Notícias do Mercado

-

23:55

US President Biden signs $1.66 trillion FY 2023 government funding bill

Reuters came out with the news suggesting more US spending and additional help to Ukraine in the fiscal year (FY) 2023 during early Friday in Asia-Pacific, late Thursday in the West.

The news quotes the White House Statement as saying, “President Joe Biden on Thursday signed a $1.66 trillion bill funding the U.S. government for the fiscal year 2023.” Reuters also stated that the bill was passed by Congress in the last week and was recently signed by Biden while he is on vacation to the Caribbean island of St. Croix.

Key quotes

The legislation includes record military funding, emergency aid to Ukraine, more aid for students with disabilities, additional funding to protect workers' rights and more job-training resources, as well as more affordable housing for families, veterans and those fleeing domestic violence.

The 4,000-plus page bill passed the Senate on a bipartisan vote of 68-29, with the support of 18 of the 50 Senate Republicans. It passed the House of Representatives on a largely party-line vote of 225-201.

Market implications

The news fails to gain any major response and should favor the US Dollar, considering the higher spending and more geopolitical fears the bill is likely to produce.

Also read: US Dollar Index Price Analysis: DXY bears are well-set to revisit monthly low

-

23:48

US Dollar Index Price Analysis: DXY bears are well-set to revisit monthly low

- US Dollar Index pares the biggest daily loss in over a week.

- Clear downside break of a two-week-old ascending support, sustained trading below 200-HMA favor sellers.

- RSI conditions suggest limited downside, highlighting the monthly bottom as strong support.

- Multiple hurdles stand tall to challenge recovery moves.

US Dollar Index (DXY) picks up bids to pare the recent losses around 104.00 as traders prepare for the last daily show of 2022.

That said, the greenback’s gauge versus the six major currencies dropped the most in nearly 10 days the previous day after it broke a two-week-old ascending trend line.

However, the RSI (14) triggered the following corrective bounce which currently jostles with the support-turned-resistance line.

Even if the quote manages to cross the immediate hurdle surrounding 104.00, the 200-HMA resistance near 104.20 could probe the DXY bulls.

It should be observed that multiple levels around 104.60 and the 105.00 round figure might challenge the US Dollar Index upside before directing it to the monthly peak of 106.00.

Alternatively, pullback moves may aim for the latest trough surrounding 103.77 if the buyers fail to cross the previous support line.

Though, the RSI (14) may again play its role in activating the DXY rebound n case the quote fails to recover from 103.77 and poke the monthly low near 103.45.

If at all the US Dollar Index remains bearish past 103.45, the 103.00 round figure and early June’s high near 102.70 could gain the DXY seller’s attention.

US Dollar Index: Hourly chart

Trend: Limited downside expected

-

23:42

WTI extends recovery to near $79.00 despite an increment in US official oil stock data

- Oil price has scaled to near $79.00 as Goldman Sachs sees a potential recovery in China’s demand.

- An addition in oil inventory data against the consensus of a drawdown failed to impact the oil recovery.

- China’s Covid situation may find its peak sooner and will regain track of progress ahead.

West Texas Intermediate (WTI), futures on NYMEX, have extended its revival move above the crucial resistance of $78.50 in the early Tokyo session. The oil price sensed buying interest around $77.00 as supply worries due to a ban on oil sales from Russia to G7 countries and the European Union joined expectations of a recovery in demand projections in China due to reopening measures.

Oil supply is expected to remain a major concern as Russia is not intended to provide fossil fuels at reduced prices than prevailing in the market. No doubt, western countries are actively looking for alternatives to Russia to address their oil demand but their sheer dependence on Russian oil will keep them in short-term pain.

Meanwhile, the sheer pace of reopening measures in Beijing by the Chinese administration has created short-term havoc due to a solid spike in the number of infections, however, Covid-19 may find its peak and the economy will regain track of progress ahead.

A note from economists at Goldman Sachs dictated that "For oil prices, we remain constructive on oil prices in the near term given the potential for improving China demand, and lower supply growth from US shale due to discipline/tight service markets, and OPEC+ quota reduction,"

On Thursday, the oil price recovery after a temporary pain from an increment in oil inventories was reported by the United States Energy Information Administration (EIA) for the week ending December 23. The official US agency showed an addition in oil stockpiles by 0.718 million barrels while the street was expecting a drawdown of 1.52 million barrels.

-

23:30

USD/CHF seesaws around nine-month low as US Dollar bears pause amid sluggish markets

- USD/CHF refreshed multi-day low the previous day amid broad-based US Dollar declines.

- Firmer sentiment, downbeat Treasury bond yields weighed on the greenback.

- Swiss KOF Leading Indicator, US Michigan PMI eyed for fresh impulse.

USD/CHF licks its wounds near 0.9235 after declining to fresh lows since March. That said, the quote’s previous weakness could be linked to the US Dollar weakness, which in turn tracked downbeat US Treasury bond yields. However, the lack of major data/events and the year-end holiday mood seem to restrict the pair’s immediate moves.

On Thursday, US Dollar Index (DXY) refreshed its weekly low to near 103.78 while justifying the first negative daily closing of the US 10-year Treasury yields in the last five days. In doing so, the benchmark bond coupon reversed from a six-week high marked on Wednesday. The downbeat US bond yields also allowed the Wall Street benchmarks to remain positive and exert more downside pressure on the USD/CHF pair.

It’s worth noting that the mixed US data and concerns surrounding China, as well as Ukraine, seemed to have favored the Swiss Franc (CHF) pair’s latest weakness.

US Initial Jobless Claims rose 225K versus 216K prior for the week ended on December 24 while the Continuing Jobless Claims increased by 1.71M from 1.669M previous readout during the week ended on December 16. However, the 4-week moving average for the same dropped to 221K versus the revised down previous readings of 221.25K.

On the other hand, around seven major nations, including the US and the UK have recently announced Covid test requirements for Chinese travelers as the virus cases swirl in the dragon nation but Beijing reverses the “Zero-Covid” policy. Further, China’s Center for Disease Control and Prevention (CDC) top epidemiologist Wu Zunyou warned that Covid is seen spreading throughout the holiday season. Alternatively, Italy’s rejection of fears of any new Covid variant, after finding 50% of flight passengers being infected by the virus, seemed to have helped the markets in ignoring the fears of the virus. On the same line could be the headlines suggesting China’s discovery of a Covid antiviral pill and hopes of the CDC board to overcome the COVID-19 fears by citing the peak of virus spread in Beijing, Tianjin and Chengdu.

It should be observed that an absence of heavy losses to lives and infrastructures during Thursday’s heavy missile fire on Kyiv and Kharkiv by Moscow joined the global back-up to Ukraine in suggesting a sooner end to the thorny issue.

Moving on, a virtual meeting between China President Xi Jinping and Russian counterpart Vladimir Putin could entertain traders. Additionally, important will be the Swiss KOF Leading Indicator for December, expected 86.9 versus 89.5, as well as the US Chicago Purchasing Managers’ Index for the said month which is likely to improve to 41.2 from 37.2 prior.

Technical analysis

Although the USD/CHF bulls are far from the table unless crossing the 21-DMA hurdle surrounding 0.9320, March 2022 low near 0.9195 could restrict the short-term downside of the Swiss Franc (CHF) pair.

-

23:07

NZD/JPY Price Analysis: Downward pressured as a bearish harami emerged, at around 85.00

- The confluence of the 20 and 100-day EMAs, around 85.00, capped the NZD/JPY rally.

- A bearish harami candle chart pattern in the NZD/JPY daily chart could exacerbate a fall toward 82.50.

- NZD/JPY: To face solid support around the 200-day EMA, which, once it gives way, further downside is expected.

The NZD/JPY continued its downtrend after plummeting more than 300 pips following the Bank of Japan (BoJ) adjustment of its Yield Curve Control (YCC) on the 10-year JGB to 0.50%, which bolstered appetite for the Japanese Yen (JPY) to the detriment of most G8 currencies. At the time of writing, the NZD/JPY is trading at 84.34, slightly above the December 29 daily low of 84.20.

NZD/JPY Price Analysis: Technical outlook

After hitting a weekly high of 84.98, the NZD/JPY formed a bearish harami candle chart pattern, which usually has a downward bias. Nevertheless, it should be said that the 200-day Exponential Moving Average (EMA) lies close to current exchange rates and could be a difficult hurdle to surpass at 84.04, which, once cleared, will exert downward pressure on the NZD/JPY. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest sellers are in charge, though the RSI is almost flat, and the RoC continues to approach its neutral level.

If the NZD/JPY clears the 200-day EMA, that could open the door for further losses. Hence, the NZD/JPY first support would be the December 28 low of 83.66. Once cleared, the NZD/JPY might fall toward the 83.00 figure, closely followed by the December 23 daily low at 82.52.

NZD/JPY Key Technical Levels

-

23:06

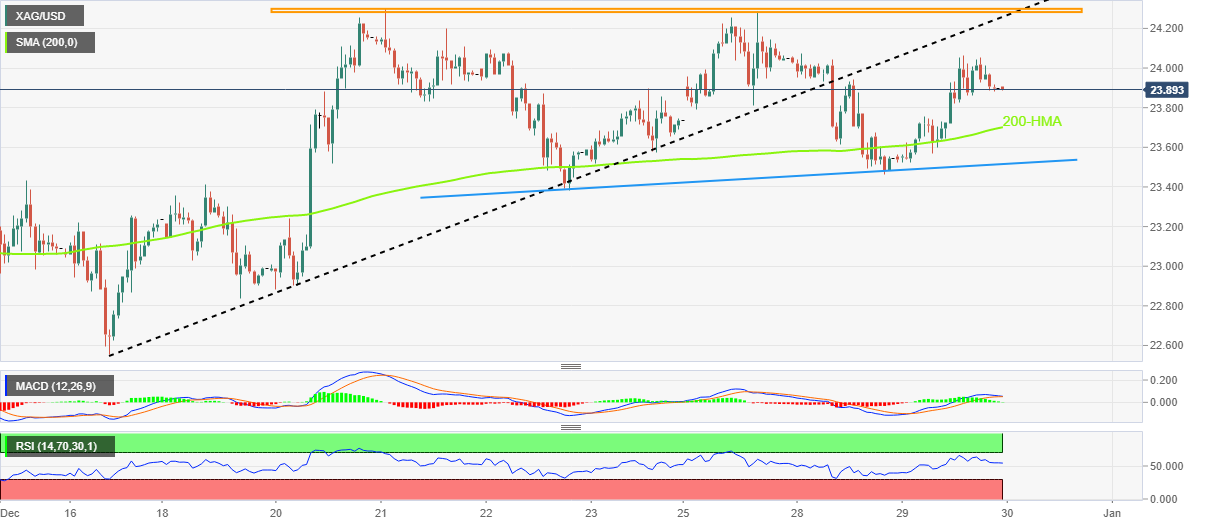

Silver Price Analysis: XAG/USD fades upside momentum below $24.00

- Silver price eases after positing the biggest daily gains in over a week.

- Impending bear cross on MACD, RSI retreat add strength to the fears of a pullback.

- 200-HMA, weekly support line to restrict short-term downside.

- Double tops around $24.30 appears the key hurdle towards the north.

Silver price (XAG/USD) slides to $23.90 as it consolidates the biggest daily jump in 10 days during early Friday.

The metal’s pullback takes clues from the looming bear cross on the MACD indicator, as well as the RSI (14) retreat.

As a result, the bullion sellers could well target the 200-HMA retest, around $23.70 by the press time.

However, an upward-sloping support line from December 22, close to $23.50 at the latest, will challenge the XAG/USD bears afterward.

It’s worth noting that the December 22 low near $23.40 is also an important support to watch for Silver traders as a break of which will confirm the “double top” bearish formation and theoretically suggest a slump towards $22.50.

Alternatively, a convergence of the previous support line from December 16 and the double tops appears the tough nut to crack for Silver buyers, around $24.30.

Should the silver buyers portray a successful run-up beyond the $24.30 hurdle, a gradual run-up toward April’s peak surrounding $26.22 can’t be ruled out. That said, the $25.00 and $26.00 round figure may act as intermediate halts during the anticipated run-up.

Silver price: Hourly chart

Trend: Pullback expected

-

23:02

USD/CAD Price Analysis: Shift of auction below 200-EMA signals more downside

- A recovery in the oil price and risk appetite theme have impacted the Lonnie asset.

- USD/CAD is auctioning below the 200-EMA which indicates weakness ahead.

- A slippage into the 20.00-40.00 range by the RSI (14) will trigger a bearish momentum.

The USD/CAD pair has turned sideways after a sheer drop from the round-level resistance of 1.3600. The Loonie asset is hovering around 1.3540 and is likely to remain highly volatile amid a recovery in the risk appetite theme and oil prices.

The US Dollar Index (DXY) witnessed a sell-off on Thursday after a rebound in the risk-perceived assets and an escalation in the number of weekly Initial Jobless Claims. Also, a recovery in oil price from $76.75 supported the Canadian Dollar.

On a two-hour scale, the Loonie asset has sensed selling pressure around 1.3600 after failing to regain auction above the upward-sloping trendline plotted from November 16 low at 1.3228. A sell-off in the United States Dollar has pushed the Lonnie asset below the 20-period Exponential Moving Average (EMA) at 1.3565. The major has also shifted its auction profile below the 200-EMA at 1.3579, which indicates that the long-term trend has turned bearish now.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range. A breakdown of the momentum oscillator inside the bearish range of 20.00-40.00, will trigger a downside momentum.

Going forward, a downside break below Tuesday’s low around 1.3484 will drag the asset toward November 22 high at 1.3444. A slippage below the latter will expose the major for more downside towards December 5 low at 1.3385.

Alternatively, a break above Wednesday’s high at 1.3612 will drive the Lonnie asset toward December 23 high around 1.3650 followed by the previous week's high around 1.3704.

USD/CAD two-hour chart

-638079517065099442.png)

-

23:01

South Korea Consumer Price Index Growth (MoM) registered at 0.2%, below expectations (0.5%) in December

-

23:00

South Korea Consumer Price Index Growth (YoY) registered at 5%, below expectations (5.1%) in December

-

22:47

EUR/USD grinds higher towards 1.0700 as US Dollar traces softer Treasury bond yields

- EUR/USD seesaws around two-week high after rising the most since mid-December.

- Market sentiment improves amid mixed concerns, weighing on the US Dollar.

- US Treasury bond yields benefits from mixed data, hopes of overcoming virus woes, geopolitical fears.

- No major data/events to test buyers but lack of market activity could probe further upside.

EUR/USD treads water around 1.0660, after refreshing a two-week high, as bulls await more clues to end the year 2022 on a positive note.

The major currency pair rose the most in nearly three weeks the previous day amid broad US Dollar weakness, mainly due to the softer US Treasury bond yields and cautious optimism in the markets.

The sentiment could be linked to the mixed data and easing fears surrounding Covid and the Russia-Ukraine tension, despite recent jitters.

That said, the US 10-year Treasury bond yields marked the first daily loss in five while reversing from the six-week high, down 1.75% to 3.82% by the end of the day. It’s worth noting that Wall Street benchmarks closed with an overall positive performance by rising more than 1.30% each.

Talking about the data, US Initial Jobless Claims rose 225K versus 216K prior for the week ended on December 24 while the Continuing Jobless Claims increased by 1.71M from 1.669M previous readout during the week ended on December 16. However, the 4-week moving average for the same dropped to 221K versus the revised down previous readings of 221.25K.

Around seven major nations have recently announced Covid test requirements for Chinese travelers as the virus cases swirl in the dragon nation but Beijing reverses the “Zero-Covid” policy. Further, China’s Center for Disease Control and Prevention (CDC) top epidemiologist Wu Zunyou warned that Covid is seen spreading throughout the holiday season.

However, Italy’s rejection of fears of any new Covid variant, after finding 50% of flight passengers being infected by the virus, seemed to have helped the markets in ignoring the fears of the virus. On the same line could be the headlines suggesting China’s discovery of a Covid antiviral pill and hopes of the CDC board to overcome the COVID-19 fears by citing the peak of virus spread in Beijing, Tianjin and Chengdu.

Elsewhere, Moscow unveiled heavy missile fire on Kyiv and Kharkiv but a lack of major victory and Ukraine’s global support, not to forget an absence of heavy losses to lives and infrastructures, seemed to have favored the risk appetite.

Looking forward, a virtual meeting between China President Xi Jinping and Russian counterpart Vladimir Putin could entertain traders while the US Chicago Purchasing Managers’ Index for December, expected 41.2 versus 37.2 prior, will decorate the calendar. Following that, Saturday’s official readings of China Manufacturing and Non-Manufacturing PMIs for the current month will be important to watch for clear directions.

Technical analysis

Although the 21-DMA support of 1.0590 restricts short-term EUR/USD downside, the pair’s advances remain elusive unless crossing the monthly high surrounding 1.0735.

-

22:32

AUD/USD Price Analysis: 0.6800 remains critical for the Australian Dollar

- AUD/USD has sensed a minor correction after a perpendicular recovery from 0.6720.

- An improvement in investors’ risk appetite has underpinned the Australian Dollar.

- The Aussie asset needs to surpass 0.6800 for an upside move ahead.

The AUD/USD pair has sensed a minor correction in the early Tokyo session after a perpendicular recovery from 0.6720. The Aussie asset is likely to extend its recovery to near the round-level resistance of 0.6800 as the risk appetite of the market participants has improved dramatically.

A stellar recovery in the S&P500 on Thursday as investors rushed for dip buying after a two-day sell-off underpinned risk-off mood. The US Dollar Index (DXY) dropped to near the lower end of the weekly trading range around 103.60.

On a four-hour scale, the Aussie asset is auctioning in a Rising Channel chart pattern, which is highly neutral as it has formed after a sell-off move from December 13 high around 0.6900. The round-level resistance of 0.6800 has remained a critical barrier for the Australian Dollar for the past 15 trading sessions.

A recovery move in the Aussie asset has pushed it above the 20-period Exponential Moving Average (EMA) around 0.6747. Also, the 200-EMA at 0.6700 is still solid, which indicates that the long-term trend is still bullish.

The Relative Strength Index (RSI) (14) is struggling to shift into the bullish range of 60.00-80.00. An occurrence of the same will trigger bullish momentum.

For an upside move, the Australian Dollar needs to surpass Wednesday’s high around 0.6800, while will drive the Aussie asset towards December 13 high around 0.6880 followed by the psychological resistance at 0.7000.

On the contrary, a breakdown of December 27 low at 0.6719 will drag the major towards December 15 low around 0.6677. A slippage below the latter will expose the asset for more downside toward December 20 low at 0.6629.

AUD/USD four-hour chart

-

22:27

Gold Price Forecast: XAU/USD benefits from softer United States Treasury bond yields, Wall Street gains

- Gold price remains on course to second monthly gain amid market’s cautious optimism, pullback in United States Treasury bond yields.

- Mixed headlines China, softer US data weighed on US Dollar and allowed XAU/USD to remain firmer despite escalating Russia-Ukraine tussle.

- Gold traders remain little active amid year-end holiday mood, light calendar.

Gold price (XAU/USD) remains firmer around $1,815, even with less momentum strength, as traders brace for the final trading day of 2022 on early Friday.

The yellow metal cheered the latest pullback in the United States Treasury bond yields to post mild gains while paying little attention to the risk-negative headlines surrounding China’s Covid conditions and the geopolitical tension in Ukraine. The reason could be linked to Beijing’s reopening, softer US Dollar and upbeat performance of Wall Street.

Gold rises as United States Treasury bond yields ease

Given the negative correlation with the United States Treasury bond yields, Gold price benefited from a pullback in the key bond coupons from the multi-day high. That said, the US 10-year Treasury bond yields marked the first daily loss in five while reversing from the six-week high, down 1.75% to 3.82% by the end of the day. It’s worth noting that Wall Street benchmarks closed with overall positive performance by rising more than 1.30% each.

In doing so, the bond market cheered mixed US data and receding hopes of the global economic recession even as the fears of the COVID-19 and geopolitical tension between Ukraine and Russia continue.

US Initial Jobless Claims rose 225K versus 216K prior for the week ended on December 24 while the Continuing Jobless Claims increased by 1.71M from 1.669M previous readout during the week ended on December 16. However, the 4-week moving average for the same dropped to 221K versus the revised down previous readings of 221.25K.

It’s worth noting that earlier in the week San Francisco Fed came out with a research that ruled out recession for at least two quarters.

China Covid conditions flash mixed signals to markets but positive for Gold

Around seven major nations have recently announced Covid test requirements for Chinese travelers as the virus cases swirl in the dragon nation but Beijing reverses the “Zero-Covid” policy.

On Thursday, China’s Center for Disease Control and Prevention (CDC) top epidemiologist Wu Zunyou warned that Covid is seen spreading throughout the holiday season.

However, Italy’s rejection of fears of any new Covid variant, after finding 50% of flight passengers being infected from the virus, seemed to have helped the markets in ignoring the fears from the virus.

On the same line could be the headlines suggesting China’s discovery of a Covid antiviral pill and hopes of the CDC board to overcome the COVID-19 fears by citing peak of virus spread in Beijing, Tianjin and Chengdu.

Given China’s status as the key Gold user, the nation’s unlock and receding virus fears help the XAU/USD price.

Russia-Ukraine fears remain ineffective despite heavy explosions

Although Moscow unveiled heavy missile fires on Kyiv and Kharkiv, a virtual meeting between China President Xi Jinping and Russian counterpart Vladimir Putin keep traders hopeful of overcoming the geopolitical tussles.

No major catalysts to entertain Gold buyers

Given the light calendar and the year-end holiday season, the Gold traders are likely to keep favoring the upside momentum considering the latest market optimism. However, risk catalysts should be eyed for clear directions as China Covid woes join the Ukraine-Russia tension.

Gold price technical analysis

Despite being mostly inactive in December, Gold price defends its early November’s breakout of the 21-Daily Moving Average (DMA) while grinding higher.

The metal’s upside momentum, however, have recently lost momentum, as per the latest red signals from the Moving Average Convergence and Divergence (MACD) indicator. Even so, the firmer Relative Strength Index (RSI) line, placed at 14, favors the north-side grind.

As a result, the XAU/USD is likely to continue trading higher, even at a slower pace, unless breaking the 21-DMA support of $1,796.

Following that, November’s peak around $1,786 and the monthly bottom of $1,765 could act as the last defense of the Gold buyers before directing the precious metal towards the late November swing low near $1,721.

Alternatively, the recent swing high near $1,833 could act as the immediate hurdle for the Gold buyers to watch before targeting another battle with an upward-sloping resistance line from early October, close to $1,850 at the latest.

In a case where the XAU/USD remains firmer past $1,850, June’s peak surrounding $1,880 could act as an intermediate halt during the metal’s rush towards the $1,900 threshold.

Gold price: Daily chart

Trend: Further upside expected

-

22:25

USD/JPY Price Analysis: Bearish engulfing pattern spurred a fall below 133.00

- USD/JPY erased the last two days of gains due to the US Dollar weakness.

- USD/JPY Price Analysis: Bearish engulfing pattern spurred Thursday’s 140 pip fall.

The USD/JPY advancement was capped around the confluence of the 20 and 200-day Exponential Moving Averages (EMAs), forming a bearish engulfing candle pattern, opening the door for further losses. Therefore, the USD/JPY is trading at 132.90

USD/JPY Price Analysis: Technical outlook

After steadily advancing towards the weekly high of 134.50, the USD/JPY plunged beneath the 133.00 figure. Worse than estimated fundamental news caused US Dollar weakness. Therefore, the USD/JPY edged lower, confirmed by oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC), in bearish territory and aiming lower. Additionally, the confluence of the 20 and 200-day EMAs, exacerbated the major’s drop, as it prepared to fall towards the December low of 130.56.

Therefore, the USD/JPY first support would be the December 27 daily low of 132.63. A breach of the latter will expose the December 26 swing low of 132.30, ahead of the 132.00 mark. AS an alternate scenario, if the USD/JPY climbs above 135.00, the USD/JPY's next resistance would be 136.00, ahead of the December 20 daily high of 137.47.

USD/JPY Key Technical Levels

-

22:05

GBP/USD aims to recapture 1.2100 as US Dollar drops amid a recovery in risk-on mood

- GBP/USD is looking to reclaim the immediate resistance of 1.2100 amid a sheer drop in the US Dollar Index.

- A significant recovery in S&P500 has triggered hopes of a decent revival in investors’ risk appetite.

- Economists at TD Securities see that US inflation will remain well above 3% by the end of Q4 2023.

The GBP/USD pair has attempted a rebound and is likely to recapture the immediate resistance of 1.2100 in the early Asian session. The Cable has gained some traction as the US Dollar Index (DXY) has dropped near the lower portion of its weekly trading range around 103.60. The USD Index is oscillating in a range of 103.60-104.50 from the past week due to the absence of critical economic events for a decisive move amid a festive week.

A steep recovery in S&P500 after a two-day sell-off is portraying a decent recovery in the risk appetite theme. Investors jumped to load up beaten-down technology stocks. Meanwhile, the 10-year US Treasury yields witnessed a halt in its four-day winning streak and dropped to 3.82%, showing that volatility is cooling-off.

The US Dollar is not displaying a significant move this week due to a handful of economic events to bring an action in the FX action. On Thursday, the Greenback faced immense pressure after an acceleration in the number of Initial Jobless Claims for the week ending December 23. The Unemployment Claims jumped to 225K from the prior release of 216K. No doubt, the employment generation process has been slowed down led by higher interest rates by the Federal Reserve (Fed), which is resulting in more jobless claims from potential job seekers.

While the Fed is working hard to achieve price stability, economists at TD Securities are of the view that inflation in the United States will remain well above 3% by the end of Q4 2023. “We look for headline inflation to end the year at a robust 7.1% YoY pace in Q4, but to slow to 3.1% in Q4 2023. We also forecast Core CPI inflation to end the year at a still-high 6.0% but to decelerate to 3.3% in Q4 2023.”

On the United Kingdom front, the ending of the CY2023 at a higher inflation rate led by higher energy prices is going to keep the Bank of England (BOE) busy next year in handling the inflation mess. BOE Governor Andrew Bailey might bank upon further increments in the interest rates to trim inflationary pressures.

-

21:54

NZD/USD hits fresh weekly high around 0.6350s on soft US Dollar after US jobless claims

- NZD/USD bounced at the 20-day EMA and clung to gains at around 0.6350s.

- US Initial Jobless Claims rose more than estimates, flashing signs the labor market is easing.

- NZD/USD Price Analysis: Upward biased, but needs to clear 0.6360, to test 0.6400.

The New Zealand Dollar (NZD) clings to its gains on Thursday, bouncing off the 20-day Exponential Moving Average (EMA) as market sentiment improved due to a worse-than-expected US jobs report. Therefore, the US Dollar (USD) lost traction and weakened against most G10 currencies. At the time of writing, the NZD/USD is trading at 0.6350.

Wall Street finished the penultimate trading day of the year with gains between 1.05% and 2.59%. A light economic calendar left the NZD/USD pair adrift to US Dollar dynamics, which bolstered the New Zealand Dollar. The US Bureau of Labor Statistics (BLS) revealed the Initial Jobless Claims for the week ended on December 24 rose by 225K, in line with expectations, though 9K above the previous week’s record. Continuing claims jumped by 1.7 million in the week that ended on December 17, the highest since early February.

The NZD/USD reacted upwards amidst thin liquidity conditions as the year’s end approached.

Since authorities relaxed its zero-tolerance policy, the jump in Covid-19 cases in China is overwhelming its healthcare system. Also, Italy reported that half of the passengers on two flights from China were Covid-19 positive, spurring a chain reaction from Western countries, imposing tests on people traveling from China.

Elsewhere the US Dollar Index (DXY), a measure of the greenback’s value against a basket of peers, drops 0.49% and exchanges hands at 103.958, undermined by falling US bond yields. The 10-year benchmark note yields 3.826%, down six bps from its opening yield.

NZD/USD Price Analysis: Technical outlook

The daily chart shows the NZD/USD pair as upward biased, though struggling to crack the weekly high of 0.6355. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) began to turn positive, suggesting buyers are moving in. However, if the NZD/USD is poised to fresh weekly highs, it will need to test the 0.6400 figure, followed by the December 13 daily high of 0.6513.

-

19:58

Forex Today: US Dollar gives up as Wall Street advances

What you need to take care of on Friday, December 30:

The US Dollar fell on Thursday, with the decline exacerbated by thin market conditions. Sentiment led the way throughout the day, with Chinese headlines triggering different market reactions. On Wednesday, financial markets were on alert after Italy reported that roughly 50% of the passengers of two flights arriving in Milan on Wednesday tested positive for COVID-19, and several western nations rushed to impose control on Chinese travelers, fearing the spread of a new strain. However, mid-European morning Italy reported they found no new covid variants in the aforementioned tests.

The mood improved ahead of the US opening, with Wall Street posting substantial gains. Nevertheless, growth and inflation concerns remain in the background. US Treasury yields were up at the shorter end of the curve, while the 10-year note yield shed 4 bps.

The EUR/USD pair peaked at 1.0689, holding on to gains ahead of the Asian opening. GBP/USD hovers around 1.2060, with Pound gains limited amid strikes going on in the United Kingdom. The 1,000 members of the Public and Commercial Services Union (PCS) are striking for four days until New Year’s Eve.

Commodity-linked currencies advanced vs their American rival. AUD/USD trades in teh 0.6780 price zone, while USD/CAD is down to 1.3540.

The Japanese yen appreciated amid the broad US Dollar weakness and news that the Bank of Japan conducted two unplanned bond purchase operations.

Spot gold edged marginally higher and finished the day at around %1,816 a troy ounce. Crude oil price weakened at the beginning of the day but trimmed most of its losses ahead of the close. WTI trades at around $78.30 a barrel

Like this article? Help us with some feedback by answering this survey:

Rate this content -

19:13

Gold Price Forecast: XAU/USD grinds higher toward $1815s on falling US yields, weaker USD

- Gold price holds to gains above $1,800 amidst thin liquidity conditions.

- The US labor market appears to ease as Initial Jobless Claims increase.

- Global central banks increased their holdings of Gold in Q3 by close to 400 metric tons.

- Gold Price Analysis: Hold above $1,800, eyeing June’s high of $1,879.45.

Gold Price advances after hitting a daily low of $1,803.30, gaining 0.83% during the North American session bolstered by falling US bond yields, which weakened the US Dollar (USD). Meanwhile, investors’ sentiment improved even though China relaxing Covid-19 policy keeps the health system pressured. At the time of writing, the XAU/USD is trading at $1,817.27, up by 0.74%.

Investors’ fears calmed following worse-than-expected US jobless claims data

Wall Street extends its gains on the penultimate trading day of the year. The US Department of Labor revealed Initial Jobless Claims for the week ended on December 24 jumped to 225K, in line with expectations, and 9K above the previous week’s record. Continuing claims rose to 1.7 million in the week that ended on December 17, the highest since early February.

Once the report hit newswires, Gold prices increased as investors’ fears for a tighter labor market eased. Additionally, US Treasury bond yields dropped, with the 10-year benchmark yield falling five bps, down to 3.830%. Consequently, the greenback weakened, as shown by the US Dollar Index (DXY), which tracks the US Dollar performance against a basket of peers, diving 0.54%, at 103.901.

According to the World Gold Council (WGC), global central banks bought Gold at the highest rate since 1967, likely led by Russia and China’s institutions. Central banks bought 399 metric tons of Gold in Q3, against 186 metric tons in Q1 and 88 metric tons in Q2.

The US economic docket will finish the year featuring the Chicago PMI on Friday. It will kick off the next year with a busy calendar, reporting S&P Global and ISM PMIs, labor market data, and the Balance of Trade.

Gold Price Analysis: Technical outlook

From a daily chart perspective, the XAU/USD remains upward biased, though unable to crack December’s high of $1,833.29. Traders should be aware that the yellow metal prices have been tracking the 20-day Exponential Moving Average (EMA) since mid-November, and Gold is trading above its 200-day EMA. Therefore, further upside is expected.

That said, XAU/USD’s first resistance would be the MTD high of $1,833.29. A breach of the latter will expose June’s high of $1,879.45, followed by the $$1,900 mark. As an alternate scenario, the XAU/USD first support would be $1,800. Break below would expose the 20-day EMA at $1,792.78, followed by the 200-day EMA at $1,765.98.

-

18:11

United States 7-Year Note Auction rose from previous 3.89% to 3.921%

-

17:46

USD/CHF Price Analysis: Retests December lows around 0.9210s, as traders ignored a doji

- USD/CHF bypasses a doji and falls beneath the 0.9300 figure.

- The USD/CHF price action suggests the pair might form a triple bottom, but oscillators point downwards.

- A fall beneath 0.9200 could exacerbate a test of the 2022 lows.

The USD/CHF disregarded a doji formed on Wednesday and extended its losses below the 0.9300 figure, as the USD/CHF is about to finish the year almost unchanged. At the time of writing, the USD/CHF is trading at 0.9231, down by 0.58%.

USD/CHF Price Analysis: Technical outlook

The daily chart shows the USD/CHF hit a daily low of 0.9210 for the third time in December, though so far clung to the 0.9200 figure. However, the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that sellers gather momentum. So a fall beneath the 0.9200 figure could pave the way towards the 2022 yearly low of 0.9091.

Otherwise, the USD/CHF might be forming a triple bottom pattern, but firstly it would need to clear the 20-day Exponential Moving Average (EMA) at 0.9335 and December’s high of 0.9347 to confirm the chart pattern. Once achieved, the USD/CHF target would be the 50-day EMA at 0.9477, followed by 0.9500.

USD/CHF Key Technical Levels

-

16:47

EUR/USD climbs toward 1.0660s after US jobless claims increased

- The Euro remains above the 1.0600 figure, eyeing a year-end close above the figure.

- US Initial Jobless Claims exceeded the previous week’s reading, showing the labor market is easing.

- EUR/USD: Flat, but if it clears 1.0700, it could reach a new MTD high; otherwise, consolidation around 1.0600 is on the cards

The Euro (EUR) held to its gains vs. the American Dollar (USD) as sentiment improved ahead of the last trading day of 2022. Data from the United States (US) showed a slight jump in unemployment claims, boosting the EUR/USD, while China’s Covid-19 relaxing restrictions keep investors nervous. At the time of writing, the EUR/USD is trading at 1.0660.

An increase in US unemployment claims weighed on the US Dollar

US economic data revealed by the Department of Labor (DoL) featured Initial Jobless Claims for the week ended on December 24, which jumped to 225K, in line with expectations, and 9K above the previous week’s record. In the meantime, continuing claims rose to 1.7 million in the week that ended on December 17, the highest since early February.

Aside from this, since authorities relaxed its zero-tolerance policy, the jump in Covid-19 cases in China is overwhelming the country’s healthcare system. Also, flights from China that landed in Italy triggered a reaction from Western countries, with some reimposing tests for people flying from China.

Elsewhere, the Russian invasion of Ukraine escalated, with newswires reporting shelling in Kyiv and other cities.

In the meantime, the Eurozone economic docket featured Spain Retail Sales MoM, exceeding the previous month’s 0.4%, jumped 3.8%, while the EU’s M3 Money Supply for November dived to 4.8% YoY, vs. estimates of 5%.

The Eurozone economic calendar will feature Spain’s inflationary readings ahead of the week, while the US docket will release the Chicago PMI for December.

EUR/USD Price Analysis: Technical outlook

Choppy trading conditions in the EUR/USD continued, as usually happens, for the last ten days of the year. However, oscillators like the Relative Strength Index (RSI) suggest the shared currency could begin the year on a higher note while the Rate of Change (RoC) is flat. If the EUR/USD clears December’s 28 high of 1.0674, that could pave the way for a 1.0700 test. Once cleared, the next resistance would be the MTD high of 1.0736. As an alternate scenario, the EUR/SUD first support would be 1.0600, followed by last week’s low of 1.0573 and the 20-day Exponential Moving Average (EMA) at 1.0564.

-

16:32

United States 4-Week Bill Auction up to 3.83% from previous 3.61%

-

16:03

USD/JPY drops to fresh lows under 133.00 on the back of a weaker US Dollar

- Japanese Yen among top performers on Thursday despite higher equity prices.

- US Dollar turns negative as Wall Street soars.

- USD/JPY is ending a four-day positive streak with a 1% loss.

The USD/JPY broke below the 133.45/50 zone after the beginning of the American session and tumbled to 132.90, a two-day low. The pair remains under pressure, hovering around 133.00, down 1% so far for the day.

The decline took place amid a weaker US Dollar across the board hit by an improvement in risk sentiment. US bond yields remained steady. The Dow Jones was rising by more than 300 points while the Nasdaq was adding 2.45%.

US economic data showed Initial Jobless Claims rose to 225K during the week ended December 24, in line with expectations while Continuing Claims rose to 1.71 million, the highest level since February. The numbers did not have an impact. Price action remains subdue.

Short-term outlook

The USD/JPY is moving with a bearish bias in the very short-term. A recovery above the 133.45/50 level would alleviate the bearish pressure; while above 133.85 the bias should change to neutral/bullish.

The Momentum is about to cross 100 in four-hour charts and price is holding below key moving averages. A consolidation below 133.00 would keep the path clear to a slide to the next strong support located at 132.45/50 (weekly low).

Technical levels

-

16:00

United States EIA Crude Oil Stocks Change increased to 0.718M in December 23 from previous -5.894M

-

15:58

Gold Price Forecast: Backdrop for XAU/USD set to improve – Credit Suisse

The backdrop for cyclical commodities is likely to stay challenging and volatile. Nonetheless, strategists at Credit Suisse believe that Gold could enjoy gains later in 2023.

Gold upside optionality could be considered

“As we enter 2023, the backdrop might still be unfavorable for cyclical markets. However, central bank tightening efforts are likely to be advanced and peak hawkishness may be near, which would provide an improving backdrop for precious metals, especially Gold.”

“As central banks risk causing a deep growth slump, we see some upside risks to Gold as we progress in time. It may be premature to build outright exposure, but we see merit in looking for medium-term upside optionality.”

-

15:33

US: Inflation to still remain above the 3% level by Q4 2023 – TDS

Both Core CPI inflation and core PCE inflation will remain above target inflation levels by the end of 2023, in the opinion of economists at TD Securities.

Will inflation fizzle out?

“We continue to forecast inflation (as measured by the CPI) to still remain above the 3% level by Q4 2023 despite the expected cumulative aid from goods deflation and shelter disinflation. We continue to judge the move to below 3% to be the real challenge as the more persistent factors driving services inflation will become more evident.”

“We look for headline inflation to end the year at a robust 7.1% YoY pace in Q4, but to slow to 3.1% in Q4 2023. We also forecast Core CPI inflation to end the year at a still-high 6.0% but to decelerate to 3.3% in Q4 2023.”

“We also expect the spread between the CPI and PCE measures to shrink through the end of next year as the factors driving the wedge normalize. We project core PCE inflation at 3.0% YoY by end-2023.”

-

15:30

United States EIA Natural Gas Storage Change down to -213B in December 23 from previous -87B

-

15:29

GBP/USD hovers around 1.2030s on upbeat sentiment, soft US Dollar

- The British Pound clings to gains on optimistic sentiment and a weaker US Dollar.

- US Jobless Claims were aligned with estimates, showing the labor market remains tight.

- Traders expect a 25 bps rate hike by the Federal Reserve on February 2023.

- GBP/USD Price Analysis: Failure to crack 1.2100 will exacerbate a fall below 1.2000.

The Pound Sterling (GBP) remains sideways during the North American session after hitting a daily low of 1.2005 against the US Dollar (USD). Risk aversion spurred by factors linked to China’s learning to live with the coronavirus keeps investors uneasy. Meanwhile, the latest unemployment claims report shows the US labor market remains tight. At the time of writing, the GBP/USD is trading at 1.2033.

US Initial Jobless Claims failed to underpin the US Dollar

Wall Street is poised for a higher open, mimicking European stock indices. The US Bureau of Labor Statistics (BLS) revealed that Initial Jobless Claims for the week ended on December 24 rose by 225K, in line with expectations. The same report showed that continuing claims jumped to 1.7 million in the week that ended on December 17, the highest since early February.

Will the Federal Reserve hike 50 or 25 bps in February 2023?

Even though the US Federal Reserve (Fed) has lifted rates towards 4.50% during 2022 to tame inflation. The US Fed Chairman, Jerome Powell, and Co., have stressed that the labor market is tight and that the unemployment rate should be higher due to the imbalance between labor supply/demand. As the year’s end approached, the CME FedWatch Tool shows investors expect a 25 bps rate hike in the February 1 meeting, while Eurodollar futures show traders estimating a 50 bps lift.

Falling US bond yields lift the GBP/USD

Elsewhere, the GBP/USD is driven by the US Dollar dynamics due to the lack of UK economic data. The US Dollar Index (DXY), a gauge that tracks the US Dollar value against a basket of six currencies, tumbles 0.36%, down to 104.093, weighed by falling US Treasury yields. The US 10-year benchmark note rate drops three bps, yielding 3.856%.

What to watch

On Friday, the UK economic docket is empty, while the US calendar will feature the Chicago PMI for December, estimated at 40.

GBP/USD Price Analysis: Technical outlook

From a daily chart perspective, the GBP/USD upside was capped by the 200 and the 20-day Exponential Moving Average (EMA), each at 1.2111 and 1.2082. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that sellers are beginning to gather momentum, even though the GBP/USD is edging up. That said, the GBP/USD first support would be the last week’s low of 1.1997. Break below will expose the 50-day EMA at 1.1936, followed by the 100-day EMA at 1.1884.

-

15:25

AUD/USD rises from three-day lows to 0.6765 as risk appetite improves

- Wall Street up sharply, Dow Jones gains more than 300 points.

- Improvement in risk sentiment boosts the Australian Dollar.

- AUD/USD moving without a clear direction, Aussie needs a confirmation above 0.6770.

The AUD/USD pair rebounded from levels near 0.6700 and printed a fresh daily low at 0.6764 during the American session amid a rally in equity prices in Wall Street.

The improvement in the demand for riskier assets in US markets weighed on the US Dollar that reversed its course, turning negative. The Dow Jones is up by 1.03% or 330 points while the Nasdaq climbs by more than 2%. US yields are moving without a clear direction, holding near recent highs. The US 10-year yield stands at 3.86% and the 2-year at 4.375.

US economic data released on Thursday showed Initial Jobless Claims rose to 225K during the week ended December 24, in line with expectation; Continuing Claims rose to 1.71 million, the highest level since February. On Friday, the Chicago PMI is due. In Australia will be a holiday.

The 0.6765/70 holds the upside

The AUD/USD is moving sideways. On the downside, the pair again found support above the 0.6700 area. A break lower could trigger an acceleration, targeting initially 0.6675.

If the Aussie manages to rise and hold firm above 0.6770 it would gain momentum, likely rising to test the weekly high area at 0.6800.

Technical levels

-

15:00

The main tailwind for USD is fading fast – HSBC

USD strength has been a very consistent story over the past two years. However, economists at HSBC note that the main tailwind for the Dollar is quickly falling away.

Upgrade of EUR and GBP to a neutral view

“USD benefited from the leadership of the Fed in setting the pace of monetary policy tightening and an attractive rate pickup compared to many other G10 currencies. But as we get closer to peak rate levels, we think those rate differentials are unlikely to widen further, and the gap may even narrow with some countries. As a result, the main tailwind for USD is fading fast.”

“USD will still get some support, however, from weakening global economic growth, relative economic resilience in the US and mixed-to-weak risk appetite.”

“We recently downgraded USD to neutral; upgraded EUR and GBP to a neutral view; and JPY and SGD to a bullish view.”

-

14:21

USD/CAD’s rebound from 1.3485 loses steam above 1.3600

- USD/CAD's recovery stalls below 1.3610.

- The Canadian dollar pares losses on the back of a mild rebound in oil prices.

- The lower US Treasury bonds are weighing on demand for the USD.

The US Dollar is treading water in the vicinity of 1.3600 on Thursday, following a solid recovery on Wednesday. The pair’s run-up from 1.3485 was capped at 1.3610 and has remained wavering on both sides of the 1.3600 level for most of the day.

The Canadian Dollar ticks up with oil prices trimming losses

The CAD is trimming losses, following its weakest daily performance in the last two weeks amid a moderate recovery in oil prices and the sluggish US Dollar’s performance in a choppy trading session.

Oil prices have appreciated about $1,5 during the European trading session, with the US benchmark West Texas Intermediate crude, picking up to $78.40 from session lows at $76.80, which might have offered some support to the commodity-linked CAD.

On the macroeconomic front, US initial Jobless Claims increased by 9.000 amounting to 225,000 in the week of December 24, with the 4-week moving average declining by 250 to 221,000 from the previous week, according to data released by the US Department of Labor.

These figures have failed to cheer a sluggish US Dollar, which has tracked the slight decline in US Treasury bond yields. The US Dollar Index has confirmed its decline below the 104.00 level, reaching fresh intra-day lows at 103.66 so far.

The yield of the benchmark US 10-year bond is trading at 3.867% at the moment of writing, 1.5 basis points lower on the day after having opened the session 2.4% down. Investor’s concerns about a potential recession in the first quarter of 2023 and a likely slowdown on the Fed’s tightening cycle are weighing on US Dollar demand

Furthermore, news reports about the soaring COVID-19 cases in China and the escalating tensions in Ukraine after Kremlin’s refusal to accept Zelenski’s peace deal proposal have crushed the optimism witnessed earlier this week after China scrapped its restrictions for inbound travelers.

Technical levels to watch

-

14:21

Gold Price Forecast: XAU/USD target range for 2023 set at $1,900 to $2,000 – Wells Fargo

While the commodity bull super-cycle has us positive on Commodities generally, strategists at Wells Fargo are neutral on the Precious Metals sector, which includes Gold.

Gold under pressure

“Gold has positives, but its negatives have been directing prices for some time now. The Dollar's 2022 ascent to a 20-year high was Gold's most potent negative, but the 2023 flattening and then reversal lower in the Dollar's value that we expect should relieve some pressure on Gold.”

“Other positives that may help in 2023 are a favorable supply/demand balance and oversold price conditions (cheap versus other commodities and negative investor sentiment).”

“Our 2023 target range of $1,900 to $2,000 reflects in-line commodity performance plus a bit extra, while Gold appears oversold. We caution investors, though, not to be too aggressive with Gold until it shows better price action.”

-

13:40

US: Weekly Initial Jobless Claims rise to 225K in week ending December 24

- Initial Jobless Claims in the US increased by 9,000 in the week ending December 24.

- US Dollar Index stays in negative territory near 104.00.

There were 225,000 initial jobless claims in the week ending December 24, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 216,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.2% and the 4-week moving average was 221,000, a decrease of 250 from the previous week's revised average.

"The advance number for seasonally adjusted insured unemployment during the week ending December 17 was 1,710,000, an increase of 41,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar Index edged lower with the initial reaction and was last seen losing 0.38% on the day at 104.05.

-

13:30

United States Initial Jobless Claims climbed from previous 216K to 225K in December 23

-

13:30

United States Continuing Jobless Claims increased to 1.71M in December 16 from previous 1.672M

-

13:30

United States Initial Jobless Claims 4-week average fell from previous 221.75K to 221K in December 23

-

13:27

Gold Price Forecast: XAU/USD, in range above $1,800 amid a moderate risk aversion

- Gold is moving directionless above $1,800 as risk appetite faded.

- Concerns about China and the escalating tensions in Ukraine have dampened investors' optimism.

- XAU/USD remains trapped within an ascending triangle pattern.

Gold futures are moving without a clear direction on Thursday trapped within a $10 range above $1,800 in a choppy market session amid growing concerns about the Chinese economy and the rising tensions in Ukraine.

China and Ukraine have dampened risk appetite

The moderate optimism observed in the first half of the week, triggered by the Chinese authorities’ decision to lift the restrictions for inbound travelers faffed on Thursday as the recent reports about the sharp increase of infections have cast doubts about a quick recovery of China’s economy.

These reports have raised suspicions about the transparency of the Chinese Government and have prompted some countries, namely the US, Italy, and India to impose mandatory tests for Chinese travelers, a move that might be followed by other countries over the coming days.

Furthermore, Ukraine is reporting the heaviest artillery shelling in some of its main cities since the war started, leaving big parts of the population between energy, which is curbing risk appetite further.

XAU/USD remains moving within an ascending triangle pattern

From a technical point of view, the daily chart shows the pair trapped within ascending triangle pattern, limited by resistance area at $1,825, and trendline support from late-November lows, now around $1,800.

With the MACD indicator in negative territory, a confirmation below the $1,800 trendline would cancel the uptrend and might trigger a deeper retreat to $1765/75 December 6 and 15 lows and November 23 low at $1720.

On the contrary, a run-up above the $1825/35 resistance area would confirm the bullish pattern and set the pair aiming to June high at $1,880 before the $1,900 psychological level.

XAU/USD daily chart

Technical levels to watch

-

13:21

High inflation is expected to last beyond 2023 – Deutsche Bank

Inflation has become a dominant topic again. In the opinion of economists at Deutsche Bank, inflation will come down more slowly in the Eurozone than in the US.

Headline inflation seems to have already peaked in the US

“Inflation will still be well above the targets set by the central banks in Europe and the US in 2023.”

“While headline inflation seems to have already peaked in the US, it might not peak in Germany and the Eurozone until February or March 2023.”

“For 2023 as a whole, we expect inflation of 7.0% for Germany, 6.0% for the Eurozone and 4.1% for the US. High inflation is expected to last beyond 2023.”

“It is unlikely that inflation in the foreseeable future will return to the relatively low levels seen before the Covid pandemic.”

-

13:00

Chile Unemployment rate declined to 7.9% in November from previous 8%

-

13:00

Russia Central Bank Reserves $ remains unchanged at $581.7B

-

12:53

GBP/USD to see an average range of 1.23-1.28 until the longer term picture shows improvement – Citi

The British Pound has recovered somewhat from the intense selling that greeted former PM Liz Truss’s unfunded tax cut proposals in September 2022. In 2023, economists at Citi expect the GBP/USD pair to move within a 1.23-1.28 range.

Sterling vulnerable to further bouts of weakness against the USD

“For Sterling to make sustained gains the UK needs to present a sustainable long-term growth strategy. The outlook for 2023 is bleak, with recession likely, the developed world’s worst external deficit and trade with the EU hampered by Brexit.”

“The BoE has an equally difficult task of trying to lower a high inflation rate without deepening the UK recession and home price declines. Against this backdrop, we see Sterling vulnerable to further bouts of weakness against the USD.”

“We expect an average range of 1.23-1.28 until the longer term picture shows improvement.”

-

12:39

USD/JPY’, capped below 133.80/90 after its reversal from 134.50

- The Dollar remains steady above 133.40, with upside moves capped at 134.80/90.

- The Yen strengthens after the BoJ announces unscheduled bond purchase operations.

- USD/JPY: Breach of 130.40 support will trigger a deeper decline – SocGen.

The US Dollar’s mild rebound from intra-day lows at 133.50 is lacking follow-through right below the 133.80/90 resistance area, and the pair remains looking for direction within a 50-pip range, after retreating from the 134.50 area on Wednesday.

The BoJ announces more bond purchases

The Japanese currency appreciated about 0.6% during the Asian session, after the Bank of Japan announced two additional rounds of unscheduled bond purchase operations, responding to market speculation that points out to further relaxation of the bonds yield’s curve controls.

On the other end, the US Dollar is trading without a clear direction in a choppy post-Christmas market, with European stock markets picking up after a negative opening as concerns about China are dampening appetite for risk.

The exponential increase in COVID-19 infections has crushed investors’ enthusiasm about the end of the Zero-COVID policy and has dampened hopes of a quick economic recovery in China.

Recent reports revealing the high pressure that the new coronavirus wave is causing on the health system have moved some countries to impose restrictions on Chinese travelers. US Italy and India have already announced mandatory tests in arrivals from China and other countries are likely to follow suit.

On the macroeconomic front, with the Japanese calendar lacking relevant releases, in the US, the weekly jobless claims and oil stocks data could ofer a fresh boost to the US dollar crosses.

USD/JPY: Breach of 130.40 might trigger a further downtrend – SocGen

Currency analysts at Société Générale observe the pair biased lower and point out to 130.40 support: “The pair is now in the vicinity to August trough near 130.40. An initial bounce is not ruled out however 138 is likely to cap (…) Failure to defend 130.40 would mean a deeper downtrend. Next potential objectives could be at projections of 128 and 2015 levels of 125.85/124.00.”

Technical levels to watch

-

12:32

Brazil Nominal Budget Balance came in at -70.371B, below expectations (-52.794B) in October

-

12:32

Brazil Primary Budget Surplus came in at -20.089B, below expectations (13.765B) in October

-

12:19

Rapid equity market recovery unlikely with central banks’ new strategy – Natixis

Central banks’ strategy now seems to be to keep interest rates moderately high for a long time. How will equitty markets react to this interest rate scenario? In the view of analyst at Natixis, it is difficult to imagine a solid equity market recovery.

Central banks’ strategy is to keep interest rates moderately high

“Central banks’ new strategy is to raise interest rates moderately and keep them moderately high for a long time, as long as inflation does not return to the vicinity of the inflation target. Given the inertia of core inflation, we should actually expect a long period of moderately high interest rates.”

“During this period, the unemployment rate will rise until it exceeds the level of the structural unemployment rate. In this situation of rising unemployment and therefore persistently weak growth, it is difficult to imagine a marked recovery in share prices. The situation was different in the past as interest rates rose sharply (above the level of core inflation) and could therefore fall rapidly.”

-

11:43

GBP/USD extends its reversal to 1.2020 in a choppy market session

- The Pound U-turns at 1.2065 slides to. 1.2020 area.

- Concerns about China and Ukraine have soured investors' sentiment.

- The US dollar trims losses as US Treasuries bounce up.

Sterling’s reversal from the intra-day high of 1.2065 seen in the early European session has extended to the 1.2020 area in a choppy market session, with the European markets picking up, following a negative opening.

Concerns about China and Ukraine are weighing sentiment

Investors’ optimism about the end of the Zero-COVID policy in China faded on Thursday as reports about the exponential growth of infections and their strain on the country’s financial system are casting doubts on a fast recovery of the Chinese Economy.

Beyond that, the rising tensions in Ukraine where the Russian army is shelling heavily Kyiv and other cities after the Kremlin’s refusal to accept Zelenski’s peace plan is weighing risk appetite further, increasing negative pressure on the GBP.

Furthermore, the 0.5% interest rate hike approved by the Bank of England in December, following November’s 0.75% hike, has raised speculation of an easier monetary tightening in 2023 and a lower Bank Rate peak which is acting as a headwind for the Sterling.

On the other end, the US Dollar is trimming losses after a negative market opening. The US Dollar Index, which measures the value of the Greenback against the most traded currencies, has bounced up from levels right above 104.00, returning to 104.30 tracing the moderate recovery on US Treasury yields.

Technical levels to watch

-

11:40

USD/TRY to advance nicely toward 22 by end-2023 – SocGen

The Lira plummeted 28.8% this year versus the USD and 23.7% against the EUR, extending the downward trend of 2020. Economists at Société Générale expect the USD/TRY to reach 22 by the end of 2023.

Higher rates could dampen growth and pummel TRY

“The Lira still faces headwinds from deeply negative real rates, a wide current account deficit and geopolitical risk.”

“We expect the TRY to gradually weaken towards 19.00/USD by 1H23 and 22.00/USD by end-2023 as the current policy mix persists.”

“General and presidential elections in June/July 2023 could mark a turning point for the currency if a new government is elected and resets monetary policy.”

“Higher rates could dampen growth and weigh on the Lira.”

-

11:31

India Trade Deficit – RBI: -83.5B (3Q) vs previous -68.6B

-

11:02

EUR/USD remains rangebound, with upside attempts capped below 1.0660 area

- The Euro pulls back below 1.0640 after another rejection at the 1.0660 resistance area.

- Concerns about China and escalating tensions in Ukraine have dampened market optimism.

- EUR/USD seen at 1.0892/10944 in Q1, 2023 – Credit Suisse.

The Euro has turned lower during Thursday’s European trading session, unable to breach 1.0660/70 resistance in the fourth consecutive attempt this week. The pair remains trading within a 60-pip horizontal range on a thin post-Christmas market.

COVID-19 and Ukraine’s war dampen appetite for risk

Investors’ moderate appetite for risk seen in the first half of the week faded on Thursday, as reports from the surging coronavirus infections in China are casting doubts about the economic recovery of the Asian country.

The exponential increase in COVID-19 cases since the Chinese authorities relaxed its Zero-Covid policy is overwhelming the country’s healthcare system. This has raised suspicion about China’s transparency which has forced the US, Italy, and India, so far, to impose mandatory tests on arrivals from China.

Furthermore, tensions are escalating in Ukraine with news reporting heavy shelling in Kyiv and other cities after the Kremlin refused to accept Zelenski’s 10-point peace plan., which is putting additional negative pressure on the Euro.

On the economic calendar, in absence of key Eurozone data, the US US weekly jobless claims and crude oil stocks figures might offer a fresh impulse to Forex markets.

EUR/USD is aiming to 1.0892/1.0944 – Credit Suisse

From a technical point of view, analysts at Credit Suisse see the pair biased higher over the next months: “We expect further strength in Q1 2023, reinforced by the large top in front-end US/Europe interest rate differentials(…)We maintain our existing bullish call for 1.0892/1.0944 – the 50% retracement of the 2021/2022 fall and broken trend resistance from early 2017, with this then ideally capping to define the top of a broad range.”

Technical levels to watch

-

11:00

Brazil Inflation Index/IGP-M above expectations (-0.77%) in December: Actual (0.45%)

-

10:56

USD to lose altitude broadly as the end of Fed rate hikes come into view – BMO

After sprinting nearly 20% in the year to the end of September, the US Dollar then pulled back roughly 7% in the final quarter of 2022. Economists at the bank of Montreal expect the greenback to lose further ground in 2023

USD/CAD to see an average exchange rate of just under 1.33 in 2023

“We look for some further softening in the year ahead, as the Fed winds down what has been the most aggressive rate-hike campaign among major central banks. The Canadian Dollar is expected to modestly benefit from this move, albeit perhaps less than other major currencies, as the BoC is nearly done with its rate hikes.

“The Loonie will likely be a bit lower on average in 2023 than this year due to the big pullback late in 2022 (we expect an average exchange rate of just under $1.33 in the coming year).

“Stretch call: A soggy USD and a pick-up in China’s domestic economy help support commodity prices, even in the face of a North American recession, and the oil price average in 2023 (of about $90) is higher than current levels.”

-

10:27

USD/CHF resumes its downtrend and hits fresh week lows below 0.9245

- The dollar dives 0.5% on the day to test week lows at 0.9245.

- US Treasury bonds slide amid a negative market mood.

- Concerns about surging COVID-19 cases are casting doubts on China's economic recovery.

The Greenback’s reversal from Wednesday’s highs near 0.9300 is gaining traction on Thursday’s European trading with the pair testing fresh intra-week lows below 0.9245, following a mild recovery attempt, which was capped at 0.9285 earlier today.

From a wider perspective, the pair is resuming its downtrend from the 0.9340 resistance area tested at the start of the week, dangerously approaching a key support hurdle around 0.9210/20.

The Dollar retreats as US bond yields tick down

With the economic calendar lacking first-tier indicators, the moderate decline in US Bond yields, with the benchmark 10-year note ticking down 2.4 basis points to 3.862% amid a sourer market mood is weighing on US Dollar’s demand.

The surging COVID-19 infections in China since the Government relaxed its Zero-Covid policy are overwhelming the country’s healthcare system, crushing market hopes of a solid recovery in the world’s second major economy.

Against this backdrop, some countries have started imposing restrictions on inbound travelers from China. The US and Italy have established mandatory tests on arrivals from the Asian country and India has just announced a similar measure.

Furthermore, escalating tensions in Ukraine, with the Russian army shelling Kyiv and other cities following Putin’s refusal to accept Zelenski’s 10-point peace plan, has contributed to dampening market sentiment

On the economic calendar, the Swiss ZEW survey posted larger-than-expected improvement on Wednesday. Economic expectations improved to a -42.8 reading in December against market expectations of -50.5 and from the -57.5 seen in the previous month.

Today the US weekly jobless claims and crude oil stocks figures will be observed in an otherwise thin post-Christmas calendar.

Technical levels to watch

-

10:18

Equities seen higher by the end of next year – JP Morgan

In the view of economists at JP Morgan, stocks has pre-empted the macro troubles set to unfold in 2023 and look increasingly attractive.

The bull case for equities

“While we are not calling the bottom for equity markets, we do think that the risk vs. reward for equities in 2023 has improved, given the declines in 2022.”

“With quite a lot of bad news already factored in, we think that the potential for further downside is more limited than at the start of 2022.”

“Importantly, the probability that stocks will be higher by the end of next year has increased sufficiently to make it our base case.”

-

09:48

USD/ZAR to plummet toward 15.00 by end-2023 – SocGen

The Rand fell around 10% versus the US Dollar on a spot return basis this year. Looking ahead, economists at Société Générale expect the USD/ZAR pair to plunge to 15 by the end of 2023.

Rates are likely to stay at 8% until the end of 2023

“Despite the heightened political uncertainties, we remain positive on the ZAR. The re-opening of China and broader USD depreciation should deflate USD/ZAR in our view towards 15.00 by end-2023.”

“Headline inflation peaked five months ago but remains above the target range of 3-6%. We expect the central bank to slow the pace of tightening and deliver two more hikes of 50 bps in 1Q23 to 8%. Rates are likely to stay at this level until the end of 2023.”

“GDP growth may moderate from 1.9% this year to 1.2% in 2023.”

-

09:35

GBP/JPY Price Analysis: Pound, under pressure, testing support at 160.90

- The Pound dips 0.5% on the day after failing to confirm above 161.90 Fib. resistance.

- The pair has broken the near-term upward trendline and is now testing the 160.90 support area.

- Below 160.90, the next potential targets are 160.00 round revel and 158.55.

The Sterling is losing ground on Thursday, to put an end to a three-day recovery from the 158.90 area. The pair has lost nearly 0.5% on the day so far, retreating from Wednesday’s highs at 162.35 to test previous resistance turned support at 160.90.

The pair was unable to confirm the 38,2% Fibonacci Resistance level at 161.90 on Wednesday and has been gaining negative traction on Thursday, amid a sourer market sentiment.

Technical indicators are turning lower

On its reversal, the GBP has broken trendline support from last week's lows and is testing the mentioned 160.90 support area (December 21, 27 highs).

With the MACD in the four-hour chart on the verge of a bearish cross and RSI treading below the 50 level, a confirmation below 160.90 would strengthen bears and open the path toward the 160.00 round level on its way to a three-month low at 158.55.

On the contrary, a positive reaction should reach past the previous trendline support, now at 161.30, and the confluence of Fibonacci resistance and the 50-SMA at 161.80. This would ease negative pressure and set the pair’s focus on the December 28 peak, at 162.30.

GBP/JPY 4-hour chart

Technical levels to watch

-

09:34

China’s Health Official warns of Covid spreading throughout the holiday season

China’s Center for Disease Control and Prevention (CDC) top epidemiologist Wu Zunyou warned at a briefing on Thursday, Covid is seen spreading throughout the holiday season.

Additional quotes

“The Chinese provinces are in different stages of Covid outbreak.”

“Covid outbreaks have peaked in Beijing, Tianjin and Chengdu.”

“China is strengthening its Covid variant monitoring.”

Meanwhile, China's Senior health official Liang said that the country “will report to the World Health Organization (WHIO) if we find any new Covid variant.”

Market reaction

Despite a minor improvement in risk sentiment, the Chinese proxy, AUD/USD, remains pressured toward 0.6700. The pair is trading at 0.6722, down 0.18% on the day.

-

09:13

European Monetary Union M3 Money Supply (3m) fell from previous 5.8% to 5.4% in November

-

09:11

US Dollar to peak and then weaken in 2023 – Citi

Economists at Citi look for an end to the US Dollar’s mighty ascent.

CAD to strengthen once broader USD strength wanes

“We expect the US Dollar rally since 2021 to exhaust itself sometime in 2023 and then to reverse course. This is partly because the Fed is likely to stop raising interest rates more aggressively than other G10 central banks as economic growth slows.”

“Positioning for dollar strength has become a crowded trade as investors seek out “safe haven” assets amid uncertainty. The US has large trade and fiscal deficits that should prompt softening over time.”

“We expect the Canadian Dollar to strengthen once broader US Dollar strength wanes.”

-

09:01

BoJ: To supply two-year loans against pooled collateral on January 4

The Bank of Japan (BoJ )announced the conduct of funds-supplying operations against pooled collateral on Thursday.

The BoJ will supply about JPY1 trillion at a 0.0% interest rate in operations on January 4.

No further information is provided about the same.

Related reads

- USD/JPY bounces off intraday low amid BOJ’s action mode, softer yields despite Coronavirus, Ukraine fears

- BoJ conducted unplanned bond-buying twice on Thursday

-

09:00

European Monetary Union Private Loans (YoY) meets forecasts (4.1%) in November

-

09:00

European Monetary Union M3 Money Supply (YoY) came in at 4.8%, above forecasts (4.1%) in November

-

08:47

AUD/USD reversal from 0.6800 extends to 0.6720 as market sentiment sours

- Aussie's uptrend capped at 0.6800; the pair retreats to 0.6720.

- Market mood sours on concerns about COVID-19 infections in China.

- AUD/USD remains within recent ranges with the market focused on US data.

The Aussie is set to cap a four-day uptrend on Thursday, as the pair turned lower from one-week highs at 0.6800 and has extended losses to test week lows at 0.6720 in the early European session.

Concerns about COVID-19 in China dampen risk appetite

The sharp increase of coronavirus infections in China has curbed hopes about the economic recovery of the Asian dragon, crushing the moderate optimism observed in the first half of the week.

The major Asian markets have closed Thursday’s session in the red, and European indexes are following suit posting losses between 0.17% in Frankfort and a 0.62% decline in London.

COVID-19 cases have surged in China since the Government relaxed its Zero-Covid policy, and are overwhelming the country’s healthcare system in a wave that is threatening to extend from urban to rural areas as many citizens will travel to celebrate the lunar year. with their families.

In this context, many countries are considering introducing a covid test for travelers from China. The US has already announced the mandatory tests from January 5 and Italy is considering the same measure after half of the travelers arriving on a flight from China tested positive for Coronavirus at Milan’s Malpensa Airport on Wednesday.

The sentiment-linked Aussie has been hit by the souring mood and investors’ concerns about the consequences for China’s Economic growth. In a thinned post-Christmas market, however, the pair remains within recent ranges on Thursday with the focus on the US initial jobless claims and oil stocks figures, due later today.

Technical levels to watch

-

08:46

EUR/USD to extend its rally to 1.0892/1.0944 – Credit Suisse

EUR/USD hovers around mid-1.06s. Economists at Credit Suisse expect the pair to see further gains toward 1.0892/1.0944.

Further strength in Q1 2023

“We expect further strength in Q1 2023, reinforced by the large top in front-end US/Europe interest rate differentials.”

“We maintain our existing bullish call for 1.0892/1.0944 – the 50% retracement of the 2021/2022 fall and broken trend resistance from early 2017, with this then ideally capping to define the top of a broad range. Should strength directly extend though, we would see resistance next at 1.1185, potentially 1.1275.”

“Support to define the lower end of a potential range is seen at 1.0223/1.0198.”

-

08:42

China’s Finance Ministry: Will adjust trade tariffs on some goods from January 1

Citing the tariff commission of China's state council, the country’s Finance Ministry said in a statement on Thursday, China will adjust import and export tariffs on some goods from January 1.

Additional takeaways

“China has decided to further reduce the tariffs for most favoured nations on 62 types of information technology products from July 1 next year. That step will cut China's overall tariffs to 7.3% from 7.4%.”

“Will speed and promote development and expand domestic demand.”

“Export tariffs on aluminium and aluminium alloys are to be raised.”

“The current import tariff will stay on seven types of coal until March 31 next year.”

“Will meet shoppers' demands, import tariffs will be further lowered on coffee makers and juice extractors.”

Market reaction

AUD/USD is uninspired by the above headlines, weaker by 0.08% on the day at 0.6730, as of writing.

-

08:12

USD/CNY to gradually dip towards 6.80 by end-2023 – SocGen

The Chinese Yuan has come a long way, recovering to around 7.00/USD from the low of 7.32 in late October. Economists at Société Générale expect the USD/CNY to move slightly down toward 6.80 by the end of 2023.

CNY is likely to underperform other Asian currencies

“Our forecast is for the currency to gradually recover towards 6.80/USD by end-2023.”