Notícias do Mercado

-

23:52

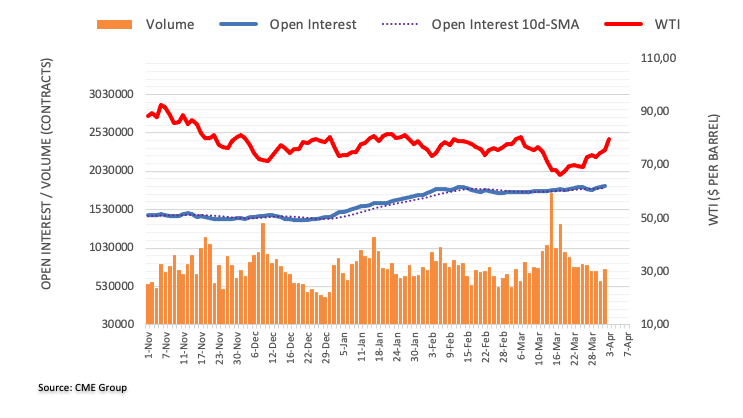

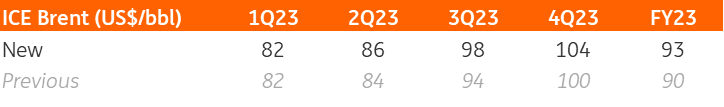

US Treasury Secretary Yellen: OPEC+ oil production cut will add uncertainty to global growth outlook

“A surprise OPEC+ oil production cut is an ‘unconstructive act’ that will add uncertainty to the global growth outlook and to burdens on consumers at a time of high inflation,” US Treasury Secretary Janet Yellen on Monday per Reuters.

"I think it's a regrettable action that OPEC decided to take. I'm not sure yet just what the price impact will be. I think we need to wait a little longer for, you know, to really assess that," Yellen told reporters after an event at Yale University.

It’s worth noting that US President Joe Biden also reacted to the OPEC+ output cut while terming it as, “Not as bad as you think.”

Additional comments

Clearly, it's not a positive for global growth.

And it adds to uncertainty and burdens at a time when inflation is already high and holding prices down is a top priority.

A reduction in gasoline prices from last year's peaks had helped limit inflation and it would be detrimental if the trend were reversed.

Asked about the impact of the $60 per barrel price cap on Russian crude oil imports that Western allies imposed, she said she did not view the OPEC+ production cut plan as a significant factor to "have any impact on the appropriate level of the cap.

Coalition countries could revisit the price cap level if a change was deemed appropriate, ‘But I don't see that that's appropriate at this time.’

I want to withhold judgment now on just what impact this will have on oil prices, although I know there's been some reaction today," she said of the OPEC+ move.

Deposit outflows from small and medium-sized banks were diminishing, but I was watching the situation closely and was ‘not willing to allow contagious runs to develop’ in the US banking system.

Confidence in the banking system was strengthened by actions taken by the Treasury, Federal Reserve and Federal Deposit Insurance Corp after the failures of Silicon Valley Bank and Signature Bank.

My read is that outflows from smaller and medium-sized banks are diminishing, and matters are stabilizing, but it's a situation we're watching very closely.

We've focused on a range of issues including financial, risks and have not put all of our focus on climate risks.

I don't think there's a fundamental problem with the banking system.

Also read: Forex Today: Markets remain upbeat despite OPEC+ surprise output cut; RBA next

-

23:41

NZIER QSBO: RBNZ tightening looks to be gaining traction in dampening demand

“New Zealand's business confidence in the first quarter showed some positive developments with both business confidence and firms' own trading activity recovering slightly,” according to the latest New Zealand Institute of Economic Research (NZIER) Quarterly Survey of Business Opinion (QSBO).

The NZIER QSBO statement also said, “The tightening in monetary policy by the Reserve Bank since November 2021 looks to be gaining traction in dampening demand in the economy.”

Additional comments

A net 66% of firms surveyed expected general business conditions to deteriorate compared with 70% pessimism in the previous quarter.

On a seasonally adjusted basis, 61% expected business conditions to worsen, versus 74% pessimism recorded in the previous period.

The survey's measure of capacity utilization rose to 94.0%, from the previous quarter's 93.7%.

There are signs of capacity pressures easing in the New Zealand economy as demand continued to soften in the first quarter of 2023.

Builders were most downbeat in the March quarter. This reflects a continued weakening in demand, with more building sector firms reporting a decline in new orders and output.

NZD/USD grinds higher

The NZIER QSBO outcome failed to inspire NZD/USD bulls, even if they cheer the broad US Dollar weakness around 0.6300 by the press time.

Also read: NZD/USD Price Analysis: Bulls are in control but are flirting with key resistance

-

23:40

USD/CAD Price Analysis: Six-day losing spell to extend further below 1.3400

- USD/CAD has attempted a recovery after dropping to near 1.3410, however, the downside bias is still solid.

- The USD Index would extend its downside journey on expectations of an early pause in the rate-hiking spell by the Fed.

- Solid oil prices are expected to keep the Canadian Dollar on the front foot.

The USD/CAD pair has attempted a recovery after dropping to near 1.3410 in the early Asian session. The recovery move by the Loonie asset is expected to turn into a short-lived pullback as the US Dollar Index (DXY) would extend its downside journey on expectations of an early pause in the rate-hiking spell by the Federal Reserve (Fed).

The Loonie asset has registered a six-day losing spell and more downside is in pipeline amid expectations for a further jump in oil prices. It is worth noting that Canada is the leading exporter of oil to the United States and higher oil prices will strengthen the Canadian Dollar.

Going forward, the street is expected to keep its focus on the United States Automatic Data Processing (ADP) Employment Change (March) data, which is scheduled for Wednesday. The economic data is seen lower at 205K vs. the prior release of 242K.

On a four-hour scale, the Loonie asset has shifted below the 61.8% Fibonacci retracement (plotted from February 02 low at 1.3262 to March 10 high at 1.3862) at 1.3493. The major will likely retrace its entire move.

Downward-sloping 10-and 20-period Exponential Moving Averages (EMAs) at 1.3474 and 1.3511 respectively indicate that the bearish momentum is extremely strong.

The Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-40.00, showing active downside momentum, however, an oversold situation cannot be ruled out.

A mean-reversion to near the 10-EMA would offer a bargain sell for investors and the major would continue its downside move toward February 16 low at 1.3357 and February 02 low at 1.3262.

In an alternate scenario, an upside move above the psychological resistance of 1.3500 will shift traction in the favor of US Dollar bulls, which will drive assets towards 50% and 38.2% Fibo retracements at 1.3563 and 1.3633 respectively.

USD/CAD four-hour chart

-

23:36

USD/CHF slides towards 0.9100 despite softer Swiss inflation on SNB, Fed talks

- USD/CHF holds lower grounds after downbeat start to the NFP week.

- Swiss inflation came in softer but SNB’s Schlegel sounds hawkish.

- Fed’s Cook fail to gain accolades for hawkish remarks on softer data, downbeat interest rate futures.

- Risk catalysts are crucial for clear directions amid a light calendar for the day.

USD/CHF remains pressured around 0.9125, following a downbeat start to the key week, as bears struggle to keep the reins amid a light calendar on Tuesday. Even so, the broad US Dollar weakness joins receding hawkish Fed bets and downbeat US data to weigh on the Swiss currency pair. With this, the quote ignores downbeat Swiss inflation and activity data.

On Monday, the Swiss Consumer Price Index (CPI) for March dropped to 0.2% MoM versus 0.4% expected and 0.7% prior while the YoY figures eased to 2.9% from 3.4% previous readings and 3.2% market consensus. Further, SVME Purchasing Managers’ Index (PMI) for March also eased to 47 from 48.9 initial forecasts.

On the other hand, the US ISM Manufacturing PMI dropped to the lowest levels since May 2020 in March, to 46.3 versus 47.5 expected and 47.7 prior. On the same line, the final readings of March’s S&P Global Manufacturing PMI eased to 49.2 compared to 49.3 initial estimations.

Softer US PMIs joined the market’s lack of inflation fears from the OPEC+ supply cuts and the resulting Oil price run-up to weigh on the yields. With this, the CME’s FedWatch Tool marked nearly 43% market bets on the Fed’s 0.25% rate hike in May, versus 52% expected on Friday.

Elsewhere, Swiss National Bank (SNB) Vice Chairman Martin Schlegel told Swiss broadcaster SRF in an interview broadcast on Monday that they will do everything it can to bring inflation down. The policymaker also added that he can't make any forecasts while adding, “But you can see our inflation forecasts are higher now than they were in December," he told SRF. "That means, that if necessary we will continue to raise interest rates."

It should be noted that US Federal Reserve Board Governor Lisa Cook also spoke on Monday and tried to defend the Fed’s hawkish bias by saying that the US has low unemployment and high inflation. Thus the Fed is focused on inflation at present and the disinflationary process is underway but we are not there yet.

Against this backdrop, Wall Street closed mixed and the yields were down while the US Dollar Index (DXY) dropped the most in a fortnight the previous day to test the lowest levels in two months.

Looking forward, a light calendar may allow the Cable pair to remain firmer for the day. However, Wednesday’s US ADP Employment Change, ISM Services PMI and Friday’s US Nonfarm Payrolls (NFP) are the keys for the GBP/USD pair traders to watch for clear directions.

Technical analysis

A daily closing below 0.9120 becomes necessary for the USD/CHF bears to approach a two-month-old ascending support line, close to 0.9080 at the latest. Alternatively, recovery remains elusive below a downward-sloping resistance line from early March, close to 0.9180.

-

23:29

AUD/JPY Price Analysis: Test three-week highs, but retreats below the 50-DMA

- AUD/JPY pair tests 50-DMA but fails to hold gains, capped by technical resistance.

- AUD/JPY must break through 50-day EMA and 90.00 figure for bullish continuation.

- For a bearish scenario, the AUD/JPY must reclaim the 20-DMA at 89.04.

The AUD/JPY rallied sharply on upbeat market sentiment and hit a three-week high at 90.05 but retreated somewhat towards the end of Monday’s session. As the Asian session begins, the AUD/JPY is trading at 89.81

AUD/JPY Price action

On Monday, the AUD/JPY pair tested the 50-day Exponential Moving Average (EMA)at 89.93 but could not hold to its gains above the latter. Additionally, it tested an upslope previous support trendline and turned resistance, which capped AUD/JPY’s upward move. Oscillators like the Relative Strength Index (RSI) at bullish territory shifted flat, suggesting buyers are taking a respite. The Rate of Change (RoC) portrays that buying pressure is cooling. Hence, the AUD/JPY might consolidate in the near term.

The AUD/JPY must crack the 50-day EMA and the 90.00 figure for a bullish continuation. Once cleared, the AUD/JPY could test the 100-day EMA at 90.78 before approaching the 200-day EMA at 91.04. In an alternate scenario, a bearish one, the AUD/JPY first support would be the 20-day EMA at 89.04. Break below, and the AUD/JPY will head toward the week’s low of 88.55, ahead of challenging 88.00.

AUD/JPY chart

AUD/JPY Technical levels

-

23:26

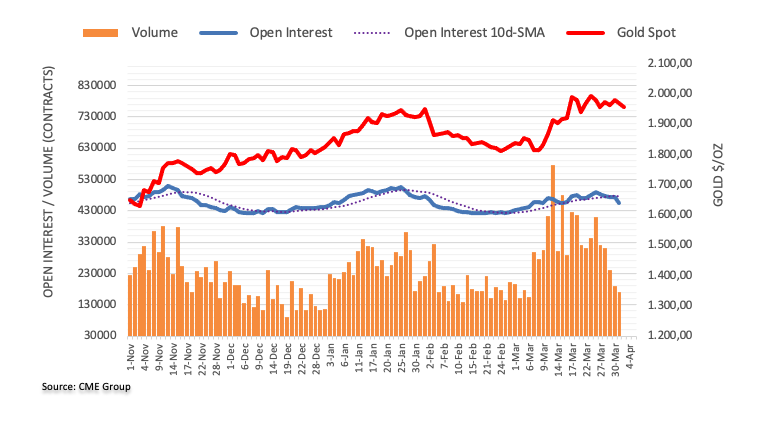

Gold Price Forecast: XAU/USD bulls in town on lower Fed bets

- Gold price is on the front foot to test into the $2,000 on US Dollar weakness.

- US Dollar weighed by poor US data, weighing on Federal Reserve hawkish sentiment.

Gold price rallied on Monday and took out the $2,000 mark with a slump in the US Dollar on the back of bond yields falling on expectations a surprise cut in The Organization of the Petroleum Exporting Countries, OPEC+, production will spur inflation. This was dimming hopes the Federal Reserve will cut interest rates this year.

The rise in the yellow metal comes after The Organization of the Petroleum Exporting Countries, OPEC+, on Sunday made an unexpected 1.1-million-barrel per day cut to production to support prices and reduce global inventories, raising the cost of oil and adding inflationary pressure as the Fed and other central banks raise interest rates to slow their economies to check rising prices.

United States of America data pulls US Dollar lower

The US data on Monday added to the narrative that the Federal Reserve is near the end of its rate-hike cycle. March Manufacturing ISM dropped 1.4pts in March to 46.3, its lowest reading since May 2020. ´´A weakening trend has been in place since May last year (56.1), but recent banking turmoil may have dented confidence further,´´ analysts at ANZ Bank said.

´New orders fell to 44.3 vs 47.0. Manufacturing is one of the most rate-sensitive sectors of the economy as goods like autos are primarily bought on credit. There continues to be encouraging news on goods inflation. Supplier delivery times fell 0.4 to 44.8, its lowest level since March 2009, and the prices sub-index fell 2.1pts to 49.2.´´

Federal funds futures are now pricing in a 60% chance of another 25 basis-point (bp) rate hike by the Fed in May, down around 5% on the back of today´s manufacturing data. Moreover, futures traders have also factored in a pause in June and rate cuts by December. Traders will now await the Services data tomorrow. ´´We look for the ISM Services index to retreat after showing signs of stabilization at a still-firm level of ~55 in Jan-Feb,´´ analysts at TD Securities said.

The US Dollar moved down to test below 102 the figure, DXY, while the US 10-year note was down 3.9 basis points to 3.432%. The two-year note was down 2.1 basis points to 4.007%.

Nonfarm Payrolls on the cards

Looking ahead, the focus this week will be on Friday's Nonfarm Payrolls jobs report, although many markets will be closed for the Easter holiday.

´´US Nonfarm Payrolls payrolls likely stayed firm at a still above-trend pace in March, though slowing from stronger prints in Jan-Feb,´´ the analysts at TD Securities explained.

´´We also look for the Unemployment Rate to stay unchanged at 3.6%, and wage growth to print a firm 0.3% MoM.´´

Gold technical analysis

As per the pre-market open weekly Gold price analysis, Gold, Chart of the Week: XAU/USD bulls remain in control, the Gold price indeed rallied:

Prior Gold price analysis

We have a bullish pennant on the daily and 4-hour charts:

Gold price update

The Gold price bulls are back in the market after an anticipated drive from around the supporting area. The Gold price bulls need to commit at this juncture to get and stay above $2,010.

-

23:13

GBP/USD bulls cheer US Dollar weakness, Fed hawks’ retreat above 1.2400

- GBP/USD grinds higher after an upbeat start to the key week.

- OPEC+ verdict fails to underpin US Dollar despite fueling Oil prices.

- Cable ignore Brexit criticism, downbeat UK inflation expectations amid broad US Dollar.

- Softer US data, yields join receding hawkish Fed bets to weigh GBP/USD price.

GBP/USD remains firmer around 1.2420 during early Tuesday in Asia as bulls approach the multi-day-old resistance area amid broad US Dollar weakness. In doing so, the Cable pair ignores downbeat inflation forecasts and Brexit concerns at home amid optimistic comments from the Bank of England (BoE) Officials.

That said, the US Dollar Index (DXY) dropped the most in a fortnight the previous day to test the lowest levels in two months as downbeat US data and yields weigh on the Federal Reserve (Fed) bets.

On Monday, US ISM Manufacturing PMI dropped to the lowest levels since May 2020 in March, to 46.3 versus 47.5 expected and 47.7 prior. On the same line, the final readings of March’s S&P Global Manufacturing PMI eased to 49.2 compared to 49.3 initial estimations.

Softer US PMIs joined the market’s lack of fears from the OPEC+ supply cuts and the resulting Oil price run-up to weigh on the yields. That said, the US 10-year Treasury bond yields printed a four-day downtrend to 3.41% at the latest.

With this, the CME’s FedWatch Tool marked nearly 43% market bets on the Fed’s 0.25% rate hike in May, versus 52% expected on Friday.

At home, Bank of England (BoE) Chief Economist Huw Pill crossed wires via Reuters while saying, “The UK banking system is well capitalized.” The policymaker also said that the Well-capitalized banks help combat inflation, though inflation is still far too high.

Further, the latest monthly survey from Citi and YouGov, published on Monday, said the UK public's inflation expectations eased in March after edging a tad higher in February. ‘For 12 months ahead, the UK public inflation expectations eased to 5.4% in March from 5.6% in February,” states the survey details.

It should be noted that No10’s confirmation that the traffic jam at Dover port was due to Brexit and political chaos around grooming gangs prod the GBP/USD buyers.

Amid these plays, Wall Street closed mixed while the riskier assets cheered the US Dollar’s weakness.

Moving on, a light calendar may allow the Cable pair to remain firmer for the day. However, Wednesday’s US ADP Employment Change, ISM Services PMI and Friday’s US Nonfarm Payrolls (NFP) are the keys for the GBP/USD pair traders to watch for clear directions.

Technical analysis

GBP/USD approaches the 1.2445-50 key resistance area comprising multiple tops marked since early December 2022. It’s worth noting that the RSI (14) conditions are firmer this time, suggesting brighter chances of the quote’s run-up beyond the critical upside hurdle. Meanwhile, the Cable sellers need validation from February’s high of 1.2270.

-

23:04

EUR/USD reclaims 1.0900 after a V-shape recovery inspired by weak US Manufacturing PMI

- EUR/USD has reclaimed the 1.0900 resistance after a V-shape recovery amid the risk-on mood.

- Weak US Manufacturing PMI data has advocated the need for an early pause in the Fed’s policy-tightening spell.

- US Manufacturing PMI has registered a fifth straight figure below 50.0.

The EUR/USD pair has recaptured the round-level resistance of 1.0900 in the early Asian session. The major currency pair showed a V-shape recovery after dropping below 1.0800. The rationale behind the bumper recovery in the shared currency pair was the release of the weak United States ISM Manufacturing PMI data, which conveys that the US growth rate is expected to show a crackdown quarterly.

S&P500 settled Monday’s session with marginal gains after a volatile trade as the Federal Reserve (Fed) is expected to pause the policy-tightening spell early to avoid a contraction in the growth rate, portraying a risk-on mood. The US Dollar Index (DXY) reported a vertical fall after a recovery move to near 103.00. The USD Index has reverted to near its weekly low around 102.00 as Fed chair Jerome Powell has to prioritize economic conditions before addressing the stubborn inflation.

Coming back to the US Manufacturing PMI data, the economic data contracted to 46.3 from the consensus of 47.5 and the former release of 47.7. This was the fifth straight figure below 50.0 and a figure of 50.0 acts as a silver line for a growth contraction.

Also, New Orders Index contracted to 44.3 from the expectations of 44.6, which indicates that forward demand is expected to remain subdued. Therefore, the Fed could consider a pause in the policy-tightening spell ahead.

On the Eurozone front, rising inflationary pressures led by a shortage of labor are bolstering the need of more rate hikes from the European Central Bank (ECB). And now fresh rise in the oil price along with expectations of more gains have added fuel to the fire. ECB President Christine Lagarde is expected to continue the rate-hiking spell as a rebound in headline Eurozone inflation is highly anticipated.

-

23:00

New Zealand NZIER Business Confidence (QoQ) climbed from previous -70% to -66% in 1Q

-

22:53

United States Total Vehicle Sales down to 14.8M in March from previous 14.9M

-

22:46

USD/MXN reclaims 18.0000 after testing a four-week low, post weak US PMIs

- US Manufacturing PMI data reveals recessionary signs as business activity contracts.

- US Treasury bond yields fall sharply as odds for another rate hike remain uncertain.

- Strong PMI reading indicates continued growth in Mexico’s manufacturing sector.

USD/MXN climbs back above the 18.0000 thresholds after testing four-week lows around 17.9644 in the early North American session. Despite broad US Dollar (USD) weakness, outward flows from the emerging markets currency weakened the Mexican Peso (MXN). At the time of writing, the USD/MXN is trading at 18.0420.

US Manufacturing PMI data reveals recessionary signs as business activity contracts

Wall Street closed with gains, except for the heavy tech Nasdaq 100. US Treasury bond yields fell sharply, as odds for another rate hike lie at 52.4%. However, money market futures are already pricing in two rate cuts by the end of 2023.

Earlier data showed a slew of Manufacturing PMI data for the United States (US) flashed recessionary signs in the US. The S&P Global and ISM revealed that business activity contracted, with the latter decreasing to 46.3 in March, below the forecast of around 47.5. The gauge plummeted to its lowest since May 2020, weighed by worse-than-estimated new orders and employment measures.

The greenback continued to extend its losses, as the US Dollar Index fell 0.52% to 102.063. US

Consequently, the greenback erased some of its earlier gains, bolstered by higher oil prices. The US Dollar Index (DXY), which tracks the buck’s value vs. a basket of six currencies, slides from 103.05 to 102.20, down 0.38%.

On the Mexican front, Business Confidence in Mexico rose to 52.9, above February’s 52.1. The S&P Global Manufacturing PMI for March registered 51.6 points. In the last 32 months (since August 2020), the indicator has been above 50 points, which is still the expansion zone.

USD/MXN Technical analysis

From a technical perspective, the USD/MXN remains neutral to downward biased. Although Monday’s price action was bullish, an inverted hammer, preceded by a downtrend and a daily close around the previous candle mid-point, could open the door for further downside. Therefore, the USD/MXN first support would be the 18.0000 mark. Breach of the latter will expose the YTD low of 17.8968, followed by 17.5000.

-

22:40

SNB´s Schlegel: Will do everything it can to bring inflation down

The Swiss National Bank will do everything it can to bring inflation down, Vice Chairman Martin Schlegel told Swiss broadcaster SRF in an interview broadcast on Monday including hiking interest rates further as well as selling foreign currencies.

Key comments

"Our mandate is crystal clear, and that is price stability."

"And we're going to do everything we can to get inflation back to the target range of 0 to 2%."

"Of course I can't make any forecasts, but you can see our inflation forecasts are higher now than they were in December," he told SRF. "That means, that if necessary we will continue to raise interest rates."

´´We don't see any signs at the moment that that could threaten financial stability in Switzerland."

"We said quite clearly at the last assessment that we are also prepared to sell foreign currencies, to actually strengthen the franc."

"That's what we did in the last quarter, to the tune of 27 billion. That's quite a big number. We look at the exchange rate and will intervene if necessary."

USD/CHF update

USD/CHF is flat on the new day on Tuesday but was pressured on Monday as the US dollar slumped. The price dropped to a low of 0.9115.

-

22:30

Fed´s Cook: US has low unemployment and high inflation

US Federal Reserve Board Governor Lisa Cook on Monday said that the US has low unemployment and high inflation. Thus the Fed is focused on inflation at present and the disinflationary process is underway but we are not there yet. On Friday, when she last spoke publically, she said that she was watching credit conditions closely and will factor in potential economic headwinds from recent banking sector turmoil as she weighs the right level of interest rates to deal with high and persistent inflation.

US Dollar update

S bond yields fell further last night following soft ISM data, dragging the US dollar lower to test belñow 102 the fiogure, DXY.

-

21:47

AUD/USD bulls move in for the kill but bears are lurking ahead of RBA

- AUD/USD jump on the US Dollar´s weakness.

- The RBA will be the key event for the day ahead.

- AUD/USD´s bearish pennant is still in play.

AUDUSD increased to a 4-week high of 0.67585 as the US Dollar slumped on Monday, surrendering earlier gains following unexpected oil output cuts from OPEC+. US data showed that the US economy continued to slow with declines in manufacturing and construction spending.

The data on Monday added to the narrative that the Federal Reserve is near the end of its rate-hike cycle. March manufacturing ISM dropped 1.4pts in March to 46.3, its lowest reading since May 2020. ´´A weakening trend has been in place since May last year (56.1), but recent banking turmoil may have dented confidence further,´´ analysts at ANZ Bank said.

´´New orders fell to 44.3 vs 47.0. Manufacturing is one of the most rate-sensitive sectors of the economy as goods like autos are primarily bought on credit. There continues to be encouraging news on goods inflation. Supplier delivery times fell 0.4 to 44.8, its lowest level since March 2009, and the prices sub-index fell 2.1pts to 49.2.´´

Meanwhile, the Reserve Bank of Australia will be the highlight for today in Asia. ´´We expect a 25bp hike in the cash rate from the RBA today, but the decision will be finely balanced,´´ analysts at ANZ Bank said. ´´ Looking at the four data releases Governor Lowe highlighted as guiding the decision, we see ongoing resilience: unemployment fell back to 3.5%; NAB business conditions remain robust, price and cost growth remained elevated and firms are still in hiring mode; retail sales were softer at +0.2% m/m, but services spending remained solid; and finally, the monthly Consumer Price Index showed inflation momentum is not slowing as much as the fall in annual inflation would suggest.´´

The analysts concluded all of the above and said, ´´the probability of a pause is the highest it’s been in some time.´´

AUD/USD technical analysis

Ahead of the event, the pair broke the resistance of the bearish pennant. While this is going against the grain, it is not uncommon to see such a move for the price only to reverse and eventually break out and not come back in the direction of the chart pattern. However, in the meantime, the bias is bullish while above 0.6700:

The W-formation would be expected to pull on the price towards support as illustrated. If the bulls commit to the trajectory, then a break of 0.6800 is needed to expel the downside bias of the overriding long-term chart pattern:

-

21:38

Forex Today: Markets remain upbeat despite OPEC+ surprise output cut; RBA next

The OPEC+ shocked markets on Monday, sending crude oil prices sharply higher, but Wall Street kept rallying. On Tuesday, attention will be back on the usual suspects. The Reserve Bank of Australia (RBA) will have its monetary policy meeting, and more inflation numbers are due in the Eurozone with the February Producer Price Index. Markets start getting ready for US employment numbers.

Here is what you need to know on Tuesday, April 4:

A surprise voluntary cut (a million barrels per day off starting in May) from the Organization of the Petroleum Exporting Countries and its allies (OPEC+) boosted sharply crude oil prices at the beginning of the week. The WTI barrel price jumped more than 5%, reaching the highest level since mid-January, above $80.00.

After the decision of the OPEC+, Wall Street indexes reached fresh monthly highs. The Dow Jones gained almost 1%, the S&P 500 rose by 0.37%, but the Nasdaq dropped 0.25%. If crude oil prices continue to increase, it will revive inflation concerns and mount pressure on central banks.

The US Dollar lost ground on Monday, affected by risk appetite and lower US yields on the back of softer-than-expected US Economic data. The ISM Manufacturing PMI came in at 46.3 in March versus the 47.5 expected. The ISM Service PMI and the ADP Employment report are due on Wednesday.

US yields tumbled, with the 10-year dropped to 3.41%, posting the lowest close in a week. The US Dollar Index is hovering around 102.00, looking at March lows. The Japanese Yen benefited from lower yields. USD/JPY reversed from weekly highs, falling to 132.40.

AUD/USD jumped, approaching 0.6800 as the Aussie outperformed. The Reserve Bank of Australia will announce its monetary policy decision. Consensus has changed from a no hike to a 25 basis points rate hike. The decision and the guidance will be relevant for the Australian Dollar.

EUR/USD rebounded sharply from under 1.0800, reaching levels above 1.0900. The area around 1.0930 continues to be the critical resistance. On Tuesday, the Eurozone will release the February Producer Price Index. GBP/USD resumed the upside, and is near the Year-to-Date high above 1.2400.

USD/CHF dropped to 0.9120, while EUR/CHF posted gains on Monday and settled at 0.9950. Switzerland reported inflation with the Consumer Price Index at 2.9% YoY, below the 3.2% of market consensus.

Gold rose more than $30 from the daily lows, finding resistance at $1,990. Silver is moving sideways around $24.00. Cryptocurrencies lost grond; Bitcoin was unable to remain above $28,000. Dogecoin surged more than 35% and then pulled back after Twitter changed the logo to the Doge meme.

Like this article? Help us with some feedback by answering this survey:

Rate this content -

20:54

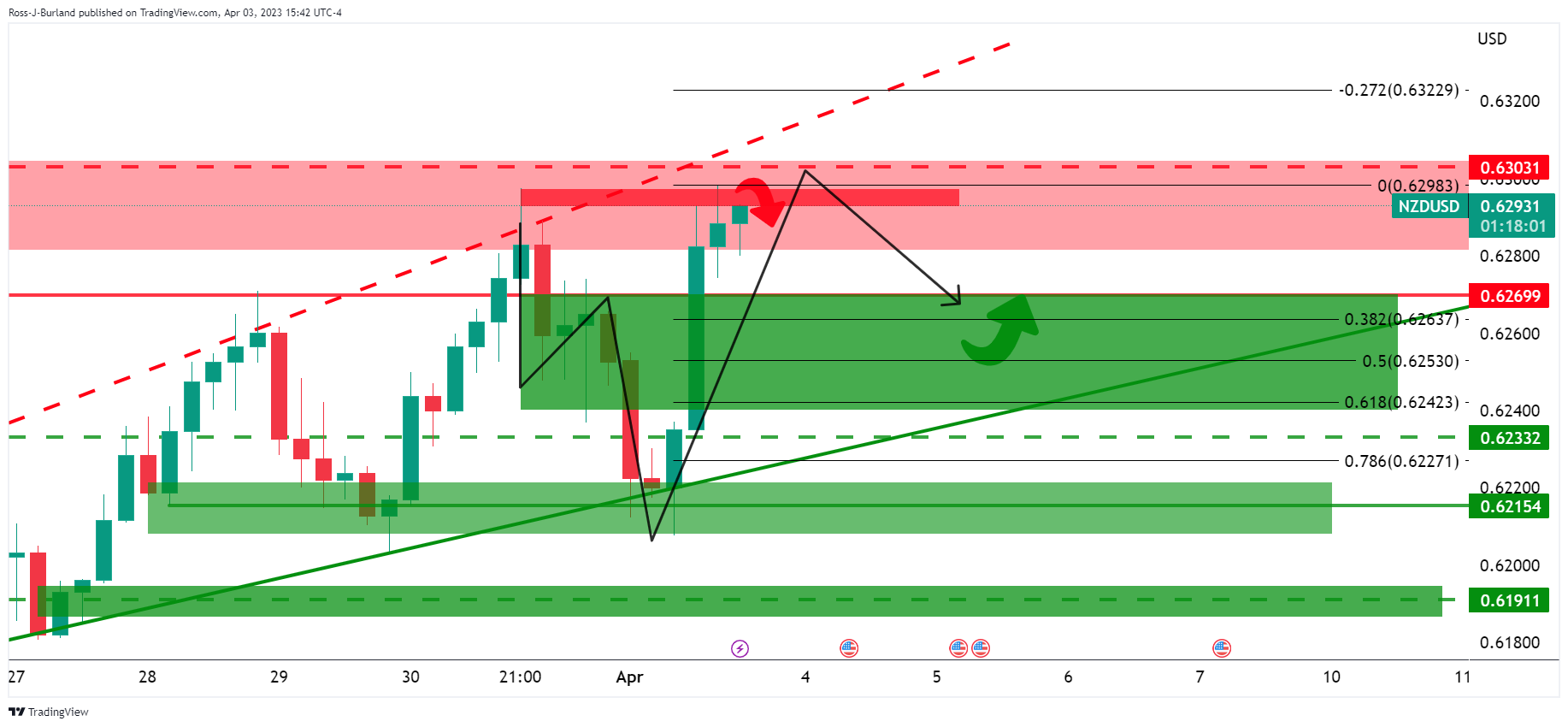

NZD/USD Price Analysis: Bulls are in control but are flirting with key resistance

- NZD/USD is rising the US Dollar´s weakness at the start of the week.

- NZD/USD bulls need to commit on the front side of the trend.

NZD/USD rallied on the back of a weaker US Dollar in the wake of soft ISM data. At the same time, the commodities sector bounced, led by oil which was supportive of the Kiwi.

´´ The question now is; will a hawkish RBNZ tomorrow give the Kiwi the “escape velocity” it needs to break above 0.63? It may well do, especially if US bond yields continue to fall and markets there fret about financial instability,´´ analysts at ANZ bank argued.

Meanwhile, the technical picture is a short-term bearish, medium-term bullish, but back to bearish again longer term as per the following analysis:

NZD/USD daily chart

The Kiwi is bullish while on the front side of the trendline but it is running into an area of resistance as per the daily chart above. A break of the trendline support would be a significant bearish development if it occurs after failures above 0.6300 resistance.

NZD/USD H4 charts

The 4-hour chart has left a W-formation at what could be the top of the bullish cycle. This is a reversion pattern and would be expected to be a pull on the price at resistance.

Zooming in, however, should the bulls commit on the front side of the trend and within the Fibonacci scale, then there will be prospects of another test of the resistance area and a break thereof would open the doors for a bullish continuation, on the front side of the bullish trend.

-

20:40

United States Total Vehicle Sales dipped from previous 14.9M to 13.3M in March

-

20:05

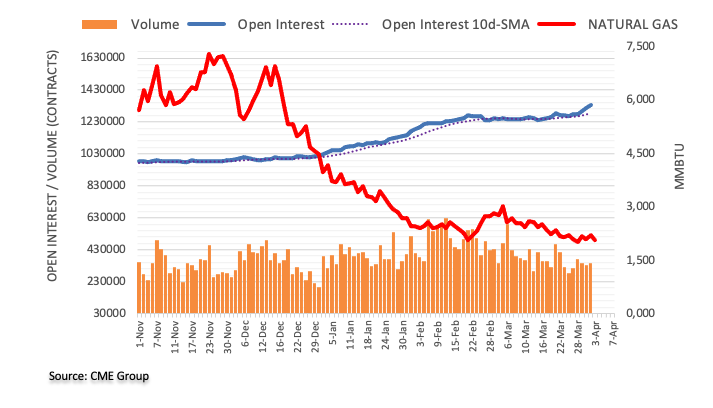

WTI bulls stay in control above the opening gap on OPEC production cut

- West Texas Intermediate holds in the bullish territory above the gap.

- OPEC+ cartel surprised the market with a 1.1-million barrel per day cut to production to support prices.

West Texas Intermediate WTI crude oil rose 6.3% on Monday and is trading at $80.44 at the time of writing. The high of the day was $81.51 while the low of the day is at $79.05. The rally in the oil price came after the OPEC+ cartel surprised the market with a 1.1-million barrel per day cut to production to support prices with the cartel saying it will reduce output ahead of the group's ministerial meeting scheduled for Monday.

It has been said that Saudi Arabia will make the bulk of the cuts, reducing output by 0.5-million barrels per day, with Russia and other members also agreeing to lower exports. ´´While the surprise production cuts from OPEC+ sent crude prices rallying, it appears unlikely to induce a further bid from CTAs just yet, with momentum signals needing prices to increase north of $85/bbl and $88/bbl for WTI and Brent crude respectively,´´ analysts at TD Securities said.,

According to the International Energy Agency, the cuts come as global inventories were on the rise, with production seen exceeding demand in the first half of the year. Meanwhile, the agency expects demand to rise above production in the second half of the year.

Nonetheless, the analysts at TD Securities explained that CTA positioning remains skewed short which suggests there is plenty of dry powder for additional buying as physical markets are now likely to tighten quicker than previously anticipated.

´´Indeed,´´ the analysts added,´´time spreads have signaled tighter markets in the aftermath of the production cuts, and on a longer-term horizon, demand expectations remain optimistic as Chinese re-opening demand takes hold.´´

The analysts concluded that ´´this could again see speculative long exposure built back up as the year progresses, which in turn could be the catalyst to kickstart further short covering from CTAs.´´

-

19:53

USD/JPY Price Analysis: Retraces after failing to crack the 200-DMA

- Bullish momentum faded after the USD/JPY could not break resistance at the 200-DMA.

- USD/JPY path of least resistance is downwards, with first support at 132.00.

- A fall beyond 132.00, and the USD/JPY could test 131.00.

USD/JPY retraces from two-week highs at around 133.75 and extends its losses below the 50-day Exponential Moving Average (EMA) at 133.25 after failing to pierce the 200-day EMA at 133.79. At the time of writing, the USD/JPY is exchanging hands at 132.28, down 0.33%.

USD/JPY Price action

From the daily chart perspective, the USD/JPY bullish momentum waned after the pair fell shy of cracking the 200-day EMA. That would’ve exposed the 134.00 figure on the upside, followed by the 100-day EMA at 134.25.

Hence, the USD/JPY resumed its downtrend direction, exacerbated by back-to-back breaks of essential support levels, like the 50 and 20-day EMAs, at 133.25 and 132.72. Additionally, the Relative Strength Index (RSI) failed to crack the 50-mid-line and headed downwards, while the Rate of Change (RoC) began to portray that sellers were gathering momentum.

Therefore, the USD/JPY path of least resistance is downwards. That said, the USD/JPY first support would be 132.00. A breach of the latter will expose the March 27 high at 131.76, followed by an upslope support trendline drawn from January lows that passes around 131.10-20. Once cleared, 131.00 would be next.

USD/JPY Daily chart

USD/JPY Technical levels

-

19:11

US: ISM signaling theme preceding recession – Wells Fargo

The ISM Manufacturing PMI Index dropped from 47.7 in February to 46.3 in March. Analysts at Wells Fargo point out that while some parts of the service sector demonstrate resilience to the fastest rate hikes in a generation, the message from today's ISM manufacturing index is that the factory sector is reeling.

Key Quotes:

“The ISM manufacturing report for March was a dud. Not only was the headline index at its lowest since 2020, every sub-component was below the breakeven 50 for the first time since 2009. All but two (production and customer inventories) were lower versus the prior month.”

“The closest thing we get to good news in today's report is that the slowing in the factory sector is pushing prices lower and supply chains are continuing to heal, benefiting from the slack.”

“The rest of the themes were those that often precede an economic recession: new orders and production are contracting, so much so that production is being transitioned to deal with backlogs.”

“We expect tighter financial conditions and growing uncertainty around recession are weighing on firms' desires to invest. The recent stress in the banking sector led to a sharp tightening in financial conditions, and we expect banks will tighten lending standards as a result. Manufacturing activity was slowing before the recent stress, and we expect tighter conditions will contribute further to that slowdown in investment spending.”

-

19:01

Brazil Trade Balance registered at 10.956B above expectations (9.05B) in March

-

19:01

Brazil Trade Balance registered at 10.9B above expectations (9.05B) in March

-

18:59

GBP/USD bulls step in on US Dollar weakness

- GBP/USD bulls take advantage of a weaker US Dollar in Monday's US trade.

- The focus will shift to the US NFP report on Good Friday.

GBP/USD was up some 0.54% in mid-morning US session trade on Monday, traveling from a low of 1.2274 to score a high of 1.2420 after the US Dollar fell sharply during the Wall Street opening hours.

The greenback was heavily dented by Monday's economic reports that showed US manufacturing activity in March slumped to its lowest level in nearly three years as new orders continued to contract. The Institute for Supply Management (ISM) reported that its Manufacturing PMI fell to 46.3 last month. This was the worst since May 2020, from 47.7 in February.

Meanwhile, last week’s PCE data, the Federal Reserve´s preferred inflation measure, were mixed. While headline and core both came in a tick lower than expected, super core accelerated for a second straight month to 4.63% YoY and is the highest since October. ´´This is not the direction that the Fed desires and so we look for the hawkish tilt in Fed comments to continue,´´ analysts at Brown Brothers Harriman explained.

Nevertheless, federal funds futures are now pricing in a 60% chance of another 25 basis-point (bp) rate hike by the Fed in May, down around 5% on the back of today´s manufacturing data. Moreover, futures traders have also factored in a pause in June and rate cuts by December. Traders will now await the Services data tomorrow. ´´We look for the ISM Services index to retreat after showing signs of stabilization at a still-firm level of ~55 in Jan-Feb,´´ analysts at TD Securities said.

BoE in focus

Domestically, with regards to the Bank of England, May's Monetary Policy Committee decision is likely to be ´´finely balanced´´, analysts at TD Securities argued.

´´Any early sight on how the (especially) centrist and hawkish MPC members are positioning themselves will be important,´´ the analysts said.

On Monday, the Bank of England Chief Economist Pill stressed that policy remains data-dependent. He said inflation remains too high but stuck with the bank’s forecast that it will fall sharply this year.

“We raised rates by 400 bp. These measures take up to eighteen months to take effect. Should more be done? We will have to see how inflation evolves.”

He added that “the UK banking system is well capitalized and that well-capitalized banks help combat inflation, though inflation is still far too high.”

“For inflation to return to its target, developments in the labor market, which remains tight, will also be decisive,´´ he said.

Analysts at Brown Brothers Harriman said that the BoE tightening expectations remain subdued. ´´The next policy meeting is May 11 and WIRP suggests around 75% odds of a 25 bp hike, with odds of another 25 bp hike topping out near 75% in Q3. As a result, the peak policy rate is now seen between 4.50-4.75%, up from 4.25% during the height of the banking panic,´´ the analysts explained.

NFP eyed as key event

Looking ahead, the focus this week will be on Friday's jobs report, although many markets will be closed for the Easter holiday.

´´US payrolls likely stayed firm at a still above-trend pace in March, though slowing from stronger prints in Jan-Feb,´´ the analysts at TD Securities explained.

´´We also look for the Unemployment Rate to stay unchanged at 3.6%, and wage growth to print a firm 0.3% MoM.´´

-

18:58

USD/CHF falls on weaker US Manufacturing PMIs, soft Swiss inflation data

- S&P Global and ISN Manufacturing PMIs entered the recessionary territory as economic conditions in the US tightened.

- US Treasury bond yields and USD plummet following poor US manufacturing data.

- USD/CHF Price Analysis: A symmetrical triangle in downtrend warrants further low prices.

USD/CHF tumbles 0.17% after hitting a daily high of 0.9196 on softer-than-expected inflation in Switzerland. Nevertheless, a weaker manufacturing activity report from the US reversed the USD/CHF pair course, as investors estimated the US Federal Reserve (Fed) would pause raising rates. At the time of typing, the USD/CHF is trading at 0.9137.

Swiss Franc Bolstered as US Manufacturing Data Misses Estimates

The Swiss Franc (CHF) got bolstered after US economic data, namely the S&P Global and ISM Manufacturing PMIs, came worse than estimated. The S&P Global Manufacturing PMI for March was 49.2, below 49.3 estimates. Later, the Institute for Supply Management (ISM) revealed its Manufacturing PMI, which plunged to 46.3, below the 47.5 foresaw and below February’s data.

Consequently, US Treasury bond yields and the US Dollar (USD) plunged. The USD/CHF extended its losses past the 0.9150 area, hitting a low of 0.9115.

The US Dollar Index (DXY), which tracks the performance of six currencies vs. the US Dollar, drops 0.39%, down to 102.196. the US 2 and 10-year Treasury bond yields are dropping two and four basis points each, at 4.005% and 3.430%, respectively.

Inflation in Switzerland came softer thane expected, with headline data at 2.9% YoY vs. 3.2% estimates. Core inflation rose by 2.2% YoY, below the 2.5% foreseen in February. In March, the Swiss National Bank (SNB) lifted rates by 50 bps to 1.50%, and its Governor, Thomas Jordan, said, “ It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term.”

USD/CHF Technical analysis

From a daily chart perspective, the USD/CHF is extending its downtrend. After forming a descending triangle in a downtrend, the USD/CHF broke below its bottom trendline, suggesting that further downside is expected. Therefore, the USD/CHF first support would be 0.9115. A breach of the latter will expose the figure at 0.9100, immediately followed by 0.9059.

-

17:22

Silver Price Forecast: XAG/USD stays above $24 despite retreating from weekly highs

- Silver price dips but staus nearby YTD highs as the US Dollar weakens.

- XAG/USD is underpinned as US Treasury bond yields collapse with investors pricing a less aggressive Fed.

- St Louis Fed President Bullard forecasts rates above 5%, says OPEC’s oil production cut will make Fed’s work “difficult.”

Silver price is trading below its opening price by around 0.37%, though it stays above the $24.00 threshold. Falling US Treasury bond yields and a soft US Dollar (USD) are two reasons for XAG/USD’s rise. At the time of writing, the XAG/USD exchanges hands at $24.01.

The sentiment is deteriorating. US equities fluctuated after the S&P and the ISM Manufacturing PMIs, showing that business activity in the US is contracting. Recessionary fears are rising, and tighter lending conditions are weighing on businesses.

Therefore, safe-haven flows towards the precious metal segment, maintaining Silver prices nearby yearly highs. US Treasury bond yields are collapsing as investors have begun to price in a less aggressive US Federal Reserve (Fed), even though an official estimates rates above 5%.

The St Louis Fed President James Bullard said that the Fed needs to raise rates above 5% and emphasized that his forecast is above the median. Bullard commented that OPEC’s cutting oil output would make the Fed’s work “difficult.”

The US Dollar Index, a measure of the buck’s performance vs. six peers, tumbles 0.41%, at 102.168.

Another reason that keeps the commodity prices higher is the Organization of Petroleum Exporting Countries and its allies’ (OPEC+) decision to reduce oil production by 1 million barrels, which led to a boost in oil prices.

XAG/USD Technical analysis

Silver’s uptrend remains intact, though testing a four-month-old resistance trendline that passes around $24.20-30. Although it opened the door for a pullback, oscillators suggest the bias remains bullish. The Relative Strength Index (RSI) is exiting overbought conditions, giving buyers a respite. At the same time, the Rate of Change (RoC), portrays that buyers remain in control but take a pause.

IF the XAG/USD breaks $24.20, it will exacerbate a test of the YTD high at $24.63, followed by the $25.00 figure. On the other hand, a daily close below $24.00 could open the door for a pullback toward the March 24 high of $23.52.

-

17:05

Gold Price Forecast: Climbs to one-week highs, eyes $2,000

- Weaker Dollar and lower Treasury yields boosts the yellow metal.

- XAU/USD up by $40 from Monday’s low, approaches $2,000.

Gold price is up by almost 1% on Monday, after rising more than $40 from the daily low. XAU/USD bottomed on Asian hours at $1,949 and then reversed it course. Recently reached at $1,990 the highest level in a week. It remains near the high, with a positive tone as the US Dollar tumbles.

After a negative weekly opening market by the shock from the OPEC+ unexpected production cut, gold stabilize and on European hours started to move higher. It accelerated after the beginning of the American session. It is hovering around $1,990 looking at the $2,000 area.

The yellow metal gained momentum amid a slide in US yields, a weaker US Dollar and risk appetite. The US 10-year yield fell to 3.40% after the release of the US ISM Manufacturing PMI. The US Dollar Index is down by 0.45%, hovering around 102.15, after reaching levels under 102.00. In Wall Street the Dow Jones is gaining by 0.68% and the S&P 500 is flat.

The positive tone in XAU/USD could trigger more gains and a test of the $2,000 area. A daily close above would point to further gains. Another failure at current levels could trigger a bearish correction. Large price swing could continue, taking into account what’s ahead in the economic calendar. After today’s softer ISM Manufacturing PMI, attention turns to Wednesday’s ADP Private Employment and ISM Service PMI; on Friday the official employment report is due.

Technical levels

-

16:30

USD/CAD declines as Canadian Dollar strengthens on weak USD, OPEC’s decision

- US factory activity shows signs of decline in March.

- The Canadian Dollar appreciated due to OPEC’s announcing a cut in oil production.

- USD/CAD Price Analysis: To stay downward biased below 1.3500; otherwise, expect a rally to 1.3600.

USD/CAD trades south of the 100-day Exponential Moving Average (EMA) as the Canadian Dollar (CAD) appreciated on oil supply shortages and a soft US Dollar (USD). The USD/CAD is exchanging hands at 1.3450 after hitting a daily high of 1.3536.

Dampened business activity in the US spurred recessionary fears

Wall Street portrays an upbeat sentiment. Two measures of factory activity in the United States (US), deteriorated, meaning a deeper economic slowdown is around the corner. The S&P Global Manufacturing PMI for March was 49.2, below 49.3 estimates. Later, the Institute for Supply Management (ISM) revealed its Manufacturing PMI, which plunged to 46.3, below the 47.5 foresaw and below February’s data.

Consequently, the greenback erased some of its earlier gains, bolstered by higher oil prices. The US Dollar Index (DXY), which tracks the buck’s value vs. a basket of six currencies, slides from 103.05 to 102.20, down 0.38%.

Hence, the USD/CAD dropped from around 1.3500 and registered a daily low of 1.3424 as traders began to price in a less aggressive US Federal Reserve (Fed).

The Organization of Petroleum Exporting Countries and its allies (OPEC+) announced over the weekend the cut of 1 million barrels of oil gave oil prices a leg up. WTI jumped over $6.00 from its Friday close at $75.68 to $81.00 a barrel.

The latest round of Fed speakers, led by the St. Louis Fed President James Bullard, said that OPEC’s decision would make the Fed’s job more difficult. Bullard reiterated that the Fed needs to raise rates above 5% and emphasized that his forecast is above the median.

On the Canadian front, the S&P Global Manufacturing PMI plummeted to 48.6 from the prior’s figure of 52.4, painting a gloomy economic outlook for Canada’s economy. Of late, the Bank of Canada’s (BoC) Business Outlook Survey (BOS) showed that around half of the firms surveyed expect the country to be in a mild recession. Additionally, 59% of businesses expect inflation above 2% until at least 2025.

USD/CAD Technical analysis

The USD/CAD tumbled below 1.3519, the 100-day EMA, which exacerbated a break below 1.3500. Although the USD/CAD pair reached a weekly low of 1.3424, the pair has recovered some ground as sentiment continues to deteriorate amidst recessionary scenarios. The USD/CAD neutral to downwards trend will continue if the pair stays below the 100-day EMA. A breach of the 1.3400 figure will expose the 200-day EMA At 1.3371. On the flip side, buyers reclaiming 1.3500 would pave the way to recover the 100-day EMA and beyond.

-

16:07

EUR/USD hits fresh highs above 1.0900 after US ISM Manufacturing PMI

- US Data: March ISM Manufacturing PMI and February Construction Spending below expectations.

- US Dollar Index tumbles as US yields sank.

- EUR/USD looking to test March highs at 1.0925/30.

The EUR/USD rose further following the release of US Economic data and printed a fresh daily high at 1.0916. It then pulled back to 1.0885. The US Dollar is under pressure amid lower yields and risk appetite.

The US Dollar Index is falling 0.50% and is about to test last week's lows near 102.00. The US 10-year dropped to 3.41%, the lowest level in a week. The lower gained momentum after the release of the US ISM Manufacturing report.

Data showed that economic activity in the US manufacturing sector continued to contract with the ISM Manufacturing PMI falling to 46.3 from 47.7 in February, below the market consensus of 47.5. Ahead of the ADP and the NFP, the Employment index fell to 46.9 from 49.1. A different report showed Construction Spending declined by 0.1% in February.

European Central Bank Robert Holzmann said a half-point hike is still on the cards for May. According to him, it the central bank slows down rate hikes to 25 bps it would be hard to go back.

The 1.0930 zone back in the radar

The EUR/USD approached the 1.0925/30 key resistance area. That zone capped the upside during the last two weeks. A break higher would strengthen the outlook for the Euro. A failure could clear the way for a bearish correction. Support levels might be located at 1.0855 and 1.0815.

Technical levels

-

15:59

USD Index likely to test YTD lows in the weeks ahead – HSBC

Sustained further USD gains would require hawkish US data surprises or tangible signs of financial sector frailties but both rates and risk appetite should point to a weaker USD over the near term, in the view of economists at HSBC.

Banking on a weaker USD

“While the USD may continue to enjoy bouts of support when concerns about financial sector frailties are prominent, we believe the bigger picture is likely to drive the USD weaker over the near term.”

“US data generally point to reasonable US economic activity and retreating inflationary pressures, but it would only take an unexpectedly strong US employment report (7 April) or a punchy CPI reading (12 April) to bring back thoughts of a more hawkish Fed.”

“We think that a test of year-to-date lows on the DXY is likely in the weeks ahead.”

-

15:48

IEA: OPEC+ cuts risk exacerbating strained market

In a statement published on Monday, the International Energy Agency (IEA) said that OPEC+ decision to cut oil output risks exacerbating a strained market by pushing up oil prices amid inflationary pressures, per Reuters.

Global oil markets were already set to tighten in the second half of 2023 with a potential for substantial supply deficit, the IEA further noted.

Market reaction

This headline doesn't seem to be having a noticeable impact on crude oil prices. As of writing, the barrel of West Texas Intermediate (WTI) was trading at $80.30, rising 6.1% on a daily basis.

-

15:37

BOC Survey: Half of firms expect Canada to be in mild recession over next year

In its quarterly Business Outlook Survey published on Monday, the Bank of Canada said about half of polled firms expect Canada to go into a mild recession over the next year, down from roughly two-thirds in the previous survey, per Reuters.

Additional takeaways

"79% of firms expect inflation to remain above 3% for the next two years, down from 84% in Q4."

"59% of firms expect inflation to stay well above 2% until at least 2025."

"For 5th consecutive quarter, businesses anticipate sales growth to slow; slowdown follows period of exceptional strength over the past year."

"Businesses link expectations of weaker sales growth to rate hikes, high inflation and concern over a recession."

"Although surveys were conducted before global banking stresses emerged in early March, evidence suggests business sentiment has not changed much since then."

"Firms continue to view labor market as tight, although labor shortages and wage growth pressure have eased."

"Firms expect size and pace of output prices to moderate; this suggests firms are gradually shifting closer to normal price-setting practices."

"Separate BOC Q1 survey on consumer expectations shows 20.3% of Canadians expect significant economic decline in next 12 months, 37.7% expect small decline."

"Expectations for 1-year ahead inflation fell to 6.03% from 7.18% in Q4; 2-years ahead inflation expectations drop to 4.27% from 5.14%."

"Expectations for 5-year ahead inflation have edged down to 2.92% from 3.10%."

Market reaction

The USD/CAD stays under bearish pressure and was last seen losing 0.6% on the day at 1.3437.

-

15:36

RBA Preview: Forecasts from nine major banks, another 25 bp rate hike, but risk is for a pause

The Reserve Bank of Australia (RBA) will announce its next monetary policy decision on Tuesday, April at 04:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of nine major banks regarding the upcoming central bank's decision.

The RBA is set to deliver another 25 basis points rate hike in April, lifting the Official Cash Rate (OCR) from 3.60% to 3.85%. A pause also seems prudent considering the inflation trend and the uncertainty.

Rabobank

“It remains our view that the RBA will hike by a further 25 bps in April to take the cash rate to 3.85% ahead of a possible pause in May. The softer headline inflation print for February will not be sufficient for the RBA to abandon their tightening bias as labour market indicators, forward indicators and the still comparatively high level of inflation all point to the need for further tightening.”

ANZ

“While our central case is for a 25 bps hike in April, the probability of a pause is the highest it’s been in some time. The RBA may take this option to assess the impact of rate hikes so far, given the ‘long and variable’ lags in monetary policy, along with recent global developments. We still see the question as not one of ‘where’ the cash rate peaks at (we still favour 4.1%), but ‘when’.”

ING

“We believe the RBA will leave the cash rate target unchanged at 3.6%. The RBA hinted at its most recent rate-setting meeting that it was looking at a possible pause in rates, and these inflation numbers provide the perfect excuse. We are reserving judgement on whether this marks the peak for cash rates in this cycle. Other data, including from the labour market, could swing this decision one way or the other. Markets are, however, currently betting that 3.6% marks the peak.”

Standard Chartered

“We expect the RBA to hike again by 25 bps to 3.85%. That said, the risk of a pause has risen substantially since the last March meeting. With the policy rate at only 3.6%, we may not even get to a real positive real rate by the end of 2023. Hence, we maintain our rate hike call for April.”

TDS

“We now expect the Bank to pause at the April meeting given the lower Jan-Feb CPI prints and uncertainty over the outlook from the banking turmoil in the near-term.”

SocGen

“We expect the RBA to hold the cash rate target unchanged at 3.60%. The RBA will likely say that it is appropriate to pause interest rate increases to allow more time to assess the state of the economy, mentioning the recent development in the macroeconomic data and the global economy.”

NAB

“We think the data justifies another 25 bps hike, but acknowledge it is a line ball decision with the RBA having signalled that they would ‘reconsider’ the case for a pause. The risk is the RBA pauses and retains a hiking bias, preferring to err on the side of a more protracted battle against inflation until or unless its hand is forced by the data. Governor Lowe is speaking on Wednesday, an opportunity to explain the decision.”

Citi

“For the first time since the beginning of its hiking cycle in May 2022, we expect the RBA to leave the cash rate unchanged. The shift in the view largely stems from softer-than-expected monthly CPI for both January and February. The official quarterly inflation reading will be reported at the end of April, and given the two soft monthly inflation indicator prints, we believe the Bank will now take the option to pause hiking and re-assess the inflation over the next month. However, even with a pause in April, we still expect the Governor’s statement to maintain a tightening bias.”

Wells Fargo

“Given the recent decline in inflation as well as previous dovish RBA comments, we expect a pause.”

-

15:17

USD/JPY: Weaker Yen momentum is set to fade – MUFG

USD/JPY’s rally is at risk of running out of steam. Year-end foreign bond buying might have fuelled some of this move higher and that is unlikely to be sustained while the scale of the drop in US yields still points to downside USD/JPY risks, economists at MUFG Bank report.

JPY weakness may not be sustained

“The scale of foreign bond buying in recent weeks ahead of the end of the fiscal year is unlikely to be sustained going forward and hence one feature of support for USD/JPY may fade as we move into April. Even if the macro backdrop favours buying it will unlikely be on the same scale.”

“In addition, the substantial increase in JPY short positions amongst Leveraged Funds could be a catalyst for a retracement lower in USD/JPY if the move to the upside begins to fade.”

“US yields could still grind higher from here but USD/JPY has already jumped by more than implied by short-term yields and hence the influence on lifting USD/JPY further from here is likely to diminish.”

-

15:05

US: ISM Manufacturing PMI declines to 46.3 in March vs. 47.5 expected

- US ISM Manufacturing PMI continued to decline in March.

- US Dollar Index extends its daily slide toward 102.00.

The economic activity in the US manufacturing sector continued to contract at an accelerating pace in March with the ISM Manufacturing PMI dropping to 46.3 from 47.7 in February. This reading came in worse than the market expectation of 47.5.

Further details of the publication revealed that the New Orders Index declined to 44.3 from 47 and the Employment Index edged lower to 46.9 from 49.1. Finally, the inflation component, Prices Paid Index, fell to 49.2 from 51.3, compared to analysts' estimate of 53.8.

Commenting on the report, "with Business Survey Committee panelists reporting softening new order rates over the previous 10 months, the March composite index reading reflects companies continuing to slow outputs to better match demand for the first half of 2023 and prepare for growth in the late summer/early fall period," said Timothy R. Fiore, Chair of the Institute for Supply Management.

Market reaction

The US Dollar came under renewed selling pressure after this data and the US Dollar Index was last seen losing 0.5% on the day at 102.12.

-

15:00

United States ISM Manufacturing PMI came in at 46.3, below expectations (47.5) in March

-

15:00

United States ISM Manufacturing Prices Paid below expectations (53.8) in March: Actual (49.2)

-

15:00

United States ISM Manufacturing Employment Index registered at 46.9, below expectations (49.8) in March

-

15:00

United States Construction Spending (MoM) came in at -0.1%, below expectations (0%) in February

-

15:00

United States ISM Manufacturing New Orders Index registered at 44.3, below expectations (44.6) in March

-

14:57

Renewed USD losses are ahead – Scotiabank

USD fails to hold early gains. Economists at Scotiabank expect the greenback to continue slipping.

There is some calendar risk ahead for markets this week

“The USD’s broader drop back from its early session highs leaves a negative look to the short-term chart and rather suggests that after the modest gains seen in the USD generally through month and quarter-end Friday, renewed USD losses are ahead.”

“Note that there is some calendar risk ahead for markets this week. The Good Friday holiday is not observed in the US, where the Federal government will remain open. That means that the NFP release will be out Friday morning, as usual, when many trading centers elsewhere in the world will be closed.”

-

14:45

United States S&P Global Manufacturing PMI below forecasts (49.3) in March: Actual (49.2)

-

14:45

Canada: S&P Global Manufacturing PMI declines to 48.6 in March vs. 51.7 expected

- Canadian manufacturing sector went into contraction in March.

- USD/CAD trades in negative territory at around 1.3450.

Business activity in the Canadian manufacturing sector contracted in March with S&P Global Manufacturing PMI declined to 48.6 from 52.4 in February. This reading came in below the market expectation of 51.7.

Commenting on the survey's findings, "the recovery of Canada’s manufacturing economy stalled during March, with renewed falls in both production and new orders signalled," said Paul Smith, Economics Director at S&P Global Market Intelligence.

"Broader macroeconomic uncertainty, and the negative impact of rising prices on client purchasing power were key factors that weighed on market demand," Smith further noted.

Market reaction

USD/CAD stays under bearish pressure despite the disappointing data and was last seen losing 0.5% on the day at 1.3452.

-

14:44

USD/JPY Price Analysis: Hangs near daily low, just below 133.00 amid modest USD weakness

- USD/JPY retreats from over a two-week high touched earlier this Monday.

- The emergence of fresh selling around the USD exerts downward pressure.

- The 100-day SMA and 50% Fibo. confluence hurdle holds the key for bulls.

The USD/JPY pair attracts some sellers after touching over a two-week high on Monday and trades just below the 133.00 round-figure mark during the early North American session.

The US Dollar (USD) struggles to capitalize on its intraday gains amid the uncertainty over the Fed's rate-hike path, which turns out to be a key factor exerting some downward pressure on the USD/JPY pair. The downside, however, seems limited, at least for the time being, amid a generally positive risk tone, which tends to undermine the traditional safe-haven Japanese Yen (JPY).

From a technical perspective, the USD/JPY pair faces rejection near the 133.75 confluence hurdle, comprising the 50% Fibonacci retracement level of the March downfall and the 100-day Simple Moving Average (SMA). The said area should now act as a pivotal point, which if cleared will set the stage for an extension of the recent move-up witnessed over the past week or so.

That said, oscillators on the daily chart are yet to confirm a bullish outlook, making it prudent to wait for a move beyond the aforementioned barrier before positioning for any further gains. The USD/JPY pair might then aim to surpass the 134.00 round-figure mark and accelerate the momentum towards testing the 61.8% Fibo. level resistance, around the 134.75-134.80 region.

On the flip side, any further slide below the 132.80 area, or the 38.2% Fibo. level, is likely to find decent support near the 132.25 region ahead of the 132.00 mark and the 23.6% Fibo. level, around the 131.60-131.55 zone. A convincing break below the latter could drag the USD/JPY pair below the 131.00 mark, towards the next relevant support near the 130.55-130.50 region.

USD/JPY daily chart

Key levels to watch

-

14:40

Australia: RBA predicted to hike the OCR by 25 bps – UOB

Economist at UOB Group Lee Sue Ann suggests the RBA could raise the policy rate by 25 bps at its event on April 4.

Key Takeaways

“At this juncture, we are keeping our view of one more 25bps hike in Apr, which will take the cash rate target to 3.85%. There is some near-term downside risk to this view as uncertainty remains elevated.”

“This is highlighted by the recent problems in the banking sectors in the US and Europe, with potential spill overs for Australia via lending conditions and confidence.”

-

14:31

S&P 500 Index: Next objectives at 4195 and 4270/4320 – SocGen

S&P 500 eventually defended the multi-month trend line and low of December near 3800/3760 in recent pullback. Economists at Société Générale expect the index to target 4195 and 4270/4320.

200-DMA at 3930 should be a short-term support

“S&P 500 has reestablished above both 50-DMA and 200-DMA and has also confirmed an Inverse Head and Shoulders pointing towards regain of upward momentum.”

“The index is expected to head higher towards 4195 and target of the pattern near 4270/4320.” “The 200-DMA at 3930 should be a short-term support.”

-

14:30

Canada S&P Global Manufacturing PMI came in at 48.6, below expectations (51.7) in March

-

14:19

EUR/USD Price Analysis: A solid resistance emerges around 1.0930

- EUR/USD leaves behind the earlier drop to the sub-1.0800 region.

- Further gains continue to target monthly peaks in the 1.0930 area.

EUR/USD bounces off earlier lows in the proximity of 1.0790 and regains the 1.0880 region in a volatile start of the new trading week.

The likelihood of extra advances appears favoured for the time being. Against that, the pair could now set sail to the March peak at 1.0929 (March 23) prior to a potential test of the 2023 high at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0341.

EUR/USD daily chart

-

14:02

RBA Preview: Two scenarios and their implications for AUD/USD – TDS

Economists at TD Securities discuss the Reserve Bank of Australia (RBA) interest rate decision and its implications for the AUD/USD pair.

Hike +25 bps (40% prob)

“The motivation for the RBA to hike would be 1) It would be highly unlikely 1 month will be enough time for the RBA to assess the impact of its hikes since May'22. So why stop in April?; 2) The RBA could hike in April noting inflation is still high but signaling it's moving in the right direction leaving scope to pause in May following monthly inflation data for Jan and Feb suggesting Q1'23 CPI comes in below the RBA's implied 1.5% QoQ forecast; 3) The RBA pausing in April and then hiking in May potentially adds more confusion to the RBA's message. Historically once the RBA has paused on rate hikes, it has done so for a few months. AUD/USD 0.6720.”

Base Case: Pause (60% prob)

“The case for pausing is strong: 1) The Bank clearly stated a pause would be discussed at the Apr meeting in the Mar Minutes; 2) Discussing a pause for the Apr meeting suggests the appetite to hike in BOTH April and May is low, supporting a pause in April, but leaving open the possibility of hiking in May if CPI exceeds RBA forecasts; 3) Mention of the monthly inflation series was elevated to the top of the Mar Statement and the print for Feb published last week came in below expectations following a soft Jan print – both outcomes provide the RBA with room to pause; 4) The four data points the Governor cited – inflation, employment, retail sales and business activity do not collectively support a hike. AUD/USD 0.6630.”

-

14:00

Singapore Purchasing Managers Index came in at 49.9 below forecasts (50.2) in March

-

14:00

Brazil S&P Global Manufacturing PMI registered at 47, below expectations (48.4) in March

-

13:57

When is the US ISM Manufacturing PMI and how could it affect EUR/USD?

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI for March at 14:00 GMT this Monday. The index is expected to remain in contraction territory for the fifth straight month and come in at 47.5 for March. Given that the Fed looks more at inflation than growth, investors will keep a close eye on the Prices Paid sub-component, which is anticipated to rise to 53.8 from 51.3 in February.

How could it affect EUR/USD?

Ahead of the key release, the risk-on mood weighs on the safe-haven US Dollar (USD) and assists the EUR/USD pair to stage a goodish rebound from sub-1.0800 levels, or a one-week low touched earlier this Monday. A weaker-than-expected ISM Manufacturing PMI will be seen as another sign of a slowdown in the US economy and reaffirm expectations that the Federal Reserve (Fed) might soon pause the rate-hiking cycle. This could exert additional downward pressure on the Greenback and allow the major to build on its intraday rally of around 90 pips.

Conversely, a stronger print is unlikely to provide any respite to the USD, suggesting that the path of least resistance for the USD is to the downside and supports prospects for a further near-term appreciating move for the EUR/USD pair. That said, any immediate market reaction is likely to be limited as the focus remains on this week's release of the closely-watched US monthly employment details - popularly known as the NFP report - on Friday. Nevertheless, the broader fundamental backdrop and the intraday price action support prospects for a further near-term appreciating move for the major.

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical overview and outlines important technical levels to trade the EUR/USD pair: “With the latest rebound, the Relative Strength Index (RSI) indicator on the four-hour chart rose to 50, suggesting that sellers are struggling to stay in control. On the downside, 1.0820 (Fibonacci 23.6% retracement of the latest uptrend) aligns as key support level. If the pair falls below that level and starts using it as resistance, it is likely to meet interim support at 1.0790 (static level) before testing 1.0760 (100-period Simple Moving Average (SMA), Fibonacci 38.2% retracement).”

“On the other hand, 1.0860 (static level, 20-period SMA) is the first resistance ahead of 1.0900 (psychological level) and 1.0930 (static level, March 23 high),” Eren adds further.

Key Notes

• ISM Manufacturing PMI Preview: Three reasons for an upside surprise

• EUR/USD Forecast: Euro manages to hold above key support for now

• EUR/USD: New cycle highs above 1.0930 needed to give a bit more lift – Scotiabank

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

-

13:43

USD/IDR: A drop to 14,925 should not be ruled out – UOB

A decline to the 14,925 region appears in the pipeline ahead of some stabilization in USD/IDR, notes Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

“We highlighted last Monday that ‘the sharp and rapid drop in USD/IDR has room to extend’. We added, ‘in view of the deeply oversold conditions, a sustained drop below the major support at 14,095 is unlikely’. USD/IDR dropped to a low of 14,945 before rebounding to end the week at 14,990 (-1.06%).”

“While conditions remain oversold, the weakness in USD/IDR has not stabilized. This week, barring a break above 15,230, USD/IDR could drop to 14,925 before stabilization is likely.”

-

13:37

USD/CAD: Losses to extend towards the 1.3375/1.3425 area – Scotiabank

USD/CAD breaks below 100-Day Moving Average (DMA). Economists at Scotiabank expect the pair to extend its decline toward the 1.3375/1.3425 area zone.

Firm resistance on USD rebounds to the 1.35 area

“Steady losses in USD/CAD through the past week leave the USD’s technical undertone looking soft and prone to more losses.”

“USD/CAD has broken below the 40 (1.3593) and 100 (1.3523) DMAs supports and trend oscillators are aligned bearishly for the USD on the intraday and daily charts.”

“We look for firm resistance on USD rebounds to the 1.35 area now and for USD losses to extend towards the 1.3375/1.3425 area.”

-

13:36

USD Index Price Analysis: Upside appears limited by the 55-day SMA

- DXY turns negative following a fruitless bull run above 103.00.

- The 55-day SMA near 103.40 caps the upside for the time being.

DXY comes under pressure after piercing the key barrier at the 103.00 level on Monday.

So far, it seems the index could extend the consolidative range amidst the broader bearish stance. That said, a drop below the monthly low at 101.91 (March 23) should open the door to a potential visit to the 2023 low around 100.80 (February 2). On the upside, the 55-day SMA, today at 103.36 continues to cap occasional bullish attempts.

Looking at the broader picture, while below the 200-day SMA, today at 106.54, the outlook for the index is expected to remain negative.

DXY daily chart

-

13:32

Chile IMACEC below forecasts (0.1%) in February: Actual (-0.5%)

-

13:22

South Africa Total New Vehicle Sales climbed from previous 45352 to 50157 in March

-

13:20

USD/MYR: Further range bound trade likely near term – UOB

In opinion of Markets Strategist Quek Ser Leang at UOB Group, USD/MYR is expected to keep the 4.3800-4.4350 range unchanged this week.

Key Quotes

“Last week, we expected USD/MYR to trade in a range between 4.4100 and 4.4700. However, USD/MYR dipped to 4.3800 before rebounding to end the week at 4.4100 (0.36%).”

“Despite the decline, there is no significant improvement in downward momentum. We continue to expect USD/MYR to trade in a range this week, likely between 4.3800 and 4.4350.”

-

13:18

AUD/USD jumps to nearly one-month top, above 200-day SMA ahead of US ISM PMI

- AUD/USD rallies over 100 pips intraday and touches a nearly one-month high on Monday.

- The risk-on mood weighs on the safe-haven USD and benefits the risk-sensitive Aussie.

- Traders now look to the US ISM PMI for some impetus ahead of the RBA on Tuesday.

The AUD/USD pair rebounds sharply from a four-day high, around the 0.6650 area touched earlier this Monday and builds on its solid intraday recovery through the mid-European session. Spot prices spike to the 0.6760 area, or a nearly one-month top in the last hour, with bulls making a fresh attempt to build on the momentum further beyond a technically significant 200-day Simple Moving Average (SMA).

As investors digest the potential inflationary impact of a sharp rise in Oil prices, the prevalent risk-on environment attracts fresh sellers around the safe-haven US Dollar (USD) and turns out to be a key factor that benefits the risk-sensitive Aussie. Apart from this, the AUD/USD pair's strong intraday rally could further be attributed to some short-covering ahead of the Reserve Bank of Australia (RBA) monetary policy meeting on Tuesday. The market optimism, however, is likely to be short-lived amid concerns about a deeper global economic downturn.

The worries resurfaced after data out of Asia on Friday showed that manufacturing activity in Japan contracted during March, while growth in China stalled during the reported month. Furthermore, fresh speculations that rising energy prices might force the Federal Reserve (Fed) to move back to its inflation-fighting rate hikes, which, in turn, favour the USD bulls and might cap the AUD/USD pair. the markets are now pricing in a greater chance of a 25 bps lift-off in May and the bets were lifted by a surprise production cut by OPEC+.

Hence, it will be prudent to wait for a strong follow-through buying around the AUD/USD pair before positioning for a further near-term appreciating move. Heading into the key central bank event risk, traders on Monday will take cues from the US ISM Manufacturing PMI, due later during the early North American session. This week's busy US economic docket also features the ADP report on private-sector employment and ISM Services PMI on Wednesday, followed by the crucial US monthly employment report - popularly known as NFP on Friday.

Technical levels to watch

-

13:09

EUR/JPY Price Analysis: Positive outlook remains in place

- EUR/JPY starts the week in a volatile fashion and revisits 145.00.

- The next up barrier of note comes at the December 2022 high.

EUR/JPY regains some composure and advances to the 145.00 region at the beginning of the week.