by 0.1% in September as compared to the 0.3% fall in the previous month.

According to Dhwani Mehta, Senior Analyst at FXStreet: “Amidst the continued drop in gasoline prices, easing inflation expectations and improvement in American consumers’ confidence, yet another rise in US Retail Sales may not come as a surprise for the month of September. The more precise gauge, the Control Group is expected to show an increase, which could have a significant impact on the US dollar trades.”

How Could it Affect EUR/USD?

Ahead of the key release, the US dollar attracts fresh buying on Friday and stalls the previous day's sharp retracement slide from the post-US CPI swing high. The markets are currently pricing in a greater chance of another supersized 75 bps Fed rate hike move in November, which, along with a turnaround in the risk sentiment, underpins the safe-haven buck. Any disappointment from the US macro data is likely to be overshadowed by expectations for a more aggressive policy tightening by the Fed. This, in turn, suggests the path of least resistance for the greenback is to the upside, supporting prospects for the resumption of the EUR/USD pair's descending trend.

Eren Sengezer, Editor at FXStreet, offers a brief technical outlook and writes: “EUR/USD failed to make a four-hour close above 0.9800 despite having climbed above that level earlier in the day. Meanwhile, the Relative Strength Index (RSI) indicator stays near 50, suggesting that the pair is struggling to gather bullish momentum..”

Eren also outlines important technical levels to trade the EUR/USD pair: “If the pair manages to flip 0.9800 into support, it could extend its rebound toward 0.9840 (Fibonacci 50% retracement of the latest downtrend), 0.9880 (200-period SMA, Fibonacci 61.8% retracement) and 0.9900 (psychological level)..”

“On the downside, 0.9750 (Fibonacci 23.6% retracement, 100-period SMA) aligns as key support. In case buyers fail to defend that level, additional losses toward 0.9730 (20-period SMA), 0.9680 (static level) and 0.9630 (October 13 low) could be witnessed,” Eren adds further.

Key Notes

• US Retail Sales Preview: Positive surprises eyed for dollar bulls to regain poise

• EUR/USD Forecast: Euro needs to clear 0.9800 to extend rebound

• EUR/USD: Sellers return to the market and retreat to 0.9750

About US Retail Sales

The Retail Sales released by the US Census Bureau measures the total receipts of retail stores. Monthly per cent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish).

-

11:57

Fed: Another 75 bps rate hike in November looks a done deal – ABN Amro

US Consumer Price Inflation (CPI) surprised on the upside once again. The report ensures at least another 75 bps rate hike in November, in the opinion of economists at ABN Amro.

Sticky services inflation hits 40-year high

“Core CPI inflation surprised again to the upside in September. The core CPI rose 0.6% MoM, taking annual core inflation to 6.6% YoY. Worryingly, services price growth hit a new 40-year high of 0.8% MoM, driven by a pickup in shelter inflation (0.8%), but helped along by continued strength in medical services and transportation. This is around three times the monthly pace of price growth prior to the pandemic.”

“The inflation surprise seals a 75 bps hike taking place at the November FOMC meeting, and it raises the risk that the Fed may go even further than our current base case of the fed funds rate topping out at 4.5% in the upper bound.”

“We think the Fed will be confident it has done enough to tighten monetary policy by the end of the year. But it will very much depend on the data.”

-

11:43

UK PM Truss to announce U-turn on budget and replace Kwarteng – The Times

Political Editor for The Times, Steven Swinford, tweeted on Friday that British Prime Minister Liz Truss was planning to announce plans to raise corporation tax. In a follow-up tweet, Swinford also said that PM Truss was looking to sack Finance Minister Kwasi Kwartend but added it wasn't clear who would be replacing him.

"The chancellor is due to meet the prime minister shortly to confirm the U-turn, with discussions under way in No 10 and No 11 before a public statement by the prime minister," Swinford wrote in an article.

A spokesperson for Truss refrained from commenting on these developments.

Market reaction

The GBP/USD pair recovered from daily lows and was last seen trading at 1.1270, where it was still down 0.5% on the day.

-

11:42

USD/JPY prints new 32-year peak, eyes 148.00 amid stronger USD ahead of US data

- USD/JPY gains strong follow-through traction and hits a fresh 32-year high on Friday.

- The Fed-BoJ policy divergence continues to weigh on the JPY and remains supportive.

- Speculations that Japanese authorities could intervene warrant some caution for bulls.

The USD/JPY pair continues scaling higher on the last day of the week and hits a fresh 32-year high, around the 147.75-147.80 region during the first half of the European session.

The bearish pressure surrounding the Japanese yen remains unabated on the last day of the week, which, in turn, pushes the USD/JPY pair high. The policy divergence between the Federal Reserve's aggressive interest rate hikes and the Bank of Japan's resolve to keep monetary policy ultra-loose is seen as a key factor weighing on the JPY.

In fact, the current market pricing suggests the fourth consecutive 75bps rate hike at the next FOMC policy meeting in November. The bets were lifted by Thursday's hotter US CPI report, which showed that core inflation (excluding food and energy prices) registered the biggest gain since August 1982 and shot to a new cycle peak in September.

In contrast, the BoJ, so far, has shown no inclination to raise interest rates and remains committed to continuing with its monetary easing. The dovish bias was reaffirmed by Governor Haruhiko Kuroda's remarks on Thursday, saying that increasing interest rates now was inappropriate in light of the country's economic and price conditions.

This, along with the emergence of fresh US dollar buying, remains supportive of the ongoing strong move up, though slightly overbought conditions warrant caution for bulls. Adding to this, speculations for more currency market intervention by Japanese authorities could offer support to the safe-haven JPY and cap any further gains for the USD/JPY pair.

Nevertheless, spot prices remain on track to register gains for the ninth successive week. Traders now look to the US economic docket, highlighting monthly Retail Sales figures, along with the Prelim Michigan Consumer Sentiment and Inflation Expectations Index. This might influence the USD and provide some impetus to the USD/JPY pair.

Technical levels to watch

-

11:35

USD Index to head lower on soft inflation expectations – OCBC

There was a 1% rally after the US Consumer Price Index (CPI) release but USD Index (DXY) gains were more than reversed. Downside surprises to US data may see more room for the USD to fall, according to economists at OCBC Bank.

Bias to lean against strength

“Today we have US Retail Sales, Uni of Michigan Sentiment, of which we pay close attention to 1-y and 5-10y inflation expectations component. A softer print may see DXY trade lower.”

“Daily momentum is showing very tentative signs of turning mild bearish but decline in RSI moderated. Bias to lean against strength.”

“Resistance at 113.70, 114.77 (previous high).”

“Support here at 112.40 (50% fibo retracement of Sep high top Oct low), 112 (21DMA) and 111.20 levels (23.6% fibo).”

-

11:34

US: FOMC Minutes signal a calibrated tightening – UOB

Senior Economist at UOB Group Alvin Liew reviews the latest publication of the FOMC Minutes of the September meeting.

Key Takeaways

“The key takeaway from the US Federal Reserve’s (Fed) 20/21 Sep 2022 FOMC minutes was that Fed policymakers were committed to continue its rate hikes to a restrictive policy stance and to maintain it there until inflation was on course to return to the 2% objective, while several participants noted that, ‘it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook’.

“Importantly, many participants ‘emphasized that the cost of taking too little action to bring down inflation likely outweighed the cost of taking too much action. Several participants underlined the need to maintain a restrictive stance for as long as necessary, with a couple of these participants stressing that historical experience demonstrated the danger of prematurely ending periods of tight monetary policy designed to bring down inflation’. But while the minutes indicated ongoing rate hikes at upcoming meetings, it did not offer any new details on the magnitude of the rate hikes at the next Nov FOMC meeting or the future meetings.

“FOMC Outlook – No change to our call for 75bps hike in Nov: The latest minutes does not change our Fed view, and we maintain our expectations for the FFTR to be hiked by another 75 bps rate hike in Nov FOMC to the range of 3.75-4.00%. We expect the Fed to end the year with a 50bps hike in Dec. Including the hikes so far in 2022, this implies a cumulative 425bps of increases in 2022, bringing the FFTR higher to the range of 4.25-4.50% by end of 2022. We maintain our forecast for one more 25bps rate hike in Feb 2023, bringing our terminal FFTR higher to 4.50-4.75% by end 1Q2023, and a pause to the current rate hike cycle until 1Q 2024”.

-

11:15

S&P 500 Index to see a meaningful rise on a break above 3810/40 – SocGen

US stocks stage a remarkable turnaround. The S&P 500 Index could enjoy further gains on a move above the 3810/40 region, analysts at Société Générale report.

Downward momentum has failed to regain

“S&P 500 has staged a sharp rebound after achieving 3490 completing the 50% retracement of the 2020-2022 uptrend. It is worth noting that downward momentum has failed to regain after multiple breaks below June lows.

“A short-term bounce can’t be ruled out; it would be interesting to see if the index can form a base and reclaim recent high near 3810/3840. This must be overcome for affirming a meaningful up move.”

-

11:12

Lagarde speech: Expecting to raise rates further over next several meetings

"Inflation in the euro area is far too high and it is likely to stay above the European Central Bank’s (ECB) target for an extended period of time," European Central Bank President Christine Lagarde said on Friday.

Additional takeaways

"The ECB’s Governing Council expects to raise interest rates further over the next several meetings."

"The risks to the inflation outlook are primarily on the upside."

"Despite recent adjustments, financial markets still appear to be pricing in outcomes that could turn out to be too optimistic."

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and it was last seen losing 0.4% on the day at 0.9732.

-

10:56

Gold Price Forecast: XAU/USD remains vulnerable near two-week low amid resurgent USD demand

- Gold turns lower for the second straight day amid the emergence of fresh USD buying.

- Bets for more aggressive Fed rate hikes help the USD to stall the post-US CPI decline.

- The anti-risk flow could lend support to the XAU/USD ahead of the US economic data.

Gold struggles to capitalize on the previous day's late recovery move and attracts fresh selling near the $1,671-$1,672 region on Friday. The intraday selling picks up pace during the first half of the European session and drags the XAU/USD back towards the $1,650 area.